Babbitt column | Bitcoin: the power of life without borders

In the blockchain world, many people have blown a lot of cows, but few have really passed the test of time. However, one cow has passed the public beta of more than ten years in the world –

Bitcoin said: I can't make a mistake in my account.

Maybe you think it is strange: What kind of cow is this? Which bank is missing the account? Indeed, there are no banks that add or subtract mistakes, but as the total amount of money continues to grow, it seems that no bank has visited your opinion.

"You agree, it doesn't matter if you don't agree. Anyway, your wealth will be diluted by me." The central bank said this.

- "2019 China Blockchain Industrial Park Development Report" released: Development polarization is serious, Hangzhou ranks first in comprehensive competitiveness

- Bytom Tech Angel joins the Bystack Ecology than the original technology community

- Twitter featured: US credit card 100 million user data leaked, bitcoin security re-recognized

This kind of unconsulted legal possession, people in ancient and modern China and foreign countries have sought various ways to resist, and there is only one feasible solution: the change of regime – to drive you down and exchange money for me. However, such high-level people have plundered the inequalities of lower-level people and have not been able to replace them with a more equal paradigm.

Until a decade ago, Satoshi Nakamoto put Bitcoin into the cryptographic academic circle to test it. This test seems to be a success, but at a closer look, we can only be careful to say that it has not failed so far.

However, every day after the day, the probability of success is swollen. The “success” here does not mean that the price of the currency exceeds 1 million US dollars, but it means that no matter how to toss anyone, this kind of accounting tool will not record the wrong account.

What power can blow this cow? By the power.

First, what is the power?

The power is the ability to hash a very small number.

Hash is a mathematical algorithm, whoever hashes this number, who has the right to write. Anyone can participate in the competition for billing rights. The way to compete is not on the lips, but on the power , and behind the calculations is the machine that performs the hash operation professionally.

Figure 1 A mine consisting of a mining machine

We don't need to know the internal structure of the mining machine. We just need to understand that the bookkeeping right to compete for Bitcoin is a math game.

If you can find a number within the specified time (usually about 10 minutes), you are entitled to record this page in order to be eligible for the award. The hash algorithm is mathematically defined: finding numbers is extremely difficult, but others verify that your numbers are correct but simple.

Therefore, if the verification is correct, this round of competition is over, and everyone will immediately invest in the next round of competition.

But if the account you write is tricky and not recognized by the public, the latecomer has the right not to follow your account page, but to record it after being accepted by more people, so you are losing the original record. At the same time as the account rights, they also lost the rewards they should have.

This is why the tearing of the competition is very embarrassing, but the reason why the accounts never go wrong – the participants think: it is more cost-effective to look at the account on the face of the reward .

This set of rules comes from the code preset by the Bitcoin system. Because everyone has the same code on the computer, no one can change the rules of the game. Therefore, this accounting test has been going smoothly.

The above is the simplest review of the Bitcoin system. Even if we haven't updated the column for a year, as our old friend, you have obvious strength to pass by.

Power is power , power is a good thing, but it can't be used. If you want to abuse the power in the Bitcoin world to issue additional money or pay the money, you will not get the support of the code, but you can get the opposition of other bookkeepers. Regardless of good and evil, everyone has to admit that abuse of power is equal to self-abuse of martial arts.

But there is a problem: If there is a sudden increase in the absolute power of all others, will Bitcoin not forget the original heart and keep in mind the mission?

Second, bitcoin will die

This problem is one of the dead spots of Bitcoin.

As Lord John Acton, the British thought historian, deduced in Freedom and Power: Absolute power leads to absolute corruption, and whoever has absolute power produces the technical possibility of miscounting.

Technically, no one can check and hold the absolute count, because he can find the correct number before everyone else, so he always has the right to write, so it is easy to initiate double payments.

The concept of "double payment" was introduced in the first quarter. After paying a sum of money, I used the money to buy other things and pay again. Our ordinary people generally call it a debt, but others call it "moderate inflation that is conducive to economic development."

If a double payment occurs, Bitcoin must be in the same currency as the US dollar. In other words, Bitcoin is inevitably dead, and this death will come formally when people's confidence in its failure to remember the wrong account collapses .

But why didn't this happen?

Third, human-driven computing power

On January 3, 2009, when Bitcoin was first born, it was the most dangerous time. Because Nakamoto is alone in mining at home, the net power of the whole network is the smallest, so that once there is huge computing power, the possibility of bitcoin violent is very high.

However, because of the choice to start the test in a small area, the computing power is always controllable. The term "controllable" here does not mean "can be controlled", but rather than "out of control": the development of Bitcoin's computing power, but there has never been an absolute big evil weapon, so that it does not appear A successful double payment attack.

Frankly speaking, Bitcoin can be used today. Half of the reason is because of luck. When there is a weak power, there is no bad person to lick it. When people slow down, it has more computing power than any malicious person. Moreover, once a potential bad person wants to catch up with the entire network, it will be overwhelmed by new computing power for various reasons.

It seems that a public security organ has been built in place to settle all the evil forces.

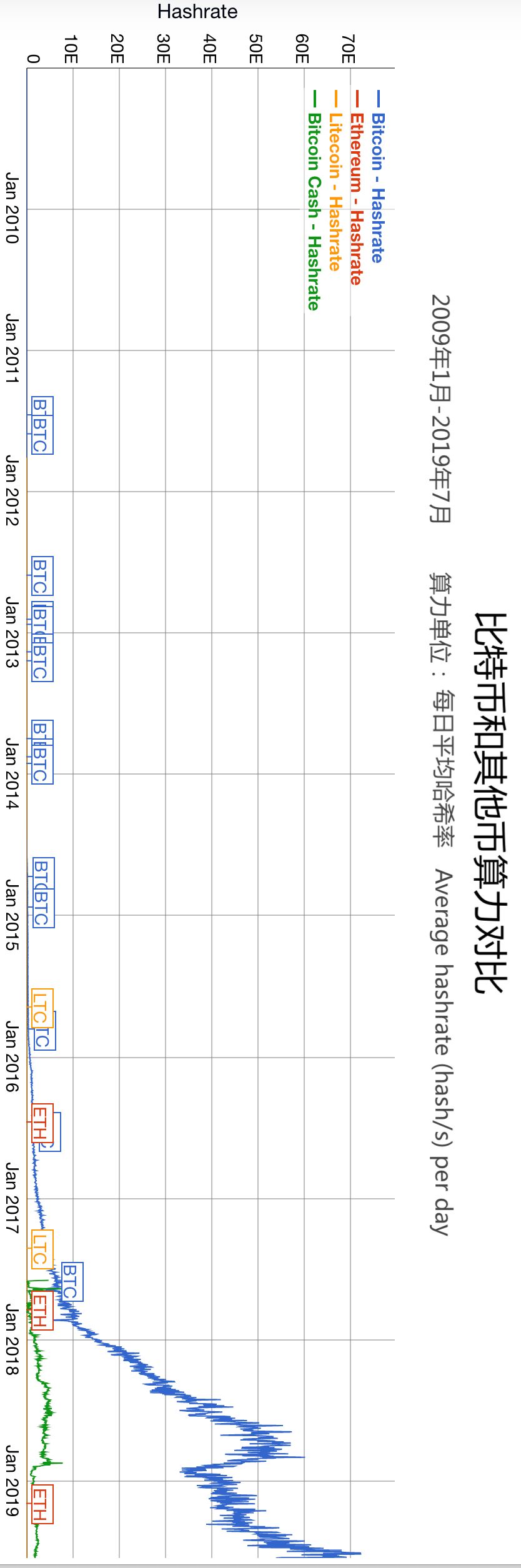

The following picture shows the history of the growth of Bitcoin in the decade from 2009 to 2019. By the way, let's take a look at the comparison between it and other currencies. Considering the long picture, please turn the phone to the 90° horizontal screen:

Figure 2 The history of computing power

Source: https://bitinfocharts.com/

You may be surprised, Bitcoin's computing power is seen, but in addition to ETH, LTC and BCH, where is the computing power of other currencies?

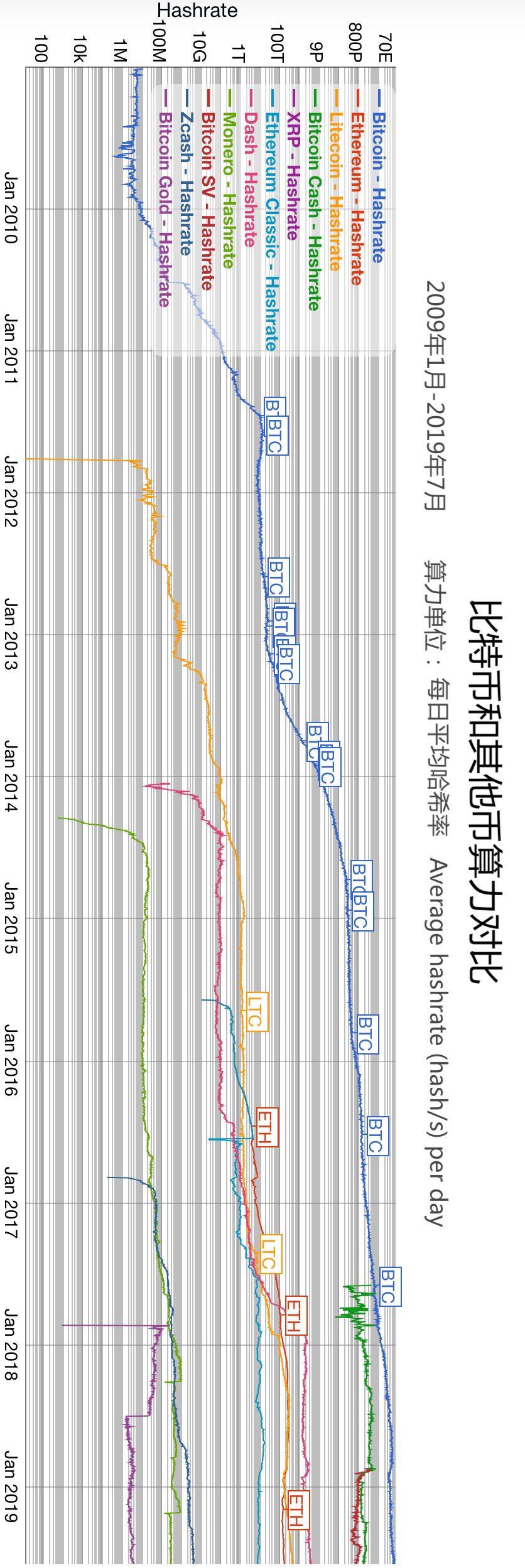

The calculation power of other currencies has been squashed. We reprocess the above diagram with logarithmic coordinates. That is to say, the following figure is exactly the same as the above figure, except that the ordinate (computation power) is different: the ordinate of the following figure Each cell represents an order of magnitude. This way we can clearly see the magnitude of other currency calculations.

To be precise, it is the small amount of other currency.

Figure 3 Calculation of power development history (logarithmic coordinates)

Source: https://bitinfocharts.com/

You see, compared to Bitcoin, the power of other currencies is not a little smaller, but a few orders of magnitude, and is a few orders of magnitude in the long run.

In the first season, "Miners are not digging, but the moat," we analyzed how a man-made and rational ordinary bookkeeper (miners) would act so that it is fighting for its best interests. It also contributes the most to protecting the bitcoin accounting system.

After all, Bitcoin is just a bookkeeping tool, just because it doesn't remember the characteristics of wrong accounts, attracting more and more people to use it as a value storage tool. Computation is the ultimate umbrella for this accounting tool. The point here is: Behind the bitcoin computing power is not the ordinary mining machine group, but people are afraid of losing the wealth of existing wealth, human nature is the base of bitcoin.

The value storage tool is just a projection of human nature, humanity is immortal, and tools are not dead.

In this sense, Bitcoin is no longer a machine, but a computing power based on human nature. It has no nationality, but it will breathe, grow taller, and be immune to infringement. All this is technically dependent. It is the power of the whole network that no one can do it right.

So, if someone asks you: Since all are virtual currency code open, why can't other currencies copy Bitcoin's success? You can ask him a question: Who is copying the power when the world is copying the code?

Conclusion

Four years ago, when I first joined a new team, although I heard Chinese in my ears, I felt that my colleagues were speaking foreign languages because I was completely ignorant of hundreds of new concepts.

Every time I mentioned a new word at the regular meeting, I felt a bullet in the flesh. At the end of the meeting, I was rolling around and the blood flowed into the river.

A newcomer wants to understand that the new term he doesn't understand is instinctively struggling, but when countless new terms come to the fore, this powerless frustration makes it easy for people to give up.

What's more, Bitcoin is something that is subversive in human history, simple in structure, but complex in terms of understanding, and complicated to unprofessional, it is impossible to understand its simplicity. degree.

Without an accurate understanding of the concept, the world of human thinking can easily collapse.

So I started to challenge myself. In October 2017, the public number was launched and updated weekly. Thank you for your support. I have gained a lot. Although I stopped for a year later, in the year, my harvest did not diminish.

The biggest gain is to bind the concept of the first and second seasons of our column into a book, publish and distribute, and especially to the mechanical industry publishing house and planner Mr. He Qidong for the full support of the book "Simple Blockchain".

Like you, as one of the onlookers of the most innovative financial tool "blockchain" of this era, I don't know the correct answer to many questions, but I want to see with you what things can stand the test of time. Who can stand up and blow out.

Blowing a calf, but also my wish: I hope that the concept in my book can protect your thinking world like the power in Bitcoin.

Author: Tom Strong

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blockchain Weekly | The overall heat of the trading market has dropped by about 30%, waiting for a good time in August

- The index becomes a new track for entrepreneurship. Can it be born to MSCI that belongs to the blockchain pass market? 丨Babbit observation

- Australia implements a cash payment limit order, digital currency or into a new favorite

- Microsoft's project is comparable to Facebook's currency, but many people still don't understand it and "make it" in the drums.

- QKL123 market analysis | The number of coins destroyed in the day, the pot of the hearing? (0730)

- The storm set off a storm, the Internet "old" is difficult to grasp the blockchain "straw"

- The bitcoin transfer advantage is once again highlighted! Whale transfer of $468 million requires only a few hundred dollars in handling fees