Bitcoin: an experiment in the form of a new currency

Ten years ago, Bitcoin was introduced into the world as a new currency system. It has caused new attention in the field of monetary economics. After a century of fully nationalized currency production systems and about 50 years of unresolved national currency standards, competition for sound currencies has long ceased to exist.

The practice of returning to gold, even in the circle of Austrian and free market thinkers, is becoming more and more impractical. It seems that there is no other way to wait for the inevitable collapse of the contemporary system, but it can be said that it has been close Several crashes.

From the perspective of academic views and public acceptance, the debate in the field of knowledge seems to have ended. With a few exceptions, such as Friedrich Hayek, most well-known economists recognized by the public are followers of the Keynesian monetary approach. Therefore, endorsing monetary nationalism and issuing legal tender money can be used as a golden alternative to cost-effectiveness, as well as a means of government financing and a “fine-tuning” of the national economy.

At the same time, although the public and academic debates on sound currency may have come to an end, the rise of new technologies has opened up new frontiers and opened the search for digital currency alternatives. An unorganized small group of individuals, consisting of individual computer scientists and cryptographers, known as cryptograms, began researching new possibilities offered by computer networks and cryptography in liberating people, including efforts to create open digital currencies. .

- Head of FinCEN, USA: Anyone must abide by the Anti-Money Laundering Act (AML), and the stable currency is no exception.

- Full deployment of cryptocurrency regulatory rules in 2020? The FATF will begin a one-year review

- Wuzhen News | BKEX founder Ji Jiaming confirmed attending the World Blockchain Conference, he will bring the heavy news of BKEX

With the pioneering work of digital payment in David Chaum (DigiCash), and later various research and practice initiatives, the most famous ones include Adam Back (HashCash), Wei Dai (b-money), and Nick Szabo (BitGold). As well as Hal Finney (RPOW), efforts to introduce digital cash are beginning to emerge. These attempts have no doubt their advantages, but all fail. They fail to provide an effective system or are attractive enough to have a substantial impact on monetary affairs.

Probably in late 2008, the introduction of Bitcoin was arguably the most important turning point in monetary affairs since 1971. 1971 was the year in which the Bretton Woods system collapsed and introduced paper currency standards that cannot be improved today. Although not immediately effective, the growth of bitcoin as a new currency began to accelerate.

Now, it has been born for more than ten years, often making headlines and becoming a part of the discussion in the US Congress. The huge success of Bitcoin has caught the attention of monetary economists and rekindled the debate over sound currencies.

Initially, Bitcoin received unremarkable attention from both sides, and it was also questioned, and it was considered to be just another bubble or an outdated trend. However, as time goes by, bitcoin growth is accelerating every year, and it begins to receive some attention, making it an ally or opponent of intellectuals. From all economics perspectives, the bitcoin phenomenon seems to be only compatible with the Austrian theory.

There is always a strong sentiment between many supporters and skeptics. On the other hand, in all other economics (blue fox note: in addition to Austrian economics), bitcoin is still considered a bubble, the market is irrational, or will eventually collapse. These school theories are incompatible with Bitcoin, because Bitcoin is not a legal currency as a currency, which is incompatible with their economic theories, especially monetary economics, which makes them new to currencies like Bitcoin. The possibility of turning a blind eye.

Although there is not much support, Bitcoin is still growing and has been strongly opposed by the academic community. However, Bitcoin continues to develop and its monetary status is more economically important than some French currency. (Blue Fox Note: Mainly refers to the fact that in some hyperinflation countries, its legal currency is not trusted by the public)

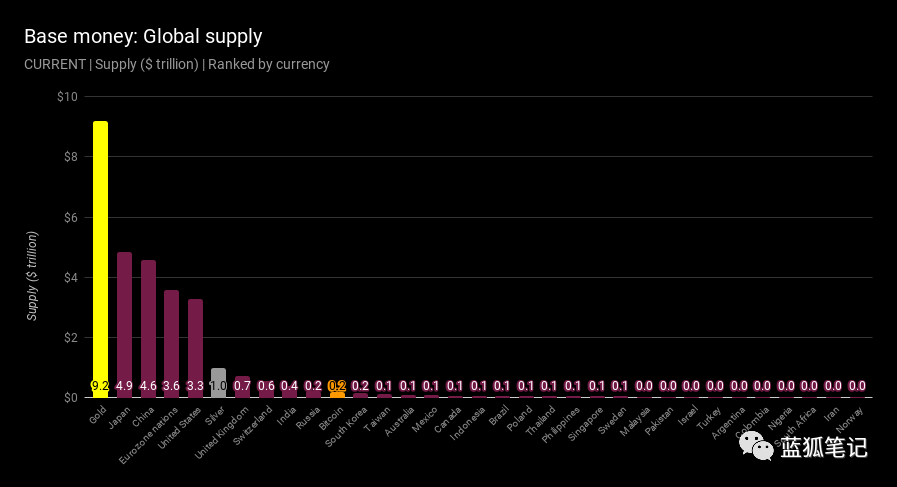

The comparison between the market value of Bitcoin and other countries' legal and precious metals. Source: cryptovoices

The comparison between the market value of Bitcoin and other countries' legal and precious metals. Source: cryptovoices

At this point, it is clear that Bitcoin can no longer be ignored, but should be carefully studied and thoroughly investigated. It seems that understanding its nature can reveal the reasons for its success, and it may have rough expectations for its future prospects.

We first studied the nature of money as the best-selling commodity, which has the lowest economic cost for its holder's future transactions. Then, we continue to explore the various factors that influence the saleability of goods and further explore the possibility of their emergence in the market as a currency. In this article, we apply this understanding to the Bitcoin case and explore the use cases of Bitcoin from the perspective of monetary economics.

Currency properties of Bitcoin

The common attributes that influence whether a commodity is suitable for becoming a currency, such as severability, portability, and persistence, are usually inherent in the physical composition of the commodity itself. Over the years, this physical limitation has caused it to affect the specific material carrier of the currency to a large extent. For example, splitting gold into small unit denominations for lower value transactions, but the physical limitations of its segmentation prevent its (physical) use in many trading scenarios, forcing people to resort to lower value metals, For example, silver and copper, and even turned to the later proof of money (Blue Fox notes: currency proofs such as gold linked to gold).

The emergence of Bitcoin as the first form of digital currency allows us to go beyond the "physical" limits of these currencies and to expand in the digital arena without existing limitations. To understand how Bitcoin enables us to improve currency attributes, we need to have a basic understanding of how it works, as well as the digital representation of Bitcoin. Bitcoin, its "most primitive" form, is a piece of software that automatically reaches a consensus on the unit ownership of Bitcoin. In other words, the original form of Bitcoin is a list of payable amounts and the conditions for spending them.

Since Bitcoin is different from previous monetary assets, it is not based on physical ownership, but on the consensus of expenditure conditions. Therefore, we should divide the discussion restrictions into two levels of consensus. The first layer, also known as the "chain" layer, is the global consensus layer we just described, and we see it as the ultimate source of truth for determining the ownership of Bitcoin units. From its nature as a global consensus layer, it is binding on all participants, so it is relatively solid and limited. Therefore, to a certain extent, it provides us with modest improvements in currency attributes.

For example, Bitcoin can be split into units that are at least "consist", which is equivalent to one billionth of a bitcoin. The segmentation process itself requires changes to the expenditure conditions assigned to the relevant units, which means that they need to be "expended" for segmentation.

We may note that, although there are restrictions on the size of the unit, it is possible to expand if necessary by changing the global consensus mechanism. While these changes are very difficult and costly to implement, they are still feasible, and new demands emerge over time that can provide us with a degree of improvement in the assets themselves. The ability to change the asset-money characteristics of assets is an unprecedented capability introduced by Bitcoin, which gives it a greater advantage over previous currencies.

The second layer, called the “out-of-chain” layer, takes advantage of the characteristics of Bitcoin, both as a consensus-based digital asset and as a programmable software. Bitcoin allows partners to create “subsets” of Bitcoin consensus. And various mechanisms can be used to trade within a subset.

If we take Bitcoin's transferability as an example, between physical locations, although it is undoubtedly very cheap and easy to transfer, the transfer of actual ownership of Bitcoin (changes in spending conditions) in the chain is to some extent Restricted, it allows approximately 600,000 final settlements (ownership transfer) per day. (Blue Fox Note: Bitcoin can reach about 7 transactions per second, and 24 hours a day can trade about 604,800 or so)

However, since transactions typically occur between collaborators (both sides wishing to trade), the outer layer allows them to use a variety of structures to reach consensus. Therefore, this supports their ability to extend to near-infinite limits of physical movement of electronic data.

There are many choices for this structure, many of which are already in research and development, each offering a wide range of different trade-offs for trading entities. A well-known case is the “Lightning Network”, which provides untrusted and instant transactions, and limits liquidity to a certain extent, providing “sidechains” such as “Liquid”, which provides the benefits of high-speed and confidential transactions, and assets. The issue introduces a trade-off of trust, which has a coalition of trusted entities that manages a consensus subset for the customer.

In the conclusion of the analysis of the currency properties of Bitcoin, we see that the conversion of monetary assets from physical to digital allows us to achieve unprecedented improvements, and also makes the asset's monetary attributes highly flexible.

Therefore, we can conclude here that, from its intrinsic properties, Bitcoin is unprecedentedly superior to all its predecessors. With this in mind, it seems that further research should be conducted on the applicability of Bitcoin as a currency. Therefore, we will continue to explore Bitcoin and its most controversial and innovative aspects of its production and supply.

Bitcoin production

Before the birth of Bitcoin, in the eyes of monetary economics authors, producing digital currency in the market was challenging and almost impossible to achieve.

The Austrian economist Jorge Guido Hillsman, who specializes in monetary economics research, expressed this widely accepted idea in one of his books. He claims that "an economic commodity that is completely defined by bits and bytes is unlikely to be spontaneous in the free market." Coincidentally, he published the book in October 2008, two months after the Bitcoin white paper was released. Bitcoin was released three months later.

The invention of Bitcoin really needed to find a solution to solve the problem that was not solved at that time, that is, the ability to control the digital scarcity of controlled supply without relying on trusted entities, to solve the "double flower" "problem.

The creators of Bitcoin solved this problem by introducing a mechanism called “Zhongben Cong Consensus”. The basic idea is to openly compete with computers to find solutions to mathematical puzzles.

The challenge puzzle is similar to random lotto. The only known way to find a solution is through random guessing, and the probability of finding the solution is the same for each guess. The solution process consumes computational power, which is primarily limited by the available energy constraints of the computing machine.

Adam Back originally proposed a similar process in 1997 as part of its HashCash system. Bitcoin works like the proposed mechanism, but Bitcoin has a key improvement to this proposal, which is that it sets a strict timetable for the production of new tokens.

Bitcoin does this by using a peer-to-peer consensus network to execute and verify currency rules and timelines, and automatically adjusts the computational work used to produce new tokens to adjust the difficulty of challenging puzzles. The production speed of the currency is basically consistent with the timetable.

Unlike previous monetary assets, such as gold, silver, and shells, these assets depend on their specific physical limitations and the scarcity of production; at the same time, they are different from the current legal currency system, which relies on credible issuers ( For example, the central bank produces money, and bitcoin is purely dependent on the mathematical system it produces.

This feature allows bitcoin validation in an objective and versatile manner and enables fair and open competition in the production of currency. Anyone can freely participate or quit freely in the competition, just by calculating the power, and have the opportunity to produce bitcoin proportionally according to the computing power it consumes.

Currency production and externalities

Historically, the production of material carriers of money has always been expensive, both directly and indirectly. For example, cattle have been used as currency in many nomadic societies, and their cost of raising (production) is high, which leads to some completely unexpected externalities, mainly due to the need for more pastures to breed them.

Gold is another example. Its production cost is also high because its mining process requires filtering a lot of dirt to get a small amount of gold. The externalities it causes are also very unpleasant, because the military occupation of gold mines, as well as the dangers and partial forced labor, bring us a variety of economic and ethical issues.

Marco Polo may be the first to introduce the concept of banknotes into the Western world. He observed an impressive concept of paper currency in China. Since he discovered this concept, the demand for “simple” currencies by rulers, bankers, and intellectuals has been growing. (Blue Fox Note: The “simple” currency here mainly refers to the currency with lower production cost, compared to the “hard” currency with high production cost such as gold)

The experiment in Europe's first paper currency took place in 1661, when the Bank of Sweden's Stockholm Bank began issuing banknotes. This experiment led to bankruptcy in just three years, but this failure seems to only increase the interest of rulers and bankers in conducting more such experiments.

For intellectuals, from the beginning of the field of political economy, they expect to make the production of money more "efficient." This idea was indeed supported by early economists like Adam Smith and John Law, who believed that the use of precious metals was an inefficient process.

Together with many other economists, especially contemporary economists, they are trying to make money production cheaper and thus more efficient. Their main method is to replace the original with cheaper alternatives such as paper. Material carrier (such as gold). They believe that this alternative monetary system can function as a precious metal, but its production costs are only a fraction of the original.

The difference between production cost and currency “face value” is what we call “simple” currency, and we should distinguish it from “hard” currency. (Blue Fox Note: “Hard” currency refers to a currency with high production costs, such as gold.) Therefore, on the surface, the difference between the two is that the production cost of “simple” currency seems to be negligible, and “hard” The production cost of money is high.

The problem of "simple" currency, and the reason why theoretical supporters like David Ricardo oppose its implementation is its externality, involving hidden costs and risks. As we all know, the real "simple" currency will never appear in the free market. This is because, for any commodity, market participants are willing to increase their production and costs until it is no longer profitable.

This means that if we try to run a “simple” monetary system in a free market, market participants will start producing a certain amount of money so that the value of each monetary unit is roughly equal to its production cost, thus offsetting the expected The "efficiency" of the "simple" currency.

Therefore, all attempts to introduce a “simple” monetary system require the state to grant a monopoly privilege to the production currency for a particular entity, which is now often referred to as the central bank. Legally, because market participants are not allowed to participate in the production of money, proponents of “simple” currencies believe that they can successfully reduce the cost of money production to the cost of printing paper money.

But this view of the almost fascinating direct and apparently visible cost of money makes those economists turn a blind eye to the many non-dominant costs of “simple” currencies.

First, the most obvious concern may be the risk of system abuse, which Ricardo proposed. From many high inflation scenarios to less significant moral hazard, the trap of “simple” currency poses a variety of risks and is abused many times by those who are capable of doing so.

This problem alone makes the trap of the "simple" currency clear. While introducing deadly risks and many moral hazards, it did not bring about significant efficiency gains. However, there are two other aspects that also expose the fallacy of “simple” currency.

In the second aspect, we may also want to look at the actual cost of running it in such a system. Since all public institutions have typical large bureaucracies and thousands of central bankers, it is difficult to say that today's “easy” and “efficient” paper currency systems are more efficient than “hard” currency systems.

In addition to this consideration, we should also note that gold production for currency purposes is still largely ongoing. Therefore, the extra cost of the “simple” currency system is mostly supplemented rather than replaced by the cost of previous “hard” currencies.

This problem becomes even more acute when we understand the fact that although the regulations themselves exclude participants directly from participating in currency production, as long as the forecast or influence of central bank policies is profitable, those regulations will still consume as much as possible. More resources.

Proponents of “simple” currencies apparently failed to consider the willingness of market participants to make full use of money production. This is why many analysts, economic forecasters, and lobbyists have created jobs. This is an indirect “simple” currency. The result of inefficiency.

The third and most critical issue is that the “simple” currency leads to manipulation of the market process. The market uses money as a tool for resource allocation, and currency holders guide the market according to their needs.

However, when using “simple” currencies, its producers (such as the Federal Reserve) have the right to disproportionately influence the allocation of resources. In fact, we can say that it can control the market in essence, because it can produce money at low cost and allocate resources according to their own wishes. Therefore, in the “simple” monetary economy, the power to allocate resources is transferred from the market to the hands of the Fed.

This dislocation of the market gradually shifts the entire economic system to an indirect central plan. Coupled with the moral hazard involved in the “simple” currency production, this process is further accelerated, with consequent destructive consequences of the central economic plan, all under the guise of market phenomena.

As we have seen, “simple” currency does not reduce the cost of money production, nor can it be more efficient in any other sense. The only function it achieves is to reduce the cost of direct visible money production while disproportionately increasing the hidden hidden costs.

We can draw two main conclusions from this analysis: The first and most obvious point is that “simple” currencies are not only inefficient, but they may even be destructive due to their risks and externalities. Second, we note that we are eager for transparency in the money production process to minimize such risks and unexpected externalities.

When we study bitcoin, one of its notable features is its production process. The most important and costly part of producing bitcoin is the process of converting energy into electricity and then converting it into power.

While all types of production require energy consumption, most other processes require energy in a very indirect manner and, more importantly, in highly specific locations.

For example, gold production requires intensive labor and many complex machines, but more importantly, it requires miners to mine at specific locations (where the gold mine is located). Therefore, the production process of gold not only has a lot of complexity, but also limits people's production in specific places.

On the other hand, the production of bitcoin allows anyone to carry out anywhere in the world, as long as there are hidden energy resources, can be used to produce bitcoin. (Blue Fox Note: In fact, although bitcoin mining has no geographical limitation in theory, it has developed to today, in order to gain power advantage, it will actually gather in areas where electricity is cheap, so it is to some extent There are also restrictions on geographic location)

This unique production process of Bitcoin has three main advantages.

First, it makes the competition in currency production more fair and open than ever, eliminates many space constraints, and achieves a truly effective market competition process. Second, making the production process simple and straightforward, Bitcoin reduces hidden costs and externalities in the currency production process. (Blue Fox Note: Externality is an important concept in economics, first proposed by the economist Marshall, it is also called the spillover effect. That is, the activity of a certain subject has an external influence on other subjects, and this influence is not It is based on price trading, but there is some concealment. It is essentially a systematic thinking, not a way of separating the problem. Reducing externalities makes the system more robust and allows us to better understand its consequences.

Third, by eliminating space constraints, Bitcoin production allows the use of previously unusable energy resources. The brutal competition in bitcoin production has forced its producers (miners) to keep their costs to a minimum, making them more efficient than their competitors.

This competition has prompted them to continue to seek the most efficient energy production process, which will minimize their subsequent production costs, and, in theory and practice, this most efficient energy comes from renewable sources. Natural resources available from these sources, such as sunlight, water, wind, and others, are cheaper than traditional sources of energy because they are abundant and underutilized.

Although the transportation cost of this energy limits its many daily availability, Bitcoin production does not have such a space limitation. As a result, Bitcoin production has driven profitable financing and development of renewable energy, and has also spurred advances in energy production.

Therefore, it is not surprising to find that most of the energy used for bitcoin production comes from renewable sources, making Bitcoin production one of the cleanest areas of the economy.

We can sum up here, as mentioned above, Bitcoin production seems to be the most ideal currency production process we may have. The fact that it is superior to the previous currency: it is a "hard" currency, plus its simple and transparent production process, open and direct competition, and the appearance of positive externalities. The second important consideration is that the money supply problem is usually related to the production process of money. This is discussed below.

Bitcoin supply

Bitcoin is a software-based asset, and this property means that its supply is ultimately controlled by its users, which is different from previous natural currency. In fact, it is a key part of the consensus rule, with a cap of 21 million bitcoins.

This is often referred to as Bitcoin's "monetary policy" and is implemented by the economic activities of each participant in the Bitcoin network. Bitcoin is a peer-to-peer network that has a decentralized nature, which means it does not have a central authority to determine the monetary policy of Bitcoin. Therefore, although in theory it can change this policy, in practice, it seems unlikely that such a change will be made, and this article does not take it into account.

This policy of Bitcoin is in stark contrast to the current policies set by the Fed. Since their inception, these institutions have been pursuing an expanding monetary supply policy. These expanded monetary policies are considered necessary to achieve “public interest” because they allow governments and “high-quality” economists to promote economic growth, reduce unemployment, and respond to the economic cycle.

In the past 100 years, their work has failed, and during this period these problems seem to have only worsened. In the current discussion, Bitcoin's monetary policy is often considered radical by many people. Many people have criticized Bitcoin for its lack of “flexible” monetary policy, which needs to be modified according to what happened. They also criticized this policy for hindering any meaningful adoption of Bitcoin.

However, the concept of this “elastic policy is necessary” has only begun to receive significant support in the last hundred years. Therefore, it is still quite new compared to the currency of thousands of years (or tens of thousands of years).

Moreover, if explored more closely, modern experiments on flexible monetary policy were developed and managed by the Fed, and it failed to achieve its stated goals. These unfulfilled promises include the inability to tame the business cycle, the failure to achieve sustained low unemployment, the inability to maintain the value of the currency, and the overall price level.

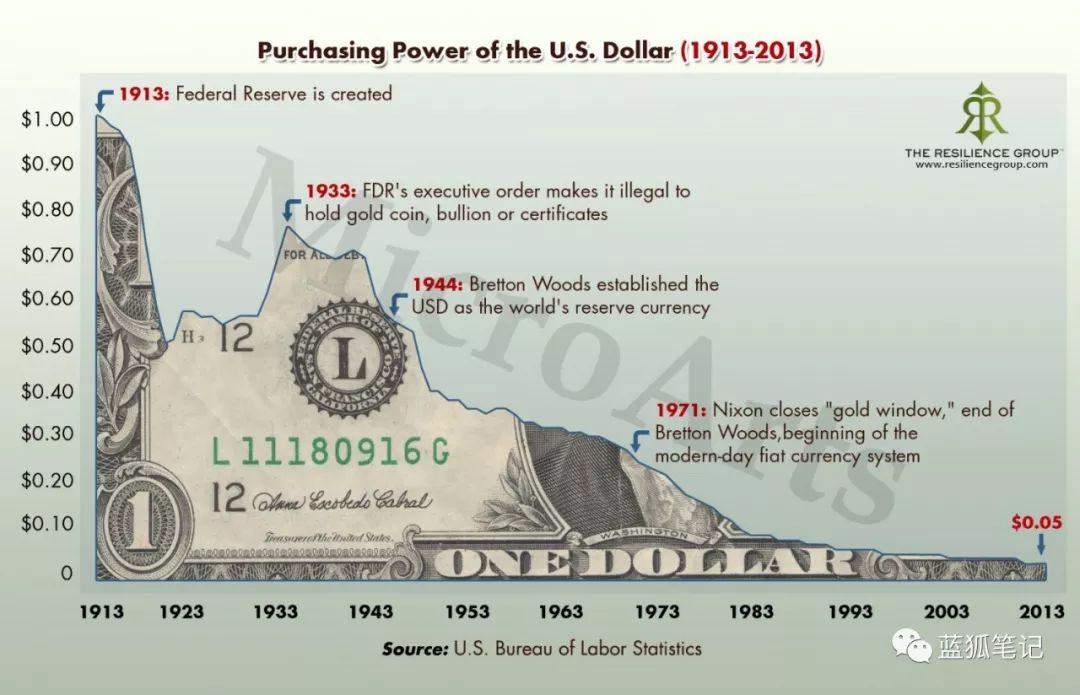

The purchasing power of the dollar (from 1913 to 2013). During this period, the US dollar lost at least 95% of its purchasing power.

The purchasing power of the dollar (from 1913 to 2013). During this period, the US dollar lost at least 95% of its purchasing power.

Many people today regard flexible monetary policy as an essential part of the currency, but given its actual merits and the results it brings, this is not convincing. This has not even mentioned its undisputed failure before modern experimentation.

In addition, we consider that more than 50 economies have collapsed due to hyperinflation in the past 100 years, and this monetary policy is less convincing. If it weren't for the flexible monetary policy, these would not happen.

A comprehensive criticism of the ills of all modern Fed systems and the erroneousness of their theoretical foundations is beyond the scope of this article. Readers can learn more on their own. From the focus of this article, it is mainly why the flexible monetary policy is not advisable, and why the limited supply of bitcoin is superior to the previous policy.

Let us first explore the "necessary" nature of flexible monetary policy. As mentioned above, the gold standard ended after the establishment of the Fed system, given its experience of failure and considering the impressive success of the gold standard prevailing during La Belle Époque. This does not seem to have any empirical basis to explain the “necessary” nature of flexible monetary policy.

However, despite the lack of such “necessity” evidence, one can still argue that such a policy is usually desirable. Therefore, we will now study this issue further.

The discussion of “simple” currency has been carried out above. In principle, it is a flexible monetary policy. We have explained some of its drawbacks. These include serious moral hazard and potential risk of system abuse and destruction. We will skip these discussed issues below and focus on the more general arguments for this type of policy, which explores the cognitive errors of such central plans for money and credit supply.

Let us assume that those who are in charge of monetary policy have successfully resisted the temptation to abuse all monetary policies and do their best to help the economy. They may have vast amounts of data and information about the relevant indicators at their disposal. Then, their task is to use all of this knowledge and insight to adjust prices to guide people to make economic decisions that will have the most positive impact on the economy in terms of those planners.

In other words, they use the effects of money and credit supply on the economy to regulate behavior such as price and unemployment. The task of these decision makers is to predict the impact that monetary policy may have on the parameters they want to adjust (CPI, unemployment rate, etc.) and seek the “best” option.

However, this means that they not only need to predict the consequences of their actions, but they also anticipate responses to these behaviors and further responses to these consequences. All experiments that predict and model the “best” monetary policy (and even assume that even such “best” options) will fail because of the nature of the economy, because the nature of the economy is complex personal behavior, more important The reason is that people will react. Human behavior and response to behavior are mostly unpredictable, but attempts to predict the effects of responses to such changes, as well as subsequent responses to changes triggered by these previous reactions, are impractical.

When we consider the limitations of the data they have, it is even more obvious that these decision makers cannot make predictions about the economy. In the field of general social phenomena, especially in the field of economic phenomena, the results depend to a large extent on all human behaviors that constitute these phenomena. Although we know how to measure specific parameters with high precision, we cannot measure many other facts related to personal economic behavior.

Hayek uses the examples of price and wages to explain the limitations of this knowledge. He said, "When determining these prices and wages, there will be the impact of specific information held by each participant in the market process, and the scientific observer or any single brain cannot fully know the sum of all the behaviors of these people. ”

Most economists have completely ignored the importance of these facts because they cannot get so many important facts. In Hayek’s words: “Economists are happy to move on, and they assume that the facts they can measure are the only relevant facts.” The Fed must open on the premise that there is no complete picture of the past and the future. Their mission.

Therefore, their predictions of economic outcomes are doomed to fail from the outset, and even if they have the appropriate method to derive predictions from the data, they cannot explain all the data that affect human behavior. As we have seen, individual behaviors are It can potentially have a devastating effect on the entire process.

The only thing I can predict is that as the Fed's policy makers continue to interfere with the supply of money and credit, this will continue to produce unpredictable behavior, with the result that they cannot predict their efforts. Bitcoin is an exact prediction of a financial bet. As long as monetary policy is flexible, we will certainly suffer from this cognitive error and the failure of prediction, and inevitably an economic crisis will occur. The economy is an interdependent system, and any human intervention can lead to unexpected by-products whose impact will be further exacerbated by further intervention.

For more than a century, economists have been trying to plan money supplies, but each intervention has always brought about a crisis. Well, perhaps at the most appropriate time to face this failure, recognizing that the economy is too complex, the Fed can't predict, and let individuals make their own decisions to form a complete picture of their actions.

So far, we have eliminated concerns about the bitcoin inelastic policy and have proven it to be better than the flexibility policy. (Blue Fox Note: Flexible monetary policy may have great shortcomings, but this does not naturally prove that inelastic monetary policy is no fault, so inflexible monetary policy also requires proof of future practice, such as Bitcoin.) However, some people will It is argued that a static inflation plan (such as 2% inflation per year) is a viable option rather than a capped supply policy. Even if there is no strict restriction on supply, although Bitcoin may still work, this inflation seems to be undesirable or even harmful.

Monetary inflation, while not necessarily harmful in itself, has a highly nonlinear and complex impact. And the impact, as we have seen, is totally unpredictable. Some people urge to modify systems that they don't understand or more complex, or worse, think they can understand the system, which may be at best harmless, but can easily cause damage.

Moreover, if we conduct more in-depth research, there seems to be no first reason for an expansionary policy.

When we understand the nature of money and its emergence in the market, this inflation seems to be very undesirable. Money is generated based on its ability to reduce transaction costs, and one of the important factors is its ability to maintain its value over time. It is well known that an increase in the money supply dilutes the value of the currency unit and its purchasing power, and thereby increases the cost of using it in delayed transactions.

Therefore, the inflation policy may reduce the value of Bitcoin's trading use, thus hindering the adoption of Bitcoin, and will not bring us any benefits. Conversely, inflation policies can reduce the accuracy of economic calculations, reduce cash storage and encourage consumption, which proves to be undesirable.

Through this section, we observe the basics of the Bitcoin production process and its monetary policy. We discussed the idea of currency production and its externalities, and how Bitcoin is a “hard” currency over other currencies. We explore the trap of “simple” currencies, more specifically the trap of flexible monetary policy, and show how Bitcoin can successfully avoid such problems.

Finally, we also see how the “hard” policy of Bitcoin's limited supply works, it takes advantage of its own and provides the right economic incentives for storage and capital accumulation, while it also provides for economic computing. A reliable measurement tool.

So far, we have explored the "inherent" nature of Bitcoin, and we have come to very positive conclusions so far. We will continue to dig deep into the currency use cases of Bitcoin by exploring external factors that affect the carrier of money and how Bitcoin handles them.

Bitcoin legislation

As mentioned before, there are three important external factors that influence the adoption of monetary material carriers: legislation, social structure, and cognitive considerations. Now, from the perspective of legislation, we will begin to study each factor and try to understand how they affect Bitcoin as a currency.

Even a simple investigation into the demise of the use of precious metals as a common currency carrier would reveal the impact of the legislatures as they pushed them to extinction. In most countries, gold initially enjoyed a monopoly position superior to other precious metals and was further centralized under the control of the central bank, which had an influence on the specific choice of metal currency.

Through the centralization of this power, they later effectively confiscated the gold assets (Executive Order 6102), preventing their daily use. In 1971, President Nixon issued an 11615 executive order that eventually broke the final connection between money and gold. The executive order ended the long process of moving from a metal currency to a non-convertible banknote standard.

This latest case shows us how powerful the legislature has in currency choice. Under the contemporary sovereign monetary system, these institutions do not seem to like the challenge from Bitcoin.

Although the legal challenges facing Bitcoin are daunting, it is precisely the design itself. Bitcoin was created from the beginning with the spirit of cryptographic punk and tried to use encryption to achieve freedom. The challenge facing Bitcoin is precisely the reason for its birth. For more than half a century, we have been living in the legal currency system, and attempts to compete in any competitive system have been closed.

In contrast, the construction of Bitcoin takes into account all past failures and it tries to survive. As its creators explained:

“Because all e-money companies have failed since the 1990s, many people automatically see it as a failed business. I hope, obviously, that the nature of the centralized control of these systems makes them doomed to failure. I believe, For the first time, we try a decentralized system that does not require trust-based systems."

Bitcoin's production and maintenance processes are highly open and provide participants with an economic incentive to match the actual demand for Bitcoin through payment transaction fees. The mechanism for storing Bitcoin with a private key is protected from being confiscated. In addition to keeping its verification costs at a very low level, we can see how all of these design goals are to make Bitcoin survive or grow under pressure.

The "legislation flexibility" of Bitcoin is so powerful and robust that a US Congressman, Patrick McHenry, even called Bitcoin "an unstoppable force." He said:

"Our government should not try to stop this kind of innovation, the government can't stop innovation, and people trying to stop it have failed."

Although many other legislators disagree with this view, this bold statement emphasizes the concept of Bitcoin and the mission behind it. We may not know if Bitcoin is really capable of withstanding the legal challenges and regulatory pressures that may be faced. The legal flexibility of Bitcoin may be its biggest improvement over the previous stable currency, and its advantage.

Now suppose that the government department understands the difficulty of blocking Bitcoin. Because it provides economic incentives, it is also possible that they will choose to use Bitcoin. Even if they cancel the use of the gold currency from our daily lives, governments (mainly through the central bank) are still accumulating a large amount of gold, which holds about 17% of the total gold on the ground.

When Bitcoin becomes important enough, the government may purchase it as a substitute for gold and profit from international currency matters, or as a hedging tool for its “value store”.

Another option for the government is to make a profit by participating in Bitcoin mining, either directly or indirectly, because they control a lot of resources for energy production. (Blue Fox note: Just as some time ago reported that Belarus tried to use nuclear power to participate in bitcoin mining) Participating in bitcoin mining business not only has a source of income for the country, but also helps bitcoin, bit The currency uses a higher energy investment to ensure its network security.

Although the possibility of government involvement in bitcoin mining or buying bitcoin is very small in the short or medium term, it may be a reasonable choice in the long run.

Social globalization and bitcoin

The second important external factor we identified is the social structure. The current trend is globalization and international cooperation. Understanding the needs of this social transformation is essential to understanding the appropriate currency for such a society. Today's society is rapidly moving towards urbanization, and the vast majority of the world's population lives in cities. The Internet is becoming more and more important in our daily lives. With more than 4 billion Internet users worldwide, this technology has far more social impact than most previous inventions.

Although society is more closely linked than before, the world is in a state of severe division of money that has not been seen for centuries. Although most of the precious metals used in the past have different weights, they are generally accepted commercially (Blue Fox notes: silver and gold were the world's most common currencies). In today's world, we have hundreds of incompatible banknotes that divide the world market and damage the global division of labor.

Most social collaboration across borders now requires currency exchange between multiple currencies. This complicates and distort economic calculations while adding additional costs and requires trusting more financial institutions. For this issue, we may increase the issue of transaction settlement. Due to the cost and regulation of cross-border mobile money, this settlement is very expensive and requires centralized processing by multiple intermediaries.

As society enters an era of global connectivity, with the unprecedented growth of electronic transactions worldwide, the demand for native currency in the digital environment is growing. At present, it is impractical to settle payments with strangers without having to trust financial intermediaries or central banks that issue currency.

Moreover, this process cannot be achieved by any existing currency system until the emergence of Bitcoin. As a fully electronic product, Bitcoin allows for settlement anywhere in the world without the need for trusted payment clearing. It does not require expensive international physical transportation, is easy to store, and is used anywhere in the world at a small cost. Looking at the structure of modern society, it seems that there is indeed a need for a native digital currency that does not require trust, which is likely to promote the adoption of Bitcoin.

Understanding Bitcoin – the cognitive barriers used by Bitcoin

Before we reach a conclusion, we will discuss the third significant external factor that affects the carrier of money, that is, cognitive factors.

Unlike previous currencies, the previous ones like gold, fur or cattle, Bitcoin has no other "real" use than currency. In this respect, it is similar to collectible currencies, such as beading and shells, and is similar in this particular aspect to current currency.

In a more conventional, although not economically accurate term, it has no "intrinsic value." It is not necessary to discuss whether such "intrinsic value" is necessary here, or rather, whether there is "intrinsic value", which is beyond the scope of this article.

For us, it is necessary to understand the cognitive barriers faced by Bitcoin because it lacks this widely-aware "real use", or does not have the natural beauty of a shell, or the legislative promotion and support of no legal currency, Bit There is nothing to promote its adoption, and there is nothing to push it to complete its initial accumulation beyond its currency use. (Blue Fox Note: The author's point of view, other currency types have "practical use" support, such as gold not only needs mining, scarcity, as well as decorative or industrial use, is recognized by everyone; French currency has state support; Bitcoin has neither “practical use” nor state support. This is why it faced a large cognitive barrier in the early days and hindered its importance to a larger scale.)

Therefore, we can say that there are only two forces that promote the adoption of Bitcoin, which is “economic” and “cognitive” without any “indirect utility”. So far, what I am talking about here is the economic power of Bitcoin, which is related to the economic incentives to use Bitcoin and the advantages it provides over traditional systems.

The second force is “cognitive power”, which involves our general understanding of money, especially the understanding of bitcoin, and the application of our knowledge in economic decision-making. In other words, the more we know about the origin of money, currency, and the nature of money, the better our decisions in this regard. The cognitive power discussed here means that the use of Bitcoin motivation is not derived from immediate and immediate benefits, but ultimately from the understanding of Bitcoin and its advantages.

Although I believe that at the beginning of Bitcoin, most of the holders participated solely because of the power of cognition, but I believe that for today, economic power is the incentive to attract the participation of the majority, but cognitive power It is the motivation that leaves them behind. This process is particularly evident during Bitcoin's “supply shock” (half), and we have witnessed a sharp rise in bitcoin prices.

The rise in prices (economic power) has caused great concern about Bitcoin, but after the hype has gradually subsided, what many people have left is the understanding of Bitcoin and its vision, which is cognitive power.

However, only when Bitcoin's economic power is so strong that cognitive power becomes unnecessary, and people use it as part of everyday life, it is possible to achieve the true adoption of Bitcoin. (Blue Fox Note: This is like ordinary people seldom think about the value support behind the money, but just use it as a common tool for life)

The final theme is the most important topic of this article, unlike the others, this is the only place where I see Bitcoin at a significant disadvantage.

For gold, it has thousands of years of history of currency use, enough to make people understand why it works so well. But Bitcoin doesn't have such luxury. On the other hand, the history of banknotes is full of failures and economic collapses, but it has successfully overcome cognitive problems by providing funding for the academic economics sector and providing the most important employment options.

The French currency provides such scholars with respected and influential high-paying jobs, which in turn establish a cognitive foundation for this monetary system and endorse them with their “certificates”. On the contrary, Bitcoin is a “hard” currency that does not create this “scientific foundation” budget for itself, nor does it provide such influential work for economists, but it will replace most of their work. So it's no surprise that you will find that few people in the economics circle will praise Bitcoin.

If there are not enough resources to understand the currency and bitcoin, then only the economic power will be promoted to adopt it. Even if it is enough, it certainly does not work well, and it seems unlikely that the transition to Bitcoin will occur before the collapse of the contemporary system, making this transition very unpleasant and unnecessary.

However, the more resources you know about Bitcoin, the more people understand Bitcoin, the faster they will adopt, and the sooner and smoother the transition to Bitcoin.

Today, after having a central bank for more than a century, people's general understanding of money is completely flawed, and even more in most academic discussions, they still believe they can use their complex mathematical models and inflation goals. "Adjust" the economy.

The 2008 economic crisis has shaken the trust of the current system, but most of the alternatives to the public that understand the currency will only exacerbate the mistakes of the contemporary system.

Nowadays, such statements are common: “Currency is stipulated by national laws.” “Currency is just a common fantasy.” Even among many Bitcoin supporters. This illustrates how extensive work is to explain bitcoin and currency.

Conclusion – the emergence of Bitcoin

From the perspective of monetary economics, the past decade has been the most interesting decade. In the meantime, we witnessed the first currency commodity invented by the free market rather than discovered, and it was monetized at an alarming rate.

Initially it seems to be just another failed proposal on the password punk mailing list, and today it has evolved into a full-featured monetary system that provides active services to millions of people around the world. Through this paper, we study the common factors affecting the marketability of money, and thus affect the adoption of money in the market, and also study the comparison between Bitcoin and the previous currency.

Now, in order to fully analyze Bitcoin, we need to give a brief overview of the process of Bitcoin's emergence, from its early days to how it might evolve in the future.

When Bitcoin was first introduced, it had no price in the first few months of its existence and was mainly used to test software. Bitcoin’s “from 0 to 1” moment was October 2009, and it released the first exchange rate and became valuable in trading for the first time. Soon after, a handful of its early adopters began trading it, injecting life into its system by providing an initial price for Bitcoin.

Since these early adopters were willing to spend money to give Bitcoin life, even though almost no one knew what Bitcoin would look like in the future, they had enough motivation to support it only because of their vision of Bitcoin's potential.

Therefore, the beginning of circulation of Bitcoin does not come from another “useful” utility, nor from authoritative decrees, but from the voluntary actions of early adopters, who cherish the construction of the bitcoin’s vision potential. Opportunities for the new monetary system.

Further, although Bitcoin has a certain transaction value, there are few available trading opportunities because its demand as a medium of exchange has just begun to condense. This means that people have to wait a lot of time to exchange compared to already established banknotes.

That is, they must hold it to adopt it. This is why the hardness and limited supply of Bitcoin are critical to their success. Without a rigid inelastic policy, the uncertainty of holding bitcoin would be too high due to monetary inflation and the consequent risk of depreciation, and would prevent Bitcoin from being truly meaningful.

The currency hardness of Bitcoin allows people to hold with confidence because they know their wealth will not be diluted.

In addition, its limited supply means that bitcoin will naturally become more valuable as its adoption rate increases, rather than being adversely affected by the value reduction caused by inflation. Therefore, the limited supply of Bitcoin itself provides a strong economic incentive for those who understand its superiority as a monetary asset to adopt it and hold it, and they expect that demand will increase over time.

Nakamoto knows this very well, he wrote:

“It’s not by changing the supply to keep the value unchanged, but by changing the supply to make the value change. As the number of users increases, the value of each unit of token will increase. It may form a positive feedback loop; As the number of users increases, the value will rise."

As far as today is concerned, Bitcoin is moving much faster than in the past, and there are more opportunities to trade. However, it has to be a long and long way to go before it becomes a widely used currency system.

Like all social cooperation phenomena, the process of monetization is also a non-linear process, and each time there is an added effect, this process will accelerate and gain. Therefore, it should not be expected that Bitcoin's circulation speed and its daily use will become considerable in the near future, but in the long run, it will accelerate.

Looking at the progress made so far, there seems to be good reason to believe that Bitcoin will eventually achieve its “critical adoption point”, which is needed to achieve rapid growth and become the common currency of the world.

Currently, Bitcoin has the fastest growth in two areas, one is the Internet sector, which has a “family advantage” (Blue Fox note: meaning native currency attributes); the other is a country with low economic freedom, such as Argentina. And other countries and regions. We can see the importance of Bitcoin for the general public.

The higher the inflation rate, the stricter the regulation, and the higher the probability that Bitcoin will be adopted. Therefore, we are not sure how Bitcoin will grow, but Bitcoin will be in demand in some countries with high economic inflation and regulation. Its people need Bitcoin to protect their wealth. In the event of an economic crisis, this situation will continue to grow substantially.

It seems that at this stage, Bitcoin is a free-market commodity. In some high-inflation countries, it effectively proves its value proposition, and its restrictions only promote its adoption. Therefore, Bitcoin is indeed worthy of being Called the anti-fragile currency.

Risk Warning: All articles in Blue Fox Notes can not be used as investment suggestions or recommendations. Investment is risky. Investment should consider individual risk tolerance. It is recommended to conduct in-depth inspections of the project and carefully make your own investment decisions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Speed reading | BTC's monetary policy is overvalued, Ethereum's monetary policy is underestimated

- Interview with Li Lin | Year after returning to the fire coin

- Research shows that bitcoin bull market still needs to wait, institutional admission is still slow

- ChainNode Review: Bit Shield Razor Blade Hardware Wallet

- Market analysis: the same view, to avoid risk

- Hurun Unicorn List: The average establishment period of blockchain enterprises is 5.36 years, which is 2.4 years lower than the overall average.

- Taking a step back, Libra is considering launching a series of stable coins.