Can the new BRC-20S open up the “DeFi summer” on Bitcoin?

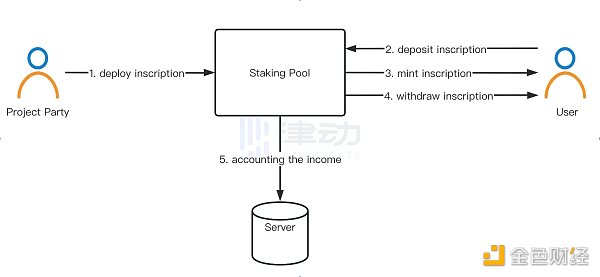

Can BRC-20S boost DeFi on Bitcoin?BRC-20S (BRC-20 Staking) is an extended version of the BRC-20 protocol proposed by OKX, aiming to introduce a staking mechanism for BRC-20 tokens or Bitcoin on the Bitcoin network.

Through BRC-20S, users can stake their own BRC-20 tokens or Bitcoin and receive corresponding BRC-20S tokens as rewards. Like BRC-20, the calculation of staking rewards will also be realized by an index. OKX will provide an open-source interface for profit calculation, and the staking revenue of any user will be calculated consistently in the backend and open-source tools to ensure the consistency of all calculations.

Currently, the deployment of BRC-20S is still pending the completion of OKX’s index and relevant infrastructure such as the BRC-20S token trading market. But we can imagine what new changes BRC-20S may bring to the market.

- Full-Chain Cryptocurrency Market Protocol TapiocaDAO Completes $6 Million Funding

- Wu’s Weekly Picks: Fed Announces Pause on Interest Rate Hikes, China’s Central Bank Cuts Medium-term Lending Rate, Judge Rejects Freezing of Binance Assets, and Top 10 News (June 9-16)

- Binance and Coinbase face SEC charges: Detailed analysis of market reaction and impact

New BRC token issuance model

Currently, the issuance of BRC-20 tokens has gradually evolved from the original publication of the ticker (token name) for everyone to self-carve to being completed through the mature BRC-20 token issuance tool Luminex. The principle of completion through Luminex is that when the project deploys BRC-20 tokens, the number of single-etched tokens is set to be the same as the total amount. All tokens are first carved into their own hands, and then users pay gas through Luminex to complete the token distribution. With Luminex, the whitelist system can already be well applied to the issuance of BRC-20 tokens, which provides help for the cold start of the project.

With support for directly staking Bitcoin to “mine” BRC-20S token rewards, BRC-20S may once again trigger new changes in the BRC token issuance model, and new projects in the future may directly complete initial token distribution by staking Bitcoin. The trend of “Bitcoin staking mining” may be triggered. At the same time, BRC-20S also supports staking BRC-20 tokens to “mine” BRC-20S token rewards, which will expand the gameplay of BRC-20 tokens. Will the leading BRC-20 token $ORDI become a “golden shovel”?

“Mother token” and “child token”

In the Ethereum ecosystem, the “double token model” has been seen frequently. BRC-20S has technically cleared the obstacles for the implementation of the “double token model” on the Bitcoin network. The next question is, how can we play?

I envisage a scenario where a “dual-token model” is adapted. The recent new concept of “recursive inscriptions” is essentially a cross-reference between the inscription resources on the Bitcoin chain. If a studio that generates art appears and trains a generative art piece using an AI model with all existing inscriptions on the chain as material every day, and then auctions it off, the BRC-20 Token can serve as the “mother token” to exert governance utility, such as deciding on the theme of the art piece generated each period (retaining or discarding which inscriptions as training materials, etc.), deciding which art pieces to put up for sale each period, external cooperation decisions of the studio, and so on. At the same time, the yields obtained by pledging this “mother token” can be used as the payment token to claim this art piece and exert utility.”

There are many scenarios where the “dual-token model” can be adapted, such as GameFi, SocialFi, and so on. Combined with “recursive inscriptions,” there are bound to be more interesting applications on the Bitcoin network.

Outlook: Pledging of Small Pictures

Since there are already BRC-20S that implement the pledging of BRC-20 Tokens, is it possible to directly pledge small pictures?

For example, by adding two keywords to the protocol, one to specify the name of the NFT series and the other to specify the effective inscription number set of the series (such as Inscription #10000, Inscription #10001, etc.). By confirming the validity of the deposit inscription that the user has engraved through off-chain indexing, the holding addresses of valid deposit inscriptions are used to calculate the pledge rewards, thus realizing the pledging of small pictures.

Conclusion

BRC-20S’s support for the pledging function on the Bitcoin network expands the imaginative space of BRC-20 Tokens and is expected to have a more positive effect on the liquidity of Bitcoin and BRC-20 Tokens. The Ordinals ecosystem that has been in development is hard not to love.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Why did the crypto community react negatively to BlackRock’s “wind-facing” application for a Bitcoin ETF?

- Arthur Hayes’ Blog: US Regulatory Pressure Intensifies, Hong Kong Welcomes Cryptocurrency – What Does This Mean?

- Why is the cryptocurrency community generally negative about applying for a Bitcoin ETF under the supervision of BlackRock?

- What does it mean when people say USDT is decoupling?

- News Weekly | US judge denies SBF’s request for prosecutor to review FTX debtor’s request

- Is BlackRock applying to the SEC for a Bitcoin ETF or a trust?

- Why did the SEC reject the approval of a bitcoin ETF for spot trading? Will BlackRock’s attempt be successful this time?