Blockchain Weekly | Bitcoin broke through $8800 and exceeded $150 billion market value for the first time this year

In the 21st week of 2019, we will analyze the development trend of the encrypted digital currency industry in the past week from the data of nine dimensions, and explain a more realistic blockchain for everyone.

Focus:

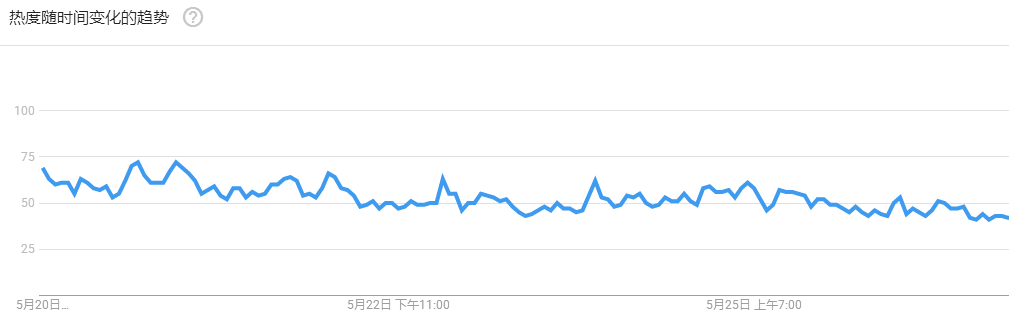

In the past seven days, the global hot trend of Bitcoin has decreased from last week, and the market sentiment is extremely greedy with last week. The details are as follows:

Total market value of cryptocurrency: +8.98%

- Gu Yanxi: Why does DeFi need to be compliant?

- Market Analysis: BTC broke new high, with market capitalization accounting for over 57%

- Zhang Jian returns: using technology to promote the company's evolution to the community

Bitcoin BTC price: +9.17%

Bitcoin weekly trading volume: -11.79%

Weekly new address: -8.14%

Weekly active address: -6.39%

Bitcoin network computing power: +0.6%

As the trade war escalated and the RMB depreciated to 6.9, Bitcoin broke through from $7900 to $8800, and the market value of Bitcoin broke through $150 billion for the first time this year. Among the TOP100 currencies, there are 80 rising currencies and 20 falling currencies. Both Bitcoin's new address and active address have dropped, indicating that BTC investors' attendance and activity have declined. At this stage, it is in the accumulation period before the big bull market. It is suitable to adopt the “fixed-rated investment method”. When there is a big drop, the purchase can be appropriately increased. Usually, more books are read and more coins are used.

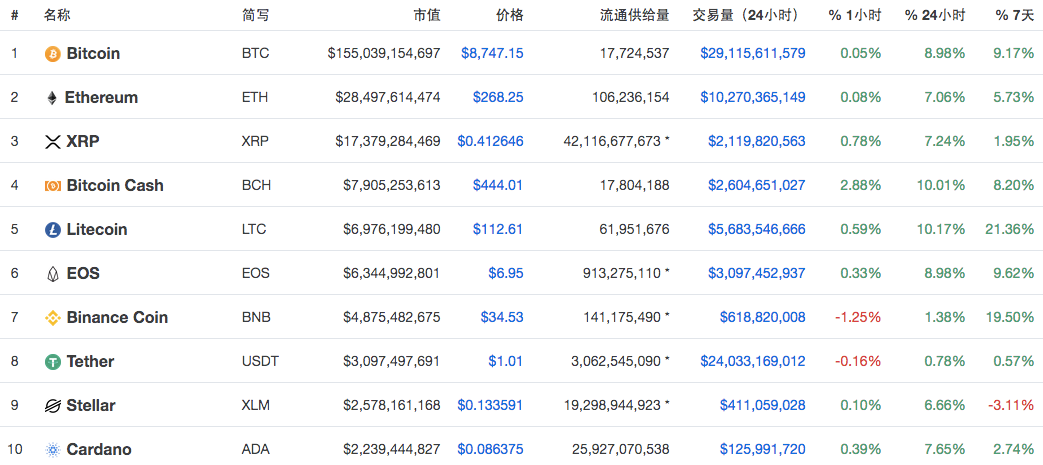

First, the weekly market value trend:

Over the past week, the total market value of cryptocurrency has risen from $247.39 billion to $269.597 billion, with a total market capitalization of +8.98%.

Among them, bitcoin BTC price: +9.17%, Ethereum ETH price: +5.73%, Ripple XRP price: +1.95%, bitcoin cash BCH price: +8.20%, EOS price: +9.62%, Litecoin LTC price: +21.36%.

(Chart source: coinmarketcap)

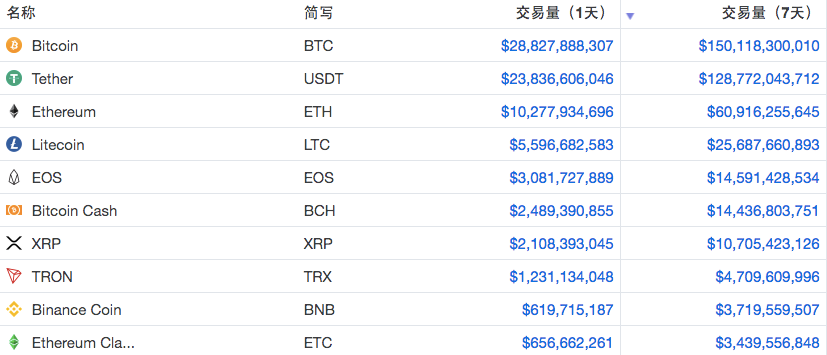

Second, the weekly trading volume list:

Bitcoin weekly trading volume dropped from 170.185 billion US dollars last week to 150.118 billion US dollars this week, and weekly trading volume: -11.79%.

The top 10 currencies in the past 7 days of digital currency trading volume are: Bitcoin BTC, TEDA USDT, Ethereum ETH, Litecoin LTC, EOS, Bitcoin Cash BCH, Ripple XRP, Wavefield TRX, Coin BNB, Ether Classic ETC. This week, the big zero coin ZEC fell out of the top ten. The specific data is as follows:

(Chart source: coinmarketcap)

Third, the number of new addresses, active addresses: (basic indicators reflecting the internal value of Bitcoin)

In the past seven days, the new address of Bitcoin dropped from 2,981,054 last week to 2,738,257 this week, and the new address added weekly: -8.14%.

The bitcoin active address in the past seven days fell from 6,048,918 last week to 5,662,689 this week, and the weekly active address: -6.39%.

Bitcoin's new address and active address have declined, indicating that BTC investors' participation and activity have decreased.

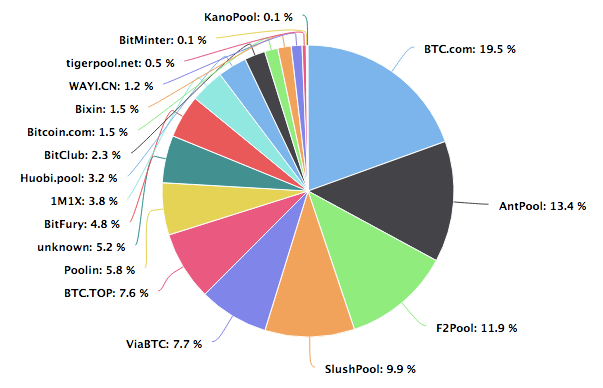

Fourth, the whole network computing power trend:

Bitcoin's total network computing power increased from 51.65EH/s last week to 51.96EH/s now, and the total network computing power: +0.6%.

At present, the income per T is 1T * 24H = 0.00003750BTC, and the next difficulty is predicted to be (+7.77%) 7.23T. The median block volume in the past two weeks is 1.23M, and the number of unconfirmed transactions is 7,117. For May 8, 2020.

(Chart source: btc.com)

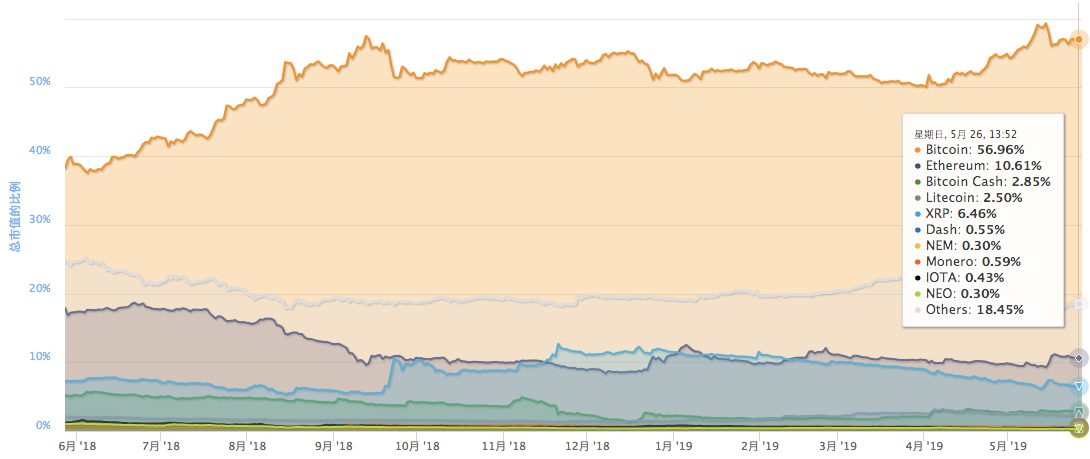

V. The proportion of the total market capitalization of mainstream currencies:

The current global cryptocurrency market bitcoin BTC market share accounted for 56.96%, Ethereum ETH accounted for 10.61%, Ripple XRP accounted for 6.46%, bitcoin cash BCH accounted for 2.85%, Litecoin LTC accounted for 2.50%.

(Chart source: coinmarketcap)

Sixth, Google Trends:

Google Trends shows how many keywords are searched globally by analyzing Google’s billions of search results worldwide.

Look at the Google Trends keyword "BTC USD", which can be used to measure the growth trend of Bitcoin users:

The five countries with the highest global “bitcoin” are: Nigeria, South Africa, Switzerland, Austria, and the Netherlands.

The five countries with the highest global “blockchain” are: Malta, Benin, Rwanda, Armenia, Zimbabwe.

Seven, bitcoin sentiment analysis:

The bitcoin market sentiment was the same as last week, and it was extremely greedy:

(Chart source: alternative.me)

Note: Bitcoin panic and greed index: 0 means "extreme panic" and 100 means "extreme greed". When investors become too scared, this may be a buying opportunity; when investors become too greedy, this means that the market will adjust, which may be a selling opportunity.

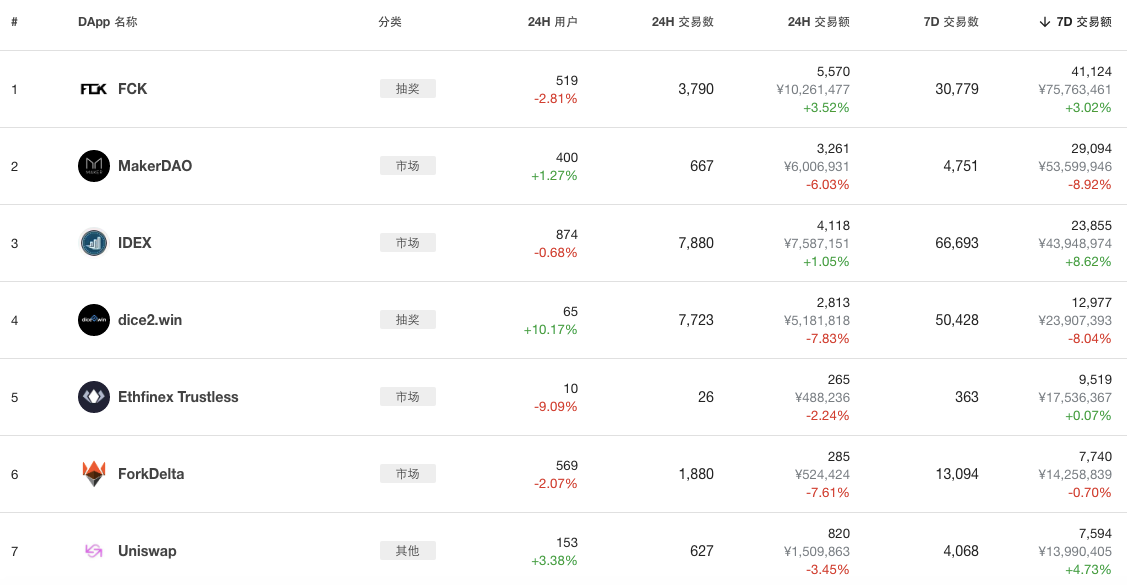

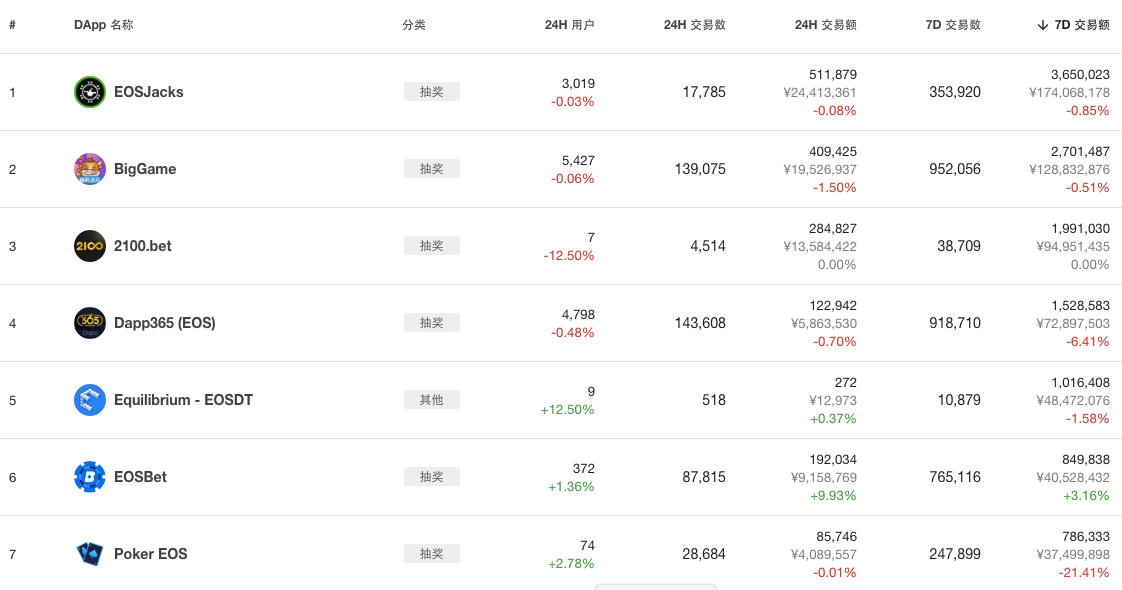

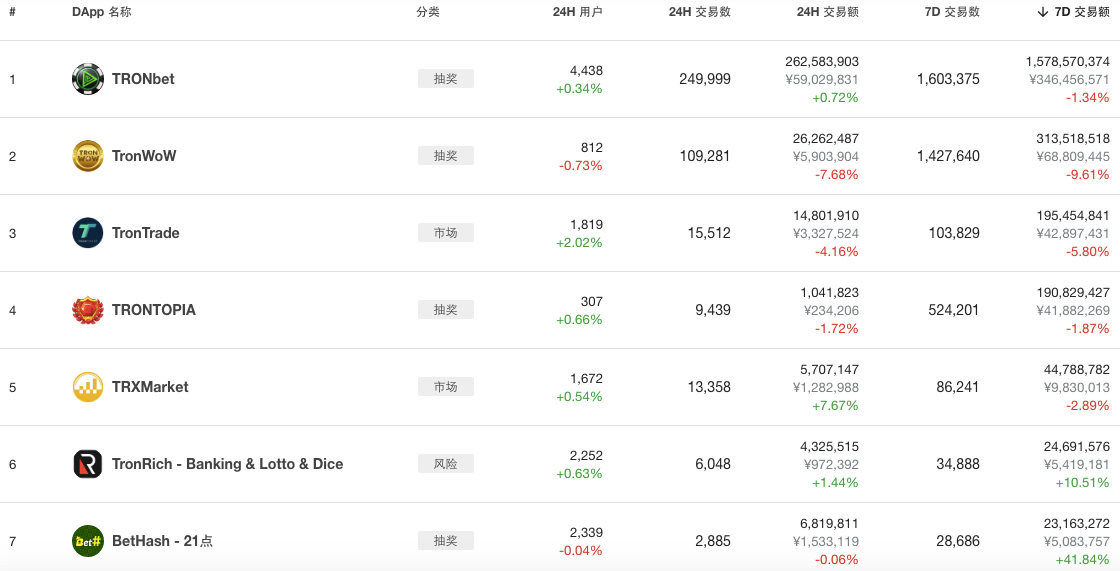

Eight, DApp turnover:

The total transaction volume of the top ten DApps based on the Ethereum blockchain is: 268 million RMB

The 7-day total transaction volume of the top ten DApps based on the EOS blockchain is: 560 million yuan

The total trading volume of the top ten DApps based on the wave field blockchain is: 531 million yuan.

Ethereum DApp rankings:

EOS DApp leaderboard:

Wave field DApp rankings:

(Chart source: DApp.review)

Nine, blockchain activity index:

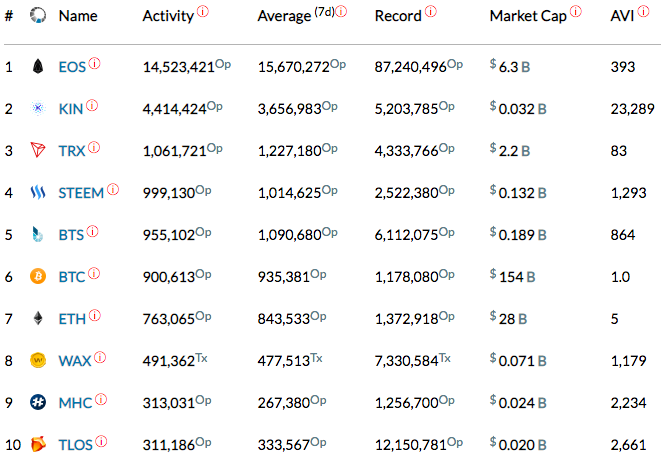

The current blockchain activity index ranks TOP10: EOS, KIN, TRX, STEEM, BTS, BTC, ETH, WAX, MHC, TLOS.

(Chart source: blocktivity.info)

Author: Xuejun currency

The copyright of this report is owned by the currency. If you need to reprint or quote, please indicate the source is “Currency”, thank you!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Market Analysis: Reproduction of BTC extortion, market collective movement

- Bulgaria holding 200,000 bitcoins has been cleared, with a package price of 15,000 Euros.

- Launching 51% of attacks to stop evil, is this choice reliable?

- Viewpoint: Blockchain is the privilege of big companies? Small companies are leading

- Kraken: 30% of employees choose to pay in bitcoin, and some even retire early

- Lightning Network Routing Cost Economics

- The game between the institution and the individual, the difference in the concept of profit determines the personal outcome