Rollups are competing fiercely. Will a monopolistic Rollup emerge from the competition?

Will a monopolistic Rollup emerge from fierce competition?Author: Huang Shiliang; Source: Lightning HSL

Currently, the battle for Rollup in the Ethereum ecosystem is unfolding. Rollup can be seen as a special public chain, which is almost the same as a public chain for users.

The battle among many public chains started around 2016, but it seems that Ethereum has ultimately formed a monopolistic advantage, and other chains currently seem to have difficulty challenging the Ethereum ecosystem. The confirmation of this monopolistic advantage of ETH is approximately in 2022, after the super bullish market formed by DeFi and NFT, the only ecosystem left is Ethereum. Previously, strong competitors such as BSC, Solana, Polkadot, and Avalanche have become weaker in the bear market.

There are many investment opportunities in public chains, but most coins are highly volatile, with more opportunities to fall into pitfalls. Holding ETH is currently a rare coin that is willing to hold for a long time without fear of roller coasters. Will the current battle for Rollup also form a monopolistic Rollup and provide investment opportunities similar to ETH?

- Ethereum Merger One Year Anniversary What Changes Have Occurred in the MEV Supply Chain

- Lawsuit tug-of-war escalates, SEC requests investigation into Binance.US assets

- Celebratory Token2049 and Serene Singapore

It should be in 2021 when the concept of Rollup started to heat up. At that time, Arbitrum had an absolute advantage in terms of technical strength and time advantage. Currently, it still has advantages in terms of technology and ecosystem.

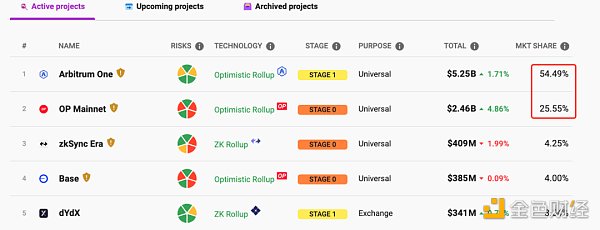

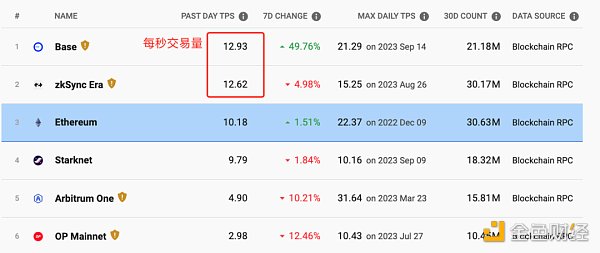

Arbitrum One currently accounts for about 55% of the TVL of all Rollups. OP Mainnet has a good economic model, issued coins earlier, and formed an alliance with many ecological products, forming a two-strong situation with Arbitrum in many indicators. Recently, Coinbase’s Base-rollup quickly took the top spot in popularity. Currently, Base’s TPS is already the highest among all Rollups.

Arbitrum One currently accounts for about 55% of the TVL of all Rollups. OP Mainnet has a good economic model, issued coins earlier, and formed an alliance with many ecological products, forming a two-strong situation with Arbitrum in many indicators. Recently, Coinbase’s Base-rollup quickly took the top spot in popularity. Currently, Base’s TPS is already the highest among all Rollups.

Zksync is probably the second in TPS due to the expectation of airdrops. These two sets of data are convenient for display, and it is too difficult to comprehensively evaluate the strengths and weaknesses of Rollups, so we can only use some simplified models for evaluation. TVL is for the present, and TPS is for the future.

Zksync is probably the second in TPS due to the expectation of airdrops. These two sets of data are convenient for display, and it is too difficult to comprehensively evaluate the strengths and weaknesses of Rollups, so we can only use some simplified models for evaluation. TVL is for the present, and TPS is for the future.

Arb and OP, which issued coins, occupy the top spot in TVL, while Base and Zksync, which did not issue coins, occupy the top spot in TPS. Imagine, if Base and Zksync also issued coins, how much would the TVL advantage of Arb and OP decrease? From these two simplified data models, I feel that the competition between Rollups has lasted for more than two years, and it is difficult to see which Rollup has the potential to form a monopolistic advantage.

From Uniswap’s victory in the fierce competition among many DEXs to become a monopolistic DEX, and from Ethereum’s victory in the fierce competition among public chains to become a monopolistic public chain, we can summarize the following perspectives to evaluate whether a project with monopolistic characteristics has emerged in a category.

1. Technical barriers.

Some performance indicators determined by technology, such as the ultimate TPS of OP-rollup can reach 100 transactions per second, and zk-rollup claims to achieve 1,000 transactions per second. For example, the lowest gas cost, like the OP camp can achieve one-tenth of L1, and zk can achieve one-twentieth? Transaction security confirmation time, such as OP can achieve the same level of security as L1 for transactions 7 days later, and zk claims to achieve a settlement time of 10 minutes. Security and decentralization are also performance indicators determined by technology.

Performance metrics determined by technologies have the potential for monopolization if a specific project is exceptionally outstanding while others are not. Uniswap’s V3 version relies on efficient and high-quality funds and its code is protected by copyright, ensuring that other projects cannot fork it for two years, thereby helping Uniswap establish a monopoly advantage. Currently, it seems that no project in the rollup category has a technical threshold that other projects cannot surpass.

2. Ecosystem threshold.

Evaluating the ecosystem of specific projects in the rollup category can be divided into the following sub-indicators.

1) The number, diversity, and activity of user communities. Typically, the current user community of ZKSync is clearly a single group of “wool party” (referring to users who solely seek benefits without contributing), which is an unreliable indicator.

2) The number, diversity, and level of brand collaboration and support from ecosystem partners and allies. For example, Op Mainnet currently has the most allies and is the most reliable. This indicator is particularly easy to form a threshold because once a large project collaborates with OP, it is not easy to cooperate with Arb, after all, everyone wants face, and it is not convenient to straddle multiple boats.

3) The number, diversity, and activity of developers. Although most rollups are project-based, meaning that rollup developers are self-funded rather than following the open-source developer model, blockchain projects still have the tradition of open source. If a rollup has the support of open-source developers, it is perceived to have better brand support. Currently, OP Mainnet seems to have relatively more open-source developers, mainly due to frequent support from the Ethereum Foundation.

Arbitrum also seems to have a considerable number of grassroots developers. Open-source developers serve as a good threshold because once they invest in a project, they are less likely to switch to others. Developers are not Sun Wukong (the Monkey King from Journey to the West). An example is Uniswap, whose developers outnumber and outperform other DEXs, making it a very impressive project.

4) The number, diversity, and Total Value Locked (TVL) of ecosystem projects, etc. If a rollup has DeFi, NFTs, gamefi, and other applications, and they are all outstanding, this is a very good threshold. Building an ecosystem is extremely difficult.

Ethereum won based on these factors. When EOS was born, it was very impressive, but its ecosystem consisted entirely of gambling projects, which did not survive a full market cycle and eventually failed. Currently, Arbitrum is the most successful in terms of ecosystem projects and has established a decent threshold compared to other rollup projects.

3. Brand influence and reputation threshold.

This is a significant and impressive threshold. Once a specific project establishes a superior brand within a category, this threshold becomes substantial. For example, Uniswap has almost become synonymous with DEX. Currently, in the rollup category, I think OP Mainnet is very clever. The project name is directly related to the technical term “Optimistic,” which has helped establish a good brand advantage.

Similar to zkevm, Polygon is also developing a Rollup and naming it zkevm. It gives the impression that they are related to the EVM. However, currently, I don’t think any specific project in the Rollup category has formed a brand advantage. Everyone is still at a similar level.

4. Innovation threshold.

Continuous release of new products and technologies is a significant threshold for projects. Uniswap and ETH have the strongest innovation capabilities in their respective fields, forming a huge threshold. Rollup is still in its early stages of development, and it is difficult to determine who has strong innovation capabilities. Op and arb have been continuously recommending new products, but it is still too early to tell.

However, there is one indicator that can be used to evaluate, which is research and development investment. Projects like arb and op have issued tokens and set aside development expenses, so it can be determined that their innovation capabilities are not lacking. And projects like zksync have raised several hundred million dollars in financing, so their innovation capabilities are estimated to be strong.

In addition, when it comes to token prices, it is more about the result rather than a monopoly factor. If a specific project has a monopoly advantage, its token price will be higher.

Finally, based on these four dimensions, I feel that in the Rollup category, it is still unclear which specific project has the potential for monopoly. Further observation is needed.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Rollups are competing fiercely, will a monopolistic Rollup be emerged as a result?

- Popular Science What is the statelessness frequently mentioned by Vitalik in recent speeches?

- How to understand that the TVL of Friend.tech is stable, but the price of Key is declining?

- Exploring Blockchain Space Creation, Use, Valuation, and Transaction

- Token2049 – Post-disaster reconstruction of industry credit and some real variables

- Interpreting the intent-centered landing challenges starting from UniSwapX and AA

- Summary of The Biography of Musk Want to Learn from Ma Yilong? Are You Crazy? Note Ma Yilong is a Chinese martial arts actor known for his unique fighting style. The original text is making a playful reference to learning from someone like Ma Yilong while discussing the biography of Elon Musk.