10 Diagrams Analyzing 4 Classic Tokenomics Models

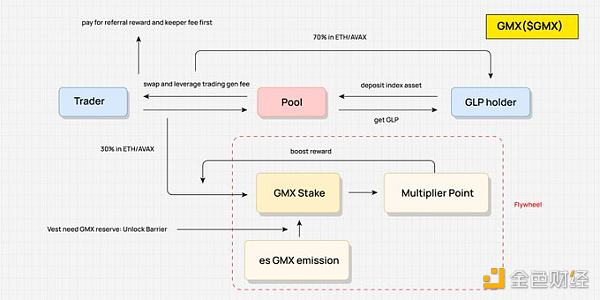

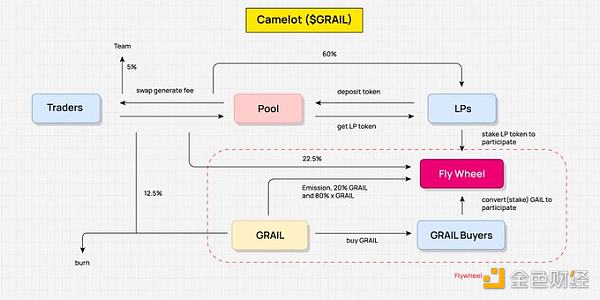

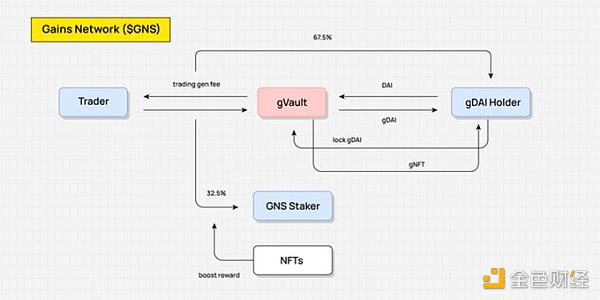

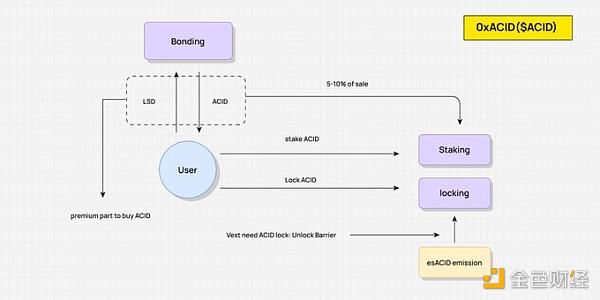

Analysis of 4 Classic Tokenomics Models using 10 Diagrams.Author: Dr.DODO, Source: author’s Twitter @DodoResearchTokenomics is the backbone of DeFi projects. Understanding the source of incentives and how they are distributed is crucial for users. In addition, the existence of a flywheel also helps to extend the sustainability of the token economy.Here, we bring you 10 Value Flow cases, covering 4 classic Tokenomic models.This tweet will cover:- vote-escrowed model: @CurveFinance, @Balancer- ve(3,3): @OlympusDAO, @VelodromeFi, @ChronosFi_- es Model: @GMX_IO, @CamelotDEX, @0xAcidDAO, @GainsNetwork_io- Lending: @AaveAave- How to draw Value Flowvote-escrowed modelIn the ve model, users lock protocol tokens in exchange for veTokens. Only with veTokens can users get a share of protocol fees, token incentives, and voting rights. Voting rights determine the distribution of token issuance, which is closely related to the profits of veToken holders.ve(3,3):(3,3) means the most favorable state – it can only be achieved when all participants choose to pledge protocol tokens. At this time, both participants and protocols are in a win-win situation.ve(3,3) is a combination of ve model and (3,3).It improves the method of protocol fee distribution, and users can only enjoy the transaction fees generated by the pool they vote for, encouraging users to vote for the pool with the strongest liquidity. Based on Olympus’ classic rebasing mechanism, later projects such as Velodrome reduced the ratio of issuance rewards to ve token holders, while Chronos completely canceled the rebasing mechanism.es Model:

The key design of the es model is the introduction of unlock barriers. To attribute the value of esToken, users need to stake a higher amount of protocol tokens. If the user decides to exit the game, unattributed esTokens will remain in the protocol, “saving” the release of protocol tokens.

- Comprehensive interpretation of DeFi options: market overview, product model and potential protocols

- Hong Kong Financial Secretary Paul Chan: There is no problem with the underlying blockchain technology of virtual assets.

- OKX will launch a signal strategy and has now opened a signal provider recruitment.

Lending:

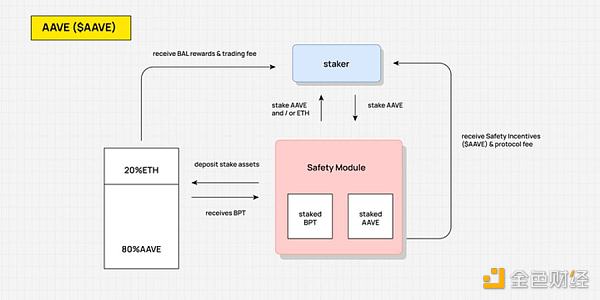

In DeFi lending protocols, tokens are mainly used for governance and collateral. In AAVE, users are incentivized to stake $AAVE in the safety module to receive security rewards and protocol fees.

How to draw a Value Flow

When researching Tokenomics, a large amount of information and numbers in project documents can be overwhelming. To extract key information related to Tokenomics, ask three questions: 1) How are protocol fees and token issuance allocated? 2) Who are the recipients of these incentives (LPs, lockers)? 3) Is there a flywheel, and how is it formed?

Tips:

Mark the generation of protocol fees/token release and connect them to different recipients; Connect participants and results (e.g., veToken holders -> token release); Use different colors to represent Pools, Tokens, participants.

We believe that Value Flow is a good foundational framework and tool for better understanding Tokenomics. Here we share it with you and encourage you to use our method to draw more Value Flows to decode new DeFi projects.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Messari: Interpreting the Success of the Blur Airdrop Model from a User Retention Perspective

- White hat disclosure: Huobi leaked OTC trading information, big account information, customer information, internal technical architecture, etc. on a large scale in 2021.

- Deep analysis of the latest vulnerability “Hamster Wheel” in Sui blockchain

- Analysis of the technical details and in-depth of the latest Sui vulnerability “Hamster Wheel”

- How to determine the quality of an X to Earn project’s economic model?

- Introduction to BRC20: Comparing Three Bitcoin Mnemonic Wallets

- Hong Kong Legislative Council releases “Development of Selected Places with Web3.0 Technology” (Full Text)