Analysis of the current status of the four mainstream Layer2 solutions Arbtrium occupies more than half of the market share, while Zora’s monthly number of creators has increased by over 97%.

Arbtrium dominates over half of the Layer2 market, while Zora's creator count has surged by 97%.Author: OurNetwork

Translation: Felix, LianGuaiNews

Currently, the Layer2 market has entered a fierce competition stage. This article analyzes the market performance of four mainstream Layer2 solutions, Optimism, Arbitrum, Zora, and Public Goods Network, based on multiple data such as total transaction fees, number of addresses, Gas fees, and number of users.

Optimism: Total fees of Layer2 network based on OP Stack reach 4400 ETH, supporting Gas at about 3.7 times that of Ethereum per second

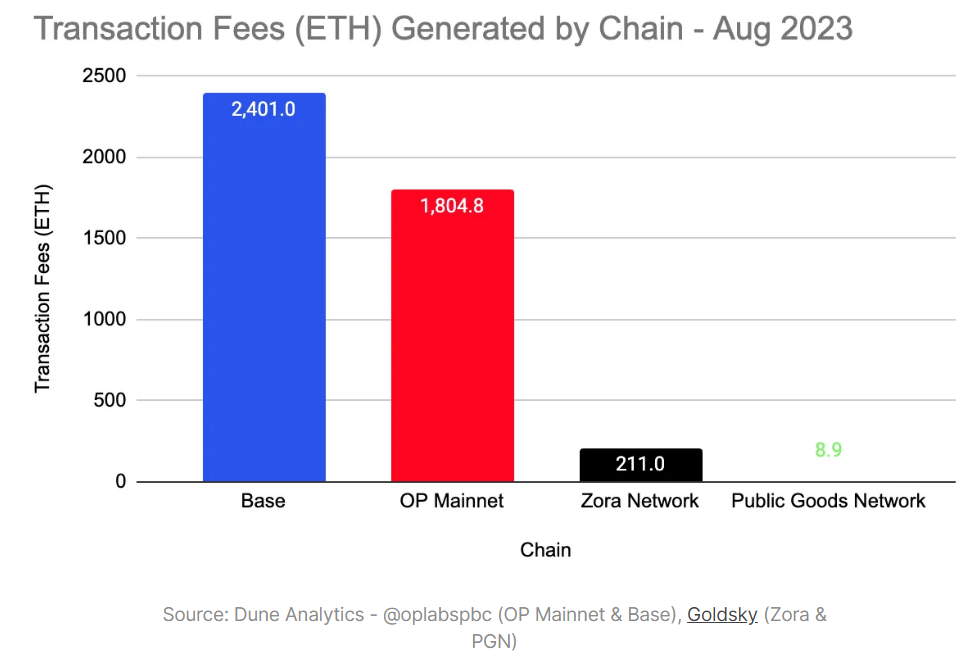

In February 2023, Optimism announced the vision of the superchain, aiming to integrate previously isolated L2s into a single interoperable and composable system. Today, Optimism is launching Ethereum L2 based on OP Stack, including OP Mainnet, Base, Zora Network, and Public Goods Network. In August, the total transaction fees of these four chains were 4400 ETH, with a net income on-chain of 2200 ETH (fees minus L1 data costs).

- LianGuai Morning News | Bitcoin network fees increased by 40% this week, with an average of 30 BTC per day.

- Fuel NFT and Market Ecosystem Inventory

- Will the arrival of various ‘X’ RC-20 standards be the future of Bitcoin?

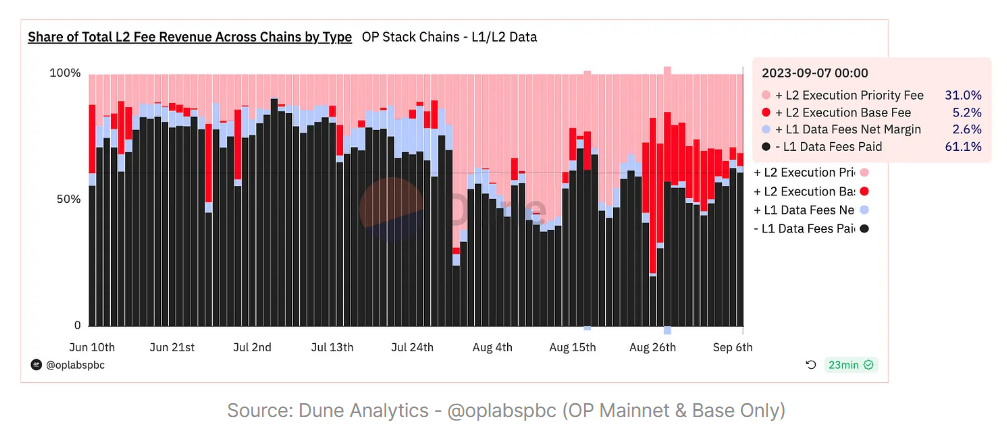

The transaction fees of OP Stack Chain are divided into:

- L1 fees: Data fees paid to L1 Ethereum. Profits become L2 income.

- L2 base fees: Gas used by L2, priced according to the EIP1559 model. L2 income.

- L2 priority fees: Tip, L2 income.

L1 fees have always been the main part of user fees, but L2 fees have also recently accounted for a certain share.

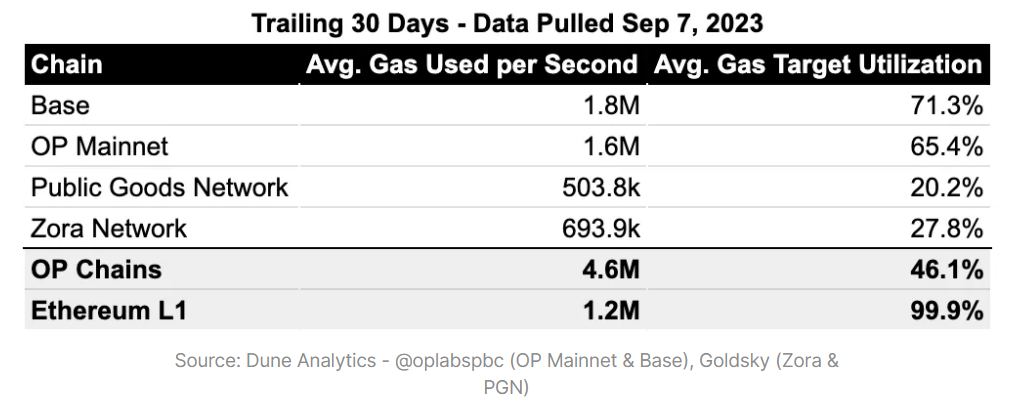

The vision of the superchain includes “making it easy to create horizontally scalable… network applications”. In the past 30 days, these four chains have supported 4.6 million Gas per second, which is 3.7 times that of Ethereum L1, but the overall utilization rate is only 46%.

Using the transactions on the Base network’s Aerodrome as an example, the cumulative transaction fees in the system can be understood in depth. The transactions used are:

- 3100 L1 Gas, paid at 19 Gwei L1 Gas price

- 178,800 L2 Gas, paid at 0.016 Gwei L2 base fee

- Users paid an additional 0.00000052 Gwei L2 priority fee

Then the transaction fees can be calculated as follows: (3.1k*19) + (178.8k*0.016) + (178.8k*0.00000052) = 0.00005 ETH ($0.09). This fee accounts for 94.4% of the L1 fees, 5.6% of the L2 base fees, and nearly 0% of the L2 priority fees.

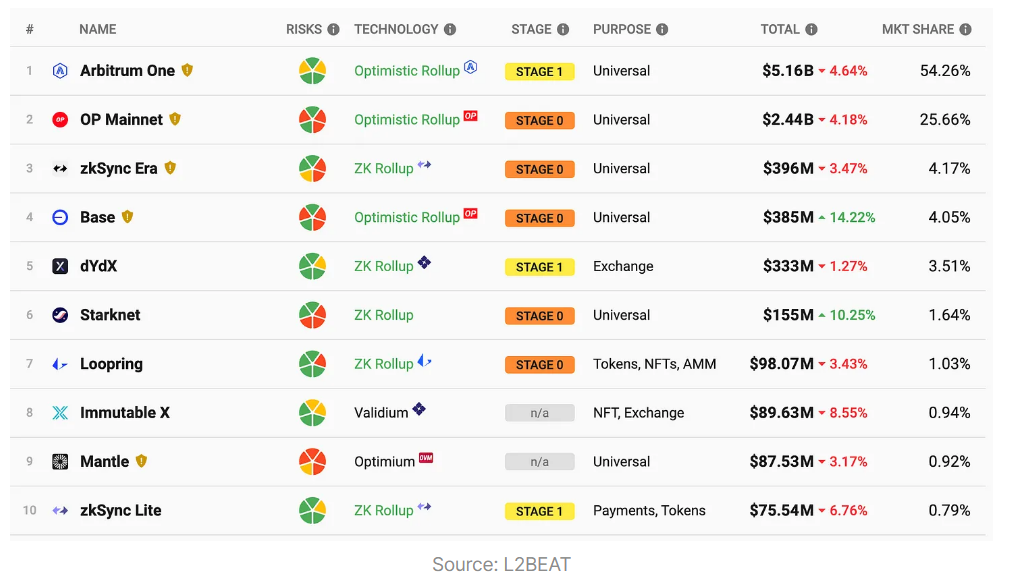

Arbitrum: Occupying over 54% of the Layer2 market share

Arbitrum is an Ethereum scaling solution with two chains: Arbitrum One (optimistic rollup) and Arbitrum Nova (general AnyTrust solution). Both solutions run on the Nitro technology stack. Currently, Arbitrum One occupies nearly 54.3% of the Layer2 market share and leads in DEX trading volume and bridged ETH quantity. Three new CEXs (Kraken, Bybit, Crypto.com) have added support for Nova, increasing the number of transactions to about 6.6 million per month (compared to about 800,000 transactions at the beginning of the year).

In addition, Arbitrum released Orbit in March, which allows developers to easily and permissionlessly deploy customizable Layer3 to fit Arbitrum One or Nova. Xai Games recently deployed a testnet based on Orbit.

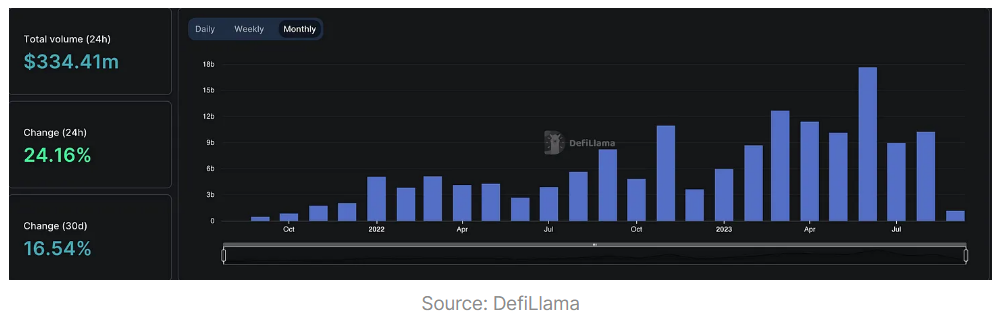

Since the launch of Arbitrum One in August 2021, the trading volume of derivatives has remained healthy even in bear markets. The 24-hour trading volume of Arbitrum One is $334 million, an increase of 16% in the past 30 days.

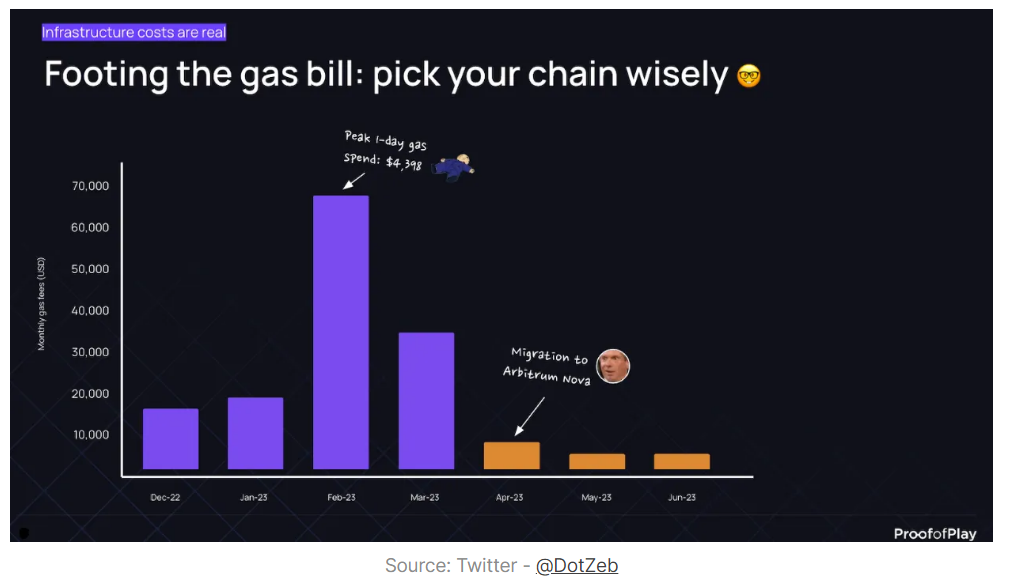

Proof of Play migrated its fully on-chain RPG “Pirate Nation” to Arbitrum Nova and observed a 20x reduction in gas costs. As part of the Pirate Nation UX, gas fees are borne by the users, and Nova’s efficiency helps the team profit from the royalties of secondary sales after considering gas costs.

Related reading: Arbitrum vs. Optimism: The new round of Red vs. Blue battle begins with Layer3

Zora Network: Total transaction volume exceeds 7 million, monthly creator count exceeds 40,000

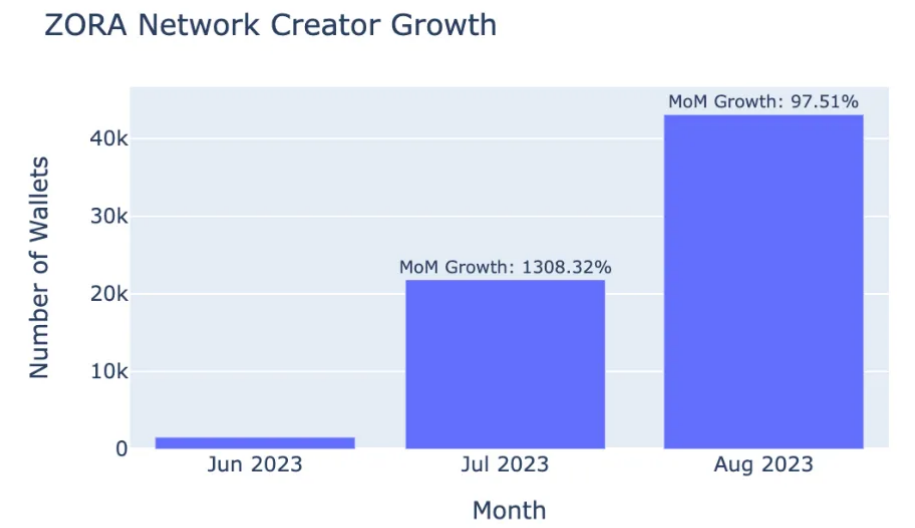

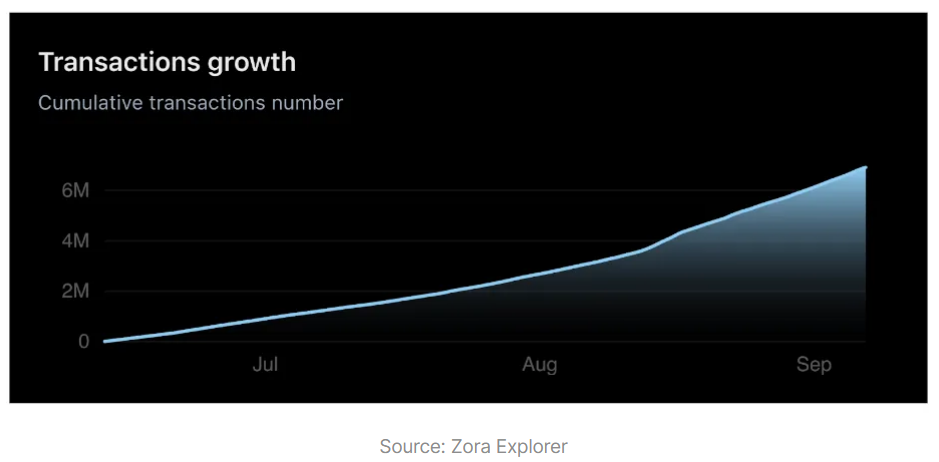

Zora is a platform for creators and collectors to mint NFTs, with tens of thousands of creators and nearly a million collectors. It recently launched Layer2 on OP Stack. Among them, more than 40,000 creators used Zora’s network in August, an increase of 97.51% compared to the previous month. In addition, since June, Zora’s trading volume has tripled, with a total of over 7 million transactions.

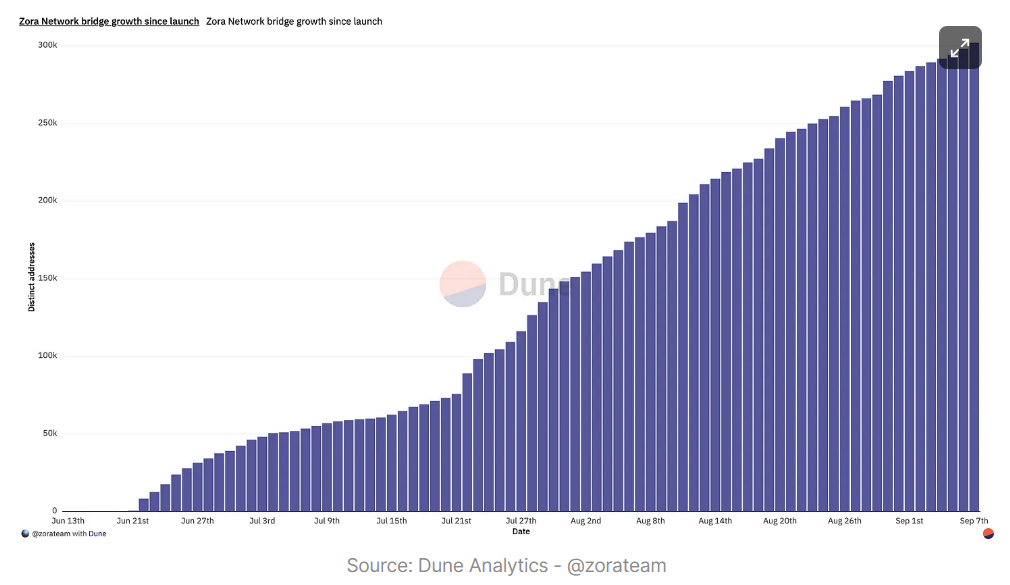

So far, Zora has bridged over 300,000 unique addresses to the Zora network. In the past two months (July to September), Zora’s bridged wallets have grown nearly 7 times.

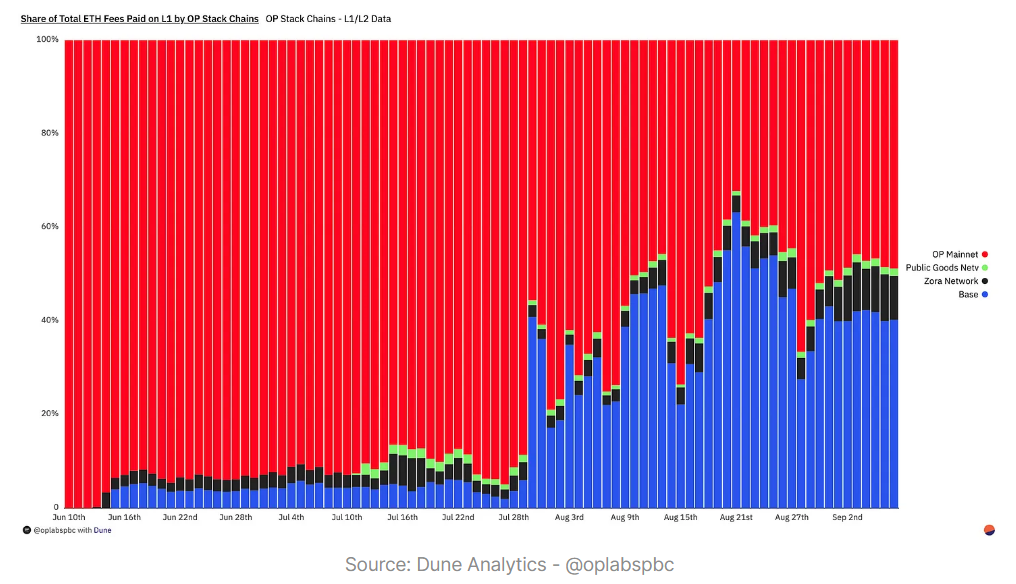

Finally, when examining the growth of OP market share, it is clear that ZORA’s share in total fees has continued to steadily increase. Even with the introduction of Base and PGN, ZORA’s proportion in OP Stack Chains has now reached 10%, indicating a resonance among NFT collectors and creators towards the transition to L2.

This transaction is used to deploy Opepen Threadition OE, the collaboration between Threadguy and Jack Butcher on Zora (July 16, 2023). Threadguy, a famous NFT KOL, expressed interest in changing his PFP and updating it to the Openopen version of his Mutant Ape. Jack Butcher subsequently launched the custom open edition NFT “Opepen Threadition” and donated all proceeds to Threadguy. Currently, the series has minted over 70,000 NFTs and generated 128 ETH in sales, while the total transaction fees for users are only 3 ETH. This was the largest L2 OE at the time and paved the way for other creators to release works beyond L1.

Related reading: Opepen Threadition launched for 2 days and received over 37,000 mintings. Why can Jack Butcher always create phenomenal NFTs?

Public Goods Network: After the mainnet launched at the end of July, the number of accounts reached approximately 13,000. Zora, Gitcoin Grants Stack, and other platforms have been deployed.

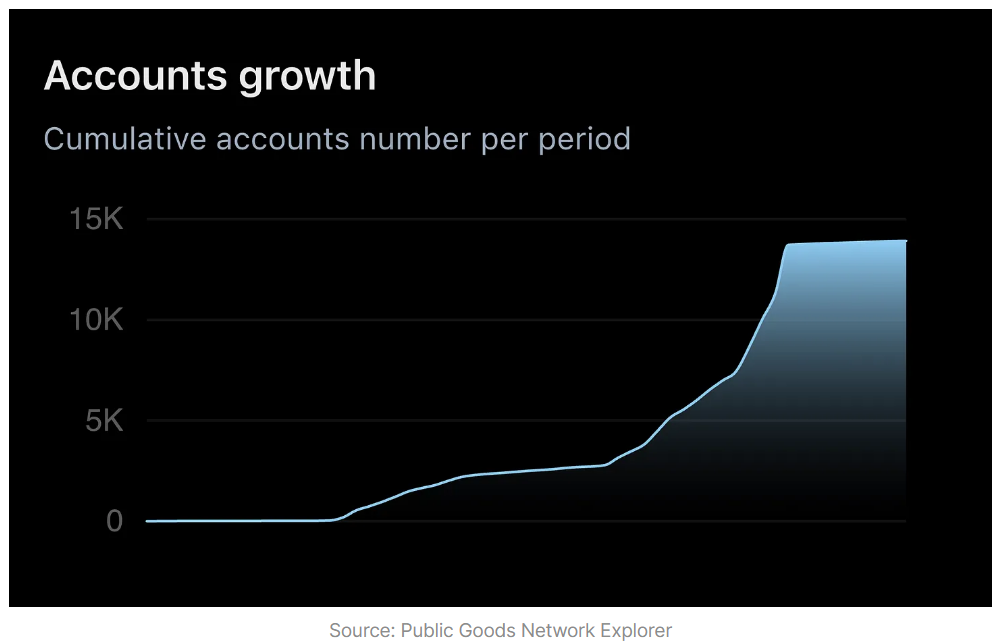

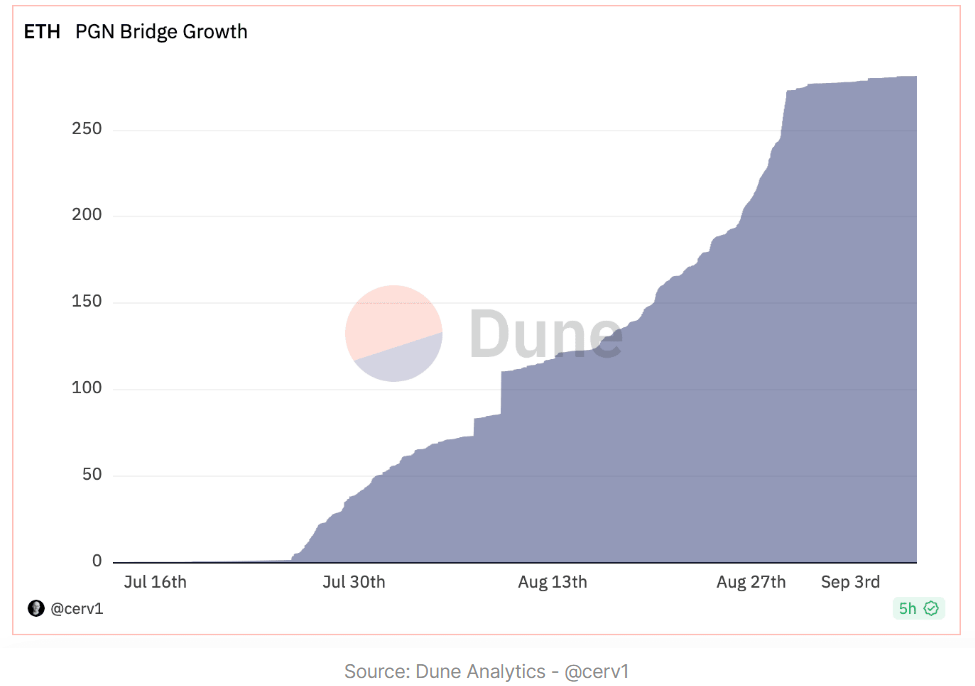

Public Goods Network (PGN) is a low-cost Layer2 OP chain, a highly composable EVM-compatible rollup that is almost identical to the OP mainnet and built on top of the OP Stack. The PGN mainnet was launched on July 25th. PGN has received support from Public Nouns, Clr.fund, Giveth, Hypercerts, Octant, Endaoment, Eco, Protocol Labs, and Gitcoin. PGN will collect the majority of sequencer fees generated by users on the network to fund public goods and public goods projects. Since its launch, PGN has created 12,474 independent wallets.

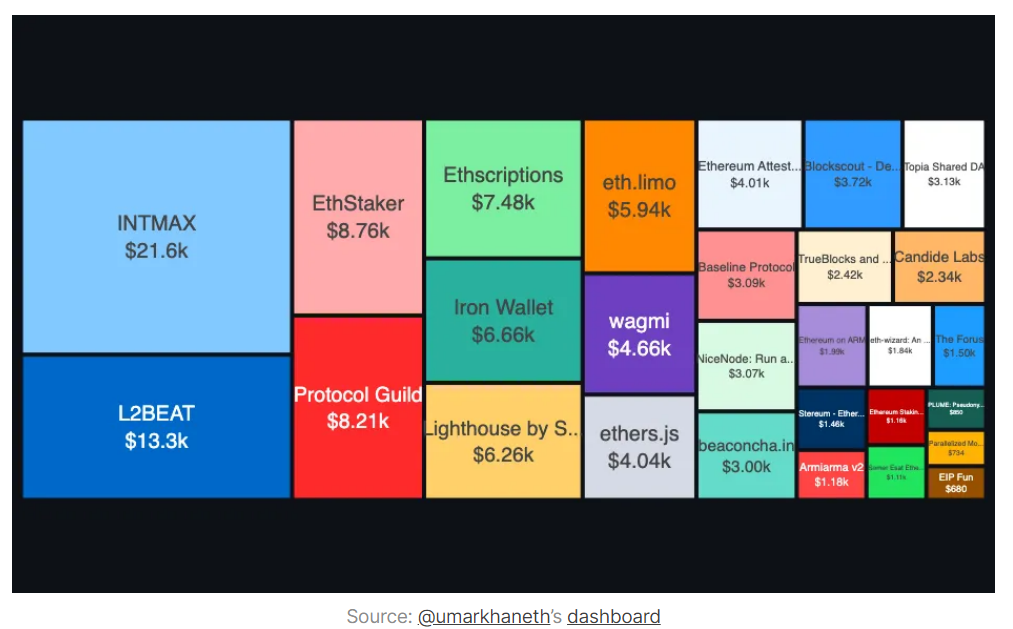

The Ethereum infrastructure running on PGN is the second round of GG18, with a total of 11,955 independent donors, $123,900 in donations, and 67,700 donations. Gitcoin Grants Stack has had a significant impact on transaction volume and demonstrated the potential for future sustainable revenue.

As of September 3rd, a total of more than 281 ETH has been bridged to PGN, with over 930 contracts deployed, including Zora, jokerace, Safe, and Gitcoin Grants Stack. Future Gitcoin rounds will also include bridging GTC (Gitcoin’s token) and bridging stablecoins.

PGN Mints NFT is the first minting on Zora and one of the first use cases for PGN besides grants. PGN will raise public goods resources by allowing users to transact on-chain, demonstrating its commitment to deploying “fees for good” on PGN to create a sustainable funding source for public goods.

PGN Mints NFT is the first minting on Zora and one of the first use cases for PGN besides grants. PGN will raise public goods resources by allowing users to transact on-chain, demonstrating its commitment to deploying “fees for good” on PGN to create a sustainable funding source for public goods.

Related reading: Decoding the PGN layer2 application chain: Based on OP Stack, opening up a new paradigm for public goods donations?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitfinex Cryptocurrency market funds outflow reached $55 billion in August.

- Under the bold political reforms, can El Salvador, which embraces Bitcoin, replicate Singapore’s successful path?

- Comprehensive Analysis of Bitcoin ETF

- Exclusive Interview with Yuga Labs We are more like Tencent of Web3, constantly changing the rules of NFT games

- Binance Labs Five Key Points to Help You Achieve Product-Market Fit

- Permissionless II Bear Market Conference Explores Opportunities in the Cryptocurrency Field

- What is a forked token?