BTC monthly report 丨 BTC has the highest volatility relative to other assets, and derivative trading activity continues to increase

Summary of key points

1. Through data analysis, it is found that there is a certain negative correlation between Bitcoin and traditional investment targets in the short term, and the negative correlation within half a year is stronger than the one-month correlation relationship; in addition, the short-term bitcoin price is in the same direction as the US dollar index. In terms of volatility, Bitcoin has the highest volatility relative to other asset targets.

2. From May to June, bitcoin prices fluctuated greatly, from $6,000 to $9,000 and then fell back to around $8,000. For the entire market, Bitcoin's market value accounted for around 55%, compared to It rose by about 15 percentage points in the same period last year.

3. The activity of Bitcoin derivatives trading continues to increase. The monthly trading volume of CME Bitcoin has exceeded the monthly trading volume of all Coinbase currencies, and future derivatives trading may continue to grow .

- Bitcoin is approaching $10,000: the rich will enter the market and the FOMO moment is coming soon?

- AI+ blockchain, Jarvis+ allows each community to have a personal assistant

- Bitcoin or going to the US to go public, is this the signal that the "bull market" drama kicked off?

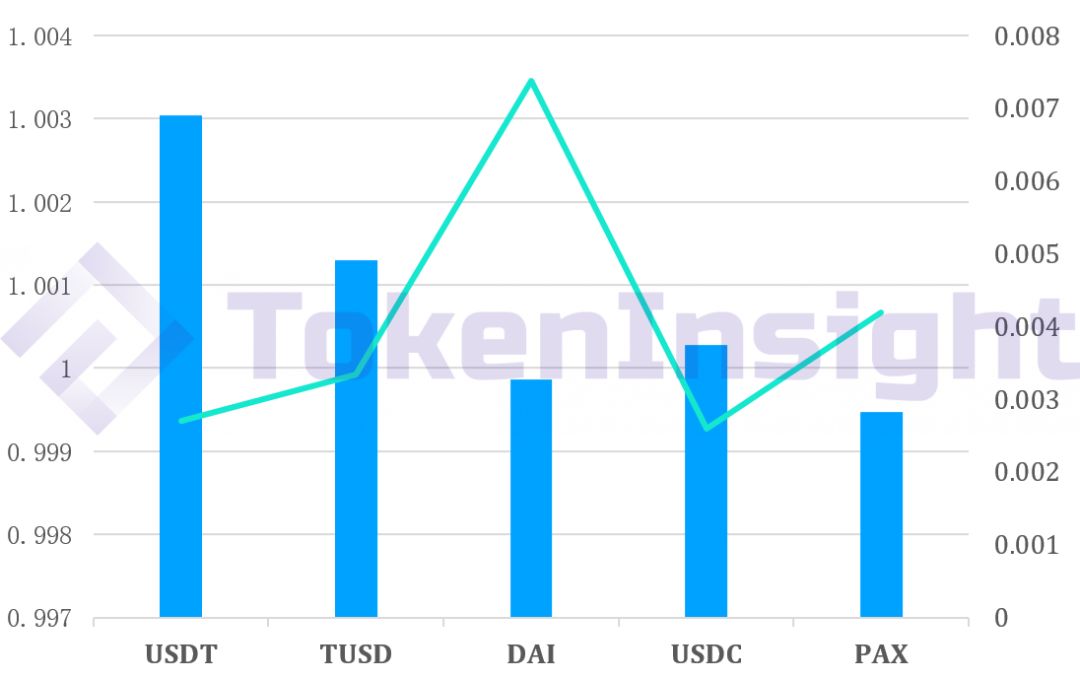

4. In terms of stable currency, the US dollar anchored stable currency generally has a premium. The USDT average premium is the highest, reaching 3%, while the worst performing is PAX. In addition to the dollar anchoring stable currency, the stable currency DAI anchored by ETH In the stable currency, the price fluctuation range is the largest .

5. The activity and price performance of the chain still showed high correlation; the average mining difficulty of Bitcoin increased more in May-June, and the average difficulty increased compared with the historical price; the reason behind the whole network is The calculation power is increased, and the mining activity is more active than the historical price. The reason for the increase in activity is 1. The market mining participation is improved, 2. The iterative upgrade of the mining machine, which can provide more than the historical cost. More computing power.

6. In terms of technology, the number of Bitcoin in the Bitcoin lightning network channel is close to 1000, which is nearly 20% higher than that in early May . In addition, Lightning Network has introduced a new Loop Out function, which can effectively increase the channel burden of a single node. The Bitcoin side chain Liquid partners continue to increase, and this month added 14 more partners, including Blue Fire Capital, BTC Trader, Cobo, etc.; while Bitcoin core developers announced Bitcoin version 0.19.0 on GitHub. Road map.

table of Contents

Macro analysis

Compliance supervision

Market analysis

Bitcoin futures

Stable currency

Chain analysis

Computing power and mining

Technological progress

Market sentiment analysis

Twitter view

Macro analysis

1.1 Alternative investment target

According to the Blackstone Group report, although only a small part of the 21st century has passed, the global market has experienced two serious market downturns and two serious and painful recovery processes. The biggest feeling for investors in this economic downturn is the slowdown in global economic growth. There is a lot of uncertainty in the market and traditional investment choices can no longer satisfy investors' choices.

With the rise of new asset classes, in addition to traditional investment options, alternative investments are increasingly favored by investors. According to Wharton's definition of Christopher Geczy, traditional investments in stocks or bonds are classified as alternative investments. In the process of making investment decisions, investors will inevitably tend to choose higher returns, avoid the impact of rising interest rates, and look for assets that are protected from market volatility. assets.

Along with the current market situation, the income of bond investment tends to be poor when the interest rate is high, while the diversification between other traditional investment assets is gradually disappearing. International stocks, investment-type US bonds, commodities and other assets The correlation between the Standard & Poor's 500 Index has increased. At this time, alternative investments have been regarded by many investors as potential supplements to traditional investments because of their own characteristics.

Traditional investment exposes exposure to the “market” to obtain a stable market “beta”, and as part of the portfolio, alternative investments also have the potential to provide investors with a higher “alpha”.

In recent years, Bitcoin has become more and more clear as an investment alternative investment target. KiHoon Hong (2016) and Baur et al. (2015) respectively relate the relationship between Bitcoin and traditional assets, and the behavior characteristics of Bitcoin user transactions. Analysis, judging that Bitcoin has begun to be accepted as an investment asset rather than a "currency".

1.1.1 Bitcoin and other assets

1.1.1.1 Asset price

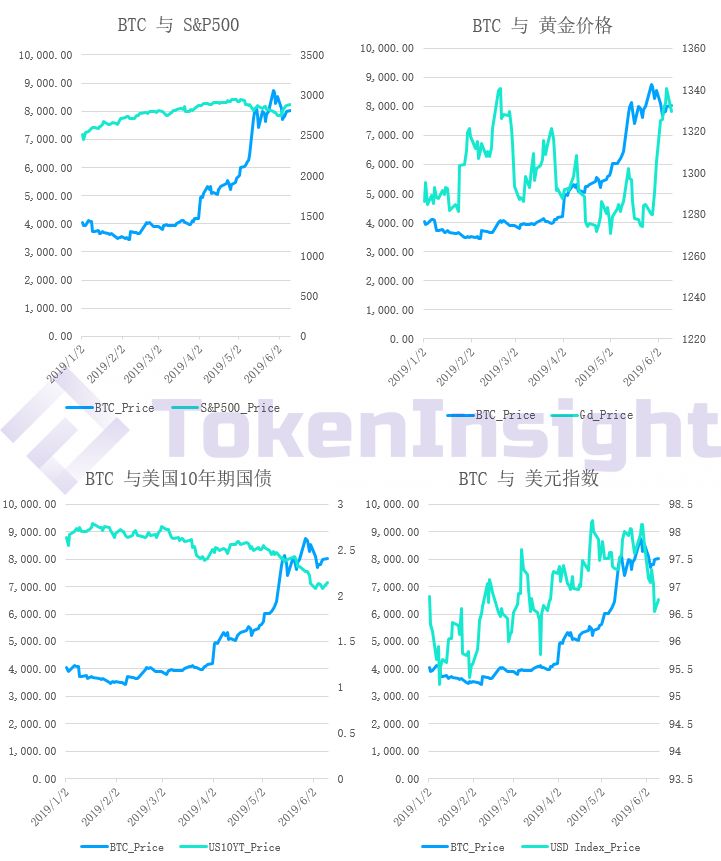

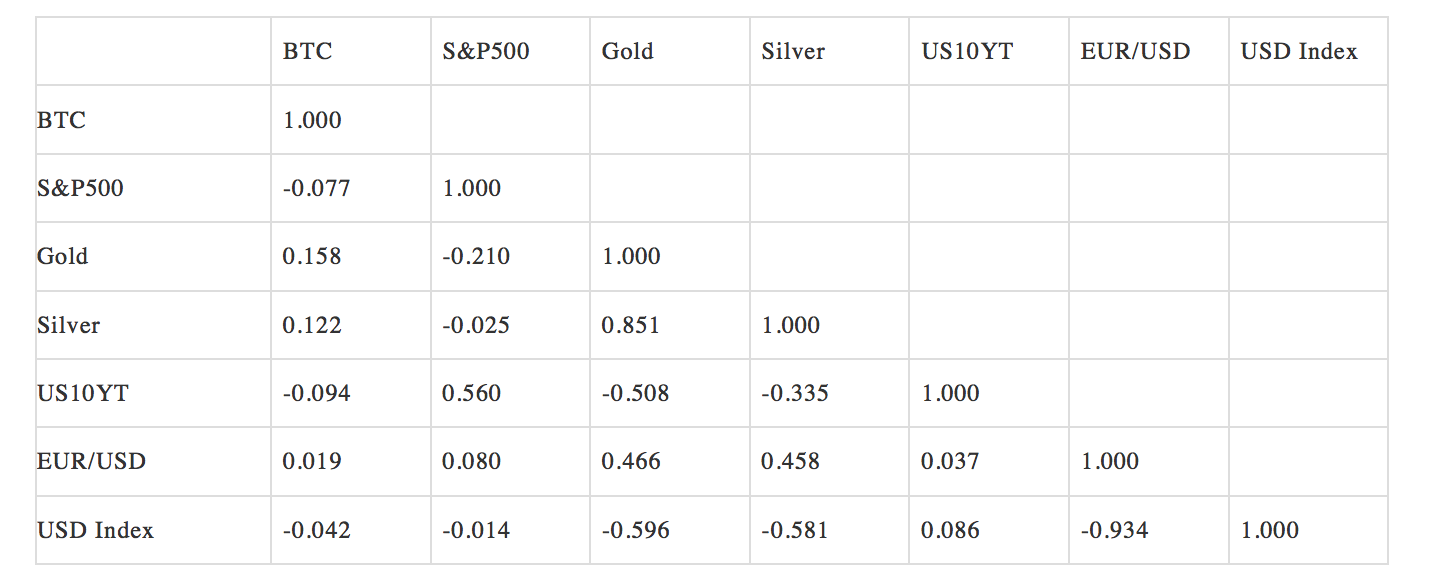

Figure 1-1 Correlation between Bitcoin and other assets (2019.01.01-2019.06.11)

Source: Investing.com, TokenInsight

Figure 1-2 Correlation between Bitcoin and other assets (2019.05.11-2019.06.11)

Source: Investing.com, TokenInsight

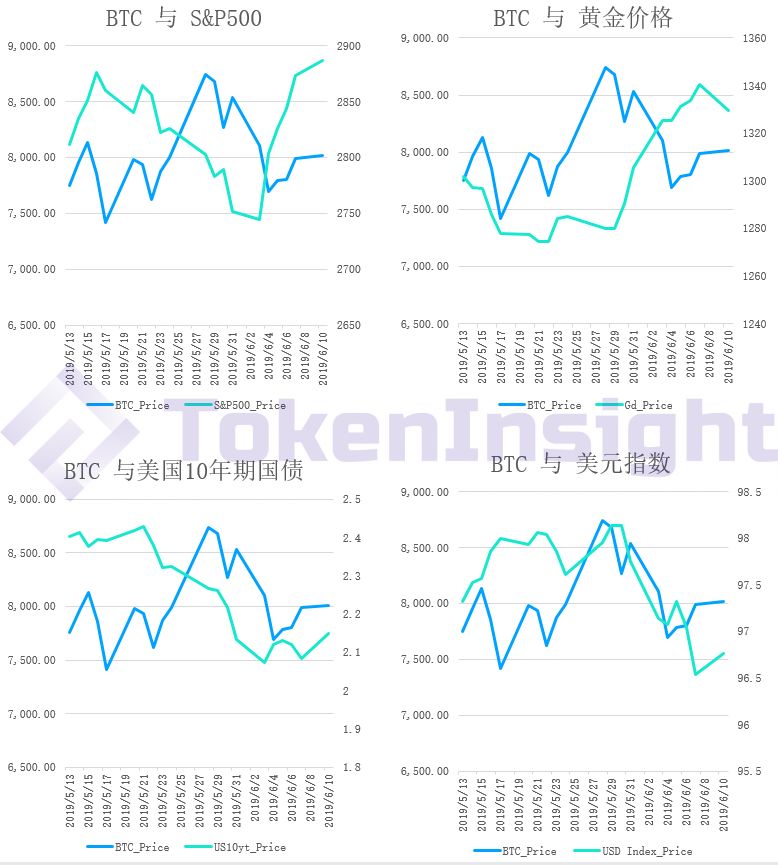

Figure 1-3 Correlation coefficient between different asset classes (2019.01.01-2019.06.11)

Source: Investing.com, TokenInsight

Figure 1-4 Correlation coefficient between different asset classes (2019.05.11-2019.06.11)

Source: Investing.com, TokenInsight

In terms of the correlation between Bitcoin and other asset classes, bitcoin prices are mostly negatively correlated with other assets, and by comparing the data for half a year and one month, it can be found that the correlation is higher when the time period is longer. Although it can be found through the data that Bitcoin seems to have a certain correlation with other asset classes, the main reason behind this should be that Bitcoin is less recognized as an asset of the portfolio, and its market value has not been compared with other asset classes. contend. Moreover, the data selection time period is short and can not support the strong correlation between Bitcoin and other asset classes.

However, it is worth noting that, unlike other asset classes, the correlation between Bitcoin and the US dollar index in both periods is positive. This may be due to the recovery of the bitcoin market since 2019, and the price rebounded from the low-end of more than 3,000 US dollars to about 8,000. At the same time, due to US economic policy, the US dollar continued to strengthen, and the US dollar index rose from around 95 points at the beginning of the year to around 97 points. The simultaneous rise of the two has caused a large positive correlation.

1.1.1.2 Asset price fluctuations

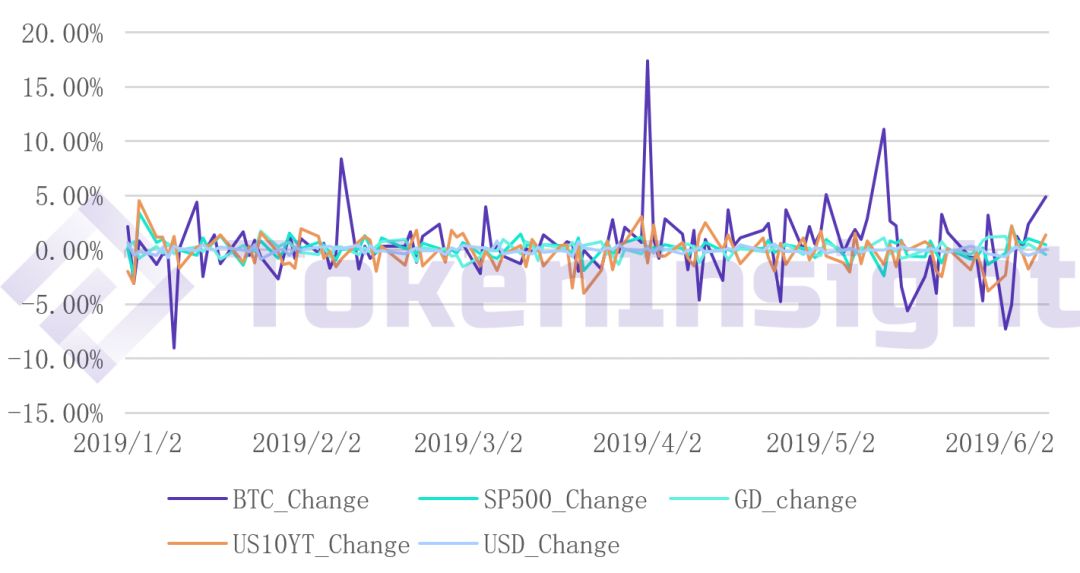

Compared with the absolute price comparison of assets, it can be seen from the comparison of asset price fluctuations that bitcoin price fluctuations have no obvious relationship with other asset price fluctuations.

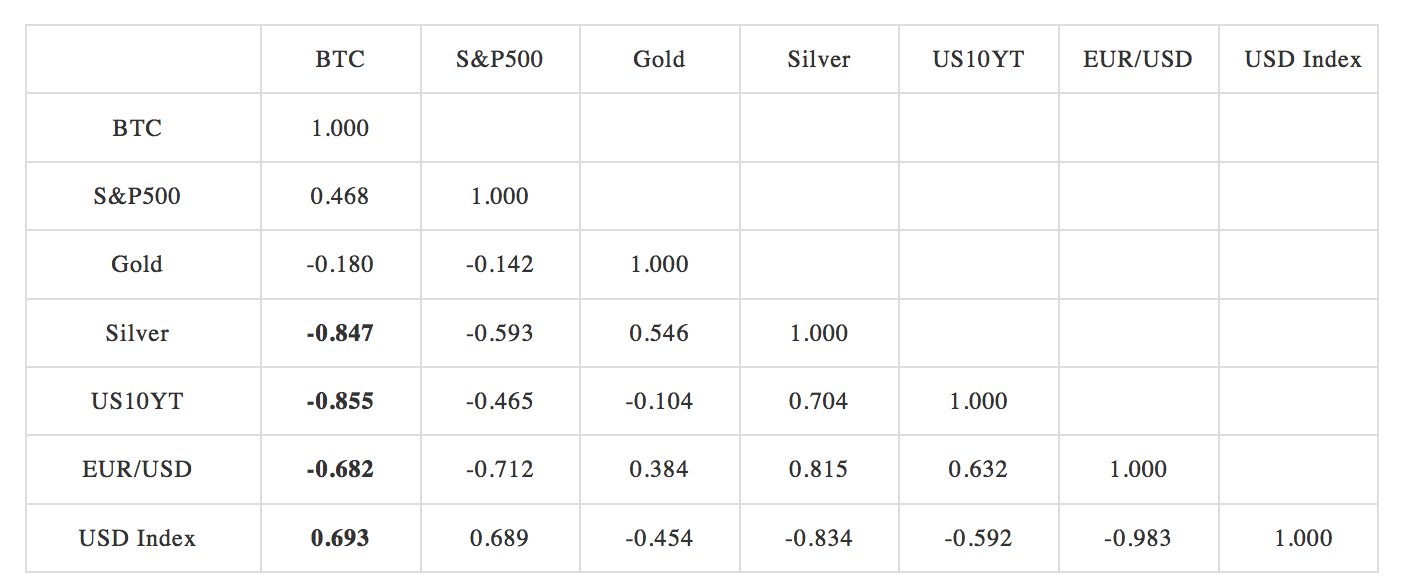

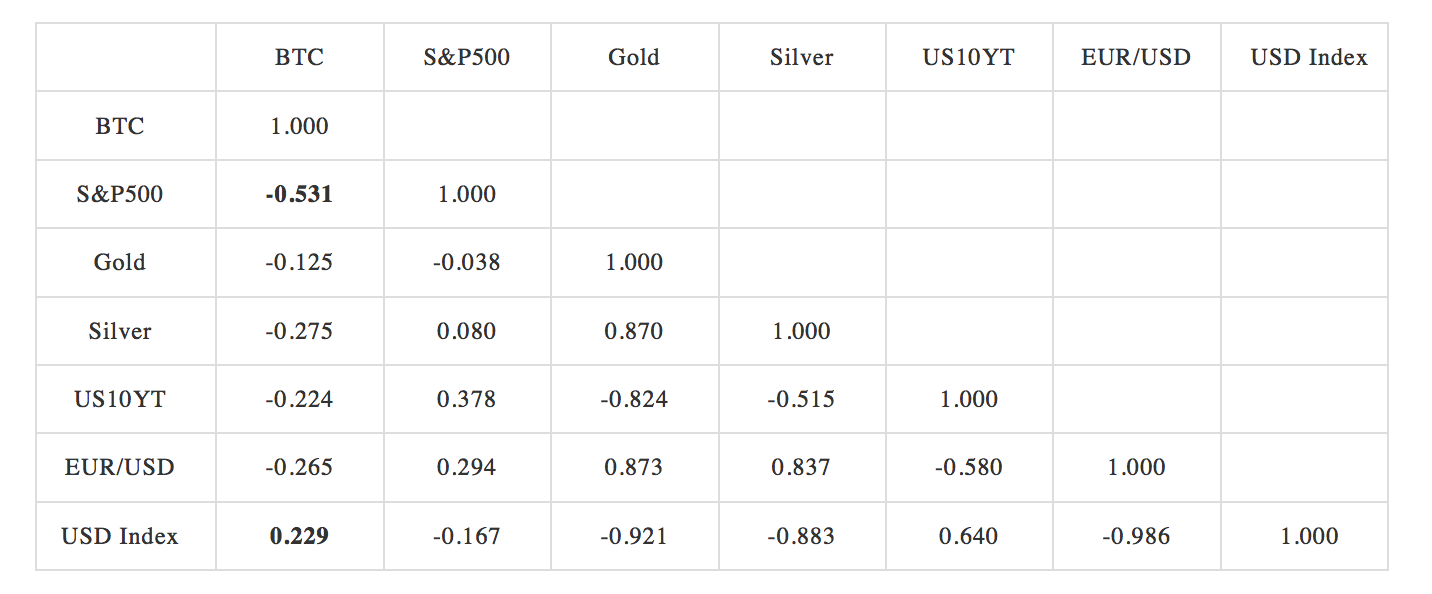

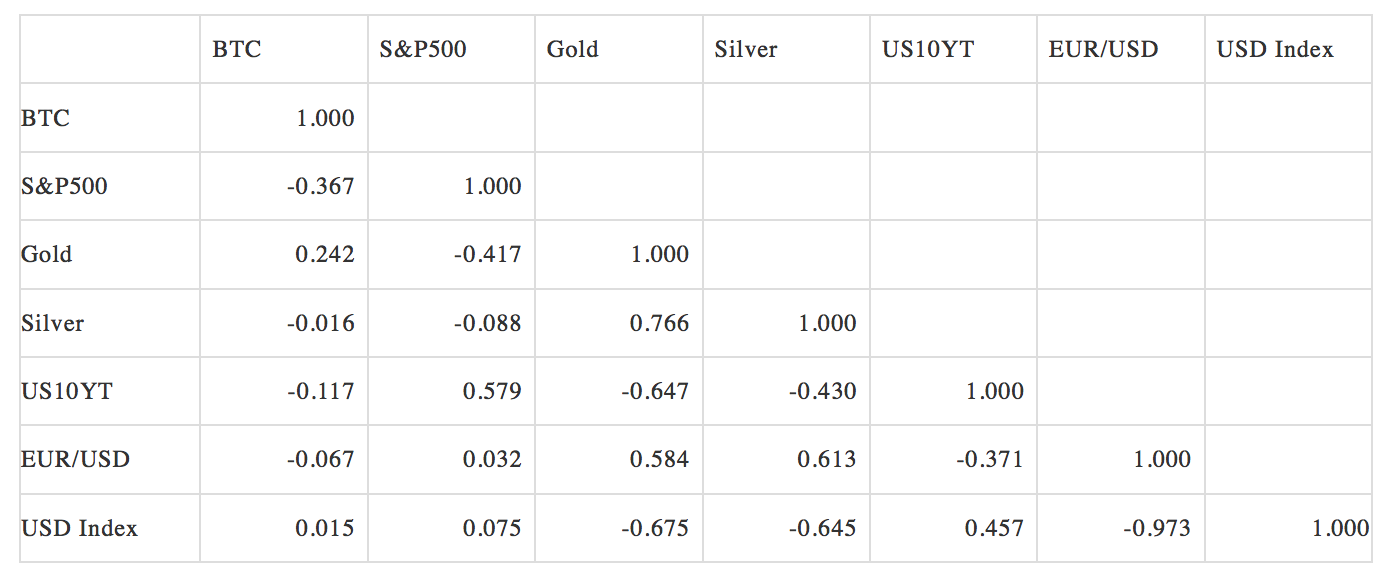

Figure 1-5 Correlation coefficient of price fluctuations of different assets (2019.01.01-2019.06.11)

Source: Investing.com, TokenInsight

Figure 1-6 Correlation coefficient of price fluctuations of different assets (2019.05.11-2019.06.11)

Source: Investing.com, TokenInsight

From the perspective of asset price fluctuations, Bitcoin has a weaker correlation with other asset classes, and the correlation (absolute value) of different asset classes rarely exceeds 0.2.

Although doubts about the manipulation of the price of Bitcoin have always existed, the characteristics of the relevance of Bitcoin as an asset class to other traditional assets have given Bitcoin an alternative investment possibility. Because of the weaker correlation with assets in other traditional markets, Bitcoin is not exposed to market exposure . Compared with other types of alternative investment targets, Bitcoin is also characterized by high liquidity .

Figure 1-7 Price fluctuations of different assets

Source: Investing.com, TokenInsight

2. Compliance supervision

To date, 113 of the 251 countries in the world have no restrictions on Bitcoin. Among the major countries such as the United States, the European Union, Japan, South Korea, Canada, and China, China has adopted a policy of prohibiting the exchange of RMB and virtual certificates for Bitcoin.

Figure 2-1 Global Bitcoin Policy Compliance Status Map

Source: Coindance.com

As of June 12, 2019, Bitcoin had reached $7,800, and the strength of the year was strong, which triggered a new round of attention.

The Chinese Bitcoin mine has attracted the attention of the government:

According to incomplete statistics, 70% of the world's Bitcoin is mined in China, and 70% of its computing power comes from Sichuan. Because the hydropower generation in the Dadu River Basin can provide cheap electricity and is not integrated into the national grid, quite a few mines are built near the Shenshan Substation, and there are many self-built power stations. Because the mine can not be legally established, it is illegal to build, and the direct sale of electricity by the power station violates the power law. The China Economic and Trade Bureau has taken the lead in setting up a working group to investigate the matter. In view of this, the Chinese government is stepping up the regulation of bitcoin, and there is still a way to go for China Bitcoin compliance.

The European Central Bank stated its position on bitcoin:

On May 9, the European Central Bank released the current attitude of the president of the bank, Mario Draghi, to Bitcoin in a youth dialogue on official Twitter. Draghi means that cryptocurrencies, such as bitcoin, are not real currencies, but assets. The euro has support from the European Central Bank and there is no support behind the cryptocurrency. At present, cryptocurrencies such as Bitcoin are not enough to have a huge impact on the economy, so the ECB will make it a high-risk asset. In addition, Bitcoin may not be within the scope of central bank supervision and supervision, and it is in the scope of consumer protection.

The Bank of Japan is wary:

Japanese Bank of Japan Governor Haruhiko Kuroda said: "Encrypted assets are not legal currency and are extremely unstable. At the same time, encrypted assets are basically not used for payment and settlement, but for speculation. Considering that encrypted assets may damage People's trust in payment settlement, the Bank of Japan will continue to monitor its movements. "

For the cryptographic assets in Australia, ICO publishes the latest guidelines:

The Australian Securities and Investments Commission (ASIC) released the latest version of the "ICO and Encrypted Assets Guidelines" on May 30th. The guidelines state that if the encrypted asset is a financial product, its issuer, the company and the exchanges it manages must hold an “Australian Financial Services License” and its “miners and transaction processors will be considered Part of the clearing and settlement process, and any business that provides cryptographic assets or services related to it, must also undergo appropriate investigations to ensure compliance.

The Malta AI&Amp; Blockchain Summit was successfully held on May 23rd:

As the first country to issue blockchain industry legislation and guidelines, and the first country with a sound regulatory system, Malta is also seen as a pioneer in the blockchain industry. On May 23, the second blockchain summit was successfully held in Malta. Malta Prime Minister Joseph Muscat and Malta Parliament Secretary Silvio Schembri will attend the summit and give a speech as guests.

The representative of the United States of Minnesota proposed a revised plan for the hard-forked tax:

Recently, the representative of the Minnesota Congress, Tom Emmer, announced plans to reintroduce the hard fork tax bill to provide a temporary safe haven for hard fork tax processing. On May 13, Emmer participated in the 2019 Consensus Conference and announced for the first time that he wanted to reform the intention to split the bill. Emmer publicly acknowledged that the cryptocurrency holder was in trouble. When there is a hard fork in the contemporary currency, the tax bureau has reason to regard it as undeclared income. Recently, Emmer and the State Administration of Taxation repeatedly proposed the bill, and the tax bureau also invited Emmer to go to the office to discuss the next move. This bill puts the tax issue on the counter after the virtual fork is hardly forked, which promotes the compliance of Bitcoin policy.

Finally, it is worth mentioning that on June 21, the Financial Action Task Force (FATF) will strengthen the supervision of money laundering and terrorist financing related to the virtual pass market in 200 countries including the United States. Major exchanges will be required to collect user information. This regulation is difficult to implement from the perspective of technology and capital, and will definitely have a greater impact on the market, but it is also the only way for compliance with the virtual certification policy.

3. Market analysis

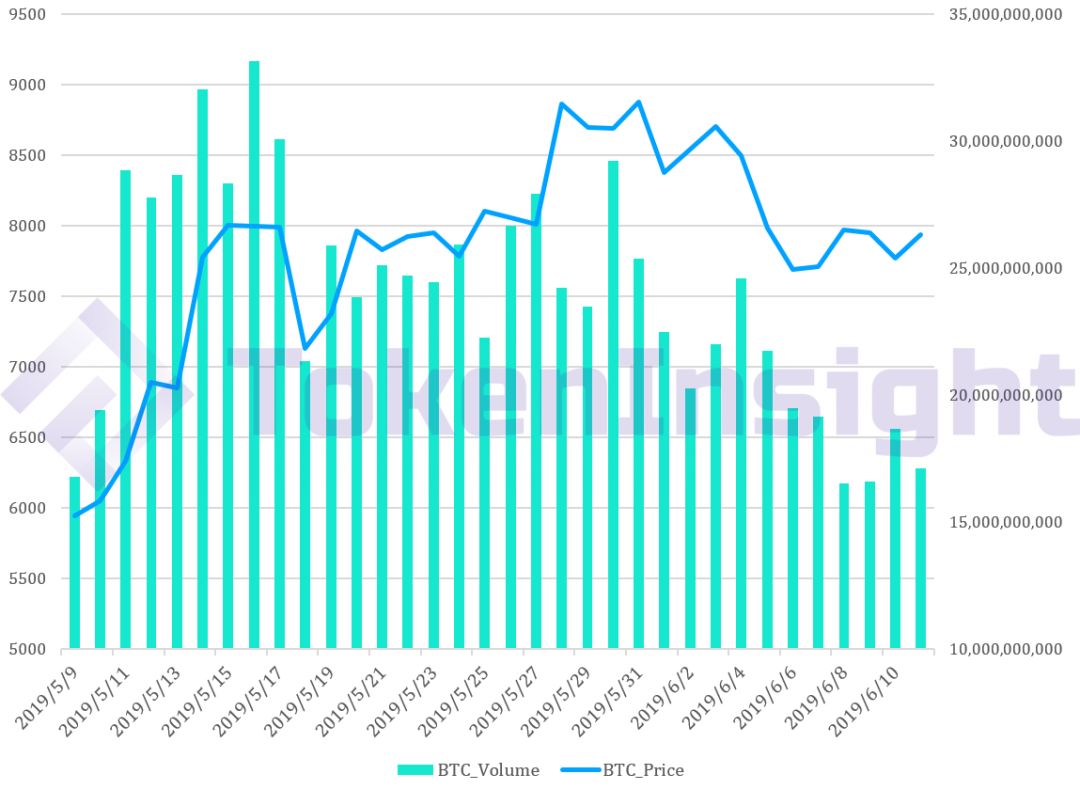

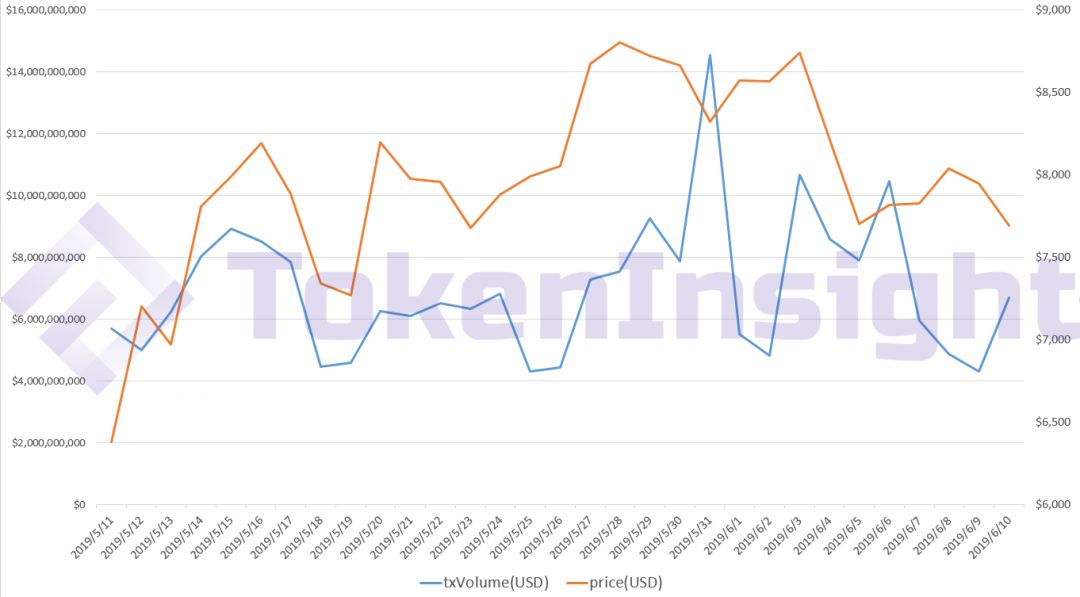

Chart 3-1 Bitcoin price and transaction volume

Source: TokenInsight

From May to June 2019, bitcoin prices fluctuated significantly. From the highest of $6,000 in early May to nearly $9,000, it quickly fell back to the level of $8,000. The transaction volume is consistent with historical performance. When the price fluctuates greatly, the user's transaction is also more frequent. When the bitcoin price suddenly rose from $6,000 to $8,000, the volume of transactions plummeted.

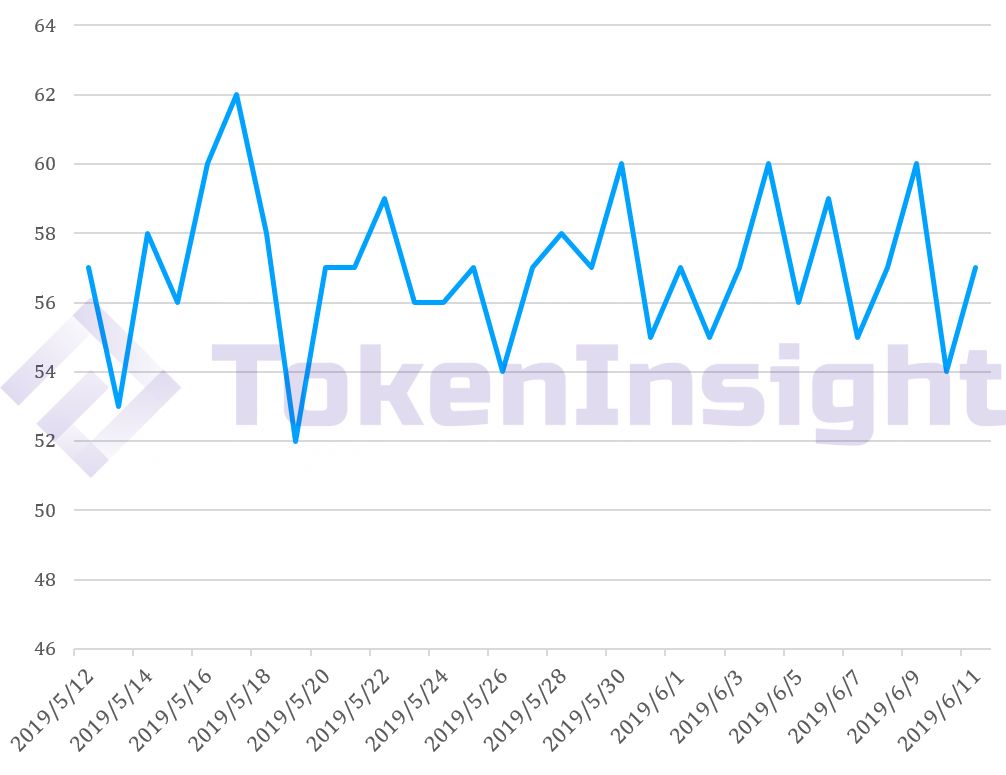

Figure 3-2 Bitcoin market value as a percentage of the overall market value of the encryption market

Source: TokenInsight

Bitcoin accounted for a large fluctuation in the market value of the market between May and June. The maximum value appeared in mid-May, and the market value accounted for 62%. But then it quickly fell back within a few days, the lowest value fell to 52%, down 10% from the maximum. Overall, the market value of Bitcoin currently accounts for around 55% of the entire market.

4. Bitcoin futures

In May 2019, CME Bitcoin futures trading hit a record high since its release in 2017.

Chart 4-1 CME Bitcoin Futures Trading Data (2019.05.06-2019.06.07)

Transaction contract volume (Million USD) Open Interest average 11,7354934646 Total value 305,11911,826111,498

Source: CME, TokenInsight

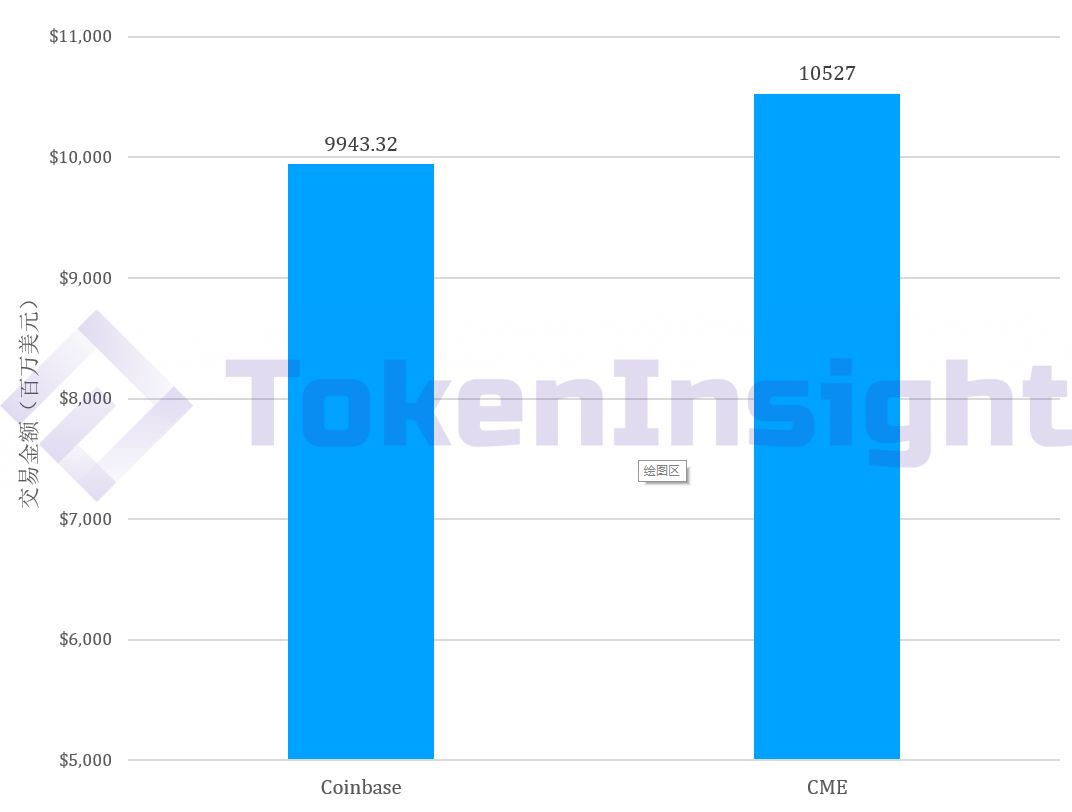

Chart 4-2 CME Futures Trading Volume and Coinbase Pro Total Trading Volume (05.13-06.07)

Source: CME, TokenInsight

The chart above shows the total volume of CME Bitcoin futures between May 13 and June 7, 2019, compared to the volume of all currencies in the Coinbase Pro exchange. During this time, CME's bitcoin trading volume has exceeded Coinbase's total trading volume.

Due to the existence of transaction fees on the Bitcoin chain and the relatively long transaction confirmation time, Bitcoin's trading behavior as an alternative investment subject is likely to move in a direction similar to "non-physical delivery". Future Bitcoin derivatives trading activity will continue to increase.

5. Stabilizing coins

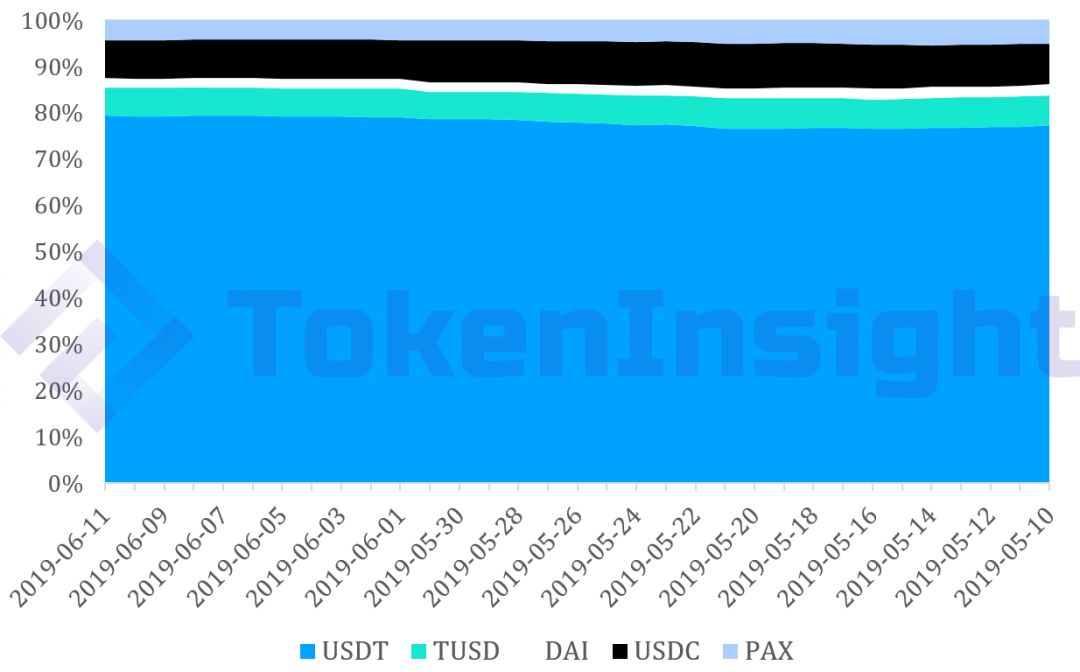

Figure 5-1 Market share of several types of stable currencies

Source: TokenInsight

In terms of stabilizing coins, USDT is still leading the market with nearly 80% market share. During the period from May to June 2019, the market share of several types of stable currencies did not change much.

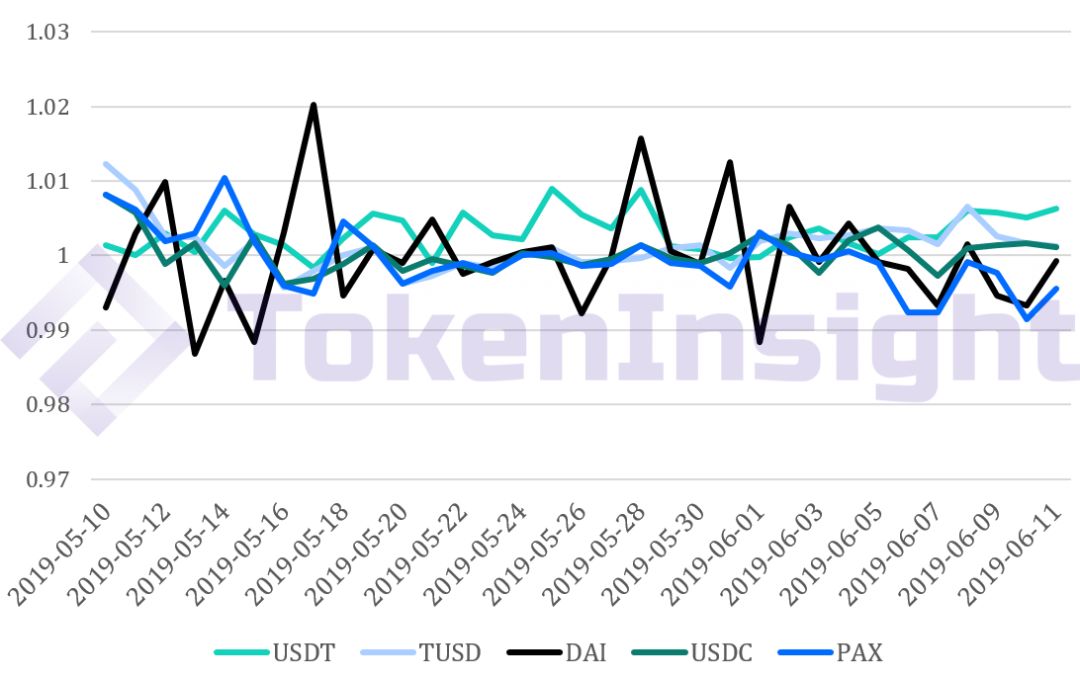

Figure 5-2 Price fluctuations of stable currencies

Source: TokenInsight

In terms of price, the stable currency collateralized by the encrypted asset ETH is still more volatile than the other stable currency (US dollar). The remaining stable currency fluctuations are smaller, and basically do not exceed the range of 0.1.

Figure 5-3 Average and standard deviation

Source: TokenInsight

The same conclusion can be found after passing the average and standard deviation of several types of stable coins. The standard deviation of DAI is the largest, about double that of other dollar-anchorized stable coins.

In terms of price, the USDT with the highest market share has an average price of more than US$1 in this month, with an average premium of US$0.03 and a premium of 3%. The TUSD and USDC are relatively stable, with a slight premium in price performance, but not to a high degree. For DAI, the average price in a month is lower than its anchored dollar level, but the degree is lower; PAX is the weakest stable currency, the average price in several types of stable coins. The lowest level, the most serious discount.

6. Chain analysis

6.1 Chain trading

Chart 6-1 The amount of the transaction on the chain (US$2019.05.10-2019.06.11)

Source: TokenInsight

From May 10 to June 10, 2019, the overall transaction on the Bitcoin chain was more active. The amount of transactions on the chain has basically remained above $4 billion. The highest value appeared on May 31, and the total amount of transactions reached $14 billion. The reason behind such a high transaction volume is the sharp fluctuation of bitcoin prices. At the end of May, the price of bitcoin quickly climbed to 9,000 US dollars, and then quickly fell back to 8,000 yuan.

Overall, bitcoin prices are more highly correlated with chain transactions. It is worth noting that the trend of bitcoin price changes is generally ahead of the chain trading situation. Judging from this point of view, due to the lag of the transaction data on the chain, it is difficult to predict the price trend of the bitcoin through the amount of the transaction on the chain. The reason behind this is that most of the current bitcoin transactions are carried out on the exchange. In fact, when the user trades on the exchange, it does not involve the transfer of the chain; in addition, the bitcoin futures transaction does not involve the actual Transfer on the chain.

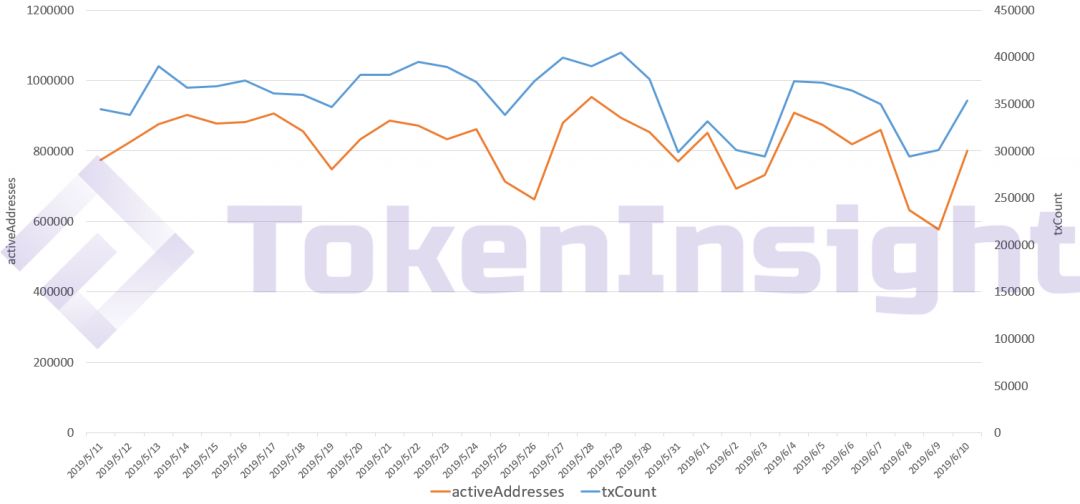

Figure 6-2 Number of trading ratios and active addresses on the chain (2019.05.10-2019.06.11)

Source: TokenInsight

The number of transactions on the chain and the number of active addresses have been basically the same. As with the price, the two quickly fell back after reaching the highest value of this period near the end of May, and then rebounded to the average level during this period.

6.2 Calculation and mining

Figure 6-3 Bitcoin average difficulty on the whole network

Source: TokenInsight

Since the difficulty of bitcoin mining is adjusted on average two weeks, it can be seen from the chart that the trend is a phase change. At present, the difficulty of mining bitcoin in the whole network has reached the highest level since 2018, which is a big improvement compared with the beginning of 2019. Of course, this is also due to the fact that bitcoin prices have started to pick up this year.

However, it is worth noting that the difficulty of mining Bitcoin in May-June has increased a lot compared to the difficulty of mining at the same price level in 2018. The speed of mining difficulty adjustment has been greatly improved compared to 2018. The main reason may be that bitcoin is getting more and more recognized by the market. After the price is warming up , the bitcoin mining practitioners adjust quickly, which makes the overall network computing power increase, which leads to the difficulty of bitcoin mining.

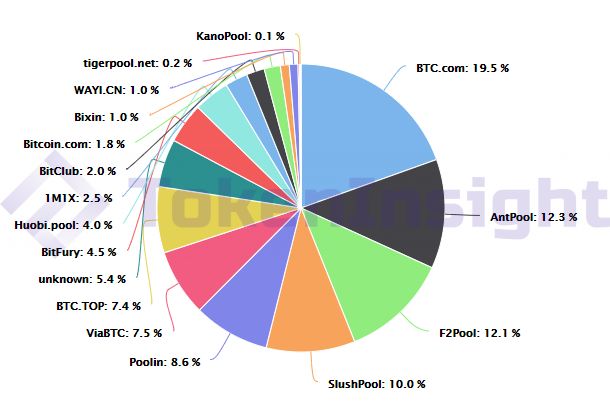

Figure 6-4 Bitcoin mining pool power distribution (2019.05.11-2019.06.11)

Source: BTC.com

6.3 Rich List

As of June 12, 2019, the total number of Bitcoins in circulation was 17,754,425. The top ten holdings of Bitcoin rich list accounted for 5.079% of the total circulation, about 901,747; the total holdings of the top 100 accounted for approximately The total circulation was 15.67%, about 2,782,118.

Figure 6-5 Bitcoin's top ten and top 100 addresses have bitcoin ratio (2019.06.12)

The top 100 address of the top 100 address Bitcoin circulation accounted for 5.079% 15.67%

Source: TokenInsight

6.4 Correlation analysis

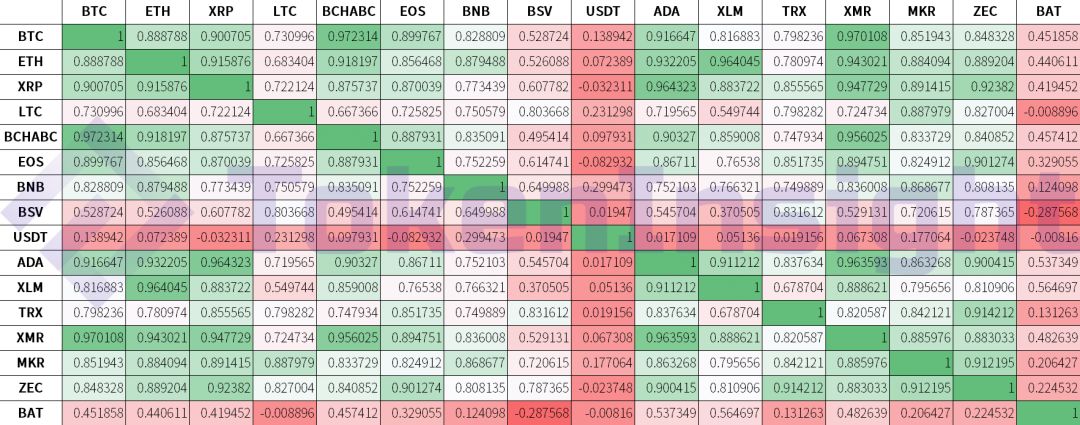

Figure 6-6 Bitcoin correlation with other currencies (2019.05.11-2019.06.02)

Source: TokenInsight

In terms of correlation, BTC has higher correlation with ETH, XRP, LTC, BCH (BCHABC), EOS and other currencies, and the correlation coefficient is basically higher than 0.8. Due to the competitive relationship between BSV and BCH (BCHABC), on the basis of strong correlation between BTC and BCH, both BTC and BSV are realized in addition to weak correlation. It is also worth noting that BAT (Basic Attention Token) is weakly correlated with most currencies.

7. Technological progress

7.1 Lightning Network Overview

As one of the auxiliary systems of the Bitcoin main network, the development of the lightning network is crucial for the large-scale low-cost application of Bitcoin in the payment field. However, in fact, the development of the Bitcoin Lightning Network has made a big breakthrough so far, and in terms of its absolute data, there is still a huge gap compared to the Bitcoin main network.

As of June 11, 2019, the number of nodes in the Bitcoin Lightning Network was about 4,400 , an increase of 4.27% from the previous month. The number of payment channels in the Lightning Network (two-two-node links, the most basic of the lightning network) The payment structure is more than 35,000, basically the same as last month's level; while the total number of Bitcoins stored in the network is about 950, worth about 7.5 million US dollars, an increase of nearly 20% from the previous month.

Figure 7-1 Bitcoin lightning network situation

Quantity (06.11) Quantity (05.11) Change Node Number 446842844.27% Channel Number 3514835298-0.42% Bitcoin Number in Channel 951.8794.319.8%

Source: bitcoinvisuals.com, TokenInsight

In addition, in these channels of the Lightning Network, each channel has an average of 0.027 bitcoins, valued at approximately $215. This also coincides with the intention of Bitcoin Lightning Network development as a micro-payment channel. In addition, this figure increased by $129 from the previous month, an increase of 148%.

7.2 Lightning Network Technology Progress

The Bitcoin Lightning Network is currently being developed by Lightning Labs. According to a announcement from Lightning Lab, the Bitcoin Lightning Network officially launched a new feature in May: Loop Out.

Loop Out was developed to alleviate the channel burden of a single node. Normally, when a channel established by two nodes in a lightning network is closed after the transaction is completed, the channel will be closed. This is necessary for nodes that need to use the lightning network at high frequencies (such as merchants accept bitcoin payments via lightning networks) to establish and close channels frequently. With the new function of Loop Out, when the bitcoin in a certain channel is taken out, the node can choose not to close the channel, keep the channel open and use it to send and receive bitcoin.

7.3 Bitcoin Side Chain Liquid

The Bitcoin side chain Liquid was developed by Blockstream, a settlement network that connects to exchanges, market makers, market managers and financial institutions. L-BTC was released on Liquid as a native asset on the side chain. The LBTC is linked to the Bitcoin main chain in both directions, and all issued LBTCs are supported by the BTC on the main chain. Through the Liquid network, users can get a faster trading experience.

Since its official release on September 27, 2018, the Liquid Network currently has 35 partners, including exchanges, wallets and other financial institutions. In early May 2019, Blockstream announced an increase of 14 partners, including Blue Fire Capital, BTC Trader, BtcTurk, Cobo, Coinut, DMM Bitcoin, FRNT Financial, Gate.io, Huobi, OpenNode, Poolin, Prycto, Sideshift AI , TaoTao, and Tilde.

7.4 Bitcoin version 0.19.0

In early May, bitcoin core developer laanwj announced an updated version of Bitcoin 0.19.0.

2019-09-01

Open Transifex translations for 0.19

Soft translation string freeze (no large or unnecessary string changes until release)

Finalize and close translations for 0.17

2019-09-15

Feature freeze (bug fixes only until release)

Translation string freeze (no more source language changes until release)

2019-10-01

Split off 0.19 branch from master

Start RC cycle, tag, and release 0.19.0rc1

Start merging for 0.20 on master branch

2019-11-03

Release 0.19.0 final (aim)

8. Market sentiment analysis

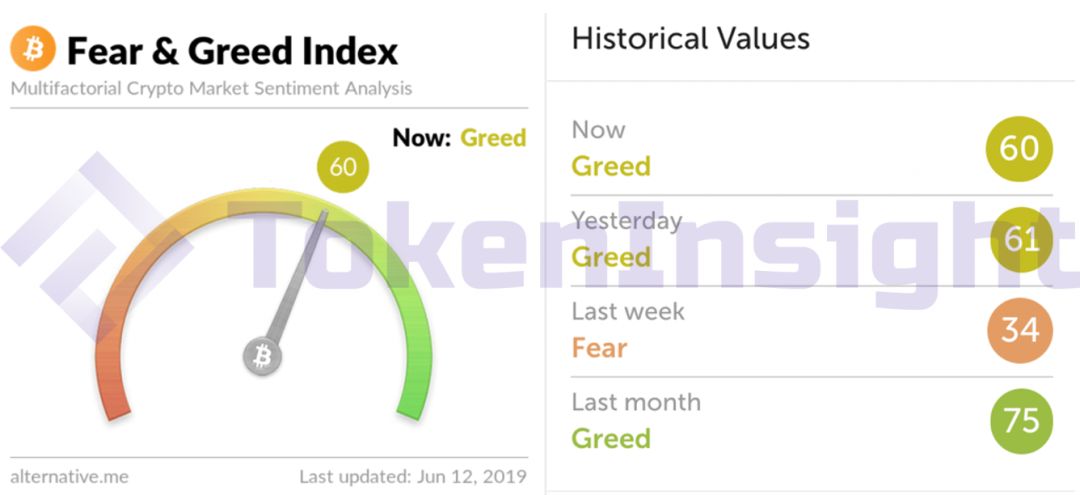

Chart 8-1 Bitcoin Market Sentiment Index

Source: Alternative.me

Due to the recent round of bull market, the average market sentiment in the past month was greedy and investment desires were high. But with Bitcoin's resurgence of market sentiment on Monday, it was once a panic. At present, market sentiment tends to be stable, and investors are slowly returning to rationality.

9. Twitter perspective

Due to a series of recent fluctuations in bitcoin prices, cryptocurrency industry experts and netizens have expressed their opinions on various social media such as Twitter.

Figure 9-1 Twitter View

Source: Twitter

Samson Mow, as Blockstream's CSO, said on Twitter "Never underestimate the impact of halving bitcoin rewards." It can be seen that Mow believes that the bitcoin award a year ago was halved until today, which still affects the price of Bitcoin.

In addition, there have been various opinions on Twitter.

Figure 9-2 Twitter View

Source: Twitter

Some people say that bitcoin's inflation rate is 1.8%, which is more stable than the central bank's 2%.

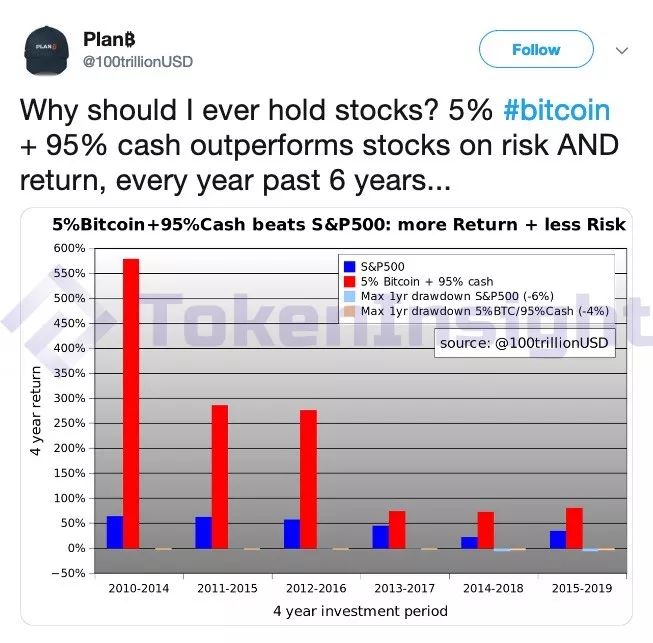

Figure 9-3 Twitter View

Source: Twitter

At the same time, Bitcoin's return and risk values are also better than the stock market indicator S&P500.

Figure 9-4 Twitter View

Source: Twitter

Some people are very confident about the future prospects of Bitcoin, and believe that the fluctuations in bitcoin prices are quite normal.

Figure 9-5 Twitter perspective

Source: Twitter

Some people also point out from a macro perspective that Bitcoin will not change the existing payment methods, and will not replace the US dollar as the current international base currency.

At the same time, AT&T , one of the four major US communications companies, announced that users can use cryptocurrency payments through BitPay , the first mobile phone operator to accept cryptocurrency payments . AT&T also said that adding a secret currency payment method can better serve customers and expand operations.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitland restarts IPO, first listed in the US in the second half of the year

- Libra is just out of the white paper. The Digital Money Institute of the People’s Bank of China has already made a pilot project.

- Blockchain fraud tricks – fake coin scams secret

- Ethereum also has Litecoin, and ETH community members plan to launch a "friendly fork"

- The US version of 94 will bring $3,000 in fluctuations! 6/21 market analysis

- Ernst & Young shocked QuadrigaCX insider: The late CEO opened a fake account and misappropriated client funds for margin trading

- Bitcoin hit 10,000 US dollars, the market started again, how to operate the follow-up market?