Research on the Correlation between Bitcoin and Gold

OverView overview

The idea that bitcoin is not a safe-haven asset; instead, it is a speculative asset with a storage value and strong uncertainty.

Viewpoint 2 At the daily level, Bitcoin is not correlated with gold, but it is moderately positively correlated with the number of active addresses. At present, the number of active addresses is relatively low, and the price is still under pressure.

Report report

Introduction to recent fundamentals

The market has been affected by various bad news since August. First, the continuous warming between the Sino-US trade war.

- Bakkt's crypto asset market expansion is a positive trend

- The blockchain is “useless”, why are we still gambling on the future and not willing to leave? | 2019 than the original chain global developer conference

- Korean media: 97% of the Korean exchanges are on the verge of bankruptcy, and the project side seeks overseas currency

- On August 2nd, Trump threatened to impose tariffs on China for four consecutive tweets, and criticized China for repeatedly saying nothing in the negotiations.

- On August 5, the RMB subsequently broke 7, and the US stock Dow Jones index fell 2.90%.

- On August 6, the United States listed China as a currency manipulator

- On August 7th, Hong Kong continued to return to the parade and began to occupy the airport.

- On August 11, the results of the Argentine presidential primaries were unexpected.

- On August 12, the 2-year and 10-year US Treasury yield curves approached upside down, with a difference of only 5.605 basis points, the closest level since June 2007.

- On August 13th, the Argentine peso fell sharply and risk aversion increased again.

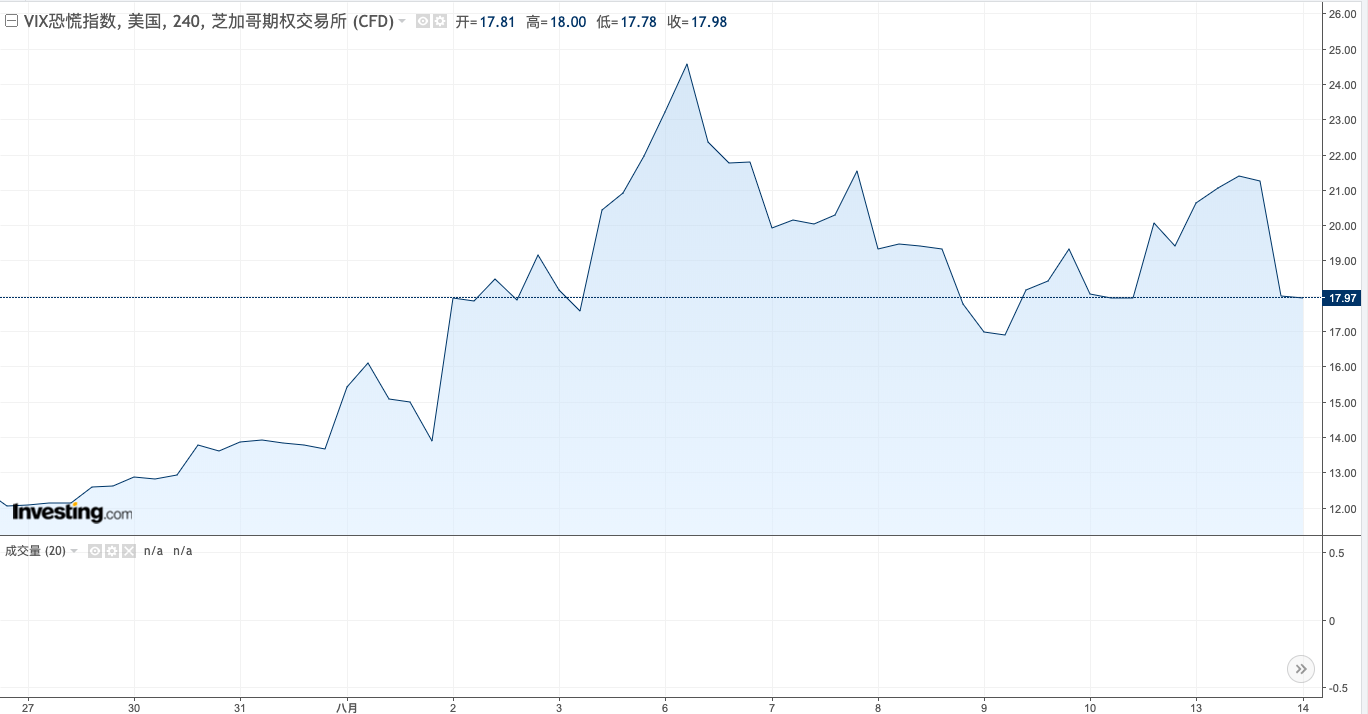

The sentiment of market participants is expressed in the panic index. The Chicago Board Options Exchange Volatility Index (Cboe VIX) soared to 24.79 on the day of the US stock market crash, up more than 100% from the beginning of the month. The VIX index is mainly used to measure investors' expectations of the volatility of the stock market in the next 30 days, also known as the “panic index”. With the stock market falling, funds poured into gold, bitcoin and other safe-haven assets, the New York Stock Exchange December gold price rose 1.3%; as of 5 pm, the US 10-year government bond price rose 1.03%. The reason is that when the global trade situation is tense, the fluctuations in the value of the French currency led by the central bank led by New Zealand and the United States, the regional conflicts continue to stage and the political instability in Argentina plague the market, the yield of government bonds. The flattening of the curve is related to the strong risk aversion of investors.

VIX Panic Index

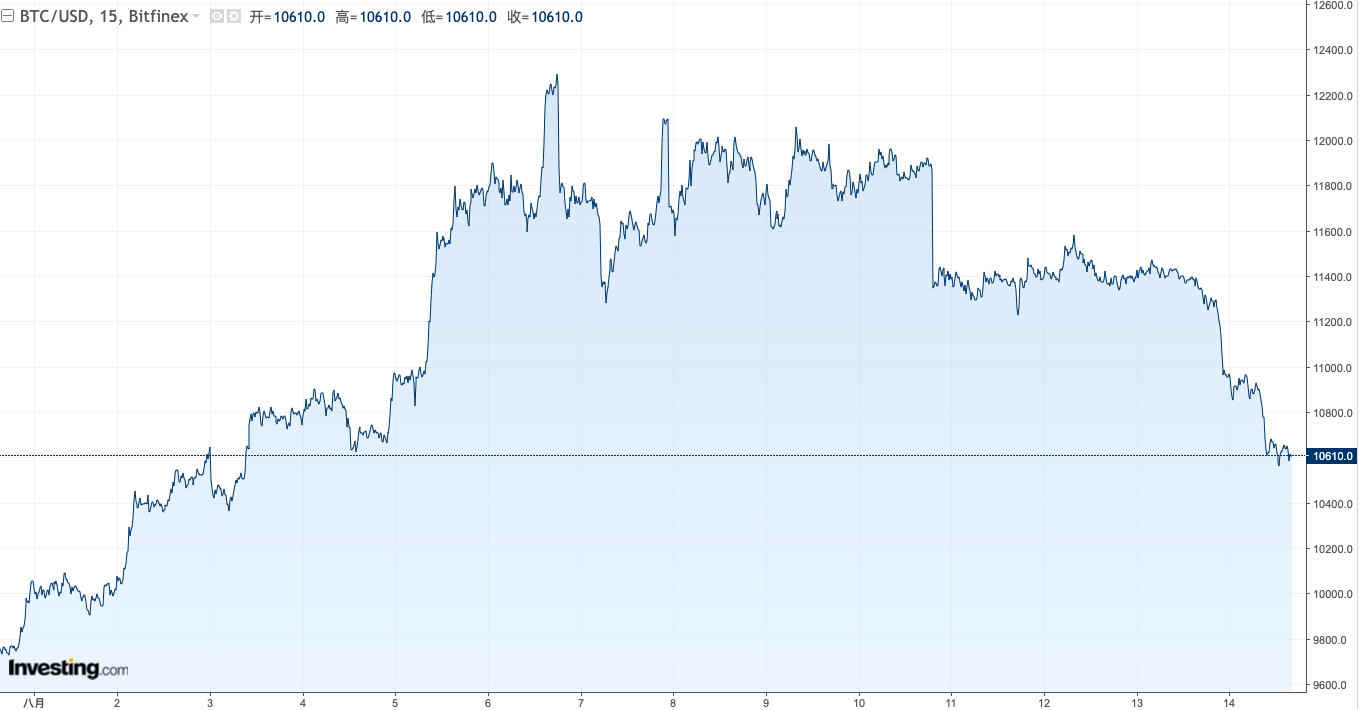

At a time when market panic has intensified, the price of gold and bitcoin has been heading north. As of the afternoon of August 14, 2019, Bitcoin rose 10.54% from the beginning of August.

Bitcoin price since August

Bitcoin price since August

The price of gold is also rising. As of the afternoon of August 14, 2019, gold futures rose 6.23% from the beginning of August.

The price of gold since August

The price of gold since August

As a result, the title of Bitcoin “Digital Gold” was picked up again, and investors began to compare Bitcoin with gold. Former Goldman Sachs partner and digital bank Galaxy Digital founder Mike Novogratz believes that Bitcoin has a special position in the digital currency field and will become the gold of the digital term. More radicals believe that Bitcoin will eventually kill gold and become the world's largest safe-haven product. Because of its scarcity, global consensus, financial and currency attributes, and the natural opposition to the French currency, there are many similarities with the role played by gold for thousands of years, and it has ushered in countless followers. So, what exactly is bitcoin and gold similar or different?

Bitcoin's hedging function

Bitcoin's circulation value

Launched in 2009, Bitcoin is the first electronic payment system and has become the most popular cryptocurrency market, surpassing Ethereum, Dash, Litecoin, Monero and Ripple. Bitcoin accounts for more than 40% of the total digital currency. In 2019, the market value reached US$188.9 billion. In mid-2018, the market value was US$117.6 billion. In mid-2017, it was US$40.5 billion, and in 2012 it was US$10 million.

Retailers have found BTC to be interesting because BTC's transaction costs are lower compared to other credit card or wire transfer transactions, probably due to its decentralization and bypassing regulatory design. At the same time, BTC's transaction costs are lower than the retail money market. Even at the peak, Bitcoin's transaction costs do not exceed 1%, and Bitcoin has a clear advantage over Swift and the banking system's 1.5%-5% transaction fee.

Bitcoin transaction cost map

Bitcoin transaction cost map

BTC's bid-ask spread is 2% lower than the retail money market. Traders prefer to use Bitcoin as an intermediary to convert one currency into another because Bitcoin offers higher interest rates than retail foreign currencies.

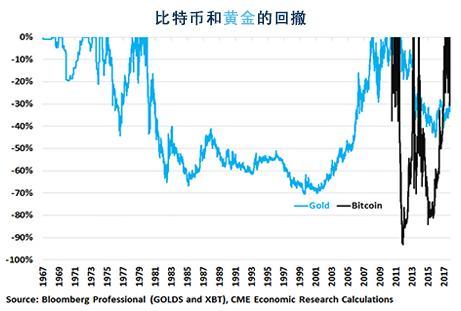

Bitcoin storage value

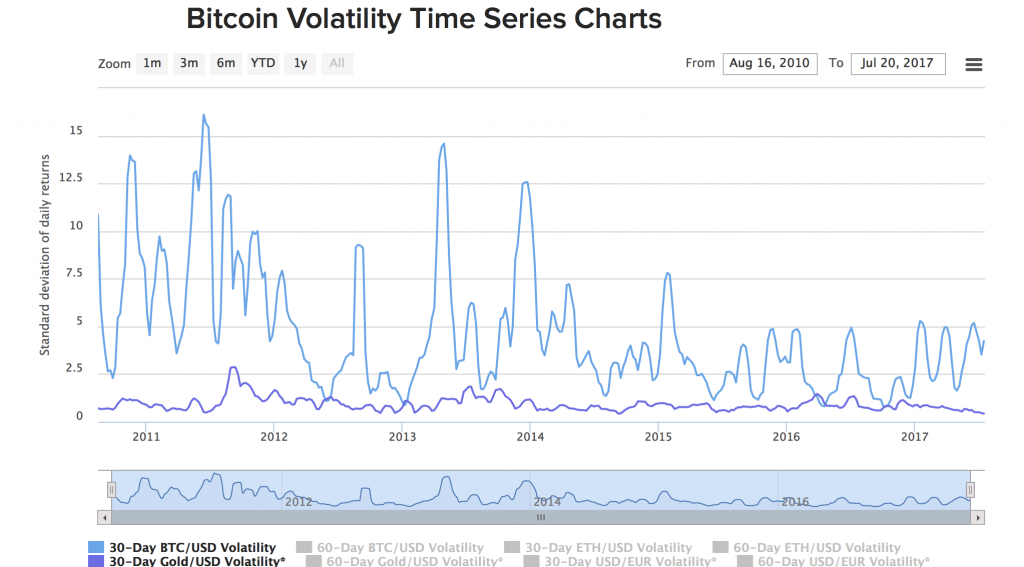

There is some controversy about whether gold and bitcoin really have the means of storage. From the perspective of the US dollar and other legal currencies, gold and bitcoin are at least not risk-free. Between 1980 and 1998, gold also retraced 70%. Despite this, gold is still dwarfed by bitcoin. Bitcoin holders have historically suffered a 175% annualized risk of being frightened. In addition, in its short history, Bitcoin has seen 93% and 84% retracement.

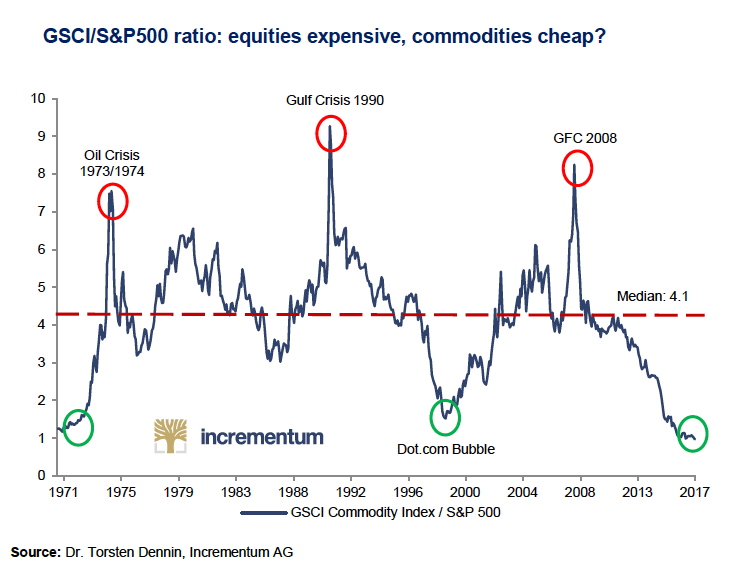

According to CME Group, the US stock market “retrieved 89% between 1929 and 1933, and did not recover lost land until 1954. Since then, the US stock market is still in 1973-1974, 2000-2002, and October 2007. By March 2009, they experienced 47%, 50%, and 60% retracements respectively. Crude oil prices have now fallen 67% from their 2008 highs.” Of course, the difference between them is that few people will Stock and crude oil are used as storage means. Instead, investors see them as risky investments.

Source: CMEE (CBOE)

Source: CMEE (CBOE)

The value of bitcoin and gold as a means of storage stems from its own scarcity. Moreover, it lacks intrinsic value as the legal currency. Economists Baker and Elbeck believe that bitcoin is just a speculative commodity, not a currency. Like many asset classes, Bitcoin also has a speculative bubble with a base price of zero. Bitcoin's excess returns and volatility are more like a highly speculative asset than a liquidity asset such as gold or dollars. The study concluded that, given the significant characteristics of Bitcoin and gold, bitcoin can get rid of its high-risk traits unless the exchange rate is stable and low-definition, because the variables are stable and controllable. Bitcoin has a storage value similar to gold.

In addition, unlike standard currency forms in circulation, Bitcoin's liquidity and volatility appear to be unaffected by the concentration system of financial institutions (such as central banks) or other major macroeconomic factors. On the contrary, the supply and demand factors of the Bitcoin market itself dominate the price behavior of Bitcoin. The main market development and price manipulation of the Bitcoin market are related to the bubble behavior. Therefore, the price of Bitcoin may be out of sync with the economic and business cycles triggered by monetary policy and the management of the central bank's money supply. It is this last attribute that shows that Bitcoin can be used as a dynamic diversification and hedging tool. However, the potential changes in cryptocurrency market efficiency and the volatility persistence in the short, medium and long term indicate that price dynamics in alternative timescales must be considered when investing in bitcoin.

Gold hedging function

Circulation value of gold

In the financial literature, the role of gold as an alternative currency, inflation hedging instruments, safe-haven assets, and its role in achieving greater risk diversification in investor portfolios are increasingly being influenced by policy makers, securities investors, and The concern of risk managers. This is especially the case after giving up gold convertibility. The role of gold as an alternative currency reflects its historical role as a means of value storage and exchange medium. Because of the dollar pricing, the alternative currency role of gold is also related to its recent function as a dollar hedging instrument, and its price volatility is closely related to currency, but not to other macroeconomic and financial variables.

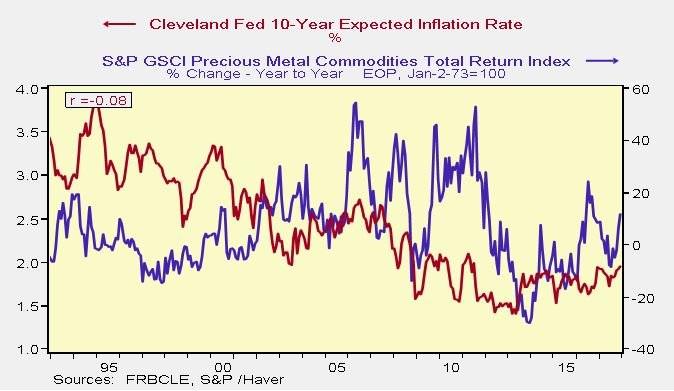

Although the relative effectiveness of gold will change over time, gold has the potential to be a long-term inflation hedging tool, especially for US CPI. This is especially true during periods of high inflation. Gold's limited inventory and short-term supply price elasticity have increased perceptions of gold as a hard currency. In the case of high inflation, gold can effectively maintain assets against depreciation. This can be seen from the investor's initial purchase of gold, which is a potential hedge against the expected inflationary effects of the Fed's first two wave of quantitative easing. At this point, gold can be used as an asset to hedge the increase in money supply.

Inflation rate vs. GSCI price

Inflation rate vs. GSCI price

Gold is also widely regarded as a safe-haven asset for stock investors (although very weak), especially in adverse market conditions. However, this method has different effects, whether in different stock markets or at different time periods. Importantly, this effect is strongest in the short term and is especially evident during the crisis. From this point of view, Bitcoin, like gold, is recognized as the most valuable cryptocurrency in the world, with limited inventory and short-term supply inelasticity.

The storage value of gold

Gold is also a strategic commodity. Energy traders use gold to hedge their positions in response to a sudden drop in oil prices. It is often used as a safe-haven asset in the stock market and in the foreign exchange market during periods of turmoil. The growth rate of gold is determined by mining output. In the past half century, the newly mined gold mine supply was 1.1%-2.4% of the existing mined gold reserves, and the gold price was generally negatively correlated with the mining supply growth. This growth rate is much lower than the money supply of the US dollar and credit. Even in the 14 years before the 2008 economic crisis, the Fed's balance sheet grew at an annual rate of 5.6%. Since the fall of 2008, this rate has increased by nearly 20% annually.

In addition, it is an indicator of the overall price changes and inflation in the world economy. The S&P GSCI index has a better Sharpe ratio, lower volatility, and lower correlation with bonds and stocks.

GSCI and S&P 500 ratio

GSCI and S&P 500 ratio

The choice of gold and bitcoin is not arbitrary, but based on the key similarities and differences between them. Gold is a tangible asset that has been used as a currency for more than two thousand years. Investors use gold futures and exchange-traded funds (etf) to buy gold, which is exposed to fluctuations in gold prices. In addition, gold is a long-term investment that can hedge stock price volatility. Similar to gold, bitcoin is a mining-based digital currency that is not regulated by market authorities (central banks). In addition, bitcoin and gold are speculative investments.

Correlation between gold and bitcoin

Quantitative analysis of gold and bitcoin

Based on the above understanding, we assessed the linkage between gold futures and the bitcoin price market. It was found that there was only a weak correlation between the two, and the results were not statistically significant, that is to say. Our research cannot prove that gold has a correlation with Bitcoin.

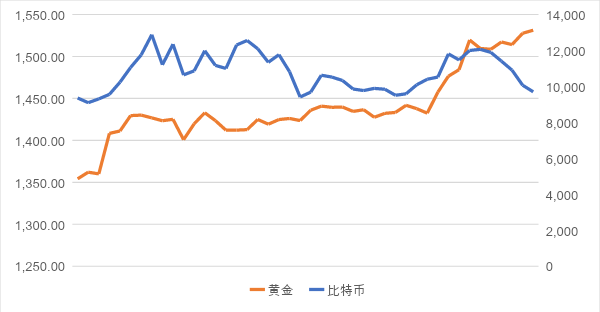

Gold and Bitcoin prices near the March curve (6.15-8.15)

Gold and Bitcoin prices near the March curve (6.15-8.15)

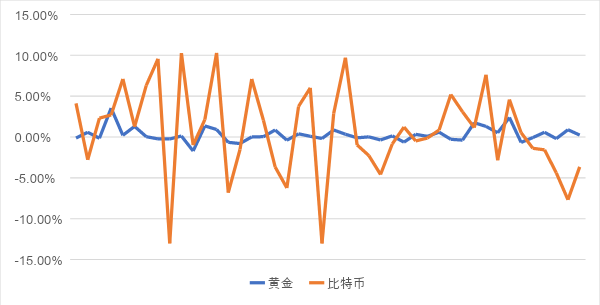

Gold and Bitcoin rise and fall near the March curve (6.15-8.15)

Gold and Bitcoin rise and fall near the March curve (6.15-8.15)

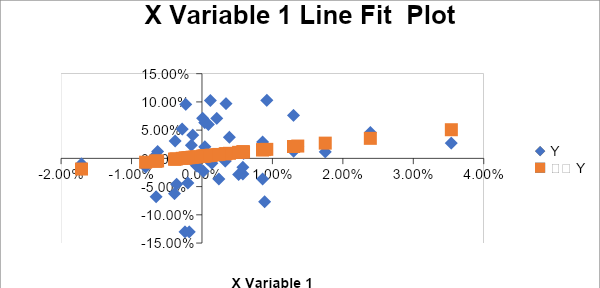

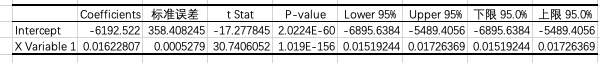

First, we collected the closing price and the price of the bitcoin and spot gold from June 15 to August 15. And calculate the volatility of these three months. According to calculations, the volatility of Bitcoin is 6.594%, which is much higher than the 0.884% of gold. At the same time, the correlation between the closing price change between Bitcoin and gold is 0.2622457, and the correlation between the change and the change is 0.2122283, which is weakly correlated. But R Square's data is less than 10%, meaning less than 10% of the data can be interpreted by the regression model.

Similarly, according to time series analysis, Bitcoin's volatility is also much larger than gold.

For the correlation between the price and the change, P Value is not significant within the 95% confidence interval, ie the weak correlation still cannot be proved effective.

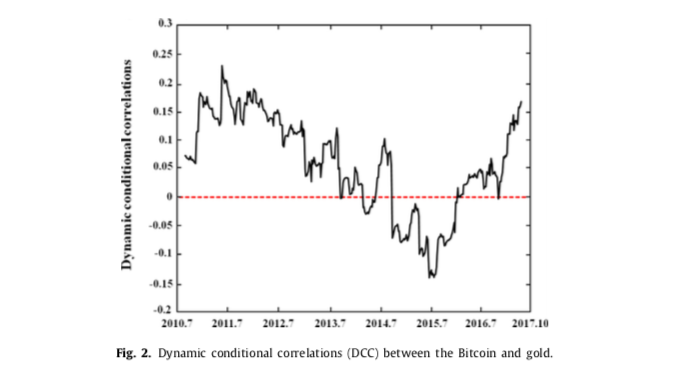

To better analyze the correlation in time series, Mclver used the dynamic condition correlation (DCC) method of the GARCH specification model to analyze the correlation between bitcoin and gold using the DCC-GARCH model. Studies have shown that bitcoin is still weakly correlated with gold in time series.

However, during certain periods of time, we found a moderate correlation between gold and bitcoin price movements. For example, in the interval from July 8 to July 12, Bitcoin is moderately negatively correlated with gold with a correlation coefficient of -0.6228. In the interval from July 15 to July 19, bitcoin and gold are moderate. Positive correlation, correlation coefficient is 0.3129.

Therefore, we conclude that although gold is positively correlated with the trend of bitcoin during certain time periods, this correlation is not significant in the long-term price curve.

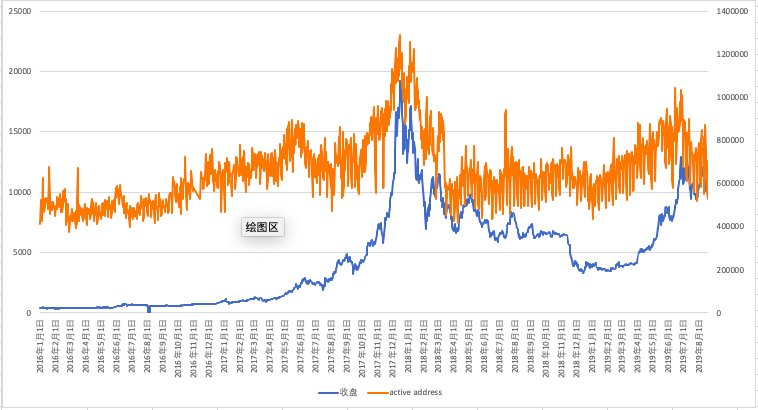

Another correlation found in the long-term price curve was found in our study, that is, the correlation coefficient between the bitcoin price and the number of active addresses is 0.6472, and this relationship is statistically significant.

Bitcoin price and active address

Bitcoin price and active address

Linear regression independent coefficient table

Linear regression independent coefficient table

Bitcoin, French currency, gold supply and value impact

Source: CME Group

If the price of the currency itself is extremely volatile, then the currency itself has a disadvantage as a bookkeeping tool compared to the US dollar. Although the US dollar will depreciate for a long time due to currency issuance and rising economic aggregates, this depreciation tends to be stable in the long run.

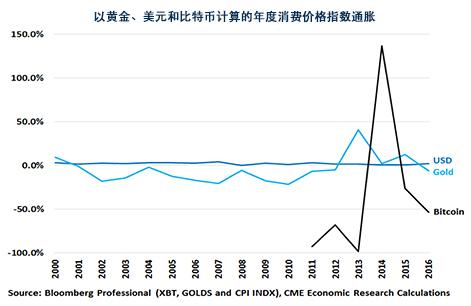

In addition to shocks, in terms of gold and bitcoin, the deflation of consumer prices will be very strong. According to the CME Group's article and data “Since December 1999, consumer prices have risen by 44% in US dollars, but by 64% in gold. In bitcoin, consumer prices have fallen by 99.98% since the end of 2010. Imagine If you have borrowed gold or bitcoin, what kind of economic disaster they will face. Repaying the loan will be almost impossible.” Therefore, due to insufficient money supply growth and long-term deflation, neither bitcoin nor gold May be used for deferred payment.

Conclusion

Gold is an effective safe-haven product in an environment full of uncertainty in the economy, but bitcoin is not. Although unstable, both are excellent storage methods. At the same time, the value of Bitcoin and gold as a means of storage is too high to encourage people to store their currency, which in turn leads to deflation and economic instability. Our research cannot prove that gold has a correlation with Bitcoin. Finally, they are not good accounting units and deferred payment instruments.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The report shows that the stable currency platform is the first Ethereum, and the second is the bit stock.

- A shares | China Construction will soon set up a blockchain financial platform, the stock price reached a new high within a year and a half

- Received more than 100 million US dollars in cryptocurrency, Fidelity announced 4 years of cryptocurrency charity record

- How much does it cost to maintain a blockchain startup?

- Hat analysts wearing XRP "mainstream coin speculation" also cautiously viewed it

- QKL123 market analysis | The strong rebound of the cottage currency, bitcoin attacked 11,000 US dollars (0819)

- Babbitt Column | Xiao Wei: Why do I object to the market value management "virtual currency"?