Review of the Rise and Fall of Cryptocurrency Exchanges in the Last 13 Years: Dominance, Scandals, and Crashes

Review of Cryptocurrency Exchanges: Dominance, Scandals, and Crashes in 13 YearsOriginal Title: Dominance, Scandals, and Collapse: A 13-Year History of Cryptocurrency Exchanges (Part I)

Authors: Ryanu, Thomas, @歪姆 YM Crypto

Source: Foresight News

In 2014, the world’s largest cryptocurrency exchange, Mt. Gox, went bankrupt after losing 850,000 bitcoins to theft.

- How to use dynamic NFTs to provide liquidity products in the Sui public chain ecosystem?

- Decoding the new standard ERC-6551: A new way of playing NFTs in wallets

- Amid the encryption winter, what makes Worldcoin capable of securing a $100 million financing?

On the day of the crisis, the price of bitcoin plummeted 25%, from $535 to $400.

Six major institutions including BTC China, Coinbase, and Bitstamp issued a joint statement to distance themselves from Mt. Gox.

While trying to salvage the industry’s reputation, all exchanges did their best to divide up the territory lost by Mt. Gox.

This unprecedented crisis was also viewed by many as a good opportunity to buy the dip.

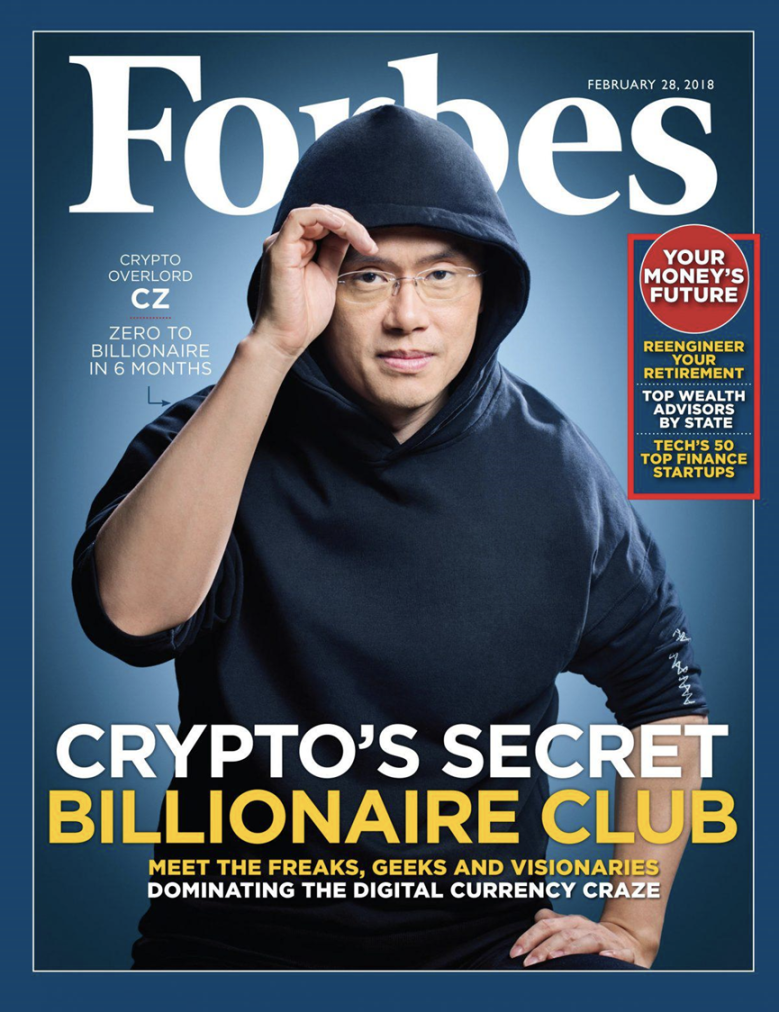

Among those who bought the dip was CZ (Changpeng Zhao), the founder of what would later become the world’s largest cryptocurrency exchange.

That year, CZ sold his house in Shanghai and went all in on bitcoin at $600. In less than a year, Shanghai real estate prices doubled, and the price of bitcoin fell to one-third of its original value.

While CZ was busy going all in on bitcoin, on the other side of the ocean in the US, Brian Armstrong’s two-year-old exchange Coinbase finally welcomed its one-millionth user, a young man named SBF who had just graduated from MIT and was applying for jobs on Wall Street.

Years later, they would all be the founders of the three major cryptocurrency exchanges and occupy the top three spots on Forbes’ 2022 cryptocurrency rich list.

Of course, this did not mark the end of the cryptocurrency exchange industry.

A year later, Brian’s net worth shrank by 75%, SBF found himself in prison, and CZ was pursued by US regulatory agencies, leading to a flurry of fake news about him, including rumors that he had been killed by the FBI.

Exchanges are undoubtedly one of the most profitable businesses in the cryptocurrency industry, as well as one of the most fiercely contested.

From the birth of the first cryptocurrency exchange to the present, the exchange industry has been turbulent, with ups and downs changing in an instant.

Platform tokens, trading mining, exchange alliances…new gameplay and innovation emerge constantly. Futures, options, stocks…new underlying assets emerge in endless succession. Theft, black box operations, and self-dealing…security and compliance issues remain unresolved.

Almost every day, we see negative news about exchanges. Unfortunately, many of these negative news items are true. The world of cryptocurrency exchanges is littered with corpses, apart from well-known examples such as Mt. Gox, Fcoin, and FTX, there are countless smaller exchanges that have been forgotten by people.

Even today, despite Binance and Coinbase occupying the leading positions and holding most of the market share, the exchange industry’s pattern remains uncertain.

This article will review the development history of cryptocurrency exchanges, focusing on four aspects: gameplay, underlying assets, security and compliance, and forms. While reviewing this history, we will think about how these factors have determined the changes in the pattern of the world of cryptocurrency exchanges.

2010-2013: The Era of Mt. Gox

After the birth of Bitcoin, for a long time, there were no exchanges. People mainly traded Bitcoin on the Bitcoin Talk forum.

Starting from 2009, New Liberty Standard began to publish the Bitcoin price calculated based on power consumption. On October 5, 2009, the price was $1 for 1,309.03 Bitcoin, equivalent to a price of 0.00076 USD per Bitcoin.

After that, some centralized exchanges were established.

On January 5, 2010, the first anniversary of Bitcoin’s birth, a Bitcoin Talk forum user named dwdollar posted: “I’m building an exchange, which will be a real trading market.”

In March 2010, Bitcoin Market was launched. However, during this period, the Bitcoin trading market was still in a very primitive stage, and Bitcoin Market often needed to be patched based on feedback from forum members. In July 2010, the father of eDonkey, Jed McCaleb, created the later dominant exchange in the industry in Beijing. By chance, Jed met Mark Karpeles on the Bitcoin Talk forum. Karpeles, born in France and settled in Japan in 2009, was referred to as “fat Frenchman.” At that time, Karpeles’ start-up company’s business was half-dead and was looking for new opportunities. He vaguely felt that Bitcoin trading might be a profitable business. And Jed wasn’t too interested in continuing to run a Bitcoin exchange, so in March 2011, Karpeles bought the exchange, while Jed retained 12% of the shares and then joined Ripple.

Up until then, they probably hadn’t thought that the exchange would reach the scale it did. In February 2011, the trading volume of the exchange was only 360,000 Bitcoins, which was worth only $329,000 at the time. After taking over, Karpeles immediately transformed the exchange, including expanding the supported currencies from only US dollars to support more than ten different currencies such as euros and Australian dollars, and redesigning the new website page. These updates took about four months to complete.

During this time, the launch of the Silk Road on the dark web provided a use case for Bitcoin, and the price of Bitcoin rose rapidly. On February 9, the price of Bitcoin reached $1. By June 8, the price of Bitcoin on the exchange had reached $32.

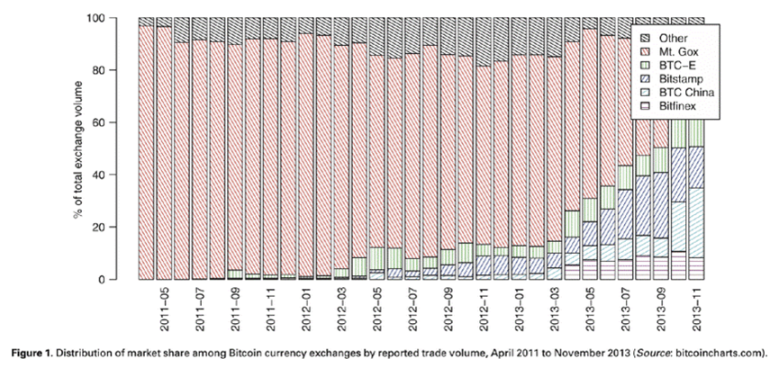

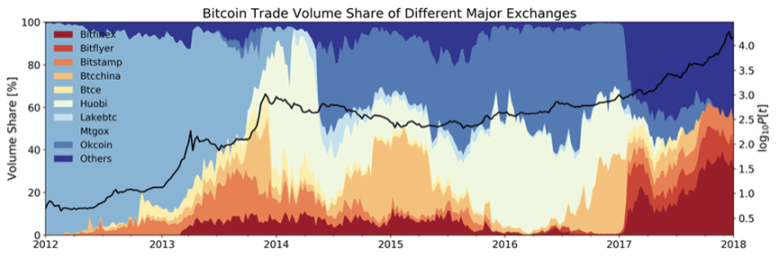

With a 32-fold increase in just four months, more new entrants were attracted to the Bitcoin market, and Mt. Gox enjoyed the largest traffic dividend, accounting for over 90% of Bitcoin transactions in April 2011.

As the price of Bitcoin skyrocketed, hackers targeted Bitcoin exchanges, including Mt. Gox.

In mid-June 2011, the price of Bitcoin on Mt. Gox plummeted from $17 to 1 cent in just a few minutes after hackers obtained a large amount of user data from Mt. Gox and sold Bitcoin from other users’ accounts for 1 cent, using their own accounts to “pick up the order.”

After discovering the problem, Mark Karpeles, the owner of Mt. Gox, hurriedly suspended trading.

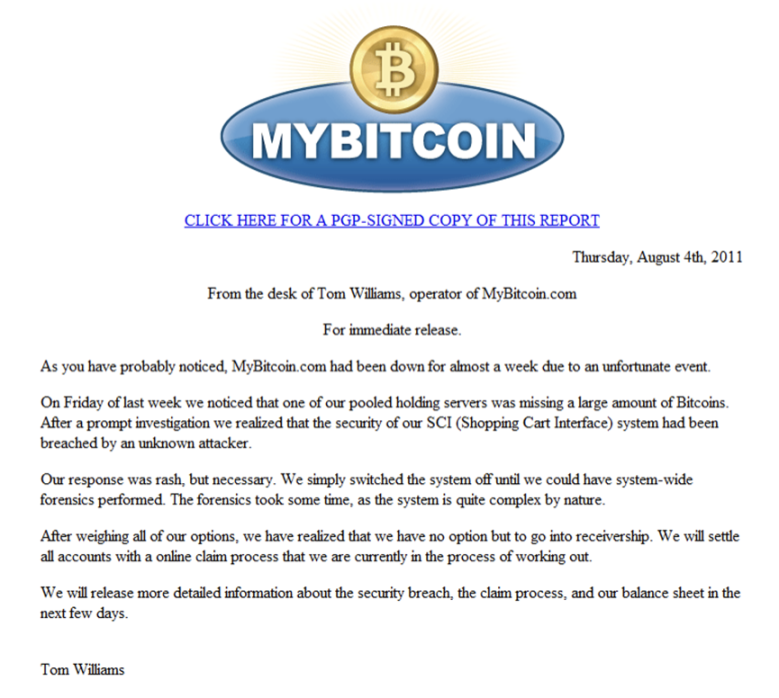

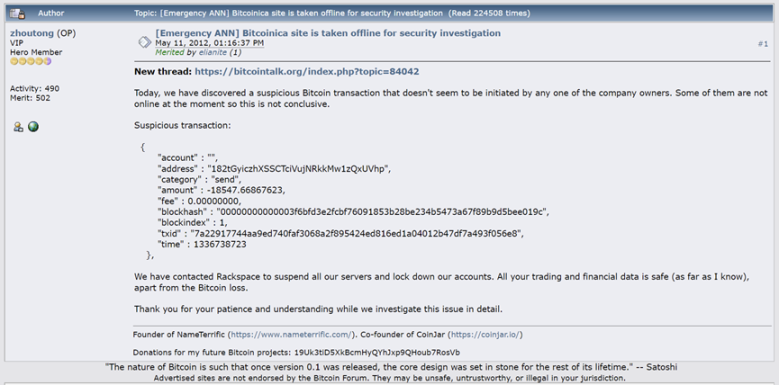

Luckily, Mt. Gox only lost 2,000 Bitcoin. In contrast, other exchanges were not so lucky, such as MyBitcoin, which went bankrupt after more than 78,000 Bitcoin were stolen in August 2011, Bitfloor, which closed after 24,000 Bitcoin were stolen in September 2012, and Bitcoinica, which went bankrupt after two attacks in March and May 2012.

https://en.bitcoin.it/wiki/File:MyBitCoin08042011.png

https://bitcointalk.org/index.php?topic=81045.0

After this incident, Karpeles urgently upgraded the security system, and Mt. Gox did not suffer a large-scale hacker attack again until 2013.

During the time that Mt. Gox was hacked, several new exchanges quietly emerged. In June 2011, the first Chinese exchange, Bitcoin China, was established. In July, Kraken was established, and in August, Bitstamp was established.

These newly established small exchanges were not yet sufficient to threaten Mt. Gox’s dominance. In the subsequent bull market, as the price of Bitcoin skyrocketed, Mt. Gox, as an “old-fashioned” exchange with several years of history and still “good” reputation, became the biggest beneficiary of the bull market.

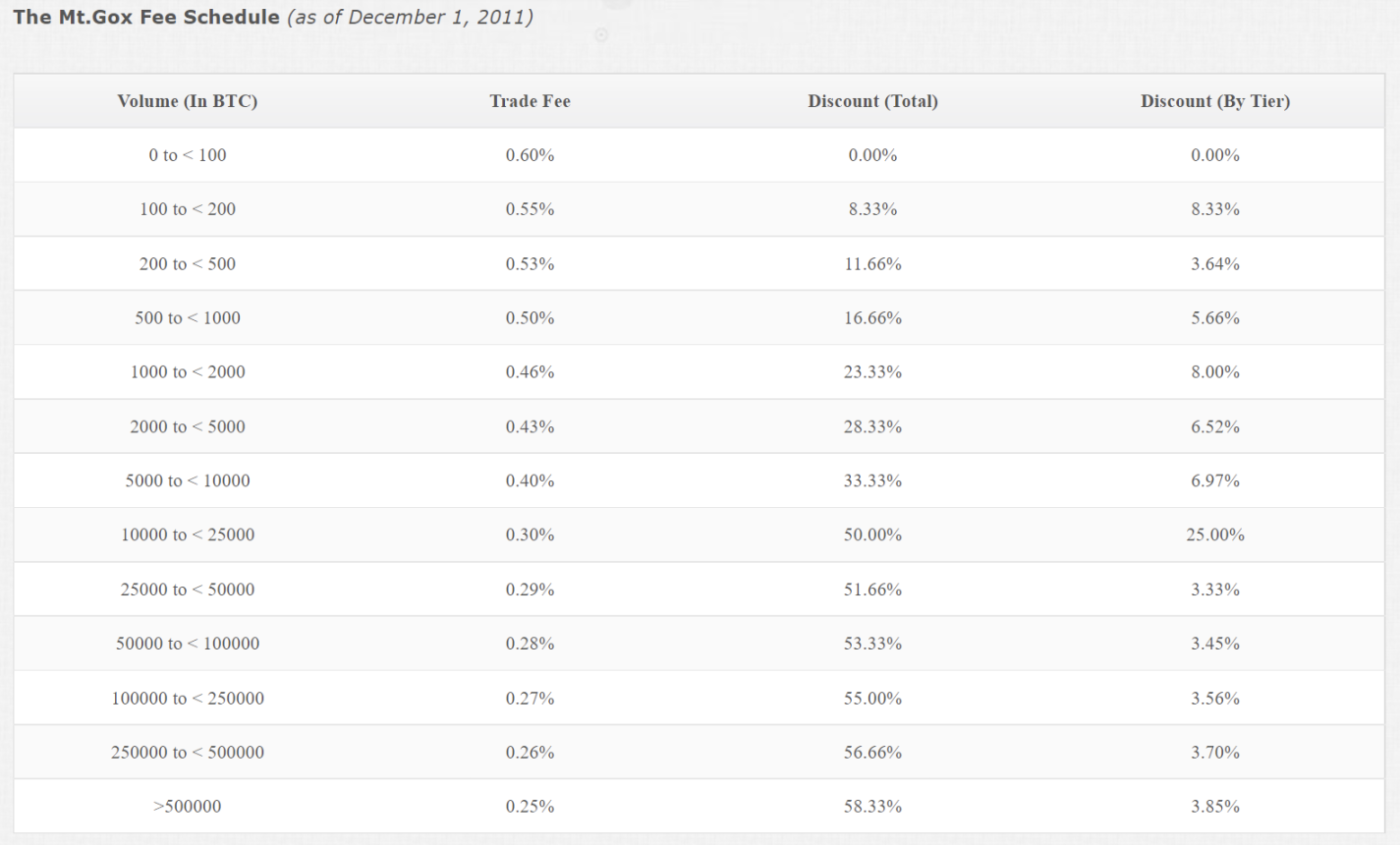

In July 2013, the number of registered users in Mentougou had reached 500,000, and through charging a transaction fee ranging from 0.6% to 0.25%, Fa Pang had become a wealthy man.

By the end of 2013, Fa Pang was estimated to have made 8 million US dollars and 345,000 bitcoins. He enjoyed his new title very much:

King of Bitcoin.

In front of the media, Fa Pang talked about the reasons for Mentougou’s success: Mentougou was one of the earliest Bitcoin trading platforms; the security measures that were upgraded after being hacked seem to be good now; it has always been seeking the legality of transactions; and it has expanded the payment scope of Bitcoin.

Such scenes easily remind people of the “savior of the currency circle” in 2022, SBF.

Ironically, they are surrounded by countless halos, pretending to represent the industry, but they themselves are the biggest landmines in the industry.

It was in 2013 that Mentougou’s business began to decline.

In May 2013, Mentougou’s US partner, CoinLab, accused Mentougou of breach of contract and claimed $75 million.

Originally, the two sides reached an agreement that CoinLab would be responsible for the operation in North America and Canada, but Mentougou, for unknown reasons, had not fulfilled the contract.

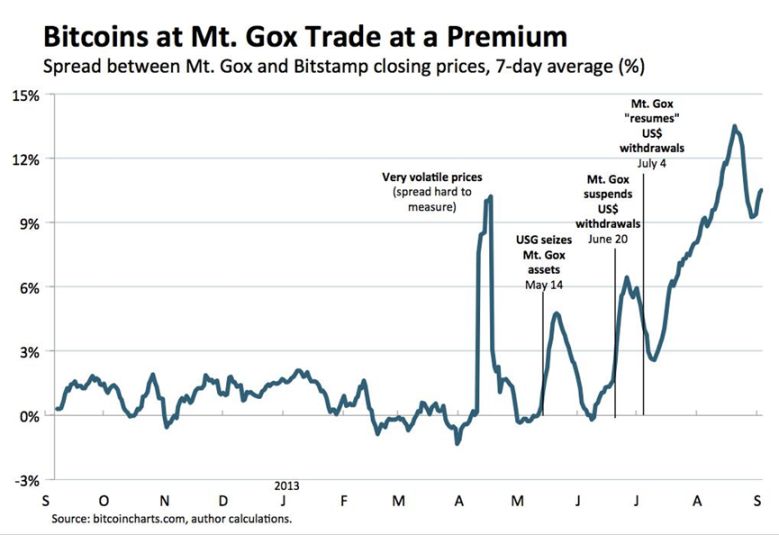

And from May to July, the US Department of Homeland Security seized Mentougou’s $5 million in funds on the grounds that Mentougou had not obtained operating licenses, and Mentougou had to suspend withdrawal of dollars.

On June 28th, Mentougou finally got the license from the US Financial Crime Enforcement Network, and announced the full resumption of withdrawals on July 4th, but successful dollar withdrawals were few and far between until September.

https://www.wsj.com/articles/BL-MBB-4101

These two incidents tarnished the reputation of Mt. Gox. Due to the difficulty of withdrawing US dollars, users began to panic and flee.

As the US dollar could not be withdrawn, but Bitcoin could flow freely, some people chose to buy the US dollars in their Mt. Gox account as Bitcoin and then transfer them out of the platform.

This kind of flight behavior resulted in a premium of up to 12% for Bitcoin prices in Mt. Gox compared to other platforms. The price of Bitcoin on Bitstamp was $129, while it reached $145 on Mt. Gox.

While Mt. Gox was busy complying with regulations, fighting lawsuits, and improving service quality, its competitors Bitstamp, BTC-E, and BTC China took advantage of its market share.

By October 2013, BTC China’s market share was nearly 33%, Bitstamp’s was 25%, while Mt. Gox’s was only 23%.

In February 2014, 850,000 Bitcoins were stolen, dealing a fatal blow to Mt. Gox.

It wasn’t until 2023 that this nine-year Mt. Gox incident would finally come to an end.

Mark Karpeles was sentenced to 30 months in prison for falsely inflating assets, with a four-year probation period, avoiding jail time.

As for the victims of the Mt. Gox theft, they were “passively locked up” for nine years, and compared to the price of Bitcoin at the time, they also received a “windfall.”

The market has been worried about what impact Mt. Gox’s 140,000 Bitcoins would have on Bitcoin.

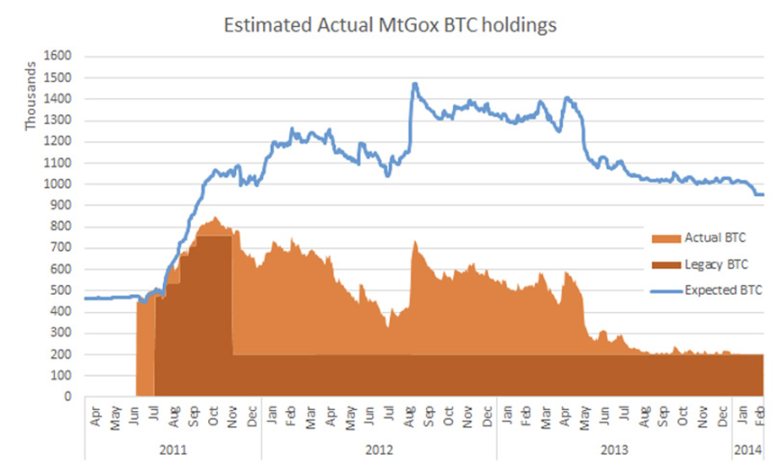

In hindsight, the Mt. Gox theft was not without warning signs. As early as March 2011, when Karpeles had just bought Mt. Gox, there was a shortfall of 80,000 Bitcoins, and Mt. Gox was hit by massive hacker attacks, which began as early as September 2011, but only erupted in mid-2013 under internal and external pressures.

Looking back at this period, the cryptocurrency trading industry was still in its early stages, with Bitcoin as the main target and limited gameplay. Security and compliance were the key factors determining the life and death of exchanges.

Compliance issues dealt a heavy blow to Mt. Gox, and incidents of exchanges going bankrupt due to reasons such as hacking and loss of coins have been frequent. Even with such large-scale crises erupting, similar events will continue to occur, constantly threatening cryptocurrency exchanges and the entire industry.

二 2014-2016: Chinese Market

As Mt. Gox gradually fell into an abyss in Japan, the landscape of Bitcoin exchanges in China was quietly changing.

The earliest Bitcoin China was a monopoly, but in the booming Bitcoin market of 2013, more and more gold diggers came.

In June 2013, Xu Mingxing founded OKCoin, and in September, Li Lin founded Huobi.

Xu Mingxing and Li Lin are both “other people’s children” in the eyes of their parents, and their experiences have many similarities.

Li Lin graduated from Tsinghua University. After Xu Mingxing was admitted to graduate school at Renmin University, he listened to a stirring speech by Jack Ma and decided to drop out and start a business. They both joined the “Hundred Regiments Battle” in 2010 and reunited in the blockchain world in 2013.

Huobi and OKCoin were both born with a golden key.

Two months after Huobi was founded, it received angel investment from ZhenFund and Dai Zhikang. In April 2014, it received investment from Sequoia Capital. OKCoin, on the other hand, received $10 million in Series A funding just three months after it went online.

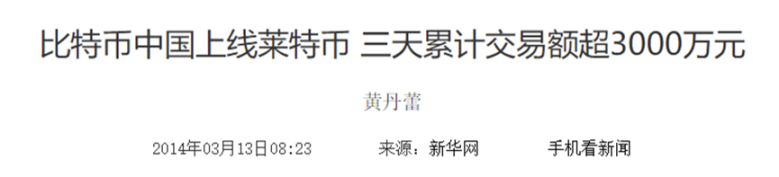

Huobi launched with the slogan “no transaction fees,” attracting a large number of users. A bunch of exchanges that couldn’t play the game closed down, and OKCoin won a victory by opening Litecoin trading in September 2013.

Although Bitcoin China founder Li Qiyuan and Litecoin founder Li Qiwei are brothers, Bitcoin China did not launch Litecoin until March 2014.

Another reason for OKCoin’s rapid expansion was that the team at the time included many big names who would later dominate the cryptocurrency industry. In 2014, CZ joined OKCoin as CTO, forming the “Iron Triangle” with CEO Xu Mingxing and “the First Lady of the Coin Circle” He Yi, which became a household name in the cryptocurrency industry. However, this Iron Triangle was not very strong, and CZ left after only a year to become a rival to OKCoin. Similar events would continue to occur, and OKCoin became known as the “Whampoa Military Academy of the Coin Circle” in people’s mouths. At the same time that CZ became CTO of OKCoin, Huobi acquired qukuai.com, a blockchain data query website created by Zhang Jian, and Zhang Jian joined Huobi as CTO. These two CTOs did not realize at the time that their experiences were laying the groundwork for the style of the next generation of exchanges, and the exchanges they created would become the protagonists of the next cycle. Another keyword for encrypted transactions in 2014 was derivatives. Bitcoin futures had appeared as early as 2012, but did not attract much attention. In June 2013, the 796 exchange, which was positioned for leveraged trading and futures, was established. At that time, Bitcoin was in a one-way upward trend, spot trading was popular, and futures trading had not yet attracted widespread attention. It was not until 2014, when Bitcoin fell all the way, that futures began to be valued by players, and the 796 exchange began to emerge. As for the three giants in the Chinese mainland market, Huobi and OKCoin both support “financing and borrowing”, while BTC China has not ventured into this area. 796, which had laid out derivatives earlier, teamed up with Huobi and OKCoin to become the three major Bitcoin derivatives exchanges, launching the first bloody battle in the derivatives field to win limited customers. Huobi, with its unique platform lending model, rose to the top in March 2014. On March 4, 2014, Huobi’s daily Bitcoin trading volume exceeded 350,000, with a trading volume of 1.5 billion yuan, setting the highest record for a global Bitcoin trading platform and accounting for 50% of the global Bitcoin trading market.

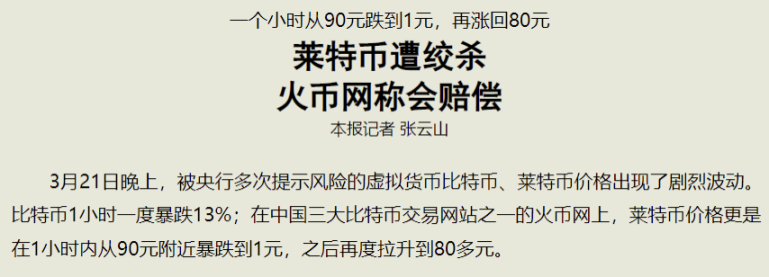

However, good times do not last forever. On March 21, the shocking “Huobi.com 3.21 Crash Event” broke out.

Those who want to climb to the top of the industry need not only their own efforts, but sometimes also rely on their peers to make fatal mistakes.

In this incident, Litecoin, which was priced close to 100 yuan on Huobi, plummeted to an incredible 1 yuan in an instant.

On March 10, 2023, a similar scene reappeared, and even more deadly, this time it happened on Huobi’s platform currency HT. In just half an hour, the price of HT fell from $4.7 to $0.3.

When the “1 yuan incident” occurred on Huobi, although there were no major problems with Litecoin on OKCoin, the price of Bitcoin plummeted from nearly 3,600 yuan to around 2,680.

The free fall of the currency prices on the two platforms caused countless players to suffer huge losses. In comparison, the price performance on the 796 platform was relatively stable, and it won the trust of many customers.

However, with the outbreak of risk events and the sluggish market, investors have raised doubts about the short-selling mechanism and financing and currency financing of the exchange.

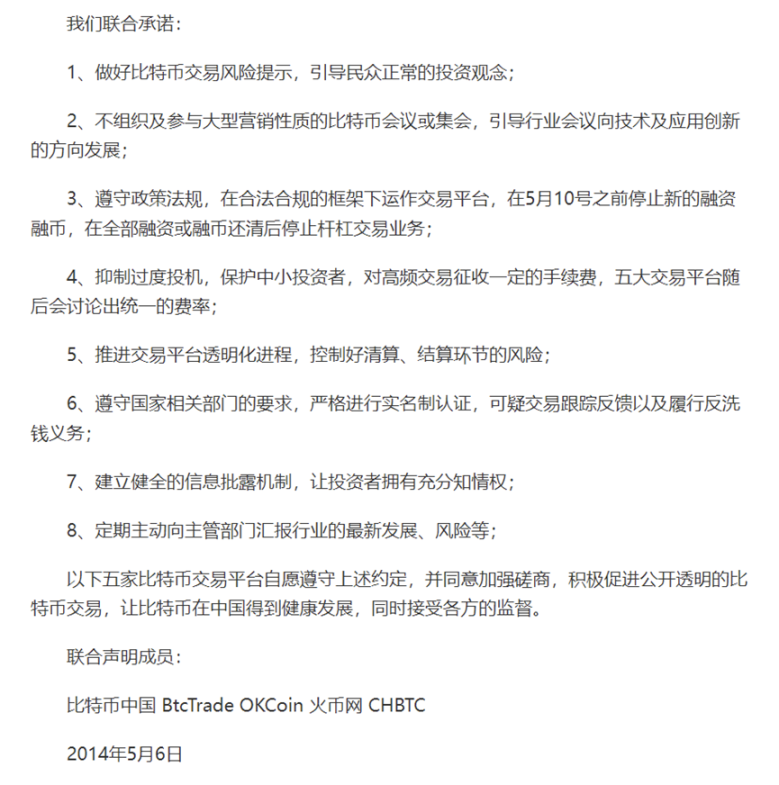

Under pressure, on May 6, Bitcoin China, Huobi, OKCoin, CHBTC, and BtcTrade, the five major Bitcoin trading platforms, jointly issued a self-discipline statement, announcing that in order to avoid excessive speculation, they will no longer conduct leveraged trading and will unify trading fees.

http://tech.sina.com.cn/i/2014-05-06/15169361845.shtml

However, the 796 exchange went its own way and did not join this joint statement.

When other exchanges successively closed their financing and currency financing businesses, the 796 exchange leaped to the top in curses and controversies, while other platforms’ market share decreased significantly after giving up lending.

The fact proves that in the face of business competition and interests, the shelf life of self-discipline statements is only one month.

Just one month later, Huobi and OKCoin restarted their financing and coin financing businesses one after another, and launched futures trading with 10 times leverage, thus starting a new round of derivative wars.

The three exchanges started a price war on transaction fees. The contract transaction fee of 796 was reduced from 0.3% to 0.03%, the opening transaction fee of OKCoin’s futures was 0.03%, and there was no closing transaction fee. The futures transaction fee of BitVC, a subsidiary of Huobi, is 0.025%, and the V-point privilege function was launched later to further reduce transaction fees.

The glory of 796 was very short-lived. 796 exchange made the headlines because of risk events on other platforms, but soon fell due to its own risk events. On November 3, 796 was unable to log in, gradually losing customer trust, and Huobi caught up, but did not persist to the end. OKCoin became the biggest winner in this round of futures wars.

From 2014 to 2016, the rise of the mainland Chinese market brought about earth-shaking changes to the exchange pattern. Huobi, OKCoin, and BTCC stood side by side, taking turns to occupy the leading position. Other exchanges were far behind in terms of volume compared to the three giants.

The former industry leader BTCC lost its first-mover advantage by insisting on not entering the derivatives business, losing a large number of customers, and began to lay out mining pool business.

During the bear market, BitMEX, established in Hong Kong in 2014, also emerged in the derivatives sector.

Although BitMEX will become an indispensable player in the derivatives field in the future, at that time, it was still a little-known small exchange.

It was not until October 2015 that BitMEX increased the trading leverage from 3 times to 100 times, and users began to flock to it. By 2016, BitMEX had also launched perpetual contracts and gradually established a foothold in the market.

During this period, cryptocurrency exchanges still frequently experienced security issues.

In January 2015, Bitstamp suffered a hacking attack and lost 19,000 bitcoins, causing a large number of users to leave.

In May 2015, Bitfinex was hacked and 1200 bitcoins were stolen.

However, a bigger disaster was yet to come. In August 2016, Bitfinex was hacked and 120,000 bitcoins (worth $72 million) were stolen.

This became the second largest bitcoin theft case after the Mt. Gox case, and bitcoin plummeted 20% that day.

However, compared to the now-historical Mt. Gox case, Bitfinex, which suffered heavy losses, is still active today.

After the theft occurred, Bitfinex announced that the loss would be shared among all users, with a 36% reduction in user account funds, but they would receive an equivalent number of BFX tokens, each representing a $1 loss.

Users can hold onto BFX tokens for redemption, or convert them 1:1 into shares of Bitfinex’s parent company iFinex. About 54.4 million BFX tokens were converted into shares, and it is rumored that DGroup founder Zhao Dong became a small shareholder of Bitfinex at that time.

By April 2017, Bitfinex had successfully redeemed all BFX tokens.

Of the 120,000 bitcoins stolen, 94,000 were recovered in February 2022, but they are still in the custody of the US Department of Justice.

Looking forward, this is not Bitfinex’s only stroke of good luck. In 2019, Bitfinex’s $850 million in funds were frozen by the US Department of Justice, and Bitfinex repeated the trick by raising $1 billion through the issuance of LEO tokens.

Looking back at this period, the play and targets of cryptocurrency exchanges have changed significantly.

In terms of gameplay, Huobi entered the market and immediately launched a price war, rising rapidly. In the subsequent derivatives war, the price war continued to play out.

OKCoin was the first to benefit from the launch of Litecoin. Later, in the bull market of 2017, as the season of altcoins arrived, the competition to list them became even fiercer.

At that time, as the market entered a bearish phase, derivatives began to emerge. BitMEX managed to secure a foothold by relying on perpetual contracts, while Bitcoin China missed the boat and lost its dominant position. 796 exchange was short-lived. In the derivatives war, OKCoin emerged as the big winner. The competition also exposed varying degrees of technical problems among the exchanges, and product quality became a key factor in determining success or failure.

In terms of security and compliance, after the theft at Mt. Gox, Bitfinex experienced the second largest cryptocurrency theft in history. However, Bitfinex was able to cleverly resolve the crisis by issuing tokens.

As the influence of Bitcoin expanded and cases such as the Mt. Gox theft occurred, Japan began studying regulatory issues related to cryptocurrencies, while banks in mainland China were banned from engaging in cryptocurrency business. Thailand, Russia, and other countries completely banned Bitcoin.

During this period, exchanges in mainland China and Hong Kong dominated the cryptocurrency world, and a large number of heavyweight players emerged, including OKCoin, Huobi, BitMEX, and Bitfinex.

At the beginning of 2023, when Hong Kong’s new cryptocurrency policies shook the cryptocurrency world, BitMEX founder Hayes commented, “Deribit is the only exchange outside of Asia that has made significant innovations in the cryptocurrency market. Based on centralized exchanges in the United States, they have not brought any innovation to the cryptocurrency market.”

Three 2017: The Rise of Binance

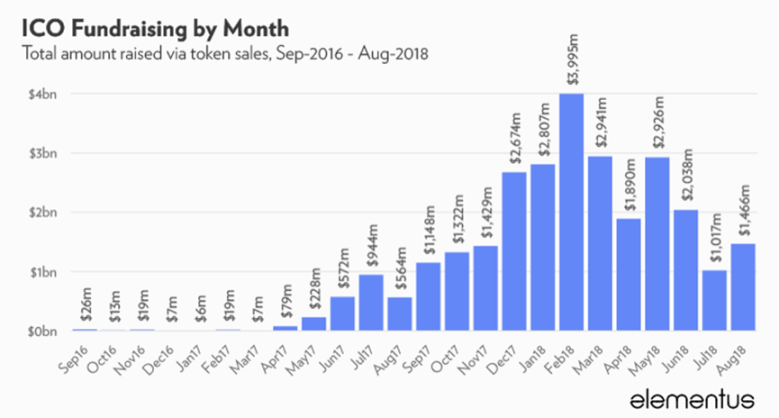

At the beginning of 2017, the price of Bitcoin broke through the previous cycle’s high point, and the market heat rekindled. The amount of funds raised through ICOs set new records.

At this time, it had been two years since CZ had left OKCoin.

In 2015, CZ and Xu Mingxing parted ways. The mutual teasing between the two became a big show in the cryptocurrency circle, and soon after, He Yi also left OKCoin.

It was this experience that laid the foundation for CZ and He Yi to later create Binance.

After leaving OKCoin, CZ founded Bijie Tech, which provided exchange-as-a-service platforms for other exchanges. According to CZ himself, Bijie had over 30 clients at the time, and business was good, but in early 2017 all of CZ’s clients went bankrupt due to regulatory reasons.

On June 14, 2017, CZ heard about ICOs for the first time at a banquet. Within three days, he had written a white paper in both Chinese and English.

The subsequent ICO was completed within a week, selling 100 million BNB and raising $15 million.

After that, it only took six months for Binance to become the world’s largest exchange.

In January 2018, CZ told Bloomberg that he was adding “millions” of users every week.

Behind this incredible speed, on the one hand, CZ and his team had been engaged in cryptocurrency trading-related businesses for many years and had accumulated considerable experience, and on the other hand, credit must be given to the frenzy during the bull market period and the ban in mainland China.

The ICO boom in 2017 raised almost 40 times as much money as in 2016.

The craziness gave birth to chaos, and ICOs became a tool for many people to defraud others, with half of the projects dying within four months of the ICO.

Under the ICO wave, exchanges also competed to list coins, and whoever could list the hottest coins the fastest could get more traffic, and getting more traffic could make the exchange the most attractive place to list coins.

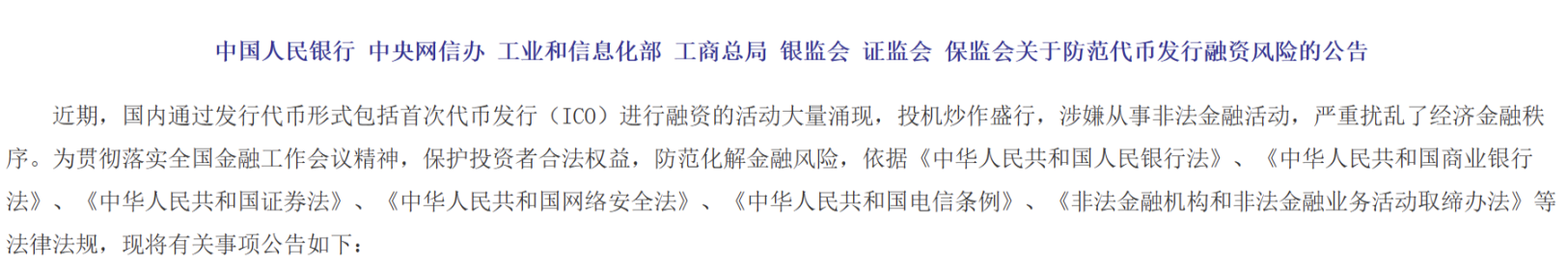

In this situation, exchanges, project parties, and evaluation ranking websites are easily colluding with each other, harvesting retail investors together, and triggering risk events, and ICOs and cryptocurrency trading were quickly cracked down on by regulatory authorities around the world.

On September 4, 2017, the People’s Bank of China and other departments issued the “Announcement on Preventing the Risk of Token Issuance and Financing,” requiring the cessation of all ICO activities, and local regulatory authorities issued notices to clear out cryptocurrency exchanges.

Cryptocurrency market plunged, causing panic among Chinese investors and prompting exchanges to move offshore. During this regulatory storm, Binance, which only offers coin-to-coin trading, took advantage of the situation and gained customers from other platforms.

After the ban, Bitcoin China declined, and Huobi and OKCoin moved their servers overseas and transformed into Huobi PRO and OKEX, respectively. They remained open to Chinese users for registration and trading, and Binance, OKEX, and Huobi became the new “big three”.

Since its inception, Binance has demonstrated superior “regulatory arbitrage” capabilities. After benefiting from regulatory “dividends” in mainland China, Binance attempted to land in Japan but quickly withdrew after Japan’s regulatory tightening. In 2019, Binance.US was established specifically for US users to evade regulatory risks. However, even so, years later, Binance could not avoid being pursued by US regulatory authorities.

In addition to regulatory “dividends”, Binance’s development has also benefited from its innovative platform currency BNB.

When Huobi quickly rose to prominence by waiving transaction fees, Binance issued BNB and continued to empower it, sharing development dividends with BNB holders through a series of measures such as reducing transaction fees, repurchasing and destroying tokens, and conducting IEOs.

Binance’s rapid development has led to CZ’s skyrocketing net worth.

In 2018, Forbes released the first cryptocurrency rich list, and CZ ranked third on the list.

During this time, Sequoia Capital, which had invested in Huobi, looked to Binance but ended up in a falling out and taking Binance to court. They also failed to catch this fast-moving train.

Two years later, Sequoia Capital got on another popular cryptocurrency exchange’s bandwagon, but ended up with a loss of more than $200 million.

This regulatory storm in mainland China also created another exchange, Bitfinex, which was attacked by hackers in 2016.

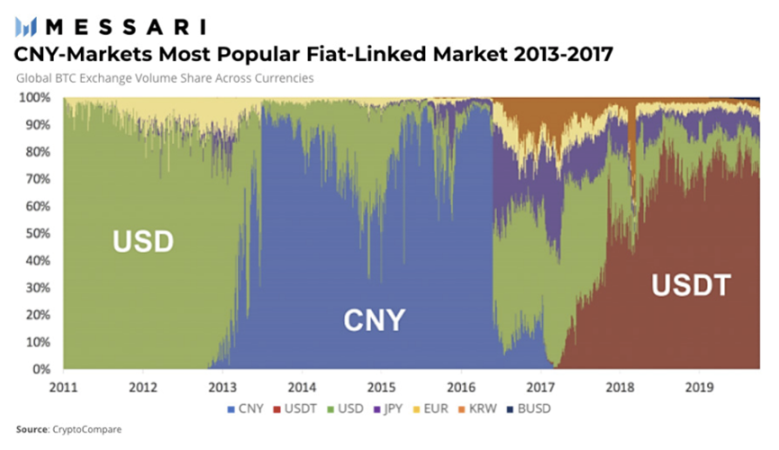

It was from 2017 that, due to the regulation of mainland China, the renminbi exited the stage of cryptocurrency trading and was replaced by USDT, which is closely related to Bitfinex.

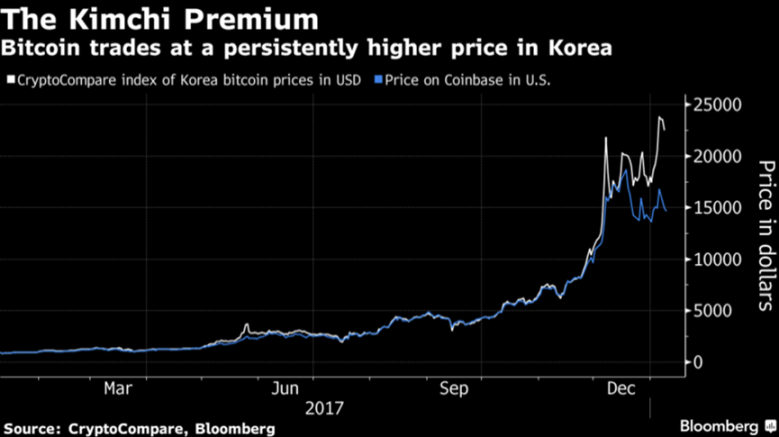

In 2017, the market frenzy also created a large number of Korean exchanges.

In 2017, the funds of Korean cryptocurrency exchanges increased 64 times compared to 2016. By early 2018, the won had become the second largest fiat currency in cryptocurrency trading, behind only the US dollar. The bitcoin trading volume of the Korean exchange Upbit also entered the top ten in the world.

The madness of Korean investors, coupled with heavy restrictions on speculation, gave rise to a kimchi premium – the price of cryptocurrencies on Korean exchanges was often more than 20% higher than in other countries.

South Korea has thus become the most popular arbitrage destination, where traders buy coins from international exchanges and sell them on Korean exchanges for a profit.

By 2017, this process had been industrialized, and even some websites had emerged to help arbitrageurs profit from moving coins from one exchange to another in Korea. These websites show where to move coins from which exchange to which Korean exchange for profit, and which coins offer the most profitable returns.

SBF is among these arbitrageurs.

In October 2017, SBF left Wall Street and founded Alameda, a cryptocurrency quant trading company that engaged in arbitrage in the Japanese and Korean markets.

After accumulating experience during this period, two years later, SBF founded FTX, which would become the world’s third largest cryptocurrency exchange, and faced off against Binance.

The frenzy of the cryptocurrency market in 2017 also attracted the attention of traditional financial giants. The two giants of the futures industry, CME and CBOE, competed around bitcoin futures.

In early December 2017, CME announced the launch of bitcoin futures, but was preempted by CBOE. The cryptocurrency market then entered its most frenzied phase, with the price of bitcoin soaring from $12,000 to nearly $20,000 in just one week, followed by a year-and-a-half bear market.

Although CBOE was the first to launch Bitcoin futures, it quickly reached its peak and trading volume continued to decline, ultimately leading to the closure of Bitcoin futures trading a year later. Looking back on this period, Binance was undoubtedly the biggest winner. Binance’s success was inseparable from the regulatory dividend in mainland China. Although Bitfinex suffered a blow from its collapse, it achieved competitive advantage as the RMB disappeared and USDT rose. Another exchange, BTC-e, was not introduced due to its founder’s imprisonment for money laundering and the exchange’s closure.

Since the birth of cryptocurrency exchanges to the present day, regulation has been a key factor affecting changes in the cryptocurrency trading landscape. This was repeatedly demonstrated by the rise of Coinbase in the United States and the four major South Korean exchanges.

In terms of gameplay, Binance pioneered the concept of platform coins, linking the development of the exchange with its holders. In terms of target markets, the arrival of the altcoin season led to various exchanges competing to list new coins. However, the crazy harvesting is not without cost, and users will ultimately vote with their feet, forcing exchanges to take users seriously.

As the market entered a bear market, traffic dividends disappeared, and the exchange industry also entered a winter. However, the battle between exchanges became even more intense. In this long winter, cryptocurrency exchanges launched a new round of derivative wars to compete for traffic, and also competed in areas such as platform coins, trading mining, and IEO. As traditional exchanges entered the cryptocurrency field and decentralized exchanges experienced explosive growth, centralized exchanges faced new crises, and security and compliance issues continued to plague the entire industry.

We will continue to review these topics with you in the next issue.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- 20 most active VCs and their largest investment in the 2023 bear market

- Future of Web3 Wallets: Innovation, Challenges, and Key Issues

- What should you pay attention to when playing MEME?

- Interpretation of investment trends from top 5 VC firms in the years after 2023

- Key factors for the future large-scale adoption of DID and specific investment directions

- Is the father of ChatGPT’s ambition to solve AI threats with cryptocurrency by airdropping to one billion people grand or is he just trying to make a quick buck?

- Sui Explorer Browser User Manual: Quickly Understand the Development of the Network