The cryptocurrency exchange "closed tide", running to catch up with P2P

The cryptocurrency exchange, once regarded as “stable and not paying”, is more crazy than other fields, and P2P will be dwarfed.

According to the incomplete statistics of inter-chain pulse, since September 2019, nearly 10 small cryptocurrency exchanges have been run or bankrupt in less than 2 months. At the end of September, even one day, there was a transaction. The chaos of the road.

On September 29th, the currency website HB.top announced that it would stop all currency recharges and the user must complete the withdrawal within 20 days…

On September 30th, users of GGBTC exchanges could not withdraw cash, suspected of running…

- Bank of Canada considers launching central bank digital currency to deal with cryptocurrency threats

- Technical exploration of cross-chain DEX prototypes: How to trade cross-chain assets within a single DEX?

- There are joys and sorrows, the blockchain battles of the Big Four accounting firms

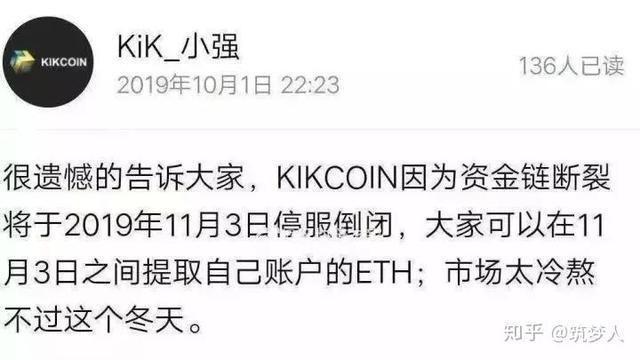

On October 1, the Kikcoin Exchange announced that it will stop shutting down on November 3 due to a broken capital chain…

……

The Kikcoin exchange was only operated for less than two and a half months from the official launch to the announcement of the closure.

In fact, as the growth of users of cryptocurrency transactions is weak, the current situation of “more porridge” in the stock market has intensified the “running tide”, and the survival environment of small and medium-sized exchanges has become more and more severe under the stimulation of domino effect. On the other hand, many second- and third-tier exchanges have begun to show their "new traffic" in response to the competitive pressures of the head exchanges such as Firecoin and OKex.

At the time of the conversion of the bulls and bears, small and medium-sized exchanges are staged a “life and death race”.

(KiKCOIN announces "stopping service")

The exchange’s “closing tide” has intensified

Constantly closing down and continually entering the market is the norm for the exchange, but the wave of “closing tides” that opened in September is more violent than ever.

From the August 30th UES Global Digital Assets Exchange was exposed to the road, the "bankruptcy" of the exchange quickly spread.

On September 2, Bitker announced that it was closed due to insolvency; on September 20, the ALLCOIN exchange was exposed for a few months and was not able to withdraw cash. It was suspected to be soft. At the end of September, the exchange network, GGBTC and Kikcoin were three. The exchange has announced bankruptcy or direct run; in early October, Shuobi.com and Ctcoin exchanges were exposed by users.

(Ctcoin exchange is exposed "running")

(After August-September 2019, closed or running exchange statistics)

At home and abroad, small and medium-sized exchanges have been suspended from bankruptcy, but the phenomenon of concentrated closure or running is extremely rare. Judging from the suspension announcements issued by some exchanges, the capital chain break is the direct cause of the collapse of most exchanges.

Some analysts pointed out that in the entire trading market, the 28th law is vividly reflected, the top 20 head exchanges account for nearly 90% of the market's profits, while the remaining small and medium-sized exchanges can only account for 10% of the profits. In a bear market, the head exchange may be safer, but small and medium-sized exchanges face financial problems, and the possibility of running and closing down will increase greatly.

For exchanges, users and traffic are fundamental to survival. In the current bear market, the number of users of cryptocurrency trading is getting less and less, while the growth of incremental users is weak, and the situation of “more porridge” is further intensified. It is inevitable that exchanges will be reshuffled.

On the other hand, as the top track of the cryptocurrency food chain, the exchange has always been the darling of capital. Even in September, when the “downturn” broke out, the exchange was still the most popular area for all types of investment institutions.

According to the statistics of the Mutual Chain Pulse Research Institute, in September 2019, there were 9 cryptocurrency exchange projects in the global blockchain financing project, with the highest proportion. In the first nine months of 2019, there were 67 financing events in the field of global cryptocurrency exchanges, involving more than 70 investment institutions.

To a certain extent, the process of capital “emphasizing” exchanges is also accelerating competition and shuffling between exchanges.

In addition, due to the fast money, low cost and low threshold, this year, many public chain projects, industry media and investment institutions have personally gone into battle, and the self-built exchanges have made the competition more intense. It is a mess.

The "closed tide" in September is just the beginning, and the bigger exchange "shuffling tide" may be on the way.

Second and third-line exchanges "new traffic"

The advent of the “downturn” of small and medium-sized exchanges has caused many second- and third-tier exchanges to rethink. In the current market of bear market stocks, the head effects of the three major exchanges of Firecoin, OKex and Coin are already very obvious. How to ensure that your platform has sufficient and continuous users and traffic to avoid repeating the mistakes of small and medium-sized exchanges?

Mining "new traffic" is becoming a breakthrough for second- and third-tier exchanges.

The so-called "new traffic" refers to the users and traffic carried by the new traffic terminal represented by wallet, community, market software, media/self media, etc. These potential users and traffic are becoming excavated by the second and third tier exchanges. Object. For example, the BiKi exchange has introduced a mechanism for community partner traffic fission in acquiring new traffic.

“BiKi has more than 2,000 community partners, which can cover 200,000 active community users.” BiKi Vice President of Commerce Tang Shi recently revealed at a blockchain conference in Xi'an that these community partners are from the captain of BiKi's early project promotion. Or the person in charge of the community, they may have 200 groups below, may cover 2, 30,000 people, bring new users to BiKi every month, and also give BiKi a lot of suggestions, which is the tentacles of our new project. .

Liu Yong, founder of BiUP Exchange, recently pointed out that since the beginning of this year, the flow structure of the currency circle has begun to change, and the competition between exchanges has gradually shifted from positive competition to competition for new traffic. “Wallets, communities, market software, self-media, etc. each carry a lot of traffic, such as MyTokey, currency cows, golden finance, currency world and various communities. These new traffic ends lack the means to directly realize before. And the profit model, and the exchange that assumes the function of digital currency trading is the best partner."

In the stock market game, opening up “new traffic” is a different approach in the channel of access to traffic. At present, the BiKi Exchange claims to have accumulated millions of users by mining "new traffic" and broke the traffic blockade of the head exchange.

But it is hard to say that this is a breakout path suitable for all second- and third-tier exchanges. Just as in the e-commerce platform war, there is only one “multiple fight”.

Next, the competition for traffic between exchanges will become increasingly fierce, and thousands of wars will be inevitable. In the bear market, facing the traffic monopoly of the head exchange, how to break through the self-help, and even turn over, is a thinking question in front of all second- and third-tier exchanges.

Text | Mutual Chain Pulse · Liang Shan Hua Rong

This article is [ inter-chain pulse ] original, reproduced please indicate the source!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Swedish central bank economist: Libra reflects the central bank's failure in cross-border payments

- BM's latest article: How to overcome artificial restrictions with untrusted smart contracts

- Analysis of the market on October 18: Will the curse that will fall for a long time be played again?

- Password Punk and Super Sovereignty: written on the eve of the 134 stable currency project

- Interpretation of the US Economic Research Institute "Who should issue CBDC" report: ignoring the consequences of wholesale digital legal currency

- "White gloves in the dollar", Libra will meet with the central bank's digital currency

- Quote analysis: the battle against the digital frontier, the Fed is also ready to play coins