OPNX Development History Tokens soar by a hundredfold, becoming a leading bankruptcy concept?

OPNX Development History Tokens skyrocket, leading the bankruptcy concept.Author: Lisa, LD Capital

OPNX, formerly known as GTX, is an exchange launched in collaboration with Su Zhu, founder of Three Arrows Capital, Kyle Davies, and Mark Lamb, co-founder of CoinFLEX. It supports the trading of bankruptcy claims, spot, and futures derivatives, aiming to simplify the claims process and build a public market for claims transactions to unlock trapped capital. OPNX tokenizes bankruptcy claims for trading on the order book trading platform and allows bankruptcy claims to be used as collateral for contract transactions.

1. Development Timeline

June 2022: CoinFLEX, a cryptocurrency derivatives exchange, experiences a liquidity crisis and announces a suspension of withdrawals.

July 2022: CoinFLEX proposes a compensation plan for users, including issuing rvUSD (Recovery Value USD) representing the value of the debt, compensating users with CoinFLEX shares and locked FLEX tokens, and further distributing existing funds. The displayed price of rvUSD on OPNX is currently $0.15, with no trading volume since August.

- Weekly Announcement | OKX platform upgrades KYC process and recommends users to complete advanced authentication; Avalanche (AVAX) will unlock tokens worth approximately $100 million.

- LianGuai Daily | The SEC files a motion for intermediate appeal regarding the Ripple case; friend.tech completes seed round investment, with LianGuairadigm participating.

- Content Marketing Methodology A Required Course for Web3 Startups

August 2022: CoinFLEX applies for restructuring in the Seychelles court. The restructuring plan is approved with nearly 99% support, granting creditors 65% of the company’s shares, allocating 15% of shares to the CoinFLEX team, and allowing B-round investors to continue as shareholders of the restructured company.

January 16, 2023: The Block reports that Su Zhu and Kyle Davies, in collaboration with CoinFLEX, plan to raise $25 million for a new cryptocurrency exchange called GTX.

March 7, 2023: @DefiIgnas tweets that GTX has completed a $25 million financing, which is confirmed by Su Zhu’s retweet. @DefiIgnas also mentions in the same thread that OPNX will acquire all assets of CoinFLEX, including personnel, technology, and tokens. FLEX will be their main token, and there may be a brand reshaping similar to AAVE/LEND.

March 9, 2023: GTX is renamed Open Exchange (OPNX).

April 4, 2023: Open Exchange (OPNX) announces its official launch, supporting cryptocurrency spot and derivatives trading. On the first day of launch, there were only two transactions with a trading volume of only $1.26.

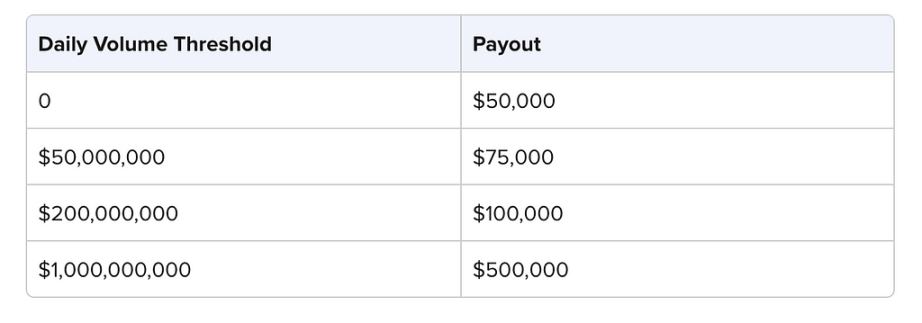

April 8, 2023: Open Exchange (OPNX) announces the launch of the Market Maker Program to incentivize liquidity for market makers. There are two main incentive methods:

1. Up to 200 VIP market makers can receive a subsidy of $5,000 per month.

2. Incentives ranging from $50,000 to $500,000 per month based on trading volume.

April 21, 2023 OPNX tweeted that its investors include AppWorks, Susquehanna (SIG), DRW, MIAX Group, China Merchant Bank International (CMBI), Token Bay Capital, Nascent, Tuwaiq Limited, etc. However, the next day, DRW, Nascent, MIAX, and Susquehanna (SIG) all denied investing in OPNX. AppWorks officially tweeted that it did not invest funds in OPNX, but rather its investor equity in CoinFlex was transferred to OPNX. It is reasonable to speculate that these investors are all investors in CoinFLEX and their equity was passively converted to OPNX after the restructuring, misleadingly described as strategic investors in the new project.

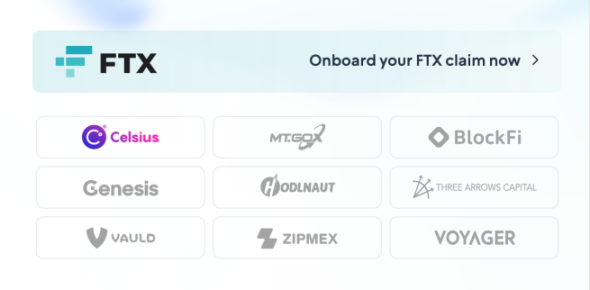

May 2, 2023 Open Exchange (OPNX) announced a partnership with real-world asset (RWA) tokenization service provider Heimdall to launch a claims trading market. Heimdall will manage the verification, transfer, and tokenization of real-world assets for OPNX users. After verification, all claims will be transferred and held in dedicated special purpose vehicles (SPVs) for each platform. Tokens will then be issued against the SPVs and credited to the accounts of claimants. The claim tokens reflect proportional ownership stakes in the claims held by the SPVs.

June 1, 2023 Open Exchange (OPNX) launched the governance token OX and the corresponding governance platform The Herd. OX offers five options for staking durations: 2 weeks, 1 month, 3 months, 6 months, and 1 year. Similar to Curve, the longer the staking duration, the more voteOX tokens are obtained, and the larger the corresponding staking rights.

June 4, 2023 OPNX announced the launch of its debt trading feature.

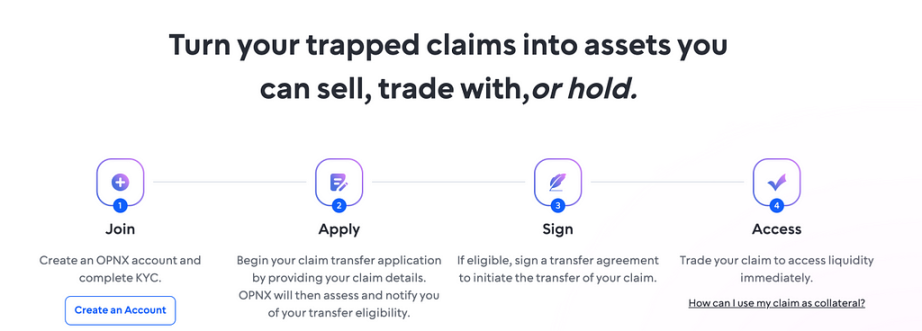

According to OPNX’s operation instructions, tokenizing debt for trading requires three steps:

1. Create an OPNX account and complete KYC

2. Provide detailed information about the debt and submit a debt transfer application

3. Sign a debt transfer agreement

After completing the above steps, you can trade debt tokens on OPNX.

The platform currently supports bond trading for Celsius and FTX, but there is little trading volume.

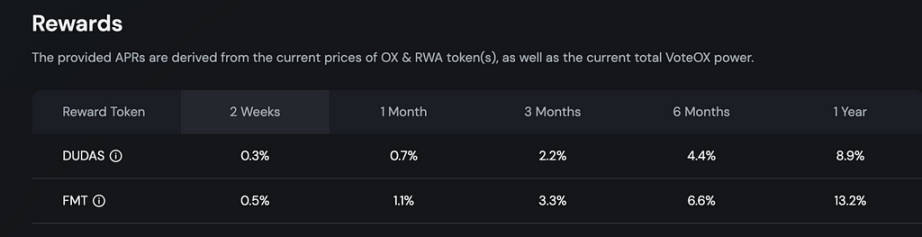

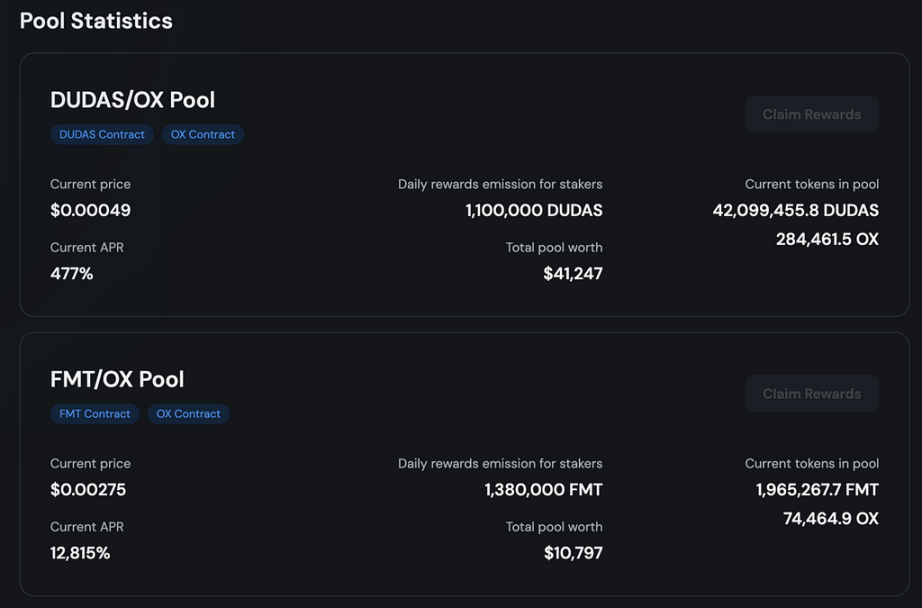

June 12, 2023 OPNX introduced Justice Token, a series of tokens issued based on certain risk events. Each token has a total supply of 1 billion, of which 75% will be distributed to OX stakers within 6 months, 20% will be allocated to JT-OX liquidity providers, and 5% will be allocated to the Milady community. The whitepaper explicitly states that Justice Token is a meme token with no intrinsic value, no underlying value support, and no expected return. Currently, two Justice Tokens, DUDAS and FTM, have been launched, with annualized returns of 8.9% and 13.2% for OX stakers, and the total liquidity pool for both tokens is only $40,000 and $10,000, respectively.

June 24, 2023 OPNX announced the launch of oUSD, a credit currency that can be exchanged 1:1 with USDT. oUSD can be used as collateral and all profits and losses in futures trading will be denominated in oUSD. Profitable traders will have positive oUSD balance and can convert oUSD profits into USDT through the oUSD/USDT trading pair. Traders with negative oUSD balance (need to pay interest) can repay the negative oUSD balance by purchasing oUSD. When the price of oUSD is higher than 1 US dollar, users have the incentive to sell oUSD, and when the price of oUSD is lower than 1 US dollar, users with negative oUSD balance have the incentive to buy and repay the borrowed position at a cheaper price to maintain the stability of the oUSD price.

June 25, 2023 OPNX announced the launch of the first LaunchLianGuaid project, Raiser (RZR), an unsecured lending market. All OX pledgers share 10% of the RZR supply allocation. The product is not yet live. RZR was launched on OPNX on July 17th with an initial price of 0.164 USDT, but there has been no trading volume so far. RZR has about 250k liquidity on Uniswap, and the daily trading volume is around $10,000.

July 26, 2023 After the first launchLianGuaid project, OPNX announced its second LaunchLianGuaid project, Gameplan, a new sports metaverse enterprise by UFC champion Khabib Nurmagomedov. The investment is led by 3AC Ventures, and some GPLAN tokens will be distributed to OX pledgers. Users can have tokens of their favorite sports teams and contribute to the decision-making process of team management, strategy, and other related matters through token voting. Gameplan currently only has Twitter and Discord and does not have an official website or whitepaper.

August 6, 2023 According to Bloomberg, OPNX has proposed injecting the equivalent of $30 million in FLEX digital tokens into the bankrupt Singaporean crypto lending platform Hodlnaut.

2. Token Economy

1. Total Supply

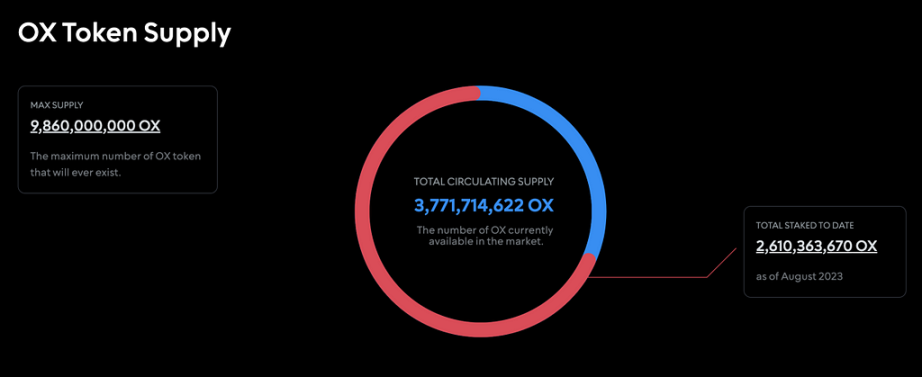

The total supply of OPNX’s platform token OX = (Total supply of FLEX – FLEX burned) * 100

9.86B = (100M – ~1.4M) * 100.

The current OX staking rate is about 70%.

2. Token Utility

- Transaction fee refund

OX allows users to trade for free by staking. If the staked OX amount held by the trader is equal to or greater than their total OPNX trading volume, they will receive a 100% refund of transaction fees. Stakers who exceed the free trading limit will receive a 50% refund of transaction fees on the remaining amount. All transaction fee rebates are paid in OX to token holders.

- Transaction fee discount

Unstaked ox users can also receive up to 50% transaction fee discount.

- Staking to receive OPNX LaunchLianGuaid & Justice Tokens airdrop rewards

- Used as collateral for futures trading

Significantly reduce the tokenization cost of RWA.

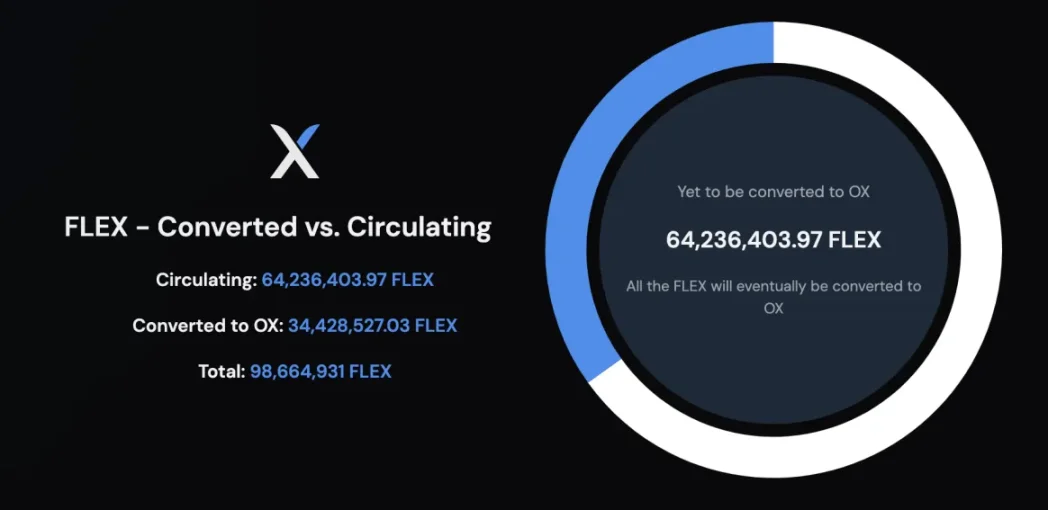

3. $FLEX-$OX Conversion

$FLEX can choose to convert $FLEX to $OX at a ratio of 1:100. If a three-month lock-up period is chosen during the conversion, a 25% bonus will be received. The preferential exchange ratio of 1:125 will end on August 28, 2023. Currently, about 35% of $FLEX has been converted to $OX.

The theoretical price ratio of FLEX:OX should be 100:1. Due to the one-way conversion mechanism, the price of FLEX should not be lower than that of OX. When the price of FLEX is lower than this ratio, users tend to convert it into OX to bring the price of FLEX back to this ratio. When the price of FLEX is higher than this ratio, users are less likely to choose to convert, but arbitrage actions cannot be completed because OX cannot be converted back to FLEX.

https://ox.opnx.com/flex-statistics

III. Price Performance

- In June 2022, after CoinFLEX announced the suspension of withdrawals, flex plummeted;

- In January 2023, after the news of GTX financing came out, Flex revived and the price entered an upward channel, reaching a high of $2.8;

- In early April 2023, Open Exchange (OPNX) officially launched, with poor business data, only two transactions on the first day of launch. After Flex was listed on OPNX, it plummeted, with a lowest drop of over 70%;

- On June 1, 2023, OX was launched, and FLEX and OX jointly entered an upward channel again. On June 5, there was a significant increase, with two launchLianGuaid messages bringing about 33% and 14% increases respectively. It has increased by hundreds of times since the beginning of the year.

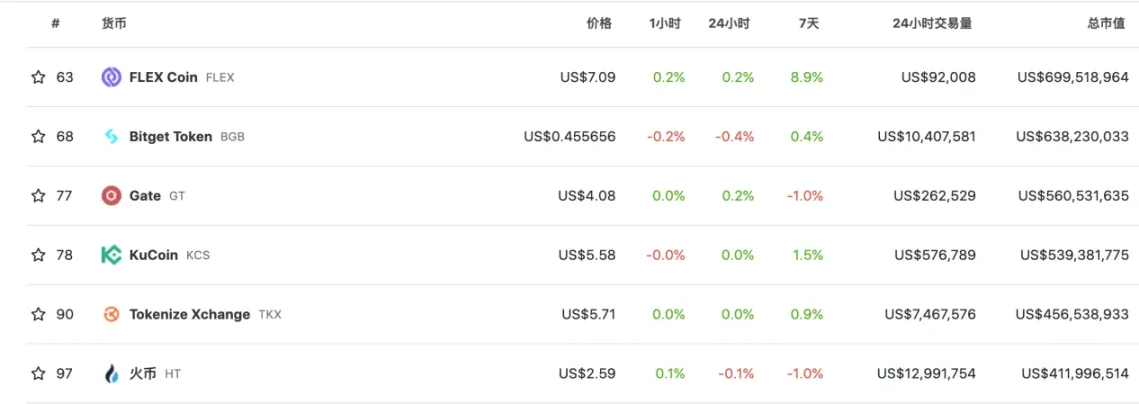

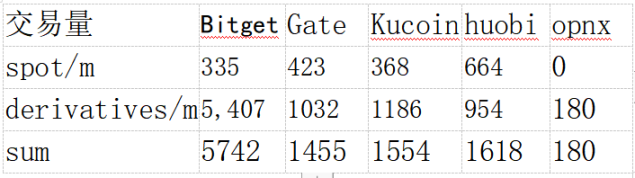

In terms of total market value, OPNX is close to $700 million, surpassing Bitget’s $640 million, Gate’s $560 million, Kucoin’s $540 million, and Huobi’s $410 million.

Source: coingecko

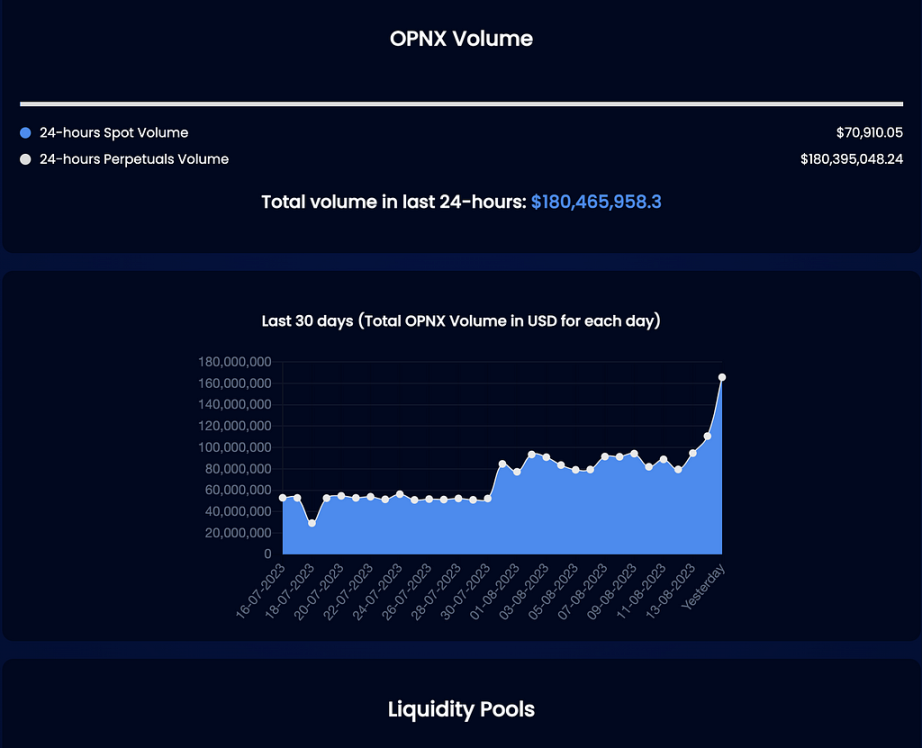

In terms of business data, OPNX’s daily trading volume has rapidly grown from single digits to over $100 million, with the majority of the trading volume happening in contract trading. The spot trading volume data is only shown as tens of thousands of dollars, which is far lower than Bitget, Gate, Kucoin, and Huobi. At the same time, OPNX’s trading data shows inconsistent volume and price fluctuations, raising doubts about the authenticity of the data.

Four, Debt Trading Track

The other two major players in the encrypted debt trading market are Xclaim and Claims-Market.

Xclaim was established in 2018 with the aim of providing transparent pricing and fast execution for crypto claimants. Founder and CEO Matthew Sedigh has 15 years of experience in the corporate restructuring industry. Currently, Xclaim offers debt trading for 5 bankrupt platforms including Genesis, FTX, BlockFi, Celsius, and Voyager, with discounts ranging from 20% to 40%. There have been 1,070 transactions with a total amount of approximately $356 million. The trading mode is mainly case by case.

https://www.x-claim.com/trade

Claims-Market is a claims product owned by investment bank Cherokee Acquisition, targeting all users of debt trading, not just crypto. The approximate process of the transaction is that the seller signs the Seller Agreement and Simple Assignment of Claim (SAC) and lists the debt rights held; the buyer signs the Buyer Agreement and chooses the appropriate offer or bid; when the transaction is reached, the signed Simple Assignment of Claim and all evidence are sent to the buyer to confirm ownership. Claims-Market also formulated the Simple LianGuaiss Through Assignment (SPTA) to facilitate secondary trading of claims. According to data from the platform, debtors have sold $190 million in debt through 294 transactions.

https://claims-market.com/transactions

On the product side, OPNX is trying to create a high liquidity standardized order book market and debt collateral function that the first two do not have.

Five, Summary

From the perspective of product conception, OPNX is the most complete and comprehensive in the debt trading track, but from the perspective of actual operation, the trading volume of tokenized debt is very low, and listing on FTX has not brought a turning point for it. The development of OPNX’s main debt trading is facing challenges and needs to be breakthrough; at the same time, OPNX frequently launches various empowering initiatives, and there is a constant stream of positive news, but the quality of the launchLianGuaid project has been criticized; in terms of valuation, OX has a higher premium compared to other exchange platform tokens.

Reference

https://support.opnx.com/en/articles/7235394-market-maker-program

https://opnx-public-files.s3.ap-northeast-1.amazonaws.com/pdf/oUSD+LiteLianGuaiper.pdf

https://www.bitpush.news/articles/3592124

https://www.theblock.co/post/202589/3ac-zhu-davies-new-crypto-exchangehttps://ox.opnx.com/#

https://opnx.com/ox-white-LianGuaiperhttps://ox.opnx.com/justice_tokens.pdf

https://twitter.com/OPNX_Official/status/1653128166326652929

https://flexstatistics.com/

https://coinflex.com/blog/coinflex-update-july-22-2022CoinFLEX Update: January 16, 2023

Translated:

https://opnx.com/ox-white-LianGuaiperhttps://ox.opnx.com/justice_tokens.pdf

https://twitter.com/OPNX_Official/status/1653128166326652929

https://flexstatistics.com/

https://coinflex.com/blog/coinflex-update-july-22-2022CoinFLEX Update: January 16, 2023

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Regulatory crackdown, slowed growth, Binance suffers two major setbacks.

- DeBank plans to launch Layer2, and the wool party has already taken action?

- Mining myself, mining out a 50% annualized return? Interpreting the Ve (3.3) game hidden behind the emerging star RDNT in the borrowing and lending market

- Cryptocurrency Track Weekly Report [2023/08/14]

- Deep analysis of ARB on-chain chips Users continue to increase their holdings, and most large holders are at a loss.

- Exclusive|Interpreting the draft guidance principles of Taiwan’s Financial Supervisory Commission Can’t use the slogan To The Moon anymore?

- Depth Latest analysis of asset risk assessment for stablecoin TrueUSD (TUSD)