Bitcoin blockchain will part ways, Libra's misery continues, 2020 blockchain enters critical period

Author: Andrew Keys

Translator: Wang Yanni

Source: Blockchain Base Camp

As the managing shareholder of Digital Asset Risk Management Advisors (DARMA Capital), and the former head of the global business development department of the blockchain software giant ConsenSys, I am concerned about the rapid development of blockchain technology and the extreme instability of the cryptocurrency market. Sex, emerging ecosystems, and decentralized culture have gained deep insights. Let me tell you: Blockchain will enter a critical period in 2020. This critical phase will determine not only the future of cryptocurrencies, but also the future of blockchain and the concept of decentralization.

- Google develops secure key project OpenSK, which could benefit cryptocurrencies

- Blockchain is a Critical Underlying Technology Architecture for Correcting the Digital Process of the Economy | Return to Common Sense

- Trezor responds to wallet vulnerabilities, attackers need physical equipment to steal cryptocurrencies

Fasten your seat belts and the thrilling journey will begin. Here are 20 predictions for the blockchain sector in 2020.

1. Ethereum is now as fast as dial-up Internet in 1996 (only 14.4kbps), but it will soon catch up to broadband.

Remember the era of dial-up Internet? Let's go back to 1996: Although AOL quickly became a household name, for most people, surfing the Internet meant exchanging various entangled lines and occupying telephone lines. Access to limited Internet products with snail-like speed. Through this 14.4kpbs connection, brave retail consumers can browse the World Wide Web while transmitting data at 1.8kbs per second. Downloading 1M bytes of data can take up to 9 minutes. All internet content is text-based, but the internet does work! The average person can see that this technology will be useful in the future, but few people can predict that the Internet will bring about comprehensive social and economic changes to the world within a few years.

Sound familiar? The current blockchain is exactly the same as the Internet of the year. 2020 in the blockchain era is equivalent to 1996 in the internet era. According to Moore's Law, the development of blockchain will also enter the era of high-speed development like the original Internet, and Ethereum 2.0 will be a huge red button. Pressing it will take us away from dial-up speed and enter the era of broadband speed.

All signs indicate that almost all industries and leading companies are studying how to implement the blockchain. Governments of various countries are afraid of falling behind in the competition and are rushing to catch up. Now that the elements of the infrastructure are in place, waiting for developers to develop , Deploy and extend the product. In 2020, we will begin to see what a true decentralized future looks like.

2. Bitcoin and blockchain will eventually part ways

Bitcoin should be respected as the elder of the digital asset community. It integrates encryption technology, peer-to-peer networks, virtual machines and consensus formation algorithms, which can elegantly solve the "double flower" and "Byzantine general problem". Nevertheless, the pace of time will not stop. Those Bitcoin supremacists who believe that Bitcoin is the focus of decentralized technology development may be experiencing a wake-up call.

As the blockchain reaches a developing watershed, the world will recognize a key difference, and this difference enthusiasts may already be familiar with-the difference between Bitcoin, Ethereum, and all other decentralized technologies. The rise of Bitcoin into digital gold is very amazing, marking the beginning of a new era of technological economy. But digital gold is just the beginning.

The current market value of gold is $ 8 trillion. This is indeed an astronomical number, but for "digital gold" like Bitcoin, it represents the upper limit of potential market opportunities. Smart contract-based blockchains like Ethereum will digitize the global economy and release value across the entire range of assets and processes. Correspondingly, the decentralized network will reach the extreme corners of every industry on the planet. We will be able to digitally represent fiat money, gold, software licenses, equity, debt, derivatives, credit scores, reputation ratings, and much more than we can imagine. This is a market opportunity valued at more than $ 80 trillion. Bitcoin is a single special use case. In contrast, Ethereum has an infinite number of use cases.

3. The haze of the global economic recession has not dissipated, fiat currencies must be vigilant!

For years, the global economy has been shrouded in uncertainty. It is no longer a question of "whether", but "when" the house of cards will collapse and have a major impact on the world. Europe may be the first country to experience recession. A quick glance at the five largest economies in Europe. Deutsche Bank in Germany is only sustaining life. Britain has been destroying the Great Wall for many years because of Brexit. Protests have been up and down in France. The economies of Spain and Italy are dying. At present, the EU is just a nominal union, and growing differences will make many countries particularly vulnerable.

As for the United States, let me portray two realities for you: In 2020, China and the United States finally reached a real trade agreement. With the US economy sailing smoothly into 2021, Donald Trump is re-elected. There is another pillar of the soaring stock market. The house of cards survived another day. If there is no trade agreement or re-election, and the global economy is further challenged, the quantitative easing tide may fall to the bottom and the value of currencies in many countries around the world will face unprecedented challenges. The value of fiat currencies may experience a sharp devaluation due to extreme inflation.

Similar to gold and oil, digital assets are scarce. If the crisis breaks out, the digital asset class will become a safe haven for the traditional central bank system. This is because the traditional central bank system will use printing to issue currency during times of crisis, which will devalue the currency.

4. Following big moves in China's cryptocurrency and blockchain fields, the US will have to step up

In January 2020, a new set of regulations will take effect, representing the Chinese government's position to support blockchain technology. It is clear that China is taking action. Countries like the U.S. that were somewhat unresponsive in supporting the development of the blockchain in the past can only be forced to catch up, and the result will bring huge net benefits to the entire industry.

5. We will continue to move towards Ethereum 2.0

The long-awaited Istanbul hard fork (the final hard fork of Ethereum 1.0) has been successfully deployed. The delayed update of the Muir Glacier difficulty bomb is icing on the cake. Vitalik Buterin has released the blockchain manager of the beacon chain, and the march towards Ethereum 2.0 is rapidly unfolding. Proof-of-stake Ethereum exists. It lives! The Serenity roadmap is fully operational. In 2020, Ethereum will quickly cross Phase 0, enter Phase 1, and start the shard chain. Then the game started.

Ethereum developers have proven their ability to work wonders. And this decentralized team is now ambitiously striding towards the goals of the roadmap, and this is the most important sign of the future success of the blockchain. For ordinary onlookers, the upgrade process may appear to be long and tortuous, but the sharpening of the wood without accidentally chopping woodworkers, and the extra time spent developing the network reasonably will benefit humanity as a whole. Although Web2 is defined by the concept of "moving fast and breaking the rules", Web3 should be guided by the words "do the right thing this time."

6. The second layer expansion solution will supercharge Ethereum

Ogre, like onion and other blockchain networks, is layer-related. With the introduction of the Istanbul Hard Fork, Ethereum is moving towards the first level of 2.0 scalability. Joe Lubin stated on SXSW last year that Ethereum will process transactions at a rate of millions of transactions per second. It is achieved through the stable upgrade of the first layer network and the integration of the second layer extension.

The Plasma "Blockchain on Blockchain" solution proposed by Poon and Buterik is not only clever and prescient, it has spawned the entire second-tier development field. The sharding chain may currently occupy a lot of public opinion controversy, but with the development of Celer, Connext and Counterfactual, the state channel will become a huge underground mycelial data network underground, releasing the main chain from the state The shackles of weights. The sidechain will quickly process a large number of low-risk transactions. Payment channels like Raiden will enable instantaneous token transfer, and ZK-Snarks will guarantee that all your data is kept confidential during transactions. The technology stack is already there, and in 2020 we will witness the birth of 2.0.

At the same time, innovative technologies such as Plasma's Optimistic Virtual Rollup mean projects can thrive without having to wait for the required transaction throughput. This is too big. In the past, the expansion of the blockchain has only stayed at the level of theory and hope. This situation no longer exists! Incredible, global, decentralized Ethereum development team will use technology to change the world, and we will always be grateful for this.

7. Various layers of the Web3.0 stack go online

A decentralized environment involves more than shards and nodes, and we will recognize this in 2020. Web 3.0 will be defined by a mesh network that connects smart contracts, file storage, messaging, payment channels, sidechains, and oracles. In 2020, many of the essential infrastructure elements of Web 3.0 will be put into use.

What is Web3.0? Here is the introduction:

- Digitalization of various assets: stocks, bonds, fiat currencies, electronic money, loyalty points, software licenses, Beyonce concert tickets, insurance policies, other derivatives and many other assets that were unimaginable before, will be natively digitized .

- Automating the agreement: Microsoft Word legal documents will become digital computer codes such as If> Then> Else, which will transfer the digital assets mentioned above in an unreliable manner, thereby creating entirely new business models, such as a A minute-by-minute employment agreement, an artwork that pays the artist a royalty each time it is sold from one owner to another, and one place that can automatically pay interest to its investors each time it receives a rent Property, a function that distributes income among band members whenever a song is played, or the ability to efficiently route an electron to different parts of the microgrid.

- Self-Sovereign Identity: No need to log in to Airbnb, Facebook, Uber, you only need to log in to your own browser, you can use the same rental hotel rooms, use social media or taxi services. But such services happen point-to-point, and do not require thin-layer rent-seeking intermediaries as traditional applications do. You will be paid one dollar a day for watching ads on social media, and Zuckerberg will not get this part of your money, and your ride and house purchase costs will be only 2/3 of the current.

To give some examples: The Interplanetary File System (IPFS) has shown the nature of data file storage on decentralized networks. Protocol Labs 'Filecoin project is built on IPFS to lease users' hard disk space for encryption. The platform is scheduled to launch in March, and the testnet has just launched.

Helium is a mesh network where participants can purchase nodes under $ 500 to provide lower bandwidth for IoT devices. Tom Shaughnessy of Delphi Digital recently pointed out: "Since its launch on August 1, 2019, more than 2,130 nodes have been launched on the network, covering more than 425 cities, accounting for 90% of the total number of US states. Under Verizon's IoT costs (600KB / year / $ 12), Helium is 99.9988% lower than Verizon's pricing (24 bytes, or 0.024 KB for $ 0.00001). We should expect the next generation of mobile phone service providers, data storage providers and any intermediaries to pass A decentralized World Wide Web for this price integration.

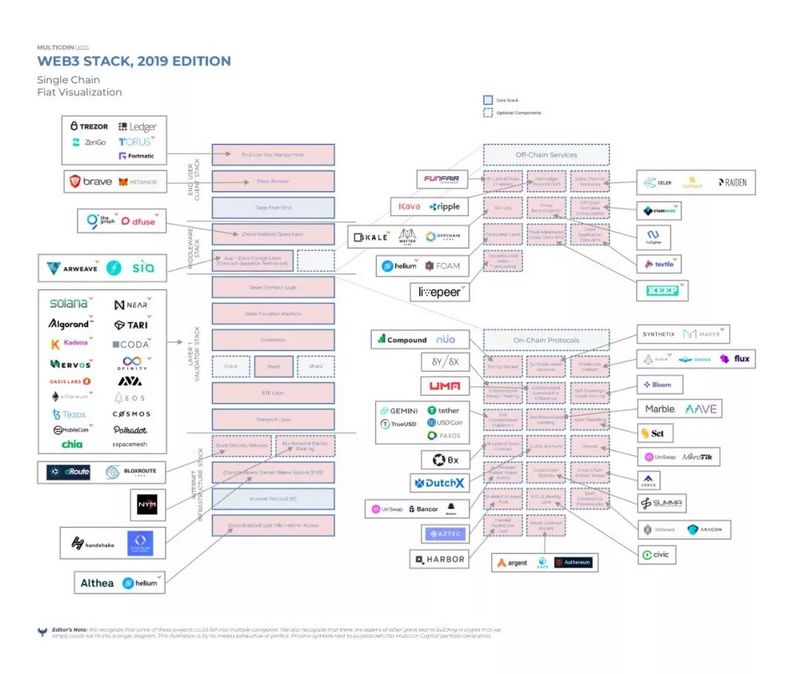

Kyle Samani and the team at Multicoin Capital did an excellent job of mapping a potential Web 3.0 software stack, using some examples of companies trying to provide solutions. Although it is still in its early stages, we will see competition for supremacy at all levels of the Web 3.0 stack. The Web3.0 stack might look something like this:

From: Multicoin Capital

8. The blockchain landscape is expected to change completely by 2021

By 2021, we will have a clearer understanding of whether new first-tier blockchain networks like Near, Polkadot, Dfinity and Nervos can make a substantial contribution to the blockchain ecosystem. Competition is good. I remind everyone that our goal is to decentralize, decentralize, and commoditize trust globally, not to win the agreement of a certain brand. In other words, the sprint towards the first layer of hegemony has only stimulated the development of Ethereum 2.0, and many competing elements are experimenting with new methods of developing the best blockchain products. Who succeeds depends on developers and users.

Ethereum has maintained the strongest developer participation so far. Some people think that this game is a success and defeat, but the development of this new technology can gain too much, and cooperation in competition will provide motivation for everyone. Dedicated blockchains that meet specific needs may also emerge. Emerging competitors in the Tier 1 space will have to deal with Matteo Leibovitz's “Dilemma of Distribution”, which stipulates the criteria that the new network must meet at the same time to generate a currency premium. They are:

- Broad / fair distribution

- Revenue generation

- Upside potential

- Legal compliance

The biggest challenge is Article 4. If a VC or many bitcoin whales have a large number of network tokens (common in the first layer of "Ethereum killer"), it will be difficult to convince the SEC that tokens are not securities, which means all these huge investments Will only destroy the VC piggy bank.

9. Libra's suffering will continue …

Facebook's Libra will not go live in any form in 2020. This so-called "decentralized wolf in sheepskin" has done a lot of work to bring the blockchain to the cusp of global public opinion-this is good, but sometimes not good. But the company is quickly realizing that even with the best plans planned by billionaires, consensus and deployment don't always start as planned. When it comes online, Libra will undoubtedly power the education and adoption of billions of people. Farmville and cryptocurrencies? I look forward to it! However, before that, given China's recent loosening policies, it is expected that organizations like WeChat, Alipay and Alibaba will actively strive to be pioneers in this field. As we enter another election year in the United States, trust in Facebook has stagnated. If social media proves to be so shocking and problematic, then we can guess the possible flaws inside Facebook's "Social Banking" version.

10. The advent of trillion-dollar companies marks the culmination and end of the third industrial revolution

When the next giant is valued at more than $ 1 trillion, it will always be a giant. The company may not even pay $ 1 in taxes and fees to the United States. This is a typical example of the huge inequalities in value acquisition in our economic system, and this phenomenon will only get worse. Legacy Web2.0 companies make billions of dollars for bourgeois shareholders by turning individuals into products. They leaked personal data into the hands of evil participants with shocking consistency. More and more companies break through the trillion dollar mark, which indicates that the later stage of capitalism is about to enter the stage of take-off. After the unavoidable collapse, we will face a once-in-a-lifetime opportunity that will stimulate a more fair, democratic, and sustainable business model. Will you be ready by then?

11. Autonomy on the Web will become a human right

Hacking and violations in the Web 2.0 and Web 3.0 environments happen almost daily, so it is clear that changes must be made. Projects like the Decentralized Identity Foundation have made significant progress in establishing an open source standard that will load trusted decentralized digital identity components into the entire blockchain ecosystem. Blockchain IDs and zero-trust datastores like those created by uPort and 3box will quickly replace the old, isolated databases that we now rely on. Establishing such a trust network is probably the most important piece of the blockchain puzzle in 2020.

Web2.0 enthusiasts like IBM and Microsoft have realized the urgency of the problem, and they have allocated a lot of resources to iterate their digital identity. But before the Internet can truly be democratized, autonomous identities must be owned by us. Ownership and privacy of data will soon be considered a human right, and autonomy is the solution to this goal.

12. CME Ethereum Futures

After bitcoin futures had options in January, I think it's time to turn to Ethereum. CME Ethereum futures will be announced and put into use in 2020. CME has nearly 125 years of innovation history in financial instruments, has bred the above two new asset classes, and has digitized the trading process. Following Bitcoin and Ethereum, CME will continue this tradition of innovation, thereby promoting the legitimacy of digital assets and opening the door for mainstream investors and institutions to start the next round of digital asset market growth. Futures and options will generate the forward demand curve, which is a necessary precursor to the emergence of a regulated ETF market. Our asset class, once childish, is growing up.

13. The billion-dollar DeFi ecosystem is only a few months away

In the first quarter of 2020, decentralized finance will continue to lead the industry. Currently more than 600 million US dollars of funds are locked in decentralized financial platforms. Funding figures will exceed one billion by the summer. Organizations like a16z are making big bets on MKR and Compound platforms, while projects like Synthetix, Uniswap, dYdX, and InstaDapp are adding support to an active area in the blockchain ecosystem, which is not entirely complete Depends on the timetable for scaling up. That said, DeFi organizations may have to spend some significant legal fees on compliance and lobbying. To give an example: In all 50 states, companies need specific permits to provide loans to retail customers. When DeFi inevitably becomes too large, regulators will regulate it accordingly.

14. The sleeping giant in the blockchain world wakes up — that's the supply chain

Counterfeit goods represent a market value of more than $ 1.8 billion per year. It is estimated that with the development of production and online sales, the market value of counterfeit goods has increased by more than 10%. Well-known brand names like Louis Vuitton and Levi's are quietly collaborating with leading blockchain companies to refine proof-of-concept trials to ensure supply and protect consumers' rights globally. Treum has demonstrated the value of the supply chain process under the protection of the blockchain, ranging from salsa sauce to tuna to skin care products. Now, major packaging retailers Wal-Mart and international food companies Nestle and Dole are taking the lead. A recent report stated that companies in Western Europe alone could save $ 450 billion by using a blockchain-based supply chain solution in fifteen years, while reducing overall operating costs by nearly 1%.

15. Art and music will take the lead in blockchain apps for consumer interfaces

For art, music and creative spaces, the impact of blockchain will be profound. A 2014 report by The Fine Arts Expert Institute (FAEI) in Geneva stated that more than 50% of the artworks it inspected were counterfeit or the artist's name was wrongly labeled. Blockchain can solve this problem now, I have personally experienced it myself. This year, I purchased the work entitled Vladimir Kush, "The Human Way". Payment records, identification certificates, and ownership history are irreversibly recorded on the Ethereum blockchain using Treum. By this time next year, this process will become more common in people's lives. What makes art an important area for adopting blockchain is not just the source of the art. Tokenized ownership and a fair business model that is not constrained by gatekeepers have attracted the attention of the art world. Please pay more attention to the art space.

16. Proof of Work is dying while killing the earth. Proof of Stake is alive.

Maybe retro games are popular, but by the end of 2020, proof of work will be considered Atari, and we will all slowly get used to the controls of this new game. The concept of proof of stake was only adopted by Vitalik Buterin and Ethereum in the early days, and now the entire industry is full of projects using equity-based validators to support blockchain networks. The reason behind it is clear: it not only releases the trilemma between speed, security, and scalability, but it also greatly reduces the burden on the earth-you know, (the earth) is the one we no matter what A place to change through a decentralized movement. Proof-of-work is wasteful in nature, but if it must be done at the expense of the environment, what does it mean to reform the economic system? It's time to move forward.

17. Supervisors will supervise

Although expectations for the blockchain and the head of the technology world may be moving quickly, the progress of regulators and governments has always been slow. Digital assets have now passed the stage of distrust of legislative and regulatory agencies, and agency and legislative policies are making adjustments to unleash the energy of technology and simplify supervision. According to the latest instructions issued by the IRS in October, the US government acknowledges that virtual currencies will play an important role in the future economy. In addition, it is well known that the CFTC does not consider Ether as a type of security. Other states should catch up with Wyoming's actions in this regard (a total of 13 laws supporting blockchain). If there is an impetus for the federal government to make progress on this issue, it is to not be left behind by China. In 2020, favorable policies on blockchain will be introduced in states, countries, and globally.

18. People without a bank account will still not have a bank account-for the time being

Decentralized finance is a compelling phenomenon that has a significant impact on both the blockchain and the global economy. But for now, its frequently repeated slogans and goals are temporarily unattainable. (Ie, the goal of 'banking the unbanked' by providing financial services to billions of people who need it most) … why? For now, the lending community is siloed, and the problems surrounding "credit" mean that those who need it most cannot get loans. These issues will certainly be eliminated over time, but during 2020, decentralized finance will continue to grow in a growing but still closed circle. But this is not a bad thing. It's better to look at it from this perspective: the industry is about to break through the $ 1 billion mark, but we are still in beta mode.

19. The user experience must be better than Web 2.0

Apple's iPhone is the best-selling phone of all time because it's simple and easy to use. Consumers only need to know these two things. Although many of our tech enthusiasts are happy to knock on the various layers of the Web 3.0 stack, to attract the majority of users, we need to abstract everything from the typical Web 3.0 user experience. This is why highly skilled UI / UX designers are now as important to the industry as low-level distributed system computer scientists.

But UX / UI means more than neat lines and minimal design. From standards to libraries, toolkits, extensions, entry, hosting and wallet integration, to show that level of functional simplicity, there is too much to be optimized behind the screen. Rimble is an example of an open source code base for optimizing the user experience for Web3.0 decentralized apps. This is expected to be the main area of development in 2020. The first wave of decentralized consumer apps pushed the blockchain to the center of the topic, but the next wave will be led by more detailed projects on blockchain integration methods.

20. "If you're in hell … then move on"-Winston Churchill

The 2017 cryptocurrency bubble and its bursts were like an overspree of the Brotherhood, leading to severe hangovers in 2018 and 2019. However, there are two types of bubbles. One (such as the 2008 housing market crash) will leave debt burden and waste, while others (such as the dot.com bubble) will help build infrastructure and make key organizations clearer. These organizations will later develop into the backbone of the industry. The bubble in the crypto industry is similar to the latter and will lead to a real, prosperous rather than speculatively driven blockchain boom.

After emerging from the irrational boom of the crypto market in 2017 and the equally irrational downturn in 2018, the core blockchain community of developers and technicians has begun work, focusing on infrastructure construction. Their labor is now bearing fruit. We are at the crossroads of the next industrial revolution starting in 2020. This progress towards global decentralization and automation will take us into the most prosperous society ever.

Tribute to the roaring 1920s!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Can Bitcoin hit a new high? | Standard consensus

- How to deal with the challenge of centralization? Vitalik releases fourth round of Gitcoin Grants analysis report

- Blockchain combines AI and sensors to open the era of intelligent industry

- CME Managing Director: CME Group Bitcoin Futures Trading Volume Reaches $ 100 Billion Since 2017

- The restless January finally passed, BSV rose 182% to lead the crypto market

- Thin application: comprehensive upgrade of the "fat protocol" of blockchain value capture theory

- Are Trezor wallets no longer secure? In just 15 minutes, hackers can steal private keys through physical access