4D Long Text: Underrated Ethereum

Source: Medium

Translator: Yin Jiansong, author of "Yin Jiansong says Blockchain"

Source: Vernacular Blockchain

- US presidential candidate Andrew Yang likes Bitcoin? These 7 points can prove

- Bai Shizhen: Proposal to issue encrypted digital currency "belt currency" to improve cross-border payment systems in countries along the "Belt and Road"

- Zuckerberg: Libra is fully handled by the foundation, and Facebook is developing the Libra wallet

Ethereum is an open, license-free blockchain that developers can use to create any type of application they want.

This year, early strokes covered with canvas began to form a coherent picture.

You don't need to look closely to see the direction of Ethereum. The protocols and applications built on Ethereum began to find products suitable for the market, and quickly established a community of thousands of paying users.

The blank area on the canvas is no longer a source of uncertainty or suspicion. Instead, they look more like opportunities: what can we build there?

Ethereum becomes more confident in 2019. After solving difficult engineering issues, the technology roadmap has become clearer, and the largest community of cryptocurrency developers is building applications that people actually pay to use.

Last year, the Ethereum community seemed to solve every major challenge facing the entire crypto industry:

- DEX on Ethereum solves the problem of no need to trust third parties by letting users conduct transactions without giving up their private keys

- Smart wallet on Ethereum can solve difficult user experience challenges without the user having to give up control of funds

- Stable coins like Dai on Ethereum are solving the problem of currency volatility, which has made other cryptocurrency payment technologies worse. On Ethereum, peer-to-peer digital cash is not a dream, but gradually becomes a reality.

This article is a summary of the most important developments and trends of Ethereum. This is an important issue that we will mention in our review ten years later.

We believe that the biggest developments in 2019 are:

1. The Ethereum economy continues to grow. DeFi is still the largest part of Ethereum, and we are seeing early signs of growth in gaming and decentralized autonomous organizations (DAOs).

2. Ethereum goes mainstream. Large companies, financial institutions, consumer brands, and even celebrities are starting to use Ethereum.

3. Ethereum 1.0 improvements. Many projects have brought significant performance improvements and have chosen the direction of long-term sustainability.

4. ETH2.0 has made progress as an engineering project and laid the foundation for its launch in early 2020.

5. The second layer has made steady progress, and new technologies have attracted the attention of the community. Aggregation and zero-knowledge technology are the biggest advances this year, while other technologies (such as state channels) have made steady progress.

01 Ether Economic Growth

In this year's review, we hope to incorporate Ethereum adoption into the overall environment of the cryptocurrency industry. An obviously important metric is: What are people actually paying for using cryptocurrencies and decentralized applications?

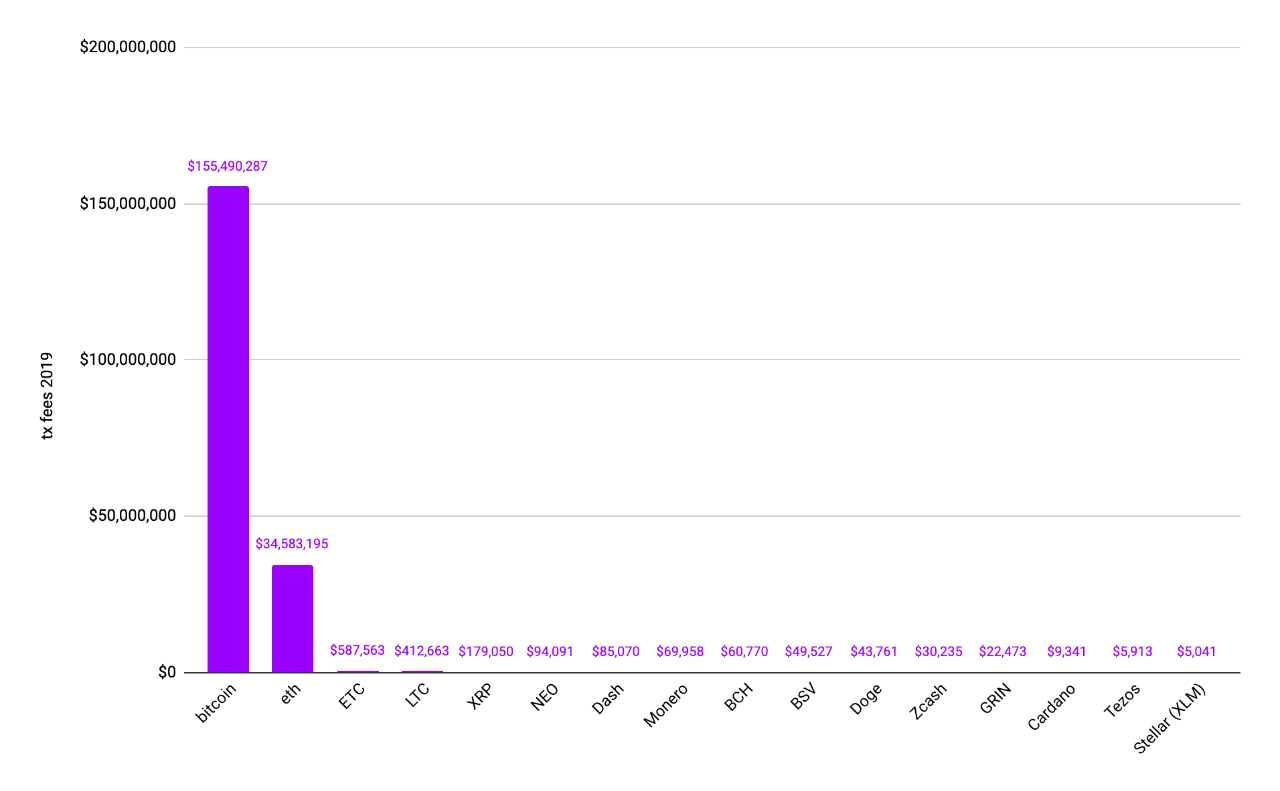

Whenever someone uses a blockchain such as Bitcoin or Ethereum, they will pay a small fee to the miner. Here are the total fees paid in 2019:

Source: Coinmetrics

The figure shows the top 16 blockchains, ranked by the fees paid for using the blockchain

The reality is that only two blockchains have important uses: Bitcoin and Ethereum.

1.DeFi Year

In 2019, DeFi (Decentralized Finance) remains the most important ecosystem in the Ethereum economy.

DeFi's vision is simple: replace the global financial system.

The Internet makes information cheap and universally accessible, while blockchain is expected to allow money to flow freely. Everyone on the planet should be able to access the financial system via the Internet: payments, savings, loans, investments. If you live in a country with a weak financial system or high inflation rates, DeFi may already be better than the financial institutions around you.

DeFi provides us with "cryptocurrency" (stable currency) with stable value, which is the necessary innovation to support any actual payment scenario. DeFi lends ETH to borrowers, enabling thousands of ETH holders to earn interest. DeFi makes it easy to create assets that can automate trading strategies and increase personal wealth.

Today, all these functions are realized , public auditing and transparency through the never-closed financial system, personal assets are sacred and inviolable, and no one can close the personally created account.

This year, one of the undervalued values of Ethereum is becoming clearer: Ethereum-based applications are interoperable and composable. If you are creating or issuing a new asset on Ethereum, you can easily "plug in" the protocol to facilitate asset trading. As David Hoffman put it, Ethereum is the "Lego building block of money" that makes it easier to create more complex systems. This allows DeFi products to take advantage of the extensive infrastructure already built and quickly become useful to users.

Although DeFi is still relatively early and at risk, the benefit is that it comes with tools that help with risk management. The reason why users who borrow ETH in DeFi can obtain higher interest rates is partly because these platforms will bring relatively high risks.

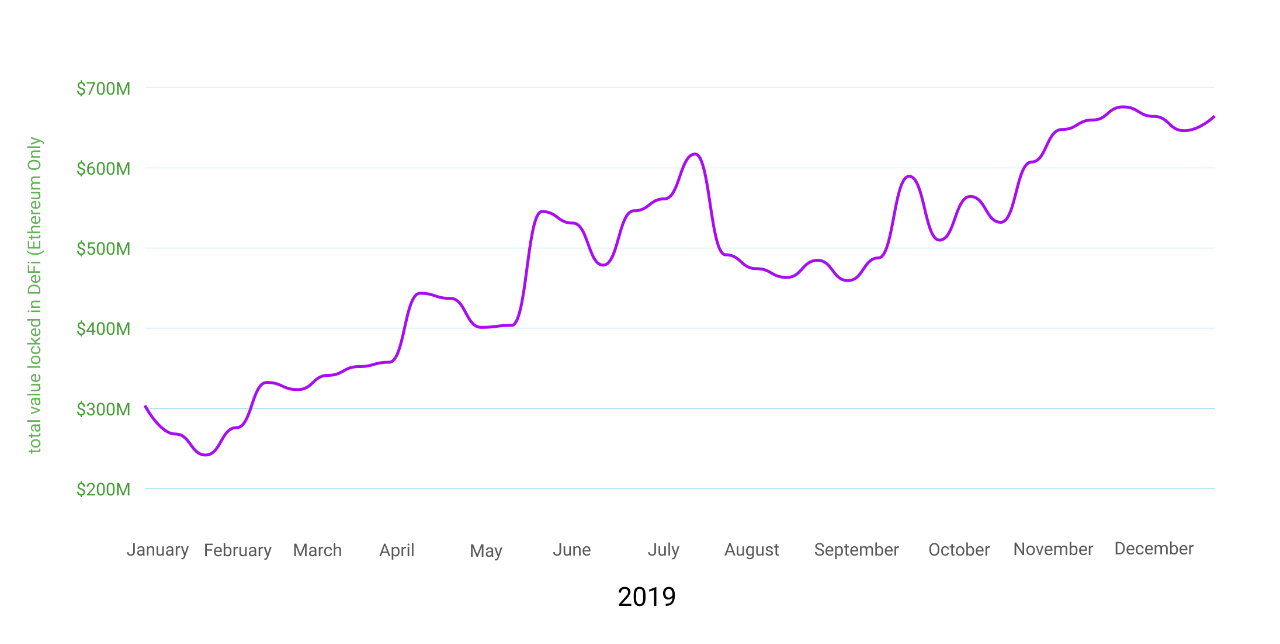

2. How much has DeFi increased in 2019?

Another way to see the growth of the DeFi ecosystem is to look at not only the total value of the locks, but also the number of accounts using them and the number of interactions between those accounts and the application.

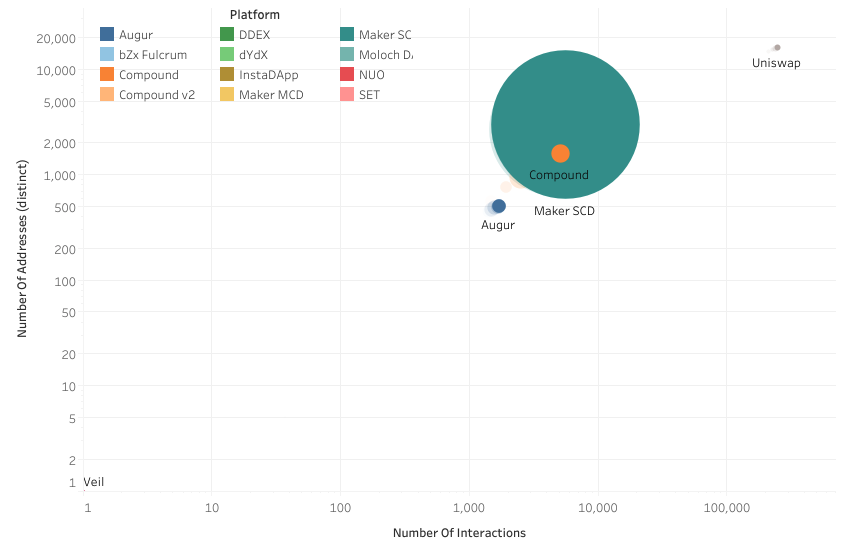

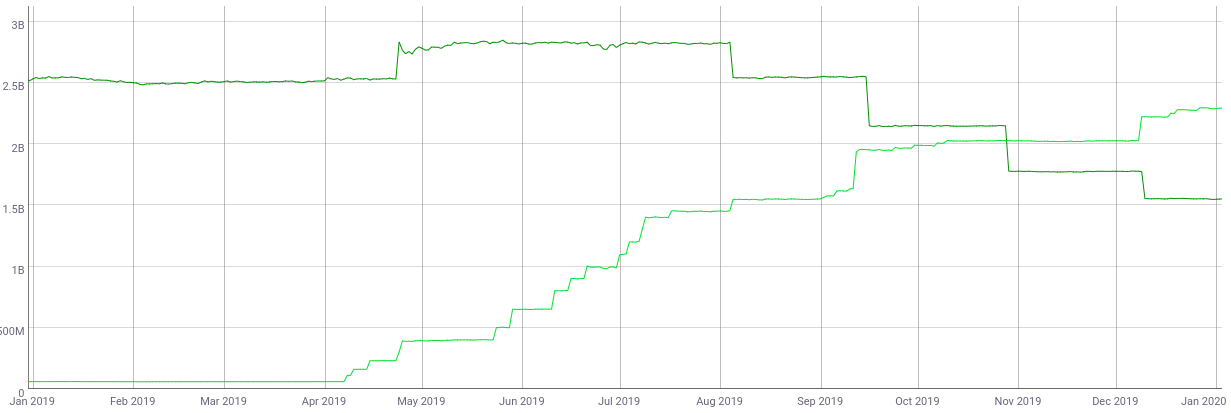

In early 2019, MakerDAO was the only DeFi protocol with a large amount of funds, totaling 1.86 million ETH (then valued at about $ 260.4 million). In the figure below, the size of the circle corresponds to the amount of ETH locked in the protocol:

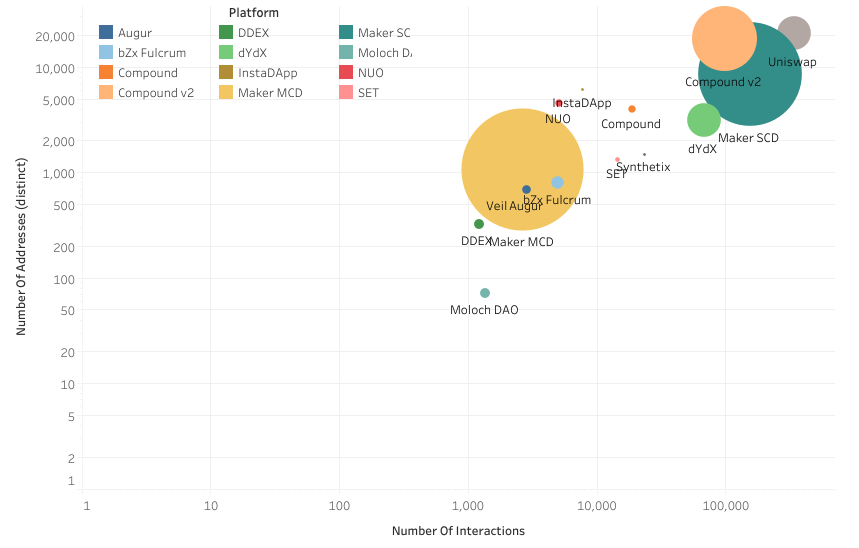

But by the end of 2019, the field has become more diverse:

Source: AlEthio

Compound's TVL (total value of "locked" assets) increased from 35,000 ETH to 350,000 ETH, an increase of 1,000%, and a rapid increase in the number of users.

MakerDAO's locked-in value is transitioning from the original "single mortgage" version of the DAI (green circle) to the "multiple mortgage" DAI (yellow circle). The TVL (total value of "locked" assets) of the two types of DAI totaled 2.15 million ETH, an increase of 16%.

3.The types and quantity of DEX are increasing

One of the most exciting developments in 2019 is the rise of Uniswap.

Uniswap is a new type of DEX. In a "normal" DEX, traders interact with each other, they agree to sell at a certain price, find a buyer, and then trade directly.

With Uniswap, you can trade directly using the Uniswap protocol. The Uniswap agreement is itself a market maker, which sets the price and provides the transaction. This is done 100% on-chain with no off-chain dependencies.

Since Uniswap is built on Ethereum, anyone can use it by calling a contract. This allows other DeFi protocols to use Uniswap as a way to open up market liquidity, enabling anyone to quickly trade new assets. Uniswap is a particularly useful "Lego Block for Money" that has been integrated into many other products and services.

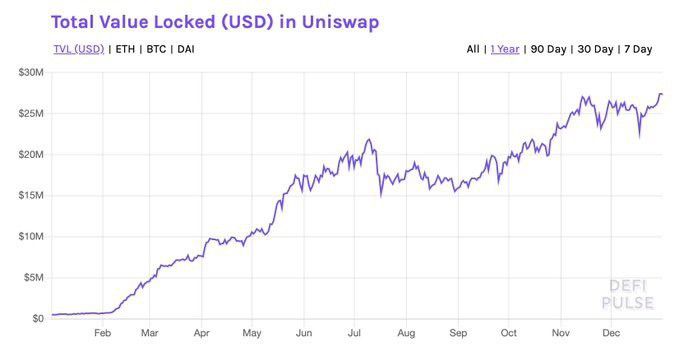

In 2019, Uniswap's average daily trading volume increased from US $ 25,000 to US $ 1.5 million (an increase of + 6,000%), and its available liquidity increased from US $ 500,000 to US $ 25 million (+ 5,000%).

During 2019, Uniswap liquidity providers (those who “locked” assets in the agreement in order to obtain a return on the provision of liquidity services) received more than $ 1.2 million in fees.

Also in 2019:

- In addition to Uniswap, the DEX on Ethereum is impressive. The total transaction volume of DEX based on Ethereum exceeds 2.3 billion U.S. dollars.

- Kyber is one of the largest DEXs, with transaction volume growing from $ 70 million to $ 380 million, an increase of 443%.

- The transaction volume at the end of 0x was $ 254 million, and the number of transactions increased by 27% (this year it focused on liquidity and R & D).

- We see the rise of DEX aggregation services that enable users to search for the best prices for all DEXs.

4. Lending services

One of the most important developments in Ethereum's DeFi ecosystem is the rapid growth of lending services.

Users of these applications can lock their cryptocurrencies into smart contracts, and other users can borrow through this contract and pay interest. In 2019, Ethereum generated more than $ 600 million in loans. That's more than twice the total value of all payday loans issued in Washington State in 2017 ($ 248 million).

For example, now you can use any existing DAI and loan it out through a “Compound Loan” agreement, starting to earn 5.9% interest each year. In 2019, Compound's TVL has grown from $ 20 million to $ 91 million. Alternatively, you can lock some ETH into the MakerDAO protocol as collateral to obtain a loan.

In 2019, users paid a 5.5 million USD fee to the MakerDAO agreement, which is higher than the sum of all transaction fees paid on each public chain except Bitcoin and Ethereum.

5.Stablecoin

Stablecoins fulfill the original vision of cryptocurrencies, namely “peer-to-peer digital cash” , which is a useful means of making cheap and fast payments via the Internet. The digital dollar you can use to pay, or get paid, in a volatile cryptocurrency market, it won't lose its value overnight.

Almost all stablecoins are built on Ethereum. This year, Ethereum gained a greater advantage and became the default platform for stablecoins. Tether, as the oldest and largest stablecoin, provided most of its balance to Ethereum, instead of being based on the full Bitcoin protocol.

6. Cambrian explosion based on Ethereum assets

A major new trend for DeFi is the expansion of products and protocols to facilitate the use of synthetic assets. The so-called "synthetic asset" refers to an asset with specific characteristics, which usually imitates the characteristics of other assets.

The programmability and interoperability of assets on Ethereum makes this operation easy. Using Ethereum smart contracts, developers create assets that can track the value of other cryptocurrencies, automatically implement specific trading strategies or create custom derivatives.

Synthetix has launched their "synthesizer" product, the ERC-20 token, which is used to track the value of major currencies, commodities or indices. It is worth noting that Synthetix has tried to implement its protocol on EOS and now considers it a mistake and has doubled its bet on Ethereum.

In 2019, users paid approximately $ 3.5 million for using Synthetix, which is higher than the sum of all transaction fees paid on each public chain except Bitcoin and Ethereum.

Also in 2019:

- The attempt to make Bitcoin available to the Ethereum network was a breakthrough. Kyber, Bitgo, and Republic have launched wBTC, an ERC-20 token that is truly backed by Bitcoin and stored in the hands of trusted custodians. In August, Keep & Summa announced their "No Trust BTC" (tBTC) plan, which does not require a central party to host BTC and is scheduled to be implemented in 2020.

- Gives Bitcoin a boost on Ethereum. Kyber, Bitgo, and Republic have launched wBTC, an ERC-20 token that is truly backed by Bitcoin and stored in the hands of trusted custodians. In August, Keep & Summa announced their “No Trust BTC” (tBTC) plan, which does not require a central party to host BTC. It is planned to be implemented in 2020.

- RealT marks the legal ownership of several homes in Detroit starting at 9932 Marlowe. The owners of these tokens can obtain liquidity through Uniswap, where they can always find counterparties to buy their shares in the house.

- Compound -cDai was mentioned above in the Lending Services section, which is an interest-generating token. Products such as cDai are narrowing the distinction between "lending services you use" and "assets you buy."

Many synthetic assets rely on some kind of "prophetic" reporting information. The “no need for trust” prediction has not yet been resolved, which remains one of the challenges in the cryptocurrency space.

7. Growth of Ethereum games

In 2019, Ethereum's gaming ecosystem shows signs of early growth.

One outstanding example is The God of Chainless : a turn-based, collectible card game similar to Blizzard's Hearthstone. The difference is that the chainless god cards are assets on Ethereum: they can be bought, sold, traded through DEX, and even one day can be used as collateral.

PoolTogEther is a non-destructive lottery system implemented by Ethereum. It's simple: the player saves the DAI into a program running on Ethereum. By automatically lending it to Compound, the currency pool earns interest over time. Then, at the end of this period, a player earned the interest earned (as of this writing: $ 688 per week). At this time there is "no loss" because if you do not win, you will not lose the "ticket" price, because you can always withdraw the principal.

PoolTogEther launched in June 2019, and its users won a total of $ 3,594 over the next six months. In the same six-month period, Tezos validators received only a total of $ 3,745 in transaction fees.

PoolTogEther is particularly striking as a sign of a larger trend: financial applications that look like games and gaming applications that look like finance are converging.

Also in 2019:

- Skyweaver, an Ethereum-based card game, released a beta version in June and raised $ 3.75 million from investors.

- Decentraland is a virtual world where assets of Ethereum exist.

- Cryptokitties-The first breakout champion on Ethereum games, maintaining its dominance.

8. Decentralized autonomous organizations

From the early days of Ethereum, people dreamed of building a decentralized autonomous organization or DAO.

The idea is simple: Ethereum allows us to write code that performs anti-censorship on a distributed, decentralized platform. We can create a program for managing funds and define governance processes for how to manage these funds. For example, define a voting process.

Since the painful "DAO" fork in 2016, this idea has been plagued by mixed historical issues. But in 2019, some new projects have renewed interest in DAO.

Although 2019 has not become the "first year of DAO", it does have at least a few "Morocco Months". MolochDAO was launched in February 2019 to fund important public goods in the Ethereum ecosystem. Members of MolochDAO use funds donated from multiple sources such as the Ethereum Foundation, Vitalik, Joe Lubin, and ConsenSys to vote on projects to be funded.

This simple model eventually became the DAO project that attracted the most attention from the Ethereum community, and was echoed by other projects such as MetaCartel and MarketingDAO.

In another notable example of the composability value of Ethereum, the "distributed fashion house" DAO Saint Fame launched their first product in December.

Saint Celebrity issues a token on Uniswap, which can later be redeemed for a specific product: designer T-shirts. Publicly trading tokens on Uniswap can make the price of T-shirts rise or fall according to demand. DAO members will vote on how to use these funds to create new T-shirt designs, which can then be sold through the same mechanism.

Holy Fame is built using Aragon, a comprehensive framework and toolkit for DAO. Aragon itself has seen signs of early adoption, and by the end of 2019, the framework had created more than 900 DAOs.

02 Ethereum goes mainstream

1. In September, NBA player Spencer Dinwiddie announced plans to "issue a token for his contract." He will sell 90 Ethereum-based tokens, which will provide holders with a portion of their future contract value and interest. In exchange, he will receive $ 13.5 million upfront in his $ 34 million contract.

The NBA initially opposed the move, claiming it violated Spencer's contract with the league. But in the following months, the plan resumed, with plans to start in January 2020.

The most surprising thing about this story is that it doesn't seem to be so different in 2019. If you speculate in 2015 that NBA players will actually use Ethereum as a financial innovation platform within a few years, then no one will take you seriously.

But this year, and other small moves towards the mainstream.

- The Sacramento Kings launched a reward token built on Ethereum.

- Star Trek has announced a collection of iconic vessels that can be collected, which will be released in NFT on Ethereum.

- Opera is the sixth largest browser in the world.It added local support for Ethereum at the end of 2018, and launched a desktop browser with a "Dapp store" in 2019.

- Samsung has released a developer platform for Ethereum and announced a new phone with a built-in Ethereum wallet.

- Ethereum's DeFi ecosystem is reported by Bloomberg.

- Gridplus, an energy company on Ethereum, went live in February and now provides power services to customers in Texas

2. In the corporate world, the line between the "enterprise blockchain" and the "Ethereum mainnet" has begun to blur.

Mainstream companies have realized that building a private or alliance chain is no different from an isolated centralized database. But they have started to become interested in the Ethereum mainnet, because Ethereum provides an open platform with billions of dollars in economic security.

Ernst & Young (EY) is one of the most powerful supporters of the enterprise's Ethereum mainnet, and Ernst & Young (EY) continues to work on the “Nightfall” project. This project aims to enable enterprises to use the Ethereum mainnet while ensuring the privacy and scalability of transactions, which solves two major problems that limit the use of Ethereum by enterprises today. In December, EY launched Nightfall V3, reducing transaction costs to a few cents.

Meanwhile, Microsoft continues to be deeply involved in the Ethereum ecosystem. In May, Microsoft released the Azure Blockchain Development Kit specifically to support Ethereum development. Microsoft's popular IDE, Visual Studio, now supports Ethereum with an extension fully integrated with Truffle. In June, they released VeriSol, a formal verification tool for Ethereum.

In October, Microsoft and the Enterprise Ethereum Alliance developed a tokenized incentive system for use within enterprise groups. Last November, Microsoft launched the Azure Blockchain Token, a service that allows businesses to publish their own tokens to Ethereum.

3. In the consumer and business environment , these advances seem small. But together they paint a clear picture: Even though people's interest in cryptocurrencies has generally diminished and flattened, Ethereum continues to extend beyond the cryptocurrency industry and is seeing early signs of adoption outside the core community.

Also in 2019:

- HyperLedger Besu became the first public chain client in Hyperledger.

- Cloudflare launches the Ethereum gateway.

- JP Morgan announced plans for cryptocurrencies supported by its JPM Coin bank. In May, they added an implementation of Zether's confidential payment agreement to Quorum.

- Santander settles a 20 million bond on the Ethereum mainnet

…

03 Ethereum 1.0 performance and sustainability

We described above that every application-from hundreds of millions of dollars in DeFi protocol, to DEX, to enterprise applications-runs on today's Ethereum protocol and today's Ethereum clients.

This year, "Ethereum 1.0" and its supported clients received some of the most important upgrades since the 2016 Ethereum Homestead release. These updates begin to address issues such as state growth, client synchronization time, client disk IO (read and write), throughput, and distribution. The number of EIPs (Ethereum Upgrade Proposals) deployed in 2019 exceeds any one year.

1.GETH

Ethereum's main customer, GETH, has received a major upgrade this year. The GETH team released v1.9.0 in July, which includes major performance improvements and many new features. This year, the GETH team reduced the time for rapid synchronization of the entire node by half, to about 4 hours, and increased disk IO (read and write) by 10 times.

The GETH team has gained an extraordinary reputation for continuously improving the main client software that supports Ethereum. Although this work may not always receive the attention of new groundbreaking applications or theoretical research fields, it is this work that makes Ethereum possible.

2.ETH 1.X

At Devcon4 in November 2018, a group of core developers began informally discussing how to make Ethereum 1.0 more performant in terms of state size, synchronization time, and disk IO (reading and writing).

Although the long-term goal is to migrate to ETH2.0.0, Ethereum must remain sustainable until then.

In the months following Devcon, the plan was called "ETH 1.X".

Although many people take this as an opportunity to propose various ideas on how to change the EVM (virtual machine), fundamentally, the core goal is always to achieve through the idea of state rent, stateless customers, or repricing gas Sustainability. The goal is a comprehensive improvement of Ethereum 1.0.

Ethereum's maximum throughput has increased from about 25 transactions per second to about 38. This was achieved by increasing the block limit to 10 million Gas, while reducing the block time to 13 seconds after the Istanbul hard fork. EIP-2028 also contributed to this improvement by reducing the cost of a single byte in tx input from 68 gas to 16 gas.

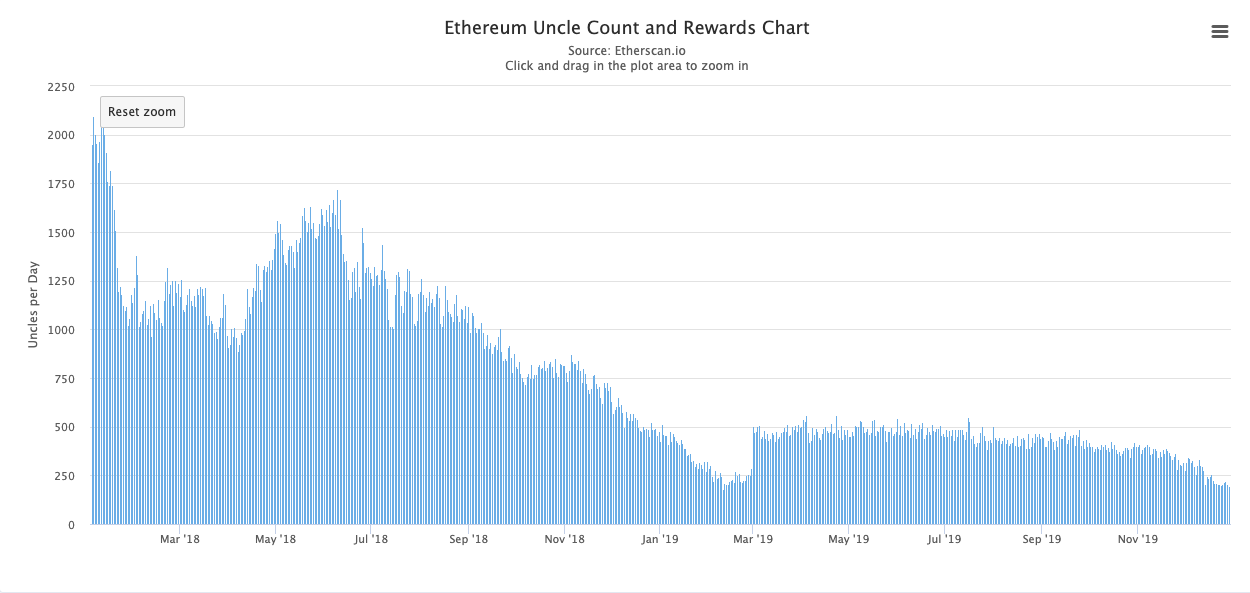

Alexey Akhunov recommends client-side optimization of parity, so that the block limit can be increased without correspondingly increasing the uncle block reward. As a result, the uncle's reward plummeted in 2019.

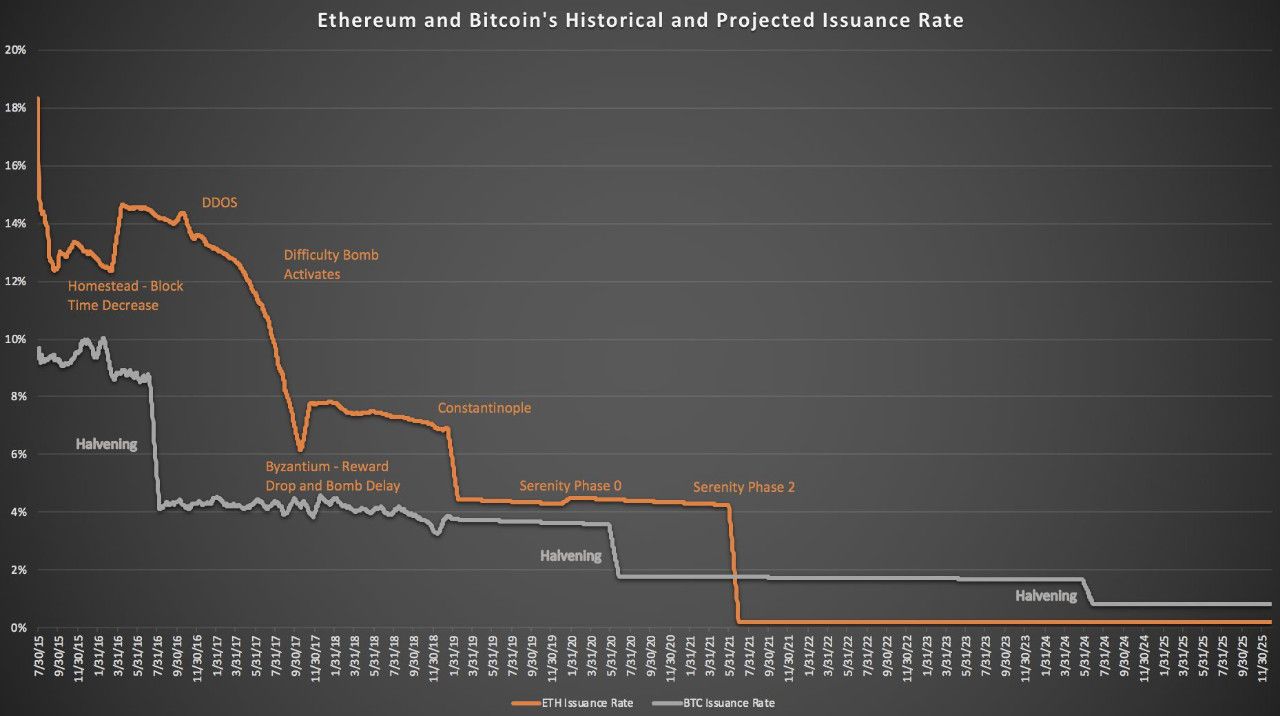

Ethereum's new ETH circulation is down in 2019. After the Constantinople hard fork issue, each block dropped from 3 ETH to 2 ETH. In addition, because the uncle block won part of the reward, the decline in the uncle block reward also reduced the circulation.

As a result, Bitcoin and Ethereum now have similar issuance rates, and when the network is fully proof of stake (POS), the planned issuance rate of ETH will drop again:

To address long-term sustainability issues, significant progress has been made in ETH1.0's "stateless" model research in 2019. Other methods considered at the beginning of the year, such as state rents, have been deprived of priority.

The goal of the stateless model is to reduce the amount of state data that each node must store. Using simple techniques such as Merkel trees, we can provide "block witnesses" to prove specific data in a specific block, without the client needing to retain state data for that block.

Many nodes will remain intact, but using these techniques we can allow some nodes to store less data.

A related project is Beam Sync, which uses witnesses to reduce the synchronization time to about a few minutes, while completing a "full" synchronization in the background. In addition, as the work progresses, other types of "semi-stateless" clients will be introduced.

3.ETH2.0

Ethereum's vision has always been a scalable proof of stake (PoS) blockchain . From the early days of cryptocurrencies, it was clear that despite a technological leap, Proof-of-Work (PoW) still had serious flaws.

Even an optimistic estimate of bitcoin's energy use can rival the total amount of energy used by countries such as Portugal or New Zealand.

Migration to proof of stake will eliminate this waste of energy and allow Ethereum to grow for decades without significantly increasing world energy consumption.

Even though the overview of Ethereum's migration to proof of stake was clear in 2015, completing the details requires careful and arduous work.

Ethereum 's migration to proof-of-stake (called ETH2.0) took longer than many expected . After years of research and development, the project changed from a research theme to an engineering challenge in 2018. In 2019, multiple independent teams jointly developed the software required to launch the first phase of ETH2.0. Now there is no doubt that ETH2.0 will be put into production in 2020.

Like any excellent open source project, ETH2.0 is also publicly built. For those who are not familiar with the "mart" model of open source software development, or those who are more familiar with cryptocurrencies controlled by a single customer team, the process seems confusing.

ETH2.0 is a large-scale project that will be rolled out in phases over several years.

The first phase-Phase 0 -is expected to start in the second quarter of 2020. This involves starting the beacon chain, which is the "backbone" of ETH2.0. Phase 1 then introduces shard chains, which are protected by the basic beacon chain. In Phase 2 , the system is integrated into a functional whole. Shard chains can be used for transactions and smart contracts, as well as all core functions familiar to today's Ethereum users.

In early 2019, nine independent teams were motivated to begin implementing the beacon chain of Phase 0. By the end of the year, ETH2.0 is starting to see a mature testnet.

As ETH 2.0 became clearer, the broad developer community was able to provide feedback and criticism, and made adjustments.

Specifically, shortly after Devcon, Vitalik posted several notes suggesting changes to the first phase to reduce the complexity of interactions between shards.

Discussions on the best methods for implementing Phases 1 and 2 and how best to migrate an existing Ethereum blockchain to ETH 2 are still ongoing. Currently, there are some proposals under debate to make ETH1.0 the first shard of ETH2.0, between phases 1 and 2. There are also active debates in various places to finalize the current ETH1.0 workload proof chain and ETH2.0's beacon chain, which will make it easier to reduce ETH issuance.

At the same time, phase 1 data availability will enable layer 2 solutions such as rollups and status channels to flourish. For example, the aggregated potential throughput (which can already promote throughput of 2,000–3,000 tps on ETH 1.0) will increase by about 100 times. ETH2.0 is coming, and it is ready to be sealed in 2020.

4. Second layer and off-chain technology

The idea behind all layer 2 technology is that we can perform expensive calculations "off-chain" while still retaining Ethereum's characteristic security guarantees. This "second layer" can process transactions or calculations faster than the Ethereum main chain, resulting in an overall more scalable network.

In late 2018, Barry Whitehat proposed ZK Rollup. The basic idea is that we perform many transactions off-chain and "bundle" them together. This "summary" transaction group is then verified using a concise zero-knowledge proof (SNARK) that confirms that each transaction is properly signed by the owner, preventing any invalid or manipulated transactions.

In early 2019, a variety of work has taken this idea in a new direction. In June, John Adler & Mikerah published their work on the "Minimum Feasible Merger Consensus", and at the same time, the Plasma Group also published their work on the "optimistic virtual machine" in July.

In the end, the research community chose "optimistic rollups" to describe such technologies, similar to the idea that Vitalik originally called "shadow chains" in a 2014 blog post. Vitalik summarized this area of research in an August blog post.

The optimistic rollup uses a similar "bundled" transaction technology similar to ZK Rollup, but uses a different mechanism to "prove" the transaction. Optimistic aggregation does not use zero-knowledge proofs (SNARK), but instead uses a cryptoeconomic mechanism that enables the system to "optimistically" assume that there are no invalid transactions while still catching, preventing, and punishing those who try.

In October, the Plasma Group released a demo that used Optimistic Rollup to provide a lightning-fast version of Uniswap on Devcon called Unipig .

ZK Rollup and Optimistic Rollup have different advantages and disadvantages.

Optimistic rollups are easier to implement in the short term, and flexible enough to be used for different applications. However, ZK Rollup has greater potential in the long run, but is more specialized due to the use of zero-knowledge proofs, and requires more R & D work before being used in various applications.

At the same time, the state channel has entered a stage that is less sexy but equally important. In the absence of prominent research issues, several teams are committed to implementing a viable framework that applications can use to support channelized applications.

In July, the main status channel team met at ETH NewYork to discuss unified standards and ensure interoperability. This led to the release of a unified specification, referred to as State Channels. Counterfactual and Magmo merged their engineering teams, replaced their brands with new joint projects, and continued to make engineering progress.

The status channel project was launched on the mainnet this year. In March, Connext (small payment platform) launched Dai Card, a simple browser-based payment system that operates on a channel basis. In September, Connext released v2.0 of its platform to the mainnet, which is based on the now unified State Channels code base.

What does all this mean?

This article is not comprehensive. There are too many things to track on Ethereum, even if you write a newsletter every week.

Other things to note:

- The introduction of smart wallets has attracted people's attention. Smart wallets use smart contracts to implement access and control logic, making wallets more useful. For example, this enables multi-factor authentication, "batch processing" transactions for ease of use, and better recovery methods in the event of a lost key. The three famous players in this category are Argent, Dharma and Gnosis Safe.

- The number of large Ethereum wallet users continues to increase. Metamask is installed in the Chrome browser store with over 1 million installs and a mobile version is available. Brave, an Ethereum-based browser, as of December, exceeded 10 million monthly active users and reached more than 350,000 "publishers" using its micropayment platform.

- The forecast market is developing steadily. Augur position holders doubled from $ 130 million to $ 270 million, Gnosis's prediction market released an alpha version, and Numerai's erasure protocol was on the mainnet mainnet.

- Ethereum Name Service (ENS) has launched a new permanent registrar that makes ENS names NFT compatible, and users have paid a total of $ 350,000 in their two registrar contracts. This is approximately equal to the total fees paid for using Dash, Monero, NEO, Bitcoin Cash, and Bitcoin SV in 2019.

- The Ethereum community has expanded its ability to fund public goods. With the launch of MolochDAO, Gitcoin grants have attracted the attention of the community, and the Ethereum Foundation grant program has been reborn as an ecosystem support.

- ETHereum.org relaunched, the Ethereum community has translated it into 20 languages, and the site has more than 100 contributors

postscript

If you only focus on general crypto news, you might consider 2019 a disappointing year. The market is sideways, the release of the new basic chain agreement is disappointing, and the blockchain industry news that has been hyped up in the past seems to disappear from the front page of the news. It seems that cryptocurrencies are dying.

However, if you've read so much, it should be easy to understand why the Ethereum community is not that opinion.

In 2019, it is clear that there is enough practical activity at the application layer, giving us confidence that Ethereum is moving in the right direction. The work carried out at the protocol level means that ETH 1.0 can continue to develop in the medium term, and stable and tangible progress has been achieved on ETH 2.0. This led people to believe that Ethereum could one day expand to billions of users. It's a harsh winter, but the ecology of Ethereum has continued to evolve.

Do you think the value of Ethereum at this stage is undervalued? Welcome to share your views in the comments area.

——End——

"Disclaimer : This article is the author's independent opinion, does not represent the vernacular blockchain position, nor does it constitute any investment opinions or suggestions. A

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Despite bank ban, cryptocurrency exchange Zebpay reopens in India

- Red Cross, we have a way for you: it's time for some new technology!

- Reflecting on the epidemic in Wuhan, what can the blockchain do for disease control and early warning?

- "Digital Dollar" latest details: or similar to the central bank's digital currency

- Popular Science | Extended Blockchain: ZK-Rollup

- Former JPMorgan Chase R & D: Why isn't the IBM blockchain real blockchain?

- U.S. CFTC chairman hints that Ethereum futures will be launched soon, and the United States should play a leading role in the blockchain field