Babbitt column | Dovey Wan: Bitcoin is not a safe haven, yet

Recently, the price of coins has risen sharply, which coincides with the escalation of trade wars, the United States sanctions Iran and other international economic and political frictions. So many people have begun to talk about the safe-haven properties of Bitcoin at the macroeconomic level. I almost believe that It is.

The desire is full, and the reality is the backbone. This cycle undoubtedly brings a lot of big money and institutional involvement (I will have two articles next, a summary of conversations with the heads of Fidelity and Vaneck's digital currency products), and many high-net-worth people in Bitcoin called " Focus on the “safe haven” attribute, but arbitrarily impose “safe haven assets” in traditional financial markets on Bitcoin, and Nakamoto’s estimate also means a face-lifting. Next, I will explain in several dimensions why Bitcoin is not a safe-haven asset in the traditional sense, and what it can “evade”.

Asset volatility

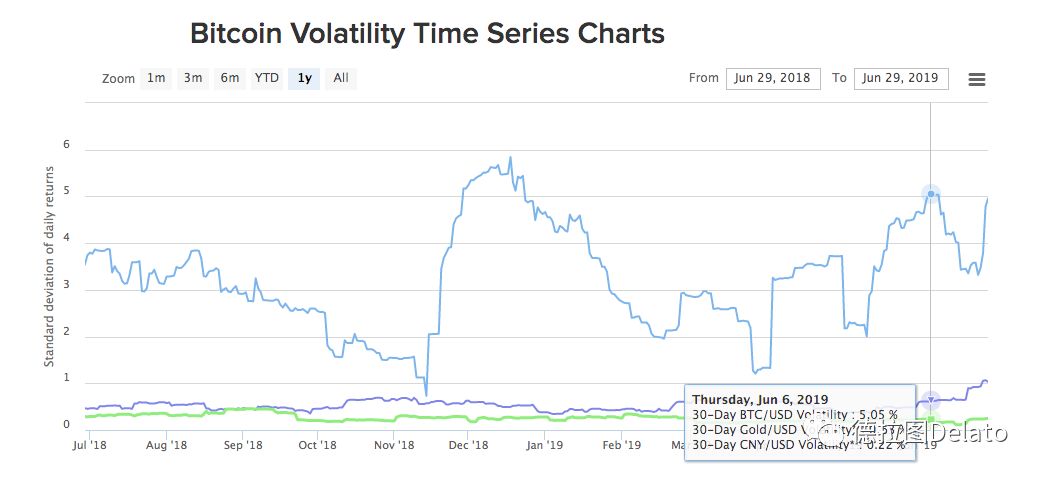

Figure 1: Bitcoin asset volatility

- Weekends are rising? Since May, 40% of BTC's rising prices have occurred on weekends.

- Where is the development bottleneck of DeFi? What is the opportunity?

- Reddit will accept cryptocurrency rewards, this time without robots

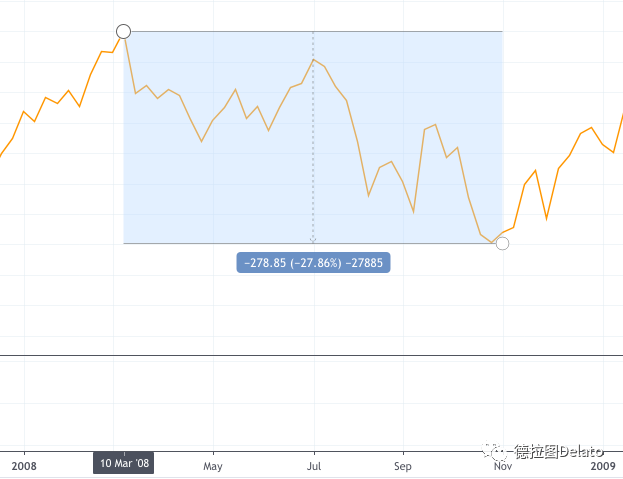

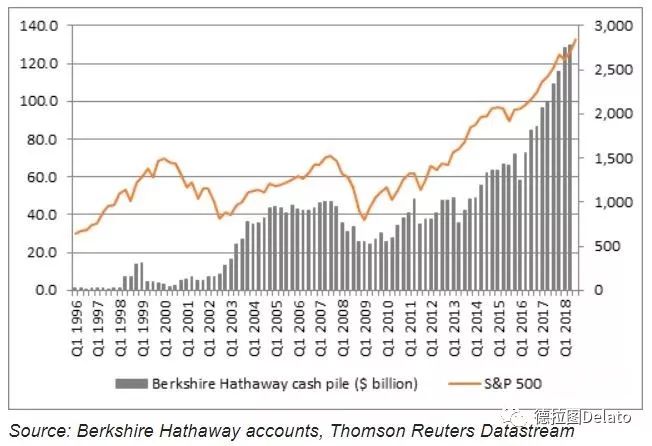

Safe-haven assets refer to assets that are more stable relative to the legal currency as the market changes. Commonly used safe-haven assets are US dollars, US dollar bonds, gold, Swiss franc yen, and so on. According to this definition, Bitcoin is far from being a safe haven. The bitcoin price fluctuation shown in Figure 1 above far exceeds the price of gold against the US dollar, or the price of the RMB against the US dollar. And all the hedging is relative to cash . In the current financial world, the dollar is the standard. As long as the US national reputation does not collapse, the dollar is always the lowest risk, the real safe-haven asset. Cash is the best configuration for the financial crisis. After all, in the worst of the 2008 financial crisis, the price of gold against the US dollar also plummeted by nearly 30% (Figure 2 below). Buffett’s recent cash position has also recently reached its all-time high (Figure 3 below). At a recent shareholder meeting, Buffett said his cash position has now reached an all-time high of $112 billion.

Figure 2: 2008 gold to dollar price

Figure 3: Buffett Cash Position History Curve

The hedging significance of gold is often only manifested in the ultimate chaos. For example, when World War II, Europe purchased materials from the United States, and many settlements were settled through gold. The United States thus gained nearly 40% of the world's gold reserves after the end of World War II, directly contributing to the dollar/gold anchor rate of the Braden forest system. The ultimate safe haven for gold comes from the settlement advantage brought about by its value consensus, which does not depend on its price pair of legal currency. With the global dollarization, the share of US dollar foreign exchange reserves fell to 61.94% from 62.40% in the previous quarter. Although it continued to decline, the US dollar is still the world's largest foreign exchange reserve. And the economic development and employment of the United States has been strong, and the national credibility of the United States is still very strong under the squandering of Trump.

Liquidity fragmentation

As a single transaction target, Bitcoin is now close to the market value of 200 billion US dollars (the same level of companies have Boeing, Intel), its liquidity can make all stocks of the same market value shame. Its 24-hour trading volume is close to $2 billion on the “Real 10” exchange (the US financial data service agency Bitwise submitted a report to the SEC, defining 10 companies due to the existence of fake and brushed transactions on a large number of exchanges. The trading volume is close to the real exchange, so many trading volume data are based on the 10 exchanges, as shown in Figure 4).

Figure 4: Bitwise mentions in its report the top 10 global exchanges with real trading volume

In addition to the above spot exchanges, the largest trading volume of Bitcoin now comes from the contract exchange Bitmex. Bitmex has completed $10 billion in Bitcoin transactions in the past year and is the king of the undisputed deal. The hidden danger behind huge liquidity comes from the high fragmentation of its liquidity, and because a large number of robot trading and contract positions are stacked at a certain price level, the price of a single exchange can lead to price linkage and domino effect, so it often “manipulates bitcoin Price is not difficult.

On May 17 this year, we witnessed bitcoin because Bitstamp's liquidity and trading depth are not enough to support a big sell order close to 2,000 bitcoins, because Bitstamp's bitcoin price is the world's largest contract exchange BitMex 50% of the price weights led to a single-single burst on BitMex, which continued to fall off the cliff after forced liquidation. At that time, the price of bitcoin fell from nearly 8,000 US dollars to 6000 US dollars.

Figure 5: Bitstamp bitcoin price plummeted on May 17, 2019

Liquidity fragmentation is also an important reason for CBOE's closure of Bitcoin futures products this year. CBOE (Chicago Options Exchange) stopped its bitcoin futures products this year, mainly because of the bleak liquidity and trading volume, and its auction pricing is based on the price of the dollar exchange Gemini, Gemini is a trading volume and liquidity The poor trade unions have led to many flaws in the design of their futures.

Bitcoin is still an 11-year-old child. The market value of 200 billion US dollars is not enough for many traditional financial market institutions to bear its "safe haven" demand, and because of the fragmentation of liquidity, block trades have become extremely difficult. Coupled with price maneuverability, this does not meet the "hazard" needs.

Asset correlation

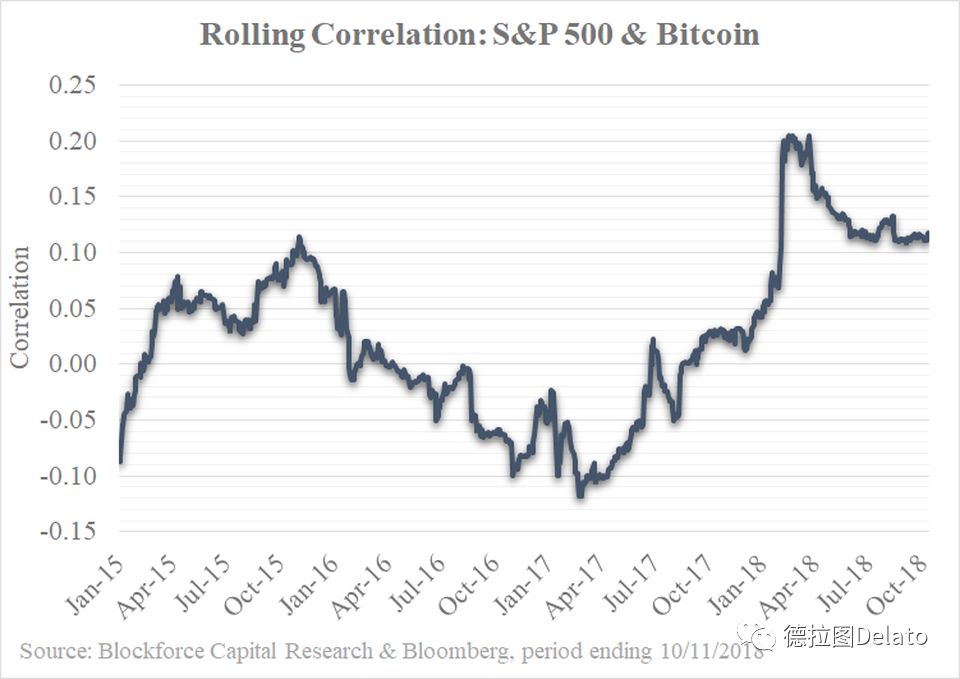

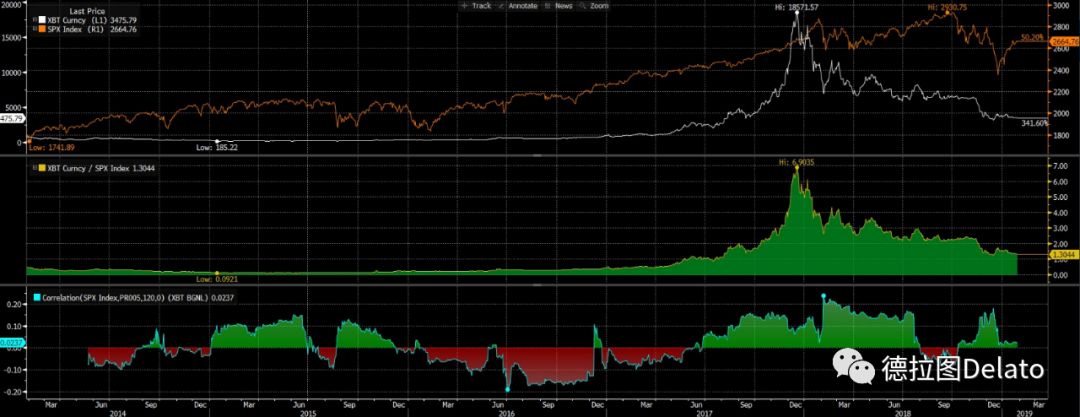

Regarding the correlation between bitcoin prices and stock market prices, unlike many people's brains, there is no significant correlation between bitcoin prices and high-risk assets (such as stocks) or low-risk assets (such as national debt) in the traditional financial world. Sexuality, there is no positive correlation, and there is no negative correlation. It is in the correlation interval below plus or minus 0.2 for a long time.

Figure 6: Price correlation between Bitcoin and SP500 in 2018

Figure 6: Price correlation between Bitcoin and SP500 in 2019

And sensitive to macroeconomic signals relative to other financial assets, Bitcoin has long been in an independent parallel world. In the picture below, after the Federal Reserve raised the signal of interest rate cuts and doves on January 30, gold rose and Bitcoin remained indifferent. Many macroeconomic signals will be over-interpreted by many speculative people, such as the Iranian crisis, the lira crisis, etc., and the real price curve may not even have a small fluctuation noise. Bitcoin's independence of relevance can be an advantage in asset allocation at best, and it cannot be a safe haven advantage on a global scale.

Figure 7: Bitcoin and gold after the US Federal Reserve cut interest rate news, the above picture bitcoin, the following figure gold

Bitcoin used to be, and now is, another asset that will be a high-risk class for a long time to come. For many traditional institutions and high-net-worth individuals, it is not a safe-haven asset, but bitcoin is similar to art. “It is a more acceptable concept. As the price of Bitcoin rises, its overall volatility is also tending to go down (Figure 8). This is good news for Bitcoin to truly become a “safe haven asset” in the future.

Figure 8: Bitcoin history 30-day price volatility

The most critical attribute of Bitcoin as an asset choice for the parallel world is its self-sovereignty (the strong ownership of hard assets, which means that in the currency, there is absolute ownership and control over the assets). This means that Bitcoin does have a safe-haven function for regional currency crises when the local currency is severely overcrowded and crashed. And because it goes beyond the scope of foreign exchange control, anyone in the world can make a bitcoin transfer with another person. But often in this extreme environment, such as today's Venezuela, the local bitcoin liquidity is much lower than the dollar liquidity, because few bitcoin holders are willing to exchange their own bitcoin for glass. Lival, the dollar became the first stop for the Venezuela people to flee the local currency.

In the real perception of the vast majority of people, the speculative nature of Bitcoin is much higher than that of other financial attributes (I am not against speculation, speculation brings liquidity and consensus communication), "The myth of riches" A villa is the most acceptable gimmick for the target group and audience at this stage.

In the long run, bitcoin is hedged by a worldwide systemic currency crisis. In the short to medium term, Bitcoin is more of a hard asset with strong ownership to resist the arbitrage and forced cession of private property by violent institutions. Nearly one-third of the German Nazis spent money during the Second World War by relying on the scraping and deprivation of Jewish property. We were born in a peaceful era, and perhaps did not realize the importance of ownership of private property, but when that day came, there was no private key. You will be caught off guard by the brutal reality.

Author: Dovey Wan

Source: De Lato Delato (WeChat public number)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Coinbase: Bitcoin is becoming mainstream in the US, and nearly half of institutional investors are considering holding cryptocurrencies

- Encrypted Currency and Stratum Crossing (1): Bitcoin is your only chance to "slap the table"

- Quote analysis: BTC weekly line receives super big Yinxian, the long market is over?

- How do programmers view Libra source code? More doubts on GitHub

- In-depth interpretation of the first reading of PlatON cloud map economic blue book

- Gu Yanxi: Commercial Bank, the victim of the blockchain era

- Morning market: cryptocurrency market is weak, bitcoin shocks slightly