With the advent of negative interest rates, can the stablecoin maintain a 1: 1 anchor with the US dollar?

Author: YOGITA KHATRI

Translation: Ziming

Source: Crypto Valley

- Journal of Party and Government Studies | Government Governance Practices of Blockchain Technology: Applications, Challenges, and Countermeasures

- MOV is officially launched, creating an ace DeFi infrastructure, making transactions everywhere

- How much does God V have? We have estimated their net assets

- The United States is ushering in an era of negative interest rates, but stablecoin issuers seem less worried.

- All top five stablecoin issuers have told The Block that they will remain anchored at 1: 1 USD.

- "Tether will continue to maintain 100% reserve support," said Stuart Hoegner, general counsel at Bitfinex.

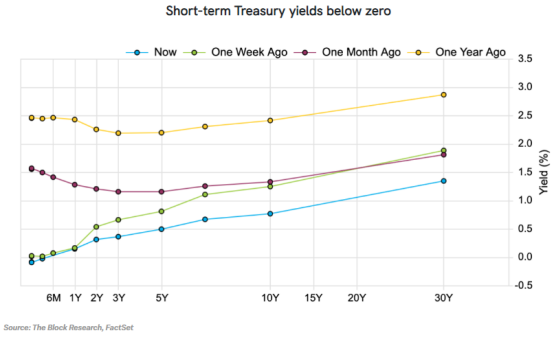

At present, the United States has ushered in an era of negative interest rates. 1-month and 3-month U.S. Treasury yields are quoted at -0.046% and -0.056%, respectively, as investors sought a safer haven (also possible in cash) during the corona virus crisis, which means " flight to safety (hereinafter referred to as FLS). " In this case, the issuer of the stablecoin pegged to the US dollar may encounter some challenges in maintaining the stablecoin's 1: 1 anchor with the US dollar.

This is because the stablecoin issuer keeps the mortgaged USD in bank accounts and earns interest on it. In the case of negative interest rates, they will be charged the cost of depositing funds, which may cause the US dollars in these accounts to be less than the number of stable coins in circulation.

Blockchain.com research lead Garrick Hilema said:

"Negative interest rates may pose a challenge to the status quo of the US dollar-backed stablecoin."

"In particular, the type of asset support held by stablecoin operators may need to be adjusted in a negative interest rate environment, and this change may bring additional risks to maintaining a 1: 1 pegged exchange rate."

Tether: Not worried about the impact of negative interest rates

Despite the existence of negative interest rates, Tether (USDT), which has an existing stablecoin market share of more than 80%, still believes that they have the ability to continue to maintain a 1: 1 anchor with the US dollar.

"Our reserve assets refer to traditional currency and cash equivalents and may from time to time also include other assets and accounts receivable arising from Tether's provision of loans to third parties. If we are in a negative interest rate environment, we still have the ability to trade Sethert Hoegner, general adviser to Tether's sister company Bitfinex, told The Block that Tether will continue to maintain 100% reserve support. Hoegner declined to comment on the specific strategy to be adopted.

![]() Other large stablecoin issuers

Other large stablecoin issuers

CENTER, the second largest stablecoin issuer (founded by crypto startups Circle and Coinbase in 2018) also stated that its USDC still has the ability to maintain a 1: 1 exchange with the US dollar.

"USDC's reserve assets are subject to the central consortium's network rules and reserve investment policies. Capital protection and liquidity are the main tasks of the consortium. These reserve assets are assets with a higher level of liquidity (such as US short-term government securities And cash deposits. "Josh Hawkins, Circle's senior vice president of global corporate communications, told The Block:" We will pay close attention to the earnings environment, more to the extent of negative interest rates, and will continue to ensure that 1USDC will always be worth 1 dollar. "But Coinbase declined to comment on the matter.

"If negative interest rates expand and persist, one possible solution for stablecoin issuers is to move from a rigid 1: 1 anchor peg to a Libra-like Net Asset Value (NAV) model. That is, if any stablecoin issuer It does choose to change the composition of its asset support (and thus may take more risk), and this model allows for fluctuations in the value of asset support. But the issuer should publicly disclose these changes to users. "

- How long the negative interest rate will last (is it just a short fall?);

- Which maturity of Treasury bonds will fall to a negative value? We have seen negative short-term yields on 30-day U.S. Treasuries before, but what about two-year Treasuries? Or what if negative returns persist for more than a week? But in my opinion, these two situations are unlikely to happen. "

Zac Prince, chief executive of BlockFi, a digital currency lender that provides stable currency rates, said it's too early to consider whether the dollar in bank accounts would incur negative holding costs.

Prince says:

"At present, USDC, GUSD and PAX and other 1: 1-backed stablecoins are already in a favorable position to maintain the same status."

Meltem Demirors, chief strategy officer of digital asset management company CoinShares, told The Block that in the presence of negative interest rates at banks, "issuers of these stablecoins must pass negative redemptions to depreciation, pass negative interest rates to digital currency holders, or Partial reserve systems, where they draw a portion of their mortgage to invest in profitable assets. "

Demirors continued:

"Abandoning the structure of depositary receipts may damage user confidence in stablecoins, but it is instructive to look at what happened to Tether in the past year. Despite the news that Tether has only received about 70% of USD support However, the use of Tether continues to grow, and Tether maintains its 80% market share in the stablecoin market. It can be said that as long as the market continues to believe that the stablecoin has sufficient use and future liquidity and market depth, then Changes in the market structure and the transition from full asset support to partial support for 1: 1 collateral may not have a significant impact on the actual use of stablecoins. "

"This obviously also hurts users. It may see a lot of USD-backed stablecoins going to an end and / or switching to different exchange models, such as a basket model." "It may also attract more attention to other collateral models, and maybe we can also see the silver lining of algorithmic stablecoins."

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Opinion: Bitcoin can only be used to deal with a special crisis, that is, the potential collapse of the fiat currency system

- Featured | Who Behind the Development of Bitcoin; Bitcoin's "Zero Fanatic Cult" Culture

- Perspectives | Analysts: "Perfect Storm" Has Formed, Bitcoin Has Become Key Global Asset

- Hunan's 2.7 billion yuan launches "digital infrastructure" involving 86 big data and key blockchain projects

- Babbitt Column | Is Global Stable Coin one step closer to birth? ——A Brief Comment on IOSCO's Stablecoin Supervision Suggestions

- WHO, IBM and Microsoft jointly develop blockchain project MiPasa to build a hot map of people with new crown pneumonia infection

- Introduction to Blockchain | Re-understanding BTC Time Chain, Mining Rewards and OTC Trading