Q2 2023 Polkadot Research Report: Revenue Decline by 32% Quarter-on-Quarter

Q2 2023 Polkadot Research Report: 32% Decline in Revenue from Previous QuarterAuthor: Nicholas Garcia, MESSARI; Translator: Matsumi, Blocking

Key Insights:

OpenGov launched on Polkadot. The new fully decentralized governance model OpenGov introduces concurrent referendums, community-centered governance structures, and enhanced delegation flexibility, resulting in more efficient and transparent decision-making processes.

XCM V3 is officially launched. The new iteration of this messaging format introduces advanced programmability, bridging capabilities with external networks, cross-chain locking, an improved fee payment mechanism, and support for NFTs.

- Binance Research Report: 88% of institutional-grade users are optimistic about the long-term development of cryptocurrency assets.

- Consensys: Global Cryptocurrency and Web3 Survey

- LD Weekly Report: ETH Staking Rate Rises to 19.43%, Layer2 TVL Total Locked Amount Reaches $9.68 Billion USD

Polkadot’s native token DOT has not been labeled as a security by the SEC. The Web3 Foundation stated that DOT has undergone changes and is no longer considered a security after three years of discussions with the SEC.

Acala and Moonbeam released their parachain slots. The initial leases for the first batch of parachains will expire in October, indicating increased competition for slots as new projects seek to join and existing projects plan to re-sign.

Introduction to Polkadot

Polkadot is a nomination proof-of-stake (NPoS) blockchain network designed to support a variety of interconnected, application-specific layer 1 chains (referred to as parachains). Each chain built within Polkadot uses Blockingrity Technologies’ blockchain development framework Substrate, which allows developers to select specific components that best suit their particular application chain. Polkadot refers to the entire parachain ecosystem connected to a base platform called the relay chain. This base platform does not support application functionality but houses all validators and is responsible for securing, managing, and connecting parachains.

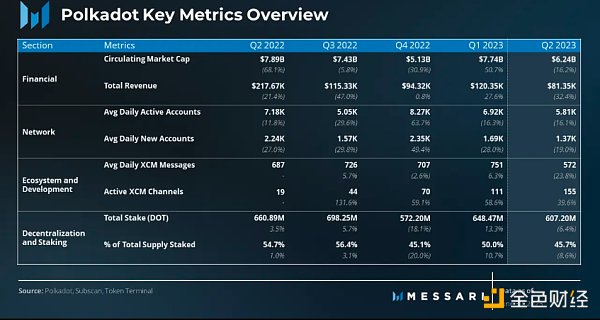

Key Metrics

(Overview of key metrics for Polkadot)

Introduction

The second quarter witnessed significant developments and events in the cryptocurrency industry, the largest of which were the lawsuits by the US Securities and Exchange Commission (SEC) against Binance and Coinbase. These lawsuits claimed that certain layer 1 tokens are securities; however, it is worth noting that Polkadot’s native token DOT was not on the SEC’s list. This omission was made after the Web3 Foundation declared that DOT underwent a transformation and is no longer considered a security after extensive discussions with the SEC.

Throughout the second quarter, Polkadot remained committed to the development and expansion of its network, demonstrating consistency in key network fundamentals such as staking, fund usage, and parachain activity. Notable milestones achieved during this period include the launch of OpenGov, the introduction of an advanced governance model, and the introduction of XCM V3 on the Polkadot mainnet. XCM V3 has already demonstrated an increase in use cases for XCM, with further growth expected in the future. In addition, the ongoing parachain slot auction leases re-signing has led to a surge in DOT bonding.

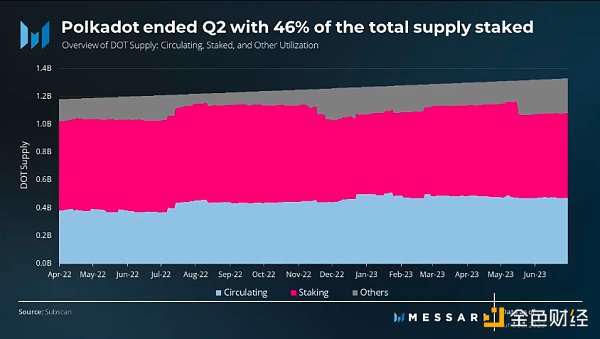

As of the end of the second quarter, Polkadot’s staking rate is 46%. This indicates that the amount of staked DOT is lower than the ideal staking rate, triggering an increase in staking rewards. At the current staking rate, the annual staking yield for DOT stakers is 16%, with an actual yield of 9%.

Treasury

(OpenGov’s launch will increase treasury usage)

Polkadot’s treasury raises funds through block rewards, validator slashing, transaction fees, and inefficient staking. Treasury funds are held in a system account and used for spending within a 24-day expenditure period, with any unspent funds being burned at a rate of 1%. It is worth noting that all financial expenditures are executed automatically on-chain, ensuring transparency and accountability.

In the second quarter, the Polkadot treasury supported various initiatives, including wallet upgrades and integrations, client upgrades, and community events such as meetups and hackathons. The launch of OpenGov on June 15 was a significant milestone, fundamentally changing financial management and supporting concurrent proposals with different requirements. The implementation of OpenGov is expected to increase treasury usage and bring significant benefits to the Polkadot community. As of the end of this quarter, the Polkadot treasury holds approximately 46.5 million DOT (240 million USD).

Accounts

(OpenGov should continue to promote relay chain activity)

Polkadot’s relay chain has several main functions, including protecting, managing, and connecting parachains. Therefore, its end users typically transact and use the network primarily through parachains. However, the relay chain does support some end user functionality, including token transfers, staking, validator elections, governance voting, and participation in parachain slot auctions.

Following the launch of OpenGov in June, account activity on the Polkadot relay chain increased. This surge can be attributed to the strengthening of governance activity, as the relay chain plays a critical role in facilitating the governance process. Throughout the second quarter, the average daily active accounts on the relay chain were 5,800, a 16% decrease from the previous quarter. As of the end of June, the entire Polkadot ecosystem has a total of 3.9 million unique accounts (public key addresses), an increase of 200,000 from the previous quarter and 600,000 since the beginning of the year.

It must be emphasized that relay chain activity does not represent the entire network activity. In order to have a comprehensive understanding of network activity, it is necessary to consider activity on parallel chains as well as XCM activity.

Developer Activity

As emphasized in the Electric Capital Developer Report, Polkadot has one of the largest developer bases in the cryptocurrency industry, with over 750 full-time developers and a total of 2,000 developers. The platform provides comprehensive developer support through its open-source technology stack, covering categories such as user interfaces, tools, APIs and languages, smart contracts, chains and trays, network maintenance tools, consensus, and networks.

To further develop its developer community, Polkadot has invested heavily in projects such as the Polkadot Blockchain Institute, which is planning its third training camp in Berkeley, California. The institute aims to provide engineers with Web3 technology skills. Additionally, the Polkadot Developer Heroes Program has been launched to foster collaboration and recognize outstanding developers. The Polkadot Developer Heroes Program has not yet announced a specific launch date.

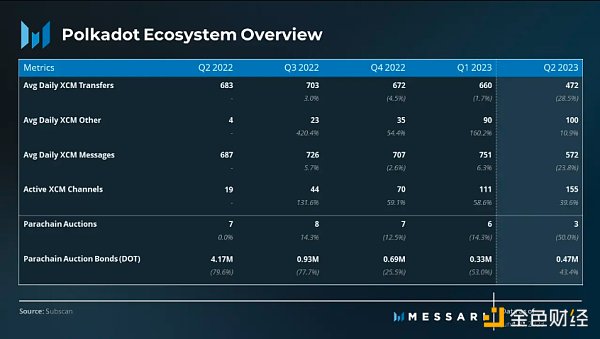

Ecosystem Overview

(Polkadot ecosystem overview)

Cross-Consensus Message Format (XCM)

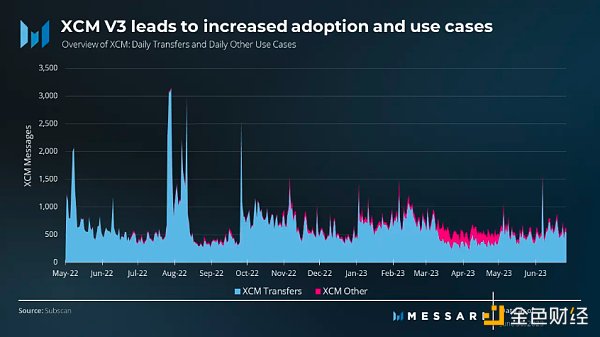

(XCM V3 Improves Adoption and Use Cases)

The Cross-Consensus Message Format (XCM) is a standardized message format and language that enables seamless communication between parallel chains and other consensus-driven systems. XCM plays a crucial role in facilitating interoperability and complex cross-consensus interactions. It allows blockchain to exchange messages, execute operations, and transfer assets, among other use cases.

The recently launched XCM V3 on June 15th has garnered significant attention. This new message passing format iteration introduces advanced programmability, bridging capabilities with external networks, cross-chain locking, improved fee payment mechanisms, and support for non-fungible tokens (NFTs).

XCM has already been of interest for various purposes prior to its launch, and this trend is expected to gain further momentum. Notably, non-asset transfer use cases account for 18% of the total XCM messages. Despite the decrease in total messages, the number of active XCM channels has increased from 111 to 155. Major XCM channels based on total transfer volume include Moonbeam <> Acala, Acala <> Moonbeam, Acala <> Blockingrallel, Interlay <> Moonbeam, and Blockingrallel <> Acala.

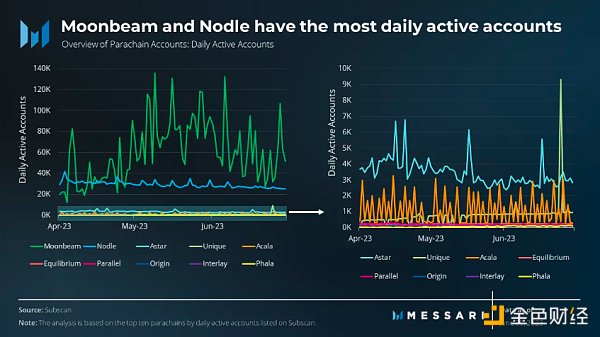

Parallel Chain Accounts

(Moonbeam and Nodle have the most daily active accounts)

When examining daily active users in the parallel chain, Moonbeam and Nodle are the clear leaders. After the launch of Uniswap V3 in June, Moonbeam’s activity surged, indicating continued excitement on the network. Nodle ranks second and is a decentralized wireless network for Internet of Things devices.

Astar ranks third in the parallel chain, followed closely by Acala and Unique Network. Astar recently announced details of Astar 2.0, an upcoming upgrade aimed at improving all aspects of the network, and the core development team announced a $3.5 million investment from Sony. Similarly, Acala launched the Acala Exodus program, which focuses on enhancing token economics, staking mechanisms, and introducing new infrastructure and features. Unique Network, which runs as a parallel chain optimized for NFTs, ranks fifth with 777 daily active users.

In the second quarter, the entire Polkadot ecosystem had an average of 295,000 active users per month, including external signers and token receivers.

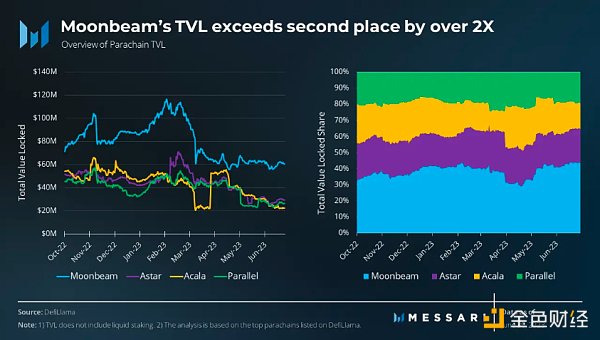

Parallel Chain TVL

(Moonbeam’s TVL is more than twice that of second place)

Like active accounts, Moonbeam is also the leader in TVL. Moonbeam’s TVL for this quarter is $60 million, more than twice that of the second-ranked parallel chain. The following three parallel chains, Acala, Astar, and Blockingrallel, all maintain a TVL of $20 million. The total TVL of the four major parallel chains is $140 million. However, it must be acknowledged that accurately determining this value is still challenging for all parallel chains.

When considering liquidity mining, the TVL pattern changes significantly. Blockingrallel becomes the protocol with the highest TVL, reaching $190 million, mainly driven by its liquidity mining platform. Acala is the second-largest protocol with a TVL of $170 million, also supported by its liquidity mining platform.

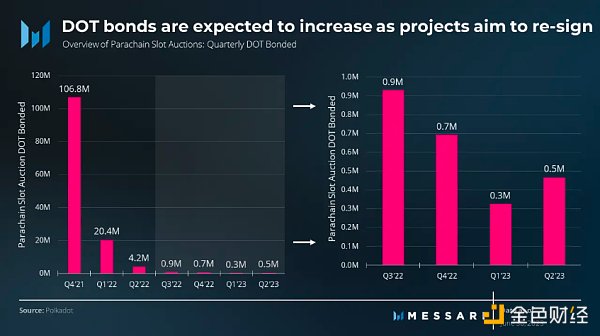

Parallel Chain Auctions

With the project re-signing, DOT bonds are expected to increase. The initial slot auction plan was for 41 auctions from November 2021 to March 2023, with new slot auctions held every two weeks. However, in the second quarter of 2023, after completing the first 41 slot auctions, the transition to monthly slot auctions was made, resulting in three slot auction winners in that quarter. Six slot auctions are planned for the third quarter.

In the second quarter, two of the three winners, Acala and Moonbeam, have re-signed. The initial leases of Acala and Moonbeam will expire on October 24th. Therefore, it is reasonable to expect that more original protocols, including Astar, Blockingrallel, and Clover, will try to win seats to extend their leases. The combination of existing projects seeking re-signing and new projects aiming to join the network will intensify competition and should lead to an increase in the amount of bound DOT.

The only new parallel chain this quarter is Moonsama. Moonsama is the first NFT market for generative NFTs on the Moonriver network. The platform facilitates the exchange of digital assets between on-chain and off-chain applications and is designed to integrate with various metaverse. The main features of Moonsama include an auto-battler-style combat engine and Moonsama multi-universe chat.

Finally, 467,000 DOT ($2.4 million) were staked in the second quarter of 2023, up 43% from the previous quarter.

Other ecosystem highlights

Mythical Games announced plans to migrate its Mythical Chain from Ethereum to Polkadot to launch the new Mythos ecosystem.

Kilt announced a partnership with Deloitte and Polimec to issue reusable KYC credentials.

Frequent and social media application MeWe announced a partnership to onboard its 20 million users onto the chain.

Composable Finance shared the launch of the Centauri IBC Bridge beta, allowing for bridging between Polkadot and Kusama and Cosmos.

Aventus Network and Beatport announced a partnership and plans to launch a music NFT market.

Energy Web announced plans to transition to Polkadot and launch a parallel chain.

Binance supports USDT deposits and withdrawals on Polkadot.

Throughout the second quarter, the number of active validators on Polkadot remained stable at 297 with no immediate plans for change. The validator reward model continues to demonstrate its effectiveness in promoting validator stake decentralization. Of the 297 validators, 97% (289 validators) maintain stake amounts of between 1.6 million and 2.2 million DOT.

The uniform reward distribution of the validator model incentivizes node operators to operate multiple validators. This strategy has been adopted by entities such as Coinbase Cloud with 12 validators, P2P.org with 18 validators, Zug Capital with 14 validators, and Jaco with 9 validators.

Staking

(46% of total supply staked at the end of Q2 for Polkadot)

As of Q2, Polkadot’s staking ratio is approximately 46%, equivalent to 607 million staked DOT out of the total supply. Although slightly below the ideal staking rate, the lower percentage will encourage staking rewards to increase in order to incentivize more participation in staking. Polkadot has maintained a stable staking percentage close to the ideal rate.

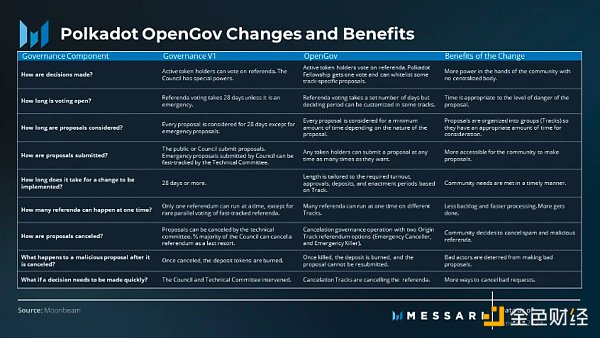

OpenGov

(Changes and benefits of Polkadot’s OpenGov)

Polkadot’s new governance model, OpenGov, has officially launched, marking an important milestone after months of anticipation. The referenda in the OpenGov system go through a structured lifecycle, including an import period for proposal submissions, a decision period for voting and approval, and a enactment period for implementation. OpenGov allows for multiple referenda to be conducted simultaneously, accelerating the passage of proposals. The number of proposals in OpenGov during the initial six months of operation on Kusama increased by over four times the previous year.

In the OpenGov system, the Council and Technical Committee are replaced by the Fellowship, which serves as a developer DAO, ensuring power decentralization through community voting and checks and balances. Additionally, the new model introduces delegation flexibility, allowing users to delegate voting power according to token amounts they believe in and commit to. These changes reflect Polkadot’s commitment to a more community-centered governance approach, promoting a more democratic and efficient decision-making process.

Conclusion

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Decoding Chainalysis research report: How retail traders, veterans, and institutions contribute value to exchanges?

- Unrest and Consequences of Centralized Communities: Reddit Protests in Progress

- Game Article: Key Points in Designing Economic Systems

- Huang Licheng sues online detective ZachXBT for defamation

- How to effectively hedge USDT risk on the chain when unexpected events occur?

- OKX Ventures Latest Research Report: Rethinking Oracles, Seeing the Seen and the Unseen

- Deep Experience Report: How to Layout Web3 Social Protocol Lens Protocol in Advance?