About Staking, which exploded in 2019, you need to understand these eight points.

introduction

Following the popular concepts of ICO, Certified Economy and DAPP in 2018, the new concept of “Staking (Pledge Economy)” took the limelight in 2019 and became increasingly hot in the POS Consensus Ecology led by Ethereum. On September 22nd, the Ethereum PoS mine pool and node operator Rocket Pool announced that it will open the first ETH 2.0 Staking test service on September 24, within the capital institutions, exchanges, mining pools, wallets and other circles. The roles are all deployed around Staking.

Many practitioners have asserted that 2019 will become the first year of Staking's pledge economy, and the overall market size is about to explode. Under the scrutiny, it is not difficult to find that the pledge economy is much more specific and direct than the vague concept of the CIS economy, and it is much more relevant to the interests of ordinary investors.

Today, we will focus on the development status, commercial potential and investment opportunities of Staking's emerging ecology. It will also trace back the rise of Staking and the current interests of various eco-participants and ordinary users. The full text is elaborated on the following sections.

- What is the nature of Staking?

- How did the Staking economy emerge?

- What does Staking mean for the encryption industry?

- What are the sources and implementation methods of Staking?

- What business opportunities are the Staking model generating?

- How to control the timing of Staking?

- How to choose a reliable Staking project?

What is the nature of Staking?

Staking (mortgage) is a unique behavior in the POS (Equity Proof) consensus project. It refers to the behavior of the token holder who obtains the staking reward through the pledge of the token and obtains the corresponding income according to the equity he owns.

- Blockchain and the traditional financial industry turtles race, who can win?

- Getting started with blockchain | Can Google's latest quantum computer crack bitcoin? Is the wallet safe?

- People who want to rely on Bakkt scams are really disappointed.

To be able to get the Staking reward, the holder of the currency (ordinary investor/institutional investor) needs to choose a node (which can be a wallet, an exchange, a third-party operator, etc.) to commission, or build a node by itself, and then pass the pledge and vote. , commissioning and locking, etc. to obtain transaction fees, block rewards and dividends and other Staking rewards. Therefore, Staking can also be easily understood as a commercial format that holds money, pledges mining or locks mining.

The “pledge” here is a chain entrusting action, which means that the user transfers the POS mining power (ie, the right to use) to the node, and the node replaces the user mining to generate the income and then distributes it to the user, but from beginning to end, the token Ownership is in the hands of the user.

In essence, Staking can be seen as a sub-section of DEFi (Decentralized Finance). Because the essence of Staking is the process of asset regeneration and subsequent redistribution of blockchain projects, more and more POS projects are now trying to innovate the design and practice of the Staking distribution mechanism.

It can be seen that Staking is actually a topic that has a relationship with each of the holders. It will trigger each token holder to think about the design of the token economy model of the currency he holds (including the issuance setting, mining). Reward distribution, etc.), participate in “holding the currency mining”, the feasibility and necessary measurement of the Staking income.

How did the Staking economy emerge?

As mentioned above, Staking is a characteristic behavior in the POS project, and its popularity is naturally inseparable from the rise of the POS consensus mechanism.

- The POS concept was introduced as early as 2011. The Peercoin project in 2012 can be regarded as the first project with built-in PoS consensus. Then people saw the advantages of the POS mechanism.

- Then, between 2012 and 2015, many POS projects (such as NXT, BLK, SHDW, etc.) were launched, and they reached a high market value in the bull market in 2014, but they quickly faded out of sight after the bear market fell in 2015. At that time, people's research on PoS was not deep enough, and many problems were exposed in the project practice. The security of the entire POS network was greatly threatened.

- Starting from 2015~2016, the market has produced a large number of emerging POS projects (such as Tezos, EOS, ONT, Cosmos, Polkadot, Cardano, etc.), which have made a lot of improvements and innovations in the design of POS mechanism.

- These emerging mainstream projects will be launched in 2018 (EOS, ONT, Tezos, etc.) in 2019 (Cosmos, Polkadot, etc.), especially as the implementation phase of Ethereum 2.0 is approaching (expected to switch to POS consensus mechanism in 2020) ), the market's enthusiasm for POS projects is unprecedentedly high.

Staking itself is a participatory behavior of POS consensus. Most of the initial development of each project will set up some incentives to enhance the participation of Staking and maintain the security and activity of the POS network. The Staking economy has become the hottest topic nowadays and is expected to be reshaped. The pattern of the entire encryption industry changes the relationship between the money holders, verifiers and systems, bringing more business opportunities.

In addition, the idea of “bear market currency” is also very compatible with the Staking economic model. For the majority of bearers in the deep bear market, there is no big benefit for short-term operations, and the Staking consensus for participating in POS projects does not require marking. Without frequent operations, you can realize the interest of holding money (some need only lock the position to get the corresponding income), which is equivalent to increasing the investment choice of a type of fixed-income products.

What does Staking mean for the encryption industry?

The value of the Staking economy in the encryption industry is mainly in two aspects.

First, maintain the security of the chain itself. The more tokens are pledged on the whole network, the higher the security of the chain. Most POS public chain projects often need to entrust to participate in node governance and community voting, otherwise the rights and interests will be diluted;

Second, stimulate community activity. Compared to the POW, the tokens are sold out and the Staking economy will make the token holders in the POS project more closely linked to the chain itself. The Staking behavior itself is participating in the POS consensus, and the Staking incentives make the users more Extensive participation, and encourage ordinary holders to take the initiative to pay attention to the consensus rules of different chains, and actively seek and supervise the work of nodes to earn staking benefits, which will leave more value for the public chain community and ecological construction.

From the perspective of the application distribution of global institutions, Staking's economic model is obviously more favored by wallets and exchanges, because Staking's natural technological advantages can keep the user's stickiness with the times.

What business opportunities are the Staking model generating?

The evolution of the POW Consensus and the history of the Bitcoin Gold Rush show that the ultimate winner of the market is not the miners who work alone and the people who sell BTCs in the secondary market, but the large manufacturers that sell miners (by Bitcoin and Jianan Minzhi is represented) and large-scale miners' organizations (mine mines).

Well, in the wake of the rise of the POS consensus, all parties in the market are already ready to go. In order to seize a place on the new road of Staking, Staking Eco is gestating a large number of new business models.

(1) POS mining pool

The first to bear the brunt is the mining pool. Like the PoW pools (the bitcoin pools that were combined to increase mining revenues, such as f2pool, Antpool, etc.), the POS pool was seen as an emerging business opportunity. The main business model is that the mining pool helps the POS project holders to exercise their rights. The holders are entrusted to the professional service team to carry out the Staking operation to obtain the rights of individuals, and these service teams (such as the US Stake.us) are from A certain hosting fee will be charged.

(2) Empowering wallets and exchanges

Perhaps in the near future, the Staking service will become the standard for mainstream wallets and exchanges.

At present, the existing blockchain wallet on the market has been unable to find a suitable business model, and the multi-functional monotony is only used to store digital currency, and there is not much added value. Staking economy encourages users to use the coins stored in the wallet to mine and earn income, which brings new opportunities to the wallet, and provides more new ways of playing (such as lock-up airdrops, reloading mines, etc.) and new usage scenarios ( Such as Staking data services, Staking insurance and other new service scenarios).

In addition, as an “large account” in the encryption market, the exchange can also use Staking to pledge the user's currency in the exchange to obtain additional income. At the same time, the node is operated and enjoys the annual income of each project, and can pass part of it. Revenue feedback is shared with users to achieve new, retained and promoted activities.

(3) Professional node operation team

As mentioned above, the security of many POS public link projects depends on the majority of nodes to maintain. To encourage the participation of the nodes, most projects will pre-specify a part of the additional incentives or reserve a part of the tokens as node incentives.

Due to the cost of operating nodes, professional node operations teams also have certain needs.

Professional teams can maintain nodes on different chains and participate in PoS mining. There are a lot of trivial tasks, long-term tracking of the community's status, keeping up with the community's timely upgrades and adhering to different chain rules to avoid being Slash and so on.

(4) Empowering project party air investment business

The current airdrop service is to find an address to vote, very inefficient and blind, can not judge the real situation of the address, Staking can solve this problem, the process of mortgage, voting can naturally determine the authenticity of the address can be targeted, there are Help the project side to improve resource utilization.

(5) Empower DApp

With regard to the combination of Staking and application scenarios, Staking can make Staking simple and fun, while also increasing the value of DApp and increasing the stickiness of users using DApp.

(6) Other business opportunities

For example, financial derivatives, PoS has a fixed-income nature, similar to traditional financial consolidation products, can be packaged into various wealth management products, provide stable income for the holders, and train a group of long-term investors and believers.

Staking revenue source

As mentioned above, the essence of Staking's economy is the process by which users earn revenues such as block rewards, transaction fees and dividends through operations such as lockout, pledge, voting, and authorization. In general, in the POS project, the benefits of Staking (that is, the rewards of the POS system) are mainly derived from three major blocks.

1) Inflation reward

Inflation rewards are the main source of income for Staking's behavior.

Under the PoS (Equity Proof) mechanism, the probability of obtaining the billing rights is determined by the duration of the user holding the token and the quantity. Similar to the stock dividend system of modern enterprises, the more shares held, the more dividends are obtained. This undoubtedly spawned new mining reward rules and incentives: packaging transaction information by network nodes, maintaining network security and governance, this process is the "Stake" behavior in POS networks (similar to "mining" in PoW ), the node that completes the above work can obtain the system-issued token reward (ie, Staking incentive).

In order to maintain the dynamic balance between the number of circulating tokens and the amount of pledge tokens, the proportion of inflation in most projects is inversely related to the proportion of coins plucked by nodes: that is, the higher the proportion of node pledge, the smaller the annual inflation rate. When Staking's annualized income becomes higher, more coins will be pledged, and the amount of currency will be reduced, which will have a certain impact on the use of the entire system. At this time, the reverse adjustment of the entire incentive system will be triggered: inflation incentives will be reduced. The annualized rate of return is reduced, and the pledge and currency are up to a new dynamic equilibrium.

2) Project party rewards

In the initial stage of the main online line of most projects, some tokens will be used as nodes to participate in rewards or subsidies, and everyone is encouraged to participate in the node. Of course, this part of the reward will decrease with time and project progress.

As the ecology matures, there will be more and more projects in the future. The staking income is derived from the income of the ecology itself, such as handling fees; but for now, it is basically dependent on the continuous release of tokens.

3) Block fee

The blockchain system needs to attract as many users as possible to participate, activate the network value, and the transaction fee reward is positively correlated with the work income and network usage of the block node or the service node.

As the blockchain ecology continues to mature, the income of each project ecology itself may gradually increase (such as handling fees), and into the Staking income pool, but for the time being, the Staking revenue of most projects still depends on the token. Constant release.

Overall, in the Staking economy, the user's actual rate of return is not equal to the inflation rate of the pass. In fact, the actual rate of return of users is determined by many factors such as inflation rate, mortgage rate, price changes and so on.

Staking implementation

At present, the Staking implementation methods on the market can be mainly divided into two types.

1) One is to hold the mine, ie mine [PoS project].

Under the consensus mechanism of PoS (Proof of Stake), nodes are responsible for packaging transaction information, maintaining network operations, and participating in community governance.

The currency is the mining method. For example, in the typical PoS public chain Cosmos or IOST, the holder of the currency can mortgage the token to the node and can directly obtain the corresponding dividend.

2) The other is "commissioning" mining [DPOS project]

Usually occurs in the DPoS chain of the derivative mechanism of PoS. The holder of the currency needs to vote for the node (the currency is mortgaged to the node), and the selected node obtains the proceeds and then returns it to the user privately. There is also the same as the underlying public chain, in order to better decentralization and security, the use of PoSW's staking mode is to first mine the coin and mine again, in order to maximize the miner's computing power, The miner must obtain a certificate corresponding to its proportion of the total network computing power.

How to control the timing of Staking?

Participating in Staking is not like buying and selling transactions in digital currencies, and the control requirements for timing are not so strong. Some people think that Staking is more suitable for the bear market layout, but in fact, Staking is essentially a model of currency-bearing interest, similar to Alipay's balance treasure service, whether in a bull market or a bear market, for those who hold Staking tokens. There should be a market.

Staking is more suitable for playing in a bear market only for those who trade on a centralized exchange. For the network, the amount of Staking is transferred from the self-owned currency Staking to the centralized exchange when the bear turns to the cow. The exchange or the wallet that opens the transaction will enjoy this part of the income. The difference is that the exchange The users in the market only care about the price of the currency, and do not care about the interest rate. The interest during this time may be taken away by the exchange directly, and most of the coins in the decentralized wallet that can both trade and Staking are still in the hands of the user. Interest is also in the hands of users.

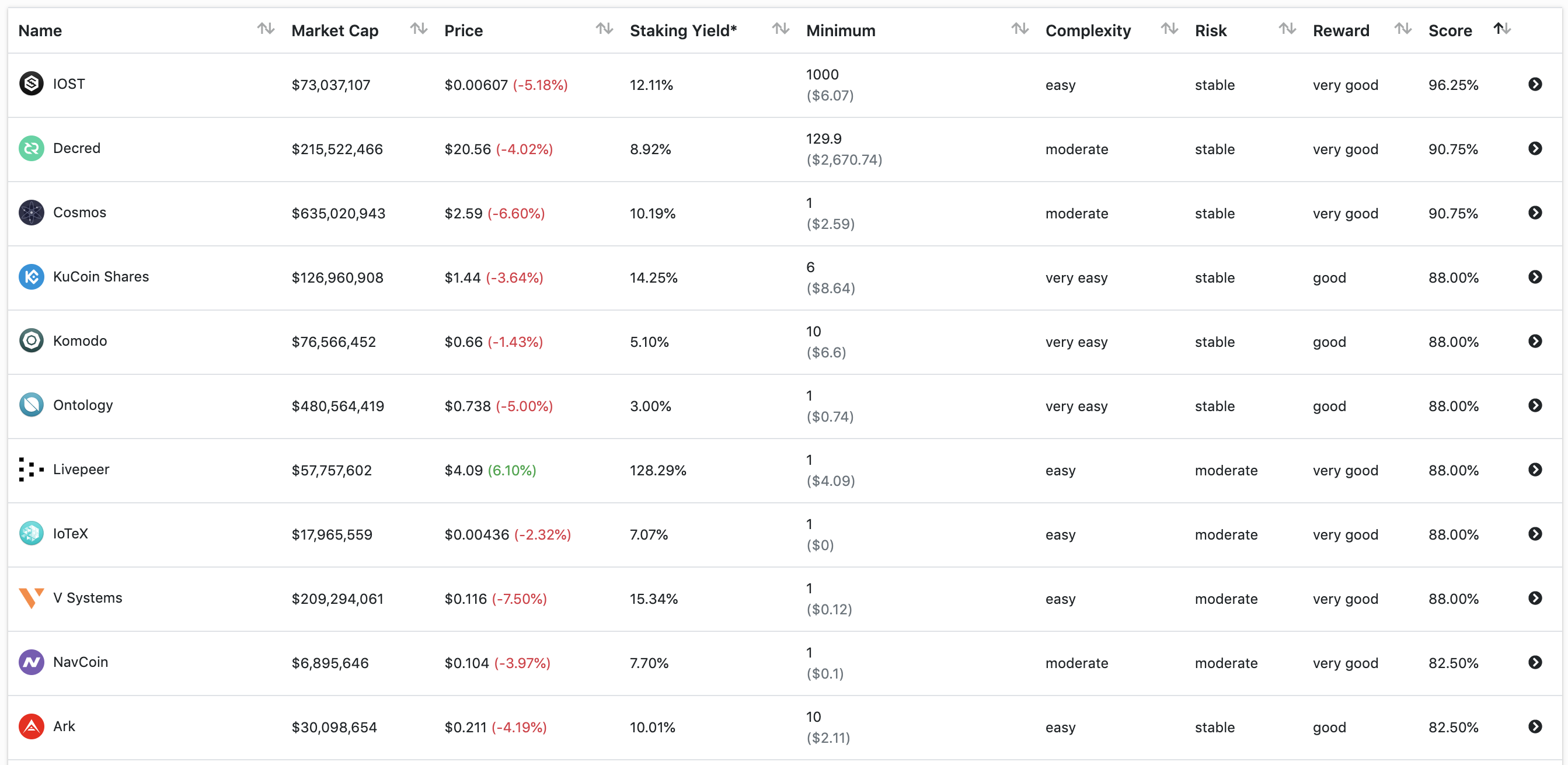

However, how to attract users to continue to be interested in staking is a problem. For speculative needs or consideration of opportunity costs , the holders are likely to have no continuous motivation for Staking. According to the data of nearly 100 projects included in the website of stakingrewards.com, the average annual rate of return of Staking is 13.08%, and the annual rate of return of the Ethereum plan is 4.30%. Obviously, the annual take-off of 10%-20% is on the currency circle. Many users are not attractive.

Source: https://stakingrewards.com (16:00, September 24, 2019)

How to choose a reliable Staking project?

Want to choose a reliable currency circle "Yuebao", through the Staking pledge behavior for a long time "lie earn", users should not only pay attention to the profit rate that the node or the client can provide, but also should pay attention to the system design and team of the project itself. Qualifications, as well as the technical strength of the nodes and other factors. Focus on several factors:

1) Yield

The starting point of Staking itself is to obtain long-term stable returns. Before the user entrusts the token to the Staking service provider (node/mine pool/other operation service provider), in addition to understanding the integrity and technical strength of the service provider, the most important thing is to care about the Staking service provider. "How much."

Most Staking service providers will clearly list the rate of return and whether they will provide the user with financial compensation separately if there is an unexpected situation (such as failure to complete the task as required or if the deposit is not received).

In general, the Staking yield can be calculated simply by the formula “Revenue = inflation rate / staking ratio”. Among them, the inflation rate is the project's token increase rate, which is basically publicly announced in advance. The Staking ratio is the proportion of tokens pledged in the entire project token, because only the pledge part can enjoy the additional tokens. The average pledge of the project is only about 30%.

Of course, the part of the proceeds that the user finally receives is deducted from the handling fee charged by the Staking service provider. The charging standards of different projects and different service providers are different. Currently, the charging standard of the nodes on the market is probably the mortgage income that the user can obtain. %-20% have it.

Investors in the legal currency standard need to understand that the revenue of Staking comes from the issuance of the project Token, and there is a risk of depreciation in the issuance. If you pay too much attention to high fixed income, choose a low-level pass for Staking, and the price of the currency will fall, and you may end up losing more than you. Therefore, rational investors should find a balance between Staking yield and project grade.

2) Project team

The qualification and credibility of the project team determines whether the project will survive for a long time. This can be judged by understanding the project's prospects, whether the project has clear and long-term planning, the consensus and confidence of the participants, and the ratings of the rating agencies.

3) System design

Since the main source of staking revenue is the new generation of coins that are continuously released, the speed of the whole ecological value can catch up with the new release rate of the token. If it cannot catch up, the decline in the price of the currency is likely to be greater than that obtained by staking. The value of the income, so it is necessary to consider in detail the issuance mechanism and economic system design of the project.

summary

For the rapid rise of the Staking economy, the market is mixed.

Some people believe that this indicates that the encryption market will have a formalized and fixed-investment investment product. In addition, the currency price fluctuates drastically and the trading strategy risk is high. More and more people hope to make long-term projects for their long-term optimistic projects. investment.

Others believe that Staking faces centralization risks, price fluctuation risks, trusted node reliability risks and liquidity risks. It may be difficult for ordinary users to correctly understand Staking benefits and avoid various investment risks.

But no matter what, we have seen that the pledge economy is more specific than the more vague general concept of the CIS economy, and it is more relevant to the interests of ordinary investors.

In addition, the Staking economy may be an inevitable trend in the current market from a large number of POW to POS conversion. Throughout the POW mining ecology, a relatively complete commercial closed loop has been formed. There are chip manufacturers and mining machine manufacturers in the upstream, mines and mining pools in the middle, and miners in the downstream. The mining machine manufacturers sell the mining machines to miners, and miners dig. The currency that comes out benefits from the market, and this business model may even be the only mature model in the blockchain industry.

In contrast to the POS mining ecology, the Staking economic segment is still in its early stages. Although there are fire coins, the Cobo wallet and the Bit.Fish, the MATPool pool owned by Babbitt, there is still no one. With the giants in the world, the blank of the entire Staking market is both an opportunity and a challenge. I believe that soon, there will be more comprehensive and professional Staking service providers and giants to make up for this gap.

Source: Shallot blockchain

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The first domestic "Digital Currency Dictionary" was launched at the New Moganshan Conference, and the Babit Think Tank was the main editor.

- One-quarter of the nodes are hosted by AWS, is Ethereum really decentralized?

- Fighting against the US SEC? The Kik app will be closed and its cryptocurrency subsidiary will be laid off

- Science | Bitcoin governance

- Babbitt Column | On the Similarities and Differences of Traditional Contracts, Electronic Contracts and Smart Contracts

- Opinion: On the three major reasons for government cryptocurrency to replace banknotes

- North Korea is developing its own cryptocurrency to circumvent international sanctions