RWA Potential Exploration What is the Next Large-Scale Application Track After USD Stablecoin?

RWA Potential Exploration Next Large-Scale Application Track After USD Stablecoin?Real World Assets (RWA) refers to traditional assets that are tokenized through blockchain technology, giving these assets digital form and programmable characteristics. This article will step by step introduce how RWA can become the next track for achieving scalable applications after stablecoins like the US dollar.

TLDR

-

The characteristics of RWA assets, such as high transparency and strong liquidity, make them the next track for achieving scalable applications in Defi after stablecoins like the US dollar.

-

RWA roughly has three development directions: public chains with a similar experience to non-custodial Defi, public chains with regulatory whitelist transaction characteristics, and limited transactions only on private chains or consortium chains. The first direction has the highest composability and is the development direction we most want to see.

-

Currently, Defi does not have a good way to retain existing assets or introduce new assets. Tradfi faces urgent problems such as liquidity, transparency, and transaction costs. Introducing RWA can to some extent solve the current problems of both sides and promote the integration of Defi and Tradfi.

-

Referring to the concept of RWA, we can extend to CWA (Crypto-World Asset), such as BTC ETF and other financial instruments in the traditional financial market that participate in the cryptocurrency market. The deep-seated needs of both parties can be attributed to the urgent need for investors to launch risk-matched segmented products to improve financial efficiency.

-

In terms of comprehensive user transaction costs, asset holding costs, and resistance to compliance requirements, US Treasury ETF assets are the best choice for early-scale application of RWA. For the current development of RWA, compliance risk, counterparty risk, and US Treasury default risk are the main sources of uncertainty.

-

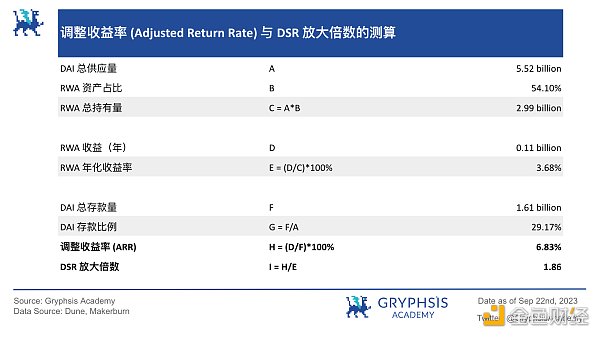

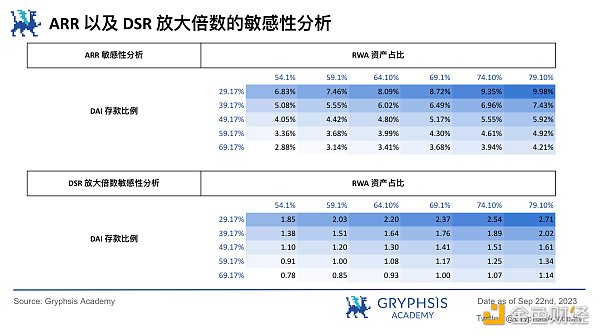

By introducing RWA assets, MakerDAO currently achieves an adjusted yield of about 6.83%. Due to the relatively low deposit ratio of DAI, Maker can amplify DSR to 1.86 times the yield of RWA. Currently, MakerDAO offers a 5% yield to DAI depositors, slightly higher than the yield of US Treasury ETF. It not only achieves considerable income through RWA income but also brings this income onto the chain for DAI depositors.

-

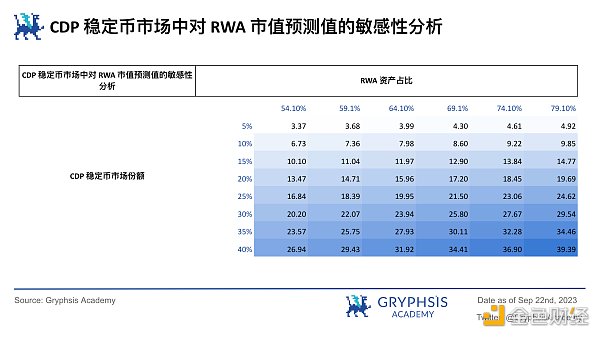

As CDP stablecoin projects gradually catch up with MakerDAO and gradually use RWA as their underlying assets, RWA will have a doubling growth space in the CDP stablecoin market as the market share of CDP stablecoins and the proportion of RWA assets increase, with a rough range of $15.96 billion to $21.50 billion.

-

With the improvement of compliance supervision, RWA will start from standardized assets and gradually expand to non-standard assets. Combined with CWA, it will realize the transformation of blockchain technology from the back end to the front end. RWA will also become the key track for the integration of Defi and Tradfi and achieve scalable applications.

RWA Overview

Real World Assets (RWA) refer to traditional assets that are tokenized using blockchain technology, giving them digital form and programmable characteristics. In this framework, various types of assets – from real estate and infrastructure to artwork and private equity – can be transformed into digital tokens. These tokens are not just numerical symbols of asset value, but also contain multi-dimensional information about the corresponding physical assets, including but not limited to the nature of the assets, current status, historical transaction records, and ownership structure. Broadly speaking, the widely used USD stablecoins are also a form of RWA, namely the tokenization of the US dollar. This article will step by step introduce how RWA can become the next track for mass adoption after USD stablecoins.

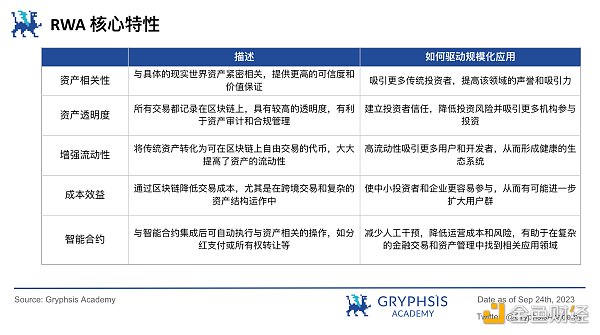

RWA assets, with their unique multi-dimensional advantages, have the potential to achieve mass adoption in the blockchain ecosystem. Their high asset correlation and transaction transparency can establish investor trust, while enhanced liquidity and cost efficiency strongly drive market activity and diversity. The introduction of smart contracts further enhances operational efficiency, while simplifying compliance and auditing processes. These core features pave the way for RWA to become the next track for mass adoption after USD stablecoins, indicating its broad prospects in the blockchain and even the entire financial industry. Of course, RWA assets are diverse, which assets will be scaled up on the chain first? What are the risks or challenges of on-chainization for different assets?

Overall, the relatively easy and already scaled tokenization markets are fixed income assets and rare metal assets. Although the market value of gold tokenization has exceeded 1 billion (represented mainly by projects $LianGuaiXG and $XAUT), from the perspective of the pain points and needs of the current DeFi, starting with standardized fixed income assets such as US bonds/US bond ETFs to bring real yield assets on-chain is currently a relatively easy and more efficient way.

Based on the blockchain and KYC strictness, RWA mainly has three development directions:

1. Public Chain and Permissionless Experience

The first direction emphasizes achieving as much permissionless trading of assets on the public chain as possible to provide a user experience close to DeFi. In this model, real world assets are tokenized and freely traded on the public chain without the need for centralized approval or permission, and asset transfers are not subject to any restrictions. This approach maximizes asset liquidity and market participation while reducing transaction costs. However, this DeFi-like experience also brings a series of regulatory and compliance challenges, including but not limited to anti-money laundering (AML) and KYC issues. Therefore, although this direction has obvious advantages, it also needs to address corresponding risks and compliance issues.

2. Public Chains and Regulatory Whitelists

The second approach is a compromise, where assets may be traded on public chains but may be subject to some form of regulation or have certain thresholds, such as restrictions on participants through an address whitelist mechanism. In this case, only addresses that have been verified and added to the whitelist can participate in RWA transactions. This approach provides a certain level of liquidity and transparency while allowing regulatory agencies to conduct more effective supervision and compliance checks. Thus, it strikes a balance between the permissionless and fully regulated models.

3. Private Chains/Consortium Chains and Complex KYC Processes

The third approach is to conduct RWA transactions on private chains or consortium chains, which typically involve complex KYC processes and stricter regulatory control. Currently, there is minimal asset composability in this mode. In this model, validating nodes are usually government-validated institutions with certain thresholds, ensuring that the entire system operates in a highly compliant and controllable environment. Although this approach may limit asset liquidity and market participation, it provides the highest level of regulatory compliance and data security. This is the model preferred by many governments and traditional financial institutions.

Why is RWA Needed?

DeFi Perspective:

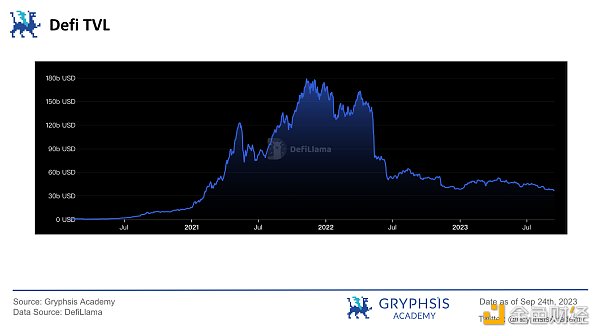

From the above DeFi TVL data, we can see that since the market panic and massive sell-off triggered by the UST decoupling in May 2022, the TVL in the DeFi sector has been declining. Currently, it is difficult for projects and narratives to attract off-chain funds, so there is a need for new narrative structures and participants. Drawing on the characteristics of RWA mentioned above, bringing real-world assets onto the chain to provide real asset value is perhaps the best solution at present.

At the same time, in order to retain on-chain funds or attract off-chain funds, the high yield that DeFi can offer is a key data point that funds pursue. However, the quasi-parallel yield of $UST has led to a lack of trust in high yields. RWA, by adding real-world asset-backed real yields to the protocol, can effectively solve this problem.

TradFi Perspective:

1. Strong Regulatory Control and Limitations of Liquidity Tools

Although the traditional financial system has made significant progress in asset securitization and liquidity, such as real estate investment trusts (REITs) and exchange-traded funds (ETFs), these tools are still subject to strict regulatory and structural limitations. For example, REITs and ETFs often need to meet a series of complex compliance requirements, which not only increase operating costs but also restrict product innovation and market participation. Therefore, although these tools have improved asset liquidity to some extent, there is still ample room for improvement.

2. Limitations in the Private Credit Market

In the private market, especially in the private credit market, there are various limitations and unmet needs. These markets are typically manual, slow, opaque, and have high operating costs. The capital matching process involves multiple steps, from finding and qualifying investors and investment opportunities to initial capital allocation, secondary trading of assets, and management. These factors lead to inefficient capital allocation and suboptimal customer experience.

3. The “black box” problem of complex financial products

When creating complex financial products, the traditional financial system often faces the “black box” problem, which is a lack of transparency and traceability, making it difficult to penetrate underlying assets. This opacity not only increases risks but also limits the trust and participation of market participants. By mapping underlying assets onto the blockchain and packaging them into products through the composability of smart contracts, regulatory authorities only need to regulate the custody of the underlying assets, allowing the process of creating complex financial products based on simple ones to remain open and transparent, thereby solving this problem. The convenience in terms of regulation may enhance the diversity and liquidity of blockchain-based financial products compared to traditional financial means.

In general, TradFi faces the main challenges and demands of improving liquidity, increasing transparency, and reducing costs. RWA provides effective solutions to these problems through tokenization and blockchain technology. Especially in the private market and complex financial product areas, RWA is expected to bring unprecedented transparency and efficiency, thus solving the core bottlenecks of the traditional financial system. By introducing RWA, the traditional financial system is expected to achieve higher capital efficiency, broader market participation, and lower transaction costs, promoting the health and sustainable development of the entire financial ecosystem.

At the same time, it is easy to observe that both traditional and official institutions in TradFi and project parties in DeFi have been deeply involved in the RWA field for many years, seeking opportunities for synergy and integration between the two. Here, we cannot help but mention a concept that has received recent attention – Bitcoin ETF, and based on this concept, we can extend a new concept – CWA (Crypto-World Assets)

RWA and CWA

As Bitcoin gradually becomes a mainstream investment category, major financial institutions are actively applying for approval of Bitcoin ETFs. This trend not only signifies the gradual integration of crypto assets into the traditional financial system but also provides us with a new perspective to consider these assets: the concept of CWA (Crypto-World Assets). CWA has many similarities with RWA, mainly reflected in asset standardization and liquidity enhancement. However, while RWA focuses on tokenizing real-world assets, CWA standardizes crypto assets and related financial products in the real world. We can see the prototypes of both, which are the on-chain issuance of US Treasury bonds/US Treasury ETFs and the approval and issuance transactions of Bitcoin ETFs in the real world.

Like RWA, CWA also faces a series of regulatory and compliance issues. However, due to the decentralized and cross-border nature of crypto assets, these issues are more complex in the context of CWA. For example, the approval of Bitcoin ETFs requires addressing multiple regulatory challenges, including but not limited to asset custody, price manipulation, and market regulation. But the introduction of CWA is expected to further improve the liquidity and market participation of crypto assets. By combining crypto assets with traditional financial products, CWA can not only attract more traditional investors into the crypto market but also provide more investment and risk management tools for existing crypto investors.

Whether it is RWA or CWA, their underlying needs and reasons can be traced back to the introduction of risk-matching segmented products that improve financial efficiency. Efficient financial markets promote increased speculation, which further drives demand for more assets and investment opportunities. In this context, both traditional financial institutions and DeFi platforms need RWA and CWA to establish pathways for capital flow, attracting more users and capital. RWA and CWA, as new forms of financial innovation, not only meet the market’s demand for diversified assets and stable returns, but also promote the flow of funds to more efficient areas. By breaking down the barriers between Tradfi and DeFi, RWA and CWA are expected to drive the development of the entire financial ecosystem towards greater efficiency, transparency, and sustainability. This not only improves the overall efficiency of the financial market, but also provides investors with more investment choices and better risk management tools. This is also an important basis for the scaled application of RWA.

Why U.S. Treasury Bond ETF Assets?

Educational Costs

Let’s think about why stablecoins pegged to the U.S. dollar have become the application area for mass adoption of cryptocurrencies. Why not Bitcoin or other native cryptocurrencies in the crypto community, or why not stablecoins pegged to other national fiat currencies?

Firstly, the educational cost for users is an important but often overlooked consideration. For most users, understanding and accepting new financial products and technologies takes time and effort. Secondly, compared to other fiat stablecoins, stablecoins pegged to the U.S. dollar are more easily accepted by users worldwide, and the U.S. dollar itself is the world’s primary reserve currency and trading currency. Its widespread cross-border use significantly reduces the cost of educating users. Therefore, stablecoins pegged to the U.S. dollar can gain market trust more quickly with the help of users’ understanding and trust in the U.S. dollar. At the same time, due to the global dominance of the U.S. dollar, related educational materials and resources are easier to standardize and globalize, further reducing the difficulty of education in multilingual and multicultural environments. Lower user educational costs are often an important factor in achieving scaled application.

Similarly, this is also why we use U.S. Treasury-related assets instead of bonds issued by other sovereign countries. U.S. Treasury bonds are widely regarded as one of the safest assets in the world, and their high reputation and liquidity in the global financial market reduce resistance for users to accept new financial products or investment channels. High market transparency and audit standards provide strong information support for users, thereby reducing the cost of ongoing education and market promotion. In addition, the stability and global liquidity of U.S. Treasury bonds also help shorten the user learning curve and facilitate the accelerated adaptation and acceptance of new users through community interaction and social certification. Of course, transparency and audit issues should not be ignored. The U.S. financial market is characterized by high transparency and strict audit standards, which also provide reliability and credibility for U.S. Treasury bond assets.

Real Yield

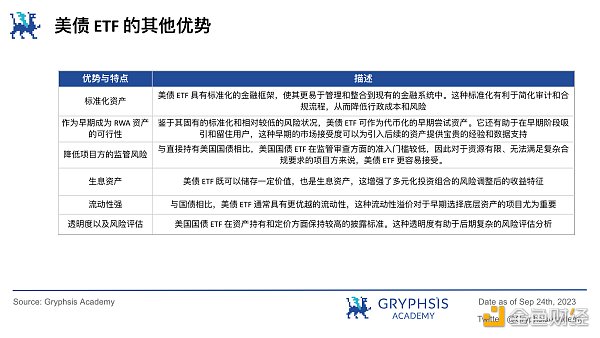

Tether ($USDT), as the most widely used stablecoin in the cryptocurrency field, has always faced transparency and compliance issues regarding reserve assets. The lack of transparency provides space for Tether to potentially issue excessive $USDT without sufficient reserves, allowing them to use the excess funds for other financial activities and investments. These profits are not returned to $USDT holders, but are owned by Tether company. This is particularly concerning in the current DeFi environment, as it raises the question of how to fairly distribute such potential profits to members of the DeFi ecosystem. In this context, US government bonds, with their relative stability, standardization, and lower risk, have become a viable option as the underlying asset for stablecoin issuers. Based on this, US Treasury ETFs not only reduce regulatory risks compared to US government bonds, but also make it easier for issuers to access these assets and their yields (see the comparison in the table below for the eligibility to purchase US government bonds and US Treasury ETFs).

Overall, US Treasury ETFs become a powerful option that can address the transparency and counterparty risks associated with stablecoins like $USDT and other centralized stablecoins as underlying assets for issuers like MakerDAO. They also have the potential to drive the acceptance of cryptocurrencies by the general public. Using US Treasury ETFs as underlying assets not only provides a more transparent and regulated investment avenue, but also allows for a fairer distribution of investment returns to all participants. This can have a positive impact on the DeFi ecosystem by meeting the requirements of public acceptance and regulatory compliance. Therefore, we are now seeing many stablecoin projects, like MakerDAO, starting to incorporate real yield from their collateralized stablecoins into US government bonds. We believe that in the future, this will become a necessary element for CDP stablecoins (Collateralized Debt Position is a protocol that generates stablecoins by locking collateral in smart contracts) and even the stablecoin market, bringing real yield backed by real-world assets to DeFi. Compared to stablecoins like $USDT, stablecoins that map RWA asset yields on the chain are more transparent in terms of underlying assets and returns, and the distribution of returns is fairer. They also have higher credibility and acceptance for regulatory authorities. For stablecoin issuers, although they may sacrifice some black-box profits, they can gain a larger market and stability with the cooperation of regulatory authorities. The mass adoption of RWA assets is at least a win-win situation for the stablecoin field.

Advantages of US Treasury ETFs

Based on the comparison table above between US government bonds and US Treasury ETFs, directly purchasing US government bonds has higher requirements for investors in all aspects, especially for decentralized stablecoin issuers who already have compliance risks, or other DeFi project teams that want to obtain real-world asset returns. Therefore, if there is a reliable ETF issuer as a partner, directly purchasing US Treasury ETF assets is a lower-cost and more liquid approach compared to directly holding US government bond assets. At the same time, as shown in the table below, DeFi project teams holding US Treasury ETF assets have multiple advantages compared to other real-world assets.

According to Mint Ventures researcher @Colin (refer to ‘Web3 National Debt Business Discussion: The Only Solution for Short-Term RWA’), the main advantage of using US Treasury ETF as underlying assets is that it greatly simplifies the asset management process. Under this arrangement, all management responsibilities related to underlying assets, including liquidity management and rolling bonds, are handled by the ETF issuer and manager. This approach effectively reduces the operational burden and risks of asset management for project teams. Furthermore, US Treasury ETFs have not experienced any major risk issues to date, so project teams do not need to be particularly concerned about such risks. Currently, they only need to select the largest, most liquid, and standardized assets in the market to include in their investment portfolios. Compared to holding US Treasury assets themselves, US Treasury ETFs allow project teams to focus on their core business while delegating complex asset management tasks to professional ETF issuers and managers, thereby reducing operational risks and improving efficiency.

In summary, US Treasury ETFs have multiple advantages as on-chain assets, including their standardized characteristics, potential as early targets for RWA exploration, relatively low compliance requirements, and ability to serve as interest-bearing assets. These advantages make them a worthy option, especially for project teams that want to explore and experiment with on-chain real-world assets at an early stage. Of course, these considerations are based on the current limited size of the tokenized asset market. According to the asset tokenization document released by the Federal Reserve Board in August, as the scale gradually expands, the high liquidity and composability advantages of tokenized assets may lead to price fragility in traditional financial markets, or the transmission of price fluctuations in the cryptocurrency market to traditional asset markets. This is also one of the concerns of investors and regulatory agencies, and effective solutions are still awaiting. Additionally, as US bond yields decline in the future, finding similar products to US bonds will also be a major challenge for DeFi.

How to achieve on-chain RWA assets?

Although the RWA market has already taken shape, it is still in the exploratory stage. Different project teams and financial institutions in DeFi and TradFi are also trying different solutions for on-chain assetization. Combining the three development directions of RWA mentioned above, we can see that the closest to the DeFi experience at present is MakerDAO, which penetrates RWA asset income into DAI deposit rates (DSR); or various tokenization methods of real-world assets, such as whitelist trading models like Ondo Finance and green bonds issued on a private chain by the Hong Kong government through Goldman Sachs’ tokenization platform GS DAP.

Approaches to on-chain RWA assets by MakerDAO:

Although MakerDAO has been planning the development of RWA since 2020, according to the development of regulatory compliance, it has only obtained income from RWA assets, mainly US Treasury assets, through different institutions, and allocated this portion of the penetrated US Treasury income to some DAI holders through DSR (DAI deposit rates). In other words, it can be considered as tokenizing the economic rights of RWA assets rather than ownership rights, but considering that it is currently the closest way to obtain real-world asset income in the DeFi experience, it is expected that with the improvement of regulatory compliance, MakerDAO and its partner institutions will further tokenize RWA assets and have higher composability. Next, taking the two main Vault Types currently holding US Treasury assets in MakerDAO, RWA007-A (Monetails Clydesdale) and RWA015 (BlockTower Andromeda & Centriduge), as examples, let’s take a look at the paths through which projects have already implemented on-chain US Treasury ETFs.

I Monetails Glydesdale

Referring to the MIP65 proposal, we can have a general understanding of how the third-party institution Monetalis can assist MakerDAO in holding US Treasury ETF assets. First, MakerDAO has proposed solutions to the three main issues of uninterest-bearing assets, concentration risk, and negative publicity impact brought by stablecoins, especially $USDC and $USDP assets, which account for more than 50% of the balance sheet. They believe that by holding short-term government bonds, they can generate positive returns while reducing the risk exposure to existing stablecoin issuers.

The initial idea of MakerDAO is to manage these assets by setting a target debt ceiling and a minimum/maximum range for each fiat-backed stablecoin ($USDC/$USDP, etc.). When the debt ceiling of a stablecoin’s PSM pool exceeds the maximum limit, the excess funds will be converted into cash and invested in an ETF of short-term investment-grade bonds, thereby reducing the risk exposure to that stablecoin and potentially increasing returns. On the contrary, if the debt ceiling is below the minimum limit, the system will allow manual intervention, usually executed by MKR holders. The overall mechanism aims to manage the supply and demand of DAI more effectively while balancing risk diversification and yield enhancement. The choice of bond ETF as an investment tool is mainly based on considerations of liquidity, simplicity, cost-effectiveness, and risk management. ETFs not only provide high liquidity and asset diversification to reduce overall risk but also, compared to managed accounts, offer simplicity and cost-effectiveness despite lower yields at the time. In addition, as ETFs are managed and supervised by professional asset management companies and regulatory agencies, they also provide a certain level of transparency and security. From the perspective of risk management and yield acquisition in MIP65, it is difficult for us to see MakerDAO’s intention to develop RWAs. However, through its collaboration with Monetails and the collaboration project in MIP68, we can see MakerDAO’s long-term plans for developing RWAs.

According to Monetails’ description in MIP68: MakerDAO’s vision for RWAs is to achieve the integration of Maker and Tradfi by introducing diversified and high-quality RWA assets through similar institutions such as Monetails, enabling credit assessments and other businesses to be conducted in a more flexible, innovative, and market-responsive manner, and realizing Maker’s vision of Clean Money. The most ambitious goal is for Maker to create and operate integrated services that involve the tokenization of high-quality Tradfi and Defi, becoming an integrated service operator for the fusion of Tradfi and Defi on-chain and off-chain. Such a massive market is indeed attractive, let’s see how Monetails specifically implements it.

First, find a solid integration point to rapidly increase transaction volume without significantly changing the existing daily operations of Defi and Tradfi. Then, gradually achieve more comprehensive on-chain integration based on the foundation of large-scale capital flows. Ultimately, more closely integrate DeFi with the traditional financial market, transitioning from experimentation to the mainstream. In other words, this is a basic plan for Monetails’ development of RWA business, and it serves as a complement to RWA businesses in various fields such as Centrifuge, Maple, TrueFi, etc.

So how is it implemented specifically? According to MIP68, there are generally three main entities:

-

ARENA is committed to solving the complex interaction problems between traditional finance and DeFi, that is, finding suitable integration points as breakthroughs for growth, including but not limited to compliance, operations, and technology, in order to achieve the organic integration and long-term development of the two, acting as a bridge between the two.

-

In terms of TradFi, Glydesdale is mainly responsible for managing and initiating relationships with financial institutions, establishing trust, analyzing and matching suitable products and demands, and implementing these relationships. It also solves the conflicts and challenges between DeFi and TradFi at the practical level. Currently, the two have their own inherent needs and expectations, but there is limited tolerance for compromise. Clydesdale’s existence is to fill the gap between DeFi and TradFi as an intermediary solution, especially for DeFi protocols like MakerDAO, it provides a path to gradually attract and integrate large financial institutions.

-

At the same time, Lusitano is an asset management platform that specifically attracts and integrates teams with specific asset category experience and proven performance. By creating a flexible platform, it not only promotes the deep integration of DeFi and TradFi, but also serves as an empirical tool to demonstrate the feasibility and innovation capabilities of DeFi. The platform particularly focuses on driving teams towards ESG and the green economy, thus establishing a broader and more diverse cooperation relationship between DeFi and TradFi.

In other words, through the above plan, MakerDAO and Monetails clearly introduce RWA assets as collateral for development, providing real-world asset guarantees for DAO revenue, and at the same time, it can be seen that both parties are interested in expanding into a broader market. Next, let’s take a look at how BlockTower Andromeda and Centrifuge, who have also reached a cooperation with Maker, operate.

II The Path of BlockTower Andromeda and Centrifuge

If the cooperation between MakerDAO and Monetails is a deep advancement of their consensus on the vision of RWA, then the three-party cooperation between MakerDAO, BlockTower Andromeda, and Centrifuge provides almost a complete set of solutions for introducing RWA assets for other projects, especially the latter two see their main mission as creating a repeatable, scalable, and reliable framework for RWA investments, which is a key aspect in the process of scaling RWA applications. At the same time, we can also see that at this point, MakerDAO has a greater ambition for the integration of TradFi and DeFi, that is, an ambitious plan to push MakerDAO and DAI into a broader social and commercial field, especially in emerging markets and real-world applications.

MakerDAO achieves indirect holding of real-world assets such as US Treasury bonds through its cooperation with the Centrifuge platform. This process is highly innovative, combining the advantages of traditional finance and blockchain technology. First, the asset management company BlockTower Andromeda creates SPVs, which are associated with the fund pools established on the Centrifuge platform. This setup ensures the independence of each fund pool and also gives each fund pool a certain legal personality, helping to reduce compliance and operational risks.

Borrowers issue NFTs through SPV that correspond to real-world assets they hold, such as US Treasury bonds. These NFTs are considered on-chain representations of these assets and are locked in Centrifuge’s relevant funding pool to extract the corresponding loan. This step is crucial because it provides additional transparency and traceability through blockchain, making external audits and risk assessments easier and more reliable. These NFTs are grouped into asset pools, which are further divided into two types of tokens: $DROP and $TIN. The $DROP token represents the senior portion of the asset pool with lower risk, while the $TIN token represents the junior portion with higher risk.

As the main debt purchaser for Centrifuge, MakerDAO integrates directly with Centrifuge’s funding pool, allowing it to directly extract the corresponding DAI stablecoin from its Vault through the $DROP token. This direct integration greatly simplifies the process of debt purchasing and management, improving the efficiency and usability of the entire system. Through this integration, MakerDAO not only gains robust returns associated with real-world assets like US Treasury bonds but also manages and optimizes its balance sheet more effectively. To ensure investment security, Centrifuge introduces a series of complex risk-layering and protection mechanisms. The two most important concepts are the “Minimum Subordination Percentage” and the “Epoch Mechanism.” The former is used to ensure that senior assets ($DROP) have sufficient risk buffers to prevent unexpected losses. The latter is a redemption mechanism that allows token holders to redeem based on the cash flow of underlying assets, with $DROP holders having priority. These mechanisms collectively provide MakerDAO with additional risk protection.

However, this mechanism is not without risk. First, the system involves multiple counterparties and complex contractual relationships, which increases compliance risk, counterparty risk, and legal risk. Second, although the setup of SPV and funding pools reduces centralization risk to some extent, interactions with real-world assets may still bring other forms of risk, such as liquidity risk and market risk. Furthermore, as this model is relatively new, how to deal with potential security issues such as governance attacks still needs further exploration and resolution.

Undoubtedly, not every project can gradually connect with holding RWA assets through collaborations with institutions similar to MakerDAO, like Monetails. Indirectly holding real-world assets through infrastructure institutions like BlockTower Andromeda and Centrifuge that specifically put RWA assets on-chain not only simplifies the process and reduces costs but also, more importantly, currently does not require self-assumption of legal compliance costs while accessing a greater variety of assets. This infrastructure development is crucial for achieving the vision of scaling the application of RWA. Of course, what MakerDAO has achieved so far is only “tokenizing” the economic rights of RWA assets. If we follow the original concept of asset tokenization, Ondo Finance’s approach to putting assets on-chain is more in line with the RWA concept.

Ondo Finance Whitelist Trading Mode for US Treasury Bond Token:

The $OUSG token is a cryptocurrency token that represents an investor’s ownership in the Ondo I LP fund. Ondo I LP is a limited partnership registered in Delaware, which attracts on-chain investors to invest in and hold fund assets such as ETF assets. The $OUSG token is different from regular cryptocurrencies or assets; it is a token associated with specific fund assets.

Technically, $OUSG is a token based on the Ethereum smart contract. It can track investors’ fund shares on the chain and can be used in the subscription and redemption processes of the fund. When investors want to subscribe to the fund, they need to go through Ondo I LP’s KYC/AML process. This usually involves providing personal identification, financial information, etc. Once completed, the investor’s Ethereum wallet address will be added to the whitelist so that they can send USDC to the fund’s smart contract for subscription. This process is completed by the smart contract, including the receipt of funds and the allocation of shares.

After investors send USDC to the fund’s smart contract, the contract will automatically transfer the funds to the fund account hosted by Coinbase. Then, Ondo Investment Management (Ondo IM) will convert the USDC into dollars and transfer it to Clear Street’s cash account through a cooperating bank (a securities broker and qualified custodian). There, Ondo IM uses these funds to purchase ETF shares. After the subscription is completed, investors will receive an equivalent amount of $OUSG tokens as proof of their share in the fund. These $OUSG tokens can be stored in an Ethereum wallet or used on other platforms (composability) and can also be used for future redemption operations.

When investors are ready to redeem their shares, they can send $OUSG tokens to the fund’s smart contract to submit a redemption request. The smart contract will automatically record this operation. Then, Ondo IM will sell enough ETF shares on Clear Street to meet the redemption request. The resulting dollars will be converted into USDC and sent to the investor’s Ethereum wallet via Coinbase.

It can be said that Ondo Finance has currently found a more compromise way, which also shows us the next step after the securitization of RWA assets, namely the composability of RWA tokens. However, due to compliance development, we still cannot be very optimistic about this whitelist approach.

Hong Kong Government Evergreen Project:

In the Evergreen project, the tokenization of bonds is divided into multiple stages for issuance and subscription, some of which are carried out on the Goldman Sachs GS DAP platform. Initially, the platform is only open to platform participants such as the Hong Kong SAR Government, Hong Kong Securities Clearing Company Limited (CMU), distributors, custodian banks, and secondary market traders, and these participants are assigned corresponding roles and responsibilities, with high entry barriers. Non-direct platform participants will hold their interests through custodian banks (similar to customers who have undergone rigorous KYC by banks).

For tokenized bonds, some steps are conducted off-chain, such as record-keeping and pricing. At the same time, on the day of record-keeping and pricing, CMU will create smart contracts on the blockchain that represent the actual rights of tokenized bonds, as well as smart contract instructions that represent HKD cash tokens. At this point, authenticated participants such as distributors need to transfer the corresponding funds to the real-time gross settlement system (RTGS) account managed by CMU to participate in the subscription process on the platform through smart contracts.

In this project, the digital platform consists of the Canton blockchain, which is responsible for the interpretation and execution of smart contracts, and the Hyperledger Besy, which is a communication and consensus ledger between nodes running on Ethereum. Both are private chains, providing higher security and privacy. It is worth noting that the visibility of certain smart contracts to different participants in this project depends on whether they are signatories or observers of the relevant smart contracts.

Finally, various payment and clearing activities throughout the bond lifecycle, such as interest payments and principal repayments, are conducted using HKD cash tokens minted by the HKMA on the digital platform. Smart contracts automatically handle these payment and clearing operations. Compared to using digital tokens minted by entities other than the HKMA or any central bank for transactions of other digital securities, which may be tokens specifically designed for individual transactions and are flexible but highly unstable in terms of counterparty risk, operational risk, and liquidity, using a unified HKD cash token for transactions ensures the smooth progress of the entire process of the Evergreen project.

Taking into account the three methods mentioned above, the tokenization of securities by the Hong Kong government can be said to be highly compliant and controllable. However, this may only be an attempt by traditional institutions to improve the efficiency and reduce the cost of financial asset transactions using blockchain technology, and may not necessarily be strong evidence of the scale application and growth of RWA.

Data Analysis

With the continuous interest rate hikes by the Fed starting in early 2022, the yield of US Treasury bonds has also increased significantly. The yield of the 2-year Treasury bond, which was only 0.15% on average at the end of 2021, soared to an average of 4.5% at the end of 2022. It can be seen that the resolution to introduce US Treasury bond assets by MakerDAO is almost synchronized with the Fed’s interest rate hike resolution. Undoubtedly, MakerDAO has already earned a considerable profit through RWA and has also distributed a portion of the profit to DAI holders. We can roughly estimate the Adjusted Return Rate (ARR) brought to DAI depositors by RWA assets and the amplification factor of DSR in the process of generating income from RWA assets.

In the above table, the Adjusted Return Rate (ARR) is calculated by dividing the annual income of RWA (D, 0.11 billion) by the total amount of DAI deposits (F, 1.61 billion). This adjusted return rate can be regarded as the theoretical rate of return that DAI depositors can potentially obtain through the MakerDAO platform based on the current deposit ratio and the annual income of RWA, although it is indirectly realized through RWA assets. In addition, the amplification factor of DSR (Dai Savings Rate) is calculated by dividing the Adjusted Return Rate (ARR) by the annual yield of RWA (E, 3.68%). This ratio reflects the increase in the rate of return that DAI depositors can obtain through the DSR mechanism compared to directly holding RWA assets. A DSR amplification factor of 1.86 indicates that through the DSR mechanism, DAI depositors can achieve an annualized rate of return almost twice as high as directly holding RWA assets. This amplification factor shows the potential value and advantages in terms of potential returns provided by the DSR mechanism to DAI depositors. In this case, the DSR mechanism seems to provide DAI depositors with a higher rate of return, allowing them to achieve better investment returns over the course of a year.

So why is the ARR almost twice as high as the RWA annual yield? This is because the current DAI deposit rate is not high, and MakerDAO can distribute the income obtained through RWA to a relatively smaller scale of DAI depositors. This is also why we see Maker offering a DSR as high as 8%. But how do we determine if this is a Ponzi scheme? We believe that as long as Maker ensures the transparency of underlying assets and profit & cost, if the historical average data of DSR is lower than the actual yield of RWA assets, it means that the on-chain yield is backed by real-world asset returns. Higher yields will attract more DAI deposits, increasing the total amount of DAI deposits, and thus increasing the DAI deposit ratio, which leads to a decrease in the amplification factor of ARR and DSR, meaning that the same RWA income is shared by more people.

In summary, MakerDAO has been successful in penetrating stable income from RWA assets and distributing the income to DAI depositors. Having transparent real-world assets as a guarantee for yield is a major gap in the current DeFi landscape and will be the most fundamental layer for future RWA applications at scale. Of course, US Treasury bonds may not always maintain such high interest rates, but assuming that MakerDAO can obtain a stable annual yield of 3.68% through RWA, sensitivity analysis of the proportion of RWA as underlying assets and DAI deposit ratio is conducted for ARR and DSR.

In the table above, the left column lists different DAI deposit ratios, and the top column lists different RWA asset ratios. As the DAI deposit ratio increases, the annual yield of DAI depositors gradually decreases, and the amplification factor of DSR also decreases, which means that the deposit yield of DAI gradually approaches or falls below the real income MakerDAO obtains from RWA assets. As MakerDAO uses more and more RWA assets as collateral, its real income also increases, and it can be seen that the DAI deposit rate and DSR amplification factor also increase accordingly.

Currently, holding DAI deposits to obtain a near risk-free deposit rate in DeFi is a good development direction explored by MakerDAO for this type of CDP stablecoin, especially in the current environment where relatively high risk-free interest rates on US Treasury bonds can be obtained. Based on this, we roughly predict the future market value of the RWA sector in the CDP market.

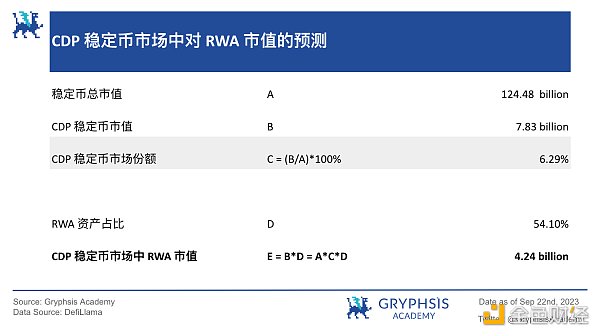

According to MakerDAO’s current RWA asset ratio of 54.1%, the market value of RWA in the CDP stablecoin market is approximately $4.24 billion. As mentioned above, with the large-scale application of RWA, the market share of CDP stablecoins will increase accordingly due to their ability to distribute stable and transparent yield from RWA assets to stablecoin depositors. Therefore, we will conduct a simple sensitivity analysis of the market value of RWA in the CDP stablecoin market. (Unit: billion)

The left column in the table above shows the market share of CDP stablecoins, and the top represents the proportion of RWA as underlying assets. It can be seen that with the increase of both, the market value of RWA has grown significantly. Compared to the mainstream stablecoin $USDC, this CDP stablecoin, which is equivalent to having a deposit interest rate, is more transparent and has a fairer distribution of returns to holders. It can be reasonably speculated that more projects will follow MakerDAO’s example and gradually replace their underlying assets with RWA assets. However, this may only be a small part of the RWA’s scaled application landscape.

Summary and Outlook

Through in-depth analysis and evidence-based data, we believe that RWA demonstrates tremendous market potential and long-term growth prospects. With the advancement of RWA’s scaled application, both the Defi and Tradfi fields will encounter numerous new opportunities, and even achieve partial integration and fusion. However, the current unclear attitude towards regulation and compliance remains the main obstacle to the scaled application of RWA. Although we expect RWA to achieve a similar experience to DeFi on public chains and permissionless systems after the regulatory framework is clarified, excessive optimism in the short term still needs to be cautious.

By observing the practices of MakerDAO, Ondo Finance, and the Hong Kong government, we have preliminarily seen various solutions and potential applications of RWA. We look forward to further leveraging its characteristics and addressing various problems faced by DeFi and TradFi as RWA’s scale gradually expands.

Looking ahead, the development of RWA has laid the foundation for innovative changes in the financial field. In terms of asset selection, RWA will initially focus on standardized assets such as US treasuries, US treasury ETFs, gold, REITs, and high-grade corporate bonds, which have mature trading mechanisms and higher liquidity, providing a solid foundation for RWA. With technological advances and market maturity, we expect RWA to gradually expand to non-standardized assets such as art, real estate, and private equity, which will require more innovative thinking and solutions, including complex evaluation mechanisms and risk management strategies. This also relies on the gradual improvement of regulatory and compliance frameworks.

In terms of user acceptance, RWA’s strategy should focus on meeting investors’ demand for standardized assets first, and then gradually guide them to understand and accept non-standardized assets. This process requires not only well-designed market education and promotion strategies but also in-depth analysis of investor needs to ensure that RWA can provide investment opportunities with substantial value.

In addition, the combination of RWA and CWA is expected to drive the application of blockchain technology from the backend to the frontend. This transformation is similar to the development and evolution of the Internet from backend servers and databases to frontend user interfaces and applications, greatly enhancing the usability and popularity of the technology. At the same time, the combination of RWA and CWA will not only break the limitations of traditional financial markets but also provide investors with more and higher-quality investment choices. To achieve this goal, efforts and cooperation are needed in various aspects, including asset standardization, infrastructure construction, market education, and support for regulatory compliance.

In summary, RWA is highly likely to become an important track for achieving scale application and promoting the integration of DeFi and TradFi, following the stablecoin of the US dollar. We will continue to monitor the development of RWA and related regulatory policies in order to provide investors with accurate and timely market analysis.

References:

https://vote.makerdao.com/executive/template-executive-vote-monetalis-clydesdale-rwa007-a-onboarding-funding-ambassador-program-spf-core-unit-mkr-streams-and-transfers-october-5-2022

https://forum.makerdao.com/t/monetalis-evolution/14811

https://docs.centrifuge.io/getting-started/off-chain/

https://www.federalreserve.gov/econres/feds/tokenization-overview-and-financial-stability-implications.htm

https://drive.google.com/file/d/1x89OjKjaqPLJI-W2-U7pXiS9H_zBOyUb/view

https://drive.google.com/file/d/1kDMvQ2drS0jfbv4uB5UAUbfcObmA-I0H/view

https://www.hkma.gov.hk/media/gb_chi/doc/key-information/press-release/2023/20230824c3a1.pdf

https://docs.ondo.finance/qualified-access-products/ousg/how-it-works

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- SEC has been repeatedly ‘losing face’ in cryptocurrency cases. Is it because the US Department of Justice is intentionally balancing its power?

- What new opportunities has AI brought to the gaming industry in 2023?

- Co-founder of Three Arrows Capital, Su Zhu, has been arrested and may face 4 months of imprisonment, while co-founder Kyle Davies is still missing.

- LianGuai Morning News | Hong Kong Securities and Futures Commission Releases Multiple Lists of Virtual Asset Trading Platforms

- LianGuaintera Cryptocurrency Compensation Report 88% of practitioners work remotely, with executive salaries exceeding $5 million.

- Where is the total circulation of over 120 million Ethereum?

- GPT-4 is too costly, Microsoft can’t sustain it anymore, and it is reported to have quietly initiated Plan B.