Web3.0 Macro-Logical Thinking: From Technical Illustrations to Business Paradigms

Author: FYJ

Source: block rhythm

Editor's Note: The original title is "Web3.0 Macro Logic Thoughts"

This article is expected to read 15 minutes.

- Stirring the global central bank, the legal digital currency behind the "squid" Libra

- Ethereum in-depth comment: new address number forecast price trend valuation is afraid of historical low

- Exclusive Interpretation | Tencent Blockchain White Paper on Libra, Face Up or Downward Strike?

"With the exception of Bitcoin, we have nothing."

In the tenth year of the birth of the blockchain, this is the real idea of many people.

In fact, it is a very common phenomenon that a technology has not been applied for ten years.

In the cold winter, Blockbeats will take you through the chaotic surface world and reach the roots of the industry. Warming by the campfire, the end of the long cold night is the new dawn.

This paper aims to discuss and deduct the top-level thinking of Web 3.0 from a very distant perspective, trying to explain that the blockchain and Web3.0 are not just fundraising in the eyes of many people, but have reasonable social and business logic. The trend of the times.

Will focus on the following five main issues:

1. Why is there a Web3 and blockchain?

2. What is a blockchain?

3. What is Web3?

4. What is the relationship between Web3 and blockchain?

5. What will Web3 and blockchain bring to the world and to each individual?

Because of the limitations of the author's own thinking and knowledge, in the understanding and thinking of many problems, there will inevitably be blind spots and fallacies, and welcome to correct, supplement and explore. Block Rhythm BlockBeats believes that the Web 3.0 era will inevitably inspire and release the value and potential of each individual, one for all is all for one. I hope that these thoughts will attract more people's interest in Web3 and commit themselves to the ecological construction of Web3.0.

Information world that is leaving the ground

“In a nutshell,” a16z founder Mark Anderson wrote in an article published in the Wall Street Journal in 2011: “Software is eating the world.”

If you open the history of the S&P 500, anyone can easily feel the change brought about by this power. The top ten list: IBM, Kodak, Mobil, General Electric, one by one in the years by Amazon, Apple , Facebook and Google replaced. The profit-seeking capital has madly poured into the world of the Internet. After a wave of bubbles, the wealth of the information world is still exploding.

A common saying is that the Web1 era is an era in which users can only passively access content; the Web2 era is an era in which users create content themselves. Nowadays, many people refer to the push era represented by today's headlines as the new Web era of "content actively seeking users." So for how to define Web3, there are different ways from different angles, and the author tends to think about Web3 from higher level logic.

The Internet has only a history of less than three decades, but it has brought about tremendous changes in the world. However, the current mismatch of resources in the information world has been separated, which seriously hinders the further expansion of wealth in the information world.

US dollar "Ponzi scheme" and Bitcoin "receipt game"

Not only is the dissatisfaction with the Internet oligarchy, the gap between investment income and labor income is getting out of control in the endless inflation game of the whole world. The growing gap between the rich and the poor has led to the rise of populism: very subjective, people are infinite The resentment of the US dollar and the resentment of the US debt that is not intended to be completed is increasing.

Trump’s former aides, Bannon, believe that Bitcoin is part of populism.

When Bitcoin turned out, people were surprised to find an unlicensed, anti-censorship, decentralized investment, and most importantly: it was a deflationary asset. Since we can only be harvested under the rules laid down by the existing elites, why don't we have a table to play with ourselves? The myth of the riches in the currency circle began here.

Bitcoin has indeed achieved a number of grassroots riches in these years. In contrast, most people took the plate.

Obviously, the investment value of Bitcoin depends on the number of receivers. Although the inflation game is destined to be a chronic death, the deflation game has been thrown into the historical trash can when the Bretton Woods system was abandoned many years ago. . The author believes that the current limit of Bitcoin is a powerful alternative asset. It is the negative sentiment map of the mainstream world economic system. People are more disappointed with the mainstream, and the performance of Bitcoin will be better.

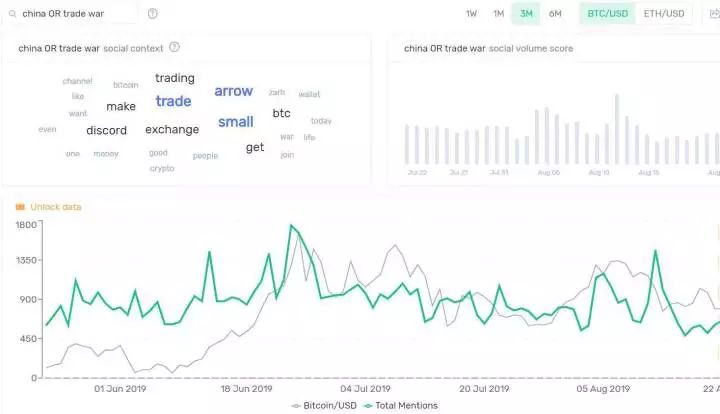

(The bitcoin price has some plausible relationship with the trade war keyword heat. It should be noted that although many people try to bring the "digital gold" hat to Bitcoin, Bitcoin has no obvious "safe haven". Attributes".)

As long as new funds continue to enter, old bitcoin holders will increasingly prefer coins rather than bitcoins. Coupled with the bitcoin-balanced interest game model and the “value store” consensus that has become more popular, the change is “uneconomical” for any camp of Bitcoin. The cognitive difference is expected. When most humans' understanding of Bitcoin is unified, the growth of Bitcoin will come to an end.

You can't count on the world to pick you up.

The World Order of Cyberspace: The Revolution of Data Confirmation

It is very easy to discover that the culture, morality and world logic of the Internet world are clearly distinguishable from the real world: the dissolution of authoritative moments (Ming Xue and Liu Xue), the viral transmission of subculture symbols, or the rapids of thunder This is reflected in the speed of lyric reversal (all kinds of sensitive social events).

But until today, many people still feel that the Internet is just an application portal, rather than the spread of the real world, which seriously underestimates the penetration of the information world into the real world.

The problems of resources, hierarchy, identity, power, supervision, distribution, etc. in the real world, as the information world carries more and more important parts of people's lives, will be mapped one by one in the virtual world: computing power is energy, storage It is land, the code is the means of production, the digital identity is the individual, and finally – "data" will be your "private property."

Web2 is the "colonial era" of the Internet.

The frenzied expansion and plunder of "traffic" is the main tone of this era. It can make cakes bigger in the crazy flow expansion, and no one will consider issues other than "growth." But when the wars of the Internet giants reached a stage of arduousness, distorted competition and user subsidies could not achieve exponential expansion, and the collapse of incremental myths was inevitable. This process will not be very fast, because when the "plunder" is over, it will involve the process of "industrialization". Just like after harvesting users, it can also carry out various levels of crushing on stocks: algorithm push, channel sinking, Community economy, and so on.

The wealth of the information world wants to continue to expand, and the marketization of virtual resources (data, computing power, storage) is inevitable. Only by letting the elements flow effectively can we create more valuable things. To achieve this, the first thing is to ensure the power of every participant in the Internet. Only when everyone has an idea of their private property will they have the motivation to participate in the construction of the entire Internet ecosystem.

And what is the private property of the information world? The most important asset in the information world is of course information, so personal property is of course personal information, that is, private data.

What needs to be understood is that the claim of rights can never be “top-down” because each group will only speak for its own interests. From Facebook, we can see that traditional Internet companies, especially those who are rapidly emerging in the "traffic war", have a sense of urgency about their "original sin." But it's a pity: without the data, they are gone.

The information world will one day pull away from gravity. In the world of cyberpunk, there are new systems and virtues that interact with the real world and interweave the human culture of the next generation. In fact, many pioneers have been exploring the issues of "code virtues", "computational law" and "decentralized autonomy" for many years.

Web3 is first and foremost a "private data rights revolution."

Blockchain: Trust Machines and Element Media

Let us first turn the perspective to the blockchain: this section will use the form of continuous questioning to discuss the nature of the blockchain.

A question of the soul: What is the blockchain?

This is a question that has been asked by countless whites and countless times, and countless answers have been made numerous times, but I will once again make a panoramic combo here: the blockchain is a highly redundant distributed technical feature. The database is functionally a non-tamperable ledger or state machine. But at the most essential level of abstraction, blockchain is a machine of trust, a machine that produces mathematical trust by tightly integrating economic games with cryptographic security.

What is the use of blockchain?

The answer to this question is closely linked to the answer to the previous question: One thing can produce "trust", and the role of the blockchain is not the role of trust? So what is the use of "trust"?

The role of trust is to simplify, simplify is to improve the efficiency of collaboration in human society. Individuals can't do things on many issues, and they can't do everything. So they have a "division of labor" and "trust" (belief is also a kind of trust, it is a trust machine in a very large scope, but it will lead to the right to interpret the faith. Centralized). The "division of labor" is finally paid for by goods and services. This is a kind of production simplification. You trust this process that you have not participated in, and directly buy the money to buy the result.

But note that trust is not without cost. The executors of the "division of labor" often do not have the motivation to maintain the legitimacy of the process, so a trusted third party of fee supervision must exist. Over time, the social value of maintaining a trusted third party will be greater and greater. They have great bargaining power and economies of scale in the upstream and downstream of the "division of labor" and have earned huge profits – this is " The origin of the institution.

In math we trust.

Blockchain uses mathematics to produce trust. When the cost of mathematical production trust is lower than the cost of maintaining trusted third parties, the blockchain is useful. It seems that, in addition to some infrastructure and regulatory issues that will be resolved sooner or later, the blockchain will no doubt be useful in the financial sector.

Another common sense question is: Why do you want to send coins?

The method of blockchain production trust naturally determines that it must issue coins, and network security and currency prices are inherently strongly coupled, and no one can do without. A decentralized, non-accessible system, which cannot be guaranteed to operate safely and steadily by code design alone, must introduce an economic system game outside the code. This is what many people call the incentive layer, that is, the person who maintains the system. Give rewards and penalties for those who damage the system.

So it can be said that the currency is the first application of the blockchain. But in essence, the blockchain is the currency, the currency is the blockchain, and all higher-level ecology is built on this currency system. The so-called trust is the trust that cannot be tampered with the record of ownership changes.

Nakamoto used the chain as a means of realizing the currency. Later, many people used the currency as a means of realizing the chain. It doesn't matter, this is just a question of whether there is a chicken or an egg first.

What is really important is that cryptocurrency is a primitive media medium in the online world: it is not the erosion of the information world by the traditional financial world, nor is it a foreign species called Fintech, and it is not a hybrid product of Alipay and WeChat. It was born in the world of nothingness, the aborigines of the cyberspace, which is the difference between "top-down" and "bottom-up".

This kind of native digital tokens is born to occupy the commanding heights of morality. The more dispersed the power of controlling his interests, the higher the trust of people in the public chain network. This leads to the next question:

What kind of social value will the blockchain produce with useful "trust"?

Blockchain is naturally a financial attribute. In different system designs, Token can be money, equity, futures, options, bonds, it can represent claims, claims, owner's rights, buy rights, sell rights, it can put all the financial products on the market today ( Even the functions including M0) are all dismantled into high-level contracts, which makes the flexibility of the elements of the entire market explode – because the essence of Token is the contract.

The digitization of contracts and the intelligence of contracts will make the efficiency of the entire business community even higher.

Contract, market, algorithmic economy

People often struggle with how to define Token. A relatively straightforward statement is "programmable currency." In fact, smart contracts and various Tokens don't have to make any strict distinctions, because under the framework of the "programmable" property, everything is just a "contract" of all sizes.

Nowadays, a lot of dazzling Defi is emerging, and there is still a long way to go from effectively using the smart weapon "nuclear weapon". With all kinds of information being included in the Internet, finally, today, the "contract" will bind value and enter the information world. And when smart contracts dominate the world, we will have a new term to describe that era—the era of algorithmic economics.

Coase's corporate market theory holds that in the market, the company seems to be a piece of floating butter. Why is there a business? Because the market fails when it comes to guiding complex commercial production, people are “distrusted” to each other and cannot cooperate for a long time. Business managers play a coordinating role in this process, and the “third parties” and “legal institutions” that supervise corporate managers become the major consumers of social trust costs.

Smart contracts are expected to reduce the boundaries of the enterprise through the enforcement of code contracts, thereby reducing the cost of trust in society. In traditional business, individuals are unable to bear the risk of continuously signing short-term labor contracts in the free market. Therefore, they tend to choose long-term labor contracts with semi-trustworthy enterprises. At present, DAO is expected to reorganize the social cooperation model. The so-called "decentralized governance" is essentially the withdrawal of the idea of "weak organization, big market" in the era of algorithmic economy. To some extent, platforms such as Meituan, Didi and Bilibili in the Web2 era have been characterized by algorithmic economics, but they are still squandering the residual value of ordinary users.

In the Web3 era, the economic incentives based on the settlement layer will unlock the innovation potential of each user. The smart contract-based contract execution will minimize the external trust cost, ubiquitous cloud resources and 5G will make the resource scheduling arbitrary.

Web3.0 is an information world that relies on the awakening of the value of Internet politicization. Higher, faster and stronger information technology will involve even more wealth into the Internet. And their foundation, the blockchain, will use its innate "programmable elemental medium" to minimize friction in the flow of capital and production factors. Finally, the political consciousness of the information world began to awaken: people realized that the world of cyberspace must have laws (perhaps code), virtues (perhaps reputation systems), identity (may be DID identity), There are governance and institutions (perhaps DAO). Of course, there is also a personal interest – ownership of your digital identity and data content.

The blockchain is the value settlement layer of Web 3.0 and is the origin of all new Web3.0 business paradigms.

Web3 technical illustration

The law of technological evolution is difficult to capture, because in the field of engineering, humans often have a path dependence on existing technologies. For example, it is very troublesome to re-install a building. It is better to continue to expand in the original building. Even if you build a new building, people often don't bother to move, unless the old building can't be added. (For example, Ethereum is not the most expensive today. Good smart contract technology, but it captures the most value). Although the trade-offs of technology implementation are often difficult to predict, the current abstraction of Web3 technology is clear: layering, decoupling, and modularity.

To put it simply, each tube has a booth that is easy to combine and can speed up everyone's trading, development and upgrade: one layer of security, one layer of tube transmission, one layer of tube storage, and different execution environments, and so on. In short, it is the division of labor. This set is now the trend of the times in Web2, the concept of containers, China and Taiwan, are the embodiment of this idea.

Some of the possible underlying technologies of Web3 are briefly described below (blockchains have been discussed earlier, so we won't repeat them here).

Data, semantics, knowledge maps and artificial intelligence

The Semantic Web is a concept put forward by the inventor of the World Wide Web, Tim Berners-Lee, in 1998. After years of obscurity, the content of the Semantic Web has been very rich.

In simple terms, the Semantic Web is a way to standardize data with uniform standards, thereby reducing data friction and speeding up data flow. Metadata, ontology, or now popular knowledge maps are the criteria used to implement this set of specifications. The general implementation method is to add an addressing label to the data, make it Web-based, and then associate it with semantics, so that the data of the entire information world is easy to calculate, manage and link.

In recent years, knowledge maps have gradually become a hot area in NLP (Natural Language Processing). But whether the Semantic Web is the direction of future artificial intelligence has always been controversial.

Cloud computing and edge computing

In the visible five years, the commercial value of cloud computing will become larger and larger. But in the future of the rapid development of the Internet of Things, edge computing will coexist with cloud computing.

The Internet of Things will connect tens of billions of devices around the world to the network, and even 5G bandwidth will not be able to carry the data generation speed of such huge devices. The scarcity of bandwidth will make a large amount of computing and storage have to be carried out under the cloud. "Edge" refers to the local resources co-processing large and unimportant local information, only important things are uploaded and interact with the cloud.

The resources of edge devices are very fragmented, so how to implement resource scheduling across devices is the key to integrating edge computing power. Huawei's Hongmeng system has taken a big step in this direction, but when personal equipment is idle, Hongmeng system seems unable to solve this resource waste. Blockchain technology can completely solve this problem by market means. A network based on edge computing and storage is part of the Web3 resource market. At present, there are many public chains on this track, but the author believes that in the current high-speed development of the Internet of Things and the centralization of cloud computing, the flexible and free edge computing market does not exist.

Decentralized storage

Decentralized storage based on IPFS may be the only solution to create a world of data security.

The contemporary data rights pattern seems to be more like the current human political map: every Internet giant is a country, the state gives everyone various rights, but the inter-regional barriers bring about the flow friction of the factors still limits the development of human economy. pace.

The information world can lead and even lead the world in integration: any type of data silos is a hindrance to the flow of information. Compared to the various global dilemmas in reality, the decentralized governance problem of storage is completely pediatric. But even so, this step is still difficult – Filecoin's "time and space proof" is still difficult to produce.

The main technical issues of decentralized storage are: how to ensure the privacy and permissions of the data stored in the de-neutralized node? Although decentralization is required in the storage architecture, there must be a centralized logic on the indexing of data. It is a big technical problem to decentralize the logical database in the storage system.

At present, the 3Box based on Ethereum, the Gaia system of Blockstack, the distributed key management system NuCypher, and the blockchain database system such as Textile, The Graph, dFuse, etc. are all possible logical layer schemes above the storage layer. , although these programs are not necessarily related to IPFS.

Digital identity

Digital identity is extremely complex and can even be said to be one of the core issues of Web3.

Because of the lack of centralized authentication, the blockchain system invented the two methods of attacking witches, PoW and PoS (the network voice right anchored the power or financial resources, not the human head). Without the basic out-of-chain identity, the basic chain voting problem will be difficult, not to mention the grand vision of governance and reputation on the chain.

A mature decentralized identity scheme is the basis for realizing data validation. Identity schemes in the Web3 era face three main problems: namespaces, authentication schemes, and out-of-chain institutions.

Identity authentication is essentially a name-based addressing, just like the identity card number corresponds to each of us. The only interpretation of the name of the head address is in the hands of our government, the root namespace of all of us. The right to interpret belongs to the state. This is the only effective real-world identity management program in human society. The current technology does not seem to have a better idea within the scope of its eyesight, so the final confirmation of personal identity must rely on the violent machine endorsement of the state to ensure absolute authority.

What can the blockchain do?

Blockchain is expected to eliminate alliance status in the business world. The oligarchs of the Web2 era are happy to let users repeatedly carry out KYC and establish identity barriers in the ecology for various reasons. Imagine that in a decentralized data system, everyone has a distinguished identity name. When you need to authorize a service, you only need to ask the certification authority of the root information for proof and pass it to the service provider for verification. The whole process only involves authenticity verification, and does not involve any data transfer to the service provider. Large data based on identity exists in the chain in the form of decentralized storage.

The above is the general idea of the W3C's DID identity standard: a digital identity goes the world.

ERC 725 proposes a standard for managing identity on the Ethereum blockchain. Presented by ERC20 standard creator Fabian Vogelsteller; uPort is an identity autonomous wallet incubated by ConsenSys. You can use uPort to create identity on Ethereum, securely log in to Dapp without password, manage your personal information and authentication, sign Ethereum transactions and numbers The signature file, the uPort team also developed an IPFS-based decentralized data storage solution, 3Box; recently Microsoft announced its decentralized identity scheme DID; and the DIF Foundation, Sovrin, the Clear protocol acquired by Coinbase, etc. Wait, the business landscape of the digital identity scheme is actually very rich.

All of the above solutions involve the interaction of encrypted identity and real identity, and the topic that cannot be avoided is KYC based on the authority. A pure virtual space address like a DNS domain name can of course be decentralized, and the elimination of such an authority is inevitable. But once the real identity is involved, whether the government will further expand its power in the Web3 era has become a haze of many people. In fact, thinking about this type of problem is completely worrying: the cryptography-based authentication and authorization system is the design of the Web3 identity—no one will monitor what you have done, but someone must prove what you have the right to do.

What is the only sign of the real world, fingerprints, faces, or genes? In any case, a future blockchain must be a blockchain with real identity.

2019: Crossroads in the encryption industry

Since the beginning of this year, IEO, privacy, Defi, "cross-chain" and "sharding" seem to have brought up the market fever in the first half of the year, but people have apparently become confused about the next possible revolutionary technology. When one technology pie is hopeless, everyone is immersed in meditation: bitcoin is valuable, model currency can make money, altcoin is a bubble, and blockchain is a scam.

The moment is an embarrassing moment, the infrastructure of technology is built to continue to advance, but the market has yet to emerge a new application that is eye-catching. No matter how majestic the new technology is, the story on the market is hard to tell: incremental game play has become a bad stock. But the author believes that when the accumulation of new technologies reaches a "singularity", the blockchain market will usher in the next "I rely on time" (FOMO) – the evolution of things is often a step-by-step transition, and non-linear accumulation.

PoS and PoW

At the moment, a number of top-level projects use PoS. The debate between PoW and PoS has been around for a long time, but there is little streamlined interpretation on the web.

Most PoW's longest chain principle determines that it is only computationally safe and not perfect. The security of completed transactions is entirely dependent on the cost of miners mining in their subsequent blocks, which is what many people call transaction settlement guarantees. Simply put, if someone else transfers you a BTC, the deal is theoretically safe when the cost of the longest chain chasing attack is greater than the double-yield for your transfer. Therefore, there will be a small transaction that can be quickly confirmed, and a large transaction needs to be confirmed after a while. Obviously, Bitcoin's 1 acknowledgment security and the 1 acknowledgment security of many small coins are not at all a level.

The security of the Bitcoin network is a game of three indicators: currency price, single-block mining revenue-cost ratio, and 51% attack-to-income cost ratio. The first two numbers are very easy to obtain, and the most difficult reason for bitcoin system security is that 51% of attacks introduce too many real-world factors, compared to PoS's simple and crude market value to prevent witch attacks, 51 % The concept of computing power is too complicated: Who has so much computing power? Is renting feasible? How to quantify equipment depreciation? Where is the electricity cheaper? What is the annual production capacity of mining machines? At the same time, miners and the ability to control the price of coins, the switching of devices with different minerals, and the concept of anti-ASIC also make the game model of the PoW world more complicated – it is very difficult to quantify the power.

This is PoW's "complex system". The complex external world factor of computing power makes all the analysis of bitcoin destined to be chaotic.

You have the right to think that this hard-to-quantify thing becomes the security of the blockchain and will become a sword of Damocles hanging on everyone's head. This is also the attack point of many PoS supporters against PoW. one. But in a different way, maybe chaos provides a stronger robustness for this system? Compared to PoW's use of the real power factor of "power" to resist witch attacks, PoS is a more pure form system. The price of the currency and the interest rate of inflation determine the logic of the economic system, and the price of the currency is A number at a glance. So it can be visually assumed that PoW is a living body and PoS is a mathematics.

It's easy to conclude that PoW's growth requires more miners, so it's pointless to disperse more coins through public offerings, because most of the holders don't mine at all, matching development costs once. The private placement or a program similar to Grin's donation and Zcash's distribution is the team's right path. On the contrary, it is unreasonable to conduct private placements in any PoS chain. How can it be possible to achieve more decentralization in computing by giving more coins to a few people? In the PoS system, only the currency can contribute to the network, and ordinary people can only participate in the network by public offering or secondary market. A network that is worthless during the startup phase needs to be qualified to make a contribution. Isn't that funny? For the time being, lock-in airdrops and Dutch shoots are compromises in the PoS startup phase. Of course, if DAO is used to quantify the construction of the network during the fundraising phase, both the capital indicator and the labor index are used to balance the centralization of token distribution, which is also an ideal solution, but it is too difficult.

The best solution that can be seen is PoW to PoS, which is also Ethereum 2.0.

Expansion of the chain war in the track

The current performance schemes are as follows (note that any combination of multiple schemes may be possible): fragmentation, cross-chain, DAG, sidechain, under-chain calculation, computation and storage separation, supernode.

No matter which method is used for expansion, one thing has become the consensus of all people: the resources on the chain are invaluable, with extreme performance optimization, strong scalability design, and prudent use. The consensus layer should be as accelerated as possible while ensuring security, while moving unnecessary calculations to the chain and placing functions for different scenarios on the sidechain.

There are two interesting arguments: Should cross-chain be isomorphic (sharding) or heterogeneous? Should the network have global security or local security? Those familiar with Ethereum 2.0, Cosmos and Polkadot should be familiar with this issue. To discuss this issue, first understand what cross-chain and sharding can bring to the blockchain: If the speed of the public chain is tricycle, then the shard is hundreds of identical high-powered tricycles, and the cross-chain is Hundreds of slightly different high-powered tricycles. There are more people to install, but the large-scale application of the traditional Internet requires an airplane instead of a bunch of tricycles. Interested parties can pay attention to the latest developments in cross-chain interoperability and can have a deeper understanding of this issue.

Change the block structure (tree map and DAG), add side chains, super nodes, all kinds of schemes just to upgrade a tricycle, such as adding a wheel to become a car, whether it is useless depends on the cost of system resources. Obviously, the resource cost performance of distributed systems can never match the centralized system, so the low resource possession and high value anchoring is the right path of the public chain. To put it bluntly, the public chain temporarily only solves the problem of ownership status change. Now is Defi. In the era of Web3, there will be data, identity, storage space, computing resources, DNS, and so on.

Cross-chain is temporarily useless.

There are only two useful chains in the world, Bitcoin and Ethereum. Polkadot and Cosmos are known as heterogeneous cross-chains, but if you don't use the Cosmos SDK and Substrate to develop zones and parallel chains (into their ecology), existing chains can only be connected to them via a bridge (in other words, sidechain gateways) Transit). So what's useful is not cross-chain, but cross-bitcoin and Ethereum.

However, Bitcoin can't be technically temporarily (and the community is not moving at all). Ethereum 2.0 can customize virtual machine optimization according to different Dapps. What should be done across the chain?

Accessing a cross-chain ecosystem is a big project. In Cosmos, the system does not provide global security, so every new chain needs to be funded for cold start; the first parallel chain release is required in Polkadot. Think about it, in fact, the two are the same thing, but the latter is all arranged by the ecology for the fundraising, so do you understand that the ecological importance of DOT is much larger than ATOM? In addition to fundraising, each chain has to design its own economic model. In Polkadot, we also discuss the security issues after losing the slot.

Many people just want a few people to be a small application, but the threshold is so high. How can we call for enough grassroots developers?

In the future, Dapp will face a divergence of ideas, namely ChainApp and Dapp. The latter is deployed in a scalable and fragmented system with a low threshold and can be done by everyone. The former will only be funded by mature killer applications. . Dapp, which performs well, can develop a brand new chain (better performance and lower operating costs) for Substrate customization on Polkadot. However, the killer application that is currently visible at the protocol layer and requires complex performance optimization is only DEX.

So you see, the coin will be Tendermint to do the coin chain, in fact, the picture is far away. If the coin chain is a Cosmos DEX side chain, or simply a Cosmos Hub, the BNB scene will be much more than just the moment. For example, mortgage DEX on BNB, and various Defi based on BNB.

The world does not need so many different agreements, and the future public chain is only about five fingers. And with Web3 as the macro logic, it's clear that you should focus on areas such as data, storage, and domain names, such as Ocean Protocol, Filecoin, Blockstack, and Handshake. In the process of comprehensive improvement of these basic fields, cross-chain operations will naturally follow development. Due to the age differences between these protocol layer technologies, cross-chain development may be compromised, not elegant, and tinkering, but this is not an important feature of engineering technology – path dependence.

Or maybe the cross-chain itself is a market for a particular use case, not in the form of a general agreement?

Importantly, we need to first develop a cheap enough and easy to use application that can fill the next generation of public links at 3000 TPS instead of going over the application to discuss interoperability. Perhaps the most valuable thing about Polkadot and Cosmos is their hair chain kit, which will expand the chain's foam to the extreme.

Big waves wash the sand, let us swear who is naked.

Immovable King Ethereum

Substrate and CosmosSDK greatly reduce the development threshold of the chain. But unfortunately, there are already enough chains now, and the next generation of chains, even if the single chain reaches thousands of TPS, can't find any application scenarios other than Defi and DAO (it can be considered that Algorand's Dutch shoot is one Decentralized financial products).

An internal reference from USV (Joint Square Ventures): We are at the turn of Finance 2.0 and Web 3.0. Combined with the above discussion, it is not difficult to draw a conclusion: If the blockchain is only Finance2.0, the bottleneck is now the infrastructure construction problem. And more imaginative decentralized applications can't, and actually don't introduce other decentralized elements—the decentralized storage, computing, bandwidth, identity, and portal (DNS) in Web3.

In the foreseeable future, the continuous improvement of Defi and DAO is the subject of the application. At this track, the Ethereum's moat is the Pacific Ocean – a market value of $20 billion will allow it to slowly smother all other smart contract platforms, and the technology of Ethereum 2.0 is also top-level.

Just as traditional financial institutions only buy bitcoin, the traditional big companies use smart contracts and only choose Ethereum. Privacy, oracles, under-chain computing and a thriving enterprise-class smart contract service will make Ethereum go further and further on the “global settlement” road.

Web3 only needs a value storage tool "bitcoin", and only needs a decentralized financial system "Ethereum". Any attempt to surpass Ethereum by benchmarking Ethereum has only one broken road ahead.

The public chain is only the first, there is no second.

5G, light node, resource market

Everyone seems to think that 5G will have a huge impact on blockchain technology, but what is the impact, but few people can say one or two.

5G will widen the gap in communication speed between regions. In the blockchain network, the 5G area is realized, and the synchronization and consensus efficiency between the nodes will be greatly improved; and the unrealized area will delay the performance of the whole network. Blockchain industry KOL card believes that this will lead to the birth of a high-performance blockchain in a specific area of high-tech entry (other regions can not join, because the bandwidth capacity can not keep up, the operating node can only be punished all the time). This is an interesting perspective, but it is similar to the idea of a super node, but the degree of centralization is lower. The author believes that, in fact, the mobile node's light node capability is constantly strengthening. In the future, the main decentralized public chain will rely more and more on the mobile side, and 5G will make this kind of public chain more and more decentralized. The project may become the next vent. The entry barrier of the node certainly cannot allow most of the backward areas to join, but most top public chains have already made a lot of compromises. It is foreseeable that Europe, the United States and East Asia will monopolize the future of the public chain network.

To take the path of a supercomputer, Solana is the leader of the next generation of public chains. It even separates storage from computation, making the computational decentralization of the supernodes dependent on storage decentralization based on common nodes, plus asynchronous and concurrent technologies, with claimed performance reaching 50,000 TPS. According to the performance comparison of the cross-chain above, this is almost equivalent to a super sports car. This order of magnitude improvement in performance is a meaningful exploration.

Solana uses a solution that separates computing from storage. In fact, it reflects the current thinking about the storage expansion of information on the chain. Bitcoin and Ethereum are both calculated for billing and stored for free. Later, there was a view that in the blockchain network, the calculation is one-time, and the storage is permanent. If there are one thousand nodes, 1MB will occupy nearly 1GB of storage space. Therefore, it is very unreasonable not to charge for storage. Therefore, EOS quantifies the three resources of computing, storage, and bandwidth, and proposes a model of how many resources there are. It turns out that this mortgage lending model is not as flexible as the computing billing model at the time, but thousands of TPS have caused the system resources to be expensive, which directly led to the Eapp Dapp ecological collapse.

Polkadot uses a resource model that combines infinite use (first parallel chain release) and how much money (parallel threads) is used after the fundraising auction; Nervos uses a very ambitious "storage as a resource" model, and clicks "How many things to store" And "How long to save" to charge, the calculation problem is directly lost to Layer2, somewhat similar to Filecoin's "time and space proof"; Ethereum's Gas model greatly limits the development of its privacy features, so how In the final form of Ethereum 2.0, various resource billing models are laid out, and the community is already conducting in-depth discussions.

F2Pool founder Shenyu has proposed the concept of "bitcoin computing power options". In fact, in the world of Web3, if both computing power and storage become commodities, then add a time dimension to both, and some similar computing power options, storage futures, and even bandwidth index, network resource fund or something. It is not surprising.

To some extent, Web3 is the marketization of the information world. Naturally, the determination of the right to private property is the first step, which is the "data-rights revolution."

Web3 business paradigm thinking

Based on all the above experiences, we may wish to start some feasible thinking.

Moat for open source applications

The open source of smart contracts is inevitable.

Only open source can give everyone confidence in their security, and later generations can build more complex composite contracts on the basis of their predecessors, and then create an ecological emergence. In the Web1 and Web2 era, many open source protocols have been used countless times, but their contributors have never had a benefit. Because the Internet is still a business service, the value will of course only converge on the direct providers of services. The Internet in the Web3 era will be a social paradigm, and the blockchain provides a way to reward the developer of the protocol layer by issuing money at the protocol layer. The so-called "fat agreement" means that the more people use this agreement, the more money they earn from holding the token position of the agreement.

A very natural question is: Where is the moat of Dapp?

The giants of traditional industries are often difficult to be threatened by ordinary users by ordinary means, because the cost barriers under heavy assets are insurmountable. The intangible assets of the connected giants are network effects. When people want to transfer to new applications, they find that no one has any business (social or takeaway life services). So no one will use a Defi copy of the same code because there is no liquidity at all.

This is the first-mover advantage of Defi products – the market.

What about the more complicated Dapp? In the world of Web3, the service-centric Internet will become a user-centric Internet. Web2's Internet company provides free services, collects user data for analysis, and arbitrarily reoccupies the attention of your use of services through advertising, in order to achieve profitability (of course, many traffic models can not be realized at all) . Users have very high conversion costs in the ecology of different oligarchs, and can be transformed freely in the same oligarchic ecology. The monopolist of traffic can almost sever the life and death of all entrepreneurs.

But in the era of Web3, can the "free service" model continue?

Authorized world

A user in the Web2 era gets a free service by signing a privacy and data authorization agreement with the application. This is a very reasonable business model.

If you simply think about whether the user needs to take ownership of the data, then virtually any service provider today will ask for your consent when you gain access to your data. If you don't agree, then you can do it, don't use it.

This is the cruel reality that Web3 needs to face.

The counter-intuitive aspect of this problem is that the Internet oligarchy not only provides services for you, but also provides an ecological network effect. For example, bilibili not only provides you with various website functions, but also the user's barrage and content creation is part of its service. Everyone provides data and content, but the power of the network effect of data and content is swayed by the platform, and this guides users to enjoy the consumption of free services.

But who would have the incentive to provide a strong infrastructure and a superior user experience without the excess profits from network effects?

There is a classic statement to reverse the description of what is decentralized: as long as you still need to log in, it is centralized.

So Web 3.0 is the world of authorization, not the world of login.

(I remember when I was very young, when each of the adsl was online, when I landed on a website or information port, I would automatically remind you what Mr. Zhang is doing.

China Unicom and China Mobile can also directly assign identity to devices under the mobile network. )

This is an essential change: the Internet is now based on service providers, users enter an ecosystem, enjoy services and create data, but what you create belongs to the service provider, you can’t bring you Other ecosystems to go; in the world of empowerment, users are the core of everything, your content is stored in your personal network identity, and when you want to use a service that needs some of your information, you are open to it. Authorization. At the same time, you can open and close different levels of authorization for many applications and services at any time. The transformation of this commercial center has caused the isolation of information islands between ecosystems, which will completely eliminate unnecessary resource loss caused by traffic wars and greatly enhance the network effect of the information world.

The key to empowering the world lies in two points: first, there is a new way of over-incentives for service providers; second, how to motivate them to participate in the construction of the information world after shaping the user's view of information assets.

This is actually another explanation for the "pass-through economy", that is, the "distribution" model of the network effect. The excess return portion of the network effect should be allocated to each participating user in a quantifiable, relatively fair manner. To some extent, this is the essence of the design of the general economy.

If you are still absolutely confident about the scarcity of the services you can provide, you can of course engage in a compulsory licensing overlord clause. However, many years of market experience tells us that apart from a few heavy asset platforms that open the channels under the line, most Internet services have no network effect, and there is really no scarcity. The scheduling of various cloud resources is now very convenient. If you add various decentralized computing and storage in the future, the launch of Internet business will become as simple as the media. Is it true that the application layer has no network effect, and is it really impossible to capture value?

The author believes that the so-called complete decentralization is not in accordance with the development law of the objective world. The reality will only change from one kind of "centralization" to another "centralization".

Decentralization and "decentralization"

The decentralization in the public chain system is divided into two levels: resource decentralization and governance decentralization.

Why should resources be decentralized? Because the public chain network is a distributed system, distributed is to achieve security and reliability. The meaning of security and reliability is that any local network damage can't beat this system, instead of Japan's AWS fault, the entire currency circle. It’s all about you. If a public-chain system is stable in the Third World War, its decentralization of resources is a success, and it can really be called a world computer with 100% availability.

At present, there are many people who criticize the centralization of the power of PoW public chain mining, but the scale effect of the calculation cannot be impossible. That is, some kind of centralization of resources is inevitable, and we need to pay attention to only the degree of problems. In the Bitcoin system, the difference between personal equipment and professional miners is 0 and 1, that is, the possibility of personal equipment digging into the mine is infinitely close to zero. And because bitcoin has a block rate of 10 minutes, a strong small miner may take several months to dig a block. The centralization barrier caused by this scale effect is very hampering the participation of ordinary users. Even so, bitcoin computing power has not appeared in the top five mining pools in the world. If there is an accident in the first-line mining pool, there will be a profitable second-line computing power to participate in mining. It can be seen that the centralization of resources is almost too unpreventive to the security and reliability of Bitcoin.

Of course, future PoWs and PoSs will be more decentralized in resources. Conflux's latest PoW chain can even achieve a block rate of 4 per second, and the small miners will have a much shorter payback period with the same revenue (for example: 1 year for 1 coin, now 1/month) 12 coins). Ethereum 2.0 will use the way of assigning computing tasks according to the number of mortgage tokens to lower the threshold of the node. This method will control the scale effect of the mortgage within a reasonable range (the size of the household will not be the difference between 0 and 1) . Being more friendly to ordinary users will undoubtedly promote the participation of ordinary users in the network, and more participants will greatly improve the system stability of the blockchain network.

Why is governance going to be centralized? Because the centralization of governance requires the establishment of a third-party supervision agency, it will naturally lead to an increase in the cost of trust. At the same time, the excess income earned by the governance center will be distributed to everyone on the network as a cost, which will lower the overall efficiency of the society. Decentralization of governance often requires multiple conflicting interests in the network.

The decentralization of Bitcoin in governance is very successful: miners, retail investors and core developers have achieved subtle power checks and balances, and retail investors seem to be weak, but they can vote with their feet through positions; miners look strong, actually It’s a loose sand; core developers seem to have mastered the power of change, and in fact everyone has the veto power over them. Bitcoin is well suited for value storage because no single interest group can control the interests of everyone, and all unilateral change efforts are “uneconomical”. But the shortcomings are also obvious – it's almost impossible to self-itate. However, not iterating is an advantage of value storage.

Governance (go) centralization is about iterations, that is, whether someone can have an arbitrary influence on the future direction of the system. If this influence is on the chain, it will make the system unbalanced and lose the foundation of the blockchain. But if this transcendental force is outside the system, it will be very beneficial to the iterative upgrade of the system, Vitalik and Gavin Wood are the detached power outside the system. Blockchain is still in the wild, so to some extent, centralization of governance under this chain is necessary, otherwise the world will stop at Bitcoin.

Ethereum is a little more central to governance than Bitcoin, which comes from Vitalik's detached status in the community. It is because of this status that Ethereum is likely to slowly innovate and eventually complete the transformation of 2.0.

Web2's network effect (data and traffic) dividend is centralized, which hinders the further flow of information elements, so the economic model of blockchain utilization almost coincides with the centralization of the network effect dividend—the ideal Web3 network No one can earn excess returns by monopolizing data and attention. But this is not the same as whether the blockchain system itself is logically (governed) centralized, or computationally (whether there are mines or node vendors).

The essence of Web3 decentralization is to "divide" through "checks and balances." Therefore, it cannot be said that EOS is a centralized public trust chain. Representative system is still a direction of the public chain, but more exploration is needed.

Please always note that any type of decentralization is just a means, not an end.

(Blocked BeatBeats Note: Regarding what is decentralized, Vitalik also has a special description in its blog.)

Dismantling DAO

DAO (Decentralized Governance) is considered to be half of the commercial chain of the blockchain, and its importance is self-evident. Politics and economy are brothers. In the next generation of the Internet as a social paradigm, Defi and DAO naturally complement each other.

DAO has the following distinct features:

- DAO uses the network to organize, so DAO can easily achieve cross-regional collaboration across the globe compared to traditional businesses.

- DAO relies on an incentive system based on economic games, so it is suitable for problems that are easy to quantify and simple in model.

- The arbitrariness of online communication determines that DAO is difficult to perform work that requires strong execution.

- The nature of the smart contract "code is law" makes it difficult for DAO's mechanism to quickly adapt, so DAO is not suitable for work that requires flexibility.

DAO can be understood as the specific expression of "algorithm economy" above. The above characteristics are summarized as one question: What kind of organization can be purely algorithm driven?

This kind of thing has already existed in the world – any video game is algorithmically driven. It can be considered that DAO is a game that connects the real world economic system, DAO is a blockchain game, and blockchain game is DAO. The two do not have to be strictly distinguished because they are children of the algorithm.

Tracing trillions of markets

One question that has not yet been answered in the previous article is: If the data is confirmed and there is no excess profit brought by its network effect, who will have the motivation to provide a good user experience? What will be the next centralized scarcity resource?

One noteworthy thing is that the billing model for the Web3 market is returning to Web1. Almost all blockchain applications are billed.

Layer1 has actually created a way to motivate creators—ICO, who only need to get things done and then sell their initial tokens to make big money. Later, people found that because ICO would make the project party have a lot of money from the beginning, it seems to be in line with market rationality rather than doing things, running or passive absenteeism. So I later had the IEO that the exchange endorsed, with Grin, Zcash and Conflux turned back to PoW, there are also airdrop types like Edgware, and this is undoubtedly a way to protect investors. The author believes that with the exploration of the industry, the fundraising method of Layer1 will become more reasonable and perfect.

But what's bizarre now is that Defi, which is a middleware protocol and application layer, is also sending money. Maybe these coins have more or less design considerations such as “mortgage participation in ecological operation” and “governance”, but this is not doubtful. :Layer1 Up If the coins are issued on each floor, the blockchain is too difficult to use?

If we think of Defi and the oracle as an infrastructure for the time being, the massive applications that will be carried by the upper layers in the future will give them the confidence to create their own ecological coins. Dapp can't always send coins too?

So is Web 3.0 free or chargeable? Its mainstream profit model will also be advertising (is it possible to focus on marketization represented by Brave)? What kind of business model will be born based on the new user data game model? What are the uses of the data and how it is priced according to its different functions (such as how it is used for AI training), and should artificial intelligence be decentralized or centralized? Will intelligent resources be the next monopoly scarce resource? Where is the investment window that captures the most value? How to position investors in decentralized business? Where is the next trillion market?

There are no answers to all the questions, and there are no such problems at all. Only by participating in the construction of Web3, in action and reflection, we can find the way to the future.

Conclusion

No matter which "centers" are removed and which "centers" are established, the value capture of business models cannot be separated from the word "abstract". From "platform economy" to "traffic barrier", from "fat agreement" to "middleware", it is not at the logical hub, abstracting complex transactions into simple services, coupled with a viable profit model. And the moat, can only make clouds and dragons.

We don't have to over-expect the changes that the blockchain will bring to the world, and we don't have to doubt ourselves in the denial of everyone. People always overestimate changes in two to three years and underestimate the world after 10 years. In the era of the heyday of each generation, young people will think that the cause in their hands is changing the world. We can have this mentality: the blockchain will not subvert anything, it will only let everyone accept the changes it brings to the world.

The world can't be changed, but we can embrace the new world one step earlier than others.

The revolution has been quietly staged, and the interesting thing about thinking is to use the unchanging truth to derive the transformed things.

Although business is ever-changing, humanity is eternal.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Academic Direction | How does Bitcoin drive breakthrough innovation in accounting?

- Viewpoint | Blockchain is a digital social governance system for AI smart new species

- Bitfinex parent company submits a search application to the US court, intending to recover the frozen 880 million US dollars

- The World Internet Conference is coming. I found a blockchain company in Wuzhen.

- In the questioning, how does Libra's currency basket fall? Single anchor instead of integrated anchoring?

- The currency will be added to the legal currency transaction pair. The first supported legal currency is the Russian ruble.

- Exclusive interpretation | Tencent blockchain released 3 editions of white papers in 3 years, these landing applications are the most concerned