A paper on the cryptocurrency mining industry panorama

Digging mining and underlying hardware are often overlooked, but they play a very important role in blockchain networks.

As of July 2019, including mining incentives and transaction costs, Bitcoin miners generated more than $6 billion in annual revenue.

In the field of cryptocurrencies, providing safe mining and related hardware for Bitcoin and other cryptocurrency items is often overlooked. However, due to the connection with the exchange, mining is actually one of the core markets that generate considerable revenue.

In this article, I will share an overview of bitcoin and encrypted mining, support the underlying hardware for mining and its ecosystem landscape, and delve into the revenue and market size of this area.

- USDT, the invisible sword of Damocles

- The SEC issued a second no-objection letter, and the company’s tokens do not need to be registered as securities.

- A large amount of capital has poured into the field of bitcoin mining, and the computing power has risen sharply.

How does cryptocurrency mining work?

Proof of work (mining) is the process of adding new transactions to the Bitcoin blockchain and how to agree on the correct order of these transactions (consensus) .

My favorite analogy is to think of this process as a Sudoku game. This is a problem that requires a lot of brainpower to solve, and once it is resolved, it is easy for others to verify that you have found the right answer.

There is a nice video on Youtube that can help you understand more intuitively how blocks are created, how they are chained, how transactions are added to blockchains, and how mining plays a central role in this process. (https://youtu.be/_160oMzblY8)

In essence, miners, or computers distributed around the world, are competing to solve a computationally intensive problem of verifying the next block in the blockchain (and the underlying transactions within the block) . The first miner to solve this problem will receive a reward (coinbase reward + transaction fee) . Once this new block is found, all miners on the network can verify that the block is correct and continue to work on the next block in the chain.

The role of miners in the bitcoin and encryption ecosystem

All the computers in the world that are competing to solve the next problem constitute the mining ecosystem. All of these computing resources are one of the core elements of the basic security provided for Bitcoin.

Through this network, Bitcoin participants can expect:

- Their transactions will be confirmed on the Bitcoin blockchain.

- Their transactions will be carried out in the correct order (to prevent double flowers) .

- The history of the Bitcoin blockchain will remain the same (invariant) .

In return, the miners receive compensation for the newly minted bitcoin (coinbase reward) plus the transaction costs associated with each transaction. If participants want a stronger guarantee that their trades will be added to the Bitcoin blockchain, they can increase the amount they are willing to pay when setting a fee for their trade.

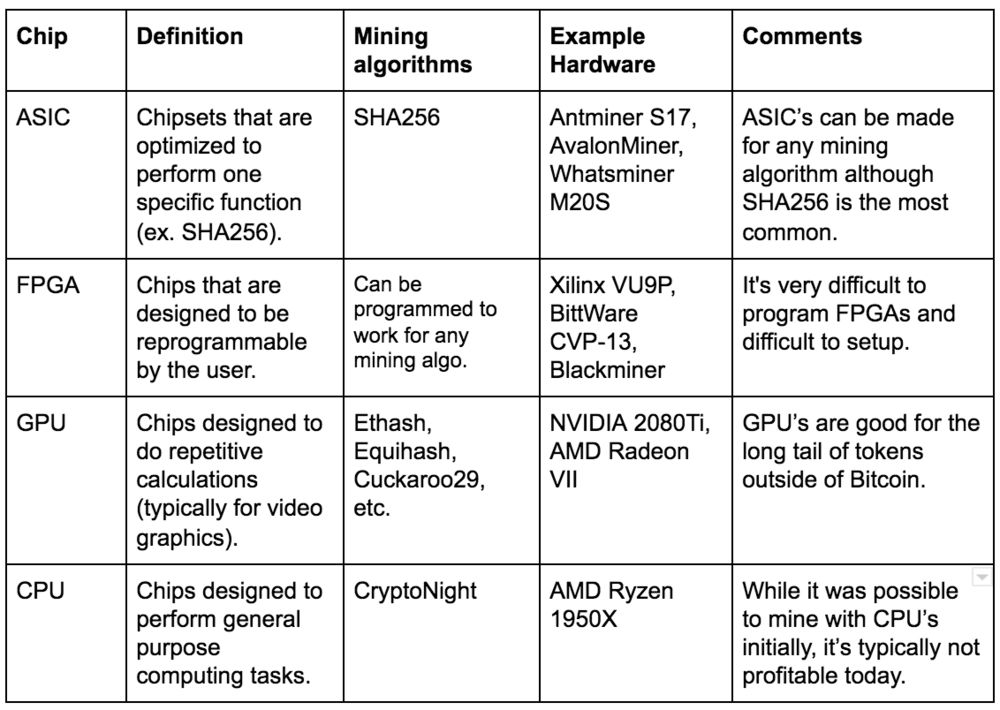

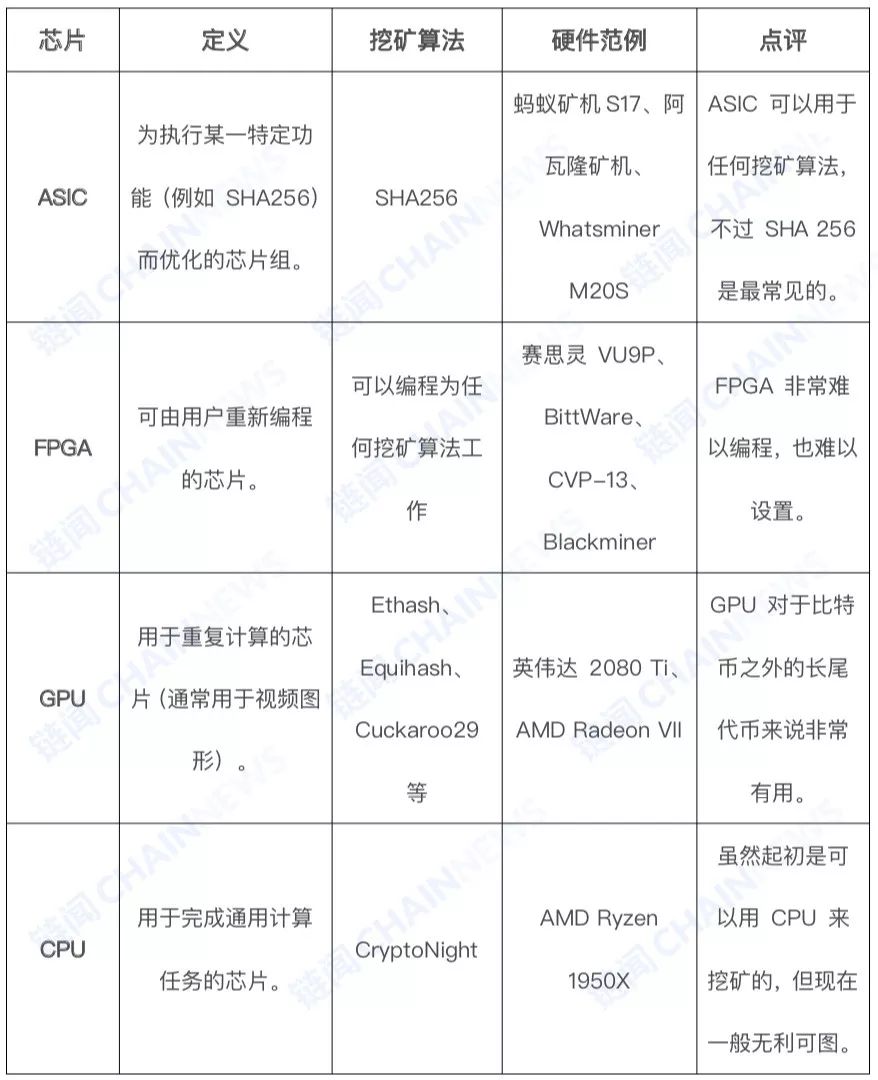

Mining hardware

While it is profitable to use the consumer-grade central processing unit (CPU) to mine bitcoin in the early days of the Bitcoin network, it is impractical to do so when the bitcoin network has grown to today's scale.

The Bitcoin ecosystem is dominated by application specific integrated circuits (ASICs) . For most other cryptocurrencies, graphics processing units (GPUs) and field programmable gate arrays (FPGAs) are the primary form. In addition, there are some coins, which use the same hash algorithm as Bitcoin (SHA256) and are compatible with Bitcoin mining ASICs.

Mining ecology panorama

The following is a panoramic view of the mining class, from chip to end user service:

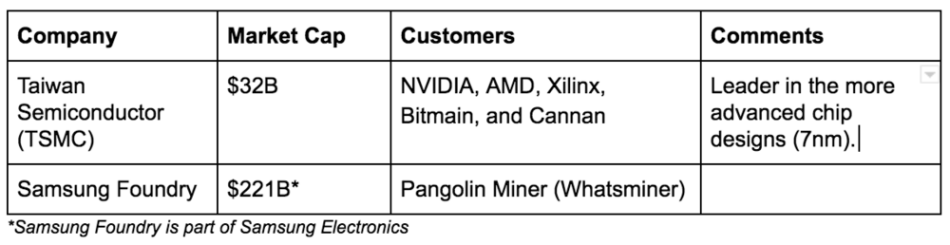

Chip manufacturing

TSMC and Samsung are two core semiconductor foundries that produce all of the silicon used in mining hardware. In particular, Taiwan has a dominant share in the chipset supply chain.

For example, NVIDIA , AMD, Xilinx , Bitmain and Cannan all have TSMC as their core production line.

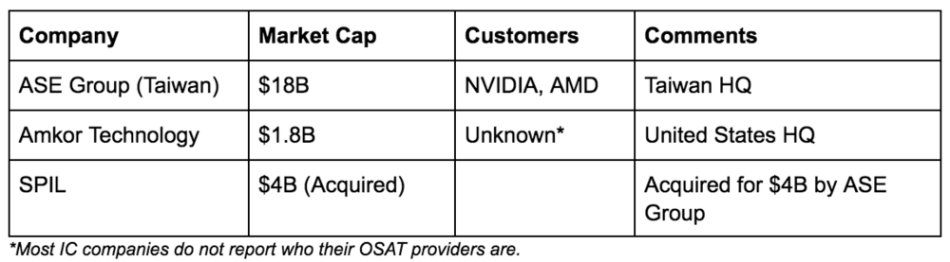

Packaging, testing, assembly

Once the wafers are complete, you need to test them, cut them, package them into the final chip, and test again. The entire process is usually handled by OSAT (outsourcing assembly and testing company) , the largest of which are Taiwan's ASE Group and Amkor Technology .

IC design and manufacturer

Companies that design and sell chips are often referred to as fabless chip companies, leaving manufacturing to chip manufacturing and OSAT.

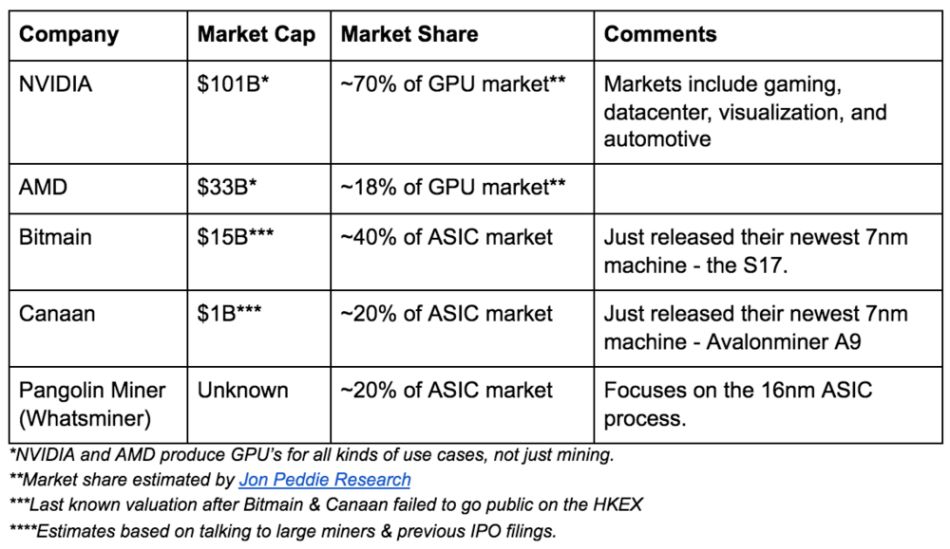

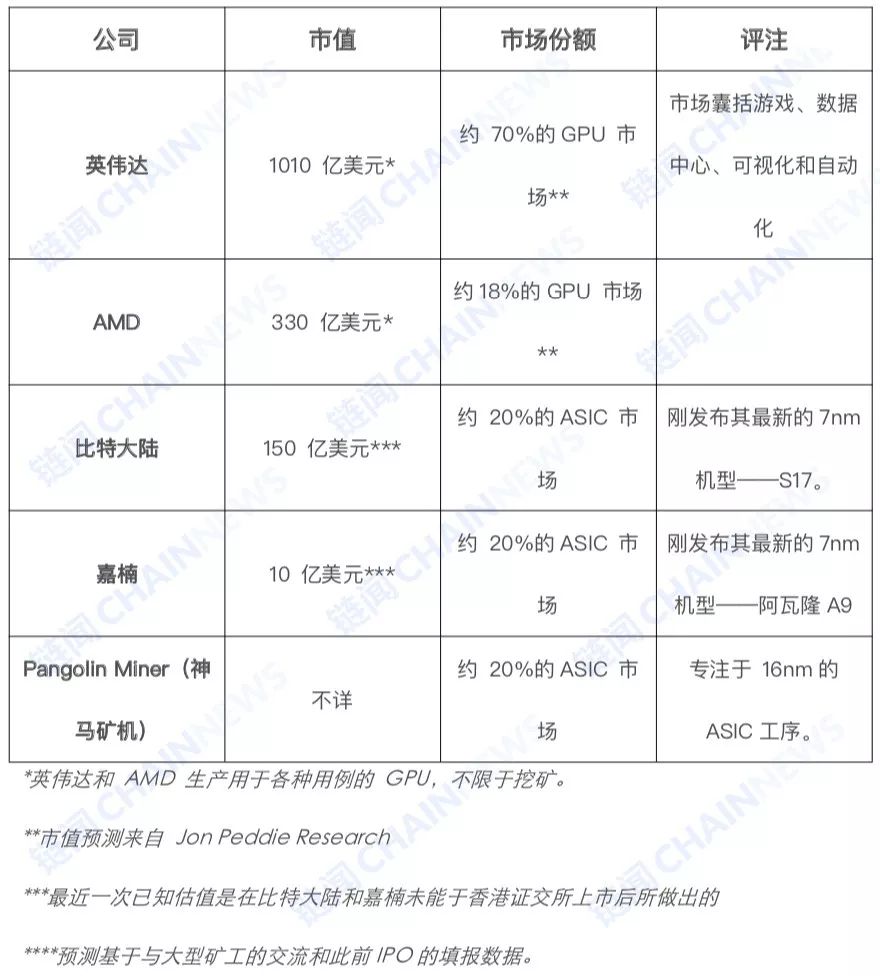

On the GPU side, the two largest manufacturers are NVIDIA and AMD. The largest manufacturer in the FPGA field is Cissing. While focusing on the ASIC industry in the encryption industry, the top three companies are Bit Micro (the other name is Pangolin Miner), a producer of Bitian , Jianan and Shenma mining machines.

In addition to these three manufacturers, there are other IC design companies in the field, including: Ebang , Innosilicon , Bitfury, Obelisk and more.

Miners and mines

Once the chip is produced, it can be used to mine the cryptocurrency. The ASIC is specifically designed for mining of an algorithm (most typically SHA256 and Bitcoin) , while the GPU has more flexibility.

Miners include: people using a machine for mining, small mining operations (5-10 machines) , medium-sized mines (10-100 machines) , large mining operations (100-1000 machines) to industrial scale Mining base (1000 + machines) .

The largest operation I've heard so far has been the mining of 100,000 machines in multiple locations.

In addition to designing chips, some manufacturers themselves mine, such as Bitland, Jianan, and Microbit. Bitcoin publicly discloses their "self-mining" records every month.

Mining operations of any size can be directed to a pool (more on this later) , or if they are large enough, they can mine themselves – aggregate all the hashing power to find the blocks directly without having to The hash rate is mixed with other miners.

Controversially, mining chip makers may use machines to mine before selling their own mining machines. However, if you really have a device that generates revenue, you have no reason to leave it in the warehouse, but use it until you can sell it.

Mine pool (single currency and multi-currency)

For individual and non-industrial miners, joining a mine pool is more economically justified than mining itself. The pool pools the min calculations of many miners to smooth the return curve of each miner. The pool is responsible for optimizing all computing power, running mining records, collecting and distributing rewards, and charging an additional fee for the service.

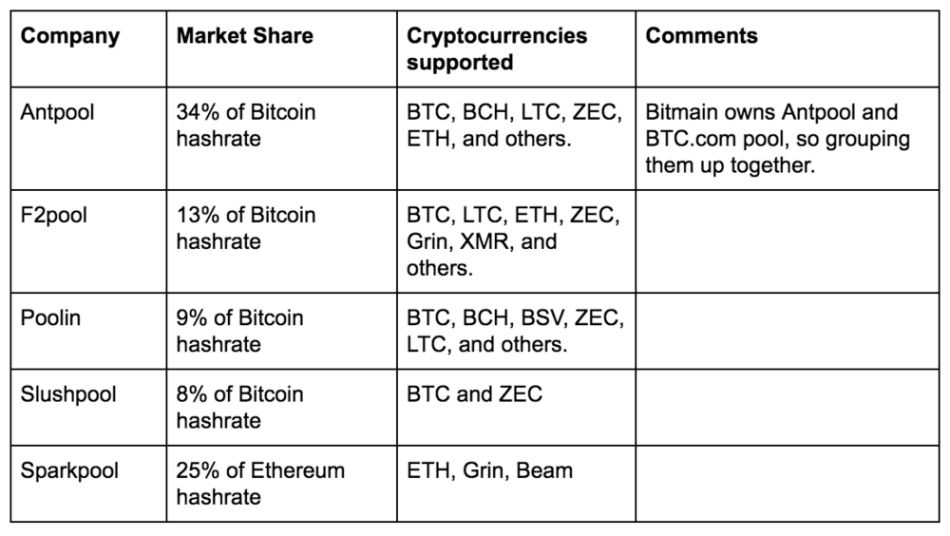

Some mines focus on specific cryptocurrencies. For example, the Spark Pool is mainly for ETH and Grin, while other mines cover all major cryptocurrencies, such as Ant Pool, F2Pool, Coin Bank, and Slushpool. All of these pools began to focus on a cryptocurrency, usually bitcoin, which was later extended to cover all forms of cryptocurrency.

One of my favorite analogies is that the operation of the mine pool can be imagined as an office lottery pool. By bringing together all the colleague's lottery tickets in the office, everyone (miners) can have a better win (block reward) in getting rewards.

At the same time, with the mining pool, you have to believe that their services report both accurate returns and the exact number of votes each person in the pool has. In terms of transparency, there are reports such as PoolWatch tracking and comparing reports from different mines.

Hash computing market

As a miner, in addition to using his own hash calculations to mine, you can also choose to sell your calculations to others. Usually, this is done on a trading market, the biggest market is called NiceHash . There is a smaller P2P market called Mining Rig Rentals .

In these markets, people can sell computing power for various types of cryptocurrencies on any given set of mining algorithms, as well as buy computing power.

There are many reasons why people buy computing power. The most important reason is that purchasing power is a way to enter the cryptocurrency highway from the ramp.

Many times, people use hashing power to speculate on various cryptocurrencies, for example, to buy SHA256 hashing power and use it to dig Bitcoin SV (BSV) instead of bitcoin. This is a bad business…

Cloud mining

Cloud mining is a service that consumers can directly purchase a hash computing contract without having to personally operate any hardware. It is similar to the computing market above cloud mining services and is usually operated by a central supplier.

The two largest companies in the field are Genesis Mining in the United States and Bitdeer in Asia. Similarly, similar to the above, one of the main reasons for users to purchase hash computing is to quickly enter the field of cryptocurrency. In this way, people can use French currency to buy bitcoin and other cryptocurrencies directly without going through the exchange.

Intelligent miner

Smart miners are an emerging category. The background is that mining is a complex task, and participants need to understand hardware, networks, energy, hash rate prediction, and specific algorithm optimization. Crucially, all of these inputs are constantly changing every day, and new long-tailed cryptocurrencies continue to appear and disappear.

The goal of intelligent miners like Honeyminer is to optimize all of these factors, whether they are consumer-level or professional miners can earn as much as possible through the hashing power they have.

Two other similar products are HashFish and Cudo Miner .

In a short period of time, these products have gathered a considerable amount of hash computing power in the market.

Overview of the size and income of the mining market

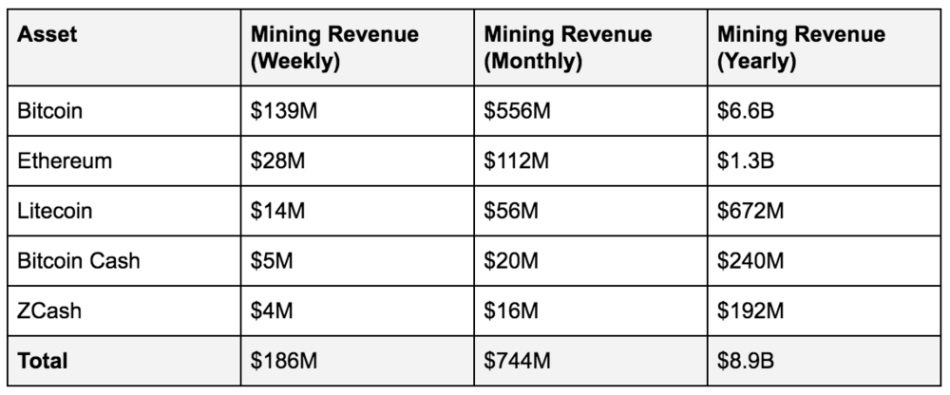

The encrypted mining industry generates annual revenues of more than $8 billion.

The income comes from two parts, one is the block reward, and the other is the transaction cost of each block on the blockchain of all workload proof types. Based on the latest data from the mining awards released by CoinMetrics on June 25, 2019, the following are the weekly, monthly and annual revenue operating rates for mining.

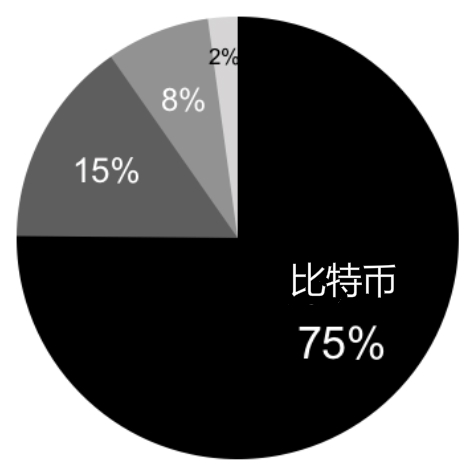

In the field of cryptocurrency mining, Bitcoin still dominates , and only the Bitcoin network has created 75% of mining revenue.

This also matches Bitcoin's market capitalization. According to CoinMarketCap, as of July 1, 2019, Bitcoin accounted for 60% of the total market value of all cryptocurrencies.

However, the total revenue generated by mining is directly linked to the price of the relevant cryptocurrency, so it is mapped to the underlying cryptocurrency market, so it is difficult for Wall Street to understand the valuation of companies in the industry. Below we will also introduce this in depth.

Understand the profitability of the mining industry

The total revenue, total cost and profitability of mining mining participants depend on several key factors.

Capital expenditure (Capex)

For miners, the main capital expenditure is the cost of the mine itself, plus the cost of all facilities/buildings required for operations.

For example, if you want to buy the latest S17 model on 10,000 Bits, it will cost $16 million at retail price. Large miners can get special discounts; however, when the mine is in short supply, even supply is difficult to guarantee, let alone price negotiations.

This has not taken into account the cost of constructing mining facilities that have evolved from amateur activities to truly specialized, industrial-scale operations.

Operating expenses (Opex)

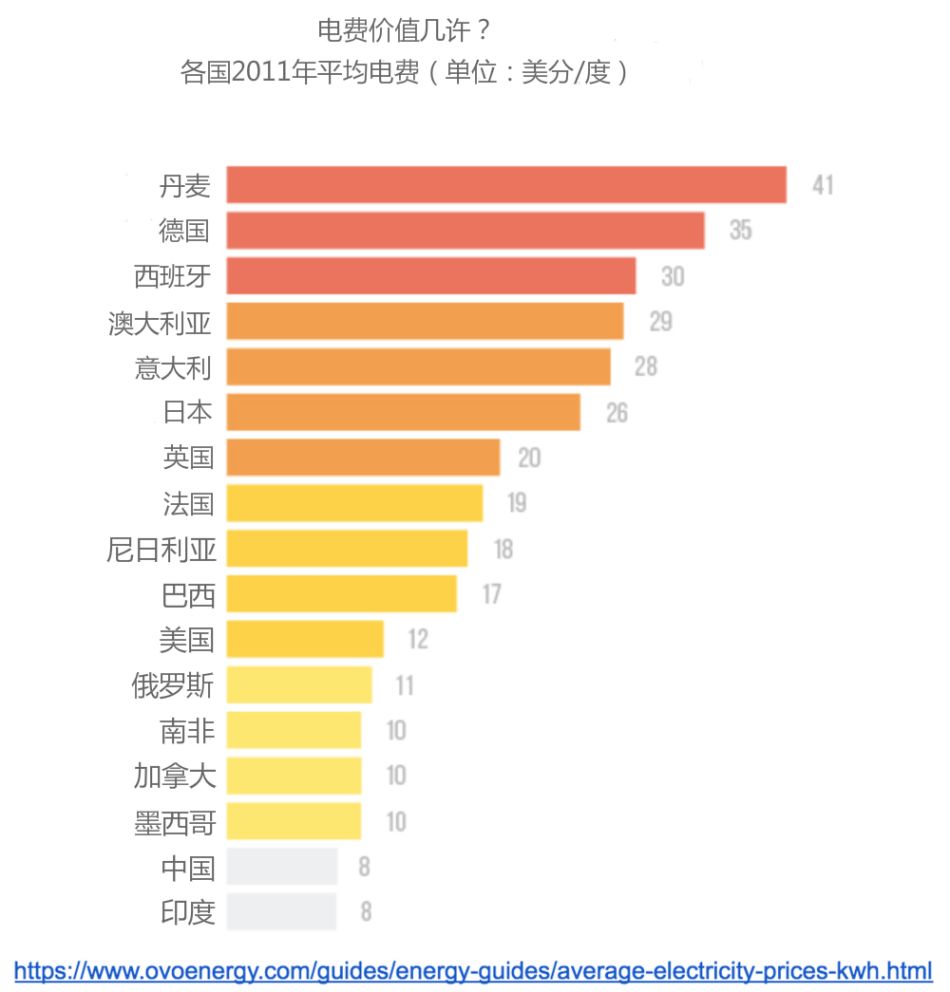

For miners, the main operating expense is the electricity bill that powers the machine every day.

For example, if you run a 10,000-bit S17 miner 24 hours a day, 7 days a week, if the energy cost per kWh is 5 cents, then your daily electricity bill is $36,000, or about 13 million a year. Dollars – and this is just to power the mining machine.

The average electricity bill varies greatly depending on where you are and what power source you use.

Miners are naturally motivated to find the world's cheapest energy, which is why Coinshares estimates that 75% of the Bitcoin network's energy comes from renewable sources, mainly hydropower.

In addition to the cost of electricity for mining machines, other operating costs include: cooling, labor, maintenance, safety, and general facility operations. The general rule of thumb is to roughly estimate the current operating costs by 1.5 times the energy cost.

According to our example above, a mine operates a 10,000-bit S7 mine, and a rough estimate of the cost is as follows:

- $16 million in capital expenditures + $3 million (import tax) + $4 million (facilities + security)

- $20 million in operating costs (per year)

- $67 million in possible revenue (based on today's bitcoin price) .

This is only a rough estimate, just to illustrate the scale of the factors that miners need to deal with. The real cost will be highly dependent on your location and built-in factors.

However, these factors are always constantly changing based on market factors, and we will continue to discuss them.

Market factors affecting the industry

Although operating costs and capital expenditures are two factors that miners can control, various market forces are ultimately working, and they largely determine the profitability of mining.

Miner costs and available supplies

Unlike many traditional products, mining manufacturers ( Bitland , Jianan, Shenma Mining, etc.) will adjust the price of the mining machine based on the profitability of the mining machine (bitcoin price) .

During the period of large-scale upswing, the value of the underlying cryptocurrency and the mining machine itself may fluctuate drastically. In the midst of madness, the entire secondary market is committed to buying more hardware, and old machines will once again become profitable.

In general, I always want the price of the machine to be close to the fair value that the machine produced at that point in time.

In addition, mining hardware is often limited in supply, especially for newer machines. Take the bitland S17 as an example, these miners are completely sold out. I talked to some of the people on this team and they don't expect to be back in supply until November.

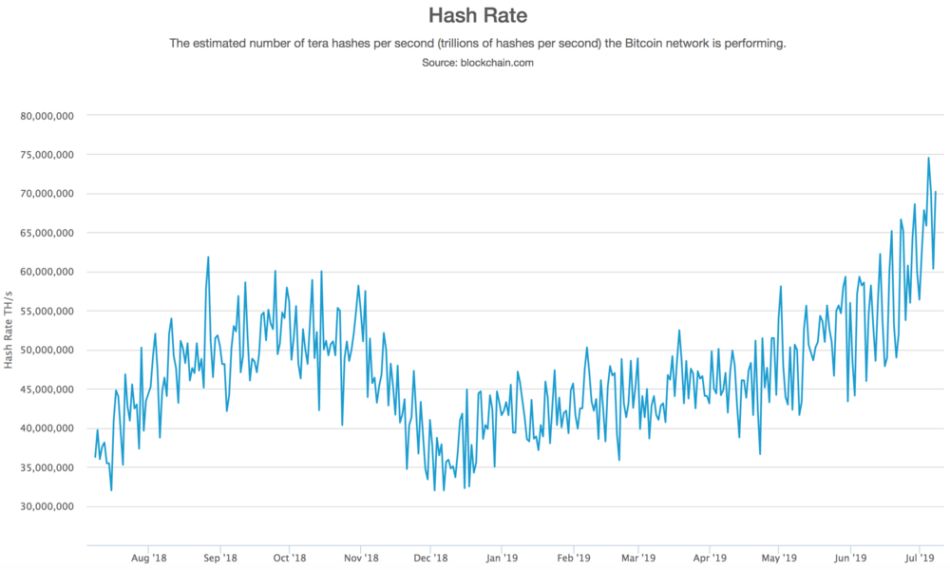

Hash computing power

The chances of miners solving the next block are directly proportional to their computing power in the entire bitcoin network (for simplicity, Bitcoin is used as an example) .

Let's take a somewhat simplified example to illustrate this. If you are a miner who controls 1% of Bitcoin's computing power (compared to Bitcoin's overall computing power) , then you may get a total return on the Bitcoin network. 1%.

However, the overall hash rate of Bitcoin is always changing, so the profitability of each miner depends on how many miners enter or leave the ecosystem. The Bitcoin protocol has an internal method for difficulty level adjustment (for more information, see here: https://en.bitcoin.it/wiki/Difficulty) .

Bitcoin price

Because the block reward is paid in the cryptocurrency of the blockchain. For example, if you are digging bitcoin, the block rewards you receive will be paid in bitcoin. Therefore, the bonus amount is directly linked to the price of Bitcoin itself.

The higher the bitcoin price, the higher the value of the mining award. Since you are engaged in mining, you are fundamentally doing more of the cryptocurrency you are mining because your profitability depends on it.

One of the main reasons why Bitcoin has become the dominant cryptocurrency is the transparent, open and fair supply schedule for Bitcoin. Starting from the creation block, Bitcoin has a fixed supply on a fixed supply schedule – the total cap of Bitcoin is only 21 million.

Mining is the way new Bitcoin is created and released into the world. Today, the reward for each bitcoin block is 12.5 bitcoins; however, this bonus is reduced every 210,000 blocks. Upon reaching the #630000 block height (estimated around May 24, 2020) , this bonus will drop to 6.25 bitcoins – this is called a halving event.

To see how previous halving events affected Bitcoin and other cryptocurrency networks, check out CoinMetrics' excellent blog post, which sorts out the previous halving event. (https://coinmetrics.substack.com/p/coin-metrics-state-of-the-network-43a)

If you want to learn more about Bitcoin's supply schedule and what happens after all bitcoins have been created, read these two posts about Bitcoin supply and overall security budget:

Article one: https://en.bitcoin.it/wiki/Controlled_supply

Article 2: https://blog.picks.co/bitcoins-security-is-fine-93391d9b61a8.

In short, the price of Bitcoin and the supply schedule of Bitcoin have greatly affected the profitability of mining itself.

Most worth remembering information

After delving into the mining field of cryptocurrency, the main conclusions I have reached are as follows:

- Although digging mining and underlying hardware are often overlooked, they play a very important role in the blockchain network.

- Hash rate = cryptocurrency = money. For many people, the hash rate is a key channel into the world of encryption.

- Just as we see the financialization of Bitcoin, I expect that we will also see similar financialization of the hash rate.

The chain is authorized by the author of this article to translate and publish the Chinese version.

Written by: Chris McCann, General Partner, Proof of Capital, Blockchain Investor

Compile: Zhan Wei

Source: Chain smell

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Reshaping the scalability of blockchains: separation of state and time

- Ethereum is becoming more vulnerable, and its power has fallen more than 42% from its highest point in history.

- The Digital Dimension of RMB Internationalization: What is the anchor of sovereign currency internationalization?

- Bitcoin will reach $100,000 in 2019? Claiming to be a "time traverser" from 2025

- Introduction | Carl: Punishment in Eth 2.0

- The latest development of the Ethereum Layer-2 protocol: Plasma and state channels go hand in hand

- The Galaxy Consensus Node plans to add Southeast Asian members – RiveX!