Bakkt's crypto asset market expansion is a positive trend

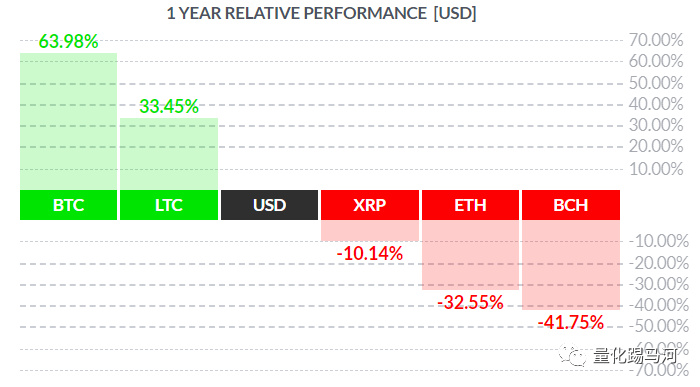

Figure Mainstream cryptocurrency nearly one year yield (source: Finviz)

Content Guide: On August 16, Bakkt, a background-rich bitcoin futures trading platform, announced that it will launch a Bitcoin futures contract on September 23. After the news was released, the entire cryptocurrency community was almost boiling. In fact, for some time, the enthusiasm of cryptocurrency futures exchanges has continued to rise, and the expansion of the crypto-equity market driven by Bakkt, LedgerX and ErisX is a trend-oriented deduction, which will consist of market participants, incremental funds, and crypto assets valuations. Price discovery, market games and other aspects have long-term and profound impact on the crypto-asset market.

First, let's take a look at the latest developments in cryptocurrency futures exchanges such as Bakkt, LedgerX, ErisX, Seed CX, and Blade.

- The blockchain is “useless”, why are we still gambling on the future and not willing to leave? | 2019 than the original chain global developer conference

- Korean media: 97% of the Korean exchanges are on the verge of bankruptcy, and the project side seeks overseas currency

- The report shows that the stable currency platform is the first Ethereum, and the second is the bit stock.

Bakkt

In early August 2018, the New York Stock Exchange (NYSE) parent company, the Intercontinental Exchange (ICE), and Microsoft, Starbucks, BCG and other companies jointly launched the hacked asset trading platform Bakkt. The company aims to create an open, seamless global network that allows investors, businesses and consumers to buy, store and pay for digital assets in a simple, efficient and secure manner.

On August 16th, Bakkt announced on its official Medium blog that it will work with ICE futures US and ICE Clear US on September 23 to launch daily and monthly bitcoin futures contracts for custody and physical delivery. Bakkt's Bitcoin futures will be traded on ICE futures US and settled at ICE Clear US.

Image source: Bakkt official website (August 19, 2019)

Bakkt CEO Kelly Loeffler said in a statement that the contract has been approved by the US Commodity Futures Trading Commission (CFTC) and user testing has begun. Approved by the New York State Financial Services Authority, Bakkt will set up a custodian, the Bakkt Trust Company, which will store bitcoin for physical delivery futures. This provides customers with regulatory transparency and security while providing a regulated global exchange in a market that lacks institutional-level infrastructure services.

She pointed out that the digital asset market has so far been a global and well-developed market, but they are mainly for individual investors, not institutional investors. Bakkt is making up the gap into this market and addressing the issue of mitigating institutional participation. “Whether we are concerned about liquidity, market quality and regulatory deficiencies, or issues related to reliability, cost and operational risk, we are responding to these challenges in a transparent manner.”

"We believe that a benchmark that can be referenced globally will create confidence in the true price of Bitcoin." Kelly Loeffler told the media that this is an important step in building more trust. The fragmentation of bitcoin transactions means that people lack confidence in prices, and ICE's futures contracts will enable traders to judge and express their views through a one-year price curve.

Bakkt said that some brokerage firms that have partnered with ICE for futures trading have agreed to deal with these encryption contracts. ICE said its ultimate goal is to create an ecosystem that encourages pension funds, endowments and other institutions to invest more in cryptocurrencies and make it easier for consumers to buy products in cryptocurrencies.

Previously, Bakkt originally planned to list physical bitcoin futures contracts in December last year. The CFTC officials were skeptical about how customers' cryptocurrencies would be stored and to avoid possible theft and manipulation. On July 22nd, Bakkt conducted a user acceptance test to ensure that customers, clearing members and suppliers were able to communicate effectively when they tried the contract.

Considering the background of Bakkt and its advantages in terms of hosting and compliance, we expect Bakkt to become a super-channel for institutional investors to enter the cryptocurrency market.

LedgerX

At the end of July, CoinDesk reported that LedgerX, the first federally regulated compliant digital currency derivatives exchange in the United States, officially launched the first batch of bitcoin futures contracts in the United States. But since then LedgerX has clarified that its platform currently only has bitcoin spot and options trading, and there is no bitcoin futures.

LedgerX's new products are aimed at not only institutional investors, but also individual investors, who can trade contracts only through the KYC process. President Paul Chou said that individual investors can trade their futures on the company's latest Omni platform, and institutional clients can trade futures like other LedgerX products.

Paul Chou also said that for the past six years, we have been engaged in this business, not only have been seeking financial institutions to join, but also spent a lot of time to contact and educate the regulators, let them understand the importance of this, "cryptocurrency applies For everyone, we have never started offering this service only to hedge funds or institutional clients."

Ledgerx was founded in 2014, but it was not until 2017 that it began offering physical settlement of bitcoin derivatives. However, its options and swaps were originally aimed at institutional clients. It filed the necessary license application with the US Commodity Futures Trading Commission (CFTC) in November 2018 and disclosed the news that Bitcoin futures will be offered in April this year.

ErisX

According to Coindesk's July 1 report, the US Commodity Futures Trading Commission (CFTC) has granted the ErisX Derivatives Clearinghouse (DCO) license to crypto-derivatives provider supported by online stockbroker TD Ameritrade, which the exchange has acquired. Secondary approval above the designated contract market (DCM) license. This means that the company can now launch cryptocurrency futures products with the support of US regulators.

ErisX said it will launch a physical settlement of futures contracts later this year, the exact time is not clear. ErisX CEO Thomas Chippas said that ErisX is different from other platforms currently offering cryptocurrency futures on the market. ErisX "uses traditional DCM (transaction) and DCO (clearing) models to divide transactions and settlement functions." This reflects institutional investors. Demand for other asset portfolios (outside the spot) is increasing, and this increase in demand will help drive the cryptocurrency market into the broader user community. ”

The ErisX Exchange was founded by former Citigroup executive Thomas Chippas and has received numerous investments from large Wall Street institutions and is a legal exchange with multi-domain licenses.

In October 2018, according to Bloomberg News, TD Ameritrade announced that it has invested in the virtual currency exchange ErisX, and plans to provide cryptocurrency spot contracts and futures contracts.

In May 2019, TD Ameritrade announced once again that it will work with ErisX's team to develop and launch cryptocurrency trading products.

Seed CX

Recently, the Seed SEF (swap execution agency), a subsidiary of the cryptocurrency exchange Seed CX, has begun user acceptance testing of the physical settlement bitcoin margin swap business. Seed SEF revealed that the test will run through August and will wait for regulatory review after completion and will launch the product in the US market in the future.

SeedCX co-founder and CEO Edward Woodford said: "We are working closely with the US Commodity Futures Trading Commission (CFTC) and hope to launch the product to the public within the next three months." It also revealed that they have been in the past ten Working closely with regulators for eight months, it is still awaiting final approval, making SeedSEF a “self-certified” bitcoin swap product. As the “first” test platform for physical settlement of Bitcoin margin swaps, the new product will be a combination of margin and physical settlement, which means that traders will be allowed to use leveraged positions to buy or sell physical delivery bits in the future. currency.

Image source: Seed CX website (August 19, 2019)

Seed SEF plans to list weekly and monthly contract combinations in the form of announcements, with four weekly contracts, three consecutive monthly contracts, and two quarterly monthly contracts. The combination of contracts in this time frame is very unique and will be a “perfect complement” to existing products on the market.

CME

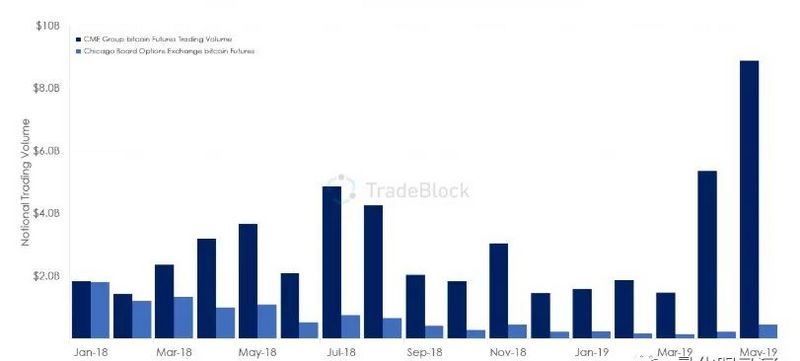

The traditional financial derivatives exchange, the Chicago Mercantile Exchange (CME) and the Chicago Board Options Exchange (CBOE), launched a dollar-denominated bitcoin futures contract in December 2017. Since the trading volume of Bitcoin futures contracts is relatively small, CBOE officially stopped the Bitcoin futures trading after the last bitcoin futures contract was settled on June 19.

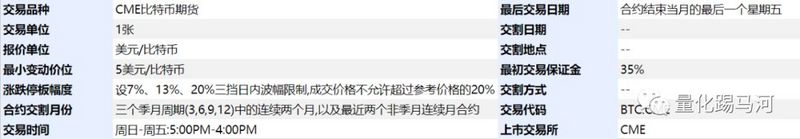

Figure CME Bitcoin Futures Contract Details (Source: Wind)

Figure CME Bitcoin Futures Contract (Continuous) Transactions and Positions (Data Source: Wind)

Figure CME and CBOE bitcoin futures nominal trading volume comparison (data source: TradeBlock)

Blade

According to CoinDesk, the cryptocurrency derivatives exchange Blade recently received $4.3 million in seed round financing, including Coinbase, SV Angel, A.Capital, Slow Ventures, Justin Kan and Adam D'Angelo. The exchange is scheduled to go live in a few weeks.

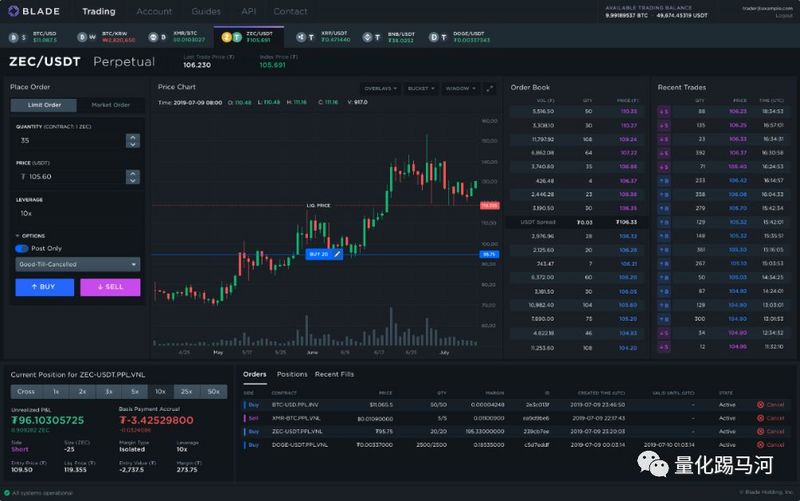

The Blade Exchange mainly provides perpetual swap contracts based on cryptocurrency and has designed three new rule improvements, including: the perpetual contract will be developed using standard simple contracts; the perpetual contract will be executed using USDT stable currency. Settlement and as a margin; for cryptocurrency pairs, the leverage of the transaction can be up to 150 times. Blade is expected to launch 7 different trading pairs (involving BTC, Monroe, Dogecoin, Zcash, Rebo, Coin and USDT).

Figure Balde trading interface

It is reported that due to the stricter regulation of cryptocurrencies by US government agencies, US investors will not be able to legally participate in the trading of the Blade Exchange. Blade itself is an offshore entity with a US subsidiary that is primarily oriented to the East Asian region. Jeff Byun, CEO of Blade Exchange, said that the Blade Exchange hopes to create a cryptocurrency "basic layer of risk hedging markets."

Encrypted asset market expansion is a positive trend

Analysis of the above cryptocurrency futures exchange dynamics, we can find that the encryption asset derivatives trading market is undercurrent, Bakkt are pushing the historical trend of the expansion of the crypto-asset market to a deeper interpretation.

Encrypted assets as an emerging asset class will accelerate penetration in the institutional investor portfolio. According to the cryptocurrency of nearly 2,900 spot transactions tracked by Golden Finance, the latest market capitalization is nearly 2 trillion yuan. With the development of blockchain technology and the penetration of industry applications, the obstacles such as custody and compliance of encrypted asset transactions have been gradually solved. Encrypted assets such as BTC, ETH, LTC and BCH are being used as new asset classes and are continuously included in institutional investment. In the asset portfolio, the consensus on the asset allocation value of the encrypted assets in the investor group is continuously strengthened, and the encrypted asset market will continue to usher in incremental funds. Due to the margin trading mechanism of futures contracts, the introduction of the physical delivery mechanism will continue to bring incremental funds to the crypto-asset market, and the amount of encrypted assets will also grow rapidly.

The combination of various types of funds in the crypto-asset market determines the final direction of the market, rather than the incremental funds driven by Bakkt. The launch of the compliant cryptocurrency futures exchange represented by Bakkt provides a super-channel for institutional investors to enter and exit the crypto-equity market. Institutional investors' investment decisions are generally more cautious and rigorous, and decision-making is also more tactical. In the face of the immature crypto-asset market, it is more cautious, market maturity, valuation rationality, price volatility, customer subjective Willingness, etc. are the decisive factors in determining whether or not to enter or enter the game. Bakkt and other compliant crypto-equity exchanges only provide an efficient channel for institutional funds to enter and exit, and are not essentially decisive for crypto-equity.

The launch of the Bitcoin physical delivery futures exchange will accelerate the maturity of the crypto-asset market. The crypto-asset market is in the early stage of development and is currently considered to be extremely immature. The policy at the national and industry levels is highly uncertain, and the barriers at the regulatory level are extremely large. Fraud and hacking attacks also occur from time to time. Institutional investors continue to enter the market, which will accelerate the penetration of the mainstream BTC consensus in cryptographic communities such as ETH, LTC, BCH, and EOS. It will accelerate the pace of policy formulation and regulatory coordination, and will accelerate the maturity of the crypto-asset market.

A reasonable valuation model for cryptographic assets will continue to emerge, the price discovery mechanism will be more perfect, and market effectiveness will increase. Bakkt potentially drives institutional investors to continue to enter the market. The investment logic of institutional investors determines its strong demand for a reasonable valuation model for cryptographic assets, which will greatly enrich the theoretical system of cryptographic asset valuation, rather than being limited to the current A relatively single value storage valuation model. At the same time, the far-month futures trading can realize the future asset price discovery to a certain extent, and then improve the price discovery mechanism of the encrypted assets and enhance the market effectiveness.

The game of crypto-equity will become more complicated, and the advantages of quantitative trading strategies will be more obvious. The types of participants in the crypto-asset market will be more abundant, and the degree of game behind it will be more complicated. Institutional investors have diversified investment strategies, and have long been tested by the market, mature strategies, and complete investment research systems, which will make it more difficult for individual investors to grasp the investment opportunities in the crypto-asset market. The quantitative trading strategy has the characteristics of rapid market volatility and strict investment discipline, and will exert obvious advantages. The management scale of the quantitative fund will also be greatly expanded.

This article comes from quantify the Kicking Horse River (ID: gh_e9da2a6cbc62) , Author: quantify the Kicking Horse River

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- A shares | China Construction will soon set up a blockchain financial platform, the stock price reached a new high within a year and a half

- Received more than 100 million US dollars in cryptocurrency, Fidelity announced 4 years of cryptocurrency charity record

- How much does it cost to maintain a blockchain startup?

- Hat analysts wearing XRP "mainstream coin speculation" also cautiously viewed it

- QKL123 market analysis | The strong rebound of the cottage currency, bitcoin attacked 11,000 US dollars (0819)

- Babbitt Column | Xiao Wei: Why do I object to the market value management "virtual currency"?

- Why did Litecoin fall 25% after halving? Analysts say the downtrend will change