Bitcoin hit 10,000 US dollars, the market started again, how to operate the follow-up market?

The rise is topless and the bottom is not bottom. This is the law of the capital market. I believe that most people do not think that Bitcoin's earnings in the past week will outperform most of the currencies, especially certain altcoins, and the trend in the past week is particularly disappointing.

I believe that in the past few days, the investors who have changed their investment thinking and discovered the laws of the market, that is, the funds embrace the mainstream currency and are not cold for the altcoin.

This is determined by the main line of this round of bull market, institutional funds enter, not individual retail investors. In the 17-year bull market, retail investors entered the market and grabbed a lot of money. They bought cheap, the influx of funds, so that the price of the altcoin sky soared, and then the withdrawal of funds began to plummet. This is the institution’s admission.

- The 320% increase in Litecoin is the power to halve the cryptocurrency?

- Babbitt column | Cai Weide: Facebook currency brings new currency competition?

- To meet customer needs, PwC launches new cryptocurrency trading audit tool

The funds allocated by the organization are completely different from those of the retail investors. The funds of the institutions are still safe in the face of earnings. Therefore, the altcoins that are heavily controlled are not considered within the scope. In their eyes, only bitcoin is used. Even ETH will not consider .

Therefore, it can be clearly seen that the price trend of Bitcoin is extremely strong, while others are inferior. This is in line with the A-shares. I believe that the investment in the A-shares in the past few years will be significantly higher than that in the growth stocks, because foreign investors are buying companies with stable performance and stable growth like Kweichow Moutai, Wuliangye and Ping An. They are pursuing a steady return, rather than a sharp rise and fall.

Since then, as institutions enter, the price of Bitcoin will begin to move closer to stability, rather than today's skyrocketing. Of course, this takes a long time. Most of the funds in Bitcoin are still dominated by venture capital, and the surge will continue to occur.

In fact, most of the coins that performed well this year have a lot to do with the funds. Most of the currencies supported by the funds have a good increase. A large number of locks have reduced liquidity and contributed to the skyrocketing.

The skyrocketing of this Ethereum has a lot to do with this, but I don't recommend everyone to participate in similar gambling, so I won't repeat it here. This is like the fact that 17 years of 1CO fueled ETH, which is a short-term liquidity shortage caused by a large number of locks.

In fact, the early bitcoin is also survived by disgraceful means. There is no dark net, and perhaps bitcoin has long since disappeared. Therefore, history can be washed white, the most blatant is the wave field!

Not much nonsense, I maintain the previous view, Bitcoin will continue to rise, the mainstream currency will increase, and the altcoin will have a staged market, so everyone can hold the currency to rise. Pay attention to the public number: the big devil in the currency circle, get more investment advice.

From the indicators point of view, bitcoin volume has risen, hitting a maximum of $9,800. Tens of thousands of people are only a matter of time. Once they go up, the shock will become severe, and the position can be reduced as much as possible.

From the point of view of indicators, the continuous upswing for 3 days, the formation of three small Yangxian, the volume of trading has begun to enlarge, and there are constantly funds to join the ranks of chasing. After the MACD formed a golden cross above the 0-axis, it accelerated the upside. It is consistent with my prediction, and there is room for improvement. Once the top divergence occurs, the real callback will come; KDJ and RSI have returned to strength, and the Bollinger Band has also begun. Opening, the price goes up the upper rail.

On the whole, Bitcoin still has room to rise, and it can continue to buy in the callback stage. Once it breaks through, it can be appropriately reduced, and it may encounter greater resistance.

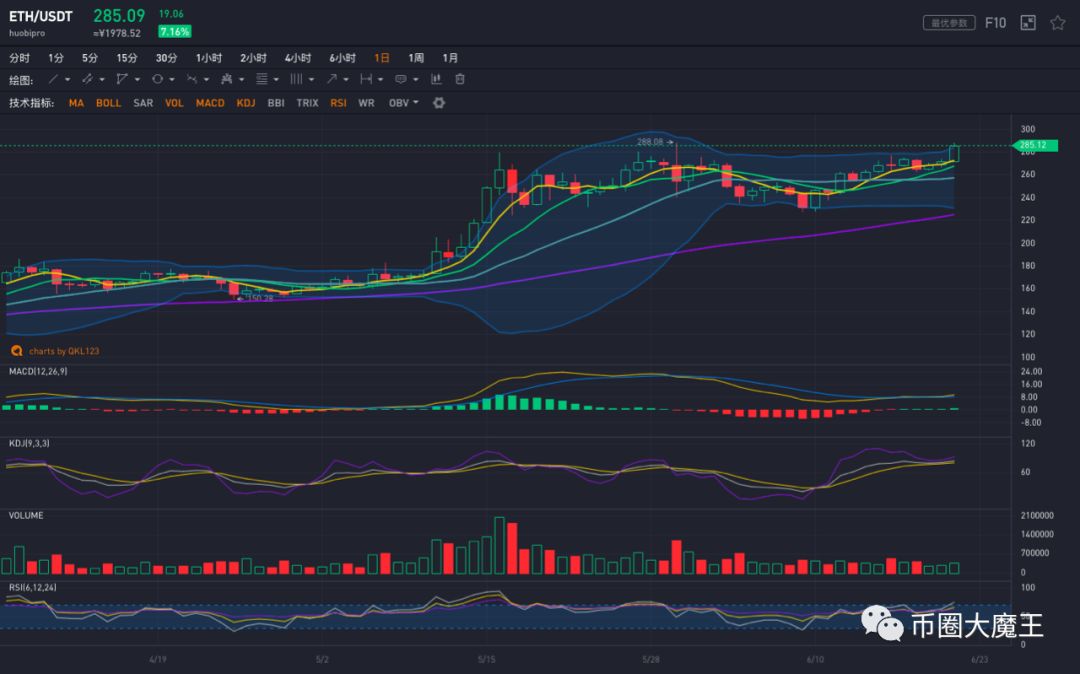

ETH increased its volume today and achieved a breakthrough, setting a new high in the stage of rebound. The follow-up may continue to remain strong, and it is OK to hold the currency. From the indicator point of view, the flat Bollinger line opened at one stroke, the price broke through the upper rail of Brin, and the rise was very strong. Yesterday, the change was made, and today it really rose.

On the indicator point of view, MACD once again has a golden cross, and the subsequent upside is larger and stronger; KDJ and RSI are also pulled up to the buyer's market. On the whole, the follow-up will continue to attack, and the $300 is likely to break.

EOS reached the end of the convergence triangle, and today's heavy volume rose slightly. The Bollinger Band began to close and fluctuated. However, the MACD is still in the form of a golden fork. Once it starts to pull up, it will be very large, and it is more optimistic about the future trend; KDJ and RSI Also reached a strong position.

EOS is in a more fully-returned currency, and the follow-up may continue to rise. You can focus on it and buy it for around $7.

On the whole, the market continues to be strong and is expected to continue to rise. The upside is still there. Some oversold altcoins can also be concerned. After the mainstream currency market, funds will flow to the altcoin, and you can look for potential appreciation value. Altcoin, pay attention to the public number: the big devil in the currency circle, get more investment advice.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Internet dividends are exhausted, Facebook is vying for digital credit dividends

- Video|"8""Qin CEO Yu Xueyu: Let users join the industry through three levels of participation

- US Food and Drug Administration + four giants deploy blockchain, blockchain penetrates into medical field

- Foreign media: hire a former Google senior consultant, Bakkt or will launch a digital asset wallet

- Bank of England Governor: Distributed ledger technology has the potential to unlock the liquidity of billions of bank funds

- Encrypted Currency Quotes Weekly: Facebook assists BTC to break the dollar?

- Facebook currency, Amazon response: very fresh, but speculative