Introduction | tBTC: A New Bitcoin Sidechain Design

tBTC is a Bitcoin anchor token recently announced on Ethereum . The purpose of cross-chain anchoring tokens is to copy assets from one chain to another while maintaining the characteristics of the assets as much as possible. In other words, a cross-chain can turn any blockchain into a Bitcoin sidechain.

The concept of sidechain was first proposed in 2010. It promises better scalability, greater stability, better confidentiality and richer status, while also allowing the Bitcoin mainnet to develop slowly and conservatively. In addition, even if there is a problem with the side chain, it will not have any consequences on the main chain.

Bitcoin users can access capital markets (such as: MakerDAO and Compound), gambling markets (such as: Augur), decentralized exchanges (such as: Uniswap) through reliable Bitcoin tokens on Ethereum, and may become popular in the future. Applications such as mixers, private transfers, innovative hosting solutions and DAOs. At the same time, these applications will be able to obtain the superior liquidity and currency attributes of Bitcoin.

Design space for cross-chain anchoring tokens

This article takes tBTC as an example to discuss the cross-chain design in general. Expected characteristics of such anchored tokens may include:

- Exchange service provider AlphaPoint raises $ 5.6 million, Galaxy Digital takes another shot

- Loss of $ 98 billion per year! Nike, CK, Tommy Hilfiger seek to use blockchain technology to tackle counterfeiting

- Japan-Korea exchange stolen, U.S. sanctions Chinese OTC money changer? 3800BTC transaction reveals the process behind

- Anti-censorship: anyone, regardless of status or jurisdiction, can create, redeem, and use tokens.

- Anti-confiscation: Neither custodians or other third parties can seize stored tokens.

- Price stability relative to Bitcoin: Tokens closely track the price of Bitcoin, thus inheriting its monetary attributes.

- Acceptable operating costs : The system can provide services at attractive prices for both users and custodians.

If someone can replicate all the above attributes on another chain, the trust model will be close to (though not equal to) the characteristics of using Bitcoin on the main chain. In fact, all cross-chain anchoring tokens need to proactively compromise Bitcoin, prioritize certain functions, and sacrifice other functions. Whether these compromises are desirable in some cases, or even more desirable, depends on the purpose for which the user initially needs the token.

Redeemable vs. Non-redeemable

The goal of every Bitcoin anchor token is to introduce tokens (such as WBTC and LBTC) that have real Bitcoin attributes but are on another chain. In order to maintain the monetary properties of Bitcoin, token transactions should be as close as possible to the original currency transactions. This can be achieved in two ways:

Packaging method

The first method is applied to WBTC, Liquid, and tBTC. According to this method, the custodian accepts the customer's Bitcoin savings and "packages" it by issuing a proxy token for each of the managed Bitcoin tokens on the sidechain . Depositors can then use proxy tokens on the sidechain, such as selling at a premium or lending on the DeFi market. Any purchaser of the proxy token can redeem it with the corresponding escrow bitcoin tokens.

As long as the system can ensure that a bitcoin can always create a proxy token, and a proxy token can always be redeemed with another bitcoin, it can rely on sensible market participants to maintain parity between them. If the transaction price of the proxy token is lower than the bitcoin price, market participants will purchase a discounted proxy token and convert it into a bitcoin deposit for immediate profit. This will reduce the supply of tokens until the market reaches a new equilibrium point and prices return to parity. If the transaction price of the agent token is higher than the bitcoin price, it will incentivize arbitrageurs to increase supply by creating more agent tokens, and then sell them to the market, and also make instant profits.

Synthetic method

Rather than packing bitcoin collateral, savers can also use non-bitcoin collateral to create synthetic bitcoin ("sBTC"). To understand how the system works, we take MakerDAO as an example. Although their token, Dai, is a synthetic token against the US dollar, the system can equally easily issue synthetic coins for any other asset, including Bitcoin.

Dai is created when a user deposits collateral into a mortgage debt position (CDP). Although anyone can own Dai and trade it, only CDP holders can redeem it with corresponding collateral. Because this arbitrage cycle is much longer , synthetic assets require additional mechanisms to maintain parity. To this end, MakerDAO introduced a stabilization fee (which regulates the cost of CDP) and a Dai savings rate (which regulates the cost of Dai). The combination of the two can help stabilize market supply and demand and reach an equilibrium price of one dollar.

Guaranteed vs. Trusted

As mentioned above, for each token on another chain, someone needs to control the same amount of collateral to ensure continued parity. When using non-local collateral on another chain, such as: Bitcoin collateral parasitic in the Ethereum system, this will cause an additional problem: someone must control the Bitcoin private key. Until smart contracts can be used for private key control (and it is unclear whether this can be achieved), the person who controls the private key also controls the system.

In order for the system to continue, these custodians must be motivated not to abuse their authority. We either believe that theft will not occur (for example, because the trustee's reputation will be wiped out), or we will ask them to provide remedial measures in the event of a problem. In any case, if the system is to last for a long time, it is necessary to provide an incentive for the custodian to make "non-stealing deposits" more attractive than "stealing deposits".

On the WBTC and Blockstream Liquid networks, one (WBTC) custodian or an alliance of several (Liquid network) custodians holds collateral, and users trust that they will not steal the collateral. This assumption holds in most cases because the custodian is an “indirect guarantor”. As large Bitcoin companies, they use their identity as a guarantee and are subject to the traditional legal system. Nonetheless, any system that is subject to the legal system cannot be completely exempt from licensing or prevent censorship completely.

Another option is to use bonds that are available only to other system participants and not available to any foreign party. Before the invention of public blockchains such as Bitcoin and Ethereum, this was tantamount, and it was an important invention in itself. With the advent of unlicensed tokens, we can now build a system that is guaranteed (insured) at every step of the process. In escrow systems, this can provide users with a guarantee that the custodian will either abide by the rules or lose the collateral.

The disadvantage of this method is that it costs more capital to produce. There is no doubt that these additional costs will be passed on to users, driving up the overall price of the service. Therefore, this compromise is best for services that require a lot of trust, and users don't mind paying higher prices. In some cases, stolen assets are difficult to realise. This is not the case with Bitcoin, because if a custodian withholds user funds, the funds are owned by that custodian. In other words, the Bitcoin market is highly liquid.

tBTC method: secured and redeemable

Looking back, we mentioned that the synthetic method of MakerDAO is guaranteed and redeemable, while the methods of WBTC and Liquid systems are guaranteed and redeemable for compliant users, but for non-compliant users It is secured and irredeemable. tBTC chose redeemable and guaranteed design methods that are yet to be explored.

tBTC is a decentralized and guaranteed Bitcoin custody system, which issues a token called TBTC (T Capital). Users do not need to trust custodians (called signers) because the value of the bonds deposited by these signers is higher than the value of the Bitcoins they host. If they are to transfer unauthorized funds, resulting in the value of outstanding TBTC being higher than the escrow bitcoin, the system will confiscate their bonds to purchase and offset the equivalent TBTC in the market and restore the TBTC and escrow bitcoin Of balance.

As another line of defense, each bitcoin is not held by a single signer, but is co-hosted by a randomly selected group of signers using n-of-n threshold signatures.

Unlike WBTC, the process of creating and redeeming TBTC for Bitcoin is not subject to KYC / AML or governing regulations. Anyone can deposit Bitcoin and receive TBTC, and redeem TBTC and receive Bitcoin on the Bitcoin main chain.

The main job of the tBTC system is to ensure that all TBTCs in circulation have a corresponding escrow bitcoin. Maintaining this balance is the main task of signers, and signers are obliged to monitor their bonds and increase the price of TBTC accordingly when the price of Bitcoin rises. Signers are initially required to deposit collateral equivalent to 150% of the savings value. When their bond value is below 140%, the system notifies them and initiates liquidation when the bond value is below 110%. It should be noted that although liquidation should never occur, this possibility needs to be retained as a severe punishment for the signatory's misconduct.

Each system that requires participants to provide collateral faces two major challenges: first, the cost of locking funds is high, which increases the overall cost of the system; second, bonds must be regulated, which requires the system to understand the external factors of the blockchain: The price of the collateral for the entrusted asset.

Challenge 1: the price of importing Bitcoin

In the case of tBTC, the system needs to know the bond token price of TBTC in two key periods: first, the system must know the amount of collateral required for the new deposit; second, the system must know when the deposit is under-guaranteed, and the expected difference To issue a warning or initiate liquidation directly.

In both cases, it doesn't matter if the value of the actual collateral relative to Bitcoin is higher than the reported value. Only when the actual collateral value is lower than the reported value and there is no timely and automatic liquidation setting, will the system pose risks. If the value of the collateral is never allowed to be lower than the value of escrow bitcoin, then we have to expect the signer to leave with Bitcoin.

Rather than using the oracle quote table, tBTC is seeking to use a new market-based approach whereby the lower limit of the Bitcoin price is imported from actual cross-chain orders. If the Ethereum / Bitcoin market is sufficiently liquid, market participants are not expected to allow Bitcoin to clear at a discount below the global spot price. By observing the highest bids that have not been cleared over a period of time (such as: 24 hours), we can confidently say that the reported value is indeed the lower limit of global spot prices.

If an attacker attempts to manipulate the system and register the value of the collateral above actual value, his bid must be higher than the global spot price. At the same time, rational market participants will pay attention to this "purchase wall" and start selling bitcoin to it, effectively pre-empting it. This mechanism uses the sales power of the entire market to counteract the purchasing power of operators, ensuring that the system is not damaged by manipulation.

If the market does not have sufficient liquidity, the system can still use the guaranteed oracle as a backup.

Challenge 2: reduce capital requirements

The second biggest challenge for any secured system is to reduce operating costs to a level where both rational hosts and users can participate. At the time of issuance, each TBTC that exists has a 250% value guarantee: 100% is the escrow bitcoin guarantee, and the other 150% is in Ethereum, which was signed by the signatory to protect the original BTC savings.

Since there is no known way for the market to understand these costs, the responsibility for setting the costs falls on the tBTC team. At launch, signers will receive a 50 bps (or 0.5%) escrow fee every six months, for a total of 1% of turnover each year. Given that savings must be a 150% value collateral, the signatory will achieve breakeven when the capital cost of its debt is less than 0.66% pa.

Even if we ignore the cost of redundancy (signers must be online at all times, otherwise they face the risk of layoffs), given the lower benefits, the number of people who wish to become signers may be very limited. If the rate of return is much higher, there may be more people who want to be signers, but fewer people want to be users. Whether the system can bear higher hosting fees and attract users at the same time depends mainly on the TBTC loan interest rate on Ethereum. The loan interest rate determines how much utility TBTC users can get from accessing applications such as Compound or MakerDAO.

In order to reduce the cost of signatories, the tBTC system will automatically lend bonds in Compound or other fully mortgaged capital markets. If someone wants to lend ETH (or TBTC) on Compound, they might as well become a tBTC signer or get a signer fee without paying any additional costs (in addition to the cost of redundancy). On the other hand, the risk of adding another layer of smart contracts may further weaken the "hard money" attribute of TBTC tokens.

Rather than using non-local guarantees such as Ethereum, tBTC can also introduce a working token that generates cash flow from escrow fees. In this way, the system can mainly use its future cash flow for collateral. If this working token has less volatility relative to Bitcoin in escrow than Ethereum, the overall guarantee requirement can be further reduced.

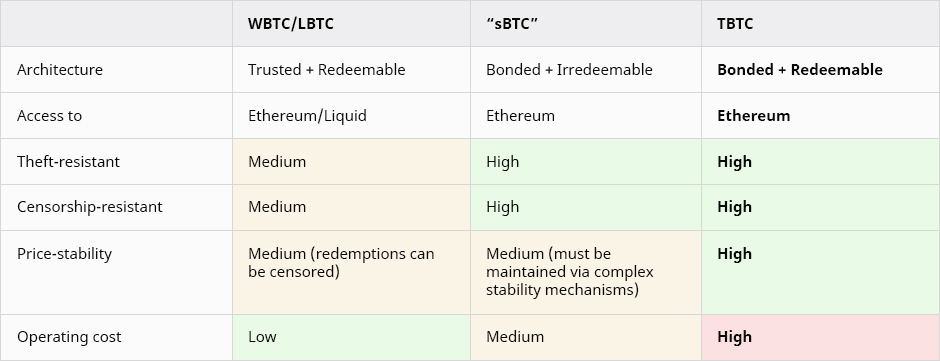

Whether these changes will reduce the cost of TBTC to a level where both users and hosts are satisfied with the system remains to be seen. At present, we can see the advantages and disadvantages of TBTC compared to other cross-chain anchoring:

in conclusion

By analyzing the ideal attributes associated with operating costs, we prove that systems like tBTC can achieve higher security by insuring each step with bonds, but bonds may be cut or confiscated due to misconduct. Whether this additional security is worth the price for users today can easily become a core issue in the crypto space.

Thanks to Arjun Balaji , Charlie Noyes , Georgios Konstantopoulos , James Prestwich , Lucas Nuzzi, and Matt Luongo for their feedback.

Su Zhu, Hasu

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Market analysis: market trading sentiment has recovered, and the bulls have begun to exert their strength?

- World Economic Forum: Can the blockchain get rid of the speculation in 2020?

- Top conversation! Coinbase CEO's Fireside Talk with A16z Founder: Blockchain and the Internet Resemble Each Other

- Viewpoint | Reveal the truth of Bitcoin's "halving market", will history really repeat itself?

- Ethereum founder Vitalik Buterin: digitalization is inevitable with or without blockchain

- Beam Sync: a new way to synchronize Ethereum nodes

- Depth | Legal and regulatory allowance, why hasn't Japan succeeded in an ICO?