Analyzing the two pairs of rivals – Sushiswap and Uniswap, LooksRare and OpenSea, explaining what vampire attacks are.

Analyzing rival pairs Sushiswap and Uniswap, LooksRare and OpenSea, and explaining vampire attacks.Definition of Vampire Attack

The concept of “vampire attack” in the cryptocurrency market is very simple. It refers to an attack where the attacker creates a protocol that is similar to or identical to the target protocol and provides more profitable and attractive incentives, in order to attract the target’s market share or users to their own side, thus “sucking” them away.

Let’s further understand this concept through two examples.

SushiSwap vs. Uniswap

SushiSwap can be considered the original and most famous “vampire” in the cryptocurrency market, with Uniswap as its target.

Weaknesses of Uniswap

Uniswap is an open-source decentralized exchange (DEX) based on automated market makers (AMMs). During the DeFi Summer of 2020, Uniswap enjoyed the market’s benefits and, with the launch of Uniswap V2, its total value locked (TVL) increased from $70 million in June to $300 million by the end of August, making it one of the leading players in the DEX space.

- Analysis of the current status of the four mainstream Layer2 solutions Arbtrium occupies more than half of the market share, while Zora’s monthly number of creators has increased by over 97%.

- LianGuai Morning News | Bitcoin network fees increased by 40% this week, with an average of 30 BTC per day.

- Fuel NFT and Market Ecosystem Inventory

However, Uniswap had vulnerabilities in its development path. At that time, it did not have a governance token or change its incentive mechanism as the platform grew. The only reward for liquidity providers was transaction fees, which was a major weakness for the platform. While liquidity providers supported the platform’s operation and bore impermanent loss, they could not gain more benefits as the platform rapidly grew. It was at this time that a developer named “Chef Nomi” seized this weakness.

Innovation of SushiSwap

Nomi created SushiSwap, which was essentially a simple fork of Uniswap. The notable feature of SushiSwap was the combination of a governance token (SUSHI) and liquidity staking rewards.

As a governance token, SUSHI also served as a platform token. In SushiSwap, 0.25% of the transaction fees in the pools were directly distributed to active liquidity providers, and 0.05% was converted into SUSHI and allocated to SUSHI holders (essentially a buyback mechanism). This meant that liquidity providers not only received a share of the platform’s transaction fees but also received token rewards.

Now, here’s the key point: SushiSwap stipulated that SUSHI would only be rewarded to users who provided liquidity in the form of Uniswap LP tokens. In other words, this was a way to attract Uniswap users to participate in SUSHI mining.

The “Sucking” Process

SushiSwap’s staking contract and SUSHI distribution began on August 28, 2020. The initial rewards were extremely aggressive, with an initial annual interest rate of 1000%. Under such incentives, users rushed to deposit their assets into eligible pools on Uniswap (including pools like USDC/ETH, SUSHI/ETH, and 13 others) and exchanged them for Uniswap V2 LP tokens, which were then quickly invested in the SushiSwap contract.

After 100,000 blocks (approximately two weeks), SushiSwap initiated liquidity migration, which involved transferring all Uniswap LP tokens to SushiSwap and exchanging the corresponding token pairs on Uniswap. The tokens were then used to initialize new SushiSwap liquidity pools. By the end of the migration, SushiSwap had accumulated approximately $800 million in tokens, accounting for about 55% of Uniswap’s liquidity at the time, while Uniswap’s total value locked (TVL) plummeted by approximately $400 million.

In retrospect, SushiSwap forked Uniswap’s architecture and introduced new reward mechanisms, creating an image of being “based on Uniswap but better than Uniswap.” Incentivized users flocked to transfer their funds to SushiSwap. Although Uniswap ultimately weathered the storm and launched its own token, UNI, SushiSwap still succeeded by quickly accumulating a significant amount of liquidity through its vampire attack strategy, securing its position among the top DEX platforms.

LooksRare ? OpenSea

Last year, the NFT market also experienced a vampire attack initiated by LooksRare against OpenSea.

Weaknesses of OpenSea

OpenSea is a comprehensive NFT trading platform where users can buy and sell various forms of NFTs, including encrypted artworks, game items, virtual properties, domain names, and financial products. The platform supports ERC-721 and ERC-1155 formats of NFTs. The platform charges a 2.5% fee for secondary transactions and up to 10% for primary minting.

As a dominant player in the NFT trading platform space, OpenSea has garnered the majority of the market share but has also received negative feedback from many users. The criticisms include inconsistent payment methods (users frequently need to convert between ETH and WETH for different types of purchases) and high transaction fees. The main issue stems from OpenSea’s highly centralized organizational structure and heavy reliance on traditional capital, making it insufficiently decentralized and not fully aligned with Web 3.0 principles.

Innovations by LooksRare

LooksRare, launched in January 2022, is also an NFT trading platform. It has learned from OpenSea’s experience and made some innovations, including:

-

Allowing hybrid payment using ETH and WETH. On the LooksRare platform, both can be used for bidding and payment.

-

Supporting series offers. This design optimizes the buyer experience for those who prioritize NFT series themes rather than specific details of each individual piece, as they do not need to list each item separately.

-

Most importantly, upgrading the fee and incentive mechanism. LooksRare charges a 2% fee on all transactions and distributes these fees among the stakers of LooksRare’s native token. The platform aims to challenge OpenSea’s dominance in the NFT space by distributing fees to the community.

This operation looks familiar, doesn’t it? This is the core idea of vampire strategy: target the weaknesses of a top project, prescribe the right medicine, better attract and control users.

“Vampire” Process

LooksRare’s specific vampire process is even more straightforward.

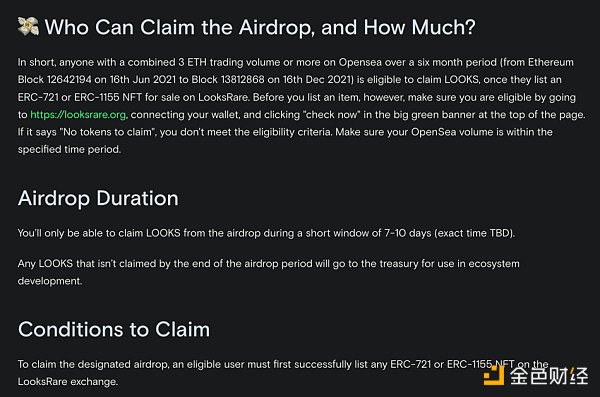

Through system screening, it identifies the big NFT traders on OpenSea (with a cumulative transaction volume of over 3 ETH in the past six months) and directly includes these big traders on its native token LOOKS airdrop whitelist. However, if these big traders want to claim LOOKS, they must first complete a transaction of 1 NFT on LooksRare.

This vampire method directly transforms many OpenSea users into traders on LooksRare, causing LooksRare’s market cap to soar to $1 billion and LOOKS price to rise to around $7, reaching a high of $7.1.

Summary

For project teams, vampire attacks are like a blow to the bottom of the pot, bringing volatility risks to the market. But from the perspective of the entire crypto market, this sharp confrontation between projects may also be a good thing—it gets the projects stirred up. In this regard, vampire attacks not only bring possibilities for improving user experience but also help alleviate the market centralization risks of monopolistic projects dominating users and market share.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Will the arrival of various ‘X’ RC-20 standards be the future of Bitcoin?

- Bitfinex Cryptocurrency market funds outflow reached $55 billion in August.

- Under the bold political reforms, can El Salvador, which embraces Bitcoin, replicate Singapore’s successful path?

- Comprehensive Analysis of Bitcoin ETF

- Exclusive Interview with Yuga Labs We are more like Tencent of Web3, constantly changing the rules of NFT games

- Binance Labs Five Key Points to Help You Achieve Product-Market Fit

- Permissionless II Bear Market Conference Explores Opportunities in the Cryptocurrency Field