Deep analysis of the intent behind SEC’s lawsuit against Binance: a jurisdictional dispute or a show of power?

Analysis of SEC's lawsuit against Binance: jurisdictional dispute or show of power?The US Securities and Exchange Commission (SEC) has sued Binance, its CEO Changpeng Zhao (CZ), and two other subsidiaries, BAM Trading Services (“BAM Trading”) and BAM Management US Holdings Inc. (“BAM Management”), accusing the defendants of violating US securities trading rules.

The 136-page lawsuit covers a variety of topics and methods related to user research and includes some parts that may be difficult to understand at first glance. In this article, Odaily Planet Daily will provide an in-depth analysis of the important parts of the entire document and some key points that may be overlooked, and attempt to analyze the information behind the text and the SEC’s understanding of Binance and the cryptocurrency industry, as well as the true intentions behind this regulatory action.

Highlights at a glance: (if you have already read the key points of the regulatory document, you can skip the first two parts of this article)

-

The SEC sued Binance and its CEO Changpeng Zhao on June 5th US time, claiming that they “improperly handled customer funds” and “deceived regulators and investors.”

-

In addition, the SEC claims that Binance mixed “billions of dollars” of customer funds and secretly transferred them to an independent company called Merit Peak Limited controlled by Binance founder Changpeng Zhao.

-

The lawsuit mentions cryptocurrencies that are classified as securities, including but not limited to BNB, BUSD, and the following cryptocurrencies: SOL, ADA, MATIC, FIL, ATOM, SAND, MANA, ALGO, AXS, and COTI.

The summary of Binance’s illegal behavior by the SEC that Odaily has reported is as follows:

-

Binance disregards federal securities laws and its protection of investors.

-

Binance provides unregistered securities sales.

-

Binance deceives investors and has features of manipulative trading.

-

Binance evades US regulation, citing the words of Binance COO: “We never want to be regulated by Binance.”

-

Binance and Changpeng Zhao claim that BAM Trading independently controls the Binance.US platform, but in reality, they are controlling it from behind the scenes.

-

Binance claims that the Binance entity will not serve US customers, but is helping high-net-worth US customers circumvent geographic restrictions behind the scenes (the March lawsuit case was also based on this reason).

-

Binance mixes billions of dollars of customer funds and secretly transfers them to an independent company called Merit Peak Limited, which is controlled by Binance founder Changpeng Zhao. This is something that regulated US exchanges cannot do.

-

Binance uses wash trading to deliberately inflate trading volume on the Binance.US platform.

-

Binance did not disclose relevant assets in accordance with securities laws.

Summary of SEC’s claims:

The SEC seeks the following final judgments:

(a) a permanent injunction prohibiting the defendants from continuing to violate the federal securities laws as alleged;

(b) an order requiring the defendants to disgorge their ill-gotten gains, with prejudgment interest;

(c) a permanent injunction prohibiting the defendants and any entity controlled directly or indirectly by them from directly or indirectly utilizing interstate commerce or the mails:

(i) to participate in any unregistered offer or sale of securities, including any digital asset securities;

(ii) to operate as any type of exchange, broker, or dealer, including but not limited to any digital asset securities;

(iii) to act as a broker or dealer without registering as such, including but not limited to any digital asset securities; and

(iv) to act as a clearing agency without registering as such, including but not limited to any digital asset securities;

(d) civil penalties against the defendants; and

(e) such other and further relief as this Court may deem just and appropriate for the protection of investors.

SEC Misunderstands “Tai Chi” in Chinese, Accusing Zhao Changpeng of Implementing a “Tai Chi Plan” Against Regulation

In its complaint, the SEC listed several pieces of evidence that Zhao Changpeng and Binance evaded U.S. regulation. Among them, the SEC cites the establishment of Binance.US as an isolation of Binance’s entity from the risk of U.S. regulation and claims that this is Zhao Changpeng’s and Binance’s adviser’s “Tai Chi Plan.” My guess is that the SEC may have misunderstood the meaning of “Tai Chi” in Chinese from some Chinese sources and thus mistakenly understood the name of this entity isolation plan as “Tai Chi.”

The SEC also mentioned that Binance’s adviser hoped that this “Tai Chi entity” would “publish a long and detailed Howey test asset evaluation framework…to demonstrate the complexity of the Howey test,” and then engage in a dialogue with the SEC to discuss “establishing or acquiring a broker/dealer or alternative trading system (ATS), expecting no success but just to delay the potential enforcement action.”

The SEC even bolded a non-official quote from Binance’s CCO, “we are just operating a f*cking illegal unregistered securities exchange in the US.”

Meanwhile, after the establishment of Binance.US, the SEC claimed that Zhao Changpeng and Binance were still guiding high-net-worth US clients to bypass geographic and KYC restrictions through various means, allowing them to trade on the more liquid Binance entity. The SEC also cited Zhao Changpeng’s words: “We do need to let users know that they can change their KYC information on Binance.com and continue to use the platform. However, this information needs to be written very carefully because anything we send will be public. We are not responsible for this.” This was also the reason why Binance was sued by the CFTC in March, that is, the Binance entity should not provide services to US customers.

The CSRC believes that BAM Trading should not be influenced by the Binance entity and Zhao Changpeng – even buying company hoodies requires budget review

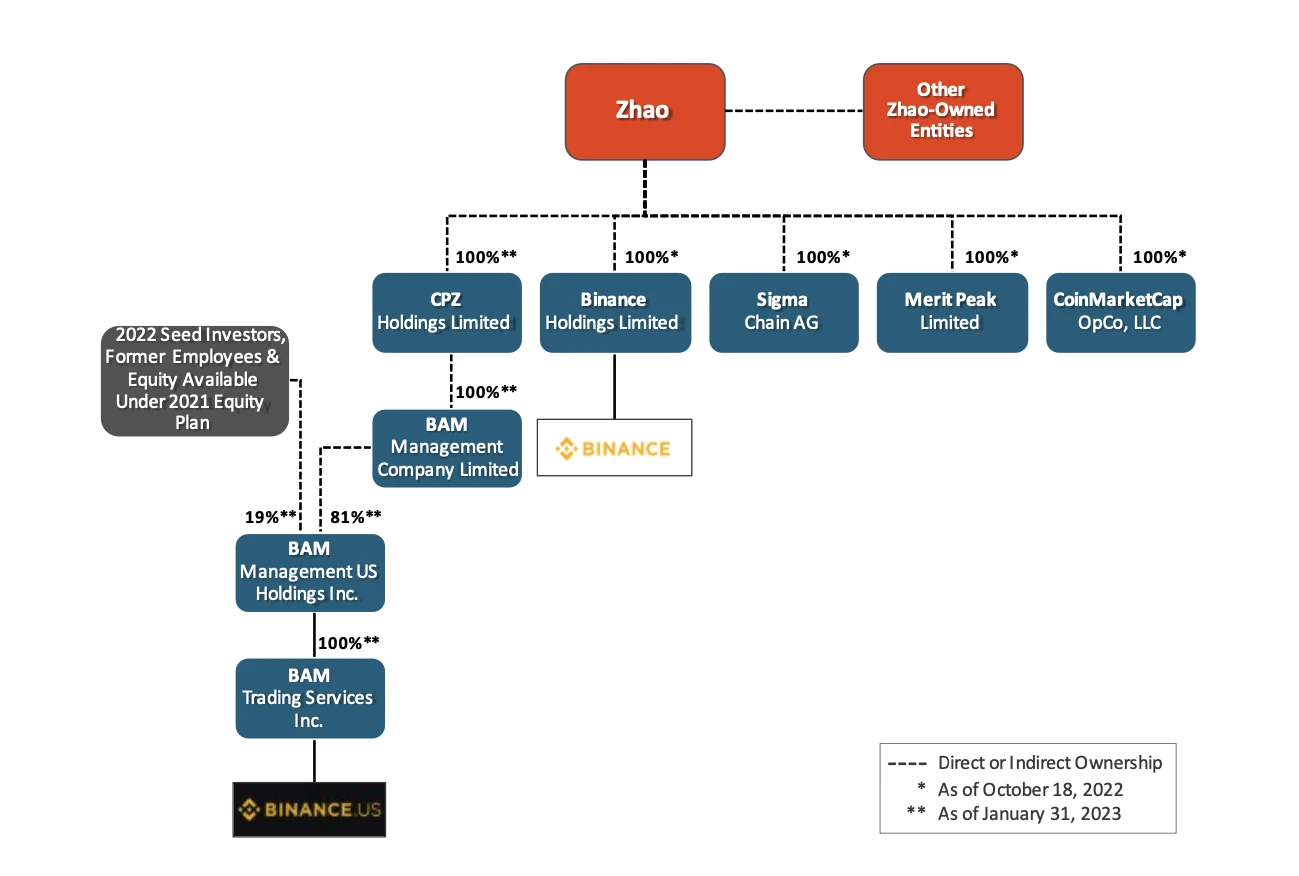

The CSRC document shows that Zhao Changpeng personally controls Binance and Binance.US platforms through various direct or indirect equity structures, despite the platform claiming considerable independence. As shown below:

The CSRC said that for most of 2021, BAM Trading employees could not access certain real-time trading data of the Binance.US platform without Zhao Changpeng’s personal approval. In addition, Zhao Changpeng and Binance controlled BAM Trading’s bank accounts and financial status. Until at least December 2020, BAM Trading employees could not control BAM Trading’s bank accounts, including the account used to deposit and transfer funds from Binance.US platform users.

At the same time, Zhao Changpeng is also responsible for approving various daily business expenses of BAM Trading. The CSRC described in the document that until at least January 30, 2020, all BAM Trading expenses exceeding $30,000 required Zhao Changpeng’s approval. BAM Trading regularly solicited Zhao Changpeng and Binance’s approval for daily business expenses, including rent, franchise taxes, legal fees, AWS hosting fees for storing Binance.US platform customer data, and even an $11,000 expenditure on purchasing Binance branded hats.

The CSRC said that from around December 2020, Binance allowed BAM Trading personnel to take control of some of BAM Trading’s bank accounts, but as of May 2023, Zhao Changpeng still has the signing authority for the BAM Trading account that holds the funds of Binance.US platform customers.

The China Securities Regulatory Commission (CSRC) states in this lawsuit that despite the establishment of BAM Trading by Zhao Changpeng, he should not exert any influence over its management.

Regarding Sigma Chain and Merit Peak: Implied Misappropriation of Funds Without Evidence

The CSRC alleges that from the early days of the Binance US platform, Zhao Changpeng instructed BAM Trading to accept two market makers he owned and controlled: Sigma Chain and Merit Peak. These two entities were operated by several Binance employees who worked under Zhao Changpeng’s direction, including a Binance logistics manager who had signing authority over BAM Trading’s US dollar account until at least December 2020.

Merit Peak traded on the platform from at least November 15, 2019 to June 10, 2021. As of April 2022, Sigma Chain was a frequent spot trader on the Binance US platform, and it continued to act as a counterparty for certain OTC trades and Convert and OCBS services on the Binance US platform. The CSRC alleges that Sigma Chain and Merit Peak’s activities on the Binance US platform, as well as their undisclosed relationships with Zhao Changpeng and Binance, involve conflicts of interest between Zhao Changpeng’s financial interests and the interests of Binance US platform customers.

For example, by 2021, at least $145 million had been transferred from BAM Trading to Sigma Chain’s account, and another $45 million had been transferred from BAM Trading’s Trust Company B account to Sigma Chain’s account. From that account, Sigma Chain spent $11 million on a yacht.

The CSRC’s description here seems to be implying that the yacht was purchased with misappropriated funds from Binance US customers, although it provides no substantive evidence.

The CSRC Alleges Tension Between Binance US and Binance, Binance Responds

According to the CSRC in this filing, in January 2020, BAM Trading employees began compiling a “shackles” list, which was a list of functions requiring “Binance personnel to answer, visit, approve, and financially support,” indicating BAM Trading’s lack of independence and understanding of platform operations. They noted, for example, a “lack of respect and transparency” between BAM Trading’s compliance team and its Asian and US teams; BAM Trading was “not allowed to expand its financial team domestically in the United States”; and BAM Trading’s legal department needed a “better understanding” of BAM Trading’s “internal controls/IT infrastructure.”

According to the document, BAM Trading CEO A explained to Binance CFO shortly after the article was published that BAM Trading employees “felt like puppets.” The SEC document states that on December 3, 2020, BAM Trading CEO A reported to Binance CFO that BAM Trading’s “daily battle” was to ask Binance’s settlement staff to “tell us about their daily work and permissions,” but Binance’s backstage office manager and another Binance employee “refused to share their screens and said you don’t need to know about our daily work.” The document also states that around March 2021, Zhao Changpeng decided to replace BAM Trading CEO A with BAM Trading CEO B, who officially took office in May 2021. Upon joining, BAM Trading CEO B realized that “there were problems with the relationship between Binance and BAM Trading, and he accepted the role on the condition that he could operate BAM Trading independently of Zhao Changpeng and Binance’s control.” BAM Trading CEO B issued several public statements stating that BAM Trading “is not a substitute for Binance.”

The SEC claims in the document that when BAM Trading CEO B took over as CEO, he quickly discovered that Binance actually exerted significant control over the operation of BAM Trading and the Binance.US platform, and was unwilling to relinquish that control. As he stated in his sworn testimony, BAM Trading CEO B “had no firsthand knowledge of [Binance’s] physical management of [Binance.US’s] servers,” but he knew “it wasn’t [BAM Trading].” Similarly, he testified that the matching engine “may be owned and operated by some entity of [Binance], but I don’t know which entity, and there are other servers that do other functions.” He therefore concluded that the company’s “biggest risk is that we rely heavily on a bunch of technology in Asia.”

(According to Odaily Planet Daily analysis, A and B are Catherine Coley and Brian Brooks, respectively. Catherine Coley served as Binance.US CEO in 2020, and Brian Brooks served as Binance.US CEO in mid-2021 and was previously the US National Bank Inspector.)

Binance strongly opposes this claim. In a statement on the lawsuit document, it said, “The SEC’s action here seems to be an attempt to hurriedly obtain jurisdiction from other regulators, with investors not seeming to be the SEC’s priority consideration. Due to our scale and global renown, Binance has now become an easy target for attack and is caught in a tug-of-war between US regulatory agencies.”

It appears that the SEC’s goal here is not to protect investors; if that were the case, the employees should have engaged in a deep conversation based on facts and made efforts to show the security of the Binance.US platform. Instead, the SEC’s true intentions here seem to be to make headlines.”

Expansion of jurisdiction over unregistered securities raises doubts

The issue of whether US exchanges offer unregistered securities or cryptocurrencies has been mentioned several times in past cryptocurrency-related cases. However, in this legal document, the SEC seems to have expanded its definition of securities.

In the lawsuit, the SEC believes that the release of BNB and BUSD falls under the category of securities, attracting investors with concepts such as expected returns. The SEC spends a lot of space in the document explaining the concepts of BNB and BUSD, as well as how to identify relevant expected returns from Binance WhiteBlockingper. Based on this logic, the SEC believes that related pledge concepts and products such as “Simple Earn” and “BNB Vault” from Binance also fall under the category of securities.

At the same time, unlike previous lawsuits, the SEC believes that ten other tokens SOL, ADA, MATIC, FIL, ATOM, SAND, MANA, ALGO, AXS, and COTI also fall under the category of securities, and spends a considerable amount of space explaining the reasons why each token should be considered a security.

It is worth mentioning that the SEC did not list ETH as a security. In 2018, Gary Gensler himself said that the SEC did not consider Ethereum to be a security. In the April hearing, Gary Gensler also refused to answer whether Ethereum was a security. Although based on the same logic, this lawsuit identifies the public chain token Solana as a security, and the contradictory logic of this before and after has led many people on Twitter to believe that there is a double standard.

It is also worth mentioning that FTX apparently never received a charge regarding offering unregistered securities from the SEC prior to the crash. Now, some voices in the market have questioned the accusations faced by Binance, and speculate that the SEC, under the leadership of Gary Gensler, may be seeking revenge on Binance for its role in the FTX crash, based on SBF and Gary Gensler’s relationship.

Real Demands Beyond the Document: Jurisdiction Dispute or Show of Power?

Some observers believe that the SEC’s lawsuit against Binance may be motivated by a dispute with the Commodity Futures Trading Commission (CFTC) over jurisdiction of cryptocurrency assets. It is worth noting that the CFTC also sued Binance in March of this year, and made similar allegations. Many of the allegations in the SEC lawsuit are similar to those made by the CFTC, which may indicate overlapping areas of concern between the two agencies.

Regulatory responsibility and jurisdiction in the cryptocurrency asset space has always been a complex issue, and competition and overlap between different agencies may arise. Therefore, some observers believe that the SEC’s lawsuit against Binance may be an attempt to strengthen its position in cryptocurrency asset regulation and compete with the CFTC for jurisdiction in this area.

Binance’s official response, on the other hand, believes that because of Binance’s global reputation and brand influence, Binance has become an easy target and may be caught in a tug-of-war between US regulatory agencies, as this lawsuit may have a show of power. Binance wrote in its official response, “Nevertheless, we stand with our fellow participants in the US digital asset markets in opposing the SEC’s overreach and will fight it vigorously.”

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Is “Li Chu” still a “hot potato”? Is Binance in trouble this time?

- dYdX Founder: Hoping Cosmos’ influence doesn’t overshadow dYdX

- Exclusive Interview with Vechain Founder Sunny: From LV to Crypto World, Web3 is the Perfect Answer for Sustainable Development

- Why is Zhao Changpeng the “heir”?

- Will “Rare Cong” be the next crypto craze?

- Why is Polkadot called Layer 0?

- Ten Questions About the Metaverse: Is There Still Hope for Virtual Land?