Are you still watching the K-line speculation?

Affected by the hacker’s hacking of about $40 million in bitcoin, Bitcoin (BTC) and Coin’s platform BNB both caused price declines in the short time after the announcement of the currency.

In this age of informationization, most of the news is always known to most people in the first place, especially when it comes to interest-related information. Especially in the field of speculative stocks and other speculations, once there are some rumors, investors will regard it as a kind of signal. For example, this time the currency security incident, it can be seen that after the announcement of the currency security, the BNB is short within an hour. The time is down 10%. The reaction rate of the currency market to the news can be described as very fast.

- Jimmy Song: Why do blockchains without bitcoin have no soul?

- US SEC Compliance Inspection Office: “Digital Assets including Cryptographic Currency and Pass” has been listed as a high-risk investment

- Reorganizing blocks to recover stolen BTCs? This article tells you why it doesn't work.

Coincidentally, there is also a key indicator of the price impact of such good news, called the K line . Figure:

The pattern I circled with a red frame is a K-line, which contains four key indicators, namely the opening price, the closing price, the lowest price, and the highest price . All the K lines in the current currency market or the stock market are all built around these four indicators.

People who have been immersed in speculative coins or stocks for many years will be accustomed to judging the future price movements in a certain period of time through the K-line, such as MACD, as well as the entanglement of certain popularity in the stock market, as shown in the figure:

In addition, people who have been scrambled for a long time have more or less a set of their own theories, look at various indicators, analyze various fold lines, and use this theory to lead their next trading operations.

Usually, after certain price indicators reach a certain standard, they can be regarded as a signal to buy or sell, and this signal can also largely influence the operation of investors.

But what's interesting is that many years of investors I've been in contact with, especially stocks. When I asked about the profitability of these years, they generally said "no loss or no profit." Eh? This is why, it is reasonable to say that the theory that has been polished for several years and ten years has more or less desirable points, but why do most people tell me that "no loss or no profit"?

Let's first look at a little story:

The ice cream on the picture looks great. The one you want to eat at first glance, if I tell you that a Ford car will be allergic to ice cream, would you think that I have a problem with my brain?

In fact, this is a real thing. In 2000, a Ford owner found his car allergic to vanilla ice cream and complained to Ford. Although it was ridiculous, Ford sent an engineer to investigate the problem.

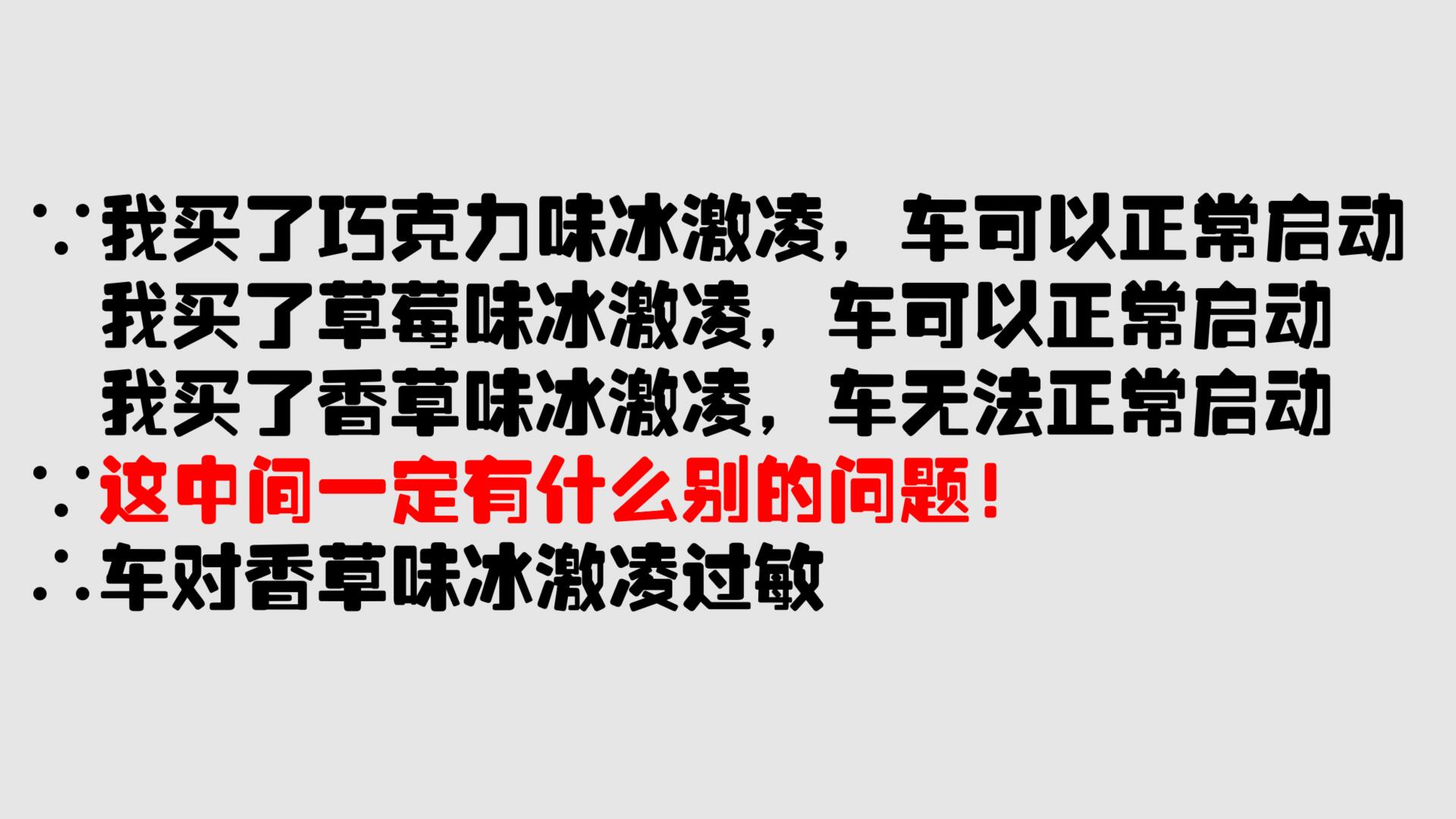

So, the engineer and the car owner met, and discussed the process of buying ice cream in the usual car owners, repeating it again. In order to restore the scene as much as possible, the engineer drove for three nights and drove to buy ice cream:

On the first night, I bought a chocolate flavor and the car started .

On the second night, I bought a strawberry flavor and the car started.

On the third night, buy vanilla, the car does not start.

As an engineer with clear logic judgment, he certainly does not think that the car will be allergic to vanilla ice cream. To this end, he began to record a variety of data, temperature, humidity, various gas emissions indicators, time spent on the way to and so on.

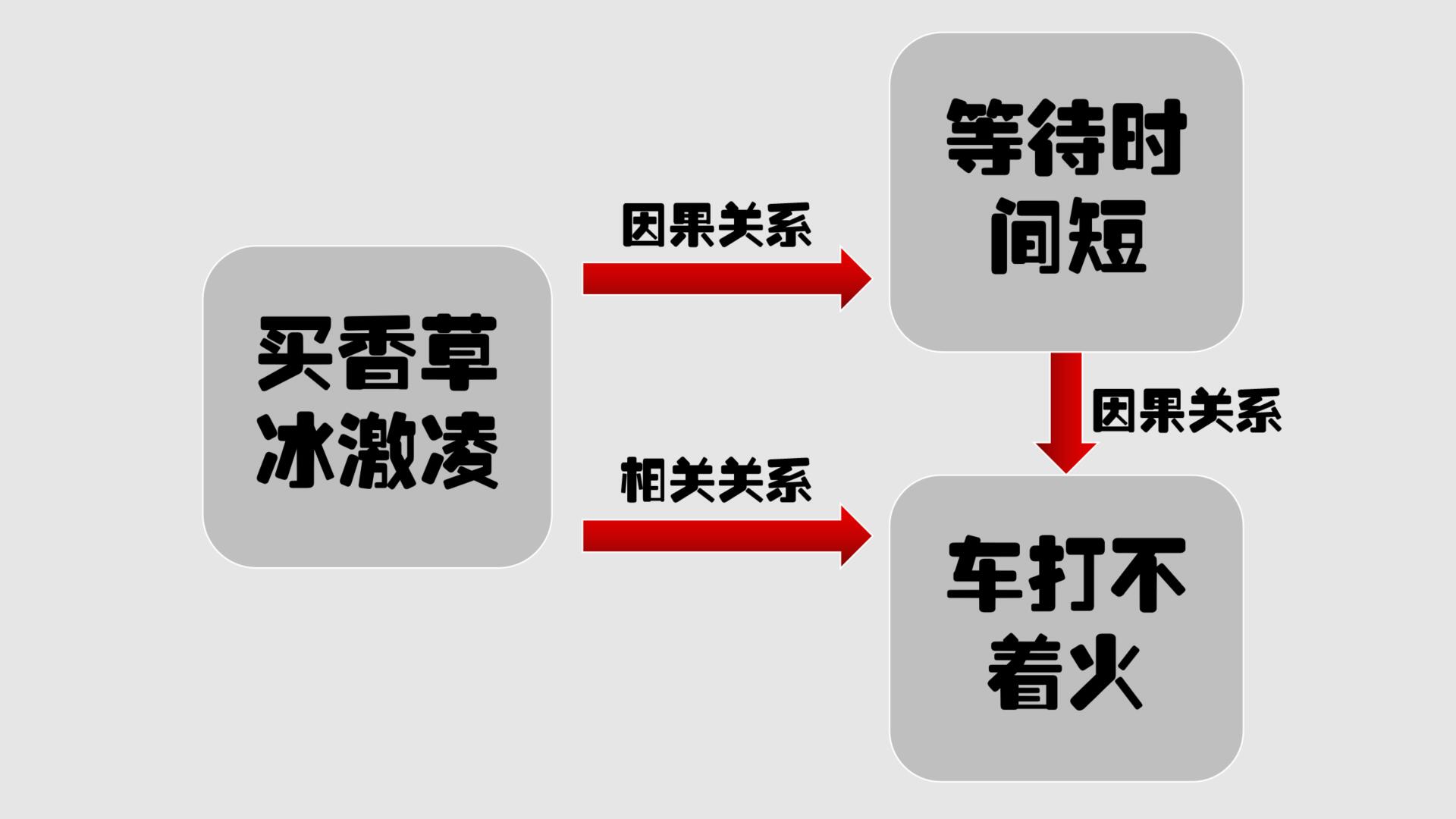

After a series of indicators, he grabbed a clue: it took less time to buy vanilla ice cream.

Because vanilla is the most popular taste, it sells well, so the store puts the vanilla ice cream cabinet in the foreground for convenience, so that you can get vanilla-flavored ice cream faster, while other ice creams are not sold so much. Ok, so I put it in the kitchen, and the time it takes to get the ice cream in the kitchen is naturally much longer than picking up a vanilla ice cream.

Using this as a clue, the engineer began to investigate the vehicle and found that the vehicle was too short to stop and restart the vehicle.

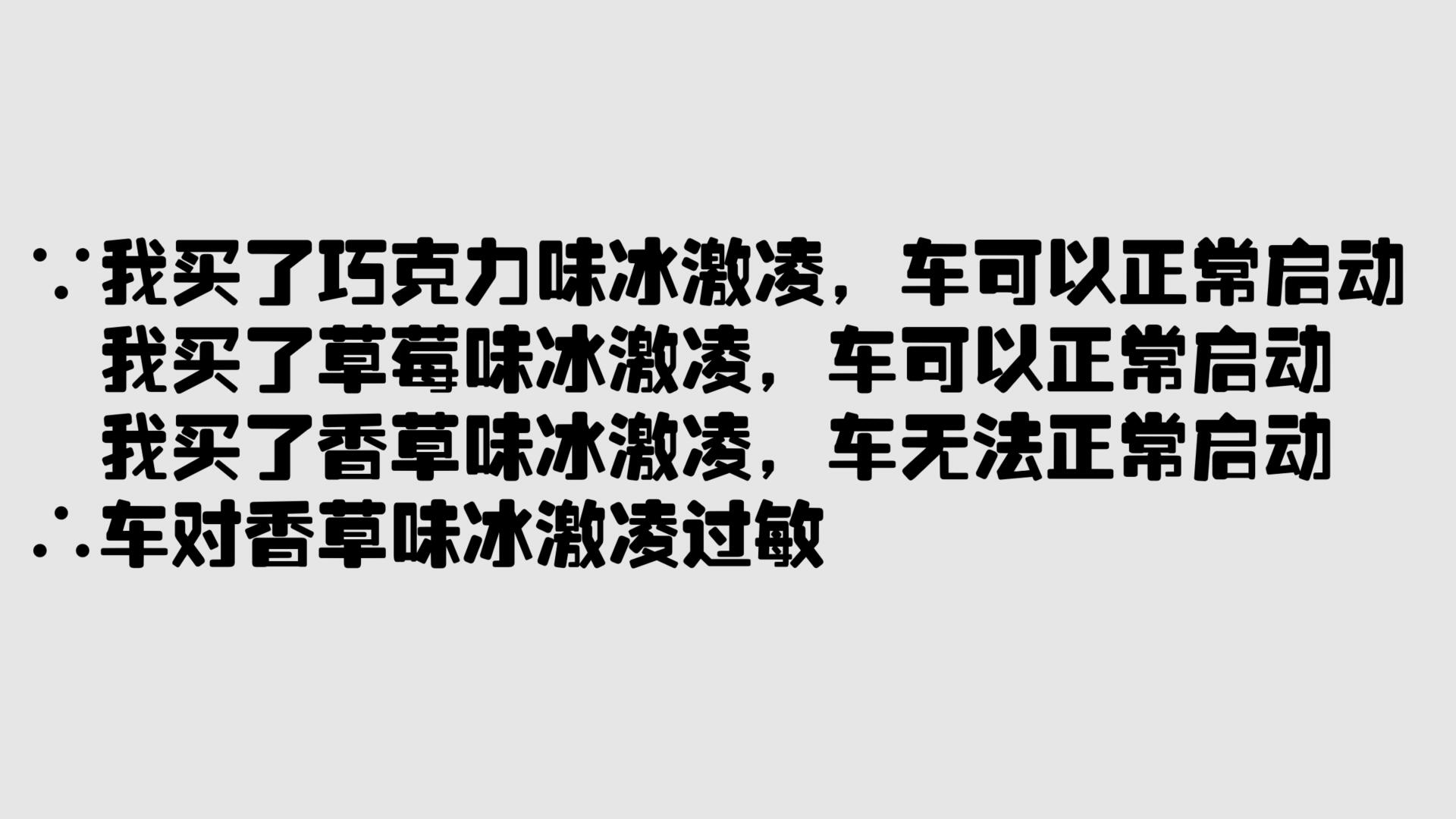

In this whole process, the owner thinks this way:

The more rational engineer thinks this way:

Sure enough, through a series of scientific data investigations, the real problem was detected.

Because the owner didn't have more expertise in the car, he subconsciously thought that the car would be allergic to the vanilla ice cream. He established a causal relationship between the vanilla ice cream and the car unable to start. Experts with rich knowledge understand that there is no causal relationship between these two events, only relevant relationships exist.

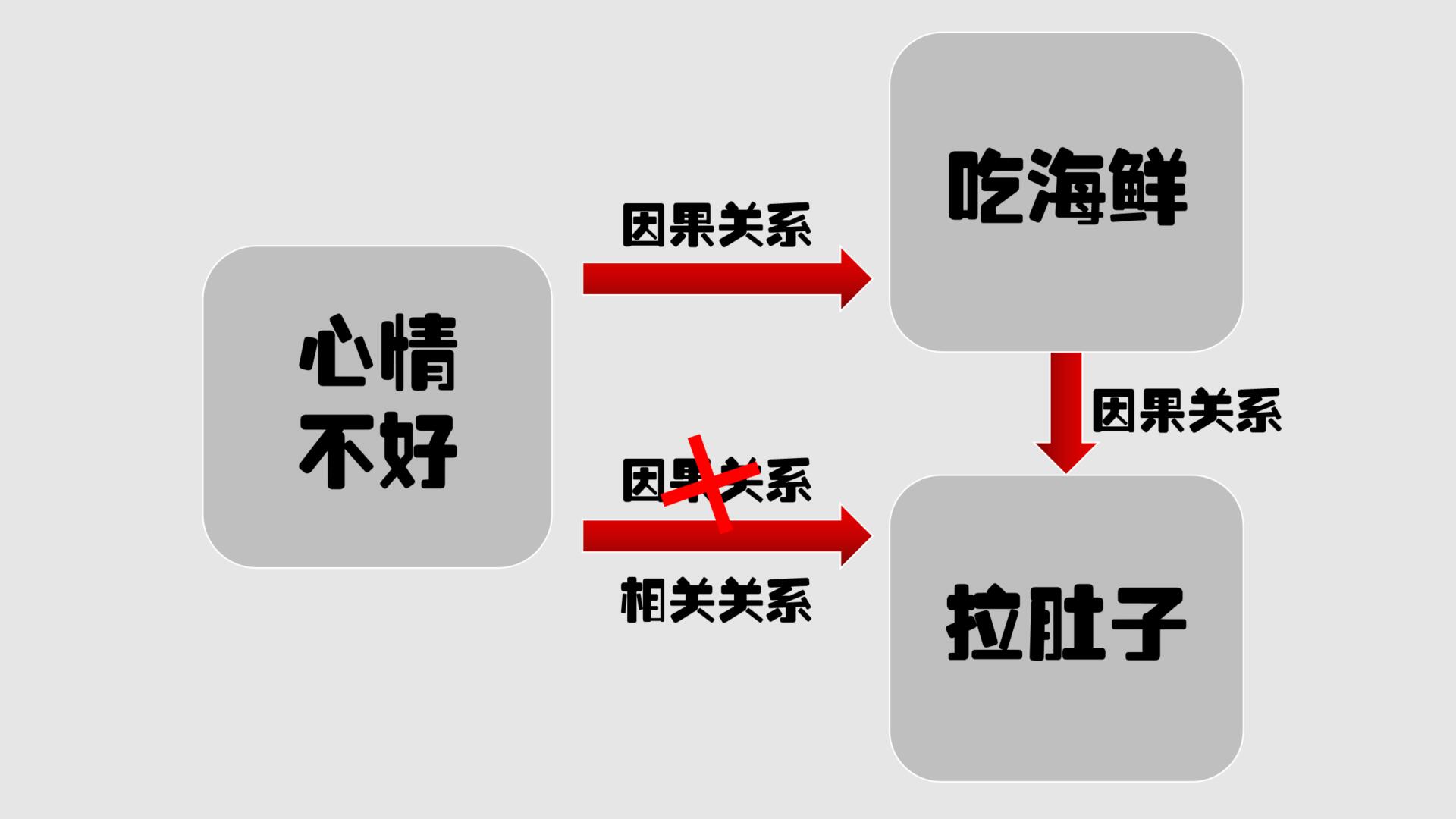

What do you mean? What is the causal relationship? What is the relationship?

For example, you are in a bad mood today, late for work, and because of the work, you have criticized the leadership, so you think that you must go to work after dinner, eat seafood! Since I am in a bad mood, I will make up for it physically, so you went to a seafood restaurant and ordered a table full of seafood. After I finished eating, I went home and took a rest. I was going to take a bath and go to rest. At this time, my stomach suddenly became painful. If you were found to be wrong, you immediately took a roll of paper towels into the toilet. This is two hours. During the period, you are constantly "suspecting the Galaxy for nine days."

So you came to a conclusion : "Oh, this is the case, every time you are in a bad mood, you have a diarrhea." We all know that if you have a bad life, you will not have a diarrhea. In this case, "the mood is not good." And "eat seafood" is the causal relationship, while "eat seafood" and "diarrhea" is the causal relationship. "The bad mood" and "diarrhea" are at most a related relationship. They can only say that they have a relationship, can not be said because In a bad mood, you pulled your stomach, as shown in the figure:

In the same way, the time to buy vanilla ice cream needs to be shorter, so the car will not catch fire, so they are also related, as shown in the figure:

Many people are easy to mistake the relationship as a causal relationship, just like thinking that the car will be allergic to vanilla ice cream, and if you are in a bad mood, you will have a diarrhea.

In the same way, the K-line is also the case. Many people use this as a basis to judge the trend of the price by judging the direction of the K-line, and they are regarded as the standard. However, we know that the K-line chart is actually based on the price changes that have occurred. The main factors are the opening price, the closing price, the highest price, the lowest price, and the individual indicators are useful for the volume factor.

That is to say, the trend of the K line is related to the future price change, which is related to the price change. However, it is definitely not because the K line has reached a certain standard, so the future price will definitely rise.

The K line can be used as a data to judge the trading point during the trading process, but it must not be used as a standard. The so-called ups and downs will never happen because the K lines you see intersect, but because the price has changed. The K line will react accordingly and then cross. What is called the Golden Fork Deaths is actually after the price changes. If you really use it as a standard, you can be sure that it is difficult to get the benefits you want.

Therefore, the longer the speculative and stocks are, the harder it is to make money. It is because in such a long period of time, you have naturally become accustomed to seeing some related things as causal, "Golden fork! Hurry to buy!" "Dead fork! Hurry to sell!"

This is the reason why the more speculation does not make money, the reason is that the phrase "ten buy seven losses, two flats and one earn".

Ok, today's Blockchain Methodology is here. In the follow-up, I will continue to introduce more quality articles to share with you. I am a blockchain teacher, I hope everyone can support them.

Author: block chain Ni Laoshi

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Market Analysis: The main wash is completed, BTC returns to 6000 USD

- Stolen 41 million knives, the currency security guards stolen?

- Rubbing money, stealing money, threatening, this North Korean hacker organization earned 4 billion a year

- Preemptive New York counterparts, SIX or the first traditional exchange to issue coins

- Listed company series | Yuanguang Software: deploying blockchain in the power industry, winning geometry

- Blockchain distribution map of 88 listed companies: 70% of the extended application, Internet companies are good at the underlying foundation

- Bitfinex: New York State Attorney General can't win