Analyzing 4 Potential Narrative Directions in the Future Cryptocurrency Market

4 Potential Narrative Directions in Future Cryptocurrency MarketAuthor: Poopman, Source: Author’s Twitter @poopmandefi; Translation: MarsBit

The next narratives will come from products that address current market pain points.

These narratives include:

1️. Re-staking

- Long Push Analyzing the 4 Potential Narrative Directions of the Future Cryptocurrency Market

- a16z Interviews Solana Co-founder People should strive to create greater ideas rather than repeat what already exists.

- An In-depth Analysis of the Bitcoin DA Adapter Solutions Chainway and Kasar Labs Does Bitcoin Need ZK Rollup?

2️. De-AI

3️. Shared Sorter

4️. Gamble-Fi ($RLB)

In this article, I will briefly outline my favorite four narratives and provide actionable insights.

You can jump to actionable insights in the following links:

Without further ado, let’s get started.

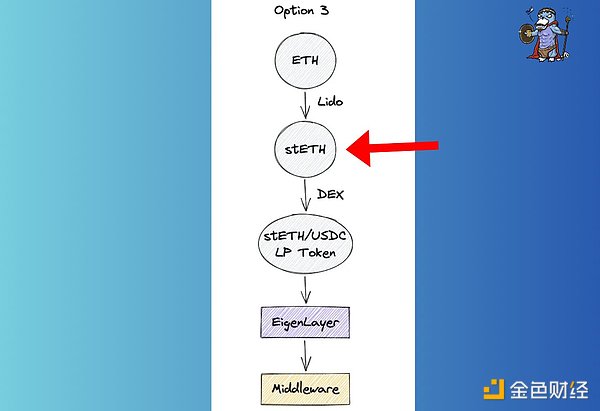

1. Re-staking

Since the Shanghai upgrade, liquidity staking has experienced exponential growth and has become the largest category, with a TVL of around $20 billion.

@eigenlayer takes advantage of this trend and has introduced re-staking.

Re-staking allows stakers to deposit LST and choose to earn additional rewards using the same underlying assets.

While stakers can benefit from the capital efficiency of staking,

the protocol can also enjoy a more secure environment with Eigenlayer’s pooled security.

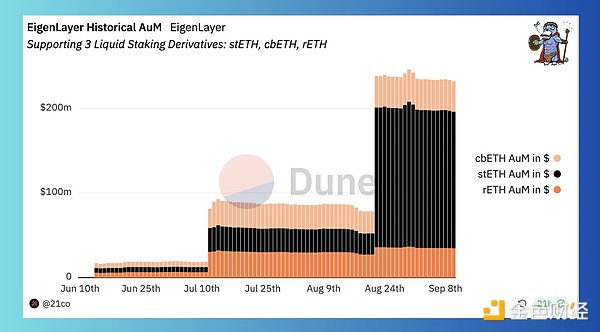

So far, @eigenlayer’s TVL has reached $232 million and has set a hard cap.

Looking ahead, I expect Eigenlayer’s TVL to continue rising as more innovative protocols join the ecosystem, attracting more trading volume and liquidity from the market.

The influx of liquidity will make it increasingly attractive to new protocols (such as @EspressoSys) to leverage Eigenlayer’s growing liquidity.

Ultimately, this can create a positive feedback loop and, optimistically speaking, push Eigenlayer’s TVL to higher levels.

Feasibility:

I am confident that Eigenlayer will generate significant revenue from staking/opt-in.

So as a retail investor, what can you do to participate in Eigenlayer?

Strategy 1:

When Eigenlayer raises the cap again, you can stake stETH/cbETH/rETH to earn staking points and rewards (but bear the risk of ETH price decline).

Strategy 2:

Once the following projects go live, re-stake and join them:

@puffer_finance

@EspressoSys

@witnesschain

@AstridFinance

2️. De-AI

In Web2, AI training is very expensive, ranging from $3 million to $12 million.

Issues such as data concentration, monopolization (controlled by large companies like Google and Amazon), and hardware limitations may hinder the development of AI.

De-AI (decentralized AI) is a potential solution to these problems.

To understand De-AI, we first need to understand the key components of traditional ML.

An ML model can be divided into 4 parts:

Data input

Data training

Data storage

Data service

In the Web3 environment, each component can be decentralized.

Why do we need decentralized AI?

The value of decentralization in AI is about ensuring data accuracy.

This concept is consistent with the theory of collective intelligence, which states that the collective intelligence generated by aggregating information in a group often leads to more accurate decisions.

In other words, using information or data from different sources often results in more accurate models than relying on a small group of experts to input data for internal AI training.

Through decentralized AI models, we can:

Train models more cost-effectively

Eliminate the risk of single points of failure

Create a market between data and models

So, what can you do to participate in this narrative?

Actions you can take:

You can participate in these projects or start hoarding their related tokens when the market falls again:

@bittensor_ ($TAO)

@gensynai (currently no tokens available)

@SingularityNET ($AGIX)

1) @bittensor_($TAO)

Bittensor is an L1 POW network on Polkadot that serves as a P2P marketplace for training ML models.

You can earn TAO tokens for collaborative training based on the value of information or spend TAO to purchase their ML services.

2) @gensynai

Gensyn is another L1 that addresses AI hardware limitations and is backed by @a16z.

It achieves this by pooling all idle GPUs in the world into a global ML supercluster that anyone can rent and use at any time.

However, they have not issued any tokens yet.

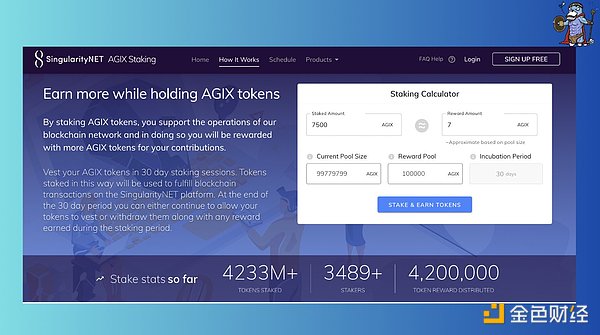

3) SingularityNET

As one of the OGs in the De-AI space, SingularityNET supports AI solutions in a P2P manner.

You can participate in liquidity mining by staking $AGIX on their staking page or simply trade when there is a buzz around AI.

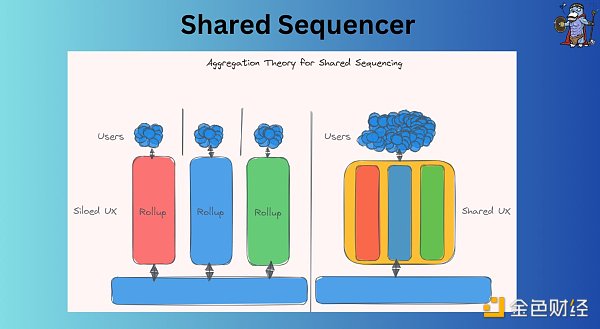

3. Shared Sequencer

L2s (such as Arbitrum, Optimism, and zksync) currently operate a centralized sequencer, which provides faster confirmation times and higher efficiency but comes at the cost of auditability risks and single points of failure.

The solution to this problem is decentralization, specifically a shared sequencer.

With a shared sequencer, each Rollup can adopt it as a “decentralized service” by sacrificing the profits from MEV.

It not only solves the auditability issue but also ensures liquidity (prevents offline situations)…

It also allows transactions from multiple Rollups to be included in one block (cross-chain composability), reducing the cost of batch submissions and providing greater resistance to MEV in combating negative externalities.

Operable:

There are some protocols applicable to shared sorters, which are likely to launch tokens to generate income and distribute governance rights. Therefore, I recommend paying close attention to:

@EspressoSys

@AstriaOrg

@radius_xyz

4. Gamble-Fi

By 2023, the scale of the online gambling market has reached $88.65 billion.

Among them, the adoption of Crypto in gambling increased by 44.6% in 2023, indicating a clear trend of Crypto adoption in the gambling industry.

Based on addictive features and Ponzi-like token economics (such as buyback, burn, or revenue sharing mechanisms), I believe that with the continuous improvement of user experience, Gamble-Fi may be one of the products to achieve large-scale adoption.

Operable:

Currently, I only hold $RLB because it generates income every month, although I am unsure if they actually buy back and burn tokens.

Nevertheless, I will continue to keep an eye on Gamble-Fi.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Behind the Explosive Popularity of TG Bots Intention Trading is Opening the Door to Web3 Interaction Intelligence

- Exploring the Significance of Web3’s Public Goods and Ownership for the Future of the Internet

- FTX Latest Debt and Asset Summary How much money is owed and how much debt can be repaid?

- FTX’s approval for liquidating $3.4 billion worth of tokens this week, what impact will it have on the market?

- FTX may be approved to liquidate $3.4 billion worth of tokens this week. What impact will it have on the market?

- August DeFi Market Review and Outlook Which Protocols and Airdrops to Focus on?

- Against the Wind How to Use Web3 to Ignite the Market and Drive Growth?