USDT fights hormones, long and short double burst 5/26 market analysis

A talk currency:

The USDT has frequently made large transfers, and the circulation has increased substantially. Akong believes that the market will enter a triangular convergence trend, and short-term fluctuations will increase, entering the long-short double-explosive market.

This picture is the USDT circulation market value and BTC price chart, the white line is the trend of BTC, and the red line is the USDT circulation market value.

From the perspective of the USDT circulation market value in 2018 compared with the market price trend, the USDT market value tends to be ahead of the BTC price change, which means that the USDT circulation will increase greatly, the market price will rise sharply, the USDT circulation will be greatly reduced, and the market price will be greatly reduced. Will fall.

- Introduction | Lightning VS Lightning: Watchtower Mode (below): Business Model

- There is no reason to believe in the blockchain?

- Noise trader

Akong talked before, before and after the 4200 US dollars, USDT appeared a large amount of money transfer, South Korea B network and BNB respectively hacked money market, the price of money in the three days after the money plunged 20%, corresponding to the USDT circulation rise.

Interestingly, every time the Wall Street institutional short position soared, USDT began to frantically issue. The latest weekly report on Wall Street came out, and the institutional short position increased again. USDT directly issued another 100 million yuan, and the price of the currency never fell.

When you are short, I will print the banknotes. If you are in stock, I will limit the coins. I will be the owner of my site. I don't want to run.

Akong’s original view is that as long as the two global spot platforms: South Korea’s B-Net and BNB open the currency, USDT will withdraw funds, the market value will begin to decline, and the corresponding market will also fall.

However, from the current stage, USDT did not choose to withdraw funds, but continued to over-fund, and the corresponding increase far exceeded that of November 2017.

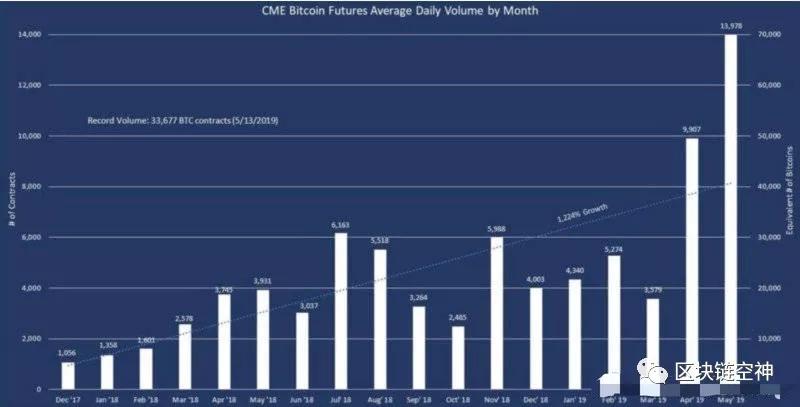

The reason for this may be related to the recent volume of the Wall Street futures platform. Many people know that CME's two-day futures trading volume has doubled and reached a record high.

Yesterday, the Bitwise report pointed out that about half of the BTC's trading volume is in the United States. From the US's attitude of freezing the big B network, it can be seen that the United States is serious about BTC.

But there is no way. In the world of blockchain, there is no authority. The Americans desperately want to seize the pricing power, but the status of USDT is still there, and the thunderstorms survived three or four times.

Akong feels that the current market operation, the best way is to patiently wait for the opportunity of BTC bottoming, ready to layout the small currency market.

In the short-term, there is also a meat-feeding operation. Just like the BSV in the previous two days, the long and short game is finally going to skyrocket and plunging. Finally, it returns to the original point. Only the cash out of the cash is the real winner.

BTC:

The external network re-transmitted Fidelity to engage in BTC mining. Fidelity Investment Co., Ltd. is the world's largest professional fund company. The first two days, Fidelity will launch an encryption hosting service, which has a certain positive impact on the currency price.

Akong feels that there are currently three long cards: Fidelity, Nasdaq, and bakkt. As long as these three cards are always present at the crucial moment, the first one has already appeared, and the two remaining moves and the market are seen. With it.

The price of the currency has shrunk and entered the triangle convergence trend. Once the price breaks through 8257 US dollars, it will rise rapidly and rise. The overall volume will continue to weaken and remain flat.

Akong believes that the price once again forms a triangular convergence trend, the operation space is not large, and the operation is dominated by high throwing and low sucking.

Next, the BTC was flat at $79.12.

Resistance level: 8086, 8217, 8345

Support level: 7912, 7790, 7510

EOS:

The rise in the price of the currency broke through 6.57 US dollars, and the short-term will break the shock pattern and increase the volume quickly.

Akong believes that EOS is still shrinking, the short-term fluctuations are weakening, waiting for the market to change, and the operation is mainly wait-and-see.

The EOS then oscillated at $6.23.

Resistance level: 6.42, 6.57, 6.73

Support level: 6.23, 6.13, 5.98

ETH:

The OK platform ETH long position exceeded the short position for the first time, indicating that the main fund is controlling the mainstream currency market, and the short-term fluctuation will increase.

The price of the currency can be further weakened. Akong believes that ETH is doing a daily shock, waiting for the market to break through the market, operating high and low, and reducing the cost of holding positions.

Next ETH was shocked at $245.4.

Resistance level: 252.8, 255.7, 270.4

Support level: 245.4, 239.7, 231.5

XRP:

The price of the currency is flat in a narrow range. Only when the volume exceeds 0.392 US dollars, can it enter a new rising market.

Akong believes that the amount of XRP can continue to weaken, continue to sort out the market, and operate on a wait-and-see basis.

Next XRP was placed at $0.371.

Resistance level: 0.392, 0.398, 0.414

Support level: 0.371, 0.362, 0.353

LTC:

The price of the currency rebounded, and the short-term fluctuations increased, indicating that the strength of the long and short games increased. As a whole, the volume continued to weaken, indicating that the currency price is still being sorted out.

Only when the volume breaks above the upper 104.5 US dollars, the short-term can quickly rise and enter the long market.

Akong believes that LTC is short-term and narrow-line finishing. The operation is mainly on the sidelines, waiting for the market to change.

Next, LTC bottomed out at $100.2.

Resistance level: 103.2, 104.5, 109.8

Support level: 100.2, 98.5, 96.4

BCH:

The price of the currency has remained flat for a narrow period of time, and the amount of energy has also dropped to a low point. The price of the currency continues to fluctuate.

Akong believes that the current trend of BCH can be focused on. Once the currency price changes rapidly, it will have a crucial impact on the overall market.

In operation, according to the daily fluctuations, the trend is high and low, and the cost of holding positions is lowered.

Next BCH was placed at $387.4.

Resistance levels: 410.2, 413.7, 420.2

Support level: 387.4, 383.8, 368.5

BNB:

The currency price turned weak, and the small-coin market began to weaken overall. Every time the market entered a period of triangular volatility, LTC and BNB were often opened, and other currencies were pulled up.

Akong believes that IE0 SGD is on the line, which is also a major reason for the BNB callback. During the warm-up period of the project, the price of the currency has risen sharply, which has driven the SGD hot spot and the inexhaustible coins to rise one by one.

Once the new currency is successfully launched, the platform currency will begin to weaken. The bottom of $28.4 is the key point of this round of bullish market. Once the volume falls below $28.4, the price of the currency will fall into the market.

Short-term confirmation of the top deviation from the trend, test the bottom support level, the operation is mainly to wait and see, then BNB bottoming $ 32.6.

Altcoin:

STORM and BTT led the market. Today, Sun Yuchen called for a single online order, suggesting that BTT and TRX will have major plans on 6.1 days, and TRX and BTT have risen sharply.

Akong feels that the currency circle may like the day of 6.1, a BM, a Sun Yuchen, all suggest that there will be a heavy update on 6.1.

The rise is also in anticipation of speculation. This is in line with the main online line. It can be done short-term before 6.1 days. It is really successful to update the line. It is necessary to lighten up and wait and see.

From the perspective of market hotspots, under the leadership of BTT, the short-term hot spot of SGD rebounded, and MATIC, TOP, CELR and FET appeared short-term market.

Akong believes that the current market is still in a turbulent trend. Once the triangle breaks through the trend, there will often be a long and short double-dip market. The spot is mainly wait-and-see, waiting for the market to change.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Where is the Schnorr signature and the Taproot soft fork proposal?

- Breaking the blockchain impossible triangle (3) – POS and POW-DAG

- Video|"8Q" HashQuark Li Chen: PoW spelling power, hard core! PoS fights soft power and diversity!

- Market Analysis: BTC continues to be at $8,000, the main force is more patient than expected

- Market Analysis: BTC continues to shrink, has to change?

- DeFi: Is it a new bottle of old wine, or is it a real future finance?

- PoW vs. PoS: Is the PoW consensus mechanism gradually abandoned?