Viewpoint | Joseph Lubin: Towards the Global Economic Settlement

Editor's Note: This article is the full text of the speech "Toward a Global Settlement Layer" by Consensys founder Joseph Lubin on Deconomy 2019. The article is copyrighted by Decrypt Media.

Decrypt Media claims: Lubin is the founder of Consensys, an incubator based in Brooks, New York, that funds DecryptMedia, but Decrypt is independent in its selection. We requested a speech because we believe it has enough reporting value and will republish the full text here.

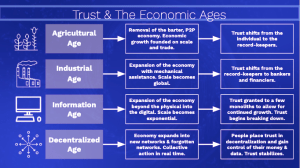

Economic age

Behind every economic era is the explosion of technological innovation, which enhances efficiency, promotes human cooperation, and brings us to a new era .

- Do you believe? Ethereum is a technology that can change the rules of the game.

- Why does cryptocurrency spread like a virus?

- The interesting step of "walking to make money" is a pyramid scheme that is draped in a blockchain coat?

During the industrial revolution, steam engines and other forms of mechanical assistance, mechanical forces extended our bodies, multiplied our power, made us stronger, better, faster, and created more in less time. value.

In the era of the information revolution, we have computer tools that can process information faster, plan and execute more complex actions, impact broader contexts, and create more value in less time.

In 1984, John Gage, the chief scientist of Sun Microsystems, pioneered the slogan "Network is the computer." Many years later, many web1 and web 2 companies promoted the network to billions of people around the world, greatly Unleashing our social nature and creating a social network/global community revolution – enabling us to organize global action in real time.

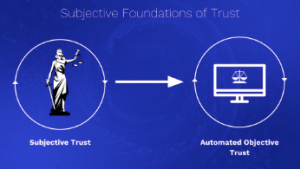

Objective trust

For thousands of years, mankind has built countless systems and technologies that have greatly improved the quality of life. But these advances are based on a somewhat fragile foundation: the basic layer of trust in society .

To create even the most basic common actions, people also need mutual trust. But in history, all the basic layers of trust in our society are based on subjective trust :

- Trust a single individual, or

- Interpersonal social network, or

- Commercial platform or institution, or

- Large central authority, such as the government.

This kind of subjective trust works well in many situations, but it can be problematic if there is misunderstanding, information asymmetry, or power inequality.

The reliance on centralized trust allows some intermediaries to extract too much value in the transaction flow.

Most of the time, they stand between content producers, service providers and customers, inject the necessary trust into the relationship, and then collect the rent. Until late, this is the only way we know about large-scale cooperation on Earth. Now, we need a new, better trust infrastructure that puts all the technical, commercial, and political tools that drive the world's operations .

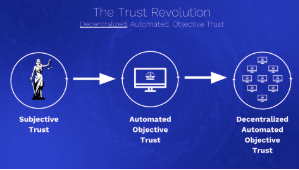

In the blockchain and distributed protocol systems, we finally have a breakthrough: automated, trust in objective things, can replace obsolete, fragile subjective trust, and then implant trust for all systems .

This trust revolution will change everything. Now we can restructure the system and society, let the agreement execute with certainty, and build truth, fairness, and fairness in the social rules system, so that everything we do will be reset to a more sound trust.

This new revolution in the global trust infrastructure—primarily driven by distributed blockchains and related protocols—will multiply all the energy we do in the era of trust automation. The economic revolution at this stage will not only allow us to create more orders of magnitude in less time, but will also likely change the definition of value.

Trust revolution

The trust characteristics of the blockchain system stem from the thoroughness of its decentralization . Some types of blockchain networks can resist manipulation – they can't be broken down by deception, even if nearly half of the nodes in the network are malicious.

With thousands of nodes in networks like Bitcoin and Ethereum, we can be sure that these systems are more resistant to manipulation than almost all systems in human history. If everyone on this planet happens to have a full-node device connected to the network, we can achieve the maximum decentralization of the blockchain network.

Workload Proof (PoW) systems are prone to decentralized attributes at the node level due to the following problems: high hardware and energy costs, channel tilt for efficient hardware, and scale efficiency at large mines.

A well-designed Proof of Entitlement (PoS) system removes these asymmetries, allowing more people to own or control hardware to participate in the network. The threshold for joining the network will be low enough that almost anyone can verify the transaction in the Ethereum network and help protect the network.

Casper's Proof of Entitlement (PoS) will provide breakthroughs in scalability while making the network more decentralized and more secure. The ACE's Ethereum Beacon Chain Test Network has been launched, and the eight teams that are building the protocol implementation should be synchronized on the shared test network within a few months.

Settlement, platform, walled garden

Settlement is the act of finalizing a sale or transaction. When the settlement is completed, all participants in the transaction will receive what they bought and sold and will no longer be in arrears. A settlement system, settlement platform or settlement layer is where the business, sale or transaction is settled.

In stock or equity transactions, settlements between securities firms will occur at the securities firm level, while other settlements may need to occur at the base level. This base layer is called the Central Depository. In the country where we are now, it is the Korea Securities Depository.

However, there is actually no global financial system that is glued together . Each garden is separated by hedges: securities firms serve within their jurisdiction; each country has a centralized custody; banks handle transactions across the country, and when it is necessary to cross the wall to complete a transaction, Acting bank relationship. The same settlement often occurs on many different types of platforms outside the financial industry. EBay, PayPal, MasterCard and Amazon can be viewed as a clearing platform for certain types of transactions. Google Play and the App Store can also be considered billing platforms. Others include travel websites and health maintenance organizations. None of these institutions is based on the interests of consumers, most of them are suffering from consumers and extracting the greatest value from us. Each is to protect their own pricing power first – limiting the freedom, choice and quality of the end user.

The traditional economy is to build the deepest and widest moat to protect competitive enterprises.

- Service providers, such as software and game developers, doctors, musicians, teachers, and Uber drivers, suffer from platform encroachment in different industries.

- In the past few decades, software developers have had to deal with different types of platforms: AOL, Compuserve, Windows, Mac, open packaging issues and browser compatibility issues (such as CompUSA and Egghead); Face these isolated Web ecosystems: iOS, a variety of Android, Facebook, App Store and Google Play.

- All along, you have to pay some fees to deliver your work to users. There is now a clean stream. On some blockchain platforms, developers can spend a few seconds deploying and using software without the need for an access mechanism, paying only a few cents.

- In the field of games, the platform on which games depend for survival—their “settlement” layer, can be said to have always had exclusive rights, which makes game production very fragile. From the ups and downs of the platform's dominance in the console war, to Facebook to control game developers by changing the economic and data access on the platform, and to today's app store also play the same powerful middleman role. Now, any developer studio can propose a scalable solution on Ethereum, such as Loom or Axie Infinity, and then anchor it to Ethereum – one that is not owned by anyone but is owned by everyone Owned platform. This platform itself will not take away 30% of your income. Nor will it change the rules imposed on you for selfish economic interests. This is the most fair base platform for the gaming industry or the “global settlement layer”. In addition, Ethereum allows scarce digital assets to flow between all games that comply with the relevant token standards. This is unprecedented, but it is also an open, shared platform is a natural result.

- Service providers like blockchain companies are subject to the financial industry platform, because worldwide, if banks believe that software development companies are developing next-generation database technologies, the decentralization of the banking structure will be unacceptable. Impact, then these software development companies can hardly establish bank relationships. But decentralized finance is on the rise, and soon blockchain companies will not have to rely on traditional financial infrastructure.

Platform risk

The regulatory and single-point control (or out of control) issues caused by closed platforms affect all aspects of the global economy. At the same time, the barriers caused by closures maintain the pricing power of enterprises at the expense of consumer service quality, cost and choice.

Therefore, all of our actions are subject to platform risks, which may be banks, game consoles, social networks, app stores, mobile phones and even countries.

Through distributed protocols, for the first time in human history, autonomous root identity information management (through a uPort-like system) was realized; privacy information was controlled (through a 3box-based personal data safe); self-employment was achieved (through Similar to the platform of Gitcoin or Bounties.Network), these implementations are based on a similar Ethereum-based (no access) trusted platform.

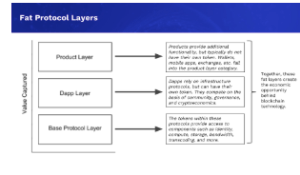

Rich protocol layer and economic opportunity

In 2016, Joel Monegro of Union Square Ventures published a blog post titled “The Rich Agreement” (also translated as “Fat Agreement”). The article points out that unlike the Internet and web protocol layers without value attributes, we will see a protocol layer that evolves from the blockchain ecosystem with its own value attributes (similar to Ethereum or other web 3.0 protocols, including: Go Centralized storage, bandwidth, complex computing, identification, location proof, etc., each protocol can be an open platform based on the tokenization protocol.

I prefer to call them a layered rich agreement, or a layered collaboration agreement.

Ethereum is an open platform based on rich protocols. It has a project called Ujo Music, and more than 1,000 artists (the number is growing at a rate of 10% per month) through which they reach their fans directly and bypass the agency to earn revenue (usually, record companies and streaming platforms) As an intermediary, 70% of these incomes will be withheld).

Later, the Ujo project will separate the creator portal from the underlying metadata and digital rights management (DRM) platform and make it a low-level platform for the world of music-related industries (one without access, based on Open platform for sharing agreements). The underlying platform can be seen as a collaboration protocol based on Ethereum. We can also build other types of collaboration agreements, including: content exhibitions, ticketing, equipment rental, venue leasing, marketing, legal services, and more. These industrial collaboration layers make full use of Ethereum's trusted layer (layer 1), the state channel layer (the second layer, which Ujo uses now), and other technologies (such as the Plasma network).

The difference between the Ujo platform (including its platform or its related platforms) and Sony BMG, Warner, Universal, BMI, ASCAP, Virgin Records, Ticketmaster is that anyone can sell music and build business on Ujo. . The platform is open to everyone and supports global billing. These music industry settlements are open, accessible without access, and to the greatest extent (in the distributed autonomous platform in which they are located) to ensure fairness.

So, will there be situations where platform governance is disrupted or unable to serve most people or companies? As we have seen in the Bitcoin and Ethereum ecosystems, the open source platform supports forks at the source level or network operations level. Bifurcation is a good thing, it allows some community members to open up new directions when they are dissatisfied with the status quo. This is also an evolutionary mechanism that facilitates exploring solutions and offering more choices. Most importantly, the threat of forks keeps us motivated and vocal . Either continuous upgrades or passive forks, switching costs between platforms is low, and artists switching their assets between different platforms is as easy as checking the box. In the initial dream of the Internet, depending on the criticism, it is far from the point of view, and now (unreviewed autonomy) has come true. Of course, we still need to continue to innovate and remain vigilant.

Vertical aggregation

In the early web era of the Internet, network protocols were indeed monetized. Cisco has done an outstanding job at the level of the agreement (general). Then, other protocols (HTTP, SMTP, XMPP) were monetized as part of the verticalization product (AOL, MSFT, Google, Facebook, Apple, Amazon, etc.). Bottom-up vertical aggregation is a good fit for businesses because it allows companies to maximize their benefits in an ecosystem as an intermediary, or to more easily expand in relevant market segments. Vertical polymerization is also a key factor in the closure of the platform and the formation of a walled garden moat. Think about what Google, Amazon/AWS, Microsoft, Apple and WeChat do.

In the blockchain era, the monetization of network protocols will advance at the level. For different industries and market segments, open platforms based on layered protocols can promote competition, because these granular platform products lower the barriers to entry. After full competition, successful experience will be difficult to replicate directly between different layers of agreement, which is in line with the original intention of competition law and anti-monopoly law. This economic structure will result in smaller and more specialized corporate organizations and fairer monetization agreements.

Granular global IT infrastructure

Unlike the value chain of commodities such as energy, grain, and hardware, the global IT infrastructure is still in the low-granulation stage of the free market economy. Many IT companies still retain a large number of sales teams and bilateral market operations. The product is still sold in the traditional way, or sold in boxes, or through an app store, or as a service, so you lock yourself in a walled garden. Even though the products of Apple, MSFT, Amazon, and Google are amazing and drive the world's rapid growth, we can still do better. By building an open platform, we can offer more choices, less imprisonment, and weaken pricing power for large corporate organizations.

Resource allocation methods such as computing, storage, and bandwidth in the cloud will gradually disappear. For example, if we let a watch complete a certain task, it will obtain resources from clothing, furniture, notebooks, and the cloud. Through a blockchain-based legal protocol platform (like OpenLaw), we can negotiate the ubiquitous allocation of compute, storage, and bandwidth resources, while using tokens for real-time payment, clearing, and settlement.

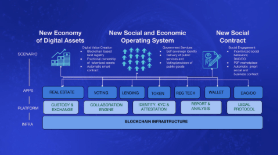

Next generation financial industry infrastructure

The next generation of financial industry infrastructure will include: centralized or decentralized spot token trading markets (using utility tokens and securitization tokens); atomic exchange agreements; stable currencies; parametric insurance products and trading markets; Platform; trade finance platform; insurance platform; open venture capital platform and decentralized governance mechanism. Futures, options, and other derivatives allow resource providers to hedge price risk and enable resource consumers to lock in prices for as long as needed. These infrastructures already exist and will mature soon.

Building a new financial infrastructure will promote the granulation and commercialization of global IT infrastructure, as well as other industries. We will see a freer free market, including: more cooperative competition; more efficient; lower entry barriers; more fair. The FinTech / DeFi revolution has enabled all of this to be spurred, and most of these advances have taken place in Ethereum.

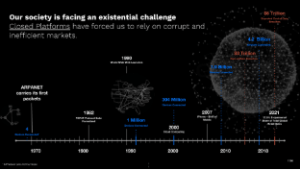

Closed platform = corruption & inefficiency

Closed platforms give rise to corruption and inefficiency .

Because of the closure and greed of the platform, the global economy is full of manipulation of the market. Even markets with high liquidity in the current economy are often corrupted. For a long time, some people who control resources and are patient have achieved self-interest by observing and manipulating the market.

Over the years, we have seen Barclays Bank and Deutsche Bank, which have run out of gold and silver scandals. Even LIBOR, the benchmark interest rate that anchors world currency prices, is often manipulated by some bank conspiracy groups. UBS, Barkley and other banks have been paying fines for frequent corruption in the trading market for decades.

If we can really make money for the whole world, financial companies and traders who control resources will spare no effort to manipulate the market for economic and political interests. We don't want the highly liquid token market to be equally vulnerable in the next generation of the economy. Therefore, we can only choose the most decentralized platform as the basic settlement layer of the global economy.

About the blockchain ecosystem: What choices are there?

Suppose we agree that freedom, choice, maximum credibility, etc. are all good attributes, so when we want to use the global clearing network with these attributes to reconstruct the enterprise and its cooperation, what are our reliable What about?

Fabric

- Probably IBM's Fabric?

- No, it cannot escape the relatively small network of private systems and licensing systems.

- Fabric can issue tokens, but only for narrow scenes.

- Fabric technology promotes closed platforms (limited access).

R3 Corda

- R3 Corda is a blockchain software service primarily for banks. It is more concerned with the trusted issue of peer-to-peer transmission than with trusted data sharing.

- Corda can issue tokens, but only for narrow scenes.

- Corda technology promotes closed platforms (limited access).

EOS

- The debate surrounding EOS has been going on for a long time because EOS is controlled by 21 super nodes and is not completely decentralized. As long as these nodes are willing, they can collude and collude; the government and other chaebols can also use bribery or force them to act against their will. This will compromise the interests and security of EOS users.

- If EOS's block nodes do evil, they will be voted out – this is the main way EOS guarantees decentralization. But this is also controversial, because unfortunately, there is no good way to test whether these super nodes collude, collude, bribe, or be forced to do something inappropriate.

- I can imagine that EOS will be used in some games; but it is completely unimaginable that the tokens of those games will be of high value because of the high risk of group value theft when using the EOS platform .

Polkadot

- Polkadot was built by the Ethereum Parity client development team – Parity is a very powerful team.

- Polkadot achieves scalability through a major heartbeat chain (or “relay chain”); there are many branches on it. Polkadot plans to release their relay chain mechanism in the third quarter of 2019.

- The Polkadot project sees Ethereum as one of the potential “virtual branches” that can be bridged.

- Any branch that wants to connect to the Polkadot middle chain ("parallel chain") must be voted through the dot (the Polkadot system token) holder. When a branch is no longer supported by most dot holders because of non-compliance, these branches are terminated or removed from the system. In fact, Polkadot is the licensing chain, and the whitelisting and blacklisting of the branching network is the core guiding principle for managing the Polkadot system .

- Suppose there is a branch that allows anyone to upload a dApp without authorization. Eventually the Dot holder may object to these actions; the system default dot holder is responsible for the entire system, so the branch will not be free to provide the service. Polkadot will be a highly controlled licensing chain platform.

Cosmos

- Cosmos also has strong technical team support.

- Cosmos does not really publish the underlying trust layer services, but rather focuses on interoperability between independent platforms. But in the next few years, in addition to allowing tokens to be transferred across networks, Cosmos does not seem to offer other interoperability features; the Cosmos team believes that the most important use case for interoperability is to transfer tokens across the network.

- I hope that Cosmos will perform better as a second-tier solution and connect to the underlying trust layer if necessary.

- We also expect Cosmos to interact with Ethereum through a token transfer bridge.

Dfinity

- Dfinity has a strong team.

- Dfinity is currently a closed network controlled by a handful of investors and token holders (the controller said that the project will be open source at some point, but no one can guarantee…), but as far as I understand, Dfinity doesn't want to do global basic trust and clearing layer services, they are more like decentralized AWS. No matter when Dfinity is released, they should all do better than expected.

- Dfinity does not seem to be a global foundation trust layer, similar to Cosmos, because their initial design choice puts the security and consistency of the system ahead of usability and applicability. As long as 34% of Dfinity's nodes are incorrectly masked by the firewall causing block delays (and many possible node errors), the entire Dfinity will stop and each system built on it will stop. This is unacceptable for many different levels of application.

Therefore, I subjectively say that for the global clearing service, there is only one suitable basic trust service available… Come, please applause!

Hey… wait, the wave field is still forgetting.

That's right, this is right.

Ethereum 1.0

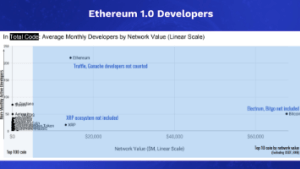

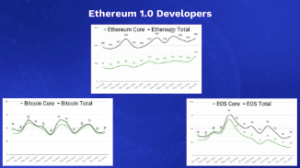

No matter how you look at it, Ethereum is the largest blockchain ecosystem. Comparing the number of core protocol engineers, Ethereum is ahead of Bitcoin, which far exceeds the sum of other blockchain systems; from the application layer developers, Gartner analysis points out the developer ratio of the Ethereum ecosystem. The second-ranked IBM Fabric is 40 times more.

Ethereum is a system that really has no access restrictions, and there is no such thing as a whitelist or a blacklist. Anyone can join Ethereum for transaction verification and upload apps. It is a global zero-review basic trust layer with no central node control or failure.

Again, no matter how you look, Ethereum is the largest blockchain ecosystem. In order to make it a global foundation settlement service layer, we still have a few things to work on:

- Ease of use (user interaction and user experience)

- Privacy and confidentiality

- Scalability

In order to attract more users, many projects are working to provide more friendly users, rather than fearing users to lose identity and tokens, forcing them to remember 12 security words. Only when the user is familiar with the entire system will the project give the user more responsibility. The emergence of blockchain introduces a new mode of operation, so we also need to educate users – just as Apple is leading the way to pinch, tap, and press the iPhone with different gestures in a gradual way. MetaMask, Burner Wallet and 3box are all looking for a simple and efficient user experience design to achieve greater market acceptance.

We have also made great progress in terms of privacy and confidentiality. Private networks can access Ethereum via, for example, Plasma technology, or secure transactions on Ethereum in a state channel, Aztec protocol, and more.

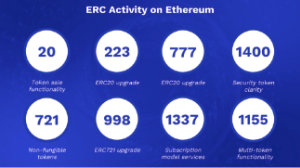

Ethereum – ERC Token

Most of the Web 3.0 standards are presented at Ethereum. The ERC token standard on Ethereum is constantly being promoted and it is another proof – proof that Ethereum is in full swing. Among them, the well-known ERC20 and ERC721 protocols have promoted the wave of tokens in recent years, and the use of non-homogeneous tokens in the game field; the ERC223 and ERC777 protocols are upgrades to the ERC20 protocol; the ERC998 protocol extends the practicality of the ERC777 protocol; The ERC1337 protocol regulates blockchain-based subscription and payment behavior; the ERC1400 protocol clarifies token security; the ERC1155 protocol proposes multiple token functions; the above is only a small part.

The momentum of Ethereum

Ethereum 2.0, Polkadot, and Dfinity all have similar architectures and functions, and the launch time is similar. Of course, I am more eager to see the Serenity stage (Ethereum 2.0) fully functional, and before the launch of these "next generation architecture", it can be recognized by the majority. Building a platform requires a lot of work, and starting a platform requires a lot of effort. The Ethereum ecosystem is diverse, professional and dynamic, and can achieve this goal quickly and well. Building a blockchain ecosystem requires a lot of work and network effects; therefore, at that time, Ethereum will be a few orders of magnitude larger than the other two, and it has been very scalable in the second layer of solutions.

Ethereum is rapidly expanding its innovations in the first (basic trusted layer) and second (application layer) services. The first layer of Ethereum is currently the only choice for global clearing services, as it prioritizes usability and applicability rather than consistency, and is relatively quick to reach consensus and rigorously guarantees maximum decentralization.

Quantification of decentralization

How to assess the degree of decentralization and thus the competitiveness between blockchains has always been the focus of attention.

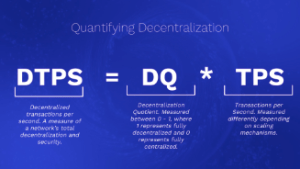

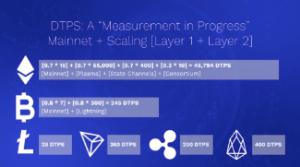

Many discussions have always focused on the scalability and tps of blockchains, but this is not the best way to measure blockchain throughput because they do not take into account the decentralization of blockchain projects. We use DTPS (or called the number of decentralized transactions per second) to replace these measures—by objectively comparing blockchain performance and potential by quantifying the degree of decentralization and throughput.

DTPS is the product of tps and DQ (decentralization factor). DQ is a parameter between 0 and 1: 1 for full centralization and 0 for full centralization. DTPS will consider the transactions of the main network, as well as the second layer of transactions that occur in parallel through sidechains, Plasma networks, state channels and other extension mechanisms.

Of course, the current problem with the DTPS indicator is whether the decentralization and throughput evaluations are sufficiently objective, especially when measuring expansions that do not occur on the main chain. On this issue, we are trying a "dynamic measurement method" and observe whether the given DTPS is objective.

We will immediately publish the site and iterate through the project in a decentralized community, while working on a way to track each blockchain ecosystem through DTPS.

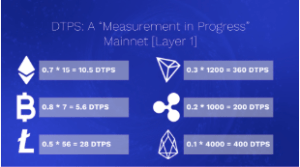

First layer DTPS

This is a DTPS sketch that excludes Layer 2 throughput. With only the basic trust layer in mind, Bitcoin and Ethereum have the highest degree of decentralization, but they perform very well in tps performance.

First layer + second layer DTPS

This DTPS sketch takes into account some of the Layer-2 throughput that has emerged. In general, under the same conditions, the lower the degree of decentralization, the smaller the DTPS and the lower the security. Today's global information infrastructure, owing to inherently centralized forms, technologies, and social habits, always uses centralized architecture and technology to handle transactions, resulting in their DTPS being almost zero; Leaks, servers are hacked, and our common security issues.

By establishing a basic clearing layer service, many blockchain networks and related systems can “anchor” their transactions on them, with each additional side chain or relationship chain joining the root chain, and the DTPS of the entire ecosystem will The water is rising.

Conclusion

The open source and sharing of the platform is a natural trend and is closely related to our daily lives. The whole piece of land is like a transport layer. We can walk freely, breathe freely, gather in the park, or play in the ocean, lakes and streams. We should also strive to make more digital infrastructures such a pure land of open sharing, and bring common interests to the whole people; as long as we put more effort into the basic protocol layer so that everyone can share resources at a low cost, then The overall social well-being will increase significantly.

If everyone can trust the value of the native digital created on a basic clearing service layer, then we can get rid of the brutal competition and resource constraints of the past, from zero and mentality to positive and collaborative.

Unconstrained and abundant thinking will promote the guiding principles of economic development with cooperation as the priority, and finally turn it into a jade. The reliable encryption economy has inspired us to succeed together, because as long as your open source platform is successful, your wealth will come.

Thank you.

Original link: https://decryptmedia.com/6343/an-overview-of-the-state-of-the-blockchain-ecosystem Author: Joseph Lubin translation & proofreading: haiki, wuwei, IAN LIU & A sword

This article is authored by the author to translate and republish EthFans.

(This article is from the EthFans of Ethereum fans, and it is strictly forbidden to reprint without the permission of the author.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- New play ILO, fancy airdrops in the currency circle?

- Introduction to blockchain | Explain the problem of General Byzantine and the principle of mining with the Romance of the Three Kingdoms

- Blockchain Friends | Dozens of hardcore practitioners, chat for 4 hours, what do they say?

- Exclusive Compilation | Can Bitcoin enter the mainstream financial market with exchange-traded funds (ETFs)?

- Nestlé and Carrefour announce that consumers can access product data via blockchain

- French Finance Minister: Do your best to support blockchain technology innovation and let France take the lead

- Blockchain and games | IPFS's God-level application lies in the game?