Opinion | Underrated Ethereum: Victory is almost doomed, the only difference is now or in the future

Editor's Note: Original title was "Undervalued Ethereum: The Treasure of Value Investors"

Full text highlights:

- In the blockchain industry, the Matthew effect is still applicable. Due to the homogeneity of the functional and application areas of the smart contract platform, it will further promote the competitive trend of "strong and strong". The following factors will promote the continuous evolution of Ethereum (ETH) into a new super species and continue to release market value;

- ETH is seriously undervalued by the market compared to Bitcoin and similar types of smart contract platforms. Under the current competitive landscape, the victory of Ethereum is almost doomed;

- Due to the use of an excess mortgage model, the development of DeFi will promote the locking of a large number of ETH assets in smart contracts, thereby reducing ETH circulation;

- After ETH2.0 will adopt the POS consensus mechanism, it will need to staking a large amount of ETH in order to become a node or participate in voting decisions;

- In other ETH applications, locked ETH is naturally stranded because of the capital turnover in commercial activities;

- The rapid evolution of Ethereum technology and the proliferation of consensus have prompted investors to actively lock positions, thereby reducing market circulation;

- In the rapid evolution driven by open source, Ethereum will form a complete suppression of a large number of similar platforms and continue to grow through the "siphon effect".

Blockchain: the master of "open source thinking" and "crypto punk"

Blockchain technology is not from scratch, but an innovative technology obtained through the organic combination of engineering based on the progress and accumulation of the entire computer technology and cryptographic technology. Among them, "open source ideas" and "crypto punk" are the two spiritual cores and technical support of blockchain technology. The former provides fertile soil for rapid evolution, while the latter provides deep technological accumulation.

Open source-driven rapid evolution has shined in software development. In 1991, under the influence of the spirit of the open source movement, Linus Benedict Torvalds, "the father of the Linux kernel," released LiNUX 001. After "free competition" and "survival of the fittest" in the global open source community, today, Linux kernel technology has spread to include the Internet and corporate intranet systems, large-scale distributed computing, databases, teaching and research systems, office applications, and mobile hardware. And other fields (such as the Android operating system). The following figure shows the rapid evolution of the Linux kernel technology over the past 30 years.

- In 2019, currency-related crimes caused US $ 6 billion in losses, and US $ 1 billion in BTC for the dark web

- Ethereum becomes the central bank's top choice? RBA begins testing central bank digital currency on Ethereum network

- Over 600 million U.S. dollars invested in a year, 71% from institutions, Grayscale annual report reveals Bitcoin trends

Linux evolution timeline, Wikipedia and Google

Linux evolution timeline, Wikipedia and Google

Obviously, open source features can not only give software a strong ability to iterate and evolve rapidly, but also enable brainstorming. The development of blockchain technology is also greatly affected by it. During the same period, the crypto-punk movement also gained further spread, the idea of protecting personal privacy through cryptography and putting an end to any crisis of trust caused by centralized institutions. These two ideas gave birth to a new technology combining the strengths of two ideas-the blockchain in the early 21st century, and produced the first successful example of blockchain applications: encrypted numbers represented by Bitcoin and Ethereum Currency .

Ethereum, the ultimate evolutionary machine: "AlphaGo" on the blockchain

Fast iterative evolution is the only way to succeed AlphaGo, and Ethereum is racing on this successful road. Bitcoin is the first successful encrypted digital currency, which has generated a huge trading market and ecology. As of now, its global market value is close to 158 billion US dollars. However, Bitcoin has a single function, does not have Turing completeness, and does not meet the application implementation under complex logic.Therefore, the blockchain technology has developed into the 2.0 era, that is, the smart contract technology represented by Ethereum (ETH) The second generation decentralized programmable application platform as the core. Among them, Ethereum pioneered the creation and application of smart contract technology. Its only native cryptocurrency is Ether (ETH), which is decentralized and scarce. It also assumes important functions such as global payment and value storage.

In fact, after Ethereum, other decentralized application platforms (referring to EOS and TRON) with ETH as a blueprint have emerged in the industry. However, Ethereum is in a strong position in technology development and commercial applications. Firmly occupies the dominant influence and status, and embarked on a comprehensive, all-domain, and ultimate evolution path similar to AlphaGo, including but not limited to:

● Leader of blockchain technology innovation

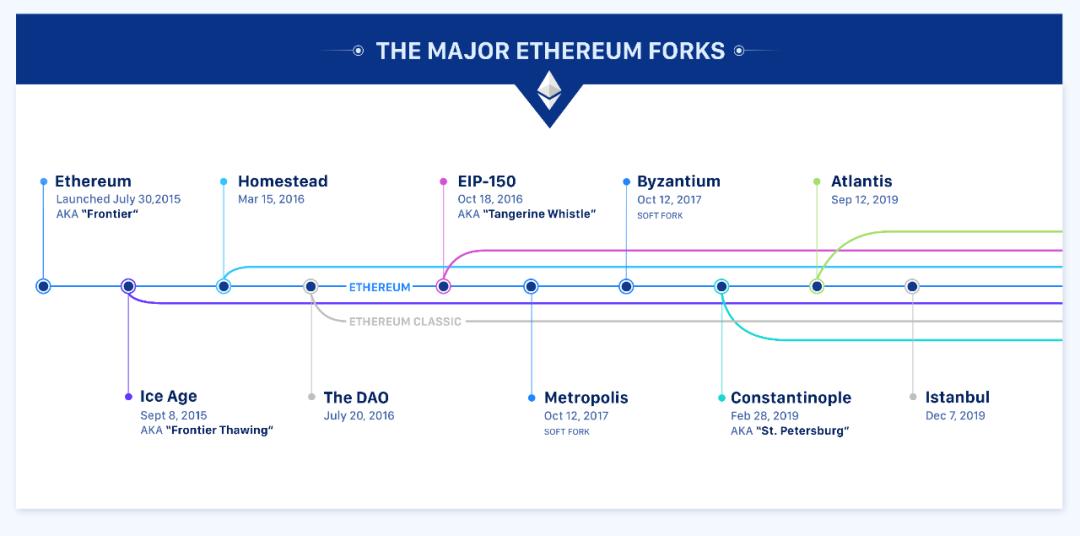

Fast and stable iterations are always the ultimate weapon of technological evolution. Ethereum upholds the "rapid iteration" engineering idea. From the beginning of the project design, it is determined that the continuous upgrade agreement will be promoted according to the plan to ensure the optimal configuration of security, availability, functionality and decentralization. Ethereum's prominent technological innovations include cutting-edge technologies such as smart contract technology, sharding technology, Plasma and Roll Up capacity expansion technologies, and Layer 2 solutions. The initial version of the network is Olympic, and it is divided into four upgrade stages. Frontier , Homestead, Metropolis and Serenity, of which the first three stages are ETH1.0, and the final stage: tranquility is ETH2.0. Among them, ETH2.0 means that Ethereum will transition from the POW consensus mechanism to the POS consensus mechanism through a series of technology upgrades. Its core technology is fragmentation technology, which will greatly improve the processing capacity of the entire distributed system. The main historical upgrade events of Ethereum are as follows:  Ethereum main history upgrade roadmap, BlockVC

Ethereum main history upgrade roadmap, BlockVC

The current Ethereum is similar to AlphaGo, which remained in the laboratory stage before 2015.Although it has not yet entered the world stage, it has shown unlimited evolutionary potential, and it will certainly shine in the future.

● Leader in Enterprise Blockchain Landing

The implementation of Ethereum-related technologies in the enterprise field is mainly carried out through the Enterprise Ethereum Alliance (EEA), which is a global industry standard organization promoted by members of the alliance. It is supported by the Ethereum development organization ConsenSys and aims to serve the Ethereum area. Blockchain technology empowers it to become an open and trusted standard. As of now, the EEA covers more than 3,000 global developers, covering more than 45 countries (including 46% in North America, 31% in Europe, 19% in Asia, and 4% in other regions), more than 300 companies, and more than 15 member organizations, including Intel, JP Morgan, Microsoft, and IC3. In terms of industrial structure, banks or financial companies account for about 24%, blockchain companies account for 5%, encrypted digital currency projects account for 17%, non-profit institutions account for 15%, academic research institutions account for 11%, and others account for 28%.

Some key members of the EEA, EEA

Some key members of the EEA, EEA

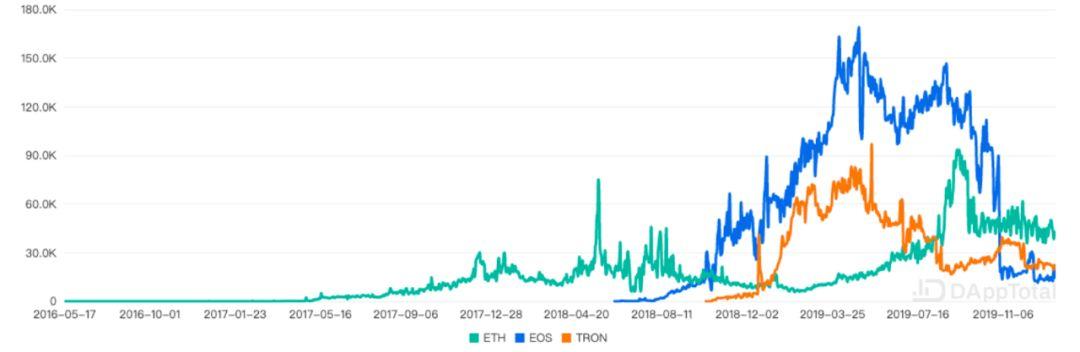

● DApp Ecological Empire Trailblazer

The Ethereum network is a public blockchain that can be accessed without permission, and supports developers to create trusted and decentralized applications (DApps) through smart contracts, including cryptocurrency wallets, financial applications, decentralized markets, Games, etc. It can be seen from the distribution of DApps that DApps on ETH are mainly distributed in the fields of games, sweepstakes, high-risk applications, exchanges, finance, tools, and platforms. Among them, the number of DApps in the game field accounts for nearly 50%. The number of active accounts on the entire network reached 6944.14K and the number of potential accounts reached 52959.63K, ranking first among similar platforms.

DApp distribution for ETH, DappTotal.com

DApp distribution for ETH, DappTotal.com

It is worth noting that DeFi is booming in the Ethereum network. According to data from intelligence tracking website Defipulse, the value of locked assets in Ethereum has reached a record high, reaching $ 779M, of which MakerDAO's locked assets account for more than 56%. MakerDAO is a lending platform and also provides a way to generate stable currency DAI through multi-asset collateral (such as ETH). In addition, DeFi can not only greatly increase the ETH lock-up rate, but also provide a candidate channel to open up the traditional financial market. It will likely accelerate the integration of the entire crypto asset industry with traditional finance in the future.

DeFi's locked-in funds in Ethereum, Defipulse.com

DeFi's locked-in funds in Ethereum, Defipulse.com

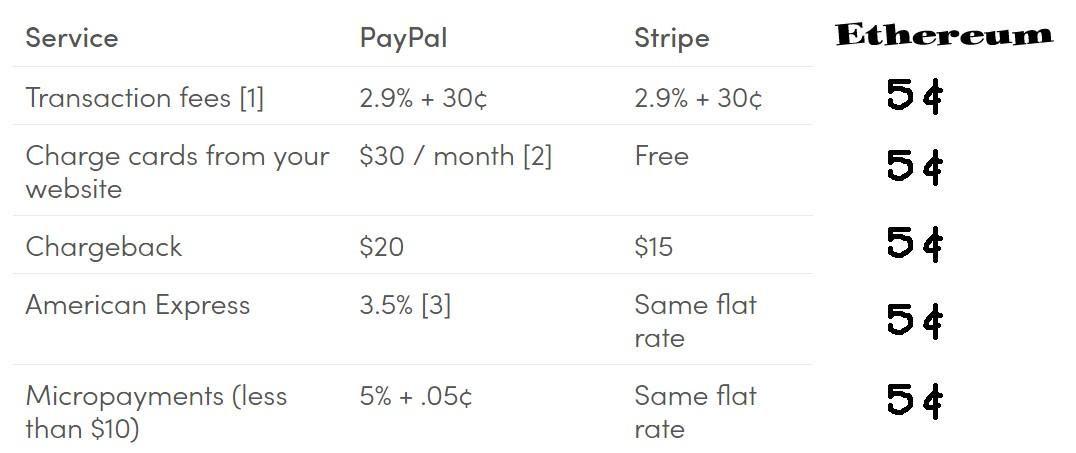

● Ethereum, a practitioner of global economic payment settlement, is becoming the payment settlement layer of the global economy. Its native token ETH has the ability to perform payment settlement, value storage, or collateral on a global scale. With the further improvement of Ethereum processing capabilities, It will even have high-frequency small payment settlement capabilities. In addition, if users choose stablecoin payment in order to prevent the price fluctuation of ETH, the Ethereum network can also provide a variety of payment options. One is the asset-stabilized stablecoin on the chain including DAI; the other is a large number of The fiat stablecoin project is migrating to Ethereum, of which USDT has migrated more than 4 billion USD of stablecoins from the Omni protocol to the Ethereum network.

From the perspective of users' global transfers, Ethereum-based payment methods have unparalleled advantages in large payments. When users make cross-border payments through traditional cross-border payment methods such as Visa or PayPal, not only may it take up to a week, but the payment fee is positively related to the payment amount. If users make global cross-border payments through Ethereum, even if the transfer amount reaches a billion dollars, the payment time will only take less than one minute, and only a payment fee of about $ 5. The blockchain technology represented by Ethereum provides a revolutionary solution for cross-border payment and settlement of the global economy.

Comparison of cross-border payment methods, Google

Comparison of cross-border payment methods, Google

Undervalued ETH

However, as the representative star project of the second-generation blockchain, Ethereum created and applied the epoch-making blockchain technology of smart contracts. The true value of its native asset ETH has always been undervalued by the market, mainly reflected in :

● Underestimated compared to BTC

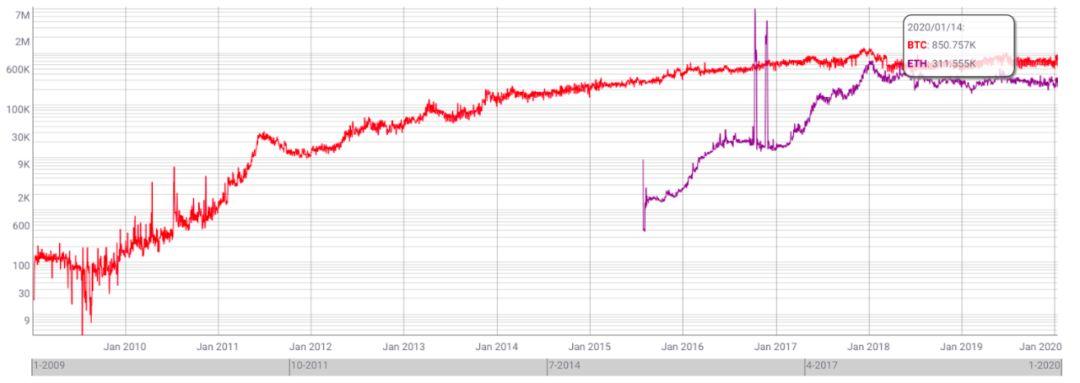

Observing the price curve of ETH / BTC, we can see that ETH has been in a downward trend in the long term in the past year, but since September 2019, the price of ETH / BTC has stabilized and has rebounded in volume in the near future.

ETH / BTC price curve (2018.12.10-2020.01.15), CoinMarketCap

ETH / BTC price curve (2018.12.10-2020.01.15), CoinMarketCap

Compared with BTC, the market value of ETH reaches approximately 17.8 billion U.S. dollars, accounting for approximately 11.2% of the market value of Bitcoin, ranking second in the global cryptocurrency market capitalization, and the number of active addresses on the entire network reaches approximately 311.6K, accounting for approximately Bitcoin active addresses 36.6% of the number. Assuming that the unit network values of the two are similar, the market value of ETH is undervalued by the market, which is significantly lower than the size of its network active addresses.

Bitcoin and Ethereum's active network addresses, Coinmetrics.io

Bitcoin and Ethereum's active network addresses, Coinmetrics.io

From the historical data of the market's rising market, according to data from the crypto digital currency exchange Binance, on December 10, 2018, BTC and ETH simultaneously reached their historical lows since 2017, which were 3149USD and 81.79USD (standard Value), and has been rising all the way since then, reaching a high point on June 24, 2019 (14000USD and 362.5USD, respectively). Currently, it has rebounded to 8660USD and 162USD. The highest increases in the past year are 444% and 442%, respectively. The lowest gains were 275% and 198%. Obviously, BTC and ETH have diverged in the recent rebound, and the increase of ETH is less than the increase of BTC, which is only 72% of the latter. Obviously, compared with the previous round of historical data, the upside of ETH is still huge.

● Undervalued compared to similar smart contract platforms

In the market performance of native digital currencies of similar smart contract platforms, the value of ETH has also been greatly underestimated. Compared with the basic data of the network ecology, as of now, the number of DApps created on Ethereum is far more than the same type of blockchain platforms, reaching nearly 4 times the number of DApps on the EOS and TRON platforms.

Comparison of the total number of DApps for ETH, EOS and TRON, DappTotal.com

Comparison of the total number of DApps for ETH, EOS and TRON, DappTotal.com

However, according to an NVTV model (Network Value to Token Value Ratio) proposed by venture capital company Placeholder, which is analogous to the traditional P / E valuation model, this model uses EOS as a standard. After comparing the market performance of similar projects, we can see that the value of EOS is about It is 100 times higher than the ETH indicator, the latter is only traded at about 2 times the token value, while the former is traded at up to 234 times the token value. This model fully shows that ETH is significantly undervalued compared to similar types of smart contract projects.

Network Value to Token Value (#NVTV ratio) model, Placeholder

Network Value to Token Value (#NVTV ratio) model, Placeholder

Outlook

From a simple analysis of the supply and demand relationship, it can be found that the price change of ETH directly depends on the supply and demand relationship, that is, the less ETH circulating in the entire ecosystem, the more conducive to the release of ETH value. According to the development trend of Ethereum, it can be determined that the following reasons will reduce the amount of ETH in circulation in the trading market, including but not limited to:

- Due to the use of an excess mortgage model, the development of DeFi will promote the locking of a large number of ETH assets in smart contracts, thereby reducing ETH circulation;

- After ETH2.0 will adopt the POS consensus mechanism, a large amount of ETH will need to be mortgaged to become nodes or participate in voting decisions;

- In other ETH applications, locked ETH is naturally stranded because of the capital turnover in commercial activities;

- The rapid evolution of Ethereum technology and the proliferation of consensus have prompted investors to actively lock positions, thereby reducing market circulation.

In the blockchain industry, the Matthew effect will still apply. Due to the homogeneity of the functional and application fields of the smart contract platform, it will further promote the competitive trend of "strong and strong". On the path of rapid evolution driven by open source, Ethereum's strong technical strength, highly active and cohesive community, and extensive application landing capabilities will form a huge "siphon effect" on all parties in the face of a large number of similar platforms, fully expanding Ether Fang's strength in community influence, technology development strength, and capital deposition. In the current competitive landscape, the victory of Ethereum is almost doomed. The only difference is that this moment is coming now or in the future.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt Column | Cutting-edge regulatory technology for capital markets

- Russia's new Prime Minister calls for priority development of the digital economy, is the opportunity for blockchain coming?

- Analysis | Which blockchain projects have the largest number of giant whales in the "ocean"?

- How will the US election affect crypto legislation?

- Zhu Jiaming's speech at the United Nations Blockchain Forum: Actively Facing the Challenges of the Global Trust Crisis and Trust Deficit

- Popular Science | DeFi Beginner's Guide

- Former CFTC chairman intends to promote "digital dollars" through non-profit foundations