Can you make money in the cryptocurrency market by means of news?

First of all, as an individual investor, the currency market is definitely a relatively weak one. Investment is actually a decision-making process for asymmetric news. For financial markets, there has never been fairness. Can the bloodthirsty market tell you fairness and transparency?

What individual investors must understand is that market news is transmitted to us, basically the information that is already three hands and four hands. Is it valuable? Perhaps worthwhile, just a small part, the vast majority of the news came out to find the man.

Intricate information, if we have been obsessed with information investment, then one day we will be lost in the fog of information, just as the macroeconomic impact on the stock market in the short term is not as big as the imagination.

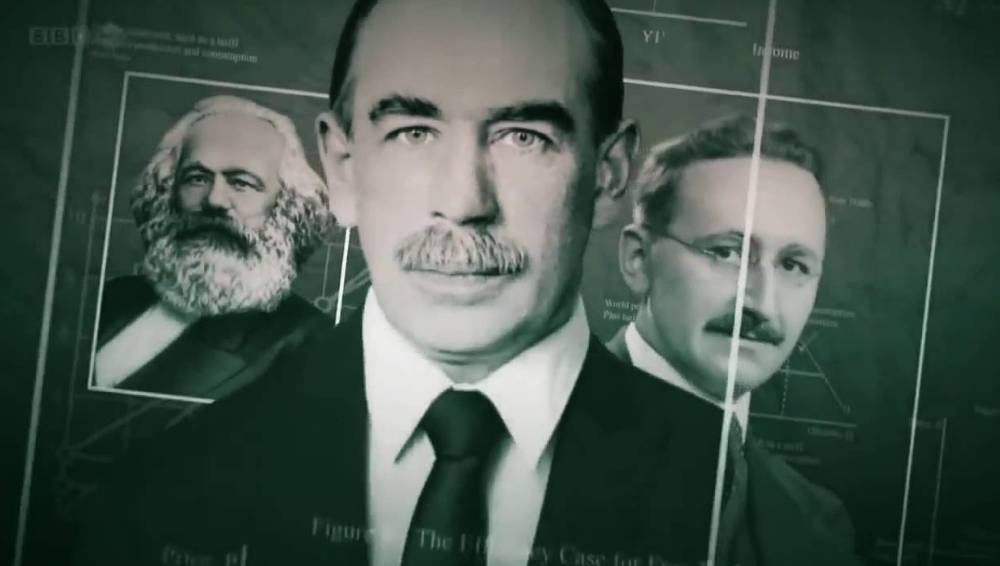

Transformation of big economists

The great economist Keynes is around forty years old. He is relatively confident in his own macroeconomic theory, so he wants to show his ambitions in actual combat. After all, economists must also earn money to support their families. In the investment process, he often relies on his own theory. Conduct actual operations.

- May 9 madman market analysis: BTC alone rose the mainstream of small coins lying in the grass is actually this

- Demystifying the giant organization behind the Facebook Stabilization Coin team

- Stabilizing the Currency War: How to properly fight the US authorities?

Keynes's favorite investment categories are foreign exchange and futures, as the two assets are most closely linked to the macro economy. He always believes. As long as you can study macro data and grasp the economic cycle, making big money is only a matter of time. After all, as an authoritative economist, the macro data and news will lead the ordinary people and take the lead.

Then the results are not ideal, confident Keynes is constantly frustrated, losing money is much more than making money.

In 1920, Keynes, based on his own theoretical analysis, bet on the appreciation of the pound, shorting the franc, the German mark and the Italian lira. As a result, the market trend is exactly the opposite of what he predicted. Several currencies all appreciated against the pound. He was directly closed out and broke a large sum of money.

In the following six or seven years, Keynes did not change himself. He always invested in ways that he thought he could make money. As a result, the five-year rate of return was lower than the market index. It can be said that the results were quite bleak. Keynes began to reflect on his investment philosophy. .

After three years of crouching, Keynes gradually changed his investment philosophy. Probably because his identity has changed, he was promoted to the finance director of King's College of Cambridge to help the school take care of some of the funds.

Surprisingly, Keynes, as a macroeconomist, began to stop predicting the economic situation, but instead looked for undervalued stocks, then bought them in large quantities and held them for a long time, turning them into a complete value investor.

Unexpectedly, the search for undervalued stocks brought him a very good return. The investment in the next fifteen years rose to an annual return of around 9%, while the UK stock market fell 15% during the same period.

Later, Keynes and his friends made an explanation for the reasons why he succeeded in investing later:

The macro economy is of course very important, but the factors affecting the macro economy are too much and too complicated, and it is difficult for ordinary people to grasp. In contrast, finding a good company with an undervalued value is much easier.

For top economists, understanding the macroeconomic situation and predicting market trends remains a difficult task, not to mention individual investors.

The recognized authority in the macroeconomic field, Yale University economics professor, and Nobel laureate Robert Schiller successfully predicted two market crashes, but he repeatedly stressed that he could not predict the market based on macroeconomic indicators, let alone Use this guide to invest to make money.

First hand news

So is there a big man in the world who makes money from the information side? Of course, there is the Soros mentioned in the previous article on the quantum hedge fund.

Those who have heard of Soros should have heard of the classic case of his short-selling pound. I have already said the case, but another small detail of the classic case of shorting the pound, there may not be many people who know:

At that time, in 1990, the United Kingdom joined the European exchange rate mechanism led by Germany and France, including the United Kingdom, Italy, the Netherlands, and Belgium. Simply put, this is a "currency regime". The mechanism requires that the exchange rate of all member countries' currencies against the German mark must be stable within a small range. Once the deviation is more, the government must intervene.

At the time, the two Germans had just reunified. In order to prevent domestic inflation, the Bundesbank continued to raise interest rates. But at this time, the UK is in a recession, and it is very necessary to cut interest rates to stimulate the economy. The mechanism of currency holdings makes it impossible for the UK to do so. At this time, Soros thought that the two countries must eventually have conflicts. Once the conflict, Germany is likely to seek self-protection and give up maintaining the stability of the British exchange rate.

After the result, there was a meeting, and Soros and the Bank of Germany Governor Schlesinger talked about the day. He asked Schlesinger, did he want to use a currency in Europe in the future? Schlesinger said: If this currency is called the German mark, he will be very happy.

Soros immediately heard the doorway inside, and he confirmed his previous thoughts: Germany is most concerned about its own monetary status, and the life and death of other member states is not important.

So he immediately ordered the team to short the Italian lira, because the worst economy in the member states was it. After the short-selling success, Soros went short and shorted the pound. As a result, you also know that Soros earned $1 billion a day.

Why Soros can make money is not to predict the direction of the economy and the macro direction, but the first-hand information that Soros has received is something that our individual investors can't match. The information that most people get is not known.

Information fog

In the currency market, the most widely spread is "the file I have seen, is true", similar rumors are numerous. For most ordinary people, you can only look at the quality of the financial media in the currency circle. The vast majority are not reliable. There is also the analysis of the market, not relying on the majority, self-selling coins have not earned a few dollars, there is qualification to analyze the market. If someone can make money, it will be written for you, unless you think that someone will be a philanthropist in the cruel market. Anyway, I will not do it anyway. Therefore, I can only write popular science articles, because I understand that the risk coefficient of the currency market is higher than most people think.

Recently, the CX currency's big market, a lot of currencies began to fly, some people began to not calm, so in the end to inquire about the gossip, those currencies began to take the mode, ready to go into the work, it is undoubtedly the fire. If you can make money in the short term, even if you can make money in the short run, you will lose money in the long run.

We are not investing in gambling. The odds of gambling are relatively low compared to investment. At that time, humanity was vulnerable to money. Some people did not think about themselves. They only saw the show of others making money, and they did not realize that others lost money. When I was hiding in the corner, I was alone in the horror of the wound.

The survivor bias effect is always at work. The vast majority of information in the capital market is invalid information. The only role is to influence your investment operations. Why do many people fail to hold bitcoin because of the media’s arbitrary conclusions and ignorance reports? Let the investors fear, you think the media is authoritative, but it is not.

Caesar’s personal attitude towards observing bitcoin in the Chinese media has always been negative. Needless to say, the danger of vigilance against finance under the regulatory environment is part of the reason, and partly because editors have no basic understanding of Bitcoin, so investment It is undoubtedly useless to expect investment decisions based on the media.

We can't expect ourselves to be reports made by professional media. Only by constantly improving self-awareness and identifying effective news can make meaningful decisions for their own investments and are not interfered with by market information.

Author: Bitcoin Caesar

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analyst: Bitcoin's uptrend may lead its price to $7,200

- Malta will build the world's first office based on blockchain system operations

- Adaptation and Change – Regulators SEC and CFTC want to increase digital asset expertise

- US Securities Commission plans to add 4 new positions to regulate digital asset market

- Bitcoin soared 5% to a new high in 2019, but can you continue to go on?

- Is it technically feasible to roll back the Bitcoin blockchain? Seeing Daxie's Discussion on Belief

- Currency security "monitoring self-stealing"? How did hackers break through heavy protection and take 7,000 bitcoins?