Anthropic, which has seen a skyrocketing valuation, has become FTX’s biggest hope for debt repayment.

Anthropic, with its soaring valuation, is FTX's best hope for repaying its debt.Author: ASXN Translation: Odaily Planet Daily Azuma

Editor’s Note:

On September 25th, artificial intelligence company Anthropic announced that it will receive a maximum investment of 4 billion US dollars from Amazon. Considering that FTX had invested 500 million US dollars in Anthropic’s Series B financing as the lead investor, many FTX creditors see this equity investment as their greatest hope of recouping their principal.

The following is a specific analysis by Boutique Digital Asset analyst ASXN on the current value of this equity investment and the potential for appreciation.

- StepN Founder Jerry What are the considerations for Web3 game creators?

- Analysis Su Zhu arrested, April detention period may be extended

- Ouroboros Capital Why are we optimistic about the future of MKR?

FTX and its related parties have been very active in the venture capital field, with data showing that they have invested billions of dollars in more than 130 companies.

Among the hundreds of transactions made by FTX, the most noteworthy investment is undoubtedly the lead investment in Anthropic’s Series B. At that time, FTX’s investment amount reached 500 million US dollars. As Anthropic continues to stir up the primary market, its soaring valuation naturally brings new expectations to FTX creditors.

First of all, here are some basic information about Anthropic. It is an artificial intelligence startup founded by former OpenAI employees and has developed an AI chat application called Claude, which is now widely regarded as the biggest competitor to OpenAI.

Since its establishment, Anthropic has raised billions of dollars in venture capital through multiple financing rounds.

In April 2022, Anthropic completed a Series B financing of 580 million US dollars, of which FTX contributed a total of 500 million US dollars, including the lead investment by SBF himself, as well as the participation of FTX co-chief engineer Nishad Singh and former Alameda CEO Caroline Ellison and other executives.

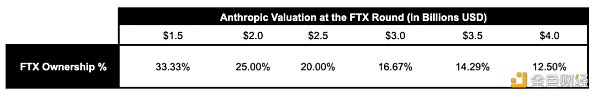

However, the valuation of this round of financing has not been disclosed, so we cannot know the specific transaction price and shareholding ratio of FTX. However, we can speculate on it based on the subsequent Series C financing.

In May 2023, SLianGuairk Capital led the Series C financing of Anthropic with 580 million US dollars. TechCrunch reported that the valuation of this round of financing is approximately 4.1 billion US dollars. Considering that the AI concept has no signs of ebbing in this cycle, it also means that the valuation in the Series B financing is unlikely to exceed 4.1 billion US dollars.

Therefore, it can be inferred that FTX’s shareholding ratio in Anthropic is likely to exceed 10%, and based on different specific valuation figures, we expect FTX’s shareholding ratio to be between 12.5% and 33.33%.

Another proof of FTX’s shareholding ratio is Google’s investment in Anthropic. In February 2023, Google invested $300 million in Anthropic, and multiple media outlets, including The Verge, reported that this transaction exchanged for a 10% stake in Anthropic.

Because FTX entered earlier and contributed more, its shareholding ratio should be greater than Google’s.

Returning to the latest developments, Anthropic has recently received a large amount of additional funding from Amazon. According to public interviews with both parties by TechCrunch, this investment will be implemented immediately with $1.25 billion, and the total subsequent investment is expected to reach $4 billion.

Although the valuation of this round of financing has not been disclosed, we can make some simple speculations based on another event at the same time.

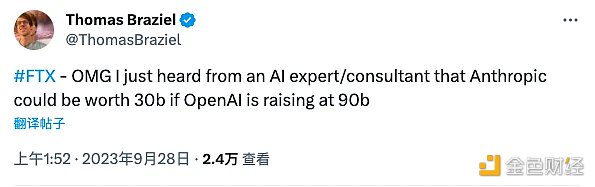

On September 27th, The Wall Street Journal reported that another AI giant, OpenAI, is in talks with potential investors to sell shares at a valuation of $90 billion. Combining the competitive situation between OpenAI and Anthropic, there are rumors that the latest valuation of Anthropic in the capital market has reached $30 billion.

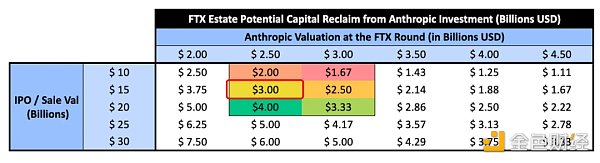

We take a more conservative calculation method, assuming that when FTX contributed, the valuation of Anthropic was $2.5 billion, and the current valuation is $15 billion. FTX’s shareholding ratio is 20% (all three data are taken as mid-range values), corresponding to a equity value of approximately $3 billion.

Now, let’s address FTX’s debt issue itself.

When FTX filed for bankruptcy, its asset gap was about $9 billion, and the documents submitted by FTX in May stated that “about $7 billion of liquidity has been recovered so far,” leaving a hole of $2 billion. If we don’t consider liquidity issues (including the real liquidity of FTX-held assets and the restrictions on the realization of Anthropic’s equity), it seems that the equity value of Anthropic is enough to cover it…

Nevertheless, for creditors who have been deeply affected by the FTX incident, the increase in the valuation of Anthropic is undoubtedly a significant change, bringing greater expectations to the victims who are still suffering from the long wait. This is also reflected in the secondary market for FTX claims, where the expected payout rate has now risen to 35%-40%, reaching a new high since the collapse of FTX.

Finally, let’s take a look at some old news.

In June of this year, insiders revealed that investment bank Perella Weinberg, which is responsible for handling the bankruptcy case of FTX, had been considering selling Anthropic’s equity held by FTX, but ultimately chose to give up.

Now, this decision may change the fate of FTX and thousands of creditors.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- RWA Potential Exploration What is the Next Large-Scale Application Track After USD Stablecoin?

- DelphiDigital What are the intent-based applications and what makes Anoma unique?

- Why is Binance in a hurry to sell its Russian business to a newly launched exchange?

- Variant Partner What are the benefits of bringing RWA onto the chain?

- SEC has been repeatedly ‘losing face’ in cryptocurrency cases. Is it because the US Department of Justice is intentionally balancing its power?

- What new opportunities has AI brought to the gaming industry in 2023?

- Co-founder of Three Arrows Capital, Su Zhu, has been arrested and may face 4 months of imprisonment, while co-founder Kyle Davies is still missing.