Bitcoin Weekly | Bitcoin chain data continues to be active, can it break through $10,000?

This week, bitcoin prices continued to rise, setting a new high. The biggest question for investors is whether Bitcoin can break through $10,000.

Gikee below analyzes the data on the chain. Where is the rising boundary of Bitcoin ?

1. Circulation market value

- Bakkt will conduct bitcoin futures trading test in July, and Bitcoin's overall network computing power hit a record high

- Compare Finality and Liveness of various consensus algorithms

- Interview with Twitter CEO Jack Dorsey: There is no real Internet company without cryptocurrency

As of Monday, the market capitalization of Bitcoin: 162.075 billion US dollars, up 20.063 billion US dollars last week, up 14.93% , equivalent to 1.127 trillion yuan, the total circulation of 177.613 million, circulation rate 84.58%, accounting for the global market value of digital currency 58.78%.

2. Secondary market

Bitcoin prices rose sharply this week, up 13.84% from the previous week, up 22.81% from the previous month and up 37% from last year, hitting an annual high. From the general trend, Bitcoin broke through 10,000 US dollars as a high probability event.

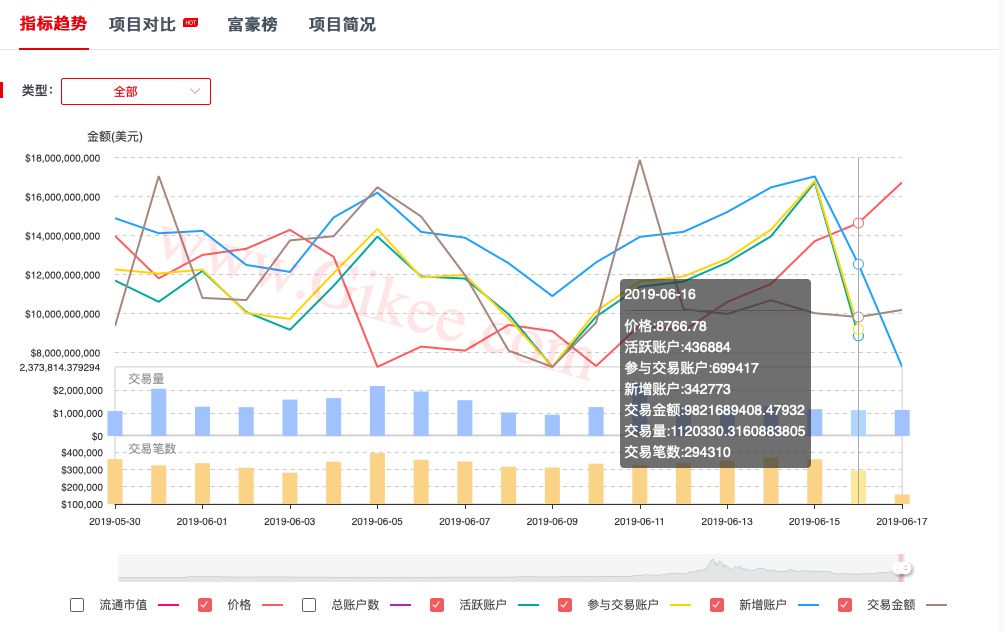

3, the chain overview

The price of bitcoin rose sharply this week, and the price started to rebound after hitting the bottom on Monday. At the same time as the price rebounded, the number of active accounts, the number of participating trading accounts, and the transaction amount increased simultaneously ; but it is worth noting that the data on the chain began to fall, which may indicate that the price is facing a callback risk in the short term.

4, add an account

This week, the number of new accounts was 2,466,900, up 6.90% from the previous week . The number of new accounts hit a new high. As prices continue to rise, a large number of investors have begun to purchase bitcoin, which shows that the attractiveness of bitcoin continues to rise.

5. Number of transactions, transaction volume, transaction amount

This week, the number of transactions was 2.37 million, up 0.82% from last week ; the transaction volume was 9605,200 bitcoins, down 11.19% from the previous month; the transaction amount was 86.514 billion US dollars, down 9.69% from the previous month.

From the transaction data, the number of transactions in Bitcoin increased slightly, but the transaction volume and transaction amount both decreased significantly, indicating that the number of small transactions increased, and the large amount of transfers decreased , mainly due to the consolidation of wallets by multiple exchanges last week.

From the overall trend, the data are rebounding at a high level during the year, which has strong support for the continued rise of the market, but the hidden danger is that if it can not continue to create new highs, it will have a greater impact on the enthusiasm with investors.

6, active account, participate in trading account, wake up account

This week, the number of active accounts was 3,418,700, up 9.67% from the previous week ; the number of participating users was 4,469,100, up 8.98% from the previous month ; and the number of accounts was 850,000, up 7.76% from the previous month .

From the account situation, this week's active accounts, participating trading accounts and waking accounts all showed a large increase, indicating that the user's enthusiasm for participation is increasing, and the entry of incremental funds will form a virtuous circle with the rise of prices.

7, computing power situation

Bitcoin's total network computing power was 50.19EH/s, down 7.67EH/s from last week, down 13.45%. From the trend point of view , the computing power first rose and then fell, and collapsed at the weekend .

From the data on the chain, Bitcoin's account data has risen sharply , and the number of new accounts has hit a record high. The number of active accounts, participating trading accounts, and wake-up accounts have all begun to bottom out, and the rising angle is more objective.

On the other hand, the transaction data on the chain has declined . The number of transactions and the transaction amount have dropped from high levels. This may be affected by the transfer of exchange wallet assets, but the potential risks cannot be ignored.

Source: Public number: gikee01

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt Column | Traffic Wars or Ignition Blockchain Technology Innovation (1): When the exchange meets Defi

- Ethereum node plummeted 1/3, what happened?

- After a year and a half of investigation, the SEC started work on Kik.

- Interview with Babbitt | FT public chain main online line, five characteristics are doing these three things?

- Bitcoin will not pick up everyone on the bus: stepping into the air is a daily life

- The scam of the cryptocurrency wallet is "in the bureau"

- Bittland renewed the complaint with the senior executives, and claimed 30 million from the founder of the coin printing 3