2019 Encryption Market Financial Industry Lending Field Research Report

The digital asset industry began to experience a “winter” in the second half of 2018 and finally recovered in the first quarter of 2019. The mainstream encryption certificate increased by more than 20% in the first quarter, and the transaction activity and the number of market participants increased significantly.

At the same time that the market is at a downturn, lending programs provide digital asset holders with a way to increase liquidity without selling digital assets at a discount.

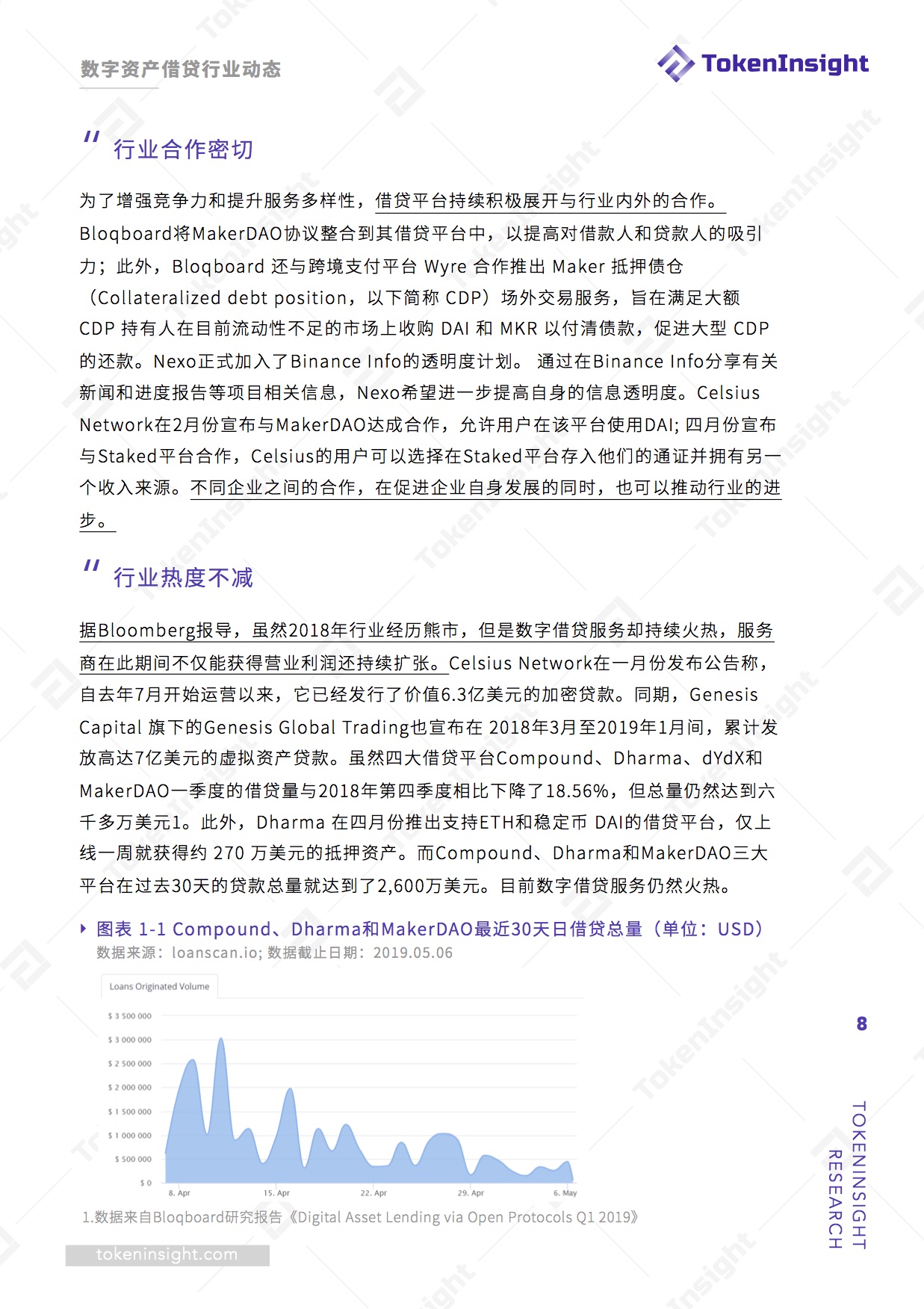

Since Q4 in 2018, the amount of admission funds and active loans in the lending market has continued to rise, and this trend continued to Q1 in 2019. At present, the active loan based on Ethereum's decentralized lending platform has exceeded 20 million USD. At the end of 2018, it rose by more than 30%.

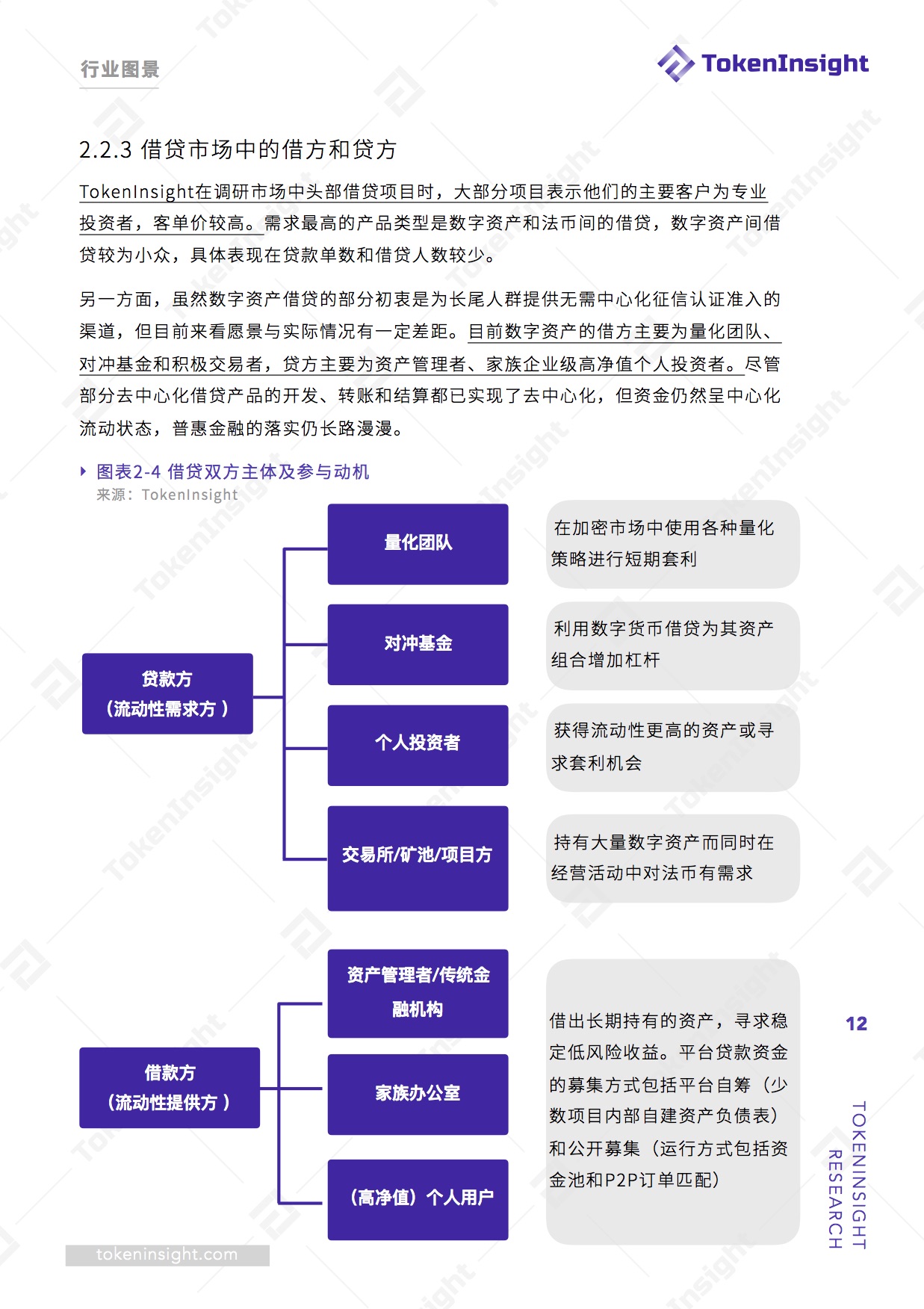

Broadly speaking, the digital asset lending business includes all market activities that use digital assets as collateral or loans . The borrowers and lenders are liquidity providers and demanders, respectively. The borrower financing method includes platform self-raising, platform establishment fund pool and P2P network.

- After five years of research, can Ethereum 2.0 be transformed from a paper into a code?

- The FT team teamed up with the consensus lab to release the FT public chain and ecology in Hong Kong, which will start the main network switch on June 16.

- The United States is difficult to block China's blockchain technology – China and the United States blockchain technology strength hard competition

It is worth noting that in this paper, TokenInsight only selected projects with digital asset lending as its main business as the research object, and examined the main developments of more than 30 digital currency lending projects in the first quarter of 2019. Accordingly, projects that use lending products as platform add-on services (such as exchanges, wallets, or wealth management platforms) will be discussed in the TokenInsight digital asset management industry study.

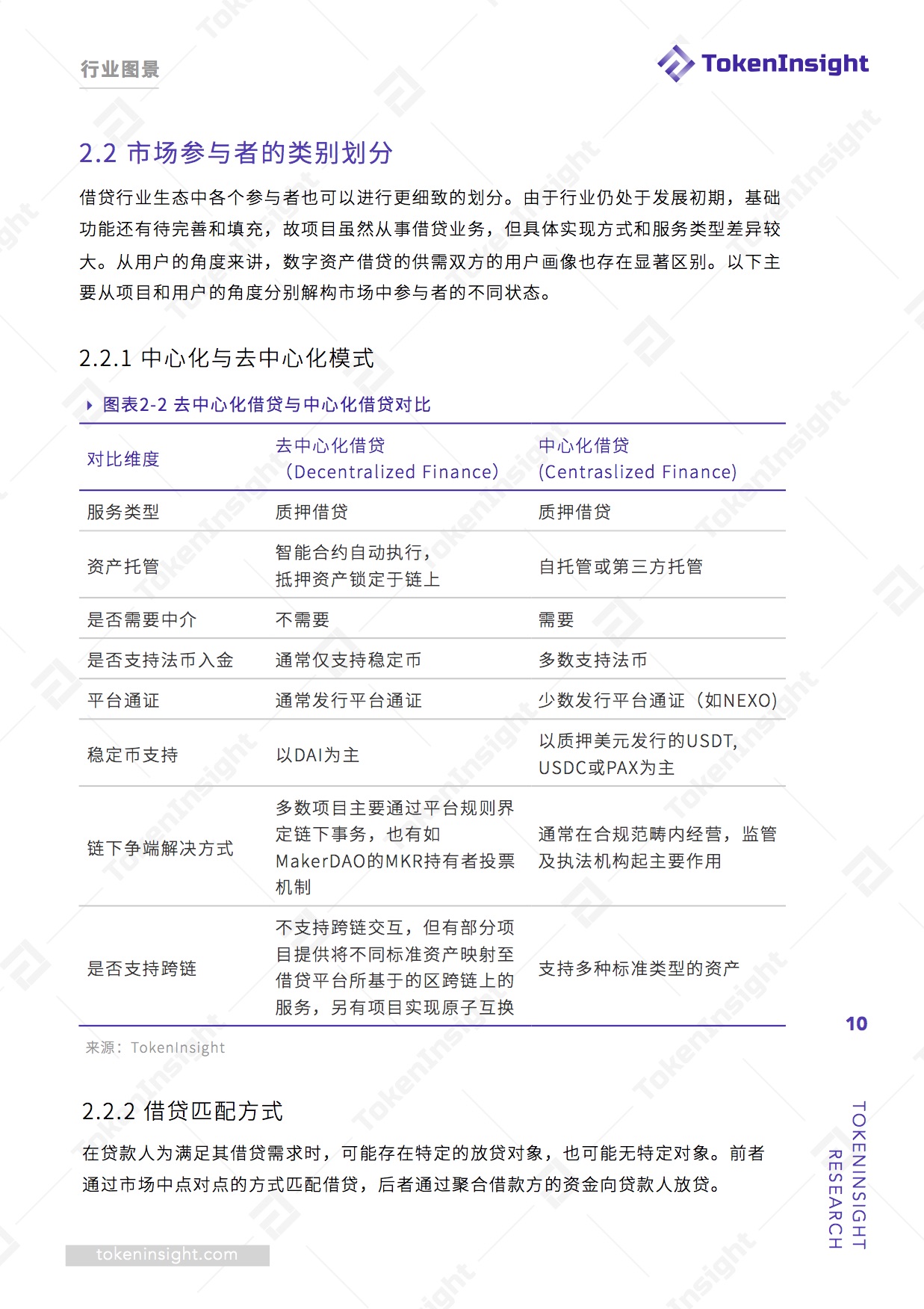

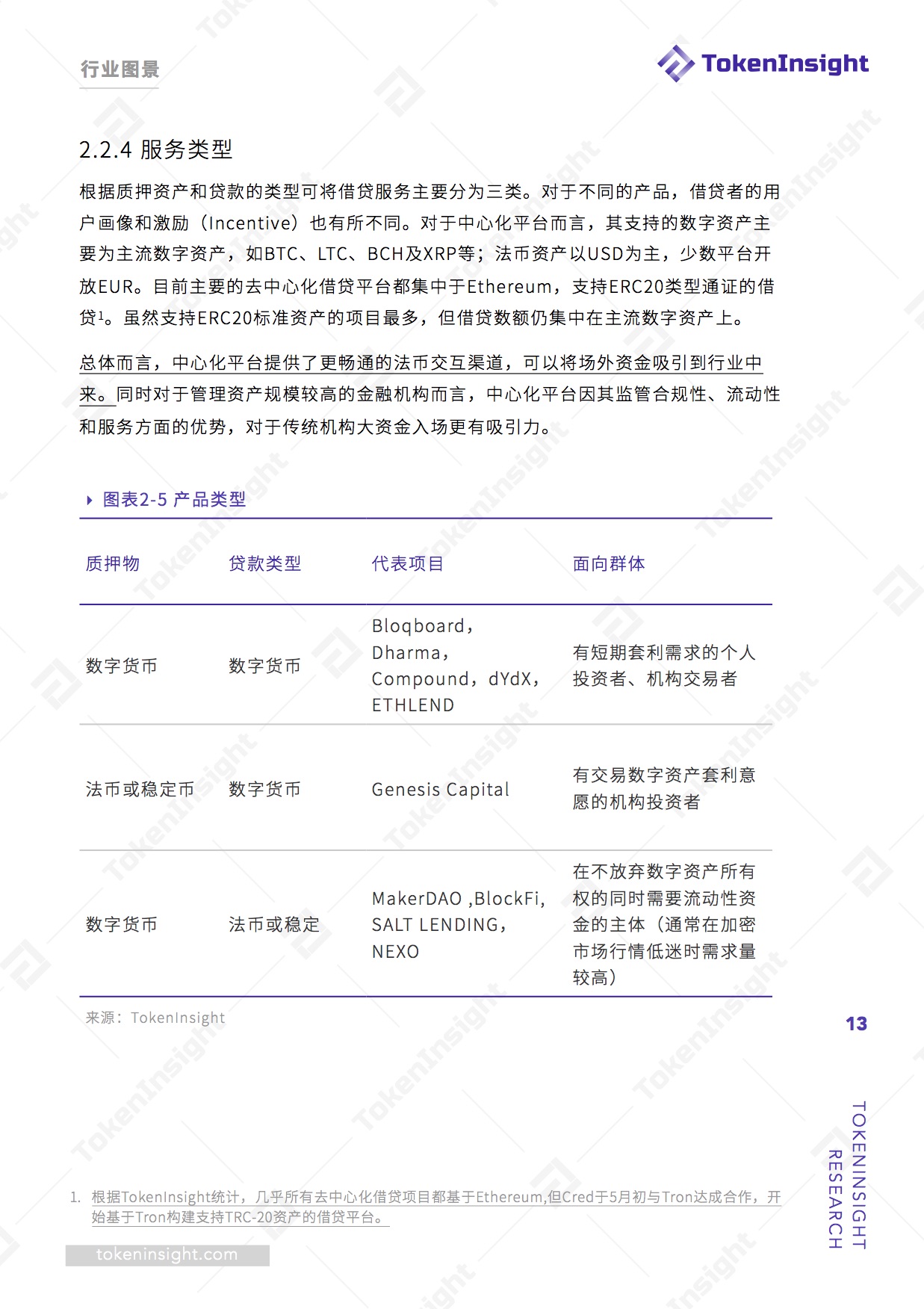

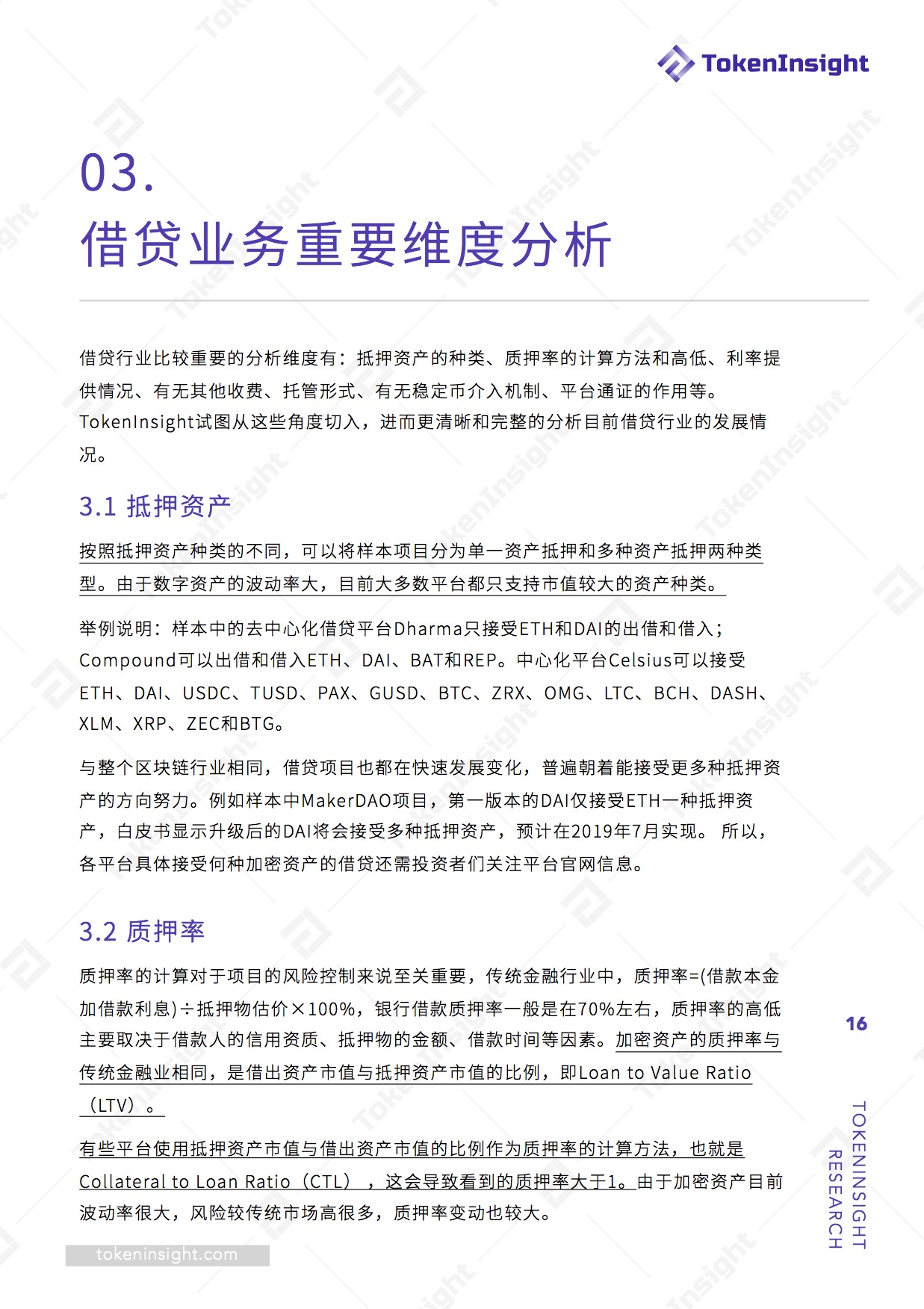

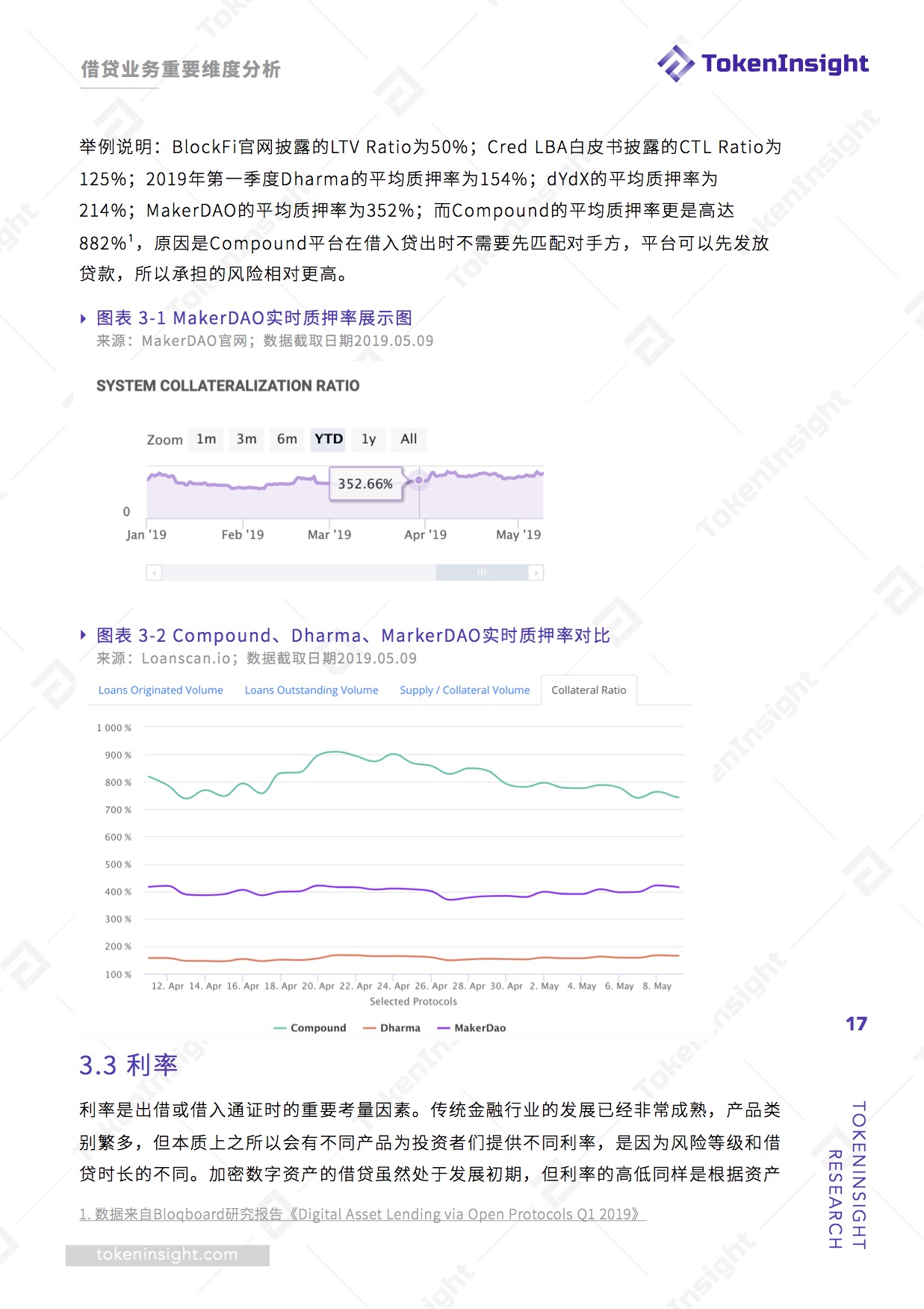

In the research scope of this paper, the business model of digital asset lending projects includes centralization and decentralized lending , among which the types of products include pledge of legal currency (or stable currency), loan digital assets, pledge of digital assets, legal currency (or stable currency), and pledge. There are three types of encryption pass certificates . All products use the over-collateralization model. The digital currency pledge rate of Q1 in 2019 (calculated according to Collateral to Loan) is more than 300%.

Overall, the industry is still in its infancy , and the scale of lending is much smaller than that of digital assets in the secondary market, and there is still room for improvement in products and services. As long as there is a lending market, the inter-bank lending business will only start, and there is very little information to check. But it is undeniable that these well-designed products provide more enrichment for the encryption market and open up more possibilities for the industry. The technological innovation of lending projects and the new format of projects through cooperation are worth looking forward to.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Mainstream currency market analysis: BTC is at a high level and fluctuating upward trend

- 2019 Encrypted Story Record: Reflections on the Hot Spots

- Observation: Which business model will break out in the Web 3.0 era?

- Ethereum founder Vitalik Buterin proposes an easy-to-integrate anonymous transaction design

- Admission to Southeast Asian communities, Validators.Online officially joined the Wanchain Galaxy Consensus Node Ecology

- The meaning of a representative behind Huawei and the enlightenment given to the blockchain

- Sino-US trade frictions are further escalated, can cryptocurrencies promote the cross-border payment revolution in international trade?