How is the NFT market performance of Azuki and Beanz? Let’s start from the borrowing and lending activities.

How are Azuki and Beanz performing in the NFT market? Let's focus on borrowing and lending activities.Source: NFTGo Research, Compiled by: Song Xue, Blocking

Introduction

What magic can a “red bean” bring us?

Since its introduction by Chiru Labs in 2022, Azuki has become a powerful force in the Web3 field, with 10,000 anime-inspired non-fungible tokens (NFTs) that have quickly sold out within minutes and generated over $29 million in sales. Azuki’s position in the NFT space has been strengthened by its product diversification and community loyalty. In addition to its eye-catching digital art, Azuki’s uniqueness also lies in its ambitious vision for a gamified metaverse called Hilumia, promising an immersive interactive experience for holders.

- Will the regulatory crackdown on Binance fall through? Analysis of recent market data changes in Binance

- Viewpoint: How to view the prospect of the cryptocurrency market?

- SEC has launched a comprehensive political battle over cryptocurrency.

This report comprehensively analyzes the performance of Azuki and Beanz in the NFT market, focusing on their community strength, borrowing dynamics, and strategic partnerships that drive their resilient growth. Through data-driven insights, we explore their trading activities, holder patterns, borrowing volume, and cross-platform appeal, ultimately showcasing how these NFTs carve out unique spaces for themselves amidst market fluctuations.

This report comprehensively analyzes the performance of Azuki and Beanz in the NFT market, focusing on their community strength, borrowing dynamics, and strategic partnerships that drive their resilient growth. Through data-driven insights, we explore their trading activities, holder patterns, borrowing volume, and cross-platform appeal, ultimately showcasing how these NFTs carve out unique spaces for themselves amidst market fluctuations.

Latest News

IPX x Chiru Labs: Revolutionary Web3 Extension

Chiru Labs, the creative force behind Azuki, has announced a significant partnership with IPX, the global IP platform known for successful collaborations with well-known brands such as BTS, Netflix, and Starbucks. This alliance marks a major leap for the popular LINE FRIENDS characters into Web3 technology, which were initially born in the LINE messaging application.

This partnership signifies a breakthrough merger between Web3 and established IP, including joint content, retail distribution of the LINE FRIENDS STORE, and immersive real-world activations. Starting with BEANZ and LINE FRIENDS IP, this collaboration has the potential to expand to other IPs, including those managed by IPX’s dedicated Web3 partners.

This partnership is significant because it will put BEANZ IP into the hands of millions of consumers who were once attracted to LINE FRIENDS. By successfully achieving IP extension, Chiru Labs and IPX not only combine like demographics but also expand their user base in a way that is managed by a minority of NFT projects. Brands like BTS further validate this collaboration by acknowledging IPX’s recognition.

Follow The Rabbit: Hype, Mystery, and Details

Azuki is back, planning to host an exciting event called “Follow The Rabbit” at the Hakkasan nightclub in Las Vegas on June 23, 2023. Following their highly acclaimed “Check Your Wallet” party and exclusive NYC NFT event, the event promises to provide attendees with an immersive experience in the Year of the Rabbit.

Reopening registration in mid-April, priority is given to Azuki and BEANZ token holders, but due to high demand, Azuki has reopened the registration window until May 28, 2023. The tickets are free, but non-holders and registrants will be required to pay a $100 refundable deposit, processed through the Tokenproof application. Participants must be at least 21 years of age.

Given Azuki’s previous interest in the NFT world, the event is significant. Since January 2022, Azuki has caused a bull market frenzy, with holders rushing to buy highly sought-after NFTs. The hype was further fueled by their Los Angeles party in March, which airdropped two NFTs to every Azuki holder. Despite controversy, Azuki has successfully maintained its growth and continues to hold a position as one of the most powerful projects in the NFT space.

The “Follow The Rabbit” event can serve as a platform for Azuki’s future plans. Along with the speculative vortex comes the fact that some Azuki whales have been swapping rare Azukis for bottom prices, suggesting potential airdrops or token claim strategies. All eyes are on Azuki as they prepare for this event, bringing suspense and excitement to the NFT community. Azuki’s mysterious founder Zagabond further fuels the intrigue, keeping community engagement high while revealing little information.

This event encapsulates the mystery and hype surrounding Azuki, making it a highly anticipated event in the NFT calendar. Whether this event truly marks the release of a new series remains to be seen, but the anticipation is palpable.

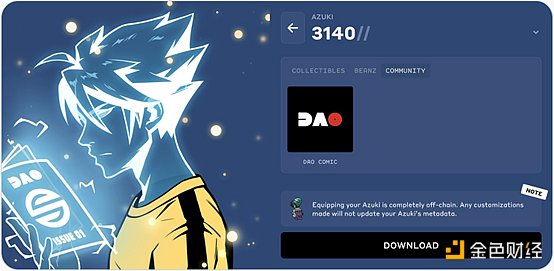

Azuki enhances interactivity with Spirit DAO comic book token feature

In an exciting development, Azuki has granted Spirit DAO (a private consortium of Azuki NFT collectors) coveted comic book token features. Spirit DAO members can equip this symbolic feature to expand their Azuki experience and stand out in the Azuki community.

This move showcases the synergy between Azuki and Spirit DAO, and underscores Azuki’s commitment to fostering creativity, collectibility, and immersive engagement. Comprised of dedicated Azuki collectors, Spirit DAO is a formidable force aimed at solidifying Azuki’s reputation in the emerging metaverse. The addition of comic book token features enhances this vision and strengthens the benefits available to Spirit DAO token holders.

The addition of Spirit DAO’s comic book token feature, accessible through the Azuki collector’s profile, further emphasizes Azuki’s contribution to dynamic community engagement. The new feature ensures that personalized Azuki tokens can be a creative off-chain experience without affecting the on-chain attributes of the tokens.

Essentially, Azuki’s collaboration with Spirit DAO through comic book token features is an important step towards enhancing user interaction and collector participation within the Azuki community. This development will drive Azuki to establish a significant brand identity in the metaverse.

Data Analysis

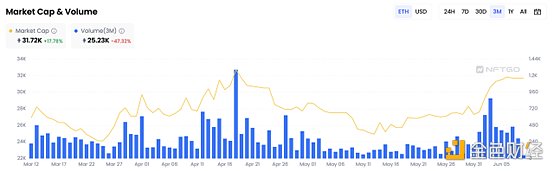

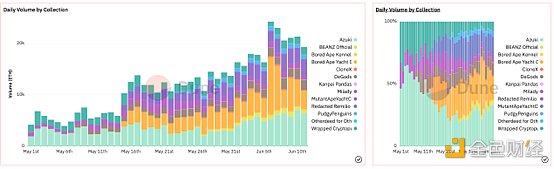

Looking back at the performance of the NFT market in the past three months, it can be seen that the market has shown a downward trend. The total market value fell sharply by 23.64% from 5.1 million ETH to 3.9 million ETH. Although the blue-chip index showed a brief rebound between May 31 and June 5, it also showed a downward trend overall, falling 12.22% from 8.5K ETH to 7.5K ETH.

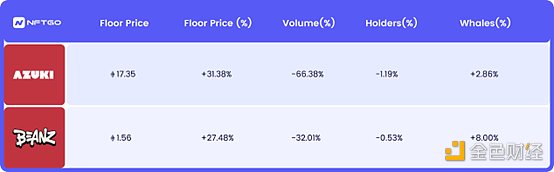

Contrary to this market trend, Azuki and Beanz NFT are performing strongly due to their strong community support and huge product appeal.

Azuki

Despite the bearish trend, Azuki continues to perform well. Its rebound is driven by a series of strategic moves, including frequent events, dynamic partnerships with IPX, and strong community support. Although the number of holders has slightly decreased, its market value is soaring, and “whale” investors are increasing, indicating that the faith of its supporters has been consolidated. This, coupled with the community’s “diamond hand” strategy, which involves a large number of transfers relative to sales, as well as a surge in high-value transfers, demonstrates the long-term value of the project. Essentially, Azuki’s counter-trend rise not only reflects its strong market position, but also its vibrant community and strategic partnerships, which can continue to drive its growth.

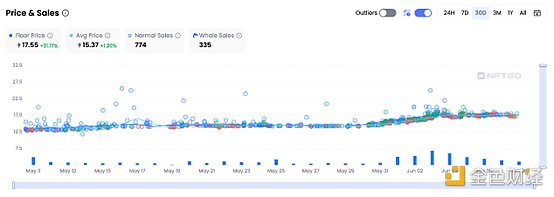

Price and Sales: Balanced Participation Drives Stable Growth

Azuki’s recent market performance has shown a stable and sustained growth trend. Last month, Azuki’s bottom price rose 31.38% from 13.34 ETH to 17.54 ETH. The average price hit a new annual high, which is an important milestone for Azuki. There was a slight fluctuation on May 17, but the overall trend is still positive, with the average price rising by 28.6% from 13.6 ETH to 17.49 ETH. The sales transaction volume brought by a large number of trades in the market is also a key indicator of the Azuki market dynamics.

Interestingly, the number of “whale” buyers and sellers is quite balanced, indicating a stable market with no obvious manipulation pressure. In addition, the situation where buyers and sellers are both “whales” is almost non-existent, indicating that the Azuki market is not only dominated by a large number of traders, but also actively participated by a wider range of collectors. This positive market performance can be attributed to Azuki’s consistent brand growth strategy and community activity participation. These factors together not only effectively maintain the interest of existing collectors, but also attract new participants to join Azuki’s NFT market.

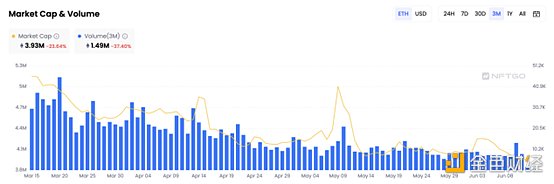

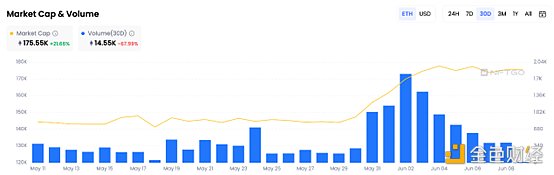

Market Cap and Trading Volume: Activity-Oriented Marketing Boosts Azuki’s Market Cap

Over the past three months, Azuki’s market cap has been on a steady upward trend, with particularly significant growth occurring between May 29 and June 1, when tickets for the highly anticipated “Follow the Rabbit” Las Vegas event were released. This event appears to have had a positive impact on investor sentiment, driving Azuki’s market cap to a historic high of 177.77K ETH. Even after a slight dip, Azuki’s current market cap remains at 175.55K ETH, representing a significant overall growth of 21.66%.

However, it is worth noting that while Azuki’s market cap has seen considerable growth, the total sales volume for Azuki over the past month has been relatively low compared to previous months. This may indicate that while investors remain optimistic about Azuki’s value, trading activity has stabilized. This could be due to investors choosing to wait before further trading in anticipation of the Las Vegas event.

Overall, the market cap and sales trends suggest that Azuki’s strategic partnerships and activity-oriented marketing are positively impacting investor sentiment and contributing to the overall market strength of the project. This reinforces the brand’s visibility in the NFT space and its potential for further growth.

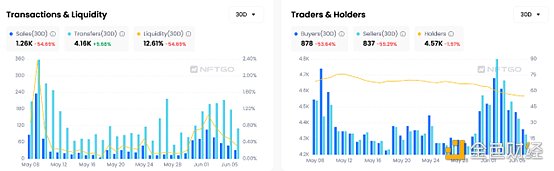

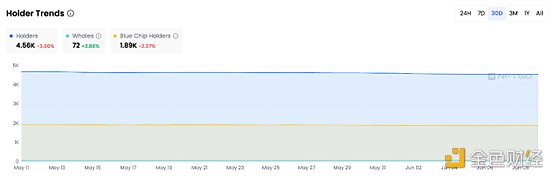

Transactions, Liquidity, and Holders: Focused Community and Whale Confidence Drive Azuki’s Market Rebound

Last month, Azuki’s ecosystem showed a fascinating trend: despite a decrease in liquidity compared to the previous three months, the number of transfers continued to exceed the number of sales. This trend not only demonstrates a strong sense of community unity, but also suggests a “diamond hand” mentality among Azuki holders, who are holding onto their assets in anticipation of long-term value, potentially influenced by the upcoming “Follow the Rabbit” event.

Meanwhile, the number of holders decreased slightly by 1.97%, but the market cap grew strongly by 21.66%. This counterintuitive phenomenon suggests that while the participant pool has shrunk slightly, remaining holders have increased their holdings, driving up Azuki’s market cap. This is consistent with our observation that the number of whales has increased by 2.86%.

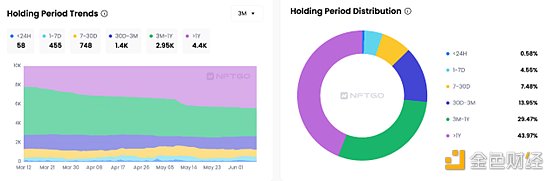

Over the past three months, the number of people holding Azuki for more than one year has steadily increased, while the number of people holding it for three months to one year has correspondingly decreased. Specifically, the number of NFTs held for more than one year has grown from 2.1K NFTs to 4.4K NFTs, an increase of 100.36%. At the same time, the number of NFTs held for three months to one year has decreased significantly by 41.37%, from 5.0K NFTs to 2.9K NFTs.

This almost identical trading volume from shorter to longer holding periods reveals an interesting trend: many investors who hold NFTs for three months to one year have chosen not to sell their NFTs. This change indicates that people are confident in Azuki’s long-term value and growth potential, further proving that Azuki’s community is not just investing for short-term gains. They seem to be participating in the project for the long term, indicating a deep-rooted trust in Azuki’s roadmap and strategic decisions made by the project team.

Fundamentally, the Azuki ecosystem is a dedicated and optimistic community. Despite market fluctuations, they still believe in Azuki’s potential and strategy, and bring a bright future to the project.

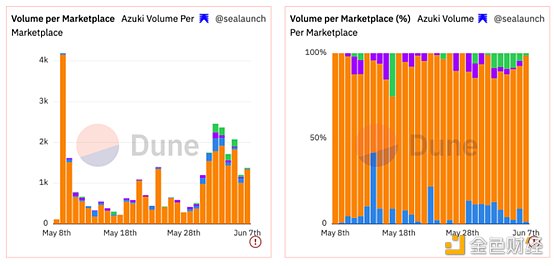

Market: Blur becomes the primary trading platform for Azuki NFTs

According to data from Dune Dashboard @sealaunch, it is clear that the Blur trading platform has become the preferred market for Azuki trading. This preference has several key reasons:

Firstly, Blur’s Blend feature allows traders to maximize the liquidity of their NFTs. Given the high price of Azuki NFTs, this feature provides an attractive advantage for new collectors who see the huge potential in Azuki. Blend allows buyers to mortgage their tokens to purchase NFTs, creating a more flexible trading environment.

Secondly, Blend trading is tax-free, which adds to its appeal. In contrast, Blur charges a 0.5% royalty fee for each transaction, making Blend a more cost-effective trading platform.

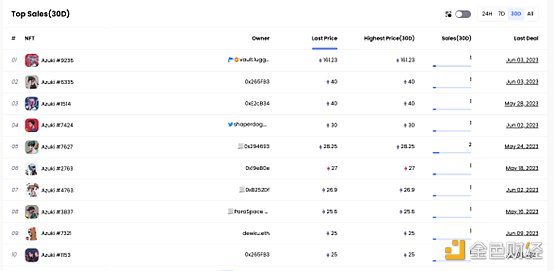

Finally, Blur’s image as a high-value trading platform has received significant sales support, such as Azuki #9236, which sold for as much as 161.2345 ETH. This record-breaking auction has expanded Blur’s reputation as a high-value trading platform, further attracting new collectors and boosting the overall position of the Azuki project in the NFT market.

Best-selling

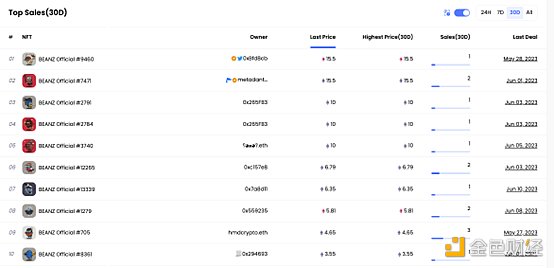

BEANZ

Lowering the threshold and improving market performance in Azuki Universe

In Azuki’s world, BEANZ plays a crucial role as an important partner and a more cost-effective alternative to Azuki. Compared to Azuki, the number of collectors of Beanz NFT has increased significantly, mainly due to their affordability, which significantly reduces the threshold for entering the Azuki world. The strategic partnership with Line Friends has facilitated the creation of Beanz IP and the launch of characters such as “Jay” and “Jelly”, significantly expanding the user base of Beanz. This collaboration helps to expose millions of new consumers to Beanz, drive a significant increase in user base, and open up new revenue streams through merchandise and activity collaborations.

After announcing this partnership, the trading volume of Beanz NFT increased significantly, from 143.32 ETH to 679.29 ETH, a significant increase of 373.97%. Another notable increase in trading volume occurred on April 18th, when it was announced that wallets holding Azuki or Beanz tokens could access Azuki’s “Follow The Rabbit” for activity registration. Beanz became the natural choice for participants, driving Beanz NFT trading volume from 256.58 ETH to 1289.19 ETH, an increase of 402.45%. This trend pushed its trading volume and market value to a three-month high.

Interestingly, after the first whale sale on May 27th, there was a brief period of whale buying, followed by a large number of whale sales. As a result, after experiencing a period of low liquidity in early May, the liquidity of Beanz began to oscillate at a higher level. Despite a relatively smaller number of holders, the market capitalization remains at its highest level in nearly three months.

Best-selling

Azuki & Beanz’s lending journey

Observing Azuki’s lending volume on the Blur platform, Azuki’s lending volume has been consistently near the top of the market in the past month, even showing a trend of oscillating upward. Starting from early May, Azuki’s lending volume rose sharply from 3437 ETH to 6408 ETH, an increase of up to 86.44%. This trend indicates that the market demand for Azuki NFTs continues to increase, consolidating its position as a strong competitor in the NFT ecosystem.

At the beginning of May, Azuki’s daily lending volume on Blur outperformed the market, accounting for more than 50% of the total lending volume. Although it has since declined slightly, it has remained in the top three market positions, with a stable sales share of 20-30%. This consistency not only strengthens the confidence of current Azuki holders, but also enhances the appeal of Azuki and Beanz to potential new collectors, thereby increasing their market visibility and attractiveness. This trend showcases the inherent strength of Azuki and Beanz in the challenging NFT market landscape, highlighting their potential for sustained growth in the future.

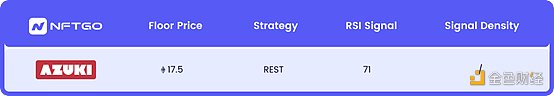

Azuki’s trading signals

Probability of rise and fall (NFA)

RSI strategy: A trading signal designed based on the buy and sell strength characteristics of the RSI. Signals below the fluctuation range indicate buying, while signals above the fluctuation range indicate selling. The greater the deviation, the stronger the signal.

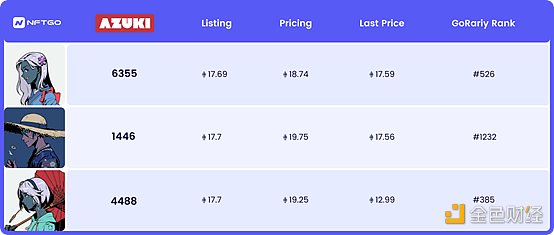

Azuki pricing and listing

Find opportunities by discovering undervalued NFTs

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Delphi Digital: Analyzing the Five Types of Instances of LSDFi: Interest Rate Swaps, CDP Stablecoins, Multi-Asset LSD, Money Markets, and DEX. Author: Delphi Digital

- What happened to the cryptocurrency market with a 30% drop in altcoins due to the “610” attack?

- SEC Complaint Reveals the Truth: Major Players Have Stumbled in the Crypto World in Recent Years

- Is the collective waterfall of altcoins just the beginning of regulatory impact?

- On the Eve of GameFi Explosion, the Competition of Chain Games “Tribes” is Underway

- Analysis of SEC’s Cryptocurrency War Trigger and 5 Possible Endings

- HOLD Cave: The Story of Bitcoin’s Growth Amidst Volatility