2023 Cryptocurrency Industry Hot Narratives and Current Situation (II) Inscriptions, Meme

2023 Crypto Industry Hot Narratives and Current Situation (II) Inscriptions, MemeAuthor: Climber, LianGuai

Inscription

An inscription is a native digital cultural product of the blockchain. It writes content into satoshis (the smallest unit of Bitcoin) using the Ordinals protocol, and can be viewed using the ordinals explorer. Inscriptions do not require separate tokens, sidechains, or changes to Bitcoin.

The Ordinals protocol, built on the Bitcoin mainnet by software engineer Casey Rodarmor, was officially launched on January 21st this year. It is a system for numbering the smallest units of Bitcoin, satoshis, with their numbers determined by the order in which they are mined and transferred. The transfer scheme is based on the order of transaction inputs and outputs, hence the name “Ordinals.”

- a16z Leading investment of $24 million in Blackbird when restaurants meet Web3

- 1kx Exploring the Design Space of Dynamic NFTs

- Web3 Weekly Financing Overview (9.25-10.1)

The Ordinals protocol is a system for numbering satoshis and tracking them in transactions. In short, users can attach additional data to satoshis and transact with them, a process called “recording.”

Ordinals are recorded directly on individual satoshis and then incorporated into blocks on the Bitcoin blockchain. Ordinals reside entirely on the blockchain and do not require sidechains or separate tokens. In this sense, Ordinals recording inherits the simplicity, immutability, security, and durability of Bitcoin itself.

Ordinals allow users to create unique NFTs by attaching additional data, such as PDFs, videos, and audio files, in addition to JPEGs.

Ordinals open up new use cases for Bitcoin, such as NFTs and new token standards. Digital artworks created with Ordinals have many advantages compared to other NFTs.

Bitcoin Ordinals is a system that allows people to order, identify, and inscribe digital content on satoshis to create digital artworks. A satoshi is the smallest unit of Bitcoin, equivalent to 0.00000001 BTC, meaning that there are 100 million satoshis in one Bitcoin.

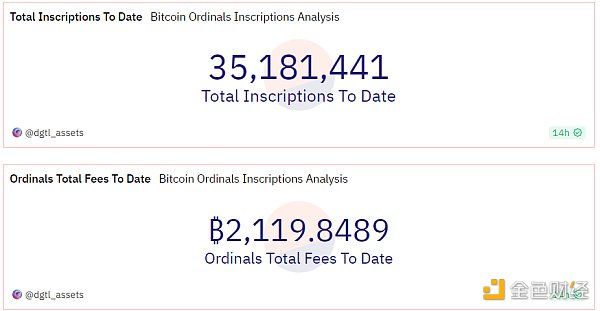

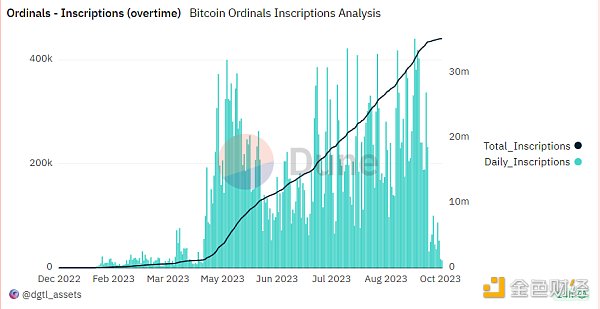

According to data from Dune, the total number of Bitcoin inscriptions has reached 35 million, with a total cost of 2119.8 BTC. In terms of quantity growth, it has been steadily increasing since its inception.

However, the token ORDI has fallen from a high point of $25.34 to $3.4, a decline of 86.7%.

Meme

In 2023, the crypto market is still in a deep bear market phase, but there are still coins that have seen gains of thousands or even tens of thousands of times, and the most representative of them is PEPE.

Meme coins typically refer to cryptocurrencies that do not have practical use cases or application value, but instead attract users and investors through “hot topics” and “humor” on social media and the internet. These coins usually have high volatility and risk.

Most popular Meme tokens are based on dogs, but this year’s hottest PEPE is based on frogs.

PEPE is an inflationary meme coin launched on Ethereum. This cryptocurrency was created as a tribute to Pepe the Frog, a popular internet meme created by Matt Furie in the early 2000s.

The project aims to capitalize on the popularity of meme coins like Shiba Inu and Dogecoin, and strives to become one of the top meme-based cryptocurrencies. PEPE attracts the cryptocurrency community through tax-free policies, a redistribution system that rewards long-term stakeholders, and a destruction mechanism to maintain the scarcity of PEPE coins.

The official MEME Twitter account posted its first tweet on April 5th, and PEPE trading started on April 15th. PEPE initially priced at around $0.000000001, with a total supply of 420.69 trillion.

The tokenomics of PEPE are as follows:

Total supply = 42.69 trillion

93.1% liquidity pool supply = 391.66 trillion (LP token burn)

6.9% allocated to the team = 29.03 trillion

In April of this year, news of profitable investments in this token emerged one after another. For example, a certain Smart Money address bought 2.52 trillion PEPE for 0.013 ETH (about $25), obtaining a profit of 32,000 times. Another Smart Money address starting with 0x4a spent 0.125 ETH (about $251) to purchase 5.9 trillion PEPE, achieving a literal market value of about $1.7 million in just four days, with an increase of over 6,000 times.

After PEPE gained popularity, it sparked a wave of meme frenzy. Since PEPE began trading on April 15th, it has continuously reached new highs, with numerous stories of hundredfold and thousandfold wealth creation. It has also been listed on centralized exchanges such as Binance and OKX. Its market capitalization has exceeded $1.3 billion, igniting the meme coin frenzy in the market, and the community has gone crazy for various meme tokens, even driving the daily active users of Uniswap to a new high since May 2021.

However, after PEPE was listed on Binance in early May, it entered an endless decline mode, and its profit since its inception has dropped to 1,082.06%.

The news in August that the PEPE team dumped and ran further caused it to decline. Media reports accused three former PEPE team members of stealing 16 trillion PEPE tokens and selling them on various cryptocurrency exchanges, and they promptly deleted their social media accounts. This incident caused the token price to drop by nearly 20% and panicked investors.

Although the official announcement states that the remaining 10 trillion tokens in the multi-signature wallet will be transferred to a new wallet, where they will be stored safely, the future of PEPE is bright after resolving internal conflicts. The team plans to use the remaining tokens to purchase PEPE domain names, and the remaining tokens will be burned in the future.

However, from the results, it is obvious that PEPE is gradually entering the dark night. For ordinary investors, losses have become an established fact.

The new Pepe token is essentially what the old Pepe token should have been, meaningless and worthless. Investors should treat it rationally.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Meng Yan ‘Reflection on the Blockchain Industry’—How can trust be generated and disseminated without relying on authority in the past decade?

- Is something with no elasticity in supply not suitable to serve as currency?

- Web3 Social Resurgence Who will be the next phenomenon-level application among friend.tech, Telegram, and others?

- Tether CTO reveals the truth about stablecoin reserves

- Vitalik’s New Article Explained in Detail Why ‘Adding Off-Protocol Functionality’ Is an Extremely Important Consideration Factor

- Rollup 2.0 The Battle of Decentralized Sorters

- Looking ahead Lightning Payment in 2025