Xiao Lei: The United States urgently cuts interest rates to deal with the crisis, how to prevent ordinary people from being "cut leek"

Author: Xiao Lei see the city (public number: kanshi1314)

As the absolute main force of the global economy, the United States has started to respond to the crisis. The Fed did not wait until the mid-month interest rate meeting and suddenly cut interest rates by 50 basis points.

At the same time, Powell, chairman of the Federal Reserve, said that the interest rate cut was to help the US economy remain strong during the crisis. This statement does not mean that the US economy can remain strong, but the point is that the crisis has come and the United States is responding.

In addition to cutting interest rates, the United States-led G7 (US, UK, Japan, France, Canada and Italy) is also preparing to take collective action (including fiscal exchange rate and trade policies) to respond to the challenge of the epidemic to the global economy.

- Grayscale Investment CEO: CBDC validates value proposition of digital currency

- Case study: How to create a synthetic trading pair?

- Bitcoin's privacy dilemma: can it be 100% anonymous?

This means that the world has entered the most concentrated crisis response model since 2008.

The epidemic may be more severe than we think. The G-7 is almost completely immune. This will make many countries take measures to reduce the economic efficiency to prevent and control the epidemic for a long time in the future, including transportation, factories, schools, and personnel. Interactions, etc., will face many risks of regulation and stagnation, and the impact on the economy is enough to be regarded as a major crisis.

In the face of this epidemic, countries should work together instead of blame each other, so there may be more international cooperation in the future, including epidemic prevention and economic rescue plans.

Of course, today I am mainly discussing the impact of the Fed's rate cut.

In this world, not all things can be explained from the "God perspective". When the crisis comes, stimulus policies will be overweighted. For some people at the top of wealth distribution, it may be a greater opportunity, but for more ordinary people In other words, the risk of real wealth shrinking comes with it.

Take the Federal Reserve's monetary policy, for the US economy and the global market, it has a certain stimulating effect, at least can reduce the cost of funds and make the market more active. But for others, by the time the crisis passes, they will face tremendous pressure to devalue the currency.

The market is composed of a large number of participating groups and trading products. For many people, they will still seek various ways to deal with risks and reduce losses.

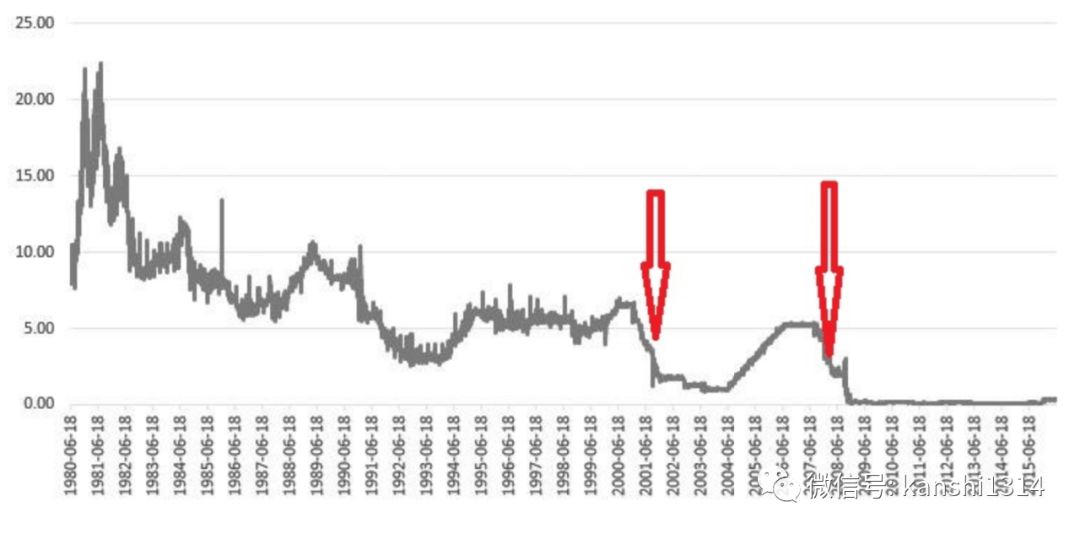

The Fed closest to us has two interest rate cut cycles, one from 2000 to 2004 and the other in 2008. Let's start with these two interest rate cuts.

The Nasdaq bubble burst in 2000, the stock market crashed, and the terrorist attacks of September 11th in 2001, the global confidence in the US economy and the US market fell to freezing point, the Fed began to cut interest rates, and within three years, the federal funds rate went from 6.5% Down to 1%. The US dollar index fell from 120 to 85, a drop of 30%.

By 2003, the SARS epidemic had appeared in the Chinese market, and in the same year China's currency investment had increased by 20% (M2 growth rate).

For ordinary people, a large amount of currency appears in the market, either because prices have risen and the purchasing power of deposits has shrunk, which is equivalent to a portion of your money being "stolen" unconsciously. Either the price of assets has skyrocketed and the gap between the rich and the poor has widened. Although your money is not small, the stock price, house prices, etc. have risen sharply. Because you do not have these assets in hand, others have suddenly a lot more than you.

This is the same for people all over the world.

As a result, people often start holding safe-haven assets when the amount of money invested increases.

It is also after 2003 that Wall Street began to smell the large-scale demand for gold from the public. By November 2004, the nation ’s first exchange-traded securities with commodities as its main asset, and the world ’s largest gold ETF fund traded in New York. Launched and became the fastest growing exchange traded product.

The fund's holdings increased by more than 7 times in just five years, reaching 1,300 tons. According to the market value at that time, the total price was close to 80 billion US dollars (about 560 billion yuan). It is important to know that the current market value of the world's largest ETF fund, the S & P 500 ETF-SPDR, is only $ 290 billion. This is the S & P 500 index fund, and it was launched as early as 1993.

I will make another comparison for you and you will know what the concept of gold ETF is 80 billion US dollars. As of the end of 2019, the total size of all non-monetary ETFs in China was only 599.1 billion yuan (about 85.5 billion U.S. dollars). In fact, it is not much different from the size of a gold ETF on Wall Street. This is a domestic non-monetary ETF that has increased by 58.94 year-on-year in 2019. %, The scale has increased by 1994 billion yuan.

In fact, during the period from 2001 to 2007, people around the world bought gold in various other ways, including the central banks of many emerging countries. If its core reasons are, the depreciation of the US dollar is the first to bear the brunt.

By 2008, the United States had a financial crisis and global liquidity dried up, meaning that everyone needs cash to "life-saving", so the dollar rose sharply, stocks, etc. fell sharply, and gold also suffered a sharp sell-off, a decline of more than 30%. .

The problem is that it was also the financial crisis in 2008 that made the global central banks worse. The Federal Reserve lowered the federal funds rate to near zero and launched a trillion dollar QE.

Similarly, in response to the impact of the US financial crisis, China ’s currency growth reached 27% in 2009, and the financial side launched a well-known 4 trillion stimulus plan.

For ordinary people, there is no other way to hedge this risk than to buy gold?

Although gold can hedge the risk of currency depreciation, it also faces strong intervention by central banks of various countries, because central banks are the main holders of gold, and even the US Federal Reserve, which controls the US dollar, still holds more than 8,000 tons of gold reserves, ranking World number one. In addition, the liquidity of gold is very limited. Although it has international attributes at the level of finance and currency, it is difficult to circulate regionally and across borders. Its hedging value is mainly psychological.

So, in 2008, when a severe financial crisis broke out in the United States, and a large-scale stimulus plan was launched globally, from 2008 to 2009, something called the digital version of gold fell from the sky. From the release of the white paper in 2008 to the first output in 2009, It seems doomed to its mark of the times. This thing is called Bitcoin.

Ten years later, the Fed's balance sheet has increased nearly five times, from less than $ 1 trillion to $ 4.2 trillion, and China's M2 currency balance has more than tripled, from 60 trillion to 2.02 million Billion.

At the same time, Bitcoin has risen from less than 1 cent to $ 10,000 today. Gold also rose from $ 680 to nearly $ 1,700 today.

As we all know, the government's stimulus is for the sake of the overall situation, so that more people can get employment and consumption, but for many people, the benefits that this stimulus can really fall on their heads are very different, even for many people. To a very small extent, what they feel is still the rise in prices and the depreciation of currencies.

Therefore, the public's demand for safe-haven assets and the creation of safe-haven assets must be accompanied by the expansion of banknotes. Twenty years ago was gold, and ten years ago was bitcoin. What will it be today?

The United States is trying to prevent Facebook from launching Libra, a blockchain digital currency based on the main currency composite index. Although it cannot solve the fundamental problem of devaluation of banknotes, this may be a trend. If the market country of digital currency is not occupied, it will be marketed. Occupied by new forces, just like the advent of the Internet era, it is not just the interest structure that is changed, but the transfer of rules and social management rights.

We see that after the Fed ’s rate cut, the US dollar interest rate will soon approach 1%. The Fed is still restarting its asset purchase plan at a scale of nearly 100 billion US dollars per month. It is only a matter of time for central banks to follow. China has already started. A 25 trillion-scale (rebuilt and approved construction) infrastructure construction plan was set up.

I don't know how many people are excited about this, and how many people are embarrassed about it, but as the invisible hand in the market and the billions of ordinary people across the globe, they will definitely give due feedback to this.

Text / Xiao Lei (If you are worried about missing important analysis, please pay attention to Xiao Lei to see the city public account)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Opinion | Members of the Korean Financial Services Commission: Lack of actual use is the biggest obstacle to the development of cryptocurrencies

- Sun Yuchen used capital hegemony to control Steem, causing controversy, the integrity of stolen users' voting rights was questioned

- Google Play delisted the app many times to provoke public outrage. When can decentralization lead the future?

- Money, commodities, or securities? What is Bitcoin? This issue will have a significant impact on the future of cryptocurrencies

- Free and Easy Weekly Review | The strongest shield of privacy is threatened, how can the blockchain resist side channel attacks?

- National consumption code, national digital currency, 40 trillion new infrastructure and ABCDE five weapons to save the economy

- The only platform currency that has been locked up-the "sandwich" exchange marginalization crisis