Analysis: Why pay attention to the challenge of stable currency to sovereign currency?

Recently, Chen Yulu, deputy governor of the People's Bank of China, said that more and more central banks and monetary authorities have started to pay attention to the challenges of public policies such as currency stability, capital control, and payment system supervision.

European Central Bank President Christine Lagarde expressed similar concerns in a recent letter to members of the European Parliament. Lagarde believes that stablecoins may lead to a highly concentrated market: controlling large digital platforms to prevent other entities from entering, and combining social media with financial data to strengthen competitive advantages. The development of a stable currency of a certain size may cause users to transfer funds from the banking system to the non-banking system, and these areas are not in the traditional financial risk protection system.

What "mana" does stablecoin have, and will cause more and more attention from central banks and monetary authorities?

What is a stablecoin?

- What kind of development will the crypto world usher in in 2020? Talk about three low-key product trends

- 8 Questions | Luo Mei, Tsinghua University: The most knowledgeable person in the field of accounting, the most knowledgeable person in the field of blockchain

- Against the halving market, 6500 at the end of this year is 3200 at the end of last year

Stablecoin is a cryptocurrency that uses fiat currencies, crypto assets or commodity currencies as collateral for issuance, or uses algorithms to control the supply of money. The issuer is an individual or the private sector. The word stable is relative to volatile cryptocurrencies such as Bitcoin and its alternatives.

The emergence of stablecoins is closely related to the sharp fluctuation of private cryptocurrency prices and excessive speculation. Bitcoin, Ethereum, Ripple, etc. have lost the possibility of being used as a practical means of payment due to large price volatility and high and low values. The holders more often treat them as an investment object, which is inappropriate. Act as a means of circulation and a store of value. For example, at the beginning of 2018, the total market value of cryptocurrencies reached an all-time high of US $ 800 billion, but only US $ 200 billion after six months. To ease the volatility of the cryptocurrency market, different kinds of stable currencies have been introduced.

There have been more than 200 stablecoin projects publicly announced by the private sector since the beginning of 2017, but in fact, more than 60 were actually launched and actively circulating, half of which were developed in Ethereum (ConsenSys, 2019). Well-known stablecoins include Tether, Libra, USDCoin, Gemini Dollar, etc.

What are the types of stablecoins?

CPMI and BIS reports: "Stable coins have many characteristics of crypto assets, but they try to stabilize the price of 'coins' by linking the value of' coins' to the value of the funding pool. '" (G7 work report, 2019) The stable currency is called the bridge connecting the real world and the virtual world. It has both the security of cryptocurrency, anonymity and global free payment mechanism, and the stability of fiat currency.

However, this statement only applies to traditional asset-backed stablecoins.

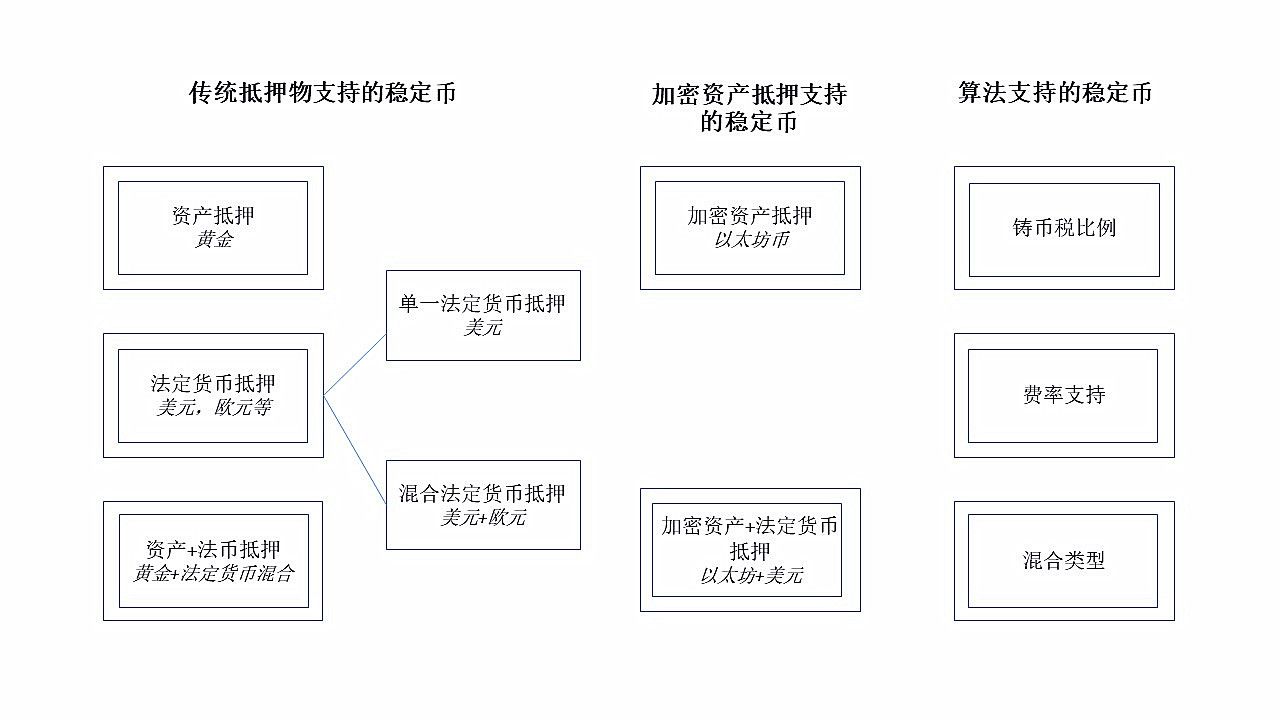

The anchoring methods of stablecoins are classified into traditional assets, crypto assets and algorithms according to the nature and form of the mortgage (see the figure below). Among them, asset-based mortgages (including traditional and crypto assets) accounted for 77%, which is an absolute advantage in stablecoins.

Source: Blockchain

The specific definitions of the above types of stablecoins have been explained in various reports and articles, and will not be repeated here. The following only explains some fiat currency mortgage stablecoins.

Fiat currency mortgage type: This type of stable currency is the earliest and most common stable currency in the market. Its currency value depends on the value of the fiat currency that is mortgaged, and has the following characteristics:

The value of the currency is linked to one or more currencies at a fixed ratio, the most common being the US dollar accounting for 66% , followed by the Euro and the Swiss franc, the Japanese yen, etc .;

The mortgaged assets are kept by a financial entity supervised by a third party, and they can be protected from hackers if they are not on-chain;

Can be traded on an exchange and redeemable from the issuer.

Taking the Tether (USDT) as an example, each Tether issued is anchored 1: 1 with the U.S. dollar, that is, each time a user purchases a Tether, the Tada Company will add one dollar of capital to its account. When the user exchanges the Thai currency back to the US dollar, the company will destroy the corresponding stable currency and pay a 5% handling fee. This issuance is very similar to modern banknote issuance, with physical objects (precious metals, later developed into securities, etc.) as collateral. This anchoring method is not on the blockchain and avoids potential hacking attacks. Mortgage conversion is a stable US dollar, so it is very popular. Since its introduction in 2015, it has attracted a large number of investors, and its market value accounts for 93% of the total value of the stable currency. %, Out of more than 50 stablecoin-listed exchanges in the world, 46 exchanges have Tether listed, which has now become the second largest active cryptocurrency. But often because of the lack of financial transparency of the company, it has been questioned that the privately issued additional USDT profit. Some insiders also reported that each TEDA had only $ 0.74 in cash and cash equivalent guarantees.

What are the uses of stablecoins?

From the current point of view, stablecoins are mainly used by cryptocurrency investors for cryptocurrency investment and hedging risks, that is, to buy other cryptocurrencies with stablecoins on exchanges that do not accept fiat currencies, and convert to stablecoins when the price of cryptocurrencies fluctuates sharply Hedging. Blockchain firmly believes that eventually stablecoins can be used for financial transactions such as remittances, loans, and payments, but some analysts and investors believe that due to the lack of a financial network that can accept and use stablecoins, the actual use of stablecoins is in addition to cryptocurrency transactions. There are basically no other practical use cases.

Why pay close attention to stablecoins

Although stablecoins have existed for a long time, the real attention and widespread attention of monetary authorities in various countries began after the release of the "Libra" white paper.

Unlike other stablecoins that are small and have limited participation, "Facebook's Libra is different in that it is an active user network that represents more than one-third of the global population and also issues a basket of sovereign currencies. An opaquely connected private digital currency. "(Lael Brainard, 2019) Libra's basic participation volume, global scale, and complexity of participants are unprecedented in stablecoins that have been issued, which has caused it It is taken for granted that all parties pay great attention.

The emergence of stablecoins has indeed provided some imagination and possibilities in terms of reducing payment costs, improving the efficiency of cross-border payments, improving the construction of payment systems in underdeveloped countries, and providing new investment channels. However, before its public policy and regulatory risks are assessed and properly resolved, its rush into the financial field is likely to have a great impact on the payment system, financial stability, and monetary policy, weakening capital controls and impacting national currencies. Negative effects of sovereignty and strengthening the hegemony of the dollar:

Payment and settlement market monopoly: represented by Libra, its management entity Facebook controls a large digital platform of 2.7 billion users, plus the possibility of combining social media data with financial data, which will bring stablecoin operators a powerful Competitive advantage undermines the environment for fair competition in the market, resulting in a situation in which a family is dominated and unrivalled. The threat posed by technology giants cannot be ignored.

Financial market price volatility: The stablecoin represented by Libracoin, with its unique bridge function, links the real and virtual currencies, resulting in the free flow of funds into and out of the financial markets of regulated economies, exacerbating domestic asset price volatility , Affecting the financial stability of a country. In the absence of unified supervision and lack of laws at present, there is no guarantee for stablecoin's mortgage management, redemption mechanism, and market operation risks, which may bring systemic risks such as runs.

Substitution of national currency sovereignty: For economies with weak currencies, high inflation rates, and weak institutional control, stable currencies that are free to enter and leave and are known to have exchange guarantees are likely to bring about new dollarization. For example, in Venezuela, which has experienced hyperinflation in recent years, the country's fiat currency, Bolivar, has shrunk by 10% every day. The country ’s increasing inflation has led to increased use of Bitcoin and other cryptocurrencies in the region. From August to December 2018, the number of merchants that accepted cryptocurrency payments increased from more than 1,000 to more than 2,500. From officially issued petroleum coins to various private cryptocurrencies, national currency sovereignty has disappeared. In May 2019, the stablecoin project Reserve invested by Bitcoin company Coinbase announced the launch of the stablecoin Reserve Dollar (RSD) in Venezuela and Angola (should be a stablecoin guaranteed by the US dollar). .

"Same business, same risk, same rules" (Christine Lagarde, 2019), which is the regulatory guiding principle that national authorities should adhere to in the face of the shock of stablecoins.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Miner prices fluctuate more than currency prices? Two things to understand before understanding the trend

- Dry goods: how to profit by “moving bricks” in the cryptocurrency market?

- Bitmain's three-line axe bets halving the market, and the mining industry behind the gamble needs to turn around?

- Subway Line 1 "Code" is about to open! Lanzhou applies blockchain technology to access two-dimensional code of rail transit

- R3, IBM, JP Morgan Chase grab Singapore, seize new fortress of blockchain trade finance

- Babbitt Live | Guo Yu: 3 minutes to understand zero-knowledge proof, why is it a double-edged sword?

- US SEC postpones ruling on another Bitcoin ETF proposal, how is this proposal different than in the past?