Wallet TokenStore thunder, how to identify the funds to avoid risk?

On June 10, 2019, the app of the wallet software TokenStore could not be used, and the official website could not be opened. The relevant assets were transferred to the exchange to cash out the transaction, and the entire project was suspected of running.

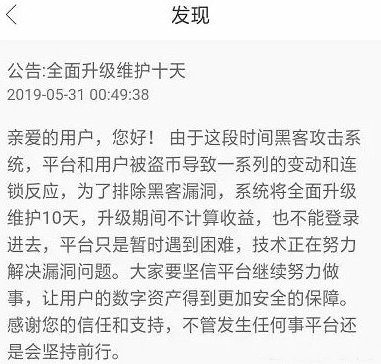

In fact, there are still some signs. Before the project party ran the road, it issued a notice of "Completely upgrade and maintain ten days", as follows:

- BTC monthly report 丨 BTC has the highest volatility relative to other assets, and derivative trading activity continues to increase

- Industry blockchain weekly news 6.15-6.21 | Thunder Group and Hong Kong University of Science and Technology jointly established blockchain laboratory

- Bitcoin is approaching $10,000: the rich will enter the market and the FOMO moment is coming soon?

Now it seems that this is to fight for time and to fight for time.

It stands to reason that this project seems to be very tall at the beginning:

- The world's first decentralized 2.0 payment tool TokenStore international big wallet

- AE technical team and Google artificial intelligence technology team cooperate with American Index Capital Group

- Using blockchain technology and artificial brain as the core

Of course, as a blockchain practitioner, when I see the above introductions, I am also confused. I don't know what the real meaning of stacking some tall words is. Of course, in addition to these tall words tempting you, there is the temptation of real money:

- Through artificial intelligence, the arbitrage of moving bricks and deposits has interest.

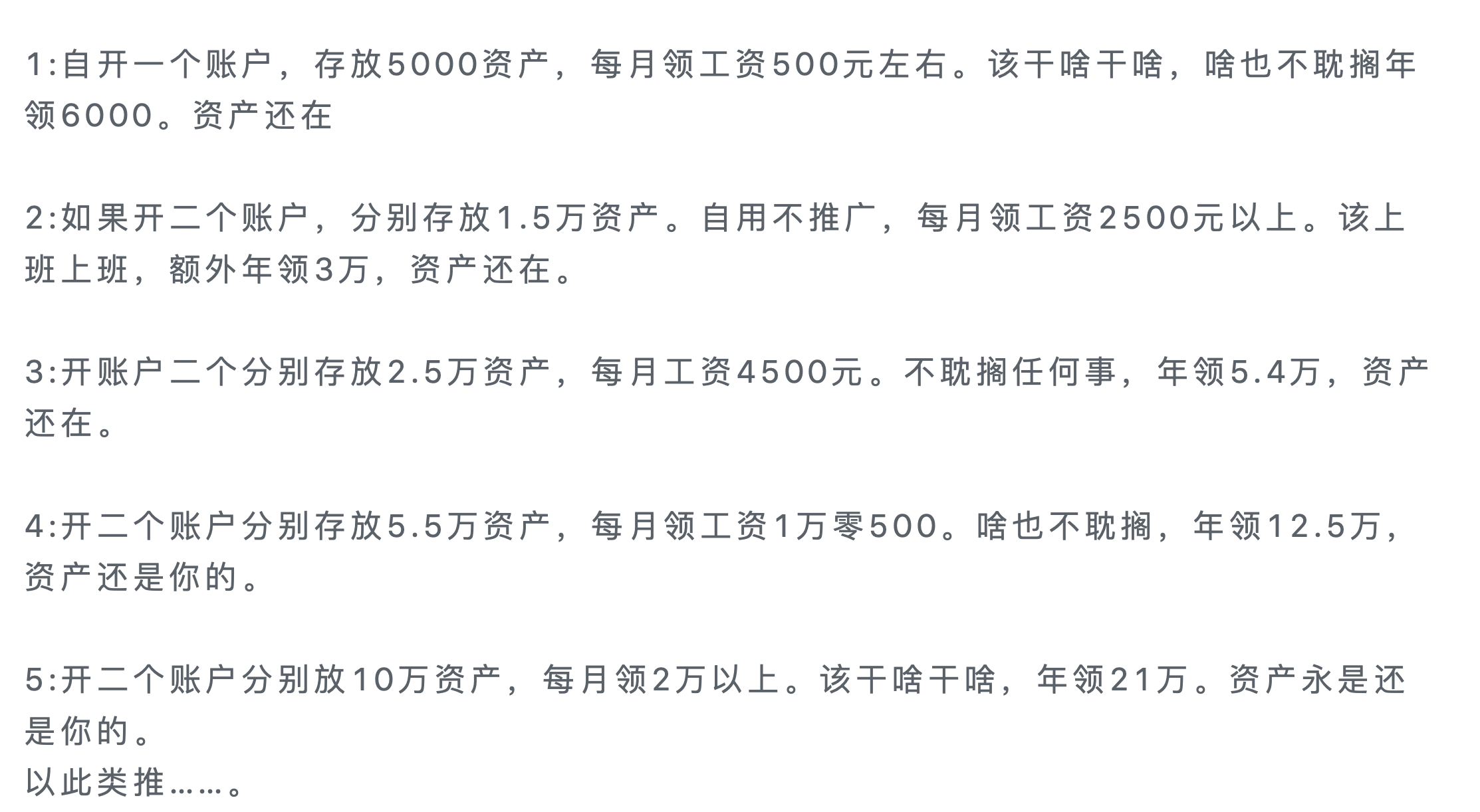

Please see the picture below:

Looking at it is not bloody, I feel that as long as the deposits go in, you can have wealth in hand? !

In fact, you are staring at interest, and people are staring at your principal!

In fact, since the blockchain has become more and more hot, various pyramid schemes and fund-slot projects have entered the market, and the users of the blockchain have been quickly delineated by the banner of the blockchain. The whole circle has been smoldering for a while. Not group, all kinds of running roads are staged.

It is possible that more than 90% of the projects on the market today are fake projects, air projects or funded projects. For personal safety, we will not list them all, but this article by Shu Ge tries to summarize the characteristics of these projects, and everyone can refer to them.

Fixed income

In fact, the project of the currency circle is similar to our traditional entrepreneurial project. The project that can truly succeed in business must be one of the best, even lower. However, due to the low cost of the currency, the various messy items are also very large, which means that their prices on the exchange are extremely uncertain, plus the pull-up of various characters. A chaotic image.

In other words, in the current scenario of the currency circle, there are many opportunities but more risks, and uncertainty is the core state of the current market. and so:

Commit to fixed income, or carry out a fixed rebate, basically determine the funding disk is undoubted.

2. Internal exchange

What is an intranet exchange?

In fact, the project party develops an exchange itself, but the exchange does not have many users outside, which is essentially made for the project's harvested users. So the above data is all fake, in other words, what they want to show you what you see.

A lot of funds are like to make an internal exchange, so that everyone can trade or even withdraw; but these are under the control of the project. When you don't want to let everyone cash out, you can stop the withdrawal at any time.

Any project that does an intranet exchange is basically determined to be a fund.

3. Moving brick arbitrage

What is the brick arbitrage?

The so-called brick arbitrage is to find a spread between different exchanges to make a profit. For example: the bitcoin of the A exchange is $7,800, and the bitcoin of the B exchange is $7,900; the bitcoin bought from the A exchange is sold on the B exchange, which is called arbitrage.

In fact, in 2017, there is a big gain in moving bricks. However, as more and more people move bricks and arbitrage, they basically use automated brick-and-mortar procedures, so there is usually not much difference between platforms. So it is possible to make some money by moving bricks, but I want to earn as much as I did. It’s hard to get a full pot.

This means that if the project can be arbitrage by moving bricks, why do you want to give it to you?

More fundamental issues are:

As long as the other party can use your funds to move bricks, then they have the ability to take away your funds.

So, regardless of whether the other party wants to roll the money, they have the ability to do these things.

4. Can't withdraw cash at any time

The basic trick of the fund disk is to “removing the east wall to make up the western wall”. When the newly-invested funds cannot support the high reward or rebate, the withdrawal will collapse.

Therefore, the project side will do everything possible to prevent users from withdrawing cash, using a variety of means:

- The longer the lock is, the higher the interest

- Use funds to invest in new projects

- The earlier the withdrawal, the higher the fee

and so,

Any project that cannot be withdrawn at any time is highly likely to be funded.

5. Stacking a lot of unknown words

In order to make your project appear taller, many fund-based projects will pile up all the current hot words, so that people who don’t understand will feel extremely tall, and those who know will feel confused and confused. What.

E.g:

- Our project combines artificial intelligence, big data, and blockchain.

- Our wallet has an automatic alpha dog function.

- Our project comes from the darknet and can send an email to each bitcoin address.

- The project uses 4.0 blockchain technology to develop and calculate the flow of computing power.

Don't be too surprised, this is their propaganda. Of course, it may also be a good screening method. If you can understand that they are nonsense, then you may not be their target customers.

Summary: Of course, some people know that there are tigers in the mountains and they are biased toward Hushan. They know that some are funds, but they hope that they can escape before the crash. However, they did not expect that they will always walk by the well. Wet shoes. In the world of investment, it may be more important to live longer.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- AI+ blockchain, Jarvis+ allows each community to have a personal assistant

- Bitcoin or going to the US to go public, is this the signal that the "bull market" drama kicked off?

- Bitland restarts IPO, first listed in the US in the second half of the year

- Libra is just out of the white paper. The Digital Money Institute of the People’s Bank of China has already made a pilot project.

- Blockchain fraud tricks – fake coin scams secret

- Ethereum also has Litecoin, and ETH community members plan to launch a "friendly fork"

- The US version of 94 will bring $3,000 in fluctuations! 6/21 market analysis