Bitcoin prequel: came into being, breaking the 2008 financial crisis

Speaking of the birth of Bitcoin, I believe that everyone is no stranger: On November 1, 2008, Beijing time, a mysterious man named Zhong Bencong released the Bitcoin White Paper: "A Peer-to-Peer Electronic Cash System." Later, on January 3, 2009, Satoshi Nakamoto personally created the first block, the Bitcoin Creation Zone, on a small server in Helsinki, Finland, and obtained the first 50 automatically generated by the system. Bitcoin rewards, the first bitcoin is here.

And now, our most intuitive understanding of Bitcoin is that it's really worth it! But where is its value? Why is it born? This is about to start from its birth background, so today Xiao Kjun explores the background of the era before the birth of Bitcoin, and talks about the biggest financial disaster in history – the 2008 financial crisis.

difficult! The beginning and end of the 2008 financial crisis

- Can you make money in the cryptocurrency market by means of news?

- May 9 madman market analysis: BTC alone rose the mainstream of small coins lying in the grass is actually this

- Demystifying the giant organization behind the Facebook Stabilization Coin team

In order to explain the 2008 financial crisis, we have to mention the US-Soviet hegemony. When the Soviet Union unemployedly developed the military and exhausted the national power and finally disintegrated, the United States entered a unique situation until the plane crashed into the building in 2001. (September 11 terrorist attacks), its dominance was incited. Beginning with this terrorist incident, the US economy was hit in the IT industry and the economy began to decline.

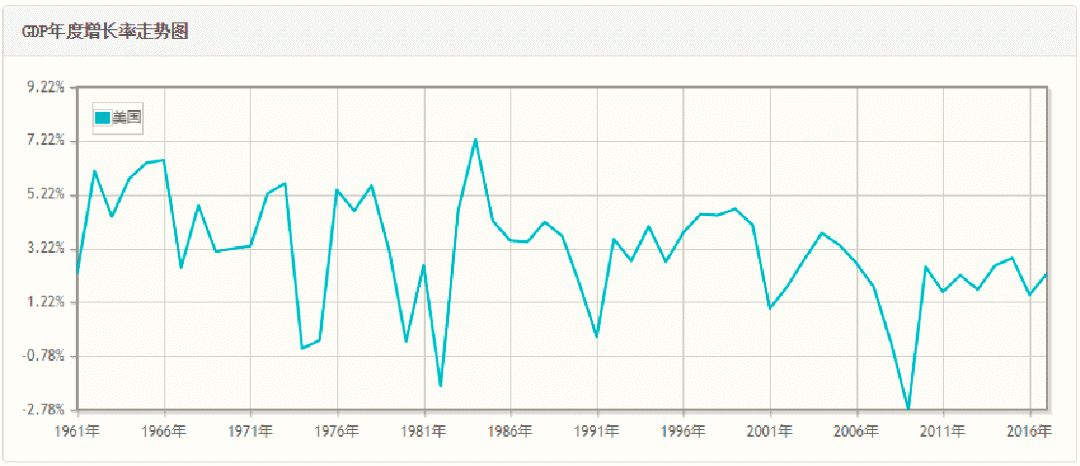

Chart: Annual growth rate chart of US GDP from 1961 to 2016

The American leader of that year was the little Bush who "dressed in a cowboy to give a speech and sent a singular intelligence to many stars." He could not allow the US economy to have no political achievements in his own hands, so he launched the Taliban war on terror and the Iraq war. 2003) to stimulate demand, a series of economic revitalization plans were introduced internally, the most important part of which was the “land policy” – “Everyone has a house”.

In the United States at the time, many people could not afford to buy a house. They did not even have a stable source of income. Although loans are a common phenomenon in the US, not all people are eligible for loans because many people have credit. Levels are not up to standard.

In order to turn these people into house slaves that continue to contribute to the country’s production, George W. Bush persuaded Congress to pass relevant bills, enabling banks to provide loans to low-credit users, who are known as “sub-lenders” and this event It also laid the groundwork for the future financial crisis. This is the famous "subprime loan."

Let's take a look at the glory of the time:

“Thinking about a good day? Buying a house to find out?”

"What? Is the savings insufficient? Loans!"

"You didn't work? Isn't the credit line enough? Nothing, I know that a loan company is not so strict!"

“Not only a zero down payment, but also low interest!”

"I still can't afford it? It doesn't matter. You only need to pay interest in the first two years. The principal of the loan can be paid in two years! Besides, with a big fixed asset in the house, is it afraid? You see that the price is rising now. So fierce, even after two years, even if you don’t sell the house, you will not only live in the house for two years, but also make a big profit!"

"Don't hesitate, as the saying goes, buy and not buy, do you dare to lend, you still dare to borrow?"

Under such temptation, countless American citizens did not hesitate to choose a loan to buy a house. Don't tell me the risk, my American people are so optimistic about the future, so cheap money, don't borrow it!

Sure enough, after the implementation of the policy, the US GDP has seen a new growth momentum, and the real estate industry bubble has been promoted.

The loan companies have certainly seen this potentially huge risk. The money has been loaned out, and the house has been sold out. It has to be recovered. Therefore, the loan companies did not hesitate to drag the investment bank of the economic community to let them find a solution!

The capital market is profit-seeking. When faced with huge profits, Wall Street is naturally excited and joined the vigorous and prosperous movement, so the real estate bubble is transferred from the credit market to the capital market.

When it comes to the capital market, the gameplay is more complicated. When the capitalists see the risks involved, they spread the risk to everyone's head and let the people pay for it.

The whole process is very simple: the subprime loan is packaged and sold by the financial company, which is legal and reasonable. For example, I have a loan of 1 million and a tax of 200,000 in ten years. I have to transfer the loan to others for 1.02 million because I urgently need 102. Ten thousand yuan of cash, so another financial company was very happy to buy it. Anyway, I don't need cash now, it is better to change into a long-term return asset, so one party takes the money, one party takes the right, everyone is very satisfied.

Then the financial company that got the loan had more ideas to play the loan and “settlement” the loan.

In other words, it divides the loan into 10,000 shares, and anyone can buy the securitized goods of the loan. This loan once again enters the market with a lower threshold, and the financial giants unite the various roads. The scholars, "teachers and scholars", "investment gods" and so on preached that the goods were instantly empty.

Self-stealing

In order to prevent everyone from defaulting at the same time, they also divided the investment privilege, the region and other conditions to spread the risk, and finally realized the risk “where to come from, where to go”, let the loan change into the ordinary people’s home, you owe The debt is still you pay the bill, and my middleman makes the difference, no risk, pure profit.

Such companies are the famous Goldman Sachs, Morgan, etc. As the world's financial giants, they have succeeded in promoting these products and later more sophisticated and more sophisticated securities and funds to the world. These assets have been re-purchased by financial institutions and individuals around the world, creating a vicious circle between buying and lending.

As the subprime mortgage interest rate is still high, more and more financial institutions are beginning to support this loan model. When it comes to this, we have clearly felt that the figures on the accounts have become larger and larger, and the actual production The value is still the same as in the past, when the real estate bubble burst, the entire US housing prices fell at the same time, but those who rely on subprime mortgages can no longer mortgage the house and then borrow new money to pay off old debts!

Wall Street in the subprime mortgage crisis

In an instant, everyone breached the contract: "Not that we want to default, we really have no money, we can return the house to the financial institution, but even if we move to the street, we still have no money!" It is rotten in the hands of financial institutions, but the money is getting less and less.

In September of 2007, the greed was replaced by panic. The large number of buyers were breached by contract, resulting in a break in the capital chain of the mortgage company. The snowballs were getting bigger and bigger, and everyone had no money in their hands. They all started selling themselves. The assets in the hands. Under the nesting, there were eggs that were finished, causing even assets such as gold to lay their guns for no reason, which led to a decline in the liquidity of the entire financial industry.

The cash is exhausted, and even the banks themselves are in jeopardy. The people no longer believe in power institutions and financial institutions because they are pushing the people into the abyss. Until September 15, 2008, Lehman Brothers, with its huge commercial real estate, ushered in the collapse of the building.

As one of the top five investment banks on Wall Street, the negative sentiment in the market reached its peak. Wall Street itself has no industrial production. The only thing they can use as a chip is the word "reputation". But at that time, who else is more unreliable than the big investment bankers on Wall Street? The Fed’s behavior of standing by and watching the whole process has ruined the idea that the people “have been short-sighted”: even Lehman Brothers, one of the Big Five, can’t get help, let alone ordinary people!

In the global financial crisis of 2008, Lehman Brothers, which has been established for more than 150 years, filed for bankruptcy

The funds of financial institutions are not working well. At the same time, all the capital chains are broken, and no one can borrow any money. The subprime credits that have been securitized have already been sold to all over the world. Wall Street is a world-scale financial center with extraordinary Influence, for a time, financial institutions all over the world have suffered losses. The ones that have survived have tightened credit. Cats spend a lot of time in one place and never dare to lend money. There is no money in the financial markets of the world! Their accounts may not be empty, but we can't see cash anymore.

In order to change this situation, the United States has come up with a very bad method: "printing money." In the following period of time, the number of dollars has risen sharply, and because of the hegemony of the dollar, the entire international system is settled in dollars. The result of the increase in the dollar bubble has been that the world has helped the United States to pay its debts. Everything is depreciating, and the financial crisis has spread from the United States to the whole world.

What ultimately led to the collapse of the real economy in 2008, people are reluctant to buy anything, let alone invest. No consumption, where is the stimulation of production? The entire economic system has entered a vicious circle… and finally formed a world-class economic crisis.

We can see that this is the rules of the game set by the world's giants, playing the real money of most ordinary investors. Some people say that this economic crisis can be attributed to the financial giants' "endless greed and contempt for risk."

Wall Street's fifth largest investment bank on the verge of bankruptcy – Bear Stearns

In any case, when everyone suffers, they still have a good life, and once they fail, they can make a comeback; for most people, this impact is enough to make them ruined and unable to breathe. However, when they set the rules, under the extremely concentrated rights, no one has the right to speak, and the currency we use can instantly become a piece of paper, no longer have any effect.

The rules are always made by a few people, but they are required by most people in the world to perform. The French currency we use is the most important medium for carrying value in our lives, but it is actually political, because it must Will be interfered by third-party forces, and once they have made any mistakes in decision-making, everyone will suffer.

In that context, Bitcoin emerged as an alternative to a non-political, non-centralized legal currency system.

Creation: Bitcoin – a solution to the financial crisis

"Bank failures, emergency rescues, political turmoil are the thrust of Bitcoin adoption, and your money is handed over to banks for custody, but if they can't be trusted, what else can you expect?"

Bitcoin appeared in 2008, and its design itself is to deal with the financial crisis and become a real "world currency."

The first thing it wants to achieve is decentralization—separating money and power. As everyone knows, Nakamoto said in the creation block of Bitcoin: "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks. (On January 3, 2009, the Chancellor of the Exchee was in the second implementation. The edge of the bank’s emergency assistance.)"

Nakamoto used this to explain the riddled financial system he wanted to replace with Bitcoin. “Peer-to-peer technology” means that the circulation of value in the world is finally no longer intervened by traditional third-party credit institutions, such as central banks and governments, who often abuse trust and intervene in the economy at the expense of public interest, such as currency overshoot. Or the introduction of certain policies is considered to be one of the causes of the economic crisis.

Bitcoin is considered a solution to the collapse of the monetary system based on central credit.

Furthermore, Bitcoin is neutral and non-tamperable – it breaks the situation of being fully owned by a third party. In the 2008 financial crisis, we will find that financial institutions play a catalytic role in the whole incident. From this perspective, the centralized currency is more insecure and easier to manipulate.

Except for hacker attacks and other insecurities that can completely defeat the system, the third parties themselves have their own positions, for example, they must be structurally political – they can access your qualifications without notifying you. You can force you to abide by their new rules, like the amount of legal currency printed, or the rules of a financial product.

Bitcoin is different. It has experienced more than ten years of growth in the tide of the Internet. Apart from the initial days, the rest of the time is not at the helm of any centralized organization. It is completely free and shared by all. Maintenance is developing. It is always subject to hacking and always winning. It has never succumbed to “community fighting” or any powerful interest group and suspicious role. In this system, the decision is always in the hands of everyone, everyone It is equal.

In the end, Bitcoin is a value storeer. Its total amount is constant, theoretically extremely stable, and there is no deflation (of course we can't define its value with its current price fluctuations. Currently Bitcoin has not been used as a means of payment, but is still treated as a kind of Financial derivatives), while French currency is much more vulnerable.

Bitcoin was born out of the background of the financial crisis. It made people see the importance of a complete independent monetary system and finally put it into action. This is the reason for its greatness.

– END –

Original article

Author: small K

Source: OK Blockchain Business School

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Stabilizing the Currency War: How to properly fight the US authorities?

- Analyst: Bitcoin's uptrend may lead its price to $7,200

- Malta will build the world's first office based on blockchain system operations

- Adaptation and Change – Regulators SEC and CFTC want to increase digital asset expertise

- US Securities Commission plans to add 4 new positions to regulate digital asset market

- Bitcoin soared 5% to a new high in 2019, but can you continue to go on?

- Is it technically feasible to roll back the Bitcoin blockchain? Seeing Daxie's Discussion on Belief