Is BlackRock applying to the SEC for a Bitcoin ETF or a trust?

Is BlackRock seeking SEC approval for a Bitcoin ETF or trust?BlackRock, one of the world’s largest asset management giants, submitted a file application for a spot Bitcoin ETF to the U.S. SEC through its subsidiary iShares this morning. The application shows that the fund being applied for is named “iShares Bitcoin Trust” and its assets “are primarily composed of Bitcoin held by the trust custodian.”

There is a huge difference and controversy in the crypto industry about whether what BlackRock applied for is a spot ETF or a trust, with some believing that BlackRock is applying for a trust that is different from trust funds such as GBTC issued by Grayscale, and is more flexible and redeemable. Another view is that BlackRock’s application is for an alternative structure of ETF, which represents publicly listed Bitcoin trust fund stocks. It is completely different from financial instruments such as GBTC and more like the well-known ETF funds managed by GLD and BlackRock’s subsidiary iShares.

What are the arguments of analysts, investors, and professionals in the crypto industry? And from the perspective of traditional finance, what are the definitions, main differences, investment risks, and advantages and disadvantages of ETFs and trusts? This article will help you clarify these misconceptions.

Is BlackRock applying for a trust?

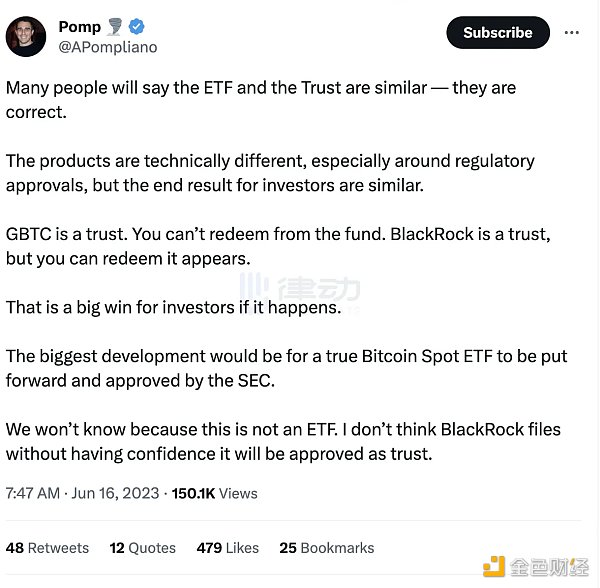

Anthony Pompliano, an investor at Pomp Investments, believes that BlackRock is applying for a trust rather than a Bitcoin ETF. Although the two are technically different, especially when it comes to regulatory approval, the result is the same for investors. Anthony Pompliano tweeted that GBTC is a trust, so you can’t redeem it from the fund. BlackRock is also a trust, but you can redeem it. If the application is approved, it would be a huge win for investors. However, the biggest bullish news is still the approval of a real Bitcoin spot ETF by the SEC.

- Why did the SEC reject the approval of a bitcoin ETF for spot trading? Will BlackRock’s attempt be successful this time?

- Inscription 2.0 Era: Can Recursive Inscriptions Push Bitcoin On-Chain Smart Contracts to be Possible?

- Reasons behind the slight USDT deviation in data analysis: Market FUD causing significant decrease in 3Pool liquidity on Curve. Author: Joy. Summary: Following SEC’s lawsuit against Binance and Coinbase and two Korean crypto agencies temporarily suspending user withdrawals, USDT has once again deviated. Written by Joy at BlockingNews.

Joey Campbell, a client manager at Web3 technology marketing studio SCRIB 3, also believes that BlackRock is submitting a trust, and he tweeted, “We are currently shocked by some people’s naming of ‘trust’ and ‘ETF’, some of which say there is no difference. The reason why ‘trust’ keeps everyone highly vigilant is because of Grayscale’s Bitcoin trust, which currently trades at a significantly lower price than its net asset value. This is because investors cannot redeem their shares for BTC. Not redeeming means that you cannot buy and sell arbitrage at a discount price on the market. This is different from BlackRock’s trust fund.”

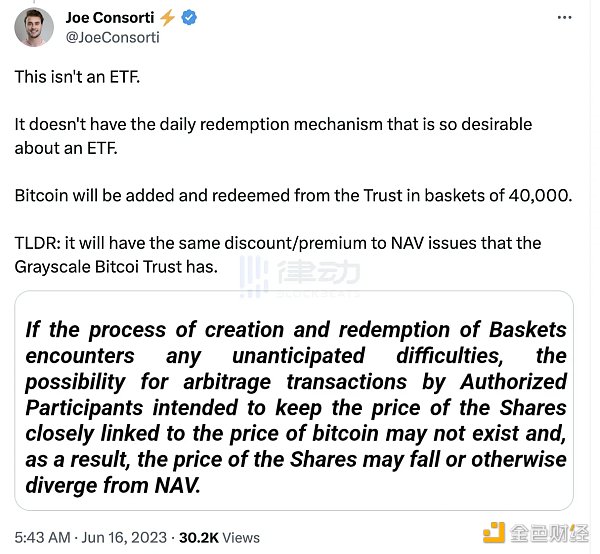

“As described in the prospectus, you will see that the Authorized Participants (APs), which are one of the primary participants in the exchange-traded fund (ETF) creation and redemption mechanism, basically are the providers of ETF liquidity and can change the supply of ETF shares in the market. They provide large blocks of fund shares for continuous redemption/creation, which means that the APs of the Trust can redeem/create funds at any time of the day.”

“For example, if 40,000 BTC (1 “block”) is worth $40 million based on the current BTC price, the fund share is calculated at about $39 million for 40,000 BTC. Then, the AP authorized participant buys the share, redeems the 40,000 BTC held by the Trust, and then sells it at a profit of $1 million.”

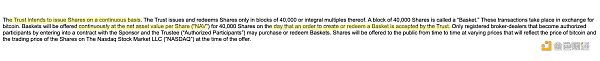

Another person who shares the same view is The Bitcoin Layer market analyst Joe Consorti, who tweeted, “This is not an ETF, but a trust. Because it does not have the daily redemption mechanism of an ETF, it will add and redeem in the form of 40,000 bitcoins per basket from the trust. It will produce asset net value premium and discount issues similar to the Grayscale Bitcoin Trust Fund.”

Another view: BlackRock applies for ETFs

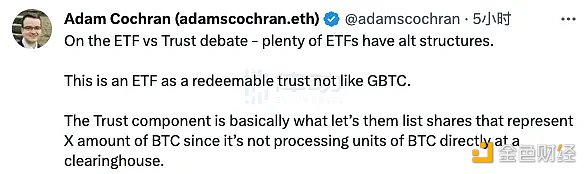

Adam Cochran, partner of CEHV, believes that BlackRock is applying for an ETF, but many ETFs have alternative structures. Unlike GBTC, BlackRock is applying for an ETF in the form of a redeemable trust, which represents publicly listed Bitcoin trust fund shares, rather than processing Bitcoin assets directly through clearing.

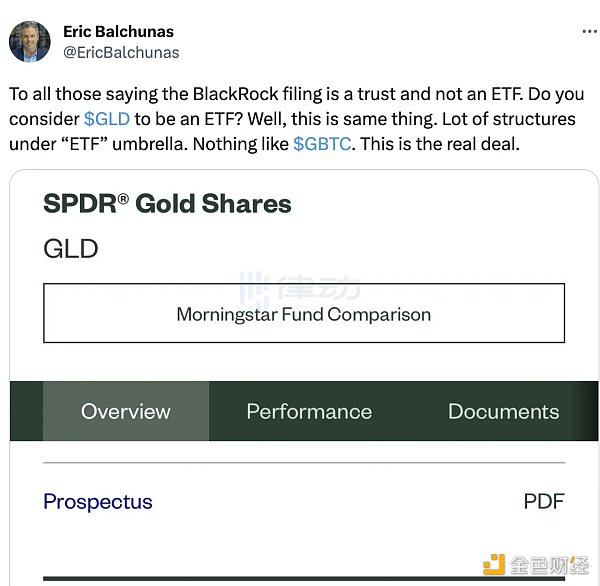

Eric Balchunas, a senior ETF analyst at Bloomberg, believes it is an ETF. He tweeted, “For those who think BlackRock is applying for a trust, not an ETF, I want to ask if you think $GLD is an ETF? In fact, they are the same. There are many different structures under the asset category of “ETF”. Completely different from $GBTC.”

Bruce Fenton, CEO of SEC-registered broker-dealer Watchdog Capital, believes that BlackRock has submitted an ETF, some people think it is a trust, but it is different from financial tools like GBTC and more like GLD and BlackRock’s multiple well-known ETF funds managed by iShares.

Considering that BlackRock’s application is not a traditional trust, nor does it fully meet the definition of an ETF, we will list the definitions and main differences between ETFs and trusts below.

What are the differences between ETFs and trusts?

ETFs are investment funds that trade on a stock exchange like individual stocks, and are a type of security that holds underlying investments such as commodities, stocks, or bonds. They are typically similar to mutual funds in that they are co-managed by the issuer. ETFs are designed to track the performance of specific market indices, sectors, or assets. When investors buy ETFs, they are purchasing shares in the underlying asset portfolio, such as stocks, bonds, or commodities. One of the advantages of investing in ETFs is that they can easily obtain a diversified package of securities. ETFs also tend to have lower costs compared to other types of investment tools.

On the other hand, investing in trusts involves investing in closed-end investment funds listed on a stock exchange. These trusts are managed by a professional fund manager who is responsible for investing the money held in the trust. The fund manager will use this money to purchase a portfolio of assets such as stocks, bonds, or property. The stock price of a trust is determined by the value of the assets held in the trust.

Overall, one of the main differences between ETFs and investment trusts is their structure. ETFs are open-ended, meaning that the available number of shares can increase or decrease according to demand. Investment trusts, on the other hand, are closed-ended, meaning that there is a fixed number of shares available. Additionally, ETFs can be bought and sold on a stock exchange throughout the trading day, just like individual stocks. However, investment trusts only trade once at the end of each trading day. The cost structure of ETFs and investment trusts is also different. ETFs tend to have lower costs than investment trusts because they are designed to track an index and require less active management. On the other hand, investment trusts are actively managed, so they may have higher fees.

In the cryptocurrency field, Grayscale’s GBTC trust fund is the absolute leader in the cryptocurrency market, managing over $35 billion in assets. The structure of investing in this trust fund is corporate-style – at least in regulatory form – and belongs to a “closed-end fund.” Therefore, the number of available shares is limited, and their supply and demand largely determine their price.

GBTC shares are not easily created and do not have an active redemption plan. This often results in a significant price difference between its net asset value. In contrast, ETFs allow market makers to create and redeem shares at will. Therefore, if there is sufficient liquidity, there is usually no premium or discount. ETFs are easier for mutual funds and pension funds to accept because they carry much less risk than closed-end trust funds like GBTC.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What impact does BlackRock’s submission of a physical Bitcoin ETF application have on the industry?

- Age of Inscription 2.0: Can Recursive Inscription Enable Bitcoin On-Chain Smart Contracts?

- Full testimony of Avalanche founder: We are standing at the edge of a new era

- How is the NFT market performance of Azuki and Beanz? Let’s start from the borrowing and lending activities.

- Will the regulatory crackdown on Binance fall through? Analysis of recent market data changes in Binance

- Viewpoint: How to view the prospect of the cryptocurrency market?

- SEC has launched a comprehensive political battle over cryptocurrency.