Will the cash between Alipay and WeChat disappear due to the central bank's digital currency?

Author: Marcello Minenna

Translation: Yue Wei

Source: Blockchain Outpost

Introduction: Digital currency competition is becoming increasingly fierce around the world. From cash to online payment to digital currency, what changes will payment methods bring to our daily lives?

- Cryptocurrency money laundering analysis: how criminals will transfer billions of dollars in 2019

- Crypto asset service provider Keystore secures $ 10 million in funding, led by Jianyuan Fund, distributed capital follow-up

- 8 asked videos | Conflux Long Fan: Only by reducing the interaction cost with the public chain will there be more applications

In recent months, the pace of competition for central bank digital currencies has been accelerating.

Not long ago, Chinese President Xi Jinping publicly stated that China should actively invest in blockchain because blockchain is the core of future technology. With the support of the government, the development of blockchain in the Chinese market will go a lot better, but it will also worry Western entrepreneurs. They all felt that in the development of digital currency, they would be overtaken by China. Zuckerberg, the president of Facebook, is a typical representative, especially recently, because of the Libra project, he felt strong resistance from Western governments and regulators.

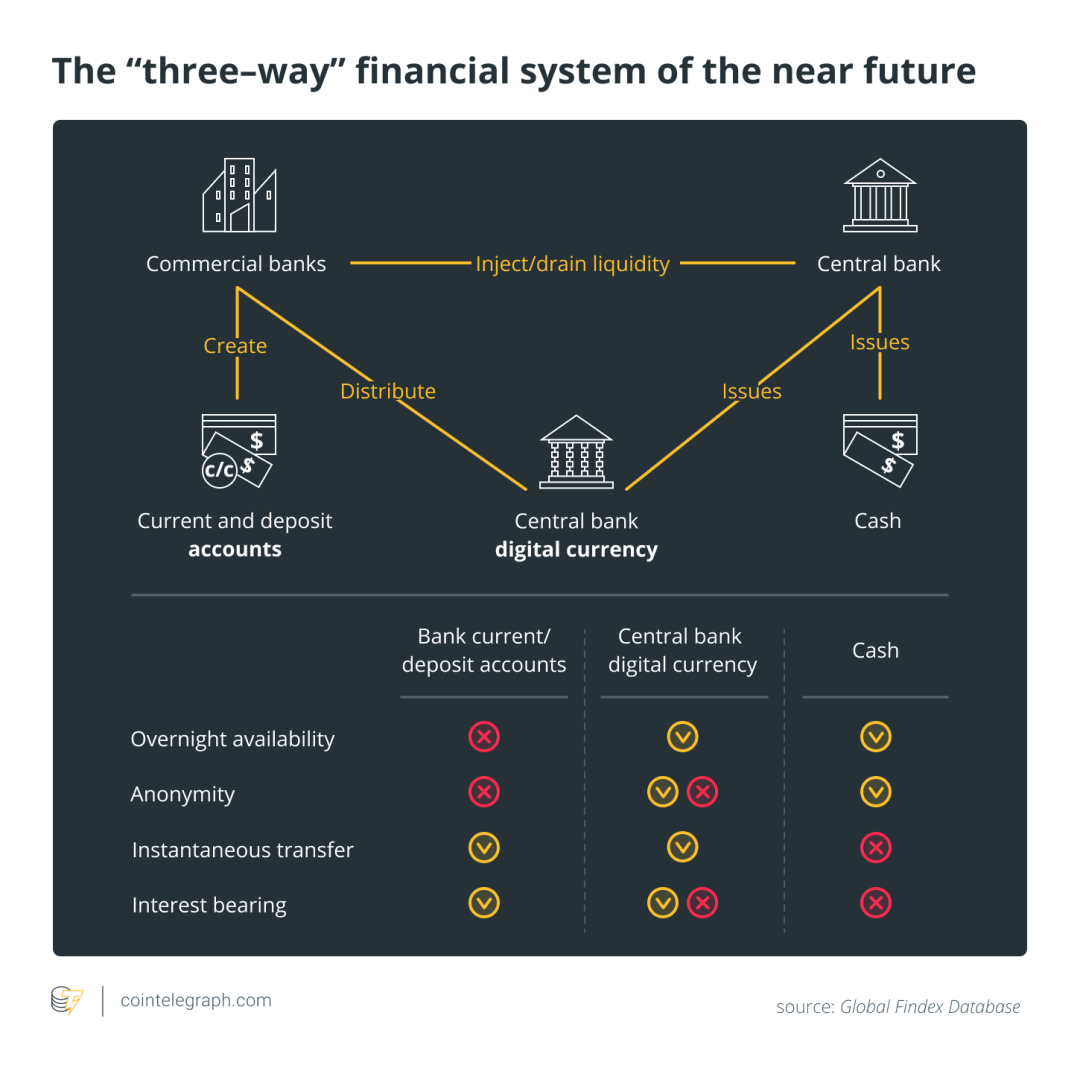

The so-called central bank digital currency is a new type of fiat currency. Ordinary users can obtain digital permissions on central bank accounts, but the "central bank" referred to here is limited to today's commercial banks. Central bank digital currencies combine the digital characteristics of bank accounts with the typical advantages of traditional cash. But there is another key question that needs to be carefully considered: to what extent is this possible? Will new currencies take the form of personal bank accounts? Can it pay interest on loans like a bank account? Or, like all typical cryptocurrencies, will it become an anonymous digital token without interest rates?

Recently, a study by the International Monetary Fund explored the appropriate monetary and technical characteristics of newly introduced central bank digital currencies, and pointed out that the characteristics of currencies depend on the economic environment and banking system in which they are circulated. In fact, if the payment method suddenly changes, it may cause economic disruption and may even have very serious side effects. In the end, with the "successful" introduction of digital currencies, the frequency of use of other payment methods may decrease to a certain threshold and then gradually disappear. For example, as the amount of cash used decreases, banks' ATMs gradually decrease, and companies gradually refuse to accept cash payments. This trend has been basically shown in Sweden.

Want to be anonymous or secure?

Generally speaking, different economic operation models have different emphasis on anonymity and payment security. Cash can basically guarantee the anonymity of transactions, but bank accounts can meet users' security needs. The significance of anonymity is that even if the transaction party has very obvious signs of tax evasion, it may not cause the suspicion of the regulators.

Recently, European Central Bank President Christine Lagarde said that currently untraceable payment methods have created an unstoppable demand in the market. In this way, consumers can avoid the unauthorized use of personal transaction data by financial fraud groups, thereby affecting their credit scores.

The design of digital currencies is different, and the corresponding anonymity and security ratio can also be adjusted freely. For example, the central bank can guarantee the anonymity between users, but according to court orders or even certain transaction restrictions, the government's supervision of user information must be retained.

If cash only comes in the form of tokens, for example, as a standard cryptocurrency that can be used by unauthenticated users and can also be purchased through anonymous payment cards in stores or online, then this central bank digital currency can indeed be tracked However, it can only be traced. In the end, there will still be the risk of loss or theft like real cash and cryptocurrencies: either the card is lost or the digital key is changed.

But the central bank digital currency is different from the above token design. Every user must open a central bank account and pass real-name authentication. In this case, digital currency accounts almost perfectly replicate (or even exceed) the security level and traceability of bank accounts.

Changes in deposit and loan interest rates will cause a series of problems

Digital currencies can interfere with the financial system and ultimately lead to people no longer needing cash and deposits. Once this happens, the first thing to face is the disappearance of cash. A central bank digital currency similar to bank deposits will prompt banks to raise deposit rates in order to maintain their market position. What's more serious is that the interest rate of loans has also risen accordingly, which has led to the voluntary contraction of corporate loan credit. In the case of economic (more or less severe) dependence on bank credit, the contraction of personal or corporate loan credit will reduce the market participation of banks, which will lead to chain reactions such as reduced investment, reduced production, and increased unemployment. Benefit from high interest rates on deposits.

If the digital currency issued by the bank has a certain interest rate, the intermediary role of the bank will be further weakened. Although a certain interest rate is a good thing for savings accounts, it seems that the disadvantages are even greater. The value of digital currencies will be eroded faster than the inflation rate of fiat currencies. In this way, there will be no speculative phenomenon of hoarding currencies. Consumers find that The digital currency in your hand is worthless and will be spent quickly.

In recent months, large-scale digital currency preparations have shown that digital currencies issued by central banks in various countries do not have cash interest rates. The reason is to protect the banking system from this potential impact. The choice of this policy will inevitably lead to fierce competition between cash and digital currencies. The prevailing belief is that society without cash participation is more convenient, but this may not always be the case. There is a clear price to pay for eliminating cash, especially for developing countries, although the price is much smaller than the reduced economic participation of the banking system.

Global bank accounts are far from universal

Recent data shows that there are still huge gaps around the world in terms of distribution of payment opportunities.

At present, half of the global population that is isolated from the financial system is located in South Asia, East Asia, and the Pacific. Among them, China's unbanked population accounts for 12%, India accounts for 21%, and Indonesia accounts for 6%. Together, these three countries account for 40%. According to 2017 data from the World Bank's Global Index, the population of the Middle East and North Africa is most isolated from standard financial institutions, and the penetration rate of bank accounts in these regions is only 14%. At present, only Denmark has achieved the full population penetration of bank accounts, ranking first in the world.

Obtaining a bank account requires many prerequisites, such as possession of certain property, identification information issued by the state, and proof of residence. But for the marginalized groups in developing countries or regions, these prerequisites are no different from a distant dream. Findex reports indicate that 1.5 billion people worldwide do not have identity information, most of them in Asia and Africa. There are other reasons for financial isolation, such as people ’s lack of financial knowledge and the low level of financial services in rural areas. In addition, there are more than 200 million small, medium and micro enterprises in the world that lack the most basic banking qualifications and lack sufficient funding support.

Cash still exists

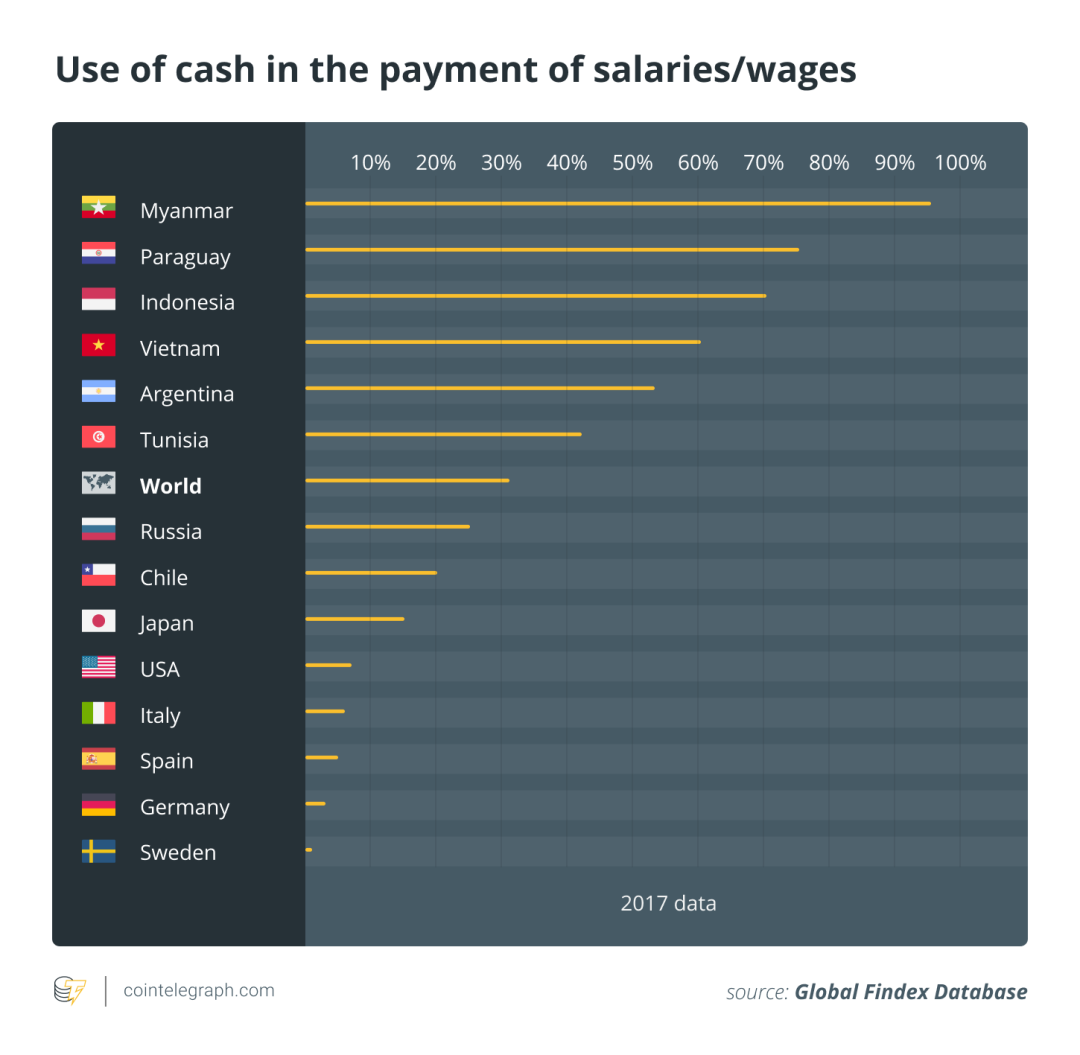

In many large developing countries, cash payments still dominate transaction activity, including compensation payments.

In India, the government has been trying to strengthen the intermediary role of banks. From 2006 to 2015, the circulation value of bank notes and coins issued by the bank still increased at a rate of 14% per year.

In Kenya, cash accounts for 98% of all transaction value. Although 75% of adults pay via mobile phone, surveys of low-income households show that digital payments account for only 1% of all expenses and only 3% of all transactions.

As a result, the government's efforts to accelerate digital payments instead of cash are continuously widening the currency payment gap, which may make the situation extreme, and groups without bank accounts are facing more serious social and economic problems.

In fact, when a digital currency was introduced into the Global Monetary Fund, low-income households waited longer for bank accounts to spread . Unlike the interest generated by bank deposits, there is no interest on the cash in hand, so when the number of bank loans triggered by the central bank's digital currency fell, low-income households suffered greater asset losses than wealthier households.

In addition, if digital currency causes cash to eventually be squeezed out of the market, such as in situations like Sweden, low-income households without bank accounts will experience further decline in convenience due to lack of better payment methods.

Therefore, from the perspective of the Global Monetary Fund system, bank depositors will become the biggest beneficiaries, and cash users who are not bank depositors will eventually become thoroughly "absolutely poor . " This is almost a retrogression to the global income distribution, and central banks and governments must weigh it.

Bank savings have many advanced features, such as real-time transfers; new types of digital currencies can increase savings, consumption, and investment, resulting in more technological innovations, creating more job opportunities, and stimulating economic growth. In addition, digital currencies can fundamentally prevent tax evasion. However, it is also necessary to consider that as a new technology, digital currency may also disrupt financial markets, thereby triggering financial earthquakes and causing long-term adverse effects.

Therefore, the best solution to mitigate the negative impact may not be to eliminate cash or the intermediate role of banks, but to create a comprehensive financial system that allows different payment methods to coexist in a balanced manner to meet the needs of different economic groups worldwide.

Related link: https://cointelegraph.com/news/the-financial-system-of-the-future-who-benefits-from-cbdcs

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blockchain speed in Zhejiang: bid farewell to 100 million paper notes in 6 months

- First | Ant Blockchain Engineer Readme: Using Blockchain to Realize Cross-City Metro Subway Codes

- Coinbase Chief Legal Officer: Analysis of three major regulatory directions in the cryptocurrency field in 2020

- State Council: accelerate the development of blockchain technology and industrial innovation

- Opinion | What impact will the new digital currency have on the international currency competition landscape?

- 2019 chain game player demand survey report: male players account for 78.8%, 66.4% of the respondents understand the difference between chain games and traditional games

- The interpretation of gimmicks and mining challenges caused by the halving of Godfish and Maya | Chain Node AMA