The inevitable outcome of Non-EVM public chains? Analyzing the reasons for the decline of ICP from multiple perspectives

Analyzing the decline of ICP from various perspectivesAuthor: Titanio, “Geek Web3”

Introduction: Since 2022, with the gradual decline of new public chains such as Solana and the increasing prosperity of Ethereum Layer2, the stories of “Ethereum killers” seem to have been forgotten by the world, and the once “hundred schools of thought” no longer exist. However, if we look back in history, the narrative of new public chains starting from EOS has always been an indispensable magnificent chapter in the development history of Web3.

When it comes to new public chains, Dfinity (ICP) is an inevitable topic. With nearly $200 million in financing, a brilliant team of cryptographers, and unique technology, ICP was once pursued by countless people; but since its high-profile launch in 2021, ICP has been falling all the way, from a highly sought-after “king project” to a despised “failed project,” leaving countless people sighing. At the same time, the thin and deserted ecosystem has made ICP pale in comparison to competitors like Solana.

Looking back on history and reflecting on the past, what factors have influenced the development of ICP’s ecosystem? Can its unique technology help its ecosystem development? Can the “failed project” revive? This article will start with the technical characteristics of ICP, and then briefly analyze the challenges in its development process, such as the flaws in its NNS governance system and the lack of unified token standards, to clearly show readers the reasons for the decline of this “king project”.

- Latest developments in the Curve incident Has the crisis been resolved? Does the founder have to sell coins and pay off debts?

- OP Research Sociology Experiment of Currency and Global Citizens

- Exclusive Interview with 1inch Co-founder How does 1inch gradually innovate to grab food from the horse’s mouth in the liquidity battle?

Technical Features of ICP: Decentralized AWS

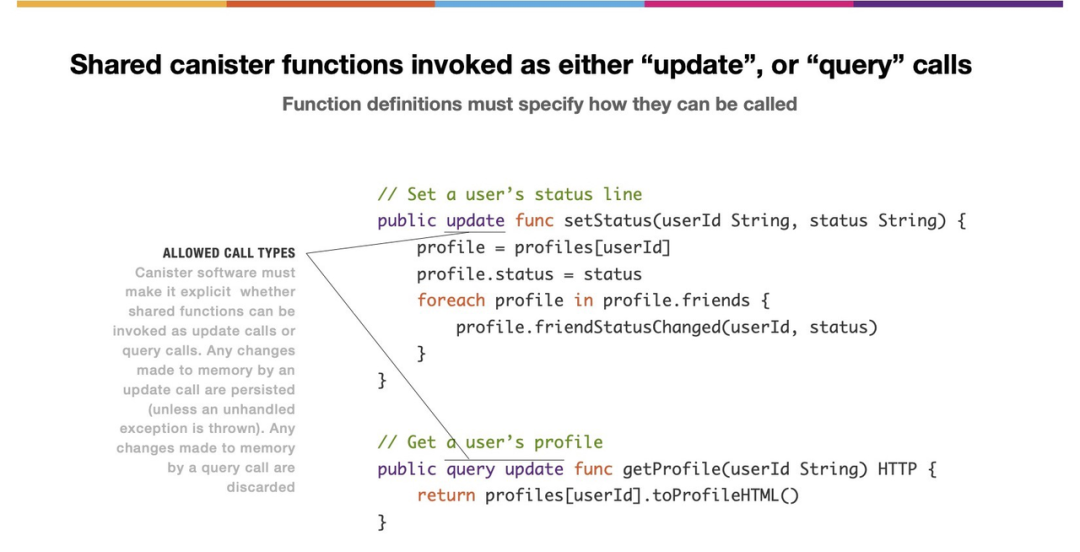

First, let’s introduce the smart contract system of ICP called Canister. It is the carrier of DApps and allows WebAssembly (WASM) bytecode to run in it, supporting programs written in multiple languages.

ICP allocates dedicated memory for each Canister. If we consider ICP as a supercomputer, then Canister is the process in the computer. Each Canister process has its own running memory, and you can encapsulate the data related to smart contracts in specific containers. This is the unique data storage method of ICP – Canister allows you to put the program’s state, database, and even frontend data (such as game assets) all in this container, with the intention of further expanding DApps. It can be said that ICP is actually a platform with containers, deploying many Canister containers on ICP nodes through containerization technology.

At the same time, Canister supports gas fee payment functionality, allowing users to pay transaction fees without owning native assets. This is essentially the “Gas Fee Payment” mechanism that many low-threshold wallets on Ethereum aim to achieve. This also creates expectations of mass adoption for ICP – users can enjoy Web2-level UX without having to initially purchase native assets (especially without having to pay high gas fees during blockchain congestion).

However, ICP has a major flaw: it does not support global state. Ethereum has a setting called “global state” where the state of all accounts is publicly visible to all smart contracts. It has a “global visible” state storage structure managed by State Trie. However, ICP is completely different. Specifically, in ICP, programs (smart contracts) have their own exclusive Canisters (containers), and the data of different smart contracts is encapsulated in their respective independent containers. The outside world cannot see the details of the data and can only access the internal data through the interfaces provided by the Canisters.

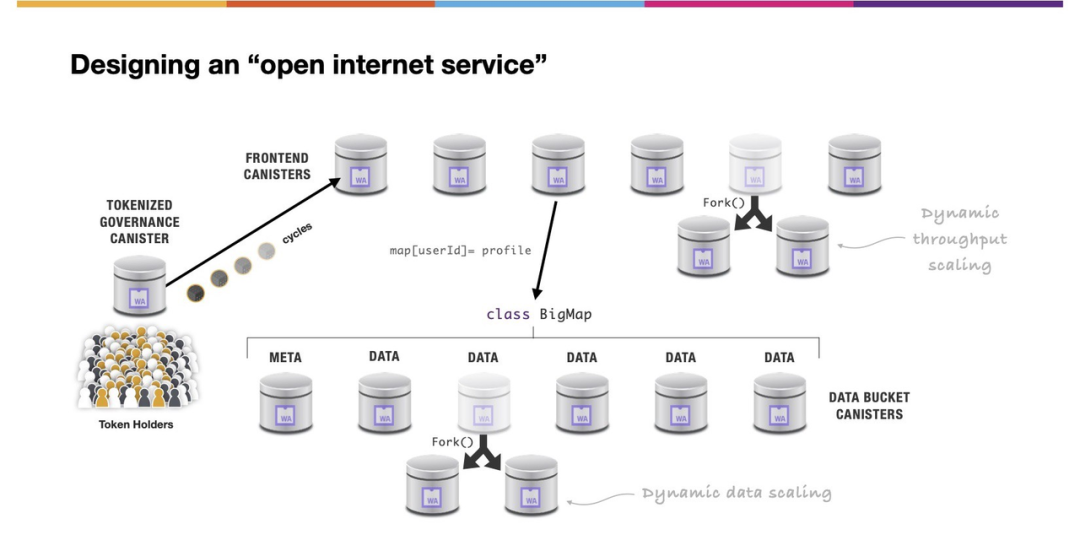

In other words, ICP does not have a “globally visible” state storage structure like Ethereum. The interaction between programs in different Canisters in ICP is asynchronous, and it cannot simultaneously complete calls to multiple contracts. Obviously, this is unfriendly to Defi protocols, making the ICP ecosystem long incompatible with Defi. Some people believe that Ethereum is a “world accounting machine” solely for asset trading, while ICP is actually a “decentralized AWS” supporting complex web applications.

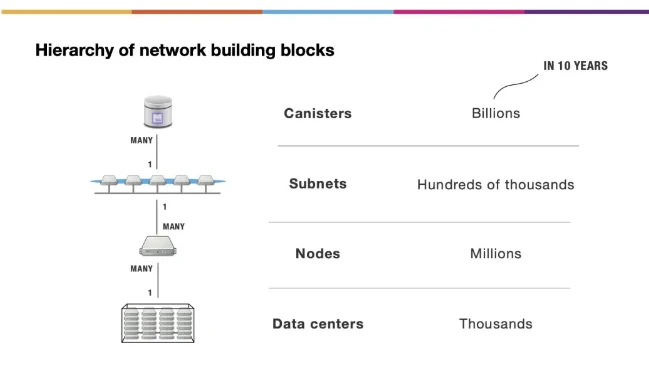

In addition to the unique Canister setting, ICP adopts a layered architecture, including Canisters, Subnets, Nodes, and Data Centers. We can think of ICP as a system composed of multiple Subnets, with each Subnet essentially being a public chain. In each Subnet, multiple Canisters are loaded, and these Canisters are the basic interoperable units in ICP, each containing the code and state uploaded by users.

The bottom layer of ICP is an independent data center hosting dedicated hardware, and Nodes run on top of the data center. Nodes are responsible for processing data and state transitions in the Subnet containers. This layered design provides ICP with higher scalability and flexibility, enabling it to meet the needs of different application scenarios in terms of scale and requirements, and also makes it feel more like a cloud service.

Some people believe that ICP achieved sharding from the beginning through Subnetization. Currently, ICP has 40 Subnets, with the largest Subnet containing 13 Validator nodes and the smallest Subnet containing only 1 Validator. Combined with the asynchronous interaction (communication) between Canisters mentioned above, the overall advantage of ICP’s design is high efficiency and the ability to achieve communication across Subnets.

Currently, all Subnets combined can produce approximately 20 blocks per second. However, due to the small number of nodes in each Subnet, its theoretical security is questionable. Applying to become an ICP node also requires approval from the ICP Foundation, and the hardware configuration of the nodes is very high (far surpassing public chains with heavier node configurations such as Solana and Sui). Therefore, the degree of decentralization of ICP has been criticized by many.

In response to this, a project in the ICP ecosystem frankly admits: after all, most of the applications running on ICP are “applications,” not financial transactions related to assets. Therefore, there is not such a strict pursuit of security. ICP is essentially a cloud platform with a higher degree of decentralization than AWS.

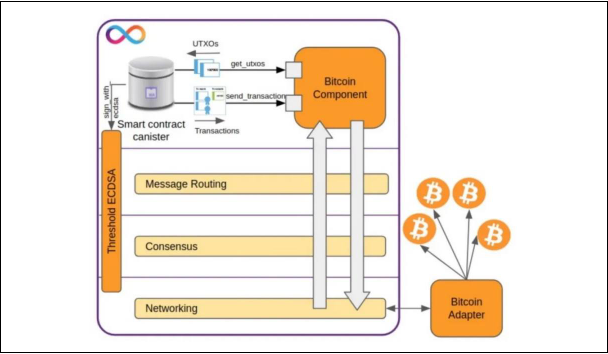

Setting aside the points mentioned above, ICP has successfully integrated BTC into its system. Through proprietary cryptographic algorithms such as Chain Key and threshold ECDSA, as well as a special retrieval mechanism, ICP and BTC can be directly integrated, allowing ICP’s smart contracts to directly hold real BTC assets rather than mapped ones. The specific implementation is as follows:

In the network layer, a BTC adapter that randomly connects to 8 nodes in the BTC network is implemented, pulling BTC blocks into the ICP network, and updating all UTXO sets based on the transaction data contained in the blocks, so that containers on ICP can know the latest state of the BTC chain, and programs within the ICP container can verify and retrieve BTC blocks and UTXOs.

At the same time, the threshold ECDSA algorithm is the key technology for enabling ICP smart contracts to accept and output BTC transactions. It is an extension of the ECDSA signature algorithm. Similar to MPC (multi-party secure computation), the protocol distributes private key fragments associated with the smart contract to subnet nodes responsible for signing in a secret sharing manner, achieving a higher level of security. In short, ICP smart contracts can delegate private key management to multiple nodes rather than a single node or the smart contract itself. When the contract needs to output a BTC transaction, it requires the cooperation of a threshold number of nodes in the subnet (2/3) to create a complete ECDSA signature and allow the transaction to proceed.

ICP’s asset integration solution goes further than the current cross-chain bridge solutions. Most cross-chain bridges only provide mappings of BTC rather than native BTC, and rely heavily on the bridge’s own nodes, which poses many security risks. On the other hand, ICP can store native BTC in the Canister and even directly store the private keys of BTC addresses.

Compared to the traditional cross-chain approach that relies on third-party bridge nodes, ICP’s BTC ledger can easily run on decentralized subnets with a large number of nodes. As long as the security of the subnet is sufficient, ICP’s BTC ledger is secure.

Rational Trap: Token Price and Token Locking

However, history has proven that even the most superior or unique technology cannot make up for the lack of ecosystem development. Since the launch of the Internet Computer, projects in the ICP ecosystem have remained “unused,” leading to a vicious cycle of “ecosystem scarcity -> outflow of excellent projects -> further loss of ecosystem participants.” The focus of this discussion is not the specific issues related to ecosystem development and support, but rather an attempt to explain from a different perspective why ICP has fallen into its current predicament.

One viewpoint is that within a few hours of ICP’s listing, it was subjected to price manipulation by certain forces (ICP’s founder has always believed it was SBF and FTX), causing the market value of ICP to skyrocket, surpassing $230 billion at one point and becoming the third largest in terms of market capitalization, after BTC and ETH. However, as the pump behavior ended, the price of ICP began to plummet, and within a short 6 weeks, the market value of ICP shrank by 90%.

The sharp decline of Token has greatly damaged the reputation of the ICP ecosystem and the Dfinity Foundation, making ICP subject to further attacks from various forces. These bears have exacerbated the process of ICP price decline, causing it to fall far below its actual value. (It is said that a16z, which has always pursued long-termism, has currently cleared its position in ICP.)

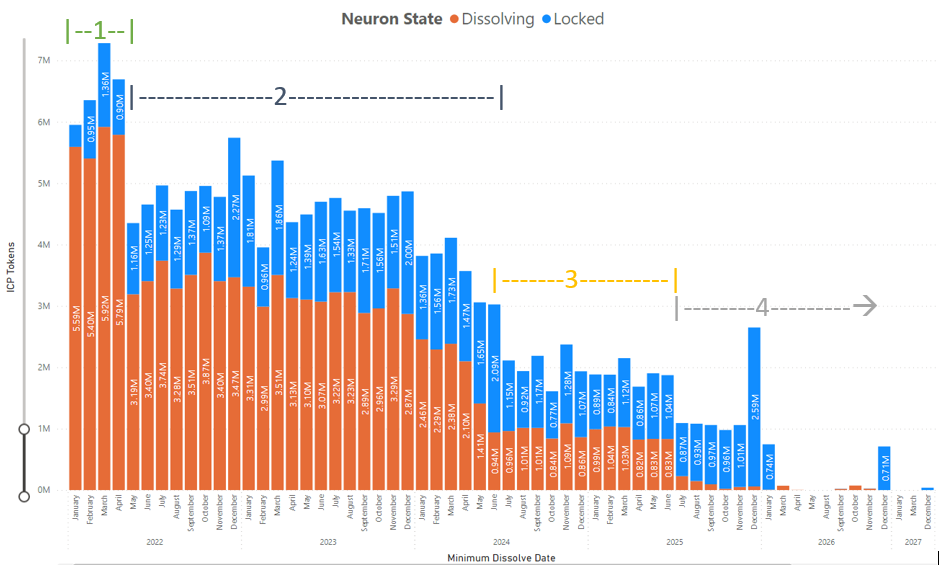

Here, the author does not intend to evaluate the truthfulness of the above statement, but only provides readers with a possible perspective (another interesting view is that a series of behaviors by ICP founder Dominic that have caused investor dissatisfaction is an important reason for the dumping of ICP and the isolation of the ecosystem). In fact, what affects the token price more is its lock-up mechanism – the original intention was to prevent early investors from “dumping” and cashing out, but the lock-up period of up to 8 years has brought about “lock-up” and selling pressure on staked assets/neuron unlocking selling pressure, as shown in the figure below:

It turns out that the lock-up of early investors by the Dfinity Foundation did not have the expected effect: the existence of a large number of bottom chips and the initial overvaluation of the price at listing have created too large a gap between the high point and the chip-dense area. Except for early investors, almost no one would be willing to participate in the rally in this price range. However, at this moment, early investors can still make profits. For them, reinvesting the interest generated during this stage to stake in NNS or selling the interest are both profitable strategies. When the token further drops to a certain price, early investors, due to the existence of opportunity costs, are actually in a state of being “locked in and losing money”. In this state, they are more inclined to sell the interest and are very likely to sell at a loss after the neuron unlocks, further exacerbating the decline.

This “selling more as it drops, selling even harder at a certain price” death spiral seriously hinders the rebound of ICP and the development of the ecosystem. Due to the characteristics of the Canister itself, Defi has long been absent in the ICP ecosystem (which in turn leads to the absence of stablecoins). Most of the time, ecosystem participants can only hold ICP tokens itself. Determined holders will find a fact: the returns brought by their contributions within the ecosystem cannot keep up with the depreciation of the token!

Rational assumptions in the game have gone further. Retail investors and project parties have turned to what they believe to be more promising public chain ecosystems (taking away liquidity), further reducing the number of Cycles burned on the chain (i.e., the number of ICP tokens). Early investors who have locked up for 8 years are willing but unable and have entered a “lying flat” state.

Although it may cause a significant drop in token prices, the author believes that if we want to resolve the death spiral as soon as possible, we must have a thorough liquidation – that is, a one-time unlocking and release of all long-term staked neurons, fully releasing liquidity. Delaying the current situation will only make things worse.

The Governance Dilemma of NNS

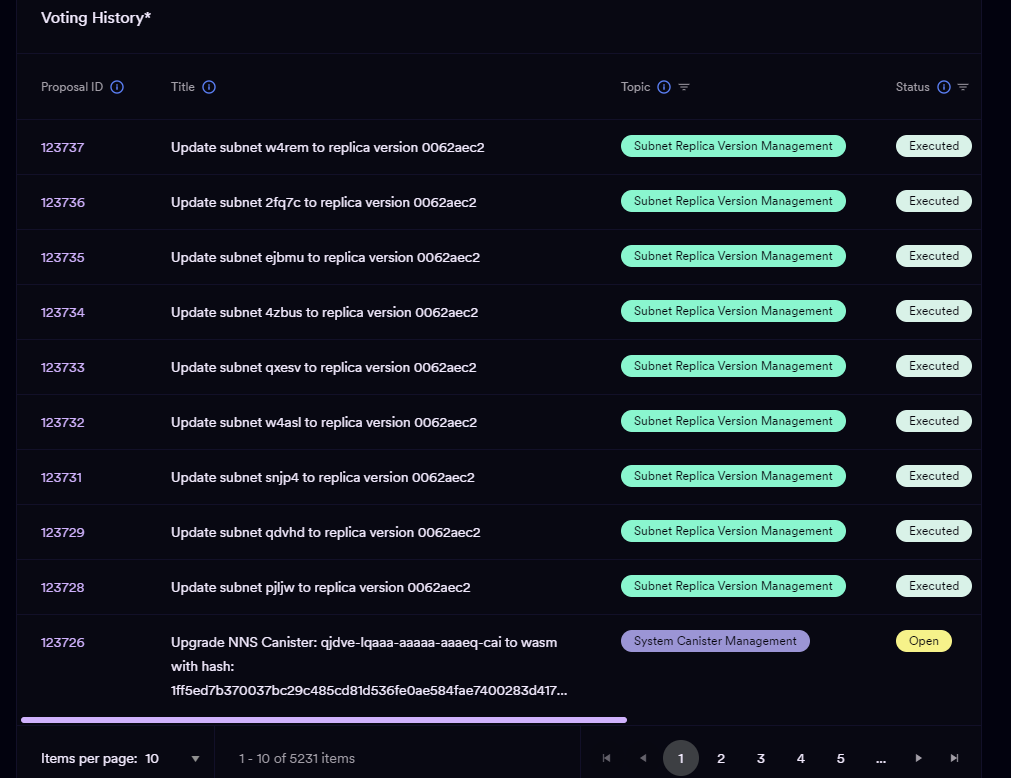

When VCs invest in projects, an important criterion for evaluation is whether the token has governance rights, and retail investors also like to consider token governance as an empowering factor. Dfinity’s NNS system allows token holders to fully participate in the governance of the public chain, but how does on-chain governance actually work?

Before analyzing the governance of public chains, it is necessary to have an understanding of the governance system. Here is a brief introduction to Dfinity’s governance system – the NNS system: NNS is an on-chain governance system that allows all community members to submit proposals and vote. The voting rights of community members are proportional to the amount of ICP they hold, and the duration of the staking period will affect their voting weight. Community members who participate in voting will receive ICP tokens as rewards, which are called “NNS rewards”. Holders who stake ICP in neurons can participate in governance by manually voting or following the votes of other neurons.

In comparison, the governance voting of many blockchain projects is “dictated” by a few entities, with only whales/investors/project teams themselves eligible to initiate governance proposals, while retail investors often only have the power to participate.

As early as two years ago, the Dfinity Foundation made adjustments to the NNS governance strategy. This reform adjusted some reward parameters of NNS governance, making it more advantageous for active voters, while the earnings of ICP stakers who do not participate in NNS governance will be greatly reduced. At the same time, the foundation no longer actively votes, further reducing the earnings of nodes that do not set voting and only follow the official neurons.

However, the governance system faces two problems:

First, because the NNS system does not restrict the right to propose proposals, but allows all neurons to propose and vote, a large number of garbage proposals have emerged. Neurons that support a large number of garbage proposals can also receive more token rewards by actively participating in governance voting (similar to Filecoin storage nodes intentionally storing a lot of garbage data) – in a sense, this behavior is a mockery of on-chain governance.

Second, the flaws brought about by the excessive democratization of the governance system – extremely low efficiency and inevitable community fragmentation. A typical example is that the community still does not have a unified token standard to this day! Indeed, developers can choose token standards according to their own circumstances, but the lack of smooth communication between Eastern and Western developer communities and the lack of mutual understanding have made the unification of token standards a distant goal, thereby adding another stumbling block to the development of the ecosystem. In this situation, liquidity will be severely fragmented, and even if a DEX is created, the swapping of assets will be severely hindered. There have been incidents of NFT loss in the past due to transfers to wallets with different token standards.

How to find a balance in the governance system so that democracy can be maintained while efficiency can also be ensured? This has been a debated issue from ancient times to the present, and from Web2 to Web3. In the trade-off, Dfinity chose the former, giving ecosystem participants full governance rights. However, from the current situation, this choice has more disadvantages than benefits for public chains that have not yet built sufficient economic interests. It has ultimately become a half-hearted decision by the foundation and a mutual dislike between existing users.

Resolving this dilemma is extremely difficult, and hoping for a charismatic leader like Andre Cronje to emerge in the ecosystem in the short term to promote development is as difficult as waiting for a “great man” to appear.

Project Drainage and Existing Circulation

All public chains that lack users and liquidity injection are inevitably trapped in a rug spiral:

Projects run away → individual investors lose confidence and suffer financial damage, leaving the ecosystem → liquidity worsens further, normal project revenue decreases or even cannot be obtained → projects run away.

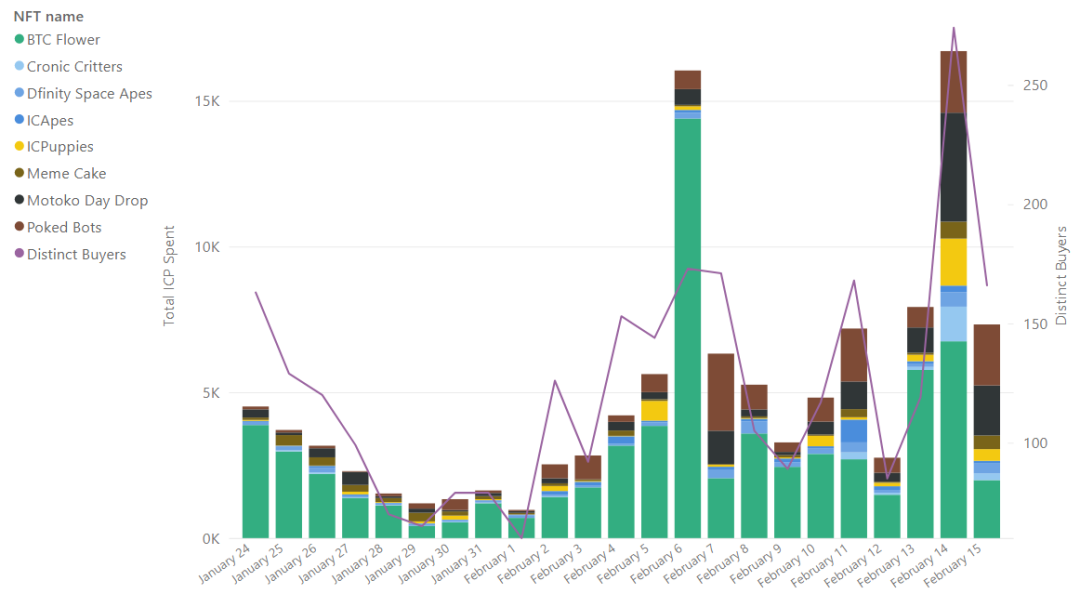

The situation on Dfinity is particularly serious. Taking the NFT sector as an example, in the early stage of the ecosystem, there was only one NFT exchange called Entrepot. Entrepot adopted a review system for NFT listings. After NFTs passed the review, they were sold on the platform. This system allowed the early NFT ecosystem to develop well, and the increase in NFT prices was also considerable. For example, based on data from February 2022, Entrepot was still performing well at that time:

However, the limitations of the platform led to a large number of rug projects flooding in, immediately impacting the nascent NFT sector. With the addition of projects such as CCC and Yumi to the NFT exchange war, Entrepot further relaxed its review of NFT projects in order to retain market share. The newly listed projects went from being quickly sold out to being ignored by users.

Normal operating project teams will also choose their own path due to the decline of the public chain. For example, Dmail, which initially adhered to the Dfinity ecosystem, eventually turned to a multi-chain ecosystem and cooperated with Sei, Worldcoin, and others.

Compared to the ecosystems of other public chains, the biggest difference in the Dfinity ecosystem is that its Defi sector is the least developed. The main reasons for this are:

- First, Dfinity did not introduce EVM, so it cannot easily fork various classic projects like Avalanche or Fantom;

- Second, the token standards within the ecosystem have not yet been unified, which to some extent weakens the liquidity within the ecosystem;

- Third, and most importantly, the unique architecture of Dfinity itself makes it different from traditional public chains in terms of global transaction atomicity. Interactions between Canisters are asynchronous, lacking a globally visible ledger, making it very difficult to develop Defi projects.

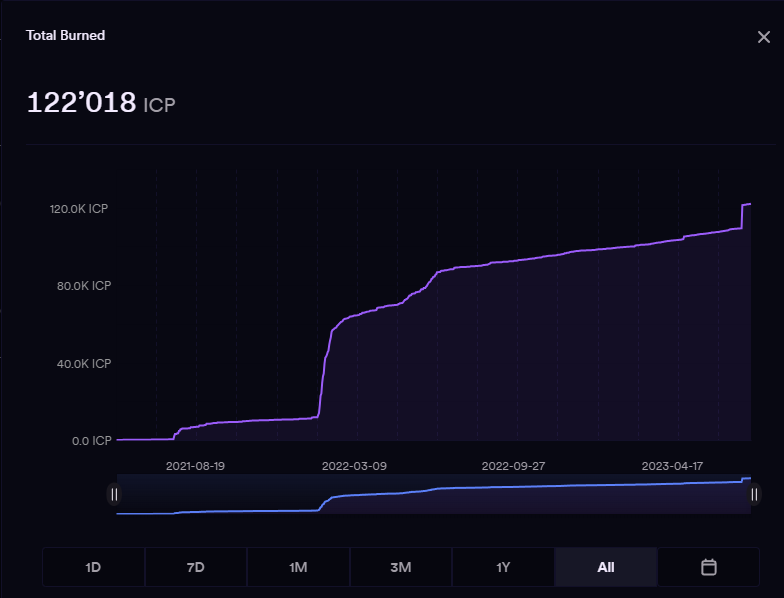

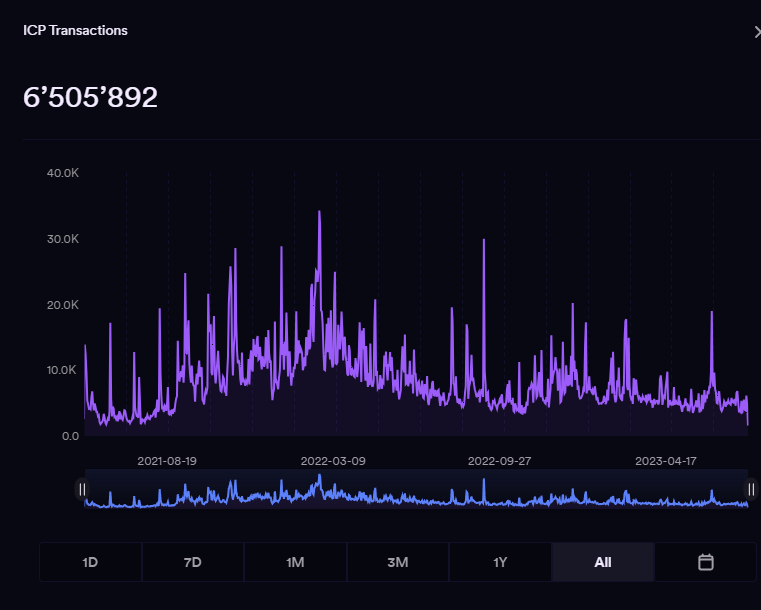

From the data of destroyed ICP and total transaction volume of ICP, the ICP ecosystem has fallen into a very awkward situation:

Summary

Actually, it is not difficult for us to understand the popularity of Dfinity in 2021. After all, the number of cryptographers in the ICP team is the highest among all public chain projects, and the team lineup is extremely luxurious: Intel, IBM, Coinbase, Facebook, Google wasm, etc.

At the same time, many well-known VCs are investors of ICP, including A16Z, Polychain, Multicoin and other top institutions. The slogan of ICP itself, “Decentralized AWS,” is also eye-catching, enticing countless people to invest real money, expecting the next milestone paradigm beyond Ethereum and EOS.

However, Dfinity’s technology did not favor its ecological construction. Although Dfinity’s technical characteristics are unique even in today’s context, such as reverse Gas, Canister’s scalability, and the architecture itself can be infinitely horizontally expanded, these features did not have the expected effect in the battle of public chains.

In addition, Dfinity’s governance system also faces challenges, including a large number of junk proposals and excessive democratization, which have been mentioned earlier. As a strong candidate once known as the “ETH killer,” it still has the potential and advantages that many public chains do not have, and these technical characteristics are important chips for its development. However, at the same time, the ICP Foundation and its ecosystem itself need to face the current challenges and make efforts to find new solutions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Extensive Article The Iron Curtain of Regulatory Control in the United States Has Fallen, What Tomorrow Will Crypto Face?

- Here is a list of cryptocurrency observations for the next week $LTC halving event, Evmos 2.0 launch…

- Outlier Ventures Data-Driven Token Design and Optimization

- EIP-7377 An excellent solution for migrating from EOA to smart contract wallets before the popularization of account abstraction.

- LianGuai Daily | Sequoia Capital reduces the size of its cryptocurrency fund to $200 million; French privacy regulatory agency launches investigation into Worldcoin.

- African Gold Rush I Help Chinese Citizens with Worldcoin KYC, Earning up to 20,000 RMB per day

- Interview with EthStorage Founder How to Scale Ethereum’s Storage Performance through Layer 2 Expansion?