Bitcoin's current plunge is the "last fall" before the bull market, and the last chance to get on the bus?

For many people in the currency circle, on September 25th, they were waking up. In the early morning, bitcoin and other mainstream currencies dive collectively, and BTC once fell to $7,700. This is the first time since mid-June that Bitcoin has fallen below $8,000, the lowest level in four months.

Suddenly fell below 8,000 yuan.

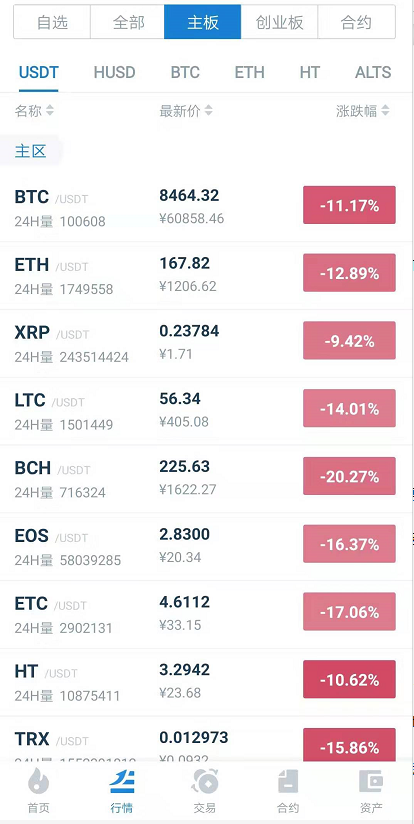

According to the data of the fire currency, the current BTC price is $8,464, which is a decrease of -11.17% within 24 hours. Other mainstreams have experienced different degrees of decline.

- MakerDAO multi-asset mortgage Dai's evolutionary road

- Based on privacy computing technology, the new generation alliance blockchain platform PlatONE is officially launched

- Pivot ERC20 Altcoin: Most high-yield tokens are concentrated

If the spot market is a bloody river, then the contract market can be described as a corpse. According to the Coin data, as of 11:00, in the past 24 hours, a total of 9.2 billion USDT (about 6.65 billion yuan) of short positions were added. Among them, Bitcoin added 6.34 million open warrants, about 72,000 BTC; EOS added 9.79 million open warrants, about 36.07 million EOS; Ethereum added 10.5 million open warrants, about 652,000 ETH.

The mainstream currency fell, and Bitcoin was sent to Weibo.

The reasons for the plunge are different

There are various reasons to explain each plunge, and this plunge does not seem to find a reason for the widespread decline that led to this plunge.

There are some speculations in the market today:

1. Some analysts pointed out that Bitcoin fell because Bitcoin broke through key resistance levels.

2. Bitcoin computing power plummeted. Earlier in Beijing time today, data from several blockchain browsers showed that bitcoin computing power fell rapidly from 98 EH/S to a minimum of 57.7 EH/s, with a 40% drop in computing power. There are rumors in the market that the large-scale mining pool switching power or encounter sealing is the reason for the decline in bitcoin prices.

The short-term calculation of the power collapse can not reflect the real situation of the calculation, can not explain the problem. Because Bitcoin's total network computing power cannot be directly monitored, it is introduced through difficulty and block time, that is, computing power = difficulty * 2^32 / block time. Therefore, the factors affecting the pre-estimation force value are mainly the block time, and the block time itself depends on the time of random collision. There is a certain uncertainty, and there may be a few cases that deviate from the theoretical mean, resulting in inaccurate calculation of the power. The short-term calculation power value can not reflect the real situation, and the calculation power estimated by the long-term observation can judge the real situation of the whole network computing power.

3, Bakkt opened less than expected. Bakkt's opening is one of the biggest benefits of the currency in this year. Bakkt is compared to the bull market engine in the market. Bakkt will bring institutional investors into the cryptocurrency and bring a wave of bull markets. However, on the first day of Bakkt's opening, only 71 bitcoins were sold, which was far below market expectations, and the positives were turned into negative.

However, Bakkt is a legally compliant futures trading market that provides services to institutional clients. The process of opening an account is complex and requires KYC, qualification verification, 1-to-1 inquiry, etc., and the threshold is very long, unlike most It is as simple as trading an exchange to register an account. Bakkt's first-day trading volume is also within the expectations of many institutional investors. Analyst Mati Greenspan believes that Bakkt is an eight-lane highway and cannot judge whether the road is good or bad based on the traffic flow on the day. Today (September 15), Bakkt's trading volume reached 215 BTC, and the volume was enlarged in 12 hours.

In fact, traditional finance enters the cryptocurrency market to make money, not to do charity. Bakkt's online BTC increase is not equal to sending money to users of the currency circle. Is this possible?

When I couldn't find a more suitable reason to explain this plunge, many people joked about the fact that Li Lin, the chairman of the Fire Coin Group, emptied the content of Weibo, causing a bloody case. Some people joked that it was the bloody case caused by the old American impeachment Trump.

The plunge has become a fact, although it has not been widely recognized, but how does the follow-up market go? Is Bitcoin at the bottom? These issues are more worthy of concern.

How to go after the market?

From the perspective of bitcoin computing power, bitcoin is better. According to btc.com data, the current bitcoin computing power is at 90.37EH/s, while the bitcoin computing power in June is 61.86EH/s. In less than three months, the bitcoin computing power is up 46%, while the bitcoin price Has been in a sideways shock. At the same time, according to the official website of Bitcoin, the new ant mine is in short supply and is out of stock. It can be seen that many institutions participate in Bitcoin by mining, which is good for Bitcoin.

At the same time, after Bakkt, Germany's second largest stock exchange, Boere Stuttgart, opened a regulated trading venue, BSDEX, for digital assets, a digital asset exchange that is fully regulated under the German Banking Act. It can be seen that the mainstream society is increasingly recognized for encryption assets such as Bitcoin.

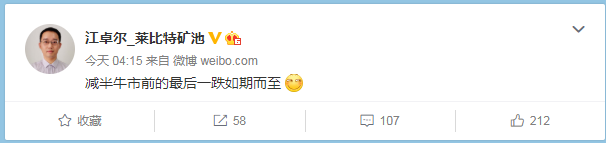

The veteran of the currency, Jiang Zall, said that this is the last drop before the halving of the bull market.

The reason for this plunge, Jiang Zhuoer said: The last round of bull market started in October 2015, this round has risen from 6 months to April, and has been halved for too long, so the middle probability is unbearable. A wave fell. This is also the last chance to get on the bus before the bull market.

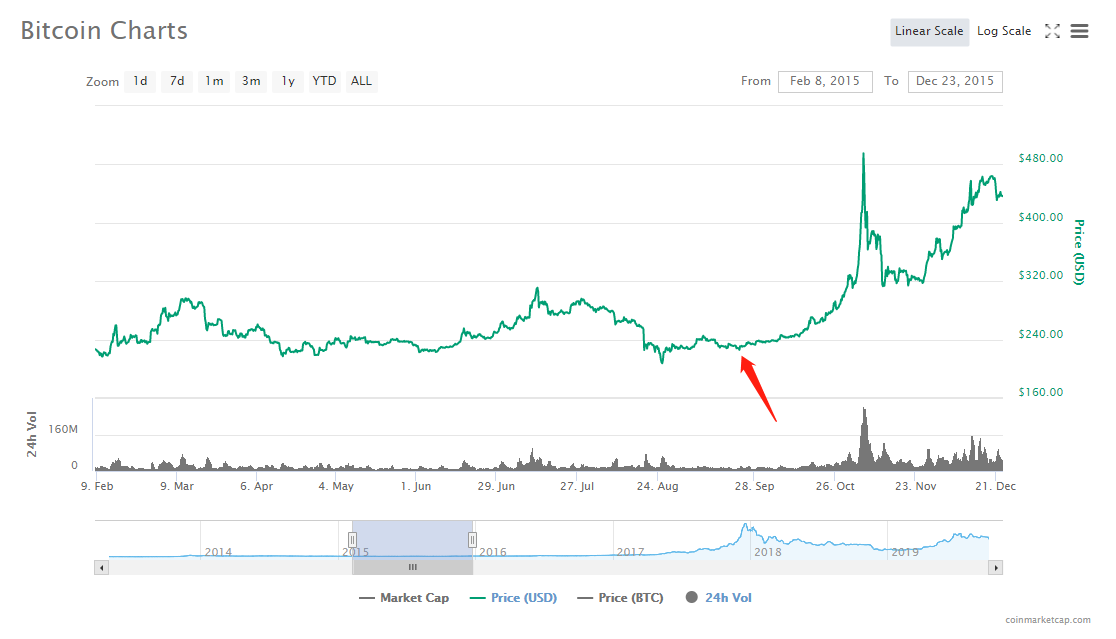

As the saying goes, history will not repeat itself, but will follow the same rhyme. Go back to Bitcoin's historical trend and look for the last drop that Jiang Jiang Zhuo said. Looking back at the last round of bitcoin halving, that is, the 2015 K-line chart, as follows:

KTC chart of 2015 BTC

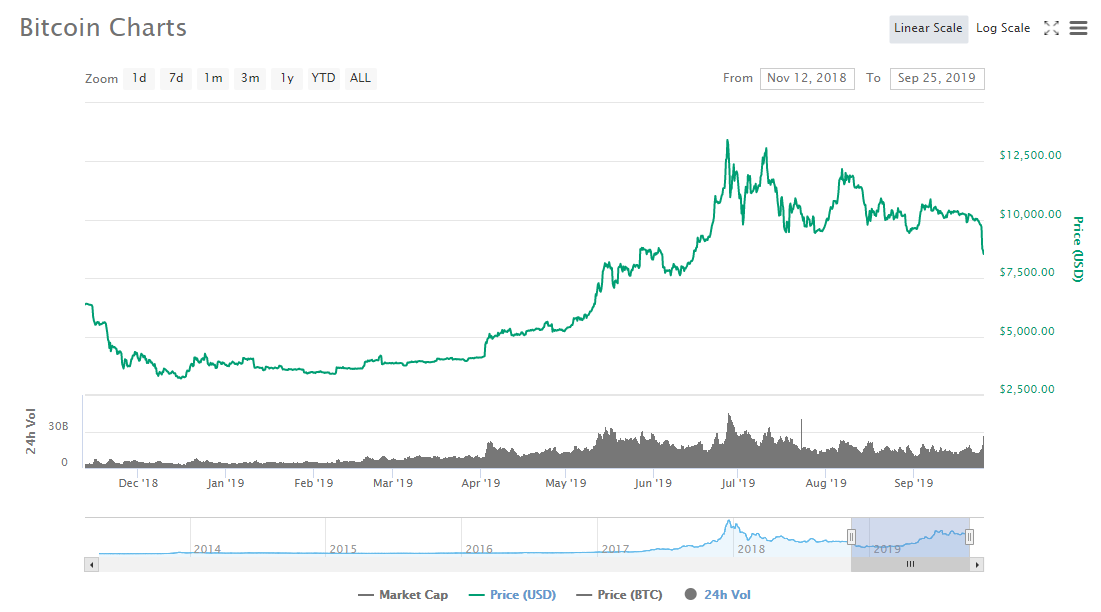

As can be seen from the figure, in October 2015, Bitcoin doubled bottom and then opened the slow cattle market. Compare the 20-year BTC K-line chart as follows:

KTC chart of BTC in 2019

There are some differences in the magnitude of the fluctuations, but the overall trend does have the same charm. If you follow the rules of history, then this down will be a good opportunity to get on the bus, and then will open a long bull market. At the same time, Bakkt's trading volume has surged in the 12 hours after Bitcoin fell.

Finally, investment is risky, especially in the currency circle, with large fluctuations and greater risks. Don't fall before dawn. As the saying goes, one day, one year, how do you understand? That is, the currency can lose one year's deposit in one day.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The secret of the mining machine chip: a wonderful story from the atomic structure

- Former Fed officials: Ending US dollar hegemony with digital currency simply won't work

- Bitcoin has no reason to be attacked? At the same time of mainstreaming, "black market transactions" will become more and more difficult

- David Marcus: Libra can be a "protocol"

- DeFi Finance is the future: starting with borrowing, but not just borrowing

- Yi Gang stated that the digital currency concept stocks were instantly "lifted", and the three main lines seized investment opportunities.

- Babbitt Watch | Soul Torture: Is the cross-chain BTC still a "real" BTC?