In 2019, currency-related crimes caused US $ 6 billion in losses, and US $ 1 billion in BTC for the dark web

Source: Hive Finance

Editor's note: The original title was "Currency-related crimes cause US $ 6 billion in losses throughout the year"

In 2019, the number and amount of money-related crimes are increasing compared to previous years. There are all kinds of illegal means such as dark web transactions, hacking, money laundering, and project running.

- Ethereum becomes the central bank's top choice? RBA begins testing central bank digital currency on Ethereum network

- Over 600 million U.S. dollars invested in a year, 71% from institutions, Grayscale annual report reveals Bitcoin trends

- Babbitt Column | Cutting-edge regulatory technology for capital markets

According to Chengdu Chain Security statistics, in 2019, global digital asset crime cases totaled more than US $ 6 billion in losses. Criminals use the anonymity of digital currencies to evade supervision, conduct speculation, illegal fundraising and other activities, which poses a great threat to the safety of public property.

This year, the use of bitcoin by the dark web also reached an all-time high, with more than $ 1 billion in bitcoin being used for illegal transactions on the dark web.

The B side of cryptocurrency innovation and wealth creation is the criticism brought by these illegal acts.

"Run the road" into a typical digital asset crime

Since the birth of cryptocurrency, it has been accompanied by controversy. Like both sides of the coin, it has a blueprint for restructuring the financial system and has become a tool for criminals to collect money.

According to blockchain analysis company Chainalysis, in 2019, the scale of bitcoin flows to criminal exchanges reached $ 2.8 billion. The company said that this number has been growing since early 2019, of which 27.5% went to Binance and 24.7% went to Huobi, involving more than 300,000 personal accounts, most of which belong to OTC traders, who are usually associated with exchange , But operates independently.

Binance Chief Compliance Officer Samuel Lim said they will continue to optimize KYC and anti-money laundering (AML) technologies to clear financial crimes in cryptocurrencies.

It is undeniable that although the exchanges continue to complete their own risk control systems, they still cannot be foolproof when dealing with issues such as money laundering.

Money laundering is only a small part of cryptocurrency crime. According to the Summary of 2019 Blockchain Security Incidents released by Chengdu Chain Security, in 2019, blockchain security issues based on blockchain digital assets are generally on the rise, and security events caused by various reasons have increased significantly. Currency crimes are numerous, and there are frequent cases of money laundering, fraud, illegal fundraising, theft, drug trafficking, and mining crimes.

According to statistics from Chengdu Chain Security, in the digital asset crime cases in 2019, the United States accounts for 28% of the world's largest, Europe accounts for 24%, and China accounts for 18%. From January to mid-December 2019, there were about 10,000 digital asset hacking incidents worldwide, and as many as 2,000 digital asset-related criminal cases occurred in China.

From 2012 to 2019, the value of digital assets such as Bitcoin has continued to increase, and the number of hacking incidents has also increased year by year. In 2012, there were only 347 hacking incidents, 5971 in 2017, and 10297 in 2019.

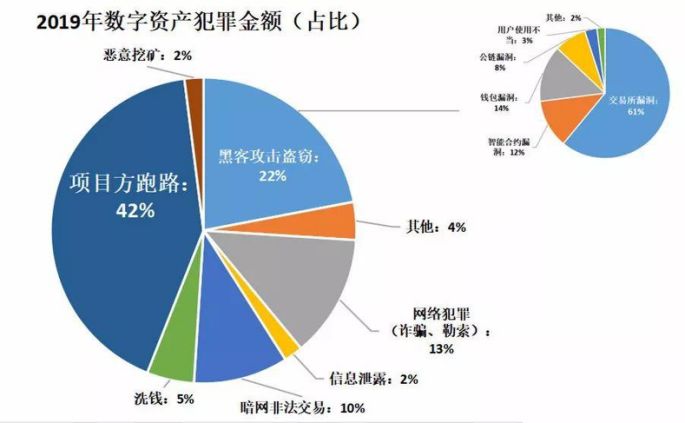

Proportion of digital asset crime in 2019

(Source: Chengdu Chain Security)

Chengdu Lian'an data shows that in 2019, the amount of crime committed by hacking and theft accounted for 22% of the total amount of the year, and the amount of crime committed by the project side exceeded that of hacking, accounting for 42%, which is the most crime type; Dark web illegal transactions accounted for 10%, cybercrime (fraud, extortion) accounted for 13%, and money laundering accounted for 5%.

Chengdu Lian'an concluded that in 2019, there are endless crime methods, ransomware and funds running mode have been changed, and criminal gangs have a wide range of sources. The number of crime cases and the total amount of criminal activities are increasing.

$ 1 billion BTC for the dark web, refreshing history

A large number of financial crimes surrounding digital assets have clouded this nascent industry. Although the popularity of blockchain and cryptocurrencies has increased in the development of more than 10 years, there are not many people who talk about the change of currency. The application in the gray area is the main factor for the misunderstanding of digital assets such as Bitcoin, and dark web transactions are one of the most criticized phenomena.

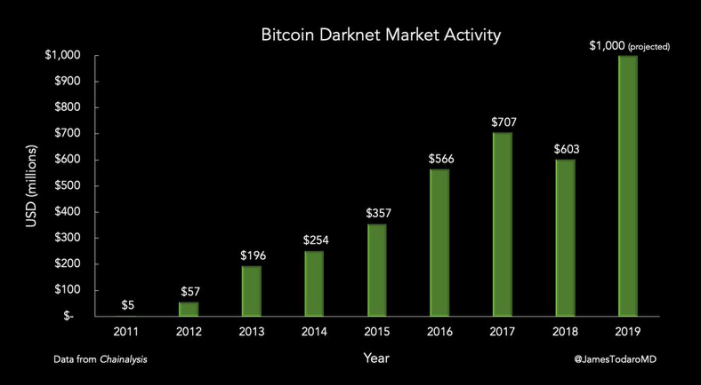

Not long ago, James Todaro, director of data analysis agency Blocktown Capital, tweeted about the use of bitcoin on the dark web every year. Although the use of bitcoin on the dark web declined in 2018, this data has significantly increased in 2019, rising from US $ 603 million in 2018 to over US $ 1 billion, refreshing the US $ 700 million created in 2017 Historical high.

Bitcoin amount used for dark web transactions from 2011 to 2019

Chengdu Lian'an statistics show that Bitcoin is the most popular digital currency on the dark web, followed by Litecoin. Bitcoin is mainly used for trading drugs in the dark web world.In addition, it is also used to purchase arms, illegal software, private information and data.

At the end of 2019, according to foreign media reports, Matthew Witters, a dark web drug lord, will serve seven years in prison for selling thousands of doses of fentanyl, most of which are traded in cryptocurrencies such as Bitcoin. Police point out that Matthew Witters was the main seller of fentanyl on AlphaBay and Dream Market in the dark web market from 2015 to 2017.

Cryptocurrencies have become the "hard currency" of black trades, which is not good news for those who expect to transform the financial world.

At this stage, there are not many practical uses of cryptocurrencies such as Bitcoin. According to the original intention of Bitcoin creator Satoshi Nakamoto, he hoped that Bitcoin is a peer-to-peer electronic payment system, but in the past 10 years, this dream has not become a popular reality, instead it has become a hype tool and a safe-haven asset.

Chengdu Lianan appeals that in the face of asset thefts caused by blockchain system security vulnerabilities, and the use of digital assets for crimes, pyramid schemes, and other illegal activities, blockchain security companies need to go all out Take responsibility. On the one hand, it assists relevant enterprises to do a good job of security protection, improve security protection capabilities, and reduce security losses; on the other hand, it vigorously assists government regulatory agencies in conducting investigations and evidence collection to effectively strengthen security supervision.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Russia's new Prime Minister calls for priority development of the digital economy, is the opportunity for blockchain coming?

- Analysis | Which blockchain projects have the largest number of giant whales in the "ocean"?

- How will the US election affect crypto legislation?

- Zhu Jiaming's speech at the United Nations Blockchain Forum: Actively Facing the Challenges of the Global Trust Crisis and Trust Deficit

- Popular Science | DeFi Beginner's Guide

- Former CFTC chairman intends to promote "digital dollars" through non-profit foundations

- 2020 Winter Davos Forum Blockchain Preview: Digital Currency Becomes Core Issue but Has No Chinese Role