Babbitt column | Five trends in blockchain in 2019

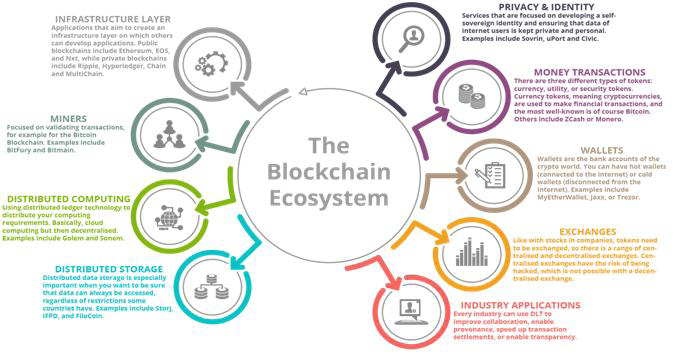

The blockchain ecosystem is rapidly expanding, releasing new blockchains and new consensus mechanisms to form a more mature ecosystem. In order to be widely used in blockchain technology, a decentralized ecosystem must be developed; in order to achieve a decentralized society, more components, global standards and substantial investments are needed .

It takes three to five years before the ecosystem is ready for a full enterprise implementation. In addition to the need to develop different industries, we will continue to see the new distributed accounting technology DLT and more exciting distribution applications. The blockchain ecosystem consists of multiple layers, as shown in the following infographic:

As the blockchain ecosystem evolves, new applications and technologies are beginning to play a role. Here are the top five trends in this year's blockchain:

- The Wall Street Journal: Why can stable coins stand out in the world of cryptocurrencies?

- Discussion | Random Number Security Problem in Blockchain

- Kik has no chance of winning this match with the SEC.

Trend 1: Convergence of blockchains and other emerging information technologies

Blockchain is not an independent technology, especially the convergence of blockchain and big data, Internet of Things or artificial intelligence (BASICED: Blockchain, AI, Security, IoT, Cloud, Edge computing, big Data) will be subversive Sex. This convergence will greatly affect how organizations should process data and how to gain insights from it, requiring new solutions and methods from organizations, regulators, and individuals to ensure that everyone ultimately benefits. In the coming years, we will increasingly see this fusion in real life.

Networked devices and online services will increase the amount of data available and analyze them through intelligent algorithms; IoT devices will be able to perform microtransactions using cryptocurrencies, and blockchain will ensure that any data transmitted between different participants is immutable , verifiable and traceable. In addition, any smart contract recorded on the blockchain will be intelligently automated, and the output of one smart contract can be the input to another smart contract, creating an intelligent decentralized autonomous organization.

The convergence of these emerging technologies is rapidly changing our lives, work and society. For organizations, it's important to look at how to use these technologies to create a better, more inclusive, fairer, and more transparent society, while respecting the privacy and security of individuals and ensuring a healthy bottom line.

Trend 2: The rise of blockchain as a service (BaaS) solution

Almost all technologies can become "service-as-a-service" solutions, and blockchain is no exception; we see more and more blockchain-as-a-service (BaaS) products. These cloud-based solutions enable organizations to rapidly develop and launch decentralized applications, while cloud-based service providers will ensure that the required infrastructure runs smoothly. This is an interesting development, and as with any “service-as-a-service” solution, more and more BaaS will accelerate the organization's application of the blockchain.

Many organizations already offer BaaS solutions, such as Amazon, Microsoft and Oracle, which offer easy-to-install blockchain solutions; they mostly support various types of blockchains, including Ethereum, Hyperledger, Corda or Fabric. The main advantage of the BaaS solution is that organizations can pay on demand at any time without any upfront costs, allowing organizations to quickly experiment with blockchains to see which technology is best for them. In the next few years, we will see more blockchain-as-a-service solutions appear and be widely adopted.

Trend 3: The best hybrid blockchain in both worlds – the fusion of private and public chains

Since the birth of Bitcoin, there has been a lot of controversy in the blockchain world: some people think that the public chain is the only real blockchain, while others think that the private blockchain or the alliance chain will be the most subversive block. chain. Now that the hybrid blockchain is coming, I hope to end this debate. They aim to achieve the best of both worlds through access control but at the same time freedom, since only known characters can access the network, so 51% of attacks are unlikely to happen (although it is certainly not impossible, but who knows who to do).

In a mixed blockchain, you can limit the visibility of certain information on the network. Some transactions can only be seen by the largest participants in the network, while others are visible to anyone. Private transactions benefit from a scalable, secure, and fast private-chain network that ensures the credibility of untrusted transactions. Mixed blockchains are very useful for regulated markets, and not all parties should see all the information. The hybrid blockchain is expected to become very popular in the coming years.

Trend 4: The Ricardian contract not only defines the intent, but also automatically executes the instructions.

Smart contracts are known as killer apps for blockchain technology and they seem to be revolutionary. But smart contracts are nothing new, and they have been around for a long time; in fact, in most modern office buildings, there are already smart contracts, for example, a decision to decide whether to allow access to a certain area is a piece of code. Pre-defined and linked to the database.

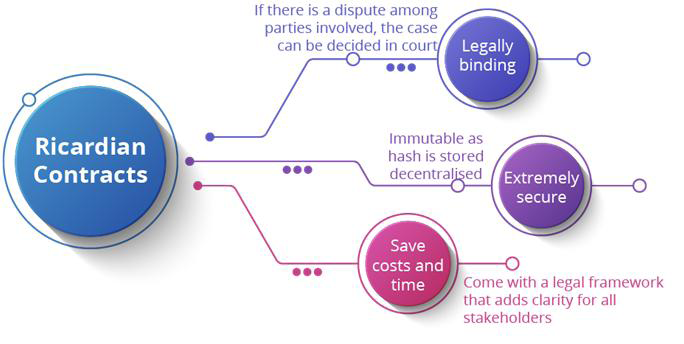

However, there is a problem with existing smart contracts that they are not legally binding. Therefore, in 2018, people became interested in the Ricardian Contracts contract. These types of contracts differ from existing smart contracts in that they are legally binding and record multi-party agreements in human-readable and machine-readable text (unlike smart contracts, smart contracts only execute the instructions defined in the agreement). ) means that it is a legal contract that is easy for readers, machines and everyone to read and understand.

The Ricardian contract uses a cryptographic signature in the legal agreement. Unlike a smart contract, if there is a dispute between the parties involved, it can be decided in court. Once a human-readable protocol is converted to a machine-readable protocol, it can be hashed and then stored in a blockchain. Thus, each part of the document can be uniquely identified by its hash, and it is not possible to change the original agreement without the other parties knowing. Therefore, the legally valid Ricardian contract is very secure and there will be many applications benefiting from the Ricardian contract in the future.

Trend 5: The rise of STO for securities tokens, replacing the initial token issuing ICO

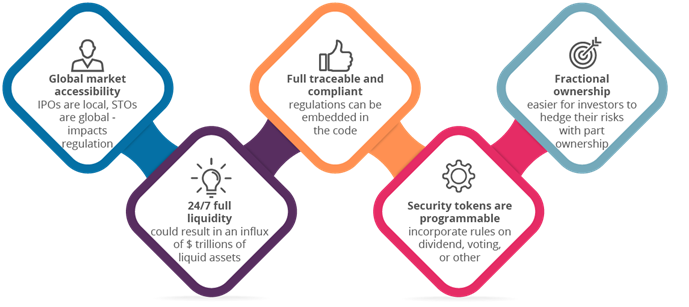

A securities token is a token that allows the owner of the token to own (the company/organization's future) equity, whether in the form of dividends, revenue sharing, or price appreciation. It constitutes an investment contract and has therefore attracted the attention of the Securities and Exchange Commission (SEC).

The distribution of securities tokens during the STO issuance. According to the structure of the STO, it can bring many benefits to investors, such as the ability to express opinions through voting, receive dividends based on the proportion of related assets or company ownership, and others. right. Moreover, STO not only benefits investors, but also benefits publishers and other stakeholders such as regulators. In short, programmable securities tokens have five major advantages over other tokens: global market, full flow, compliance, programmable, and separable.

Conclusion

Blockchain, especially when combined with other technologies, provides organizations with the opportunity to rethink their internal and external processes, eliminate inefficiencies, increase transparency, traceability, and build a better overall organization. Moreover, the examples of STO, mixed blockchain and Ricardian contract indicate that the blockchain ecosystem is still developing and improving. The organization should maintain an open vision and mentality, and promptly solve the blockchain development and changes.

This is an exciting historical moment, let us participate and witness the rapid development of this field in the next few years!

Author: Larry, Dr Rijmenam.

Babbitt Note: Ricardian Contracts is usually translated into the Ricardo contract, which was invented in 1996 by a programmer and cryptographer named Ian Grigg. For readers of Ricardian Contracts, please read: https://101blockchains.com/ricardian-contracts/

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Who is the dumbest person in the encryption market?

- Market Analysis: ETH takes the lead in breaking through, and the Mavericks market is coming again?

- Bloomberg: More than 200 countries, cryptocurrency exchanges ushered in the biggest "life and death test"

- From "Forensics" to "Certificate of Deposit"——Building a Legal Supervision Data Theory System by Using Blockchain Technology

- Viewpoint | What should be the blockchain's science and technology index?

- Digital Currency in the Eyes of Economists: Series Preface

- Who is using DApp? ETH/EOS/TRON user portraits are all secret