South Korea passes special financial bill, cryptocurrency is finally fully legalized

Original: Sharing Finance Neo

Source: Shared Finance

Cryptocurrencies are finally legal.

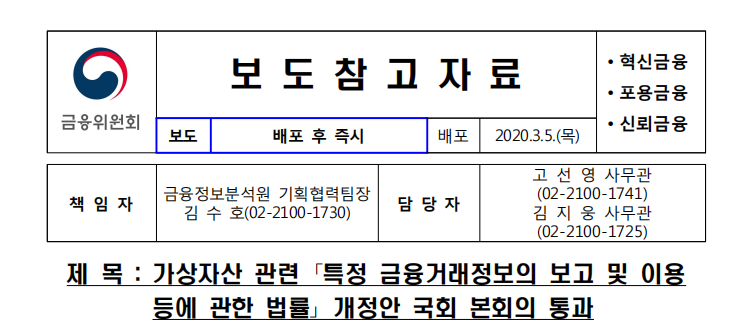

On March 5th, according to Korean media news, the Plenary Session of the Korean Parliament has passed an amendment to the special financial law, which will be implemented one year later (that is, March 2021).

- Deep digging in India's blockchain policy: behind the lifting of the cryptocurrency ban and the announcement of the blockchain national policy

- Analyst: New coronavirus will drive Bitcoin price to $ 100,000 by 2020

- Arweave secures $ 8.3 million in funding, and three giants A16z, USV and Coinbase participate in the investment

It is understood that the contents of the special financial law include the cryptocurrency exchange license system and the bank's support for real-name registration of cryptocurrency exchange account numbers. This also means that, since then, not only have virtual assets been formally legalized in Korea, but cryptocurrency exchanges have also been officially regarded as financial institutions. (Previously, the Korean cryptocurrency exchange was classified as an information provider, not a financial institution)

Special Financial Law Amendment

It is understood that the amendment complies with some of the implementation standards recommended by the Anti-Money Laundering Financial Action Task Force (FATF) and the "FIU Virtual Currency Anti-Money Laundering Guidelines" formulated by the Financial Information Agency (FIU) of the Korean Financial Services Commission.

At the same time, FIU will continue to develop a series of measures such as subordinate regulations to smoothly implement the amendment. Relevant departments will also actively collect opinions from the crypto industry and private experts.

The amendment stipulates that virtual asset operators must bear the obligation to prevent money laundering, and specifies the matters that financial companies must observe when conducting financial transactions with virtual asset operators.

The main authorization matters for the implementation of the Act include: the scope of anti-money laundering obligations plus the scope of virtual asset operators; the scope of virtual assets applicable to the law; crypto-related enterprises must be in the Financial Intelligence Unit (FIU) of the Financial Services Commission (FSC) Register and report to relevant departments; financial companies can deposit and withdraw accounts in which virtual asset operators can confirm their real names. (Starting criteria, conditions and procedures)

Virtual asset operators not only have basic anti-money laundering obligations, the obligation to report to FIU, but also additional obligations such as user classification and transaction details classification. Not only that, virtual asset operators also need to set acceptance conditions, such as the issuance of deposit and withdrawal accounts confirmed by the real names of financial company operating personnel, information protection management system certification (ISMS), and no criminal experience.

Undeclared operating companies will be punished with imprisonment of less than 5 years and a fine of less than 50 million won. This actually means that the government will directly manage the cryptocurrency market within the scope of the law.

The obligations of financial companies trading with digital asset operators include: checking the representative of the operator and the purpose of the transaction, checking whether the operator submits a declaration, and whether the funds are managed separately.

Based on the above principles, if there is a digital asset operator that does not meet the regulatory requirements, it will be forced to retire.

However, the bill will not be implemented until one year, during which all entities will have a six-month period to comply with the new law.

Good policy, some people rejoice and some worry

Faced with the good news from the South Korean Parliament, the fastest response is Binance.

This afternoon, Binance first posted on Twitter to celebrate the successful entry of South Korean virtual assets into the system circle. Then, Binance officially announced that it has reached a cooperation with South Korean fintech company BxB.Inc to jointly issue the anchor Korean won (KRW) Binance KRW (BKRW). Issued at 1 BKRW = 1 KRW.

It can be seen that Binance clearly knows the direction of the Korean currency circle policy, and has just launched its new layout at the right time. Of course, it is not difficult to speculate that with the legalization of Korean cryptocurrency, more and more crypto companies will move closer to South Korea. However, this policy may not be particularly friendly for Korean crypto companies.

In fact, although South Korean authorities have brought cryptocurrencies into the institutional circle, this also means that the government will directly manage the cryptocurrency market within the scope of the law. From the main content of this special financial law, we can find that in order to reduce risks and increase transparency of crypto asset transactions, the South Korean authorities have formulated quite strict obligations and standards.

You know, the entry of the regular army often means a complete rise of the head and a monopoly economy, and cryptocurrency exchanges are no exception.

Today, according to The News.Asia, as South Korea ’s special financial law is passed, some investors are worried that their preferred exchange may be closed, charge higher fees, or need to submit more supporting documents to continue trading on the platform , He will suffer further losses.

In fact, by the end of the six-month grace period, Korea ’s crypto exchanges may actually have only 4 to 6 exchanges to choose from, because only Upbit, Bithumb, Coinone, and Korbit have real-name banking systems, and in addition GoPax and Hanbitco are using ISMS (Information Security Management System).

All in all, with the legalization of cryptocurrencies, for local crypto companies in Korea, head companies will ride the wind of policy, and those who fail to meet the standards will face cleaning. For crypto users, in the long run, users do not have to face the hidden danger of being "harvested" by the exchange, but they may pay the price of privacy and high fees. Not only that, for those users who hold a large amount of money, there may be a A large number of small tokens return to zero.

However, with the institutionalization of cryptocurrencies in the next city, while we must make a choice, we can see that everything is going further and further on the road of being more on track, more transparent, and more acceptable.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Perspective | 2020: The turning point for bulls and bears and the opportunity for blockchain to empower traditional industries

- Reflecting on the dispute between the Steem community and Sun Yuchen, should DPoS be the one to blame?

- Indian crypto exchange lifts ban: trading volume soars 6-fold, is it global buy?

- Equity and debt double kills, the Fed cut interest rates sharply, can Bitcoin take over the "hot money" that escaped Wall Street?

- South Korea officially legalizes cryptocurrency transactions, Bitcoin stands at $ 9,000

- Only less than 10,000 blocks left! Will the Bitcoin halving effect come as expected?

- Amazon, Tesla and Bitcoin