What is the relationship between halving bitcoin and the bull market?

Author | Floating dreams

Produced|Baihua blockchain (ID: hellobtc)

The recent good news for Bitcoin is halving. Many people say that the price after Bitcoin is halved will inevitably rise. Is this really true?

01

- The first batch of six major activities of the Wuzhen Conference was released!

- Why give up big exchanges and invest in small exchanges? Game Da Yao Guo Haibin summed up the five future investment tracks of the blockchain

- Xi Jinping: Taking the blockchain as an important breakthrough for independent innovation of core technologies

How is Bitcoin halved?

What is Bitcoin production cut? This will be traced back to the rules set by Nakamoto . The reason for the birth of Bitcoin is because the country has unlimited restrictions on issuing money. Nakamoto has hoped that a currency will not be controlled by anyone, and the value transfer can be completed between any two nodes , so this peer-to-peer trading system is designed.

The bitcoin that was originally designed was not known to many people, and there were not many people involved. In order to allow more people to participate in the early stage, the mechanism of “the sooner the higher the participation income” was designed, which is what people call “ Early bird effect."

How is this mechanism implemented? Quite simply, the gain from mining each block before a node is 50 bitcoins, 25 after this node, and the next round continues to halve to 12.5 bitcoins. The current node block reward is 12.5 bitcoins. It is expected that the bitcoin block reward will become 6.25 per block after the production cut in May 2020.

Just like a piece of wood smashing half a day, you can find it inexhaustible. In theory, the reduction of bitcoin is endless. However, because the total amount of Bitcoin is limited to 21 million, the income after the halving will be infinitely low. Therefore, in about 2140, Bitcoin will be dug, and the future mining revenue will only be paid for the fee.

The above is the bitcoin production reduction mechanism. Because of the decrease in the number, many people think that Bitcoin will inevitably have a big bull market in the future.

What is the relationship between the halving of bitcoin 02 and the bull market?

Many people's inferences about the price of bitcoin are like this:

The first one: the article in the Ethereum white paper translator Lu Bin mentioned

“From June 2011 to December 2017, for a total of 78 months, the geometric average of bitcoin price growth per month was 8.64%. If the future is calculated according to historical growth, then the next 4 years is about 53 times…

Then estimate the market value of the overall digital assets is 7.42 trillion / 0.3 = 24.7 trillion US dollars. This figure may be too optimistic, because the premise is that crypto assets will continue to grow at the exponential level of the past four years… 30% off 24.7 trillion, 7.4 trillion US dollars, will be closer to reality."

Second: Bitcoin took less than a decade from the original $0.001 surge of 20 million. In the past ten years, there has been no such investment in any investment target. According to this increase, Bitcoin will continue to appreciate in the future.

The third type: Many large-capital holders think that the price of a villa in the future will be one line, and the price of bitcoin in the future will be a straight line.

In fact, in addition to the age, the world will only rise and fall, and there will be no investment targets that will only rise or fall.

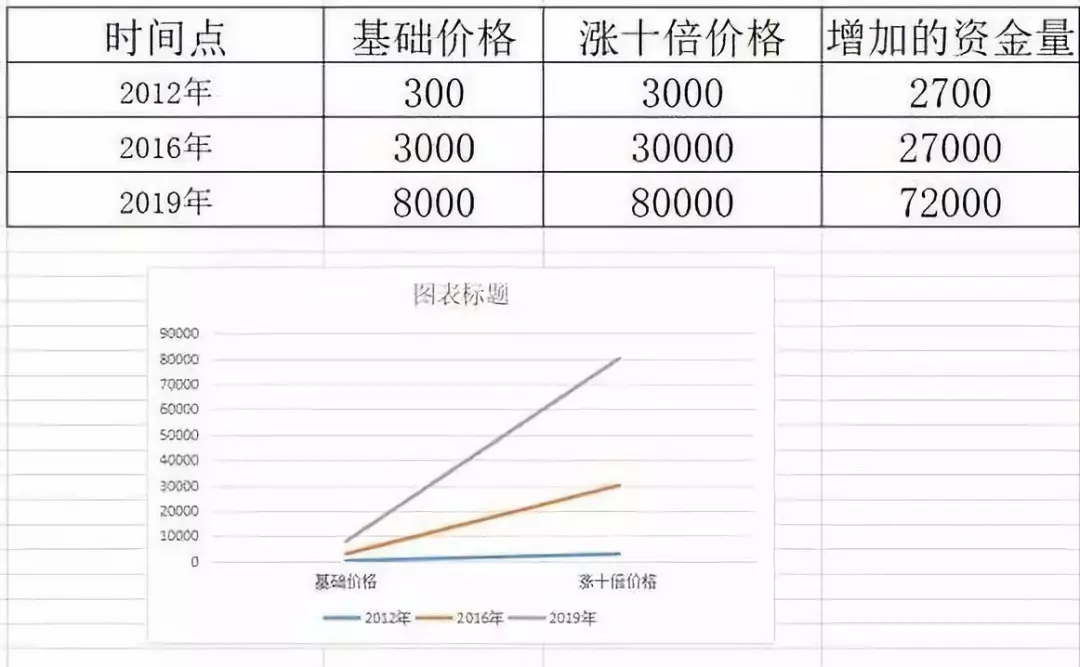

When the price of bitcoin was $300 in 2012, the amount of money needed to rise from ten to $3,000 would be $2,700; in 2016, when it was $3,000, it would be ten times, and that it would cost $27,000; in 2019, $8,000. At the time of the increase of ten times, the amount of funds required has reached 72,000 US dollars. The multiples still increase linearly, but the funds needed have already grown exponentially.

The amount of money required to turn ten times different bases is far different. The simplest example, from 1 point to 10 yuan is 1000 times, the required funds is 9.99 yuan; from 10 yuan to 100 yuan, only ten times, the amount of funds needed is already 90 yuan, compared to The amount of funds needed to increase by 0.01 yuan by 0.01 yuan has turned nearly 10 times.

Therefore, the current bitcoin price of 8,000 US dollars, want to turn ten times, the amount of money required is very scary. Even if the current $8,000 bitcoin is doubled, the amount of money needed is very alarming. Lu Bin, the translator of the Ethereum English white paper, calculated according to the average monthly growth of Bitcoin, but did not consider the amount of money needed.

On the whole, it is very difficult for the price of Bitcoin to rise like the past decade, because the amount of money needed is too large.

What do you think about the halving of Bitcoin that will bring a new round of bull market? why? Feel free to share your opinion in the message area.

——End——

『Declaration : This series of content is only for the introduction of blockchain science, and does not constitute any investment advice or advice. If there are any errors or omissions, please leave a message. You are not allowed to reprint this article by any third party without the authorization of the "Baihua Blockchain" sourced from this article. 』

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Borrow money to the DeFi agreement? Good returns, but first assess the risk

- 7 years to receive a $2 billion fee, Coinbase claims to be a unicorn unicorn

- The digital currency exchange has been caught in the throat by the legal currency.

- Privacy is the future, but the privacy currency is not

- QKL123 market analysis | Bakkt options before the CME; quantum computers are not enough (1025)

- Opinion: Why is Bakkt's failure not surprising?

- Bitcoin prices continue to fall, will the mining machine stop?