Will people who speculate on stocks go to bitcoin?

It is quite common for me to play with these two financial products at the same time. There are also many people who ask, is there a difference between speculating stocks and playing bitcoin? Is the difference big, hard to learn, etc. In fact, these two investments have many similarities, but more are different places, and the details that need attention are not the same.

Today, I will briefly talk about the similarities and differences between the two kinds of investment behaviors. Finally, I will give a little bit of personal opinion. It is appropriate to have people who are based on stocks to play Bitcoin.

The history of stocks is very long. The ancient Rome had a prototype of stocks more than 2,000 years ago. Modern stocks appeared in the Netherlands in 1602. The main role is to use an item to convert the entire value of the company into notes that can be bought and sold. This will enable the stock to become tradable, the value of the company can be greatly increased, and the shareholders will be profitable.

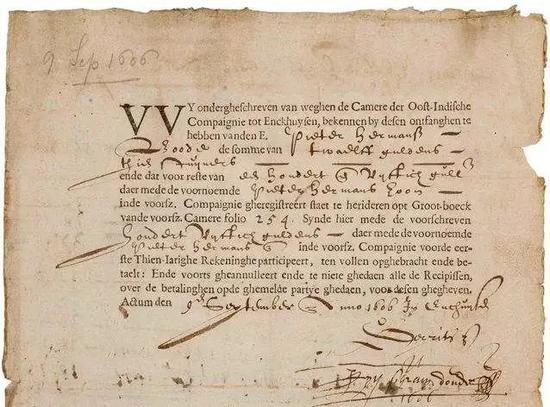

Moreover, from the time when more than 400 years ago, there were already financial activities of various operations such as shorting, doing more, washing, knocking, sitting, and so on. I have to feel the wisdom of human beings at that time. The picture below shows the world's first stock, the East India Company stock.

- When the funds are exhausted, the Ethereum Foundation will become history

- A secret history of bitcoin mining: a miner dug out 1.1 million bitcoins early in the "Patoshi mode"

- The public chain of conflict! Alien Attack Vulnerability from P2P Protocol

In modern stocks, it seems that the basic operation is not much different from that of more than 400 years ago. It is still the operation method. Of course, the gameplay is richer. The digital cryptocurrency is not the same. We will give you an example of Bitcoin.

Bitcoin was born in 2009 and has been full of financial attributes since its birth, because in the first sentence of Bitcoin's white paper, the father of Bitcoin wrote: "This article proposes a completely peer-to-peer technology. Implemented an electronic cash system that enables online payments to be initiated directly by one party and paid to the other without the need to go through any financial institution."

Such a paragraph actually made it clear that Bitcoin was originally invented to solve the problem of traditional online financial payments. After solving the problem originally conceived because of the development of Bitcoin and the blockchain technology behind it, and the fact that Bitcoin itself is becoming more and more known, the value of Bitcoin has gradually become higher and higher. There is a need to buy and sell bitcoin.

Having said that, if you look at the K line (as shown below), you can't immediately tell the difference between bitcoin trading and stock trading. The two look at the operation method is really very similar. There are also buying, selling, shorting, and retailing. The above picture shows the Shanghai Composite Index. The chart below shows the price trend of Bitcoin.

If there is a person who will buy stocks and suddenly wants to invest in Bitcoin, it is actually a problem from the difficulty of getting started. After all, the operation interface looks a lot like it, but in fact, the difference between the two is still very much. There are a few very significant differences.

time

Most intuitive, the stock market has a trading time limit, starting at 9 am and 3 pm. Bitcoin and other digital currency transactions have no time limit, and are a 7*24 non-stop market.

Quote change

Take the domestic stock market as an example, the rise or the maximum is 10%, and this rule is broken in the world of digital cryptocurrency. The range of up and down can be more than 10 points. And there are no restrictions. That is to say, getting rich overnight is not a dream at all. In the currency circle, it is really something that can happen.

The issuer and the underlying attributes are different

The issuer of the stock is actually an enterprise, and in terms of attributes, it still represents the assets of the company and a manifestation of its bond. Bitcoin is completely different. It is a practical product that has been issued first, and later became a financial product. There is still a big difference in fundamentals.

Price affected factor

Both the stock market and the price of the digital cryptocurrency market are affected by a wide range of factors. But there are still some small differences in these factors. In the stock market, the stock price of a single stock is basically linked to the development of the corresponding company. For example, if a company has significant positive news, its stock may skyrocket and then the daily limit. The digital cryptocurrency is more controlled by the market supply and demand relationship, and because there is no company behind the money to support, all the ups and downs are basically all market behavior. There are relatively fewer cases of behind-the-scenes black-box operations such as rat warehouses.

In fact, whether it is bitcoin or stocks, it is a kind of financial commodity. The cost of switching between them is not very high. Therefore, it is very common for stocks to speculate on bitcoin or to speculate on bitcoin to stocks.

Of course, the most important thing is to be cautious when entering the market. There will be risks in the hype, and the risk will be controlled. The bitcoin market is relatively more risky, but the income is higher, so you have enough understanding of the financial products you want to buy. Going to the market is a more reliable act.

Author: Nanjing Block Chaining

The copyright of this article belongs to the author, please do not reprint it. Authorized reprint, please contact the author, and indicate the source, once the infringement is found, the author will pursue the legal liability of the infringer.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Industry Insights | VentureBeat: Blockchain Helps Companies Improve Cloud Network Management

- What is the next battlefield for stable coins?

- The next vent of the currency circle gave the Ethereum holders a shot in the arm

- Rebuilding Notre Dame with Bitcoin? French Minister of Digital Affairs said that it could be considered

- Getting started with blockchain | One of the stable coin series: Why do we need stable coins?

- Depth | Financial Innovation and Currency Evolution

- V God fully responds to the currency security BSV: 4 characters long text, 4 major points (full text)